Import into accounting command

The import command is activated from the Actions menu → Import into accounting and allows you to import data from files in the following tables:

- Transactions - Bank transactions

Used to import bank statements into the Transactions table. - Transactions - Generic transactions

Used to import transactions in the Transactions table. - Accounts

Used to import accounts in the Accounts table. - VAT Codes

Used to import VAT codes into the VAT Codes table. - Exchange rates

Used to import exchange rates into the Exchange rates table. - File

Imports data into multiple tables and also into the Accounting File Properties. This type of import is used for example when converting the chart of accounts.

To import data from other programmes, see the page Retrieving data from other programs.

Import procedure

- Choose the destination table for the data.

- Choose the file type to be imported.

- Specify the name of the file.

- Choose the movements to be imported.

Supported import formats

Various import formats are available depending on the type of destination table.

- Import from other Banana Accounting files (.AC2)

Prepared to convert data from files. - Text files with header (CSV/TXT)

For files created that export data in the format required by Banana Accounting.

See the technical instructions on how to prepare these files. - Default file formats (generic)

ISO 20022 (generic). - Import via an import extension

Usually for bank statements.

The import extension is an additional Banana Accounting program that transforms data from a specific format

The user must install the appropriate extension.

Should there be a need to import from other file types not included in the list, a specific Banana Import Extension can be developed.

Import parameters

File name

- Indicate the name of the file of which the data need to be imported.

- For certain types of imports (e.g. bank statements)

- You can also indicate multiple files together, either by selecting them with the browse dialog or by entering them separately with a semicolon ";".

- You can indicate a zipper file that contains multiple import files.

- If you specify multiple files, they must all be of the same type.

Import data from clipboard (Excel)

With this option active, the data, instead of being read from the file, is read from the clipboard.

It is used to import data from files that cannot be directly read by Banana, such as bank statements in Excel format, or from another programme.

The advantage of importing data and not simply using the copy-and-paste function is that the data are converted by the import programme and completed automatically.

Proceed as follows:

- Open the file with the data using Excel.

- Select the data to be imported, including eventual header rows.

- Issue the copy command (Ctrl+C).

This option is shown only for certain import types.

UTF-8

Select whether the data to be imported is in the utf-8 format.

This option is shown only for certain import types.

Manage extensions...

This command brings you to the Mange extensions dialog window.

You can use it to:

- Look for, add or remove an import extension

- Edit the extension parameters.

Also use the command to change the extension settings.

Settings

The button allows you to change the settings of the extension.

The button is visible from the Banana version 10.1 and only if the extension allows parameters to be set.

OK Button

It starts the import process.

Error messages

If errors are reported during the execution of an import, the Import Extensions must first be updated.

If errors persist, please send us feedback, it may be that the file format has been updated by the originating bank or institution, and we will update our import filter accordingly.

Import transactions from ebanking

This page deals with the importing of transactions from bank statements, the most widely used and most useful feature, which allows you to automate the entry of transactions in the Transactions table.

Bank statement files are defined as those containing incoming and outgoing amounts on a single account. The import dialogue requires the entry of the account and the counterpart, and allows the use of the Auto-completion Rules.

On the other hand, in order to import from files that have other types of movements, e.g. from double-entry bookkeeping, please refer to the page Import Transactions (Generic). For these types of files, there is no possibility of applying the auto-completion rules.

Import procedure

- From Actions in the menu > Import into accounts > in the Import box select Transactions.

- Choose the file type to be imported.

See explanations below. - With the Browse button, choose the file from which you wish to import the transactions.

- Set the parameters as required.

See also: Import into accounting.

Next Steps

Once OK is confirmed, the data is read and the following dialogues are displayed:

- Import transactions dialog

Where instructions for completing the imported rows are to be given. - Apply rules (Advanced plan only)

When importing, records can be stored so that the programme will automatically complete the transactions in all subsequent imports.

Bank Statement Import Formats

In the dialogue for importing transactions you can choose between different file types:

- Import extensions for bank statements (the majority only with the Advanced plan)

These are additional programs that must be installed by the user and that convert the data to be imported in the formats foreseen by Banana Accounting Plus.

By using the Manage Extensions button you can install the extensions programmed for importing bank statements of different banks, credit cards and other formats.

Once the extension is installed it appears in the Extensions menu ready for import.- Bank statement Camt ISO 20022 Switzerland (Professional plan)

Reads the standard format made available by Swiss banks.

This extension also decodes the payment reference number, generated by the Invoice Layout CH10, and inserts the invoice or customer number. - Updated list of Banana Extensions for import.

- Bank statement Camt ISO 20022 Switzerland (Professional plan)

- Standard formats included in Banana Accounting Plus (Professional plan)

These are standard formats that banks make available and are included in Banana Accounting Plus:- MT 940 account statement

- Generic ISO 20022 Account Statement

Several banks in Europe make the account statement available in the standard ISO 20022 format.

- Generic format with Incoming and Outgoing Transactions TXT (Professional plan)

This is a text file of the CSV type, which uses the tabulator as a separator and presents the incoming and outgoing amounts of an account as columns.

File name

You indicate a file or even multiple files separated by a semicolon ";". You can also indicate a ZIP that contains multiple import files.

Import multiple files at the same time:

- If your bank provides daily camt053, you can select all the files for the month and import them in one step.

- If your bank provides a zip file, you can choose the file that contains all the statements.

The import files must, of course, be of the same type. You cannot import different formats together.

Import File Structure

The import file contains the typical movements of a bank statement:

- Date

- [transaction number] optional

- Description

- Incoming or outgoing amount.

When importing, the user indicates to which account the transactions are to be recorded, so that the Debit or Credit account is already created.

Import extensions can be created for any bank statement.

See Technical instructions for importing an Income and Expenses file.

Frequently asked questions:

I cannot see the format of my bank statement. What should I do?

