In this article

Revenue-based Accounting Tutorial for Ltd and LLC | SME

The ideal template for a Ltd or LLC with VAT management based on revenue. The chart of accounts is structured according to SME standards, and the VAT Codes table includes the rates valid from 01.01.2024. You can manage customers and suppliers, create invoices with QR codes, send reminders, and prepare the VAT report. Professional and immediate reports: Balance Sheet, Profit and Loss Statement, Account Cards, Journal, VAT Summaries, and many other reports, including by period. Cost Centers and Segments to monitor expenses and profitability by sector or project. Digital attachments can be added to transactions. Open the template from our WebApp or directly from the program and save the file to your computer.

In Banana WebApp openen

Open Banana Accounting Plus op uw browser zonder enige installatie. Pas het sjabloon aan, voer de transacties in en sla het bestand op uw computer op.

Open tutorial in WebAppModel documentatie

Efficient and customizable accounting management for SMEs

Our accounting template is pre-configured according to the standard framework of the Swiss Code of Obligations, specifically designed to meet the needs of small and medium-sized enterprises (SMEs) with an annual turnover equal to or greater than CHF 500,000.

Flexibility and customization

If you need to customize the chart of accounts, you can easily add new accounts. See our dedicated page on the Complete SME Chart of Accounts, which includes all the accounts and groups specified by the Swiss SME account system (Sterchi, Mattle, Helbing), ensuring perfect integration.

Simplicity and automation

Data entry is fast and intuitive, with an interface similar to Excel. You can import data directly from your bank statements or credit cards, and thanks to the use of Rules, the process becomes fully automated, drastically reducing manual work.

All-round accounting management

Record transactions quickly and automatically, keep balances always updated, and generate professional real-time reports. With our system, you can:

- Create and post invoices simultaneously

- Send reminders easily

- Make cash flow forecasts and manage budgets

- Generate Balance Sheet, Profit and Loss Statement, Account Cards and Journal

- With the VAT extension, send VAT report data online to the FTA (only with Advanced plan).

Some features require a subscription to the Banana Accounting Plus Advanced plan, such as generating the sample or XML file for the VAT report, using the new Rules functions, Filter, and temporary Sort Rows. See all the features of the Advanced plan.

Create your file

- Open the template with Banana Accounting Plus WebApp

- With the File > File Properties command, set the period, your company name, and the base currency (you can do budgeting and accounting in any currency).

- With the File > Save As command, save the file. It is useful to include the company name and year in the file name. For example, "Rossi-SA-20xx.ac2".

WARNING: if you close the browser without saving, you will lose the entered data. Always save the file to your computer.

To reopen the saved file click on File > Open.

Also see Organize accounting files locally, on network and cloud.

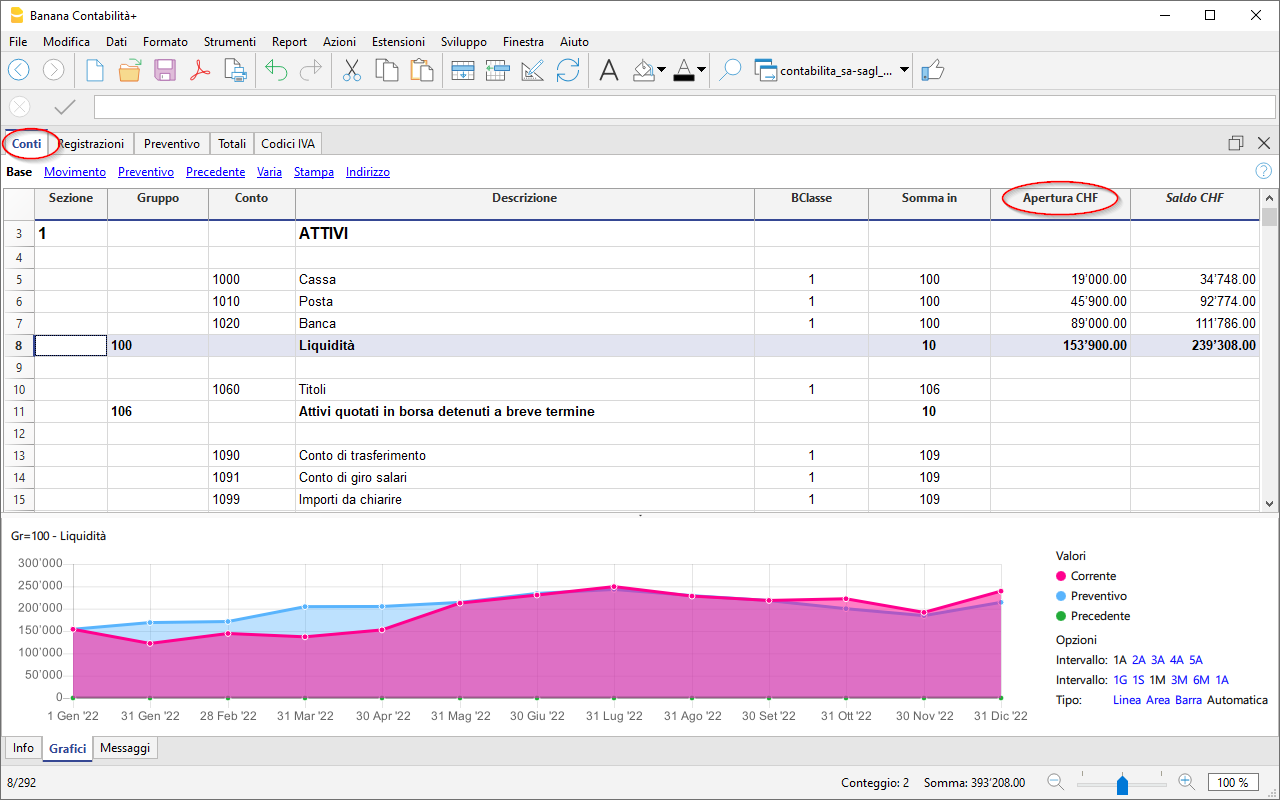

Accounts Table

When opening the template, the chart of accounts includes all the accounts to manage your business. You only need to enter:

