In this article

The settings in the VAT Codes table allow you to define all the parameters necessary to manage the procedures for registering with VAT. The settings concern:

- VAT due or recoverable.

- Transaction amount recorded as net, gross, or VAT amount at 100% (Customs VAT).

- Percentage of applicable VAT rates.

- The account in which VAT is be recorded.

- Special rounding off for each code.

- Grouping and totaling method.

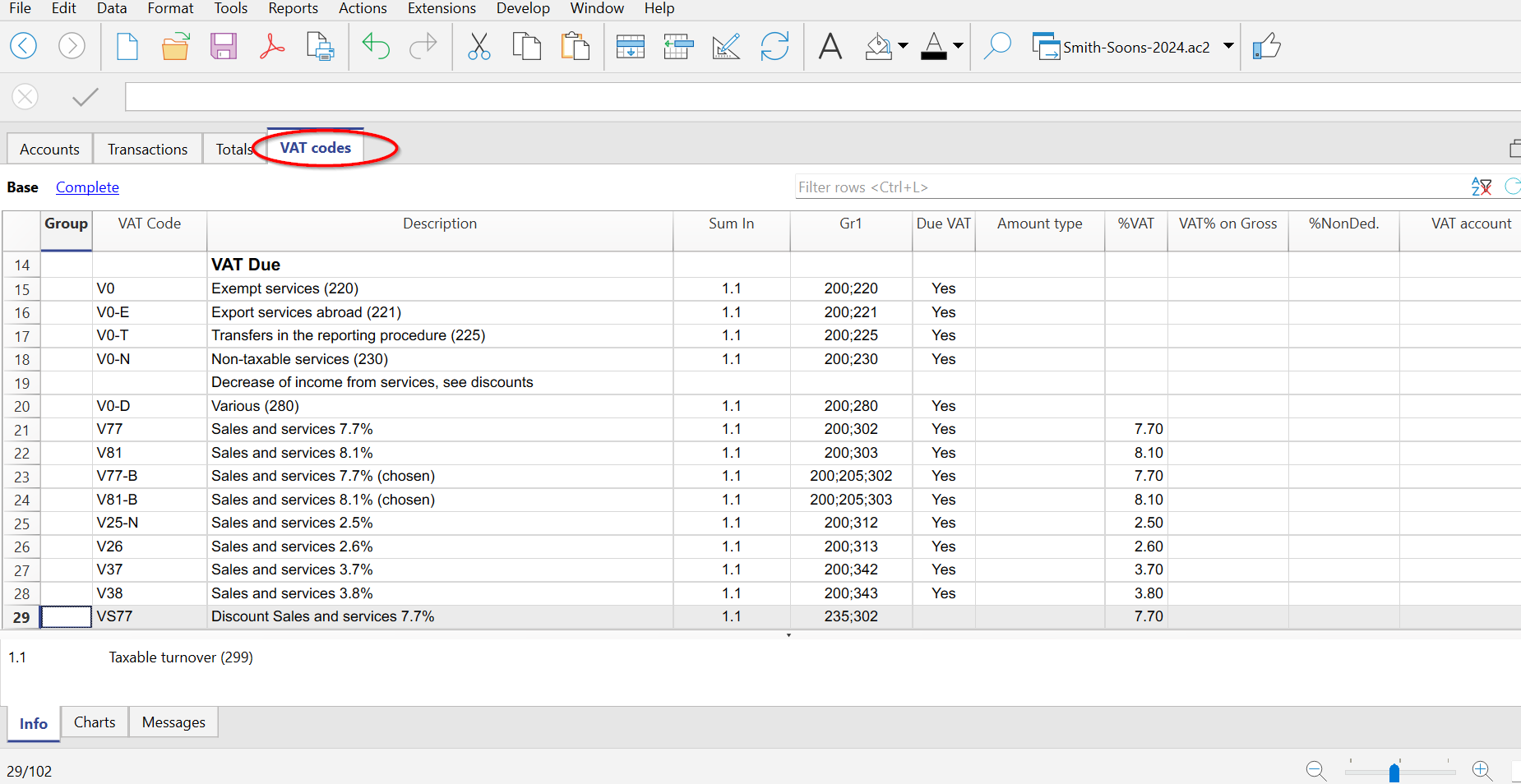

The VAT Codes table has a Base view and a Complete view. The difference between the two is the fact that the Complete view presents several columns that are not available in the Base view.

Calculation method

The parameters indicated in the VAT Codes table are being used to calculate the VAT of the individual transactions.

The parameters established in the VAT Codes table cannot be changed in the transactions. This modality guarantees that the VAT calculations are correct and consistent.

Please note: if the values of a VAT Code, which has already been used in the transactions, are being modified, the changes are not active immediately; in this case it is necessary to use the Actions > Check accounting command.

When modifying the VAT table, the program, as a precaution, displays a message in the Info window inviting for a complete recalculation.