Click onto Extensions menu > Manage Extensions... then on the Update Extensions button and enable the filter for the desired format.

I cannot see the format of the Postfinance xml statement (.tgz file). How can I import my movements?

This format is no longer supported. Please contact Postfinance and ask to receive your statement in ISO 20022 format.

I get the message "This ISO 20022 file does not contain a bank statement (camt.052/053/054)". How should I proceed?

This error message is displayed if the ISO 20022 file does not contain a bank statement. The ISO 20022 format is a generic format that can contain different types of information, such as bank statements and execution confirmations. In Banana Accounting Plus, it is only possible to import bank statements (camt.052/053/054).

My bank is not in the list of supported formats. Can it be added?

It is possible to create new extensions for formats that have not yet been implemented. Support for implementing custom formats is also available for a fee.

In eBanking (e.g. Raiffeisen Bank), when entering payments, you must choose the option 'individual order' instead of 'collective order'. Only in this way are payments imported as individual orders.

Scarica i tuoi movimenti bancari

Per poter mantenere la contabilità aziendale aggiornata, è fondamentale importare regolarmente i movimenti bancari. I movimenti permettono di automatizzare il processo di contabilizzazione, evitando l'inserimento manuale delle singole registrazioni ed eventuali errori.

Dove scaricare i movimenti

I documenti contenenti le transazioni bancarie, indipendentemente dalla modalità di acquisizione, dovrebbero essere sempre salvati nella stessa cartella. Questa può trovarsi all’interno della cartella principale della contabilità oppure in una esterna. Per una gestione ordinata, è consigliabile dare una struttura alla cartella creando sottocartelle tematiche: in questo modo si riduce il rischio di errori, soprattutto se in futuro si decide di importare i movimenti manualmente.

Mantenendo i dati sempre nella stessa posizione, si evitano problemi di importazione e non è necessario aggiornare ogni volta il percorso predefinito per l’importazione. Inoltre, è sconsigliato aprire e modificare questi file prima dell’importazione, poiché ciò può causare errori nel riconoscimento delle transazioni.

Diversi formati dei file con movimenti bancari

Il nostro software offre numerose estensioni che permettono di importare i dati contabili in diversi formati. Tra i formati più comuni troviamo CAMT, CSV e XLSX.

Il formato CAMT (Cash Management), definito dallo standard ISO 20022, è utilizzato dalle banche per fornire estratti conto elettronici in modo strutturato. I file contengono informazioni dettagliate come data, importo, descrizione e riferimenti di ogni transazione. Sono disponibili diverse tipologie di file CAMT:

- camt.052: estratto conto intraday (movimenti durante la giornata)

- camt.053: estratto conto di fine giornata

- camt.054: notifica di addebiti e accrediti con dettagli delle singole operazioni

Il formato CSV (Comma-Separated Values) è un file di testo che utilizza le virgole per separare i dati contenuti all'interno delle singole celle di una tabella. Questo formato è compatibile con la maggior parte dei software.

Il formato XLSX è un file di Microsoft Excel utilizzato per archiviare fogli di calcolo. Il file XLXS è in grado di contenere dati, formule, formattazioni, grafici e più fogli di lavoro all’interno dello stesso documento.

Di recente abbiamo sviluppato una nuova estensione che consente di importare i file CAMT di tutte le banche, rendendo l’acquisizione dei movimenti ancora più semplice e immediata.

Modalità per scaricare i movimenti

Le modalità principali per ottenere questi dati sono tre:

- L'online banking

- Il multibanking

- Il software della Mammut Soft Computing AG

A dipendenza della modalità adottata, bisogna prestare più o meno attenzione alla collocazione dei file. Lo scaricamento manuale dal portale bancario richiede maggiore attenzione.

Online banking

Il metodo manuale, tradizionale e più diffuso, prevede l’accesso diretto al portale di online banking della propria banca. Una volta effettuato il login, è possibile navigare alla sezione dedicata ai movimenti del conto e scaricare i file in uno dei formati standard compatibili con i software di contabilità.

Questo processo, seppur semplice, richiede un’interazione manuale: l’utente deve accedere alla piattaforma bancaria, selezionare il conto e scaricare e salvare i file sul proprio computer per poi importarli nel software contabile.

Multibanking

Il multibanking rappresenta un'evoluzione rispetto ai metodi manuali tradizionali, pensata per aziende o professionisti che gestiscono innumerevoli conti correnti distribuiti su banche diverse. Grazie a questa funzionalità, è possibile accedere a una sola piattaforma o interfaccia di e-banking che aggrega più conti, anche appartenenti a istituti differenti, semplificando così l’interazione con ciascuna banca. La maggior parte delle soluzioni multibanking si basa sullo standard internazionale EBICS (Electronic Banking Internet Communication Standard), che garantisce uno scambio sicuro di informazioni e ordini di pagamento tra le aziende e le banche.

Le principali fasi per l’implementazione del multibanking sono:

- Aggiornamento del contratto con la banca principale

Il primo passo consiste nel contattare la banca principale per richiedere l’attivazione del servizio multibanking. Sarà necessario sottoscrivere un’integrazione al contratto esistente, che autorizza la banca ad agire come gestore di più conti bancari. - Sottoscrizione dei mandati con le banche collegate

Per ogni banca terza che si desidera collegare, è necessario firmare un’autorizzazione che consenta alla banca principale di accedere alle informazioni dei conti corrispondenti. - Abilitazione tecnica e fornitura delle credenziali

Una volta completati i passaggi contrattuali, sarà necessario seguire le istruzioni tecniche per abilitare l’accesso tramite API o strumenti di terze parti. Questo potrà includere la fornitura delle credenziali o l’attivazione di specifiche modalità di autenticazione.