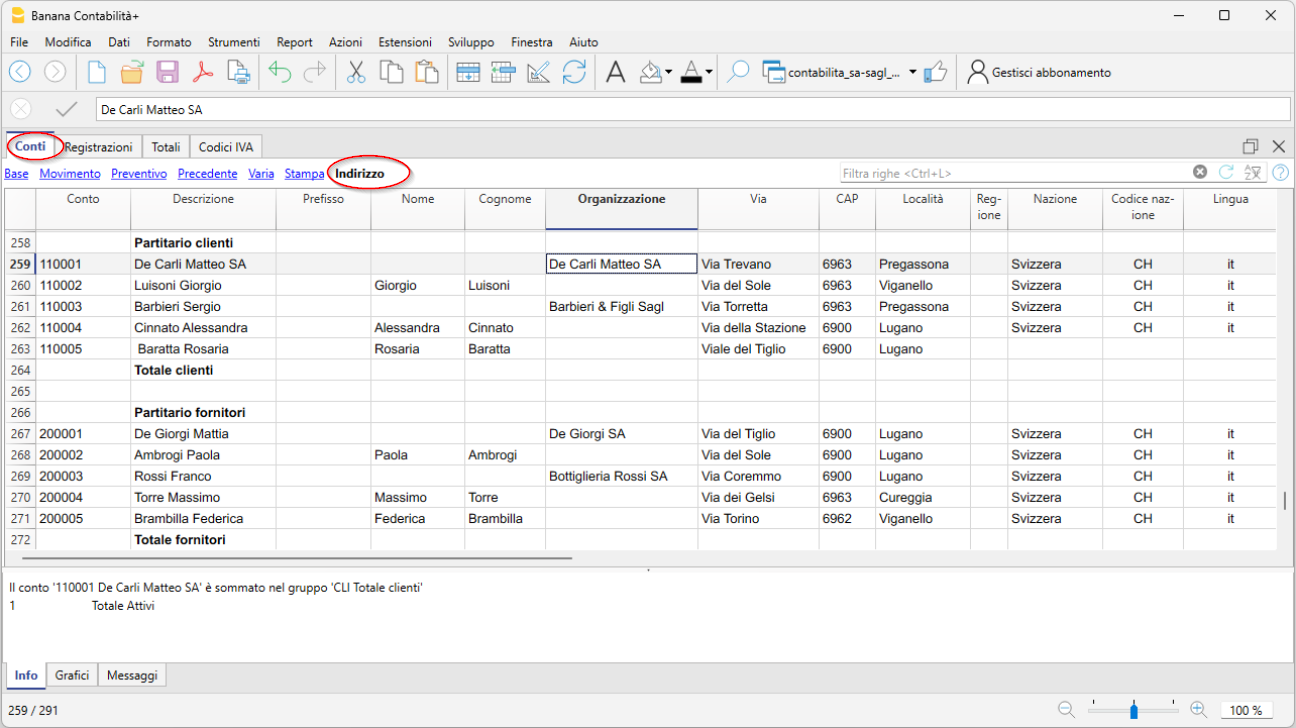

- In the Accounts table, Account column, your Customer and Supplier accounts complete with address, country code, and language.

- In the Accounts table, Opening column, the initial balance for each account (for assets and liabilities)

At year-end closing, the opening balance is carried forward automatically via Actions > Create new year.

After each transaction, the columns in the Accounts table are updated immediately, giving you a clear and instant view of your financial situation.

The Income Statement has a progressive structure, allowing the profit to be viewed in the following stages:

- Gross operating profit after deducting material and resale goods costs

- Gross operating profit after deducting personnel costs

- Operating result before depreciation, adjustments, financial results, and taxes (EBITDA)

- Operating result before financial results and taxes (EBIT)

- Operating result before taxes (EBT)

