In this article

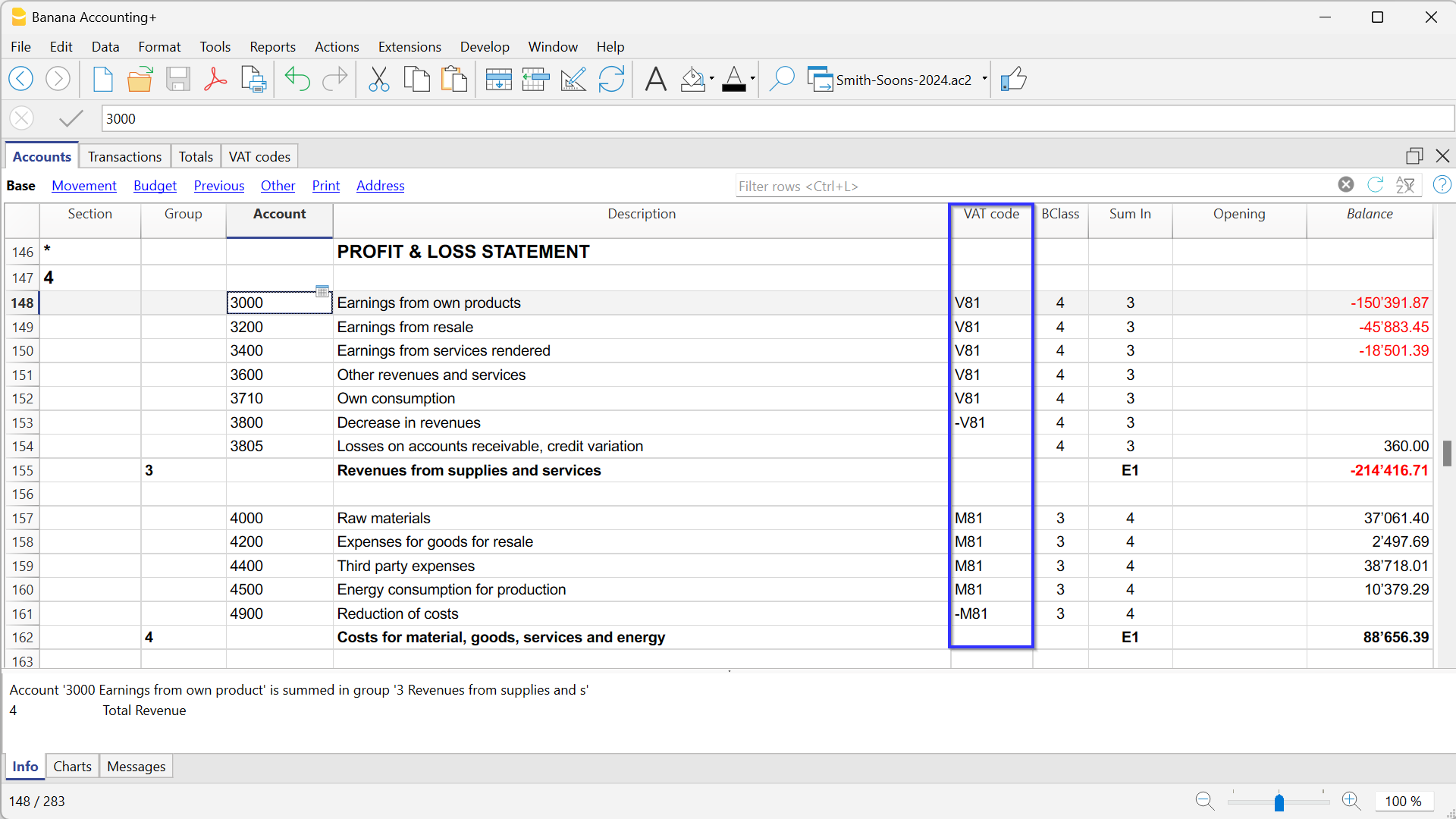

In accounting with VAT, in the Accounts table, you can automate the entry of the VAT code by associating each account with its corresponding VAT code. In this way, in the Transactions table, when you enter the account, the program automatically inserts the VAT code and completes the columns with the corresponding data.

