In this article

It is possible to manage the customers/suppliers register, even when using the cash method, as with the Cost and Profit Centers.

- We advise you to use the CC3 cost center (where the accounts are preceded by a semi-colon ";") to set up the customer and supplier register

- Set up the customers group via Reports → Customers → Settings.

For all Swiss users who manage the VAT on cash received, this setup is the best to manage the VAT. This setting allows to manage VAT optimally and to know the details for customers and suppliers.

By using this setup, the cost center balances for customers and suppliers will not appear in the Balance Sheet, but you will have all data and reports for internal purposes.

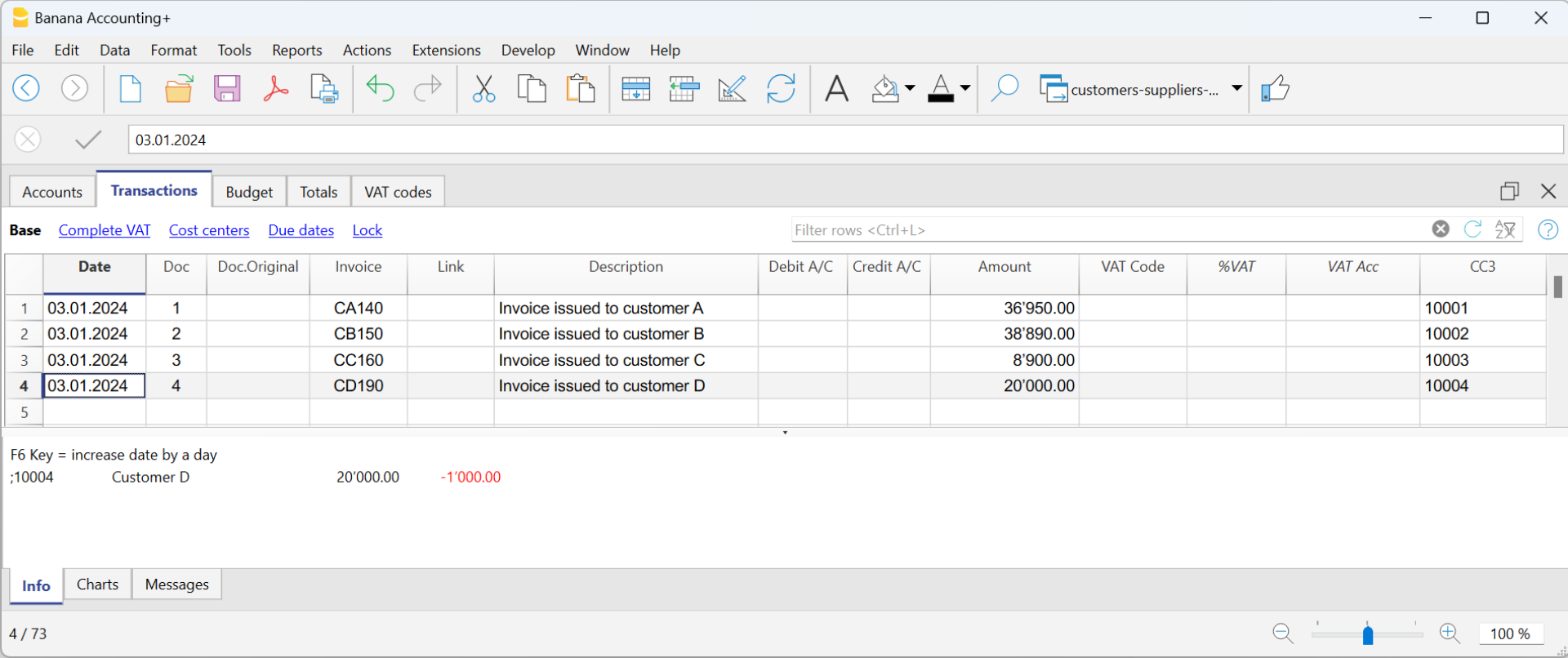

How to record when issuing an invoice

When you issue an invoice, record it as follows:

- In the Date column, enter the date of the invoice.

- In the Doc column, enter the document number if available.

- In the Invoice column, enter the invoice number.

- In the Description column, enter a description.

- In the Debit, Credit and VAT Code columns, do not enter any data.

- In the Amount column, insert the gross amount without any VAT code.

The VAT code in the case of cash management is recorded when the invoice is collected. - In the CC3 column, insert the CC3 account of the client without the ";" (ex. 10004).