- Non-operating result

- Profit or loss before taxes

- Annual profit or loss

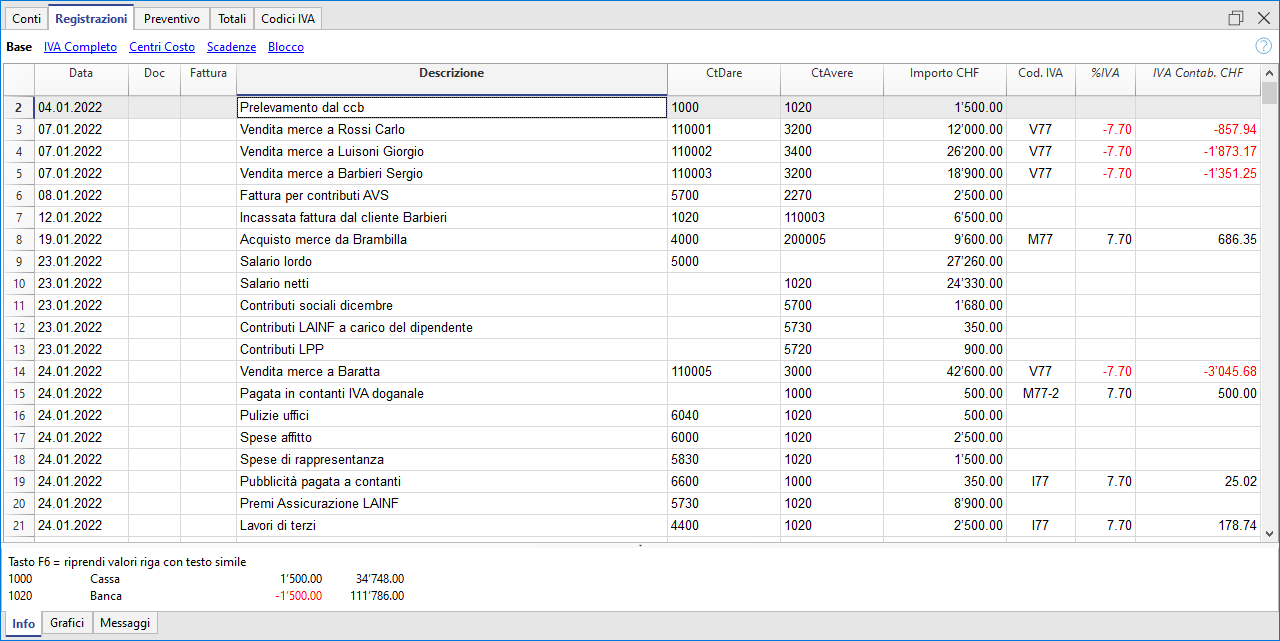

Record transactions

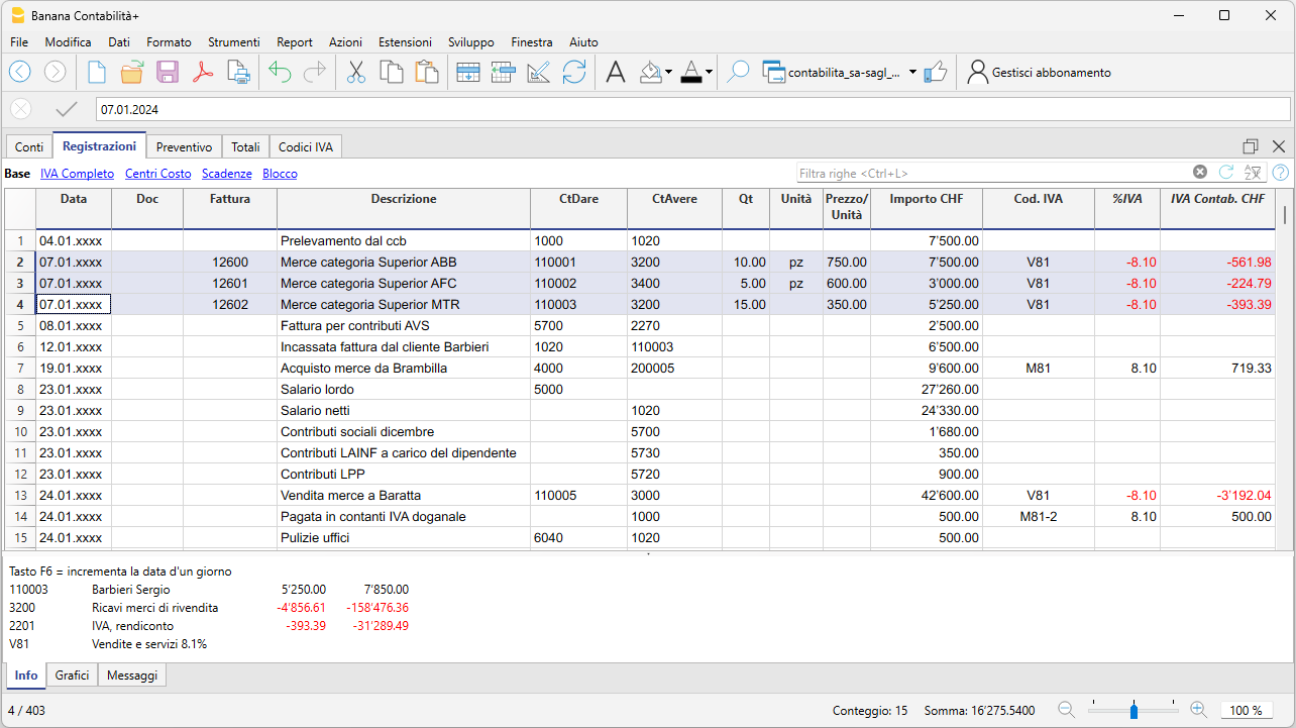

In the Transactions table, enter all daily movements. To speed up entry, we recommend using various automation features:

- The Autocomplete data entry feature allows automatic reuse of previously entered data

