In this article

The planning system based on the double-entry method allows you to prepare forecasts indicating when the operation will take place.

Unlike Excel, where you set up a sheet with the columns for the forecast periods (month, quarter or year), with Banana Accounting you simply indicate the expected date for the event. The assignment to a period is generated automatically by the program when it processes the data. You can decide to display forecasts by day, week, month, 2 months, quarter, semester, annual, 2, 5 or 10 years.

- Forecasts can be made for one or more years.

- Based on the data entered, the program calculates the liquidity, Balance Sheet and Income statement projections for the period in question.

- Daily forecasts can be obtained, particularly useful for liquidity, or even by month or year.

See Prints and financial forecast reports.

Accounting, planning and forecasting period

Accounting or forecasting is always relevant to a period. The following periods are differentiated:

- Accounting period

This is the one defined in the file properties, with start and end date.

Generally, it will be the same as the calendar year, but it can have any start and end date. - Planning period

The period for which the planning data is entered.- The schedule does not require a planning period to be set.

- It is generally assumed that it is the same as the accounting period.

- The planning period may be different from the accounting period. In the Budget table, rows are inserted which take effect beyond the accounting period.

- Transactions with dates outside the accounting period.

- Repetitive transactions without an end date or with an end date that is beyond the the accounting period.

- Forecast period

The period used by the program to calculate the forecast.- It is indicated when a print is requested.

- Use the accounting period as default.

- It can be set freely and in this way forecasts can be obtained for several years and even for several decades.

- The accounting period is used as the Forecast period for the calculation of the content of the Total column in the Budget table and of the Budget column of the Accounts and Categories tables.

- These values therefore refer to the accounting period defined in the file properties.

- If you change the accounting start and end date, the forecasts are recalculated.

- It is indicated when a print is requested.

Forecast with monthly logic

Forecast movements are entered in the Budget table indicating the date on which these are expected to occur. For the purpose of liquidity forecasting, it is important to indicate dates for revenues and costs as precisely as possible.

For all other income and expenses that occur on a day of the month or rather at the beginning or the end, such as rent, wages, bank charges and other expenses or income, it is important to indicate by selecting the day close to the actual day of payment.

For other revenues and expenses, approximations will be made. For example - except in special cases - for restaurant revenues, which come in daily, it is not adequate to make day-to-day forecasts. In this case it is sufficient to indicate the overall sales that are expected to occur in the month. We recommend to indicate day 15, the middle of the month.

Forecast for the current year

Movements with or without repetition are inserted in the Budget table.

The calculation of the forecast is generally generated, taking into account the movements that fall within the current accounting period, as defined in the file properties.

- The total amount for the current period is indicated in the Total column of the Budget table.

- The estimate balance for the current period is indicated in the Budget column of the Accounts and Categories table.

- In the various printouts, if it is indicated as the All period, there are forecasts for the current period.

If the file is also used to keep the accounting, the accounting period must obviously be the one referring to the accounting. Even when the file is used for forecasts only, it is better to set the accounting period referring to only one year. In fact, if a period of two years is entered in the base data, the values of the forecasts, in the Total and Accounts column, will be for the two years. This can lead to confusing values.

Forecasts over several years

If you insert the forecast movements with a repetition code, the program is able to prepare forecasts that extend beyond the defined period.

To obtain forecasts over several years, the movements are entered in the Budget table.

- Opening balances

- These are inserted in the Accounts table.

- Forecast movements prior to the accounting period.

- For special cases, it is also possible to insert transactions with dates prior to the accounting period.

- Attention must be paid, because these operations will change the balances at the time of opening.

- For these transactions, the Total column will be empty because it is outside the accounting period.

- Forecast movements for the accounting period.

- Movements are indicated with the date falling within the accounting period.

- If there are operations that will also repeat in the following years, the annual repetition code must be set to "Y".

- If the repetition of the operation occurs during several years, indicate the number of years before the Y, i.e. for every 2 years indicate "2Y", 5 years "5Y", 10 years "10Y".

- If the repetition does not extend beyond a set date (for example the payment of a lease), the end date must be indicated.

- Forecast movements for the following years.

- The future date, on which the transaction is expected is indicated.

- The repeat code and the end date can be indicated.

- For these transactions, the Total column will remain empty because they are outside the accounting period.

Use of formulas

The formulas allow you to automate amortization and interest calculations. When an investment increases, the income statement is also immediately updated. Formulas are especially useful when making forecasts over multiple years.

You can use the formulas to automatically adjust the amount in the repeat rows .

- The calculation of depreciation can be based on the balance of the fixed assets account.

- Interest can be calculated directly on the bank account movements.

- You can determine a sales progression.