Una volta collegate tutte le relazioni bancarie, è possibile scaricare in modo centralizzato i movimenti e i dati bancari, ed elaborare le operazioni di pagamento da un unico strumento. Pur restando in parte un processo manuale, il multibanking consente di ottimizzare tempi e risorse, riducendo il numero di accessi e semplificando la gestione complessiva.

Software della Mammut Soft Computing AG

Una soluzione più moderna e completamente automatizzata è offerta dal software sviluppato dalla Mammut Soft Computing AG. Questo sistema, una volta implementato, permette di saltare completamente il passaggio manuale di download dei file bancari perché il salvataggio avviene automaticamente in una cartella stabilita durante l’implementazione.

Il software è focalizzato sulle interfacce di scambio dati tra le banche e le aziende, offrendo il collegamento a molteplici banche nel mondo e recuperando in modo sicuro e automatizzato i dati bancari nei formati necessari. Questi dati vengono poi sincronizzati automaticamente con il gestionale contabile, rendendo superfluo l'intervento dell’utente.

I passaggi da seguire per iniziare a utilizzare il software Mammut Soft Computing AG sono i seguenti:

- Scelta della soluzione

In base alle esigenze, si può optare per la soluzione in cloud o l’installazione on-premise, quest’ultima consiste nell’installazione fisica sui dispositivi dell'utente. - Configurazione delle connessioni bancarie

Per consentire la configurazione e l’attivazione del collegamento con le banche, è necessario sottoscrivere i relativi contratti bancari. Questi collegamenti con le banche (EBICS, SWIFT, API) permettono di scaricare estratti conto e inviare pagamenti. Mammut fornisce assistenza per l’attivazione presso le banche. - Autorizzazione per l'accesso ai conti

Il cliente, per il quale viene tenuta la contabilità, concede al fiduciario l’accesso ai propri dati, affinché tutte le informazioni necessarie siano disponibili. - Integrazione con il software contabile/gestionale

Il software viene collegato al sistema contabile o gestionale interno per l’esportazione e l’importazione automatica dei dati bancari.

Il vero valore aggiunto del software è il costante aggiornamento della contabilità: download automatizzati da tutte le banche e sincronizzazione diretta con il sistema contabile assicurano che i dati siano sempre aggiornati e pronti all’uso.

Importazione e contabilizzazione automatizzata

Una volta che abbiamo a disposizione i movimenti, è possibile usufruire delle diverse funzionalità offerte da Banana. Qualsiasi sia la modalità stabilita per lo scaricamento dei dati bancari, la funzione “Importa movimenti bancari in formato ISO 20022 (avanzato) [BETA]” permette di automatizzare l’aggiornamento della contabilità in modalità partita doppia o entrate/uscite sfruttando i file CAMT (052/053/054). Il programma legge i file XML da una cartella designata, li salva in un database locale, identifica le transazioni nuove non ancora registrate e le propone per l’importazione, evitando duplicati.

I movimenti bancari, una volta importati, grazie alle nostre regole di completamento automatico (piano Advanced) vengono trasformati automaticamente in operazioni contabili complete, risparmiando tempo ed evitando errori di inserimento. In questo modo la contabilità viene effettuata in maniera più veloce, efficiente ed accurata.

Import Transactions dialog

The dialogue Import transactions is activated from the menu:

Dialogue contents

The display of dialogue elements depends on the type of file being imported:

- Single account transactions and bank statements

All elements are displayed. - Double-entry accounting transactions or others

The following elements are not displayed:- Account

- Temporary contra account

- Apply rules.

- Grouping by invoice

This element is only displayed if there is content in the import file in the DocInvoice column.

Import Transactions dialogue

This is followed by the dialogue box that allows the data to be integrated into the accounts.

Destination account

This option appears when data is imported from a bank or postal statement or the entry and exit transactions of an account in text format.

- Enter the bank account number of your chart of accounts, relative to the imported statement.

- If it is left blank, the programme enters account [A] (Account) so that you can tell whether it is a Debit or a Credit movement.

Select transactions

Start date, End date

Insert the start and end dates of the period related to the transfer of the transactions. The period can also be selected automatically in the boxes under the dates area.

Don't import if exists same External reference, Date, Amount

If activated, this option allows the user to not import already entered transactions, in order to avoid recording transactions twice. This option can only be activated when the column "ExternalRef" is present in the transactions that are going to be imported. If not, this option will be deactivated.

Sort by date

The option is active by default and allows you to have the imported transactions sorted by date.

Complete the transactions with

Autocomplete values

The option is only necessary for accounting with VAT/Sales tax and multi-currency. If activated, it allows the automatic completion of values that are missing in the imported data (for example, the exchange rate in the Exchange rate table).

Apply Rules (Advanced plan only)

The option is not available for imports of transactions from double-entry accounting files (.ac2 format).

See: Rules for transactions auto-completion.

- If this option is activated, when you confirm with OK, the Apply Rules dialogue opens.

- If you have not activated this option, you can also access the Rules by issuing the command from the menu Actions → Recurring transactions→ Apply rules...

- This option is activated by default if there are already import rules in the Recurring Transactions table.

Temporary contra account

The option is not available for imports of transactions from double-entry accounting files (.ac2 format).

A temporary account needs to be indicated to complete the contra account of the entry. The account must then be replaced with the correct contra-account, either manually or with the auto-completion rules.

The programme suggests the commented account [CA] (ContraAccount) by default.

Once the entries have been completed, there should be no more transactions using the temporary account.

Initial document number

The option is not available for imports of transactions from double-entry accounting files (.ac2 format).

This is the document number that is allocated to the first record among those imported.

The number is incremented.

Group transactions by invoice number

If the import file contains values in the DocInvoice column, the dialogue will also contain the following options:

- Group transactions by invoice number

In this case, the rows of the same invoice are being grouped in such a way that there is only one transaction for the same account and the same VAT code. Please check the explanation Import invoice data.