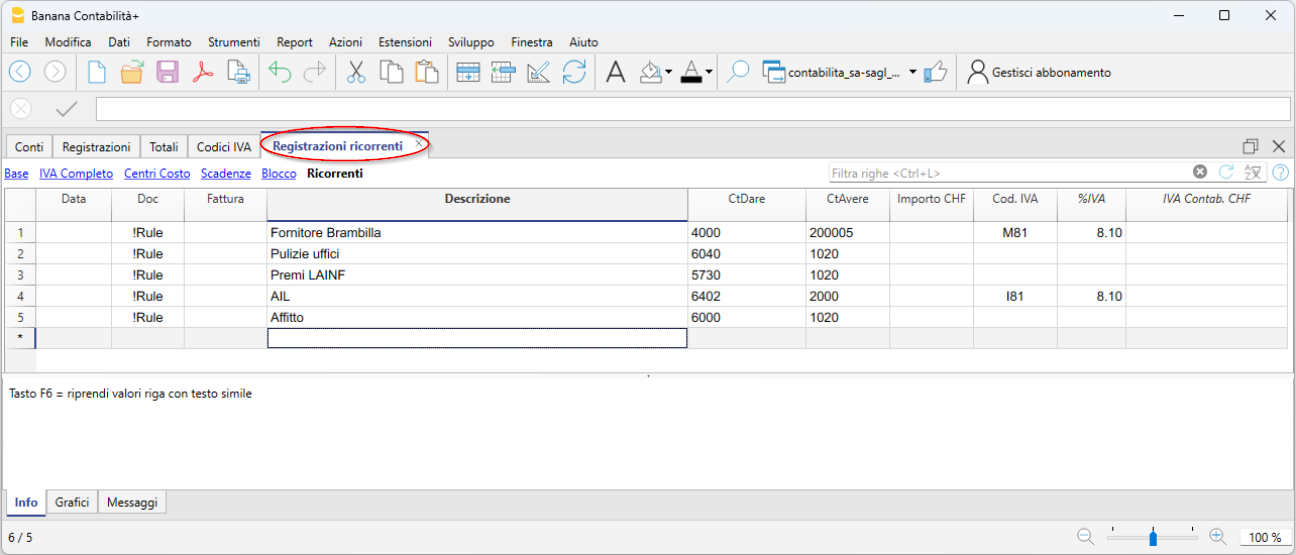

- The Recurring Transactions feature (under the Actions menu) allows you to store repetitive transactions in a dedicated table

- Importing data from the bank statement retrieves all bank transactions automatically. With the Advanced plan you can use Rules, a new feature that provides full automation of transaction entry.

- You can link each transaction to its digital receipt, and with one click, view the document.

See also Accounting files and digital receipts for better organization of your documents. - Use the Sort Transactions by Date command to order rows by progressive date.

- Use the Print/Preview command to print or export the journal in PDF format.

Transactions with VAT

To record VAT transactions, simply enter the VAT code corresponding to the operation (purchase, sale, international transactions, etc.). Calculations are made automatically, with no need to manually post to the VAT account.

In our templates, all VAT codes are pre-set in compliance with the new 2024 VAT rates.

At the end of the period, you can automatically obtain:

- VAT Summary by account, code, percentage for all transactions (Professional and Advanced plans).

- VAT Sample, Effective Method (Advanced plan only)

- VAT Sample, Flat Rate Method (Advanced plan only)

- XML file for electronic data submission (Advanced plan only).

Import transactions from bank statements with Rules (Advanced plan only)

The new Rules feature is the most advanced automation innovation, highly appreciated by our users. This technology simplifies the management of financial transactions imported from bank, postal, and credit card statements using keywords. Each recurring transaction is automatically linked to a keyword, allowing precise assignment of the counterpart, VAT code, costs, and related segments.

Thanks to this system, during subsequent imports, the software quickly recognizes transactions based on the keywords and automatically completes the entry in the Transactions table. This drastically reduces manual entry, significantly speeds up workflow, and minimizes the chance of errors.

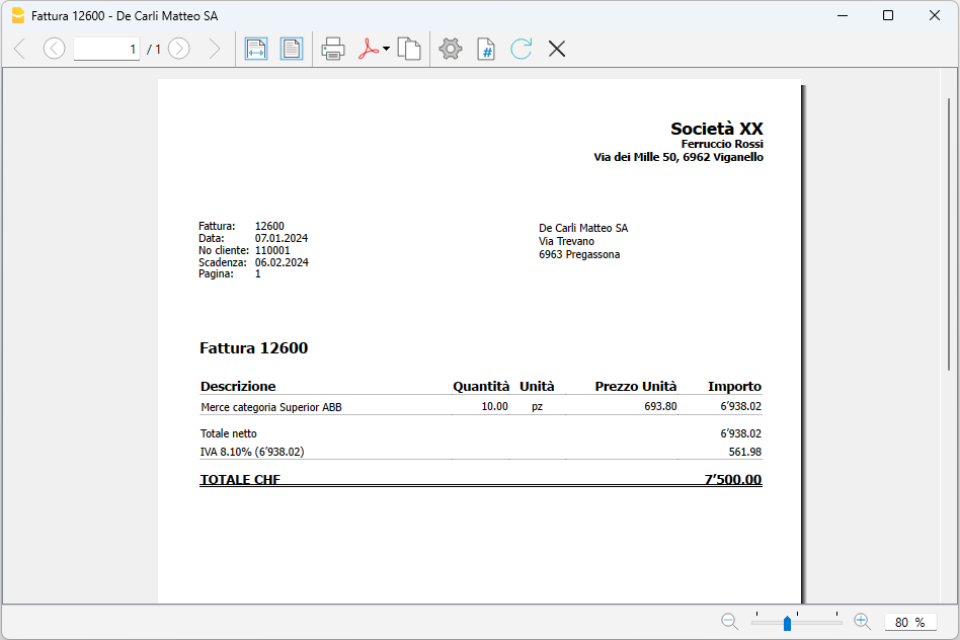

Create your invoices

Integrated invoicing in the accounting file allows invoice data to be recorded in the Transactions table. For each new invoice, insert a new transaction row.

The following settings are essential for creating invoices:

- Enter customer addresses (columns in the Address view)

- Set the customer group

- In the Transactions table, it is essential to enter the invoice number,

You can enter simple invoices on a single row or more complex invoices on multiple rows. Additionally, by enabling the Items columns (from the Tools menu), you can specify quantities, unit, and unit price.

