In this article

This function is only available in the Accounting with VAT management, and allows the user to Import VAT codes from:

- Other accounting files (*.ac2)

- A text file with column headers (text file *.txt)

Import from an accounting file

If you manage several accounts and use customised VAT codes, you can prepare the VAT code table and then import it into your other files.

- Prepare the VAT Codes table in your accounting file.

- Command Actions > Import to Accounting > VAT Codes

- Choose the name of the file containing the updated VAT Codes table.

- Choose replace all rows.

VAT Code Import Options

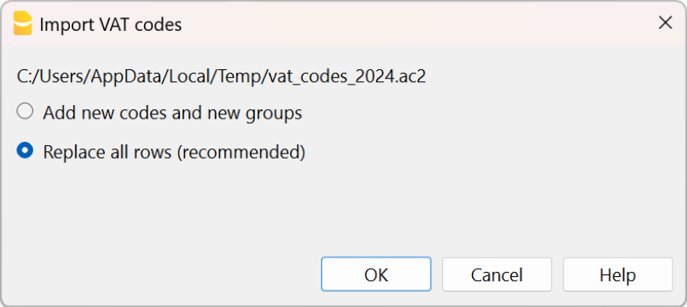

When importing from another file, several options are available.

Add new codes and groups

If this option is chosen, new codes are added and existing codes are retained.

Replace all lines

If this option is chosen, all existing VAT codes are replaced with the imported VAT codes.

VAT account not found message

If the message VAT account not found appears, the VAT account must be entered automatically in the menu File > File properties > VAT /Sales tax section.

Importing Predefined Swiss VAT Codes

This procedure shows how to import VAT codes from the model with the default VAT Codes 2024, which contain both the 2024 (VAT 8.1%) and 2018 (VAT 7.7%) rates.

See also page Swiss VAT Codes

In order to import VAT Codes, please proceed as follows:

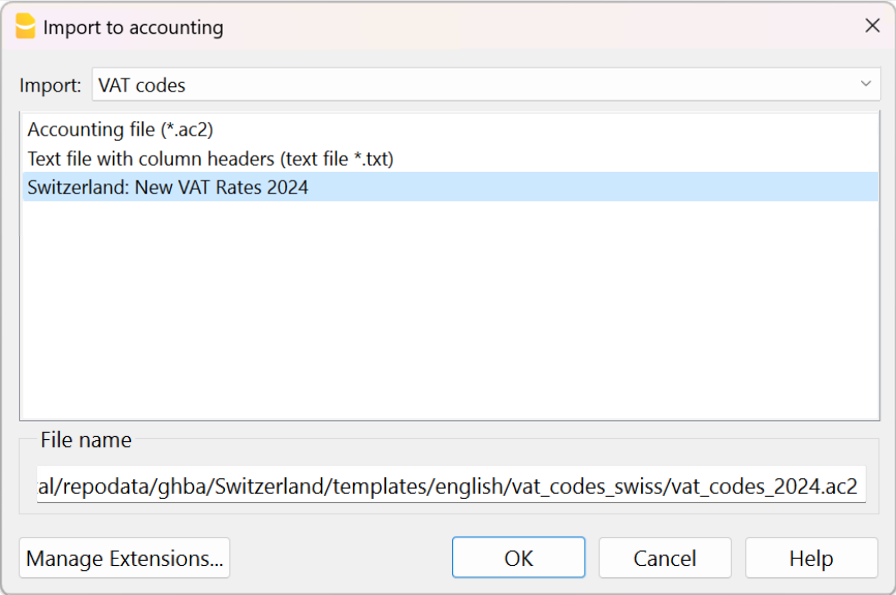

- Click Actions > Import into accounting command.

- Select VAT Codes.

- Select Switzerland new VAT Rates: in the lower field the file containing the new VAT Codes 2024 will be automatically displayed.

In the case of VAT codes of another country, you must select the file containing the VAT codes in force according to your country. - Confirm by clicking on OK

- The following window will display

VAT Management Documentation

For more information see the VAT Management page.