- Destination account for balance differences

When VAT codes are being applied, there may be rounding differences of just a few cents.

In this case, Banana Accounting Plus creates an additional transaction for every invoice into which this difference can be recorded.

Of course, it is necessary to pay attention that the data to be imported obtain a balance between debit and credit. If not, the transaction row will contain the difference between Debit and Credit.

Editing of imported transactions

The programme creates transactions and adds them to the end of the Transactions table.

The transactions can be edited or deleted.

In double-entry accounting, in the DebitAccount and CreditAccount columns and in Income/Expenses accounting, in the Account and Category columns, the programme inserts symbols.

The symbols must be replaced with the appropriate account or category.

- [A]

This symbol is shown if no account is indicated in the dialogue.

Instead of the symbol [A], the account of the bank account is to be entered. - [CA]

This symbol indicates that the contra account must be entered in the cell so that Debit transactions offset Credit transactions.

For rows with only one contra account, both the account or symbol [A] and the counterpart symbol [CA] will be on the same row.

For rows with several contra accounts (transactions on multiple rows), each row will have the account or contra account symbol [CA]. If the symbol [CA] were not indicated, it would be impossible to tell whether the movement is a Debit or a Credit movement.

Import file ISO20022

Banana Accounting Plus allows the import of bank transactions in various formats.

The ISO 20022 format is an international standard that should now be provided by all European banks. This format may also be called ISO xml, xml, camt.053, camt.054 or other names. Importing bank transactions in ISO 20022 format is possible in two ways:

Generic manual ISO20022 import

Manual import of transactions one file at a time - available with the Professional plan.

- The user downloads the ISO 20022 file from their bank and saves it in a folder on their computer.

- Then, from Banana, they manually import this file.

This import is made possible by the extension Bank Statement Camt ISO 20022 Switzerland (Banana+) for Switzerland and a generic filter distributed with the application for other countries.

The import must be repeated manually each time.

Advanced ISO20022 import [Beta]

Advanced import of transactions from multiple files simultaneously - available with the Advanced plan.

It significantly speeds up the workflow because the user no longer needs to check for which periods transactions need to be imported.

- The user defines a folder containing ISO 20022 files from different bank accounts.

- In Banana, with a command, the program notifies if there are new transactions to be imported.

This new advanced import function is made possible by the extension Swiss Camt ISO20022 Reader.

Requirements

- Use of Banana Accounting Dev-Channel with the Advanced plan.

- Use of a Double-entry accounting or Income & Expenses system.

Import bank transactions in the ISO20022 format (generic)

Banana Accounting Plus allows the import of bank transactions in different formats.

The ISO 20022 format is an international standard for the transmission of financial data that should by now be available to all European banks. This format can also be referred to as ISO xml, xml, camt.053, camt.054, and others. For some banks, the ISO 20022 format may not be available by default but needs to be requested. The ISO 20022 format replaces the old MT940 standard.

By importing bank data with the ISO20022 format, Banana Accounting Plus also allows you to automatically close open invoices of customers.

The CAMT category regroups the formats used for the account statement, reporting of account transactions and account balance confirmation:

- camt052: Account Reporting

- camt053 (including version 4): Account Statement

- camt054: Credit / Debit Notification

Preview the ISO-20022 file

Banana. offers the possibility to preview contents of a camt file.

Data importing into the current accounting

Proceed as indicated from the menu Actions > Import into accounting.

Compressed files can also be opened with this function. In this case, the program will prompt the user to select the file from which to import the data of the compressed file.

Technical notes on converting ISO 20022 files

Banana, when reading the file, tries to adapt itself to the ways in which the ISO 20022 file has been prearranged.

- As opening balance, it reads similar encodings

- As closing balance, it reads similar encodings

- All contents are read and converted into transactions

- Transaction date (Date)

- Currency date

- Transaction amount (positive or negative)

- Description

For the time being Banana Accounting displays the different descriptions as a single text. In the future, it will be possible to extract this information on a distinctive basis and indicate the columns where to allocate data. - Distinction between single transactions or transactions with details

For transactions with details, there is a row for the total and separate rows for each single transaction that constitutes the total.

Country specifications

Each country and/or bank has the possibility to insert additional information in the ISO 20022 file according to its needs. Banana Accounting Plus offers a generic filter distributed with the application and multiple country- and/or bank-specific filters distributed as Banana Extensions. To import this additional information into your accounting, you must install and use the filter that is most specific to your country and/or bank (for example Bank statement Camt ISO 20022 Switzerland (Banana+)).

Import bank transactions in the ISO20022 format (advanced) [BETA]

This new feature allows you to update your accounting by automatically importing bank transactions from Camt files (052, 053, 054). Thanks to this innovation, you can:

- Accelerate the entire transaction recording process.

- Reduce the risk of manual errors.

- Avoid duplicates, since only transactions not yet present in your accounting are imported.

The program reads the Camt files from a selected folder, saves their content in a local database, and detects any new transactions not yet recorded. These are then proposed for import into your accounting, greatly simplifying financial management. Once imported, you can leverage auto-completion rules to further streamline your work.

This feature is currently in BETA version, available for experimental use with Banana Accounting Plus (Advanced plan) in double-entry or income & expense accounting. We welcome any suggestions and feedback to improve it.

Prerequisites

- Use Banana accounting Dev-Channel with the Advanced plan.

- Use a Double-Entry or Income & Expense accounting file.

Data Preparation

Before starting the import, make sure you meet the following requirements:

- Organizing Camt Files:

Create a dedicated folder containing all the Camt (*.xml) files you want to import into your accounting.