To print the invoice go to Report > Customers > Print Invoice

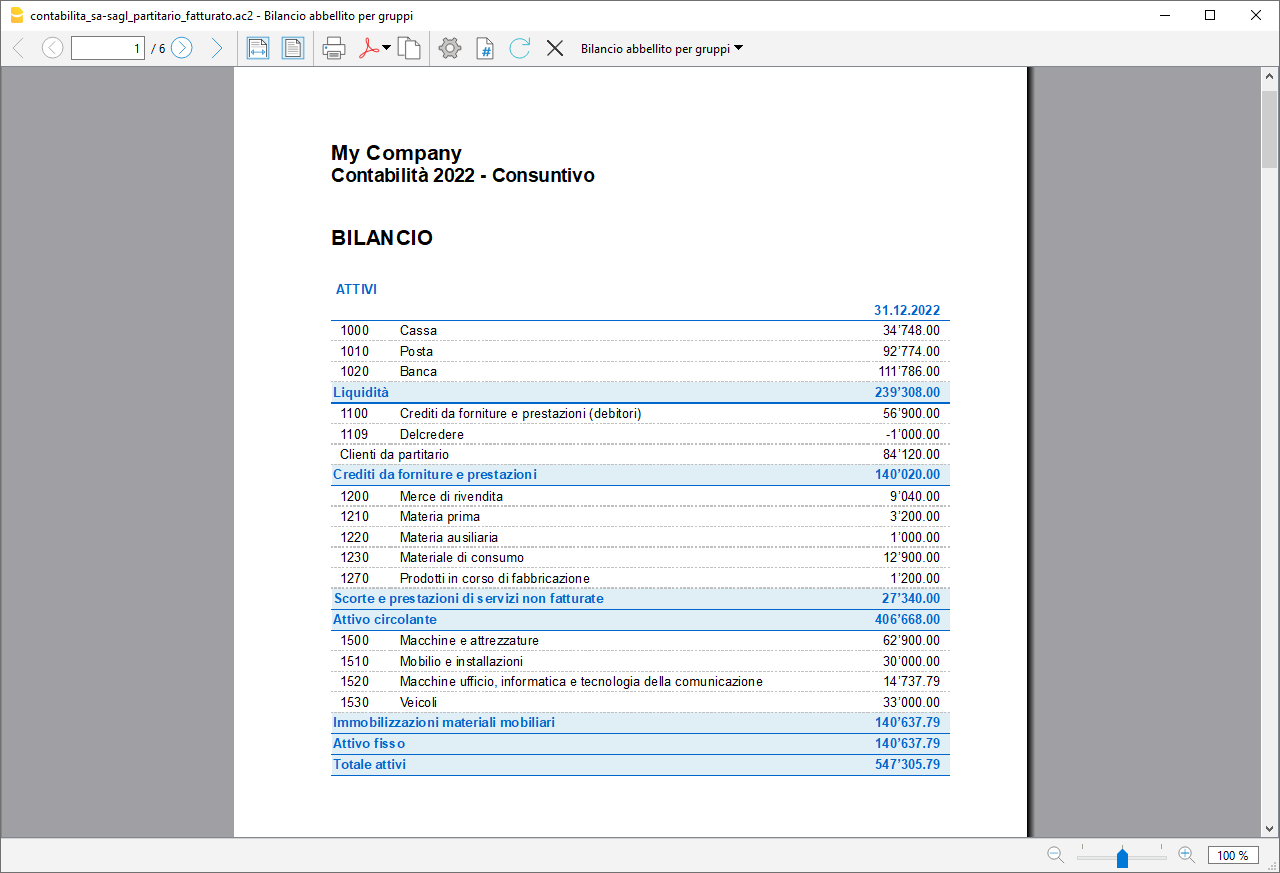

Beautified Balance Sheet with Groups

To view the Balance Sheet, click on the menu Report > Beautified Balance Sheet with Groups. You can customize the report with the columns you want to see, such as including the budget column or having Reports also by period.

Cash Flow: the lifeblood of your business

Cash flow is central to a company’s ability to operate, maintain solvency with suppliers, and generate income. Anticipating cash availability is essential to avoid mistakes, minimize risks, and optimize strategic decisions, helping you reach your goals successfully.

For optimal business management, it is crucial to have forward-looking insights, forecasting cash flow trends, sales, purchases, and future investments. Knowing whether your business will generate income is important, but forecasting cash availability is even more decisive. Without sufficient liquidity, you may be forced to cut expenses or seek financing.

With Banana Accounting, you can easily create both a cash flow forecast and a financial budget—strategic tools that will help you build a successful future for your business.

Discover the advanced forecasting features in our Documentation:

Modelvoorbeeld

Company XXX

Accounting 2024

Basic Currency: CHF

Double-entry with VAT/Sales tax

| Group | Account | Description | Sum In | Gr1 |

|---|---|---|---|---|

| BALANCE SHEET | ||||

| ASSETS | ||||

| 1000 | Cash on hand | 100 | ||

| 1010 | Post office current account | 100 | ||

| 1020 | Bank account | 100 | ||

| 1045 | Credit cards / Debit cards | 100 | ||

| 100 | Cash and cash equivalents | 10 | 1 | |

| 1060 | Bonds and stocks | 106 | ||

| 106 | Short-term assets listed on the stock exchange | 10 | ||

| 1090 | Internal transfers | 109 | ||

| 1091 | Transfer account for salaries | 109 | ||

| 1099 | Clarification account | 109 | ||

| 109 | Transfer accounts | 10 | ||

| 1100 | Receivables from deliveries and services (debtors) | 110 | ||

| 1109 | Provision for doubtful debts | 110 | ||

| 110A | Clients from register | 110 | ||

| 110 | Receivables from deliveries and services | 10 | ||

| 1140 | Advances and loans | 114 | ||

| 1176 | Withholding tax | 114 | ||

| 1179 | Tax at source | 114 | ||

| 1180 | AHV, IV, EO, ALV current account | 114 | ||

| 1190 | Various short-term receivables | 114 | ||

| 1191 | Deposits | 114 | ||

| 114 | Other short-term receivables | 10 | ||

| 1200 | Resale merchandise | 120 | ||

| 1210 | Raw materials | 120 | ||

| 1230 | Auxiliary material | 120 | ||

| 1231 | Consumables | 120 | ||

| 1260 | Finished products | 120 | ||

| 1270 | Semi-finished products | 120 | ||

| 1280 | Non-invoiced services | 120 | ||

| 120 | Inventories and non-invoiced services | 10 | 1 | |

| 1300 | Prepaid expenses | 130 | ||

| 1301 | Accrued income | 130 | ||

| 130 | Accrued income and prepaid expenses | 10 | 1 | |

| 10 | Current assets | 1 | 1 | |

| 1400 | Bonds and stocks | 140 | ||

| 1440 | Loans | 140 | ||

| 1460 | Loans/Mortgages to shareholder | 140 | ||

| 140 | Financial assets | 14 | ||

| 1480 | Participations | 148 | ||

| 148 | Participations | 14 | ||

| 1500 | Machinery and equipment | 150 | ||

| 1510 | Furniture and installations | 150 | ||

| 1520 | Office machines, information and communication technology | 150 | ||

| 1530 | Vehicles | 150 | ||

| 1540 | Tools and equipment | 150 | ||

| 150 | Movable tangible assets | 14 | ||

| 1600 | Commercial properties | 160 | ||

| 160 | Fixed tangible assets | 14 | ||

| 1700 | Patents, know-how, licences, rights and development | 170 | ||

| 1710 | Brands | 170 | ||

| 1712 | Models | 170 | ||

| 1770 | Goodwill | 170 | ||

| 170 | Intangible assets | 14 | ||

| 1850 | Unpaid share capital, nominal capital, participation certificate capital and foundation capital | 180 | ||

| 180 | Unpaid share capital or foundation capital | 14 | ||

| 14 | Fixed assets | 1 | ||

| 1 | Total assets | 00 | ||

| LIABILITIES | ||||

| 2000 | Accounts payable (creditors) | 200 | ||

| 2030 | Advance payments from third parties | 200 | ||

| 200A | Suppliers from register | 200 | ||

| 200 | Accounts payable | 20 | 1 | |

| 2100 | Short-term debt due to banks | 210 | ||

| 2120 | Financial leasing commitments | 210 | ||

| 2140 | Other onerous debts | 210 | ||

| 210 | Short-term interest-bearing debts | 20 | ||

| 2200 | VAT due | 220 | ||

| 2201 | VAT settlement account | 220 | ||

| 2206 | Withholding tax | 220 | ||

| 2208 | Direct taxes | 220 | ||

| 2209 | Tax at source | 220 | ||

| 2210 | Other short-term debts | 220 | ||

| 2260 | Debts due to shareholder | 220 | ||

| 2269 | Dividends | 220 | ||

| 2270 | AHV, IV, EO, ALV current account | 220 | ||

| 220 | Other short-term debts | 20 | ||

| 2300 | Accrued expenses | 230 | ||

| 2301 | Revenues received in advance | 230 | ||

| 2330 | Short-term provisions | 230 | ||

| 230 | Accruals and deferred income, short-term provisions | 20 | ||

| 20 | Short-term third party capital | 2A | ||

| 2400 | Due to banks | 240 | ||

| 2420 | Financial leasing commitments | 240 | ||

| 2430 | Debenture loans | 240 | ||

| 2450 | Loans | 240 | ||

| 2451 | Mortgages | 240 | ||

| 240 | Long-term interest-bearing debts | 24 | ||

| 2500 | Other long-term debts (not interest-bearing) | 250 | ||

| 250 | Other long-term debts | 24 | ||

| 2630 | Provisions | 260 | ||

| 260 | Long-term provisions and similar statutory positions | 24 | ||

| 24 | Long-term third party capital | 2A | ||

| 2A | Third party capital | 2 | ||

| 2800 | Share capital, nominal capital, participation rights or foundation capital | 280 | ||

| 280 | Nominal capital or capital of the foundation | 28 | ||

| 2900 | Premium at foundation or in the event of a capital increase | |||

| 2903 | Legal reserves | 290 | ||

| 2950 | Legal retained earnings | 290 | ||

| 2955 | Revaluation reserve | 290 | ||

| 2960 | Optional retained earnings | 290 | ||

| 290 | Reserves | 28 | ||

| 2965 | Own shares, nominal shares, share certificates and participation certificates (negative) | 296 | ||

| 296 | Own shares, nominal shares, share certificates and participation certificates (negative) | 28 | ||

| 2970 | Profit or loss carried forward | 297 | ||

| 2979 | Profit or loss for the year | 297 | ||

| 297 | Profit or loss from Balance Sheet | 28 | ||

| 28 | Equity | 2 | ||

| 2 | Total liabilities | 00 | 1 | |

| PROFIT & LOSS STATEMENT | ||||

| 3000 | Revenues from own products | 30 | ||

| 3200 | Revenues from resale merchandise | 30 | ||

| 3400 | Revenues from provided services | 30 | ||

| 3600 | Other revenues and services | 30 | ||

| 3710 | Own consumption | 30 | ||

| 3800 | Decrease in revenues | 30 | ||

| 3805 | Losses on receivables, changes in value adjustments | 30 | ||

| 3810 | Credit/debit card fees | 30 | ||

| 30 | Net amount from deliveries and services | 3 | ||

| 3900 | Changes in finished products inventories | 39 | ||

| 3901 | Changes in semi-finished products inventories | 39 | ||

| 3940 | Changes in non-invoiced services value | 39 | ||

| 39 | Changes in inventories and non-invoiced services | 3 | ||

| 3 | Revenues from supplies and services | E1 | ||

| 4000 | Material costs for production | 4 | ||

| 4200 | Merchandise costs for resale | 4 | ||

| 4400 | Expenses for services | 4 | ||

| 4500 | Energy consumption for production | 4 | ||

| 4800 | Discounts | 4 | ||

| 4 | Costs for material, goods, services and energy | E1 | ||

| E1 | Gross operating result after deducting costs for materials and resale merchandise | E2 | ||