Link a VAT code to an account (effective method)

To link a VAT code to an account:

- The VAT Code column is visible by default in the Advanced view.

If you want to display the VAT Code column in the Basic view, go to the menu Data > Columns setup > VAT Code. - Once the column is visible, enter the VAT codes related to the accounts.

If the VAT code is entered in square brackets, such as [V81], VAT will appear only on issued invoices and will not be posted.

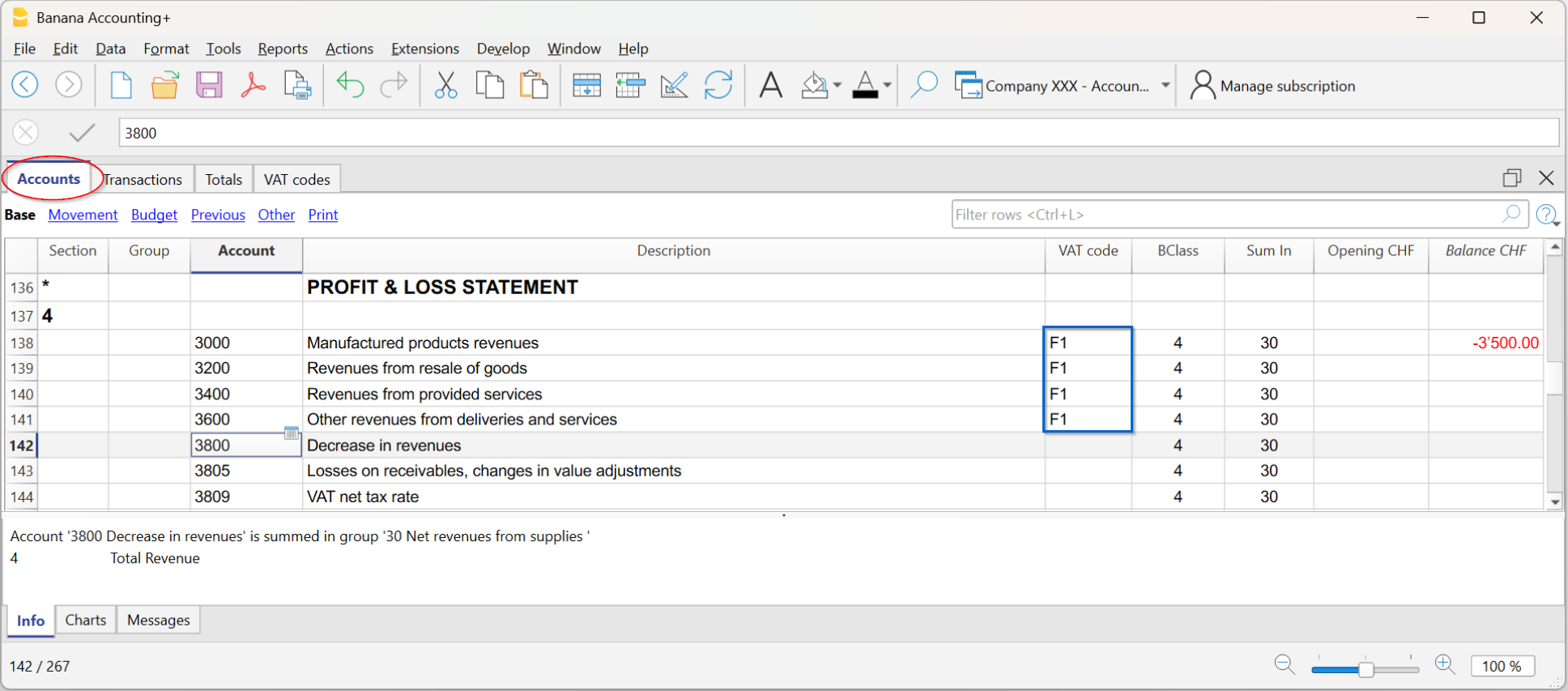

Link a VAT code to an account (flat rate method)

The procedure is the same as described in the previous paragraph:

- In the Accounts table, in the VAT Code column, enter the VAT code on the rows of the accounts related to sales.

