In this article

With Banana Accounting Plus you can get started in just a few minutes, work easily and safely, and grow with advanced features when your business needs them.

Whether you're managing a small business, an association, or personal accounting, no complex setup or technical knowledge is required: Banana guides you step by step, with ready-to-use and customizable templates that adapt to your way of working and your needs.

With Banana, accounting takes shape in three simple steps:

And the accounting is done....

Watch the 3-step accounting video: 1'00"

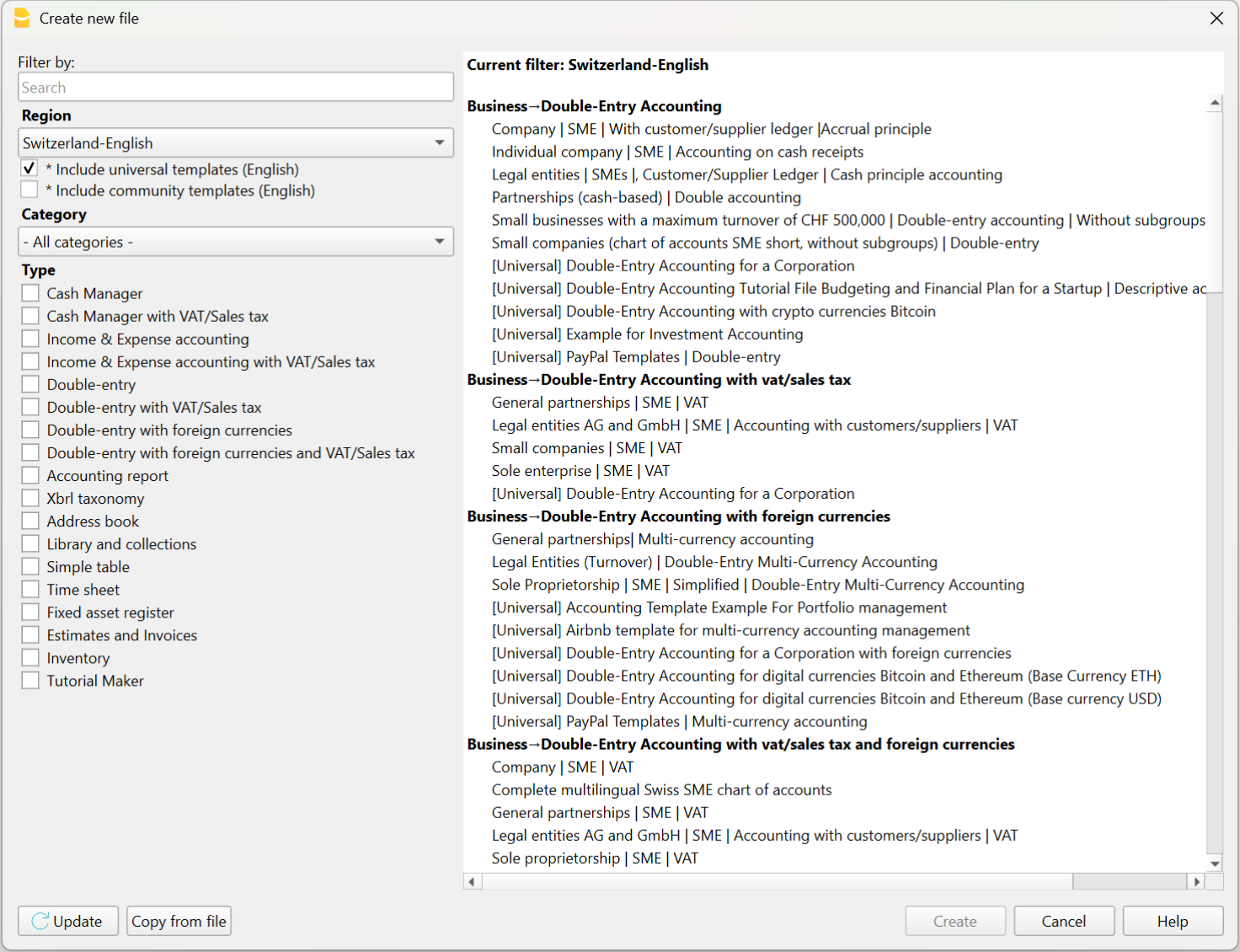

1. Choose the template that suits you best

Each Banana Accounting Plus template is already configured for a specific type of accounting, such as Income/Expense, Double-entry, Multi-currency.