| 5000 | Salaries | 5 | ||

| 5700 | AHV, IV, EO, ALV contributions | 5 | ||

| 5710 | Family allowance | 5 | ||

| 5720 | Contribution to pension funds | 5 | ||

| 5730 | Contribution to accident insurance | 5 | ||

| 5740 | Daily sickness benefits insurance | 5 | ||

| 5790 | Tax at source | 5 | ||

| 5800 | Other personnel expenses | 5 | ||

| 5810 | Personnel training | 5 | ||

| 5820 | Travel expenses | 5 | ||

| 5830 | Management flat-rate expenses | 5 | ||

| 5900 | Benefits from third parties | 5 | ||

| 5 | Personnel expenses | E2 | ||

| E2 | Gross operating result after deducting personnel expenses | E3 | ||

| 6000 | Rental | 60 | ||

| 6040 | Cleaning | 60 | ||

| 60 | Facility expenses | 6 | ||

| 6100 | Maintenance, repairs and replacement of movable tangible assets | 61 | ||

| 6105 | Leasing of movable tangible assets | 61 | ||

| 61 | Maintenance, repairs, replacements (MRR): leasing of movable tangible assets | 6 | ||

| 6200 | Repairs | 62 | ||

| 6210 | Petrol | 62 | ||

| 6220 | Liability insurance | 62 | ||

| 6260 | Vehicle leasing and rental | 62 | ||

| 6270 | Private share of vehicle expenses | 62 | ||

| 6280 | Freights | 62 | ||

| 62 | Vehicle and transport expenses | 6 | ||

| 6300 | Property insurance, charges, fees, permits | 63 | ||

| 63 | Property insurance, charges, fees, permits | 6 | ||

| 6400 | Electricity | 64 | ||

| 6410 | Heating | 64 | ||

| 6430 | Water | 64 | ||

| 6460 | Garbage | 64 | ||

| 64 | Energy and disposal costs | 6 | ||

| 6500 | Office equipment | 65 | ||

| 6503 | Specialist publications, newspapers, periodicals | 65 | ||

| 6510 | Telephone | 65 | ||

| 6512 | Internet | 65 | ||

| 6513 | Postal charges | 65 | ||

| 6570 | IT charges including leasing | 65 | ||

| 6580 | Licenses and updates expenses | 65 | ||

| 6583 | Consumables | 65 | ||

| 65 | Administrative and IT expenses | 6 | ||

| 6600 | Advertisements | 66 | ||

| 6642 | Gifts to customers | 66 | ||

| 66 | Advertising expenses | 6 | ||

| 6700 | Other operating expenses | 67 | ||

| 67 | Other operating expenses | 6 | ||

| 6 | Various operating expenses | E3 | ||

| E3 | Operating result before depreciation and value adjustments, financial results and taxes (EBITDA) | E4 | ||

| 6800 | Depreciation and value adjustments to fixed assets | 68 | ||

| 68 | Depreciation and value adjustments to fixed assets | E4 | ||

| E4 | Operating result before financial results and taxes (EBIT) | E5 | ||

| 6900 | Financial costs | 69 | ||

| 6940 | Bank costs | 69 | ||

| 6950 | Financial revenues | 69 | ||

| 69 | Financial costs and revenues | E5 | ||

| E5 | Operating result before taxes (EBT) | E6 | ||

| 7000 | Ancillary activities revenues | 7 | ||

| 7010 | Ancillary activities costs | 7 | ||

| 7500 | Operational real estate revenues | 7 | ||

| 7510 | Operational real estate costs | 7 | ||

| 7 | Ancillary operating result | E6 | ||

| 8000 | Non-operating costs | 8 | ||

| 8100 | Non-operating revenues | 8 | ||

| 8500 | Extraordinary, non-recurring or unrelated to the period costs | 8 | ||

| 8510 | Extraordinary, non-recurring or unrelated to the period revenues | 8 | ||

| 8 | Non-operating, extraordinary, non-recurring or unrelated to the period result | E6 | ||

