In this article

Even with Income and Expense accounting, you can take advantage of the advanced Auto-completion Rules for imported transactions to further automate your work. Rules are available only in the Advanced plan of Banana Accounting Plus.

With Rules you can automate the recording of recurring transactions. For each imported transaction that you expect to recur, you can create a Rule, assigning not only the counterpart account (i.e. the reason for the expense or income), but also other details such as cost center, VAT code, row color, and so on. This way, in future imports, the program will automatically apply the Rule to the corresponding transactions, importing them already complete with all the information you have defined.

You can set up Rules:

- from the Transactions table

- from the Apply Rules dialog

- from the Recurring transactions table

Below we explain how to set up Rules from the Transactions table

Rules from the Transactions table

In the Transactions table you can use already imported and completed recurring transactions to create Rules.

- Select the imported transactions (after completing counterpart, VAT if applicable, cost centers, and segments).

- Right-click and choose Create rules from selection from the menu that appears.

Transactions with rules are saved in the Recurring transactions table and can be identified in the Doc column by the “!Rule” identifier.

By saving rules complete with all details, at the next data import from the bank or postal statement, the program will insert the transactions automatically completing the counterpart and all the other stored elements. The amount is updated based on the latest import.

In the Recurring transactions table you can edit rule-based transactions at any time:

- add more transactions with rules

- delete transactions with rules that are no longer needed

- modify rules of already existing transactions

Rules from the Apply Rules dialog

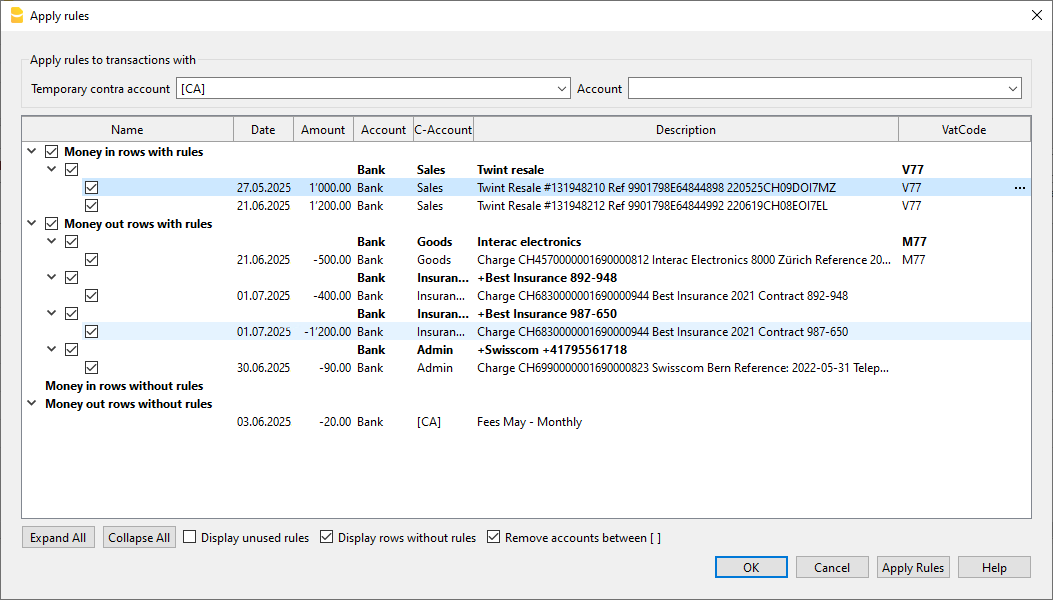

Rules can also be set at the moment when transactions are imported from the bank statement or other statements through the Apply Rules dialog.

More information is available on the following pages:

The indicated pages use double-entry accounting files as examples, but the principles are the same for income/expense accounting.

Rules from the Recurring transactions table

This procedure requires manually entering recurring transactions directly in the Recurring transactions table before recording the transactions in the Transactions table.

To follow this procedure, see the information on the following page:

The indicated page uses double-entry accounting files as examples, but the principles are the same for income/expense accounting.