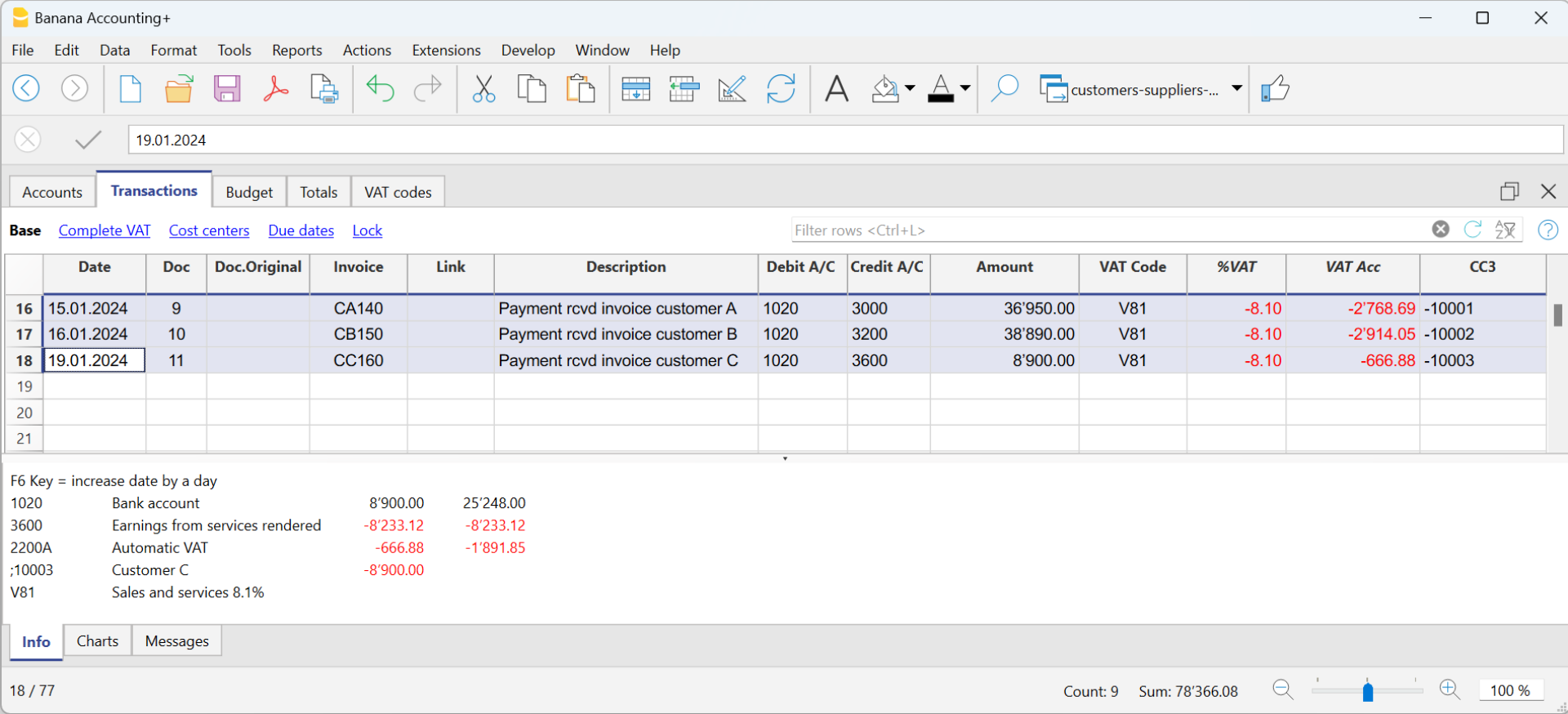

How to record when an invoice is paid

When you collect an invoice, record it as follows:

- In the Date column, enter the date the invoice was collected.

- In the Doc column, enter the document number if available.

- In the Invoice column, enter the invoice number collected.

- In the Description column, enter a description.

- In the Debit column, enter the bank account (or other cash account).

- In the Credit column, enter the revenue account corresponding to the invoice.

- In the Amount column, enter the gross amount.

- In the VAT Code column, enter the VAT code of the invoiced sales or service.

- In the CC3 column, enter the customer's CC3 account without the ";", with the minus sign "-" in front of the account (e.g. -10004).