- Purchases can be defined as a percentage.

Print with the forecast period

Thanks to the fact that movements with the repetition code or with the dates of the following years have been inserted in the Budget table, the program is able to calculate forecasts for future years.

When the report is printed, indicate the start and end date in the Period section.

Considering that the start date is January 1, 2022:

- If you want a 2-year forecast, indicate the end date as 31 December 2024.

- If you want a 5-year forecast, indicate the end date as 31 December 2027.

- If you want a 20-year forecast, indicate the end date as 31 December 2042.

The possibility of getting a forecast is available for the following printouts:

All accounting reports can contain accounting values, forecast values, or both together. The parameters available are the same for accounting reports and forecasts.

Thanks to these reports, you may generate a

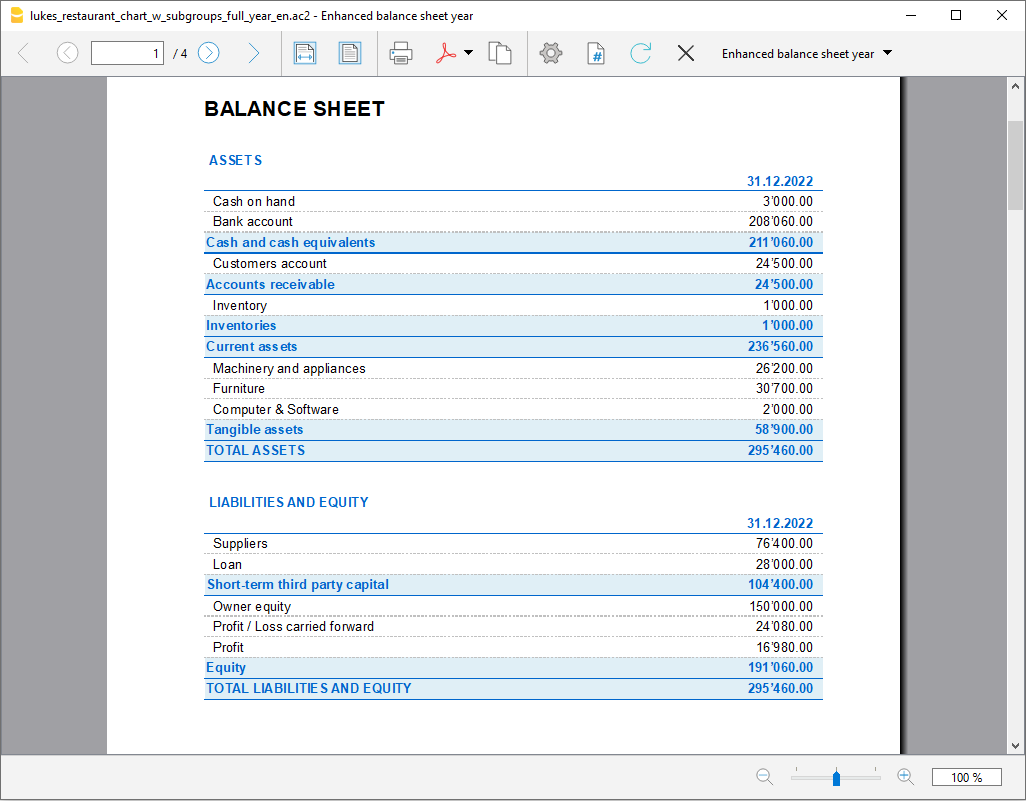

- Provisional Balance Sheet,

- Provisional Income statement,

- Liquidity planning,

- Investment planning,

- Financing planning

and more, for future interest periods.

Columns divided by period

In the Subdivision section you can use the program to create columns for the period.

You can thus display the evolution by month, quarter or year.

With Customization you can set up print formats and call them up again later. If you run forecasts over several years, it is will be useful to have pre-set customizations, overall, per year, 5 years or with the comparisons between the final balance and the estimate, which can be called up immediately .