The template you choose is therefore a complete, ready-to-use solution, with all functions, extensions, and calculations already set up for your accounting.

You can choose and open the template:

- from the program, via the menu File > New

- from our Template Store, downloading it to your computer or opening it via the WebApp (directly in the browser – still in testing phase).

Starting from a template saves you time, avoids errors, and immediately gives you a solid base to begin with.

Each template can be expanded with new features (VAT management, budgeting, cost centers) at any time, without having to rewrite your accounting data in a new file.

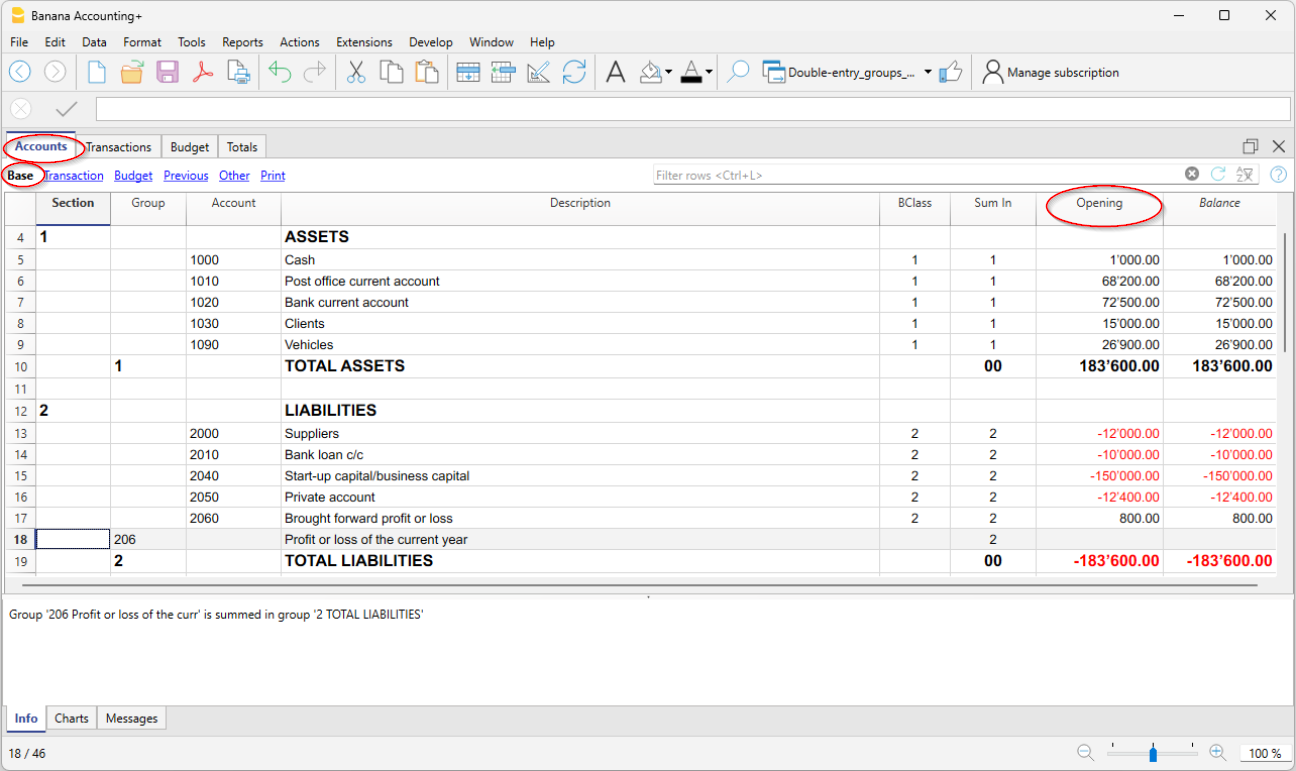

2. Customize your accounts

Each Banana Accounting template already includes a predefined Accounts table, with the most common accounts for that type of accounting, but you can freely customize it. All accounts, including those you add or edit, will appear in the balance sheets, reports, and official printouts. Here are the basic customizations:

- From the File > File Properties menu (basic data), enter your company's name and information.