In Integrated invoicing with Income/Expense accounting, with a customer ledger configured with profit centres, the option Record (+/-) cost centres as category should not be activated, as the account and category are not indicated when the invoice is issued.

More information can be found on page Clients and suppliers with VAT, using the Cash method.

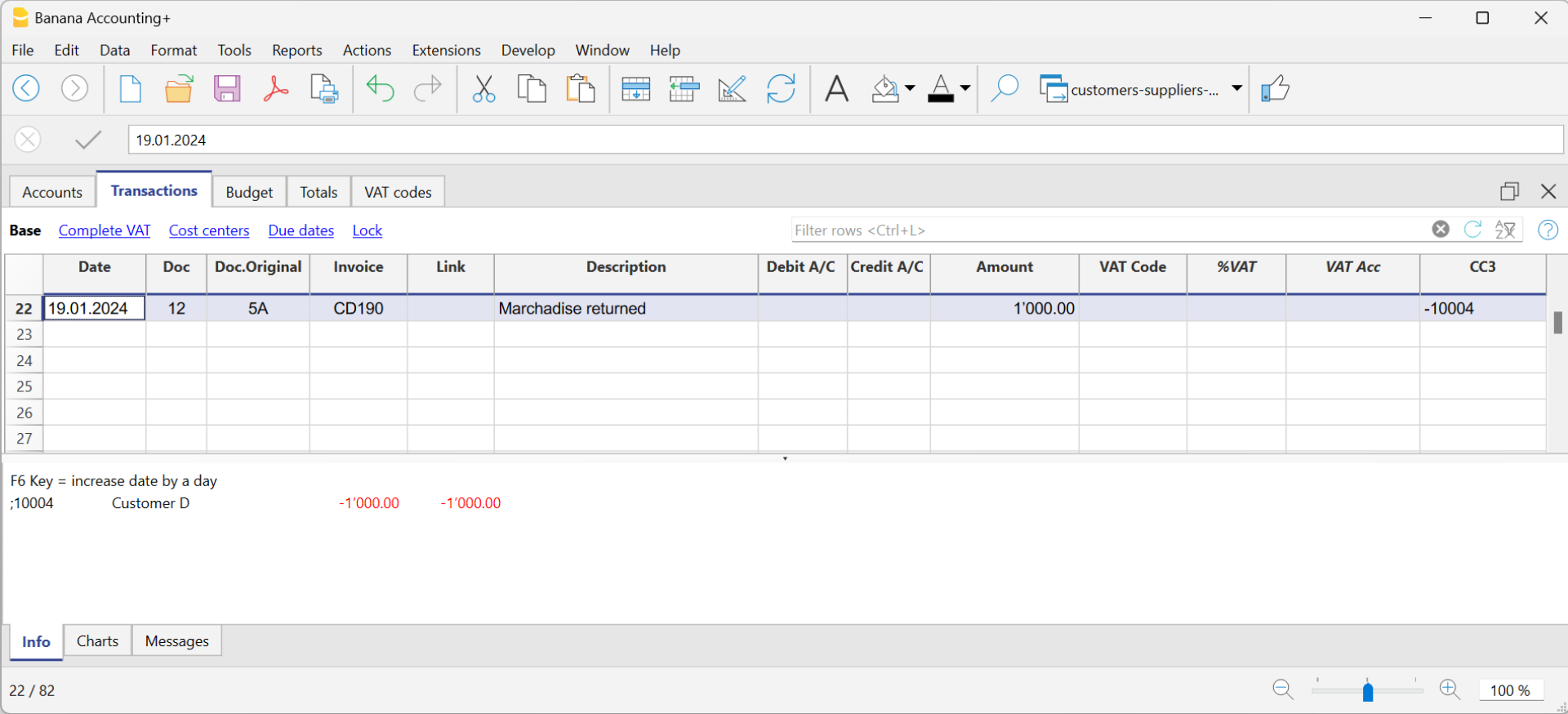

How to record a credit note with cash method

For the amount to be deducted from the initial invoice, the same invoice number must be used.

- If the adjusting document (e.g. a credit note) has a different number, which you must still keep, write this reference in another column, e.g. Doc. Original

- Enter the data for the Date, Original Document, Description columns

- Leave the Debit and Credit columns blank

- Enter the amount and in column CC3, enter the customer's cost centre with a - sign.

N.B: In order to print the credit note to be sent to the customer, you must indicate in the column TypeDoc: 12, see Credit notes.