Depending on the type of transaction, there are two cases:

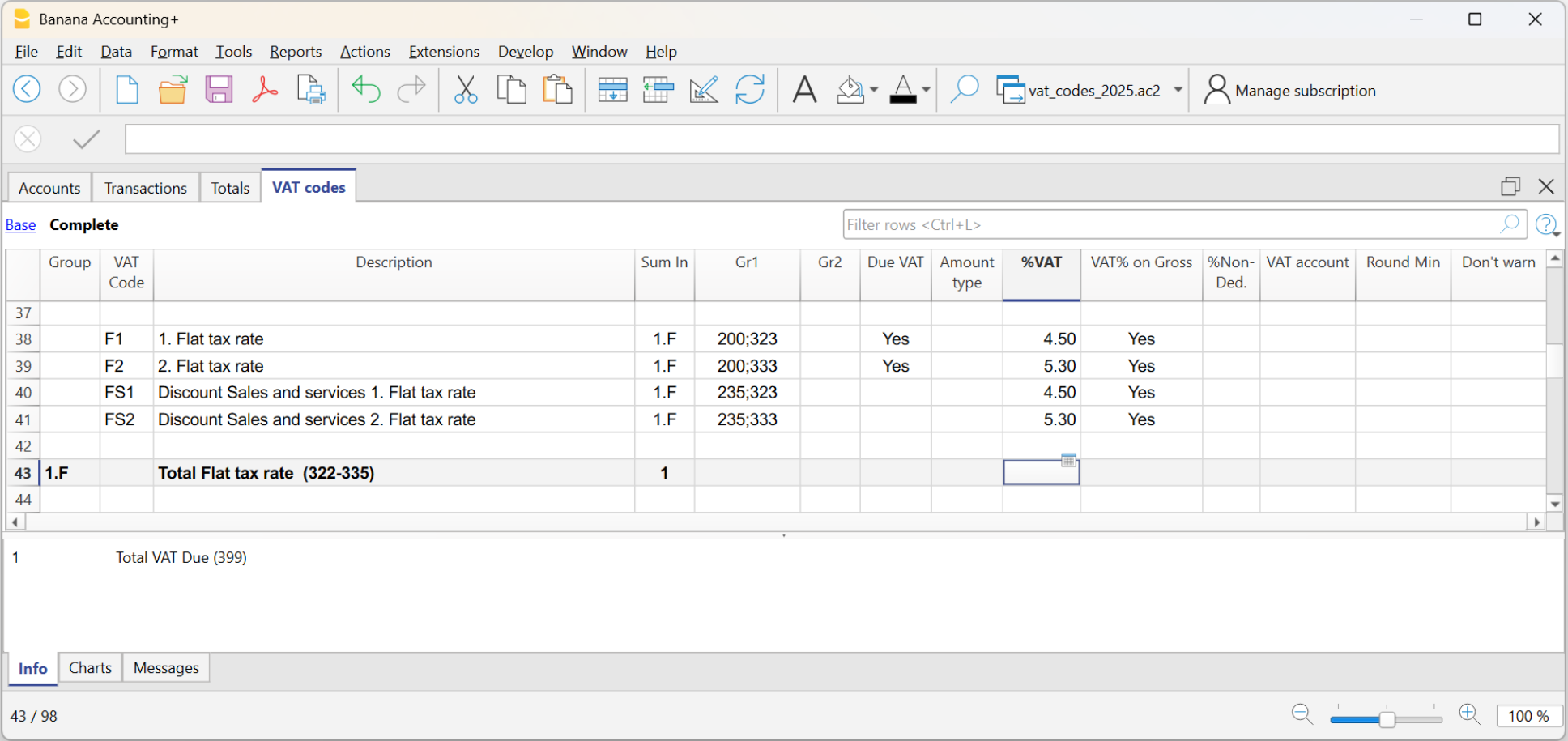

Case 1 – Transaction with VAT breakdown

If you want to record with VAT breakdown:

- In the VAT Codes table, enter the flat rate VAT rate(s).

- The program will show for each transaction:

- the gross sales amount

- and the corresponding VAT breakdown.

In this way, you get a complete detail of the taxable amount and the tax.