You can organize the files within the folder as you prefer, for example, by accounting year or by financial institution. - Access Permissions:

Ensure that the selected folder is both readable and writable by the program. This guarantees the proper saving of data and import information. - Setting IBANs:

For each account in the accounting file, make sure you have entered the IBAN in the 'BankIban' column of the 'Accounts' table.- If the column is not present, add it through the menu: Tools → Add/Remove functionality → Add address columns to the Accounts table.

- Write the IBAN in uppercase, without spaces or special characters.

- Swiss Camt ISO20022 Reader Extension:

Install the Swiss Camt ISO20022 Reader extension. This is required for the program to correctly interpret Camt files and start the import process.

First Use

The first time you use the "Import bank transactions (Camt ISO20022)" command, available under the Actions menu, the program will ask you to select the folder containing the Camt files. This choice will be saved, so that for subsequent imports the program will automatically use the same folder without asking for the path again.

Note that the first execution may take longer. The program must read, process, and save all the files in the folder, and it analyzes the content of each file. During this phase, a progress bar will display the current status of the operation, indicating both the percentage of completion and the number of files processed out of the total. The same progress indicator is shown both during the reading of the files from the folder and during the opening and reading of their contents.

On subsequent imports, the process will be much faster since the program will read and import only the content of new files, already knowing which data has been previously saved in the database. This way, future operations require significantly less time and ensure a smoother, more efficient workflow.

File Processing

The processing of Camt files occurs in two distinct phases:

- Reading Files in the Folder:

In the first phase, the program analyzes the selected folder and identifies all the files present, adding them to the internal database. During this process, a progress bar is displayed, indicating how much of the file reading has been completed compared to the total number of files. - Reading the Content of the Files:

Once file reading is completed, the program moves on to the second phase, in which it opens the files saved in the database, reads their content, and processes the data. In this phase, a dedicated progress bar is also shown, clearly displaying the percentage of completion and the number of files processed.

If, for any reason, one of these processes is interrupted, the program retains the data already saved. On the next import execution, it will automatically resume from where it left off, without having to start over. This ensures an efficient workflow and avoids repeating already completed processing steps.

Bank Transactions Import Dialog

The import dialog provides an overview of the processed files, the parameters used, and the transactions to be imported. You can modify the parameters in the dialog at any time, and the data will be recalculated immediately.

Folder Tab

The “Folder” tab provides a general overview of the import, showing the currently selected folder, the files to be processed, and some options to filter the content.

- Select Folder:

Here you can view and modify the working folder path. The program constantly checks the validity of the selected path and, if the folder does not exist or is not accessible, it displays an error. - Renaming or Moving the Folder:

If you change the folder’s name or location, remember to update the path in this dialog. The program stores the last used path and, if it cannot find it, will show a warning. - Renaming Files in the Folder:

You can freely rename the files in the folder; the program does not rely on the file name but on its content. Even if two files have different names but identical content, the program considers them duplicates and will only import one of them. - Ignore Subfolders:

By default, this option is enabled, allowing you to exclude the files located in subfolders. This is useful if, for example, you only want to import files relevant to the current accounting period, avoiding older or irrelevant data. If you disable this option, all Camt files in subdirectories will be included in the database, regardless of date or file organization. - Ignore Files Older Than...:

If you set a date in this field, the program will not read the content of files older than that date. By default, files older than the accounting opening date are saved in the database but not analyzed. Adjusting this date allows you to further refine the time filter. If you enter an invalid date, the program automatically replaces it with the current date. - Read All Files:

Clicking this button forces the immediate re-reading of all files in the folder instead of waiting for the normal daily check. This function is especially useful when you add new files and want to import them right away, without waiting for the next automatic update.

Bank Accounts Tab

The “Bank Accounts” tab provides a detailed overview of all the bank accounts present in your accounting. For each account, the program shows both static information (such as the current balance in your accounting) and dynamic data, updated based on the latest imports.

Information Displayed for Each Account

- Accounting Balance:

Shows the current amount recorded in the accounting for that account. - Last Bank Balance:

Displays the most recent bank balance detected directly from the Camt files. This lets you instantly compare the figure in your accounting with the actual bank amount. - New Transactions:

Indicates how many new movements, not yet recorded in accounting, have been detected in the Camt files. - Total New Transactions:

Shows the total monetary value of the new transactions to be imported for that account, helping you quickly assess the volume of pending operations. - Last Import:

Indicates the date when the folder was last fully read, providing a useful time reference for when the last update occurred. - Status:

- Updated: There are no new movements to import for this account.

- New transactions: Unrecorded movements have been found, ready to be imported into the accounting.

Transaction Details Tab

In the “Transaction Details” tab, you will find all the banking operations identified in the Camt files that are not yet imported into the accounting, organized by account. This view allows you to quickly analyze pending movements, verify their relevance, and select which ones to import.

- Selecting Transactions to Import:

You can temporarily exclude specific transactions or, if you prefer, all those related to a particular account using the provided checkboxes. Excluded transactions are not permanently removed; they will be proposed again the next time you open the dialog, allowing you to reassess their import at any time. Currently, it’s not possible to permanently exclude a transaction. - Consider Only Transactions Starting from a Specific Date:

To reduce the number of displayed movements, you can set a date from which to consider new transactions for import. By default, the program uses the accounting start date. By setting a different date, it will only display operations occurring after that day, ignoring previous ones. This function is particularly useful if, in the past, transactions were imported without a unique ID (ExternalReference column), typically when importing from CSV files. In these cases, simply set a date after the last recorded transaction to avoid re-proposing older movements. If you enter an invalid date, the program automatically replaces it with the current date. - Unique Identification of Transactions:

Transactions from Camt files (052, 053, 054) should always include a unique ID as required by the ISO20022 standard. This identifier enables the program to accurately detect which movements have already been imported and which are new, reducing the risk of duplicates or errors.

Settings Tab

Settings Tab

In the “Settings” tab, you can manage some advanced aspects of the import process, including the possibility to restore the initial data state and define how to recognize already processed files.

