In dit artikel

The liquidity plan is very important not only for startups, which need to assess possible investments based on available financial resources, but also for established companies to maintain balance over time.

A careful analysis of cash flows allows you to monitor that there are always sufficient funds available to meet financial obligations, such as salary payments, suppliers, taxes, and other operating expenses. Preparing a liquidity plan is essential for several reasons:

- Strategic planning: provides crucial information for strategic planning and decision-making, allowing the company to seize investment and growth opportunities promptly.

- Operational sustainability: ensures that the company always has sufficient funds to operate without interruptions, maintaining operational continuity.

- Prevention of liquidity crises: avoids emergency situations where the company cannot meet its financial obligations, preventing potential insolvency or bankruptcy.

- Optimization of financial costs: allows for efficient planning of financial resources, reducing financing costs and improving the return on available resources.

- Improvement of relationships with third parties: effective liquidity management strengthens the trust of investors, suppliers, employees, and other stakeholders in the company.

How to prepare the liquidity plan

To draft a liquidity plan, it is necessary to analyze a series of historical data and documents.

Data collection

Start by gathering a series of useful documents for the planning process:

- Bank Statements: to check recent transactions and balances from bank, postal, and credit card statements.

- Debtors and Creditors Accounts: to examine the receivables the company needs to collect and the payables it needs to settle.

- Current Balance Sheet: to draft a current balance sheet for an overview of all accounts.

- Balance Sheets of previous years and periods: to assess, based on historical data, especially revenue trends.

Banana Accounting Plus offers innovative features to create a liquidity plan, using the same chart of accounts as the accounting system and integrating it into the same accounting file without the need for separate spreadsheets.

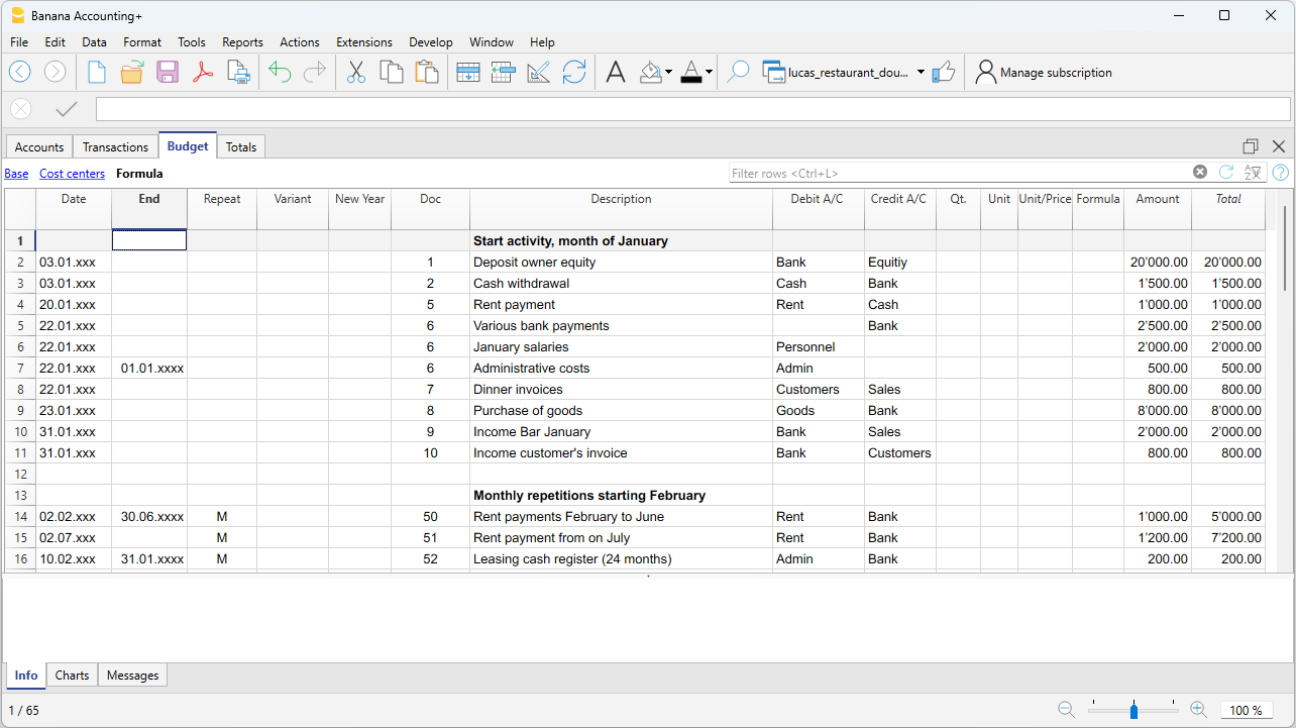

To create the liquidity plan, forecasts are entered into the Budget table as regular entries, using the Debit, Credit, Amount columns, VAT codes if any, cost centers, and segments.