| E6 | Profit or loss before taxes | E7 | ||

| 8900 | Direct taxes | 89 | ||

| 89 | Direct taxes | E7 | ||

| E7 | Annual profit or loss | 2979 | ||

| 00 | Difference should be = 0 (blank cell) | |||

| Clients register | ||||

| 110001 | Customer A | CLI | ||

| 110002 | Customer B | CLI | ||

| 110003 | Customer C | CLI | ||

| 110004 | Customer D | CLI | ||

| 110005 | Customer E | CLI | ||

| CLI | Total clients | 110A | ||

| Suppliers register | ||||

| 200001 | Supplier A | SUP | ||

| 200002 | Supplier B | SUP | ||

| 200003 | Supplier C | SUP | ||

| 200004 | Supplier D | SUP | ||

| 200005 | Supplier E | SUP | ||

| SUP | Total suppliers | 200A | ||

| COST CENTERS | ||||

| .PAC | Packaging A | INV | ||

| .RM | Raw materials A | INV | ||

| .AM | Auxiliairy materials A | INV | ||

| INV | Total inventories | |||

| ,MAN1 | Maintenance 1 | MAN | ||

| ,MAN2 | Maintenance 2 | MAN | ||

| ,MAN3 | Maintenance 3 | MAN | ||

| MAN | Total maintenance costs | |||

| ;ADV1 | Advertising type 1 | ADV | ||

| ;ADV2 | Advertising type 2 | ADV | ||

| ADV | Total advertising costs | |||

| VAT Code | Description | %VAT |

|---|---|---|

| Explanations | ||

| V = Sales (200) | ||

| VS = Discount sales and services (235) | ||

| B = Acquisition tax (38x) | ||

| M = Expenses for material and services (400) | ||

| I = Investments and other operating expenses (405) | ||

| K = Corrections (410, 415, 420) | ||

| Z = Not considered (910) | ||

| VAT codes information (do not modify) | ||

| id=vatcodes-che-2024.20230614 | ||

| Last update: 14.06.2023 | ||

| VAT Due | ||

| V0 | Exempt services (220) | |

| V0-E | Export services abroad (221) | |

| V0-T | Transfers in the reporting procedure (225) | |

| V0-N | Non-taxable services (230) | |

| Decrease of income from services, see discounts | ||

| V0-D | Various (280) | |

| V77 | Sales and services 7.7% | 7.70 |

| V81 | Sales and services 8.1% | 8.10 |

| V77-B | Sales and services 7.7% (chosen) | 7.70 |

| V81-B | Sales and services 8.1% (chosen) | 8.10 |

| V25-N | Sales and services 2.5% | 2.50 |

| V26 | Sales and services 2.6% | 2.60 |

| V37 | Sales and services 3.7% | 3.70 |

| V38 | Sales and services 3.8% | 3.80 |

| VS77 | Discount Sales and services 7.7% | 7.70 |

| VS81 | Discount Sales and services 8.1% | 8.10 |

| VS25-N | Discount Sales and services 2.5% | 2.50 |

| VS26 | Discount Sales and services 2.6% | 2.60 |

| VS37 | Discount Sales and services 3.7% | 3.70 |

| VS38 | Discount Sales and services 3.8% | 3.80 |

| Taxable turnover (299) | ||

| F1 | 1. Flat tax rate 2024 | |

| F2 | 2. Flat tax rate 2024 | |

| FS1 | Discount Sales and services 1. Flat tax rate 2024 | |

| FS2 | Discount Sales and services 2. Flat tax rate 2024 | |

| F3 | 1. Flat tax rate 2018 | |

| F4 | 2. Flat tax rate 2018 | |

| FS3 | Discount Sales and services 1. Flat tax rate 2018 | |

| FS4 | Discount Sales and services 2. Flat tax rate 2018 | |

| Total Flat tax rate (322-333) | ||

| B77 | Acquisition tax 7.7% (With VAT/Sales tax) | 7.70 |

| B77-1 | Acquisition tax 7.7% (Without VAT/Sales tax) | 7.70 |

| B77-2 | Acquisition tax 7.7% (VAT/Sales tax amount) | 7.70 |

| B81 | Acquisition tax 8.1% (With VAT/Sales tax) | 8.10 |

| B81-1 | Acquisition tax 8.1% (Without VAT/Sales tax) | 8.10 |

| B81-2 | Acquisition tax 8.1% (VAT/Sales tax amount) | 8.10 |

| Total Tax on purchases (382-383) | ||

| Total VAT Due (399) | ||

| Recoverable VAT | ||

| M0 | Exempt material- and service expenses | |

| I0 | Exempt investment and operating expenses | |

| M77 | Purchase of material and services 7.7% (With VAT/Sales tax) | 7.70 |

| M77-1 | Purchase of material and services 7.7% (Without VAT/Sales tax) | 7.70 |

| M77-2 | Purchase of material and services 7.7% (VAT/Sales tax amount) | 7.70 |

| M81 | Purchase of material and services 8.1% (With VAT/Sales tax) | 8.10 |

| M81-1 | Purchase of material and services 8.1% (Without VAT/Sales tax) | 8.10 |

| M81-2 | Purchase of material and services 8.1% (VAT/Sales tax amount) | 8.10 |

| M25 | Purchase of material and services 2.5% | 2.50 |

| M26 | Purchase of material and services 2.6% | 2.60 |

| M37 | Purchase of material and services 3.7% | 3.70 |

| M38 | Purchase of material and services 3.8% | 3.80 |

| Investment and operating expenses | ||

| I77 | Investment and operating expenses 7.7% | 7.70 |

| I77-1 | Investment and operating expenses 7.7% (Without VAT/Sales tax) | 7.70 |

| I77-2 | Investment and operating expenses 7.7% (VAT/Sales tax amount) | 7.70 |

| I81 | Investment and operating expenses 8.1% | 8.10 |

| I81-1 | Investment and operating expenses 8.1% (Without VAT/Sales tax) | 8.10 |

| I81-2 | Investment and operating expenses 8.1% (VAT/Sales tax amount) | 8.10 |

| I25 | Investment and operating expenses 2.5% | 2.50 |

| I26 | Investment and operating expenses 2.6% | 2.60 |

| I37 | Investment and operating expenses 3.7% | 3.70 |

| I38 | Investment and operating expenses 3.8% | 3.80 |

| Corrections and adjustments | ||

| K77-A | Subsequent adjustment of prior tax 7.7% (410) | 7.70 |

| K81-A | Subsequent adjustment of prior tax 8.1 % (410) | 8.10 |

| K77-B | Corrections of prior tax 7.7% (415) | 7.70 |

| K81-B | Corrections of prior tax 8.1% (415) | 8.10 |

| K77-C | Reductions of the deduction of prior tax 7.7% (420) | 7.70 |

| K81-C | Reductions of the deduction of prior tax 8.1% (420) | 8.10 |

| F1050 | Tax computation according to form Nr. 1050 | |

| F1055 | Tax computation according to form Nr. 1055 | |

| Total Recoverable VAT (479) | ||

| Total VAT payable (500) or VAT credit (510) | ||

| Other financial flows | ||

| Z0-A | Subsidies, tourist taxes collected by the tourism offices, contributions to the institutions responsible for the elimination of waste and for the supply of water (let. a - c) | |

| Z0 | Gifts, dividends, compensation for damages etc. | |

| Not considered | ||

| Final total for control | ||