- Delete Saved Data:

This function allows you to delete all data related to previous imports stored in the internal database. Once deletion is confirmed, you will be automatically redirected to the “Folder” tab, where the default values will be restored.- New Import: If you want to perform a new import after deleting the data, simply click on the “Read all files” button.

- Limited Impact on Import Data: Deleting data from the internal database does not affect any information already present in the accounting.

- Complete Database Removal: The command here only clears the database tables. If you want to completely remove the database, you must manually delete the “*.db” file in the selected folder.

- Always Verify the Existence of Files Using Hashing:

This option allows you to choose how the program identifies already processed files:- Hashing (slower): If you select this option, the program will compute a unique hash for each file, ensuring accurate duplicate detection even if names or paths change. However, this method can slow down file reading.

- Check Name, Date, and Size (default): If the checkbox is not selected, the program simply compares the file name (including path), creation date, and file size to determine uniqueness. This approach is faster but may not be as robust in scenarios where files are renamed while retaining the same content.

Database File

The program uses an SQLite database to store import-related data. The first time you activate this function, if the selected folder is valid, a database file (*.db) will be created in it.

It is important not to move or delete this file, as the program uses it as a reference for all subsequent operations. In case of loss or deletion, the program will generate a new .db file, forcing you to re-read and re-process all the files in the folder.

What is Saved in the Database?

- File List:

All the files detected in the folder are saved. If you have chosen to ignore subfolders in the settings, the files they contain will not be saved. This option is enabled by default. - Bank Accounts and Related Data:

The database stores information about the bank accounts present in the accounting. If these data are modified in the accounting file, the database updates them accordingly. - Imported Transactions:

Transactions found in the opened and read files are saved in the database, allowing you to reprocess or view them later without having to re-read the files. - Import History:

The program records who performed the import operations, when they were executed, and with which software version, providing a detailed historical trace of activities.

Log File

During the import process, the program generates a log file to help identify and diagnose potential issues. In case of anomalies or unexpected behavior, the log file provides detailed information about the operations performed, aiding developers in understanding the source of the error.

If you need assistance locating or interpreting the log file, contact our support team: they will guide you step-by-step to find the file within your active directory.

Troubleshooting

If no transactions are displayed for import despite having selected the correct folder, check the following:

- Bank Accounts: Make sure that the data related to bank accounts (including IBANs) in the “Accounts” table is complete and correct.

- Accounting Period: Check that the currently set accounting period includes the dates of the transactions you want to import. If the transactions fall outside the defined period, the program will not propose them for import.

If the problem persists after these checks, contact our technical support for further assistance.

Import transactions (generic)

The following explanation refers to the import of data into the Transactions table from files containing transactions of the double-entry type, from Banana Accounting, or other formats.

The Import of bank transactions is similar to importing transactions, but is dealt with separately in detail on the appropriate page.

Import procedure

- Via Actions in the menu > Import to accounting > In the Import box, select Transactions

- Choose the file type from which to import

See explanation below. - With the Browse button, choose the file from which to import the transactions

- Set the parameters as required.

See also: Import into accounting

Once OK is confirmed, the data are read and the following dialogue is displayed:

- Import transactions dialogue.

Where instructions must be given for the completion of the imported rows.

Importing from other Banana Accounting files

In the type of file to be imported, the programme provides a number of configurations to import data from other Banana Accounting files:

- To import transactions from an Income & Expenses accounting file (*ac2)

In order to import transactions from an Income & Expenses accounting file into a double-entry accounting file, it is necessary that the categories of the Income & Expenses file correspond to the accounts of the double-entry accounting file. - To import Cash book transactions (*ac2)

See the specific page Import Cash book transactions. - To import Double-entry accounting transactions (*ac2)

In order to import transactions from a double-entry accounting file into another double-entry accounting file, it is necessary that the accounts correspond. - To Import Fixed Asset register

Imports transactions from the Fixed Asset register .ac2 file.

Import TXT/CSV files

This format must be used to export data from another programs, which provides an export format compatible with that required by Banana Accounting. See the information at the following link:

Importing account statements with import extensions

Import Extensions are additional programs that must be installed by the user and convert the data for import into Banana Accounting.

There are extensions for importing bank statements from various banks, credit cards and other formats.

These extensions only work with the Advanced plan. All old filters will be updated over time and the new versions will only be usable for those with the Advanced plan.

Search for and install an extension:

Search and install an extension:

- Click on Manage Extensions

- Choose Import.

- Navigate to the desired extension and click onto Install.

- If the Settings button appears, it means that this extension has parameters that you can customise.

Once the extension is installed, it appears in the list of available types, directly in the Extensions menu, and you can choose it for import.

Import data from a Cash book file

Cash movements can be managed separately from the main accounting file via the Cash Manager. On a regular basis, the movements are imported into the main accounting file, grouping them according to a chosen period.

In this case you have two separate files:

- One file contains all the general accounting data (including the cash account).

- A file contains only the cash register data.

In order to integrate the cash data into the main accounting, a link must be established between the main accounting and the Cash Manager file.

There are two different ways to create the link:

- In the Cash Manager file, give the categories the same numbers as the accounts of the main accounting (double-entry accounting or Income / Expense).

- Enter the corresponding accounts of the main accounting file in the Category2 column (Categories table).

If the Category2 column is not present, it must be displayed via Data → Columns setup.

Set up the internal transfer account

When importing the cash data into the accounting file, certain settings are required so that there are no overlaps of accounting entries for payment operations between the cash account of the main accounting and the transactions imported from the Cash Manager file.

In the Main accounting file:

- In the Accounts table, enter the Internal transfer account.

In the Cash Manager file:

- In the Categories table, Categories column in the Revenue group, enter the internal transfer account (the same number set in the main accounting) as a category for payments from the bank or postal current account.