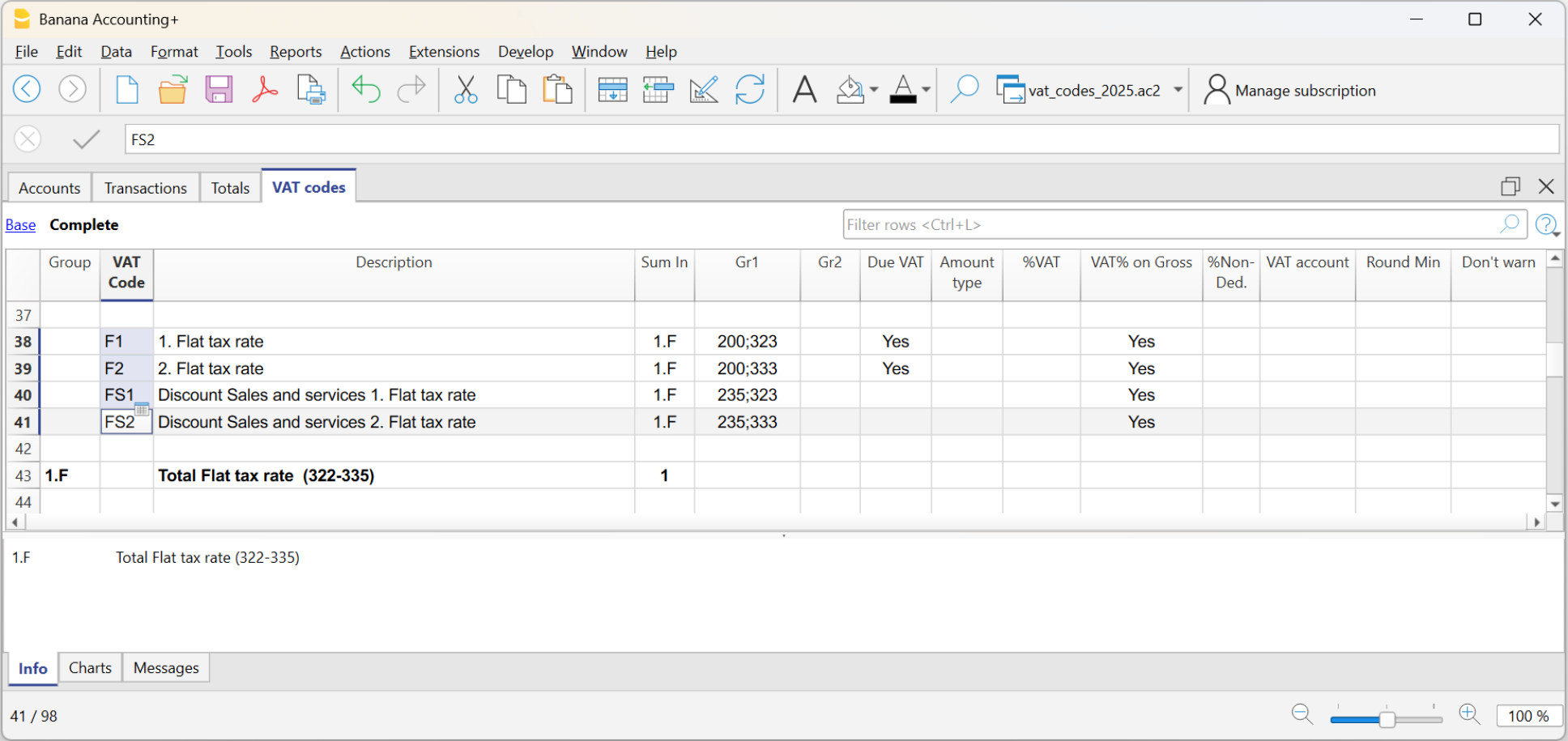

Case 2 – Transaction without VAT breakdown

If you want to record without VAT breakdown:

- In the VAT Codes table, the flat rate VAT rates must not be entered.

- In the Accounts table, in the VAT Code column, simply enter the corresponding code.

At the end of the semester (or the defined period), the program automatically calculates the VAT due based on the gross turnover amount determined from the sales transactions marked with the flat rate VAT code.

Note: if the VAT rates have changed (see New VAT Rates), the values entered in the VAT Code column must be updated manually. The same applies to transactions already present in the Transactions table (VAT Code column), which must be manually edited row by row or all at once using the Replace command.