- In the chart of accounts (the Accounts table):

- In the Description column of bank accounts, enter the names of your banks.

- Enter the accounts of your customers and suppliers with all the details (name, address, VAT number…)

- In the Opening column, enter the opening balances of your accounts.

- Save it to your PC or cloud. The template is now your own accounting file.

Banana Accounting Plus is flexible and modular: you can add new features at any time without creating a new file or losing any data already entered. This allows you to gradually evolve your accounting as your business grows. You can add immediately or later when needed:

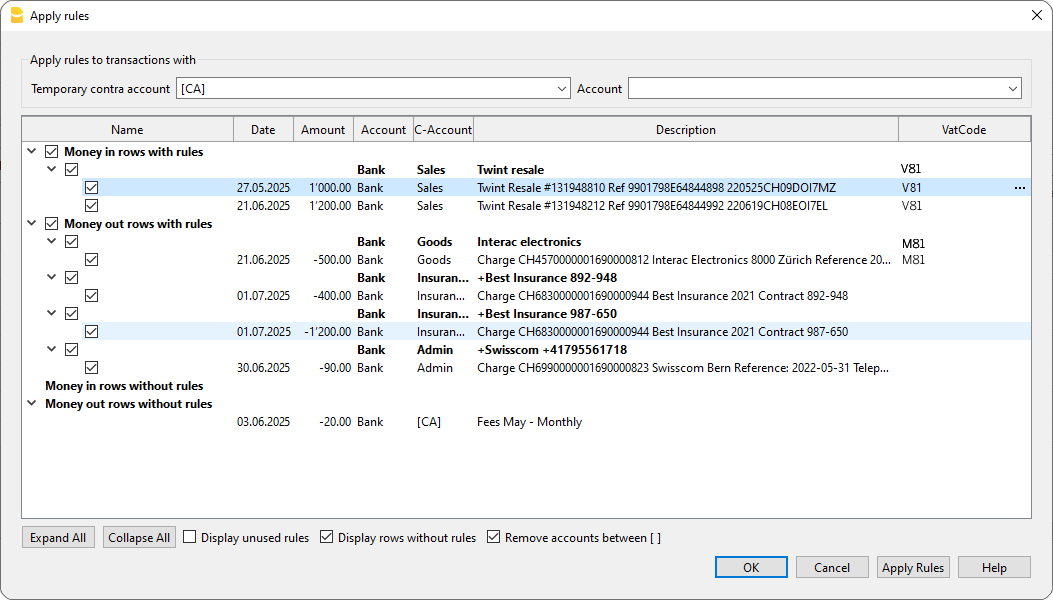

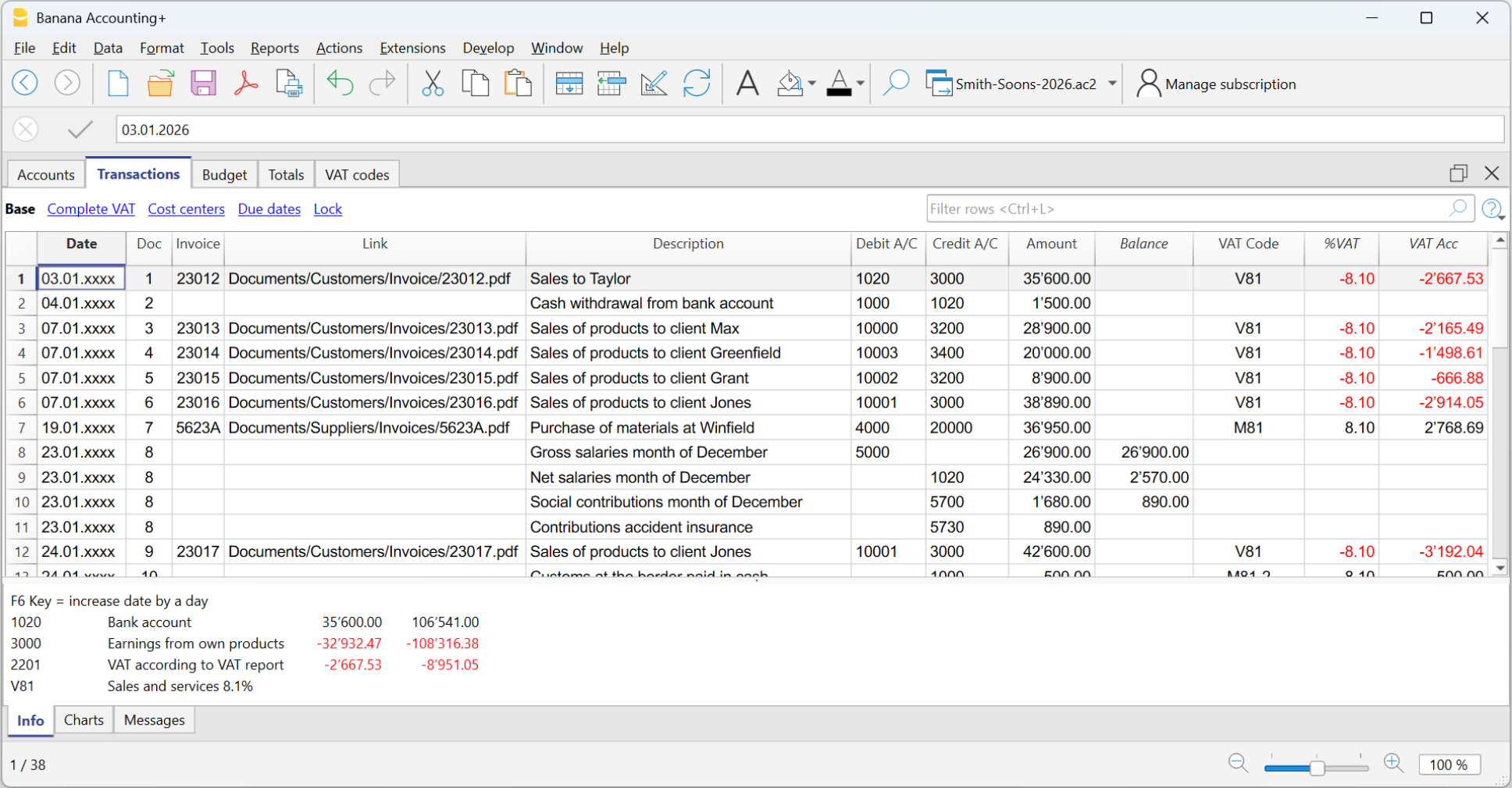

3. Import or enter transactions

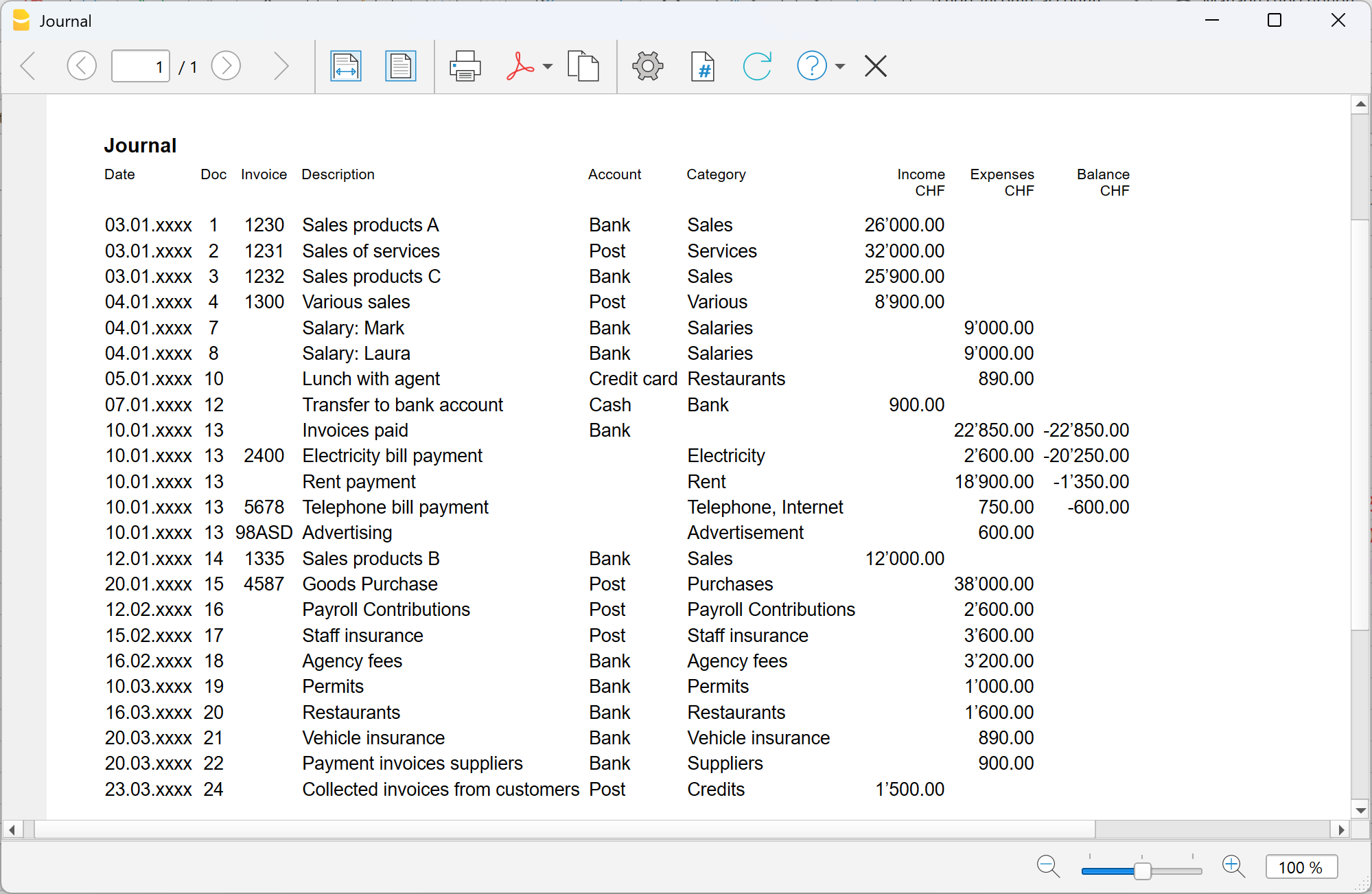

The Transactions table is the heart of the program, where all daily entries are recorded. Based on the data entered in the Transactions table, the program automatically updates account balances, and you can instantly generate all the reports you need.

To quickly enter transactions, we recommend using some time-saving features:

- Import transactions from your bank, postal account, or credit card.

- To import transactions, you need the data in .csv format (Advanced plan) or ISO 20022 standard format (camt.053, xml, … – Professional plan).

- After the import, you only need to complete the counterpart in the transaction rows.

- Use Rules (Advanced plan), to have transactions automatically recorded with no manual entry of counterpart, VAT code, or other details.

And the accounting is done...

More details about models used in different applications are available on the following pages:

- Transactions in double-entry accounting

- Transactions in multi-currency accounting

- Transactions in income & expense accounting

- Transactions in the Cash Manager

Banana Accounting Plus offers many other features to work even faster, optimising your time and saving energy.