- Alternatively, in the Categories table, Categories2 column in the Revenue group, enter the internal transfer account. In this case, a category is set in the Categories column to determine payments from the bank. The internal transfer account, located in the Categories2 column, creates the link when you import the transactions into the main ledger.

Payments from the bank account to cash account

Whenever a payment is made from the bank account to the cash desk, the movement is recorded both in the main accounting file and in the cash register file. To avoid overlapping of accounting entries when importing data from the cash desk, the internal transfer account account is used

- The receipt of funds is recorded in the cash register file, using the tour account as category or alternatively the category for payments from the bank account, if the tour account has been set in the Category2 column.

- The outflow of funds is recorded in the main accounting file, with the bank account in credit and the internal transfer account in debit.

When importing the cash register data into the main accounting file, the tour account is reset.

Import the cash register data

- Open the main accounting file

- Click Action→ Import to accounting

- In the window that appears, from the drop-down menu Import → select Transactions → Cash book movements (* .ac2) "

- Using the Browse button, select the Cash Manager file.

The explanations of this window are available at the page Import to accounting.

In accounting

Destination account

You must select the cash account number, present in Double-entry accounting or Income / Expense accounting, where the movements are to be imported.

Initial document number

An initial document number can be entered which will be attributed to the first imported transaction. In subsequent recordings, the program automatically assigns a progressive number, starting from the initial one entered.

If you do not wish to assign progressive numbering automatically, leave the box empty.

Select movements

Start date / End date (inclusive)

Enter the start and end date of the period to which the imported transactions refer.

Group transactions

By activating one of the options it is possible to choose how the movements of the period should be grouped:

- No period groupingAll rows are imported with their column contents. The Doc number present in the corresponding column of the cash register file is also imported.

- If you want to use a different numbering in the accounting and simultaneously keep the original document of the file, in the Cash Manager insert the document in the DocProtocol column.

- Monthly - groups the transactions by month.

- Quarterly - groups movements by quarter.

- Semi-annual - groups the movements by semester.

- Annual - groups the transactions by year.

One registration per account

If several categories are grouped into a single account in the accounting, but separate transactions are desired for each category, this box must be activated; the program creates recordings for each category. When using VAT codes, postings are created not only by category, but also by different VAT codes for the same category.

Note

When you have an accounting with VAT, the VAT calculations may be slightly different. If the transaction amounts are entered net, the cash account balance may also differ due to rounding differences.

The accounting file is updated with the cash register data.

Import transactions from Paypal

On the page Web filter for PayPal transactions you will find the information about the new feature that makes it possible to import all the Paypal transactions directly into Banana Accounting and the instructions on how to proceed (see below).

We have also prepared specific predefined templates for double-entry or multi-currency accounting that you can look at as an example or use as a separate accounting file just for the accounting transactions from Paypal.

More information about all types of import filters can be found on the Import filters page.

- Banana extension for importing Paypal transactions - how to proceed

- examples for the Double-entry accounting

- examples for the Multi-currency accounting

Learn more

- Double-entry accounting

- Multi-currency accounting

- Import filters - complete list

Import accounts

This command imports the accounts from a Double-entry or Income & Expenses file (*.ac2) or a text file (*.txt), and integrates them automatically in the existing Chart of accounts.

To import accounts from another file, proceed as follows:

- Via Action → Import to accounting → select Accounts in the Import box.

- Select the * .ac2 or text file type to import the accounts.

- With the Browse button, choose the file where you want to import the Accounts to imported from.

Accounts or categories can be included in current accounting by activating the following options:

Options

Include Cost Centers

When there are cost centers, these will also be carried forward.

Add new accounts

When this option is activated, all new accounts are added to the accounting plan.

Replace text description

If already existing accounts are imported, but with different descriptions, the existing descriptions are replaced by the imported ones when this option is activated.

Replace opening balance

If already existing accounts are imported with different opening balances, the existing opening balances are replaced by the imported ones when this option is activated.

Import VAT codes

This function is only available in the Accounting with VAT management, and allows the user to Import VAT codes from:

- Other accounting files (*.ac2)

- A text file with column headers (text file *.txt)

Import from an accounting file

If you manage several accounts and use customised VAT codes, you can prepare the VAT code table and then import it into your other files.

- Prepare the VAT Codes table in your accounting file.

- Command Actions > Import to Accounting > VAT Codes

- Choose the name of the file containing the updated VAT Codes table.

- Choose replace all rows.

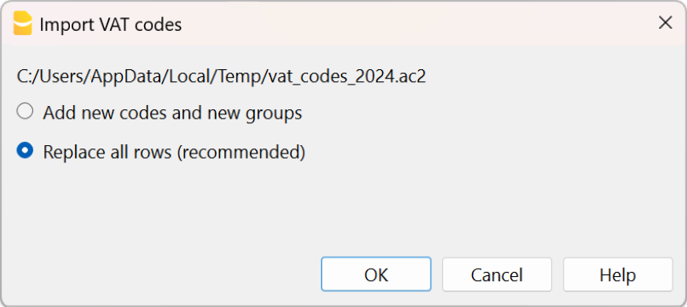

VAT Code Import Options

When importing from another file, several options are available.

Add new codes and groups

If this option is chosen, new codes are added and existing codes are retained.

Replace all lines

If this option is chosen, all existing VAT codes are replaced with the imported VAT codes.

VAT account not found message

If the message VAT account not found appears, the VAT account must be entered automatically in the menu File > File properties > VAT /Sales tax section.

Importing Predefined Swiss VAT Codes

This procedure shows how to import VAT codes from the model with the default VAT Codes 2024, which contain both the 2024 (VAT 8.1%) and 2018 (VAT 7.7%) rates.