The following Table refers to the codes being used according to the Swiss legislation:

Detailed description of the columns

In the following columns, insert the following data:

- Group: an abbreviation or a number that indicates the group to which the codes belong.

For more information on the grouping system, please refer to the Grouping System page. - VAT Code:

The program provides for three types of codes- Normal VAT codes

The abbreviation used to identify and apply the VAT code in the transactions

Used in the Transactions table, VAT Code column (e.g. V81)

Note: they cannot contain the character ":" - Special codes prefixed by the character ":"

These are not VAT codes but are used to specify VAT cases in more detail

Used in the Transactions table, Extra VAT column (e.g. :ESCL) - Reverse charge VAT codes

In reverse charge transactions, two VAT codes separated by a colon are entered; the program calculates both the VAT payable and receivable

Used in the Transactions table, VAT Code column (e.g. B81:M81)

Note: in the VAT Codes table only the two individual codes are defined; the combination is entered in the Transactions table.

- Normal VAT codes

- Description: a text for the description of the VAT Code or the group.

- Disable:

Allows you to disable VAT codes that are not used. Facilitates data entry in the Transactions table.- 1 - the VAT code is not visible in the auto-completion list (Transactions table), but it can still be used;

- 2 - the VAT code is not visible in the auto-complete list and must not be used.

- Sum in: abbreviation or number of the Group in which the row of a code must be totaled.

- Gr1: this column is used for specific groupings.

The screen capture shows the groupings for the encoding of the figures of the Swiss VAT return. - Gr2: code for additional groupings.

- Due VAT:

If the word Yes is being inserted, this means that the VAT is at debit (due to the State)

If the cell is empty, this means that the VAT is at credit (recoverable) - Amount type:

The code indicates how the VAT amount of the transaction is to be understood.- 0 (or empty cell) - with VAT/sales tax (the transaction amount is considered VAT included)

- 1 = without VAT/Sales tax (the transaction amount is considered VAT excluded)

- 2 = VAT amount (the transaction amount is considered the VAT amount, 100%)

The amount type 2 is used in particular to account for customs VAT paid or charged on the shipper's invoice. More details on the recording are available on the page: Entering VAT at customs for import

- % VAT: VAT code percentage.

- % NonDed.: if, for a VAT code, it is not possible to deduct the full 100%, enter the non deductible percentage here (example 100%)

- VAT% on gross: is usually left empty. The word "Yes" has to be inserted only if the VAT percentage has to be applied on the gross amount (VAT included) and not on the taxable amount (e.g. for flat rates).

- VAT account: The account to which the broken down VAT automatically is posted.

In the File and Accounting properties (File menu), a general account, that will be used as the VAT account, can be defined. - Round Min: minimum rounding value.

If left empty, the rounding indicated in the basic accounting data is used. - Don't warn: there are particular entries that the program might interpret as wrong, but which are in fact correct. To prevent the program from reporting error warnings, enter Yes to the code of interest.

Rechecking the accounting file

When the accounting is recalculated and the transactions are not blocked, the program resumes the VAT parameters assigned to each code in the transactions. Therefore, if a setting of a VAT code has been changed, the change is resumed in the respective columns of the transactions which are not editable by the user.

For this reason, when editing the VAT codes table, the program suggests to operate a full accounting recheck.

Adding a new percentage

When a new percentage is added, a new row has to be added; in the new row, insert the data of the new VAT code with the new percentage, while paying attention to insert the correct grouping. Don't change a code that has already been used in the transactions.

VAT codes for services provided abroad

In the VAT Codes table, it is possible to set up, in separate groups, VAT codes for the provision of services provided abroad, with specific rates for the country in which one operates and for which VAT is also due to foreign countries.

The corresponding VAT code is set for each country, which can be totaled in its own group or in a totalization group that refers to the VAT to be paid to foreign countries.

To view the amounts to be paid, go via the Reports > VAT /Sales tax report menu and select the specific code for the country or the totalization group for the VAT to be paid to foreign countries.

For the VAT to be paid in foreign countries, it is not possible to send it electronically.

Own Groupings

By creating groups with multiple totaling levels, the user can obtain the totals that are necessary for the VAT declaration.

In the VAT report, by activating the option Use own grouping scheme, the software calculates the totals exactly as indicated in the sequence of the indicated groupings in the VAT Codes table.

The groupings are being used to obtain totals for groups of transactions, for example, the totals for all exportations or importations.

Match the VAT Code to an Account

All the codes listed in the VAT Codes table can be linked to the VAT-related accounts in the Accounts table. This way, when entering transactions in the Transactions table, the program automatically inserts the corresponding VAT code.

The procedure for linking a VAT code is described on the page:

Related document:

- Import VAT codes

- National VAT documentation

Link to specific VAT documentation for Switzerland, Italy and other countries.