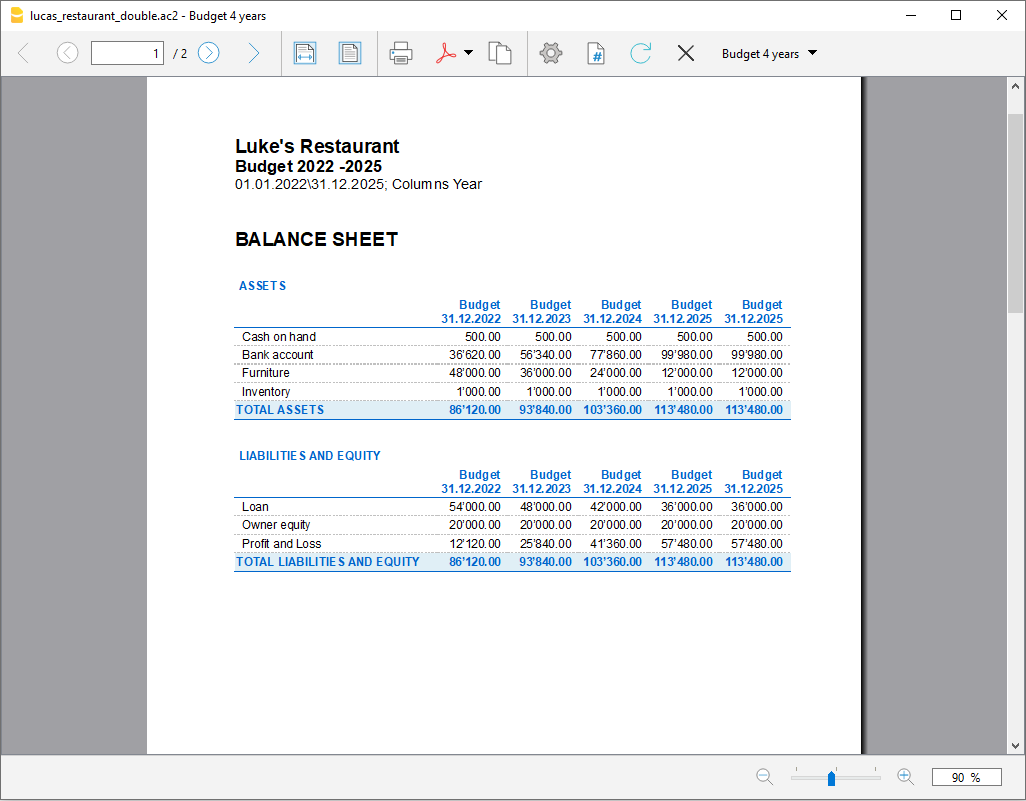

Budget - Four-year forecast

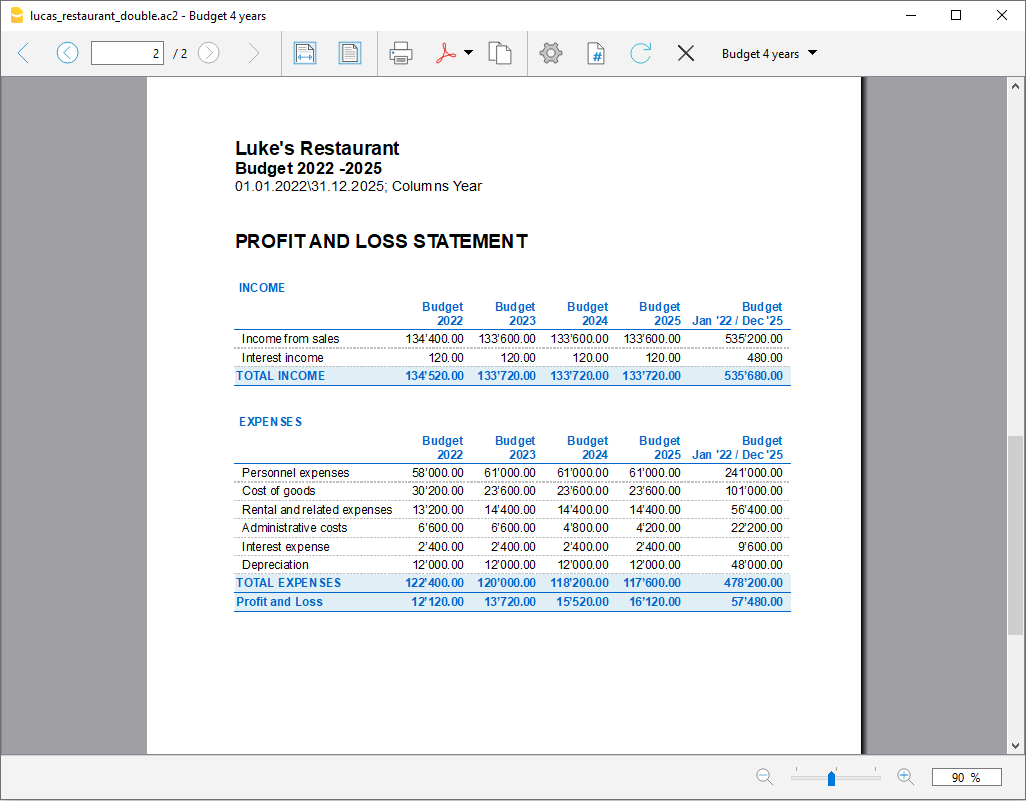

Income statement - Four-year forecast