Estimating Inflows and Outflows

When forecasting costs and revenues, it is better to be cautious. Therefore, it is recommended to not underestimate costs and not overestimate revenues, while also considering unforeseen events to avoid liquidity shortages. It is also advisable to develop a strategy to identify which costs can be reduced because they are not strictly necessary and which revenues can be optimized.

Future Outflows

Enter forecasts for future costs based on historical data and potential extraordinary expenses:

- Operating Costs: forecast operating expenses such as salaries, rent, utilities, and production costs.

- Debts and Payments: plan payments to suppliers and loan repayments.

- Other Outflows: consider other expenses like taxes, extraordinary maintenance, or investments.

Future Inflows

Enter forecasts for future revenues:

- Revenue: based on sales from the previous year for the same period, market trends, and marketing strategies, prepare estimates for sales or services. If reliable data is not available, rely on historical data from previous years.

- Other Inflows: include other possible sources of income, such as interest from investments or potential loans.

Below is an image of the table. For an explanation of the columns, refer to the page Budget Table Columns.

Liquidity Plan from the Balance Sheet

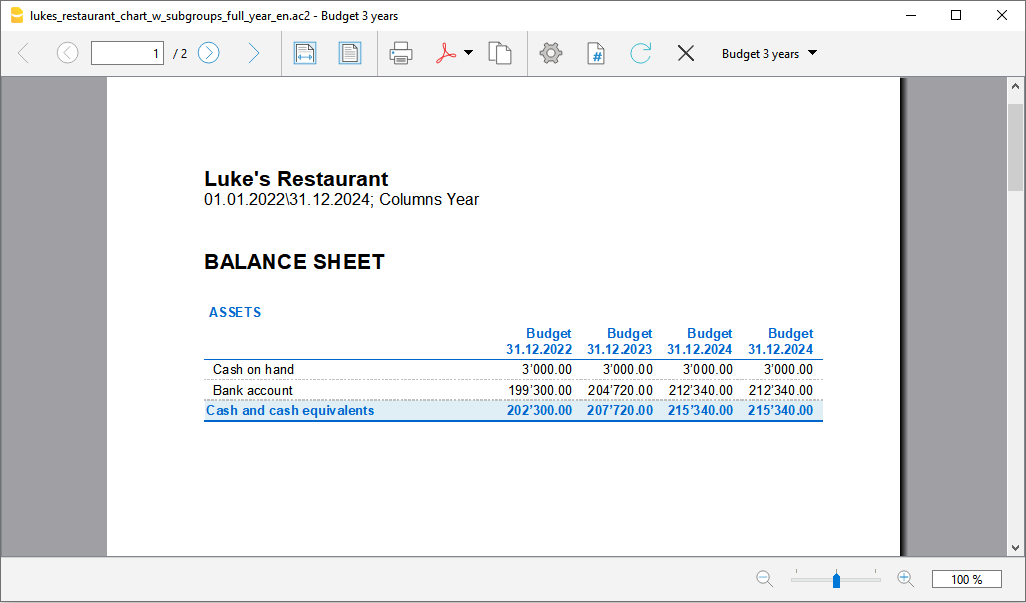

Use the command Enhanced Balance Sheet with Groups to access the forecast balance sheet report.

- In the Sections options, enable the display of the Budget for the Balance Sheet (Assets and Liabilities).

You can view current (accounting) values, budgeted values together or separately. - Set the Period.

If you specify a period beyond the accounting period, the program automatically generates multi-year forecasts. - Specify the Period Breakdown you want.

- In the Rows options, you can exclude accounts and view only the groups.

- If the setup will be used in the future, it is advisable to create a Customization.

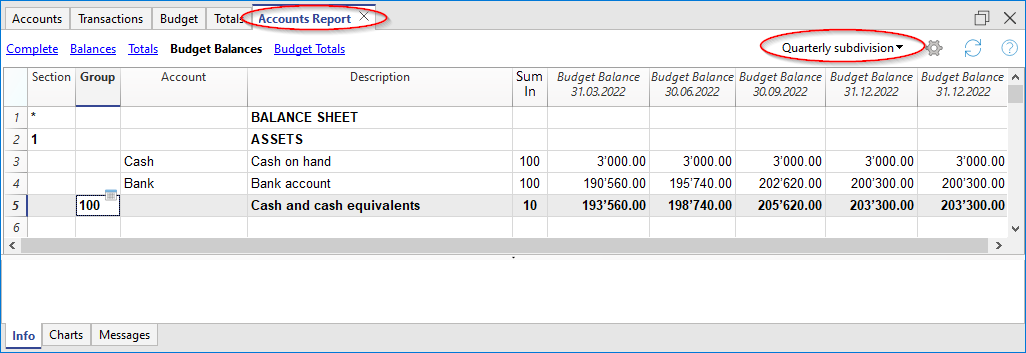

Liquidity Plan Report from the Accounts Table

The Accounting Report is similar to the Enhanced Balance Sheet with Groups, with the difference that data is displayed in columns, like in the Accounts table.

You can use the Accounting Report to get an immediate view of the liquidity accounts' evolution.