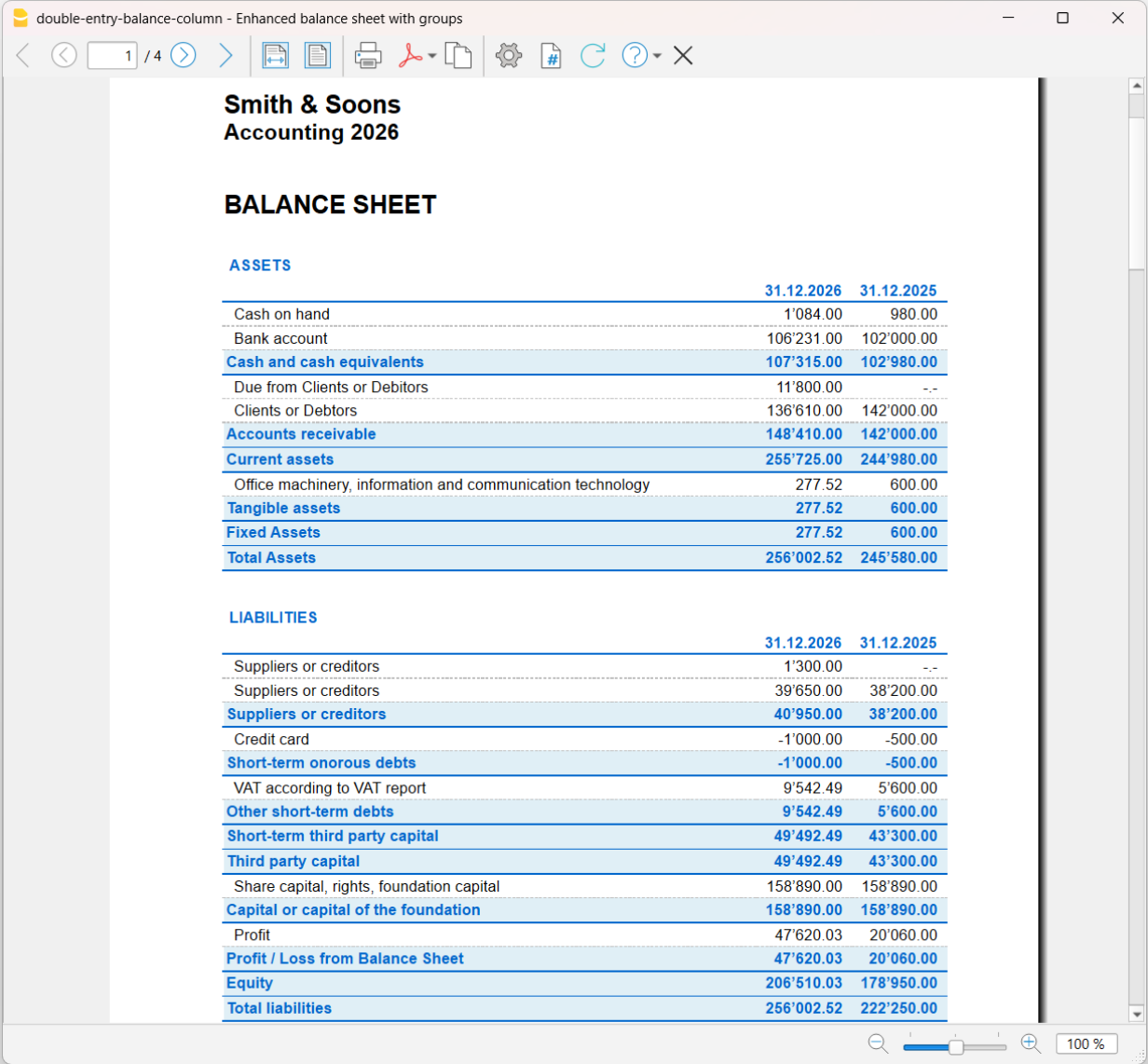

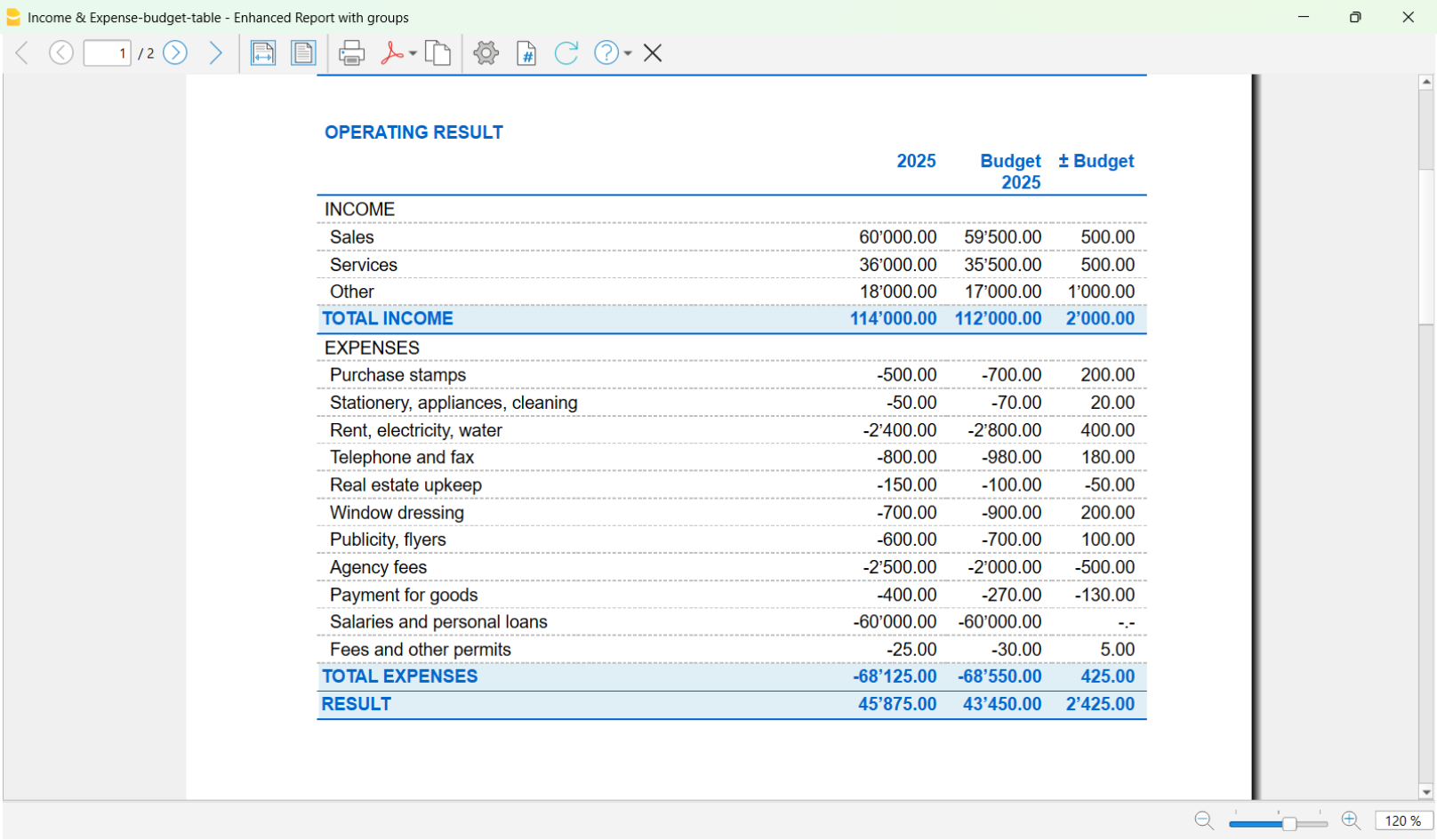

Professional Balance Sheets and Reports

With Banana Accounting Plus you can generate up-to-date reports and printouts at any time, to monitor your accounting or present data externally. You have access to a wide range of printouts, from invoices to financial statements. Most commonly used:

- Balance Sheet → shows assets and liabilities, with subgroups and organised totals.

- Profit and Loss Statement → shows costs, revenues, and net income or loss.

- Budget → compares expected values with actual ones.

- Balance sheet and profit and loss with previous year columns and corresponding variances.

- VAT Reports – with the Advanced plan, you can quickly prepare and submit the VAT report (for Switzerland).

All printouts update automatically based on your entries and the features you have activated (VAT, multi-currency, budget).

Some examples of printouts from various applications

Balance sheet from double-entry accounting, showing current year and previous year actual values.

Report from income & expense accounting, with columns for current year actual, current year budget, and variances between actual and budget.

Journal from income & expense accounting.