In this article

Introduction

In Banana Accounting it is possible to manage suppliers both with the accrual and cash method. A detailed explanation is available on the accounting with the accrual or cash principle page.

Below we explain how to set up the group and supplier accounts, so that you can have a separate invoice list for each supplier.

If you have few invoices and do not want to keep a detail by supplier, it is also possible to have only one account where all the invoices of the suppliers are recorded. In this case, the list of invoices will be grouped by all suppliers and not by a single supplier.

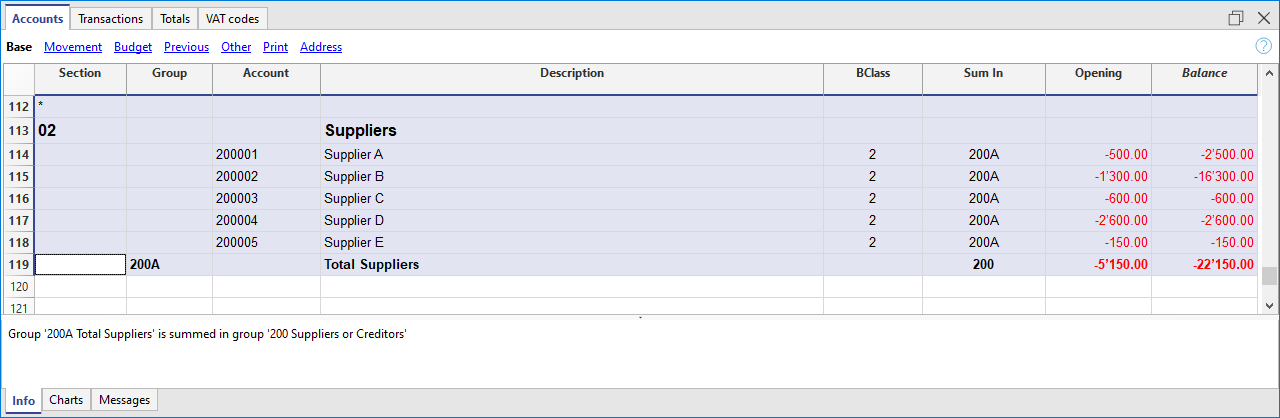

Setting up the Suppliers' register

To create the Suppliers' register, add at the end of the Chart of accounts:

- A* section (header) (see Sections)

- A 02 section for suppliers (see Sections)

- The Suppliers' accounts that are needed (see Adding a new account). Each supplier is entered on a row of the Chart of Accounts and has its own account number. The account numbering can be freely chosen (see Accounts), however it is recommended to use only numbers, in particular for the management of payments.

- A group where all the accounts payable are totaled.

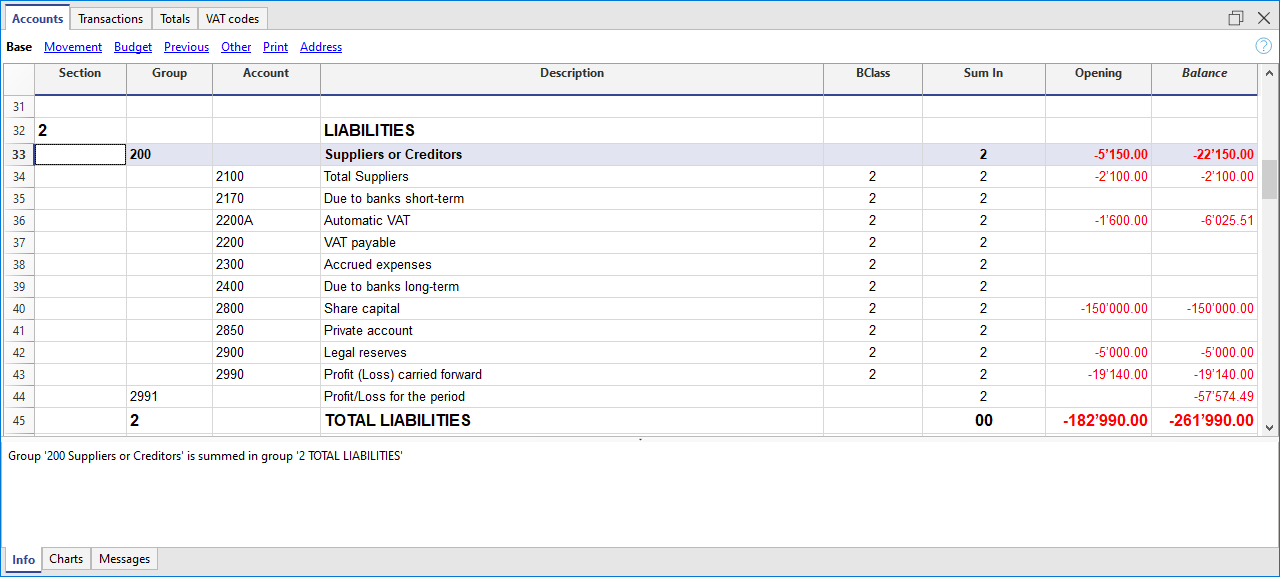

- This group is in turn totaled into a group present in the liabilities.

- The total Suppliers will be totaled in the 200A summary group of the Sum in column.

- The same code or number used for the Gr (200A), must be used in the Liabilities Group column, in the row corresponding to the Total Suppliers. The groups numbering can be freely chosen (see Groups).