See also page Swiss VAT Codes

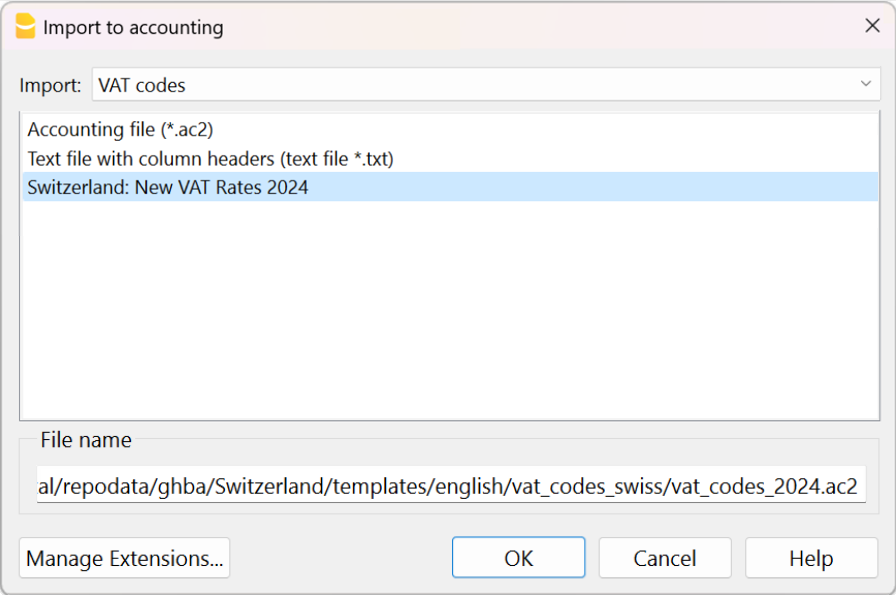

In order to import VAT Codes, please proceed as follows:

- Click Actions > Import into accounting command.

- Select VAT Codes.

- Select Switzerland new VAT Rates: in the lower field the file containing the new VAT Codes 2024 will be automatically displayed.

In the case of VAT codes of another country, you must select the file containing the VAT codes in force according to your country. - Confirm by clicking on OK

- The following window will display

VAT Management Documentation

For more information see the VAT Management page.

Import file

To import data from a Banana Accounting File, proceed as follows:

- From the Actions→ Import to accounting menu → select File in the Import box .

- Select the * .ac2 file type to import the data.

- With the Browse button, choose the file from where you want to import the data.

The below dialogue box will be displayed with several options that allow you to determine which data to import from the file.

Source file

This is the file from the which the data are being taken.

Destination file

The file that is to receive the data.

Options

Import transactions

All the rows of the Transactions table, present in the source file, will be imported.

Import recurring transactions

All the rows of the Recurring Transactions table, present in the source file, will be imported

Import budget transactions

All the rows of the Budget table, present in the source file, will be imported.

Replace amounts in Account table

The amounts of the Opening, Budget and Previous columns of the Accounts table of the destination file are being deleted and replaced with the amounts that are present in the source file.

The accounts need to correspond, thanks to the same account numbers, or when there is a replacement, in that case the option Convert account numbers should be used.

Replace accounting properties (basic data)

The File and accounting properties of the destination file will be replaced by the ones of the source file.

Convert account numbers

Using this function, the imported account numbers will be replaced with those indicated in the alternative column.

If you use this function, you must also specify the column that contains the account numbers to be used in the import instead of the existing ones.

Next to the account number column, there should be a column that indicates the alternative number to be used when importing. If no alternative number is specified, the original account number of the source file will be used.

- The account matches are in the source file

This option is to be used when for example you keep an accounting file in a country, with a specific number system, and then you need to regularly import your transactions in a different accounting file, that uses a chart of accounts with a different numbering system.- You need to add a new text column in the accounting plan (Columns setup command)

- For each account, indicate the destination account number in the table.

- The account matches are in the destination file

This option is used when for example you want to switch to a chart of accounts with a new numbering and grouping- You create a new accounting file with the new chart of accounts.

- In the chart of accounts, you create a new column where you indicate the account matches (Columns setup command).

- In this column, indicate the account numbers of the source file.

Separate the accounts with a semi-colon "1000;1001" to indicate that several accounts need to be grouped into this account.

- Column containing the account matches (Accounts table)

Indicate a column of the chart of accounts that has been added by the user and that contains the account matches.

This option is used when switching from one chart of accounts to another, and when you need to convert accounts from one numbering to another.

For more information on converting the chart of accounts, see the page transfer data to a new accounting plan.

Results and possible errors

The program will have carried forward all the data of the previous accounting, converting the account numbers.

In case the program indicates errors (absence of accounts or other), it might very well be necessary to cancel the import operation, complete the account matches and repeat the import operation.

The program, finding different charts of accounts, cannot automatically execute extended check-ups to make sure that all the data have been imported and grouped correctly.

It is therefore advised to check the result manually, verifying that the totals of the Balance sheet and the Profit and Loss statement are indeed correct.

Advanced import options

For different and more complex and automated conversion needs, we suggest to use the scripts, that allow a total customization of the conversion and the import.

Import exchange rates

This option is only present in Double-entry accounting with multi-currencies.

It lets the user import the exchange rates from another file.

How to proceed:

- From the Actions→ Import to accounting → menu select Exchange rates. in the Import box

- Select the file type * .ac2 of the exchange history or the text file:

- With the Browse button, choose the file from where you want to import the data.

Note: Exchange rate history files only show the Foreign exchange rate table and keep a record of past exchange rates.

A box with the following options are displayed:

Select date

The window lists dates with recently used changes. If you select a date, the program resumes the changes used on that specific date.

Substitute exchange rates

If you activate this option, all the exchange rate rows are replaced in the exchange rate table with the imported ones.

Add rows

If you activate this option, only the exchange rate rows that have different values are updated in the exchange rate table.