Record a received invoice

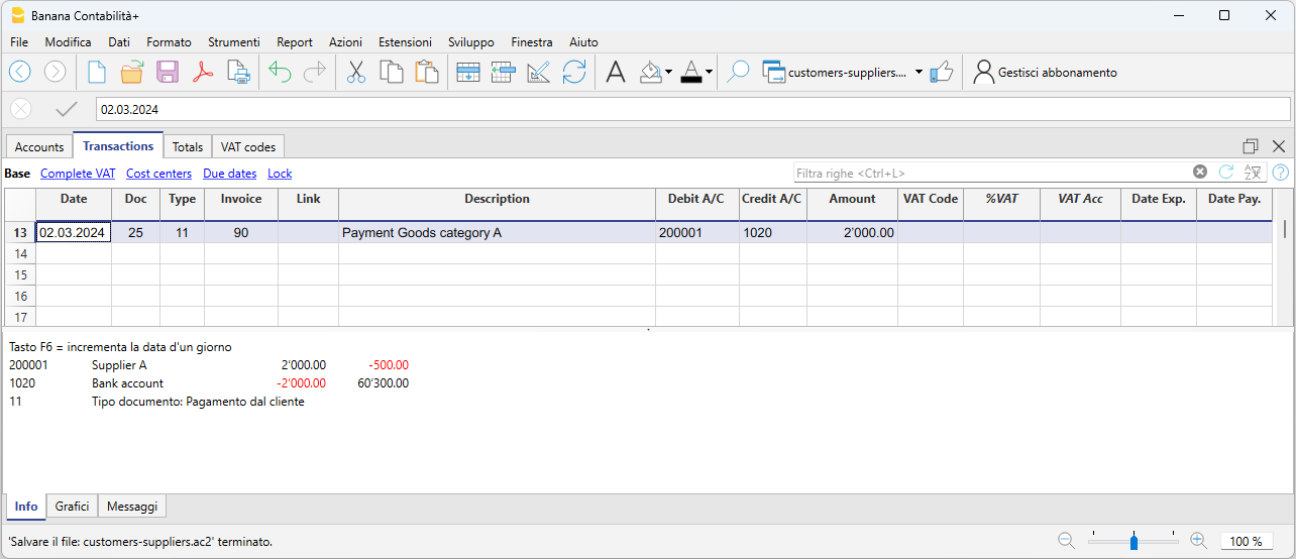

Record a payment

- Enter the transaction date

- Position yourself on the Invoice field and press the F2 key or double click on the cell.

The list of open invoices will be displayed. - Select the paid supplier invoice and press Enter.

The program will complete the transaction with the Description, Debit Account and Amount fields. As long as the contra account is not entered, the program will report the difference in the transactions.

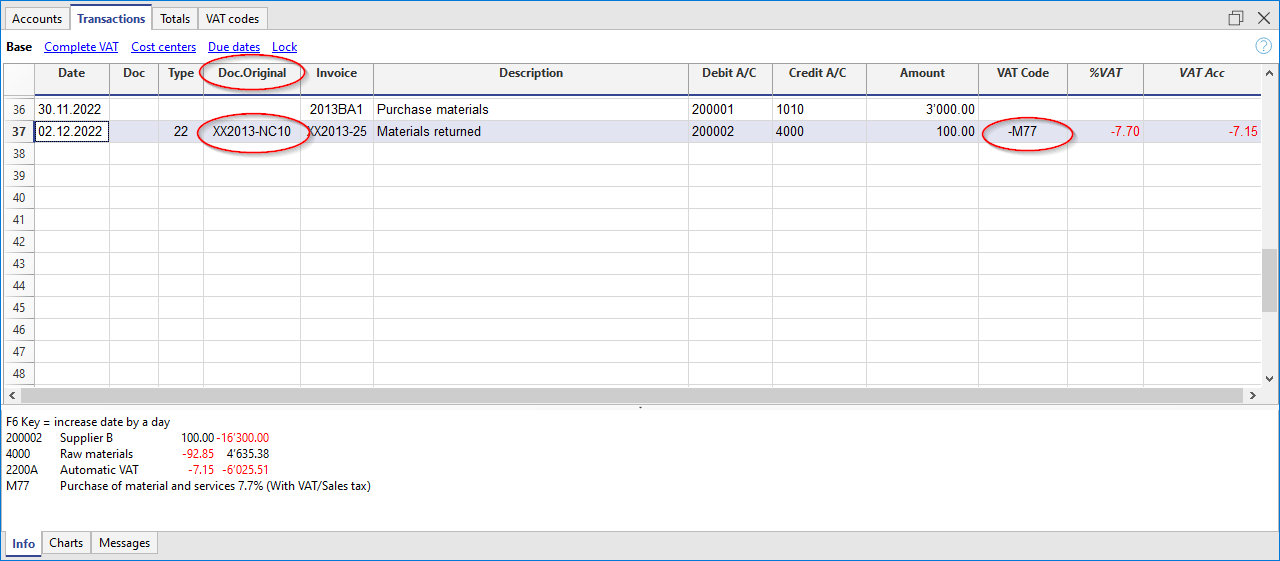

Record a credit note

The same invoice number must be used for the amount to be deducted from the initial invoice. If the adjustment document (for example a credit note) has a different numbering that you still need to keep available, write this reference in another column, for example DocOriginal.