En este artículo

In VAT management, each country requires specific VAT accounts within the chart of accounts. These accounts are used to record and manage input and output VAT:

- VAT payable – Account where VAT amounts related to sales and services are recorded.

- VAT receivable – Account where VAT amounts on purchases of goods and services are recorded.

- VAT payment account – Account where, at the end of the period, the balances of VAT payable and VAT receivable are transferred.

The account balance represents the VAT to be paid to the tax authorities or the credit to be received. This account is cleared once the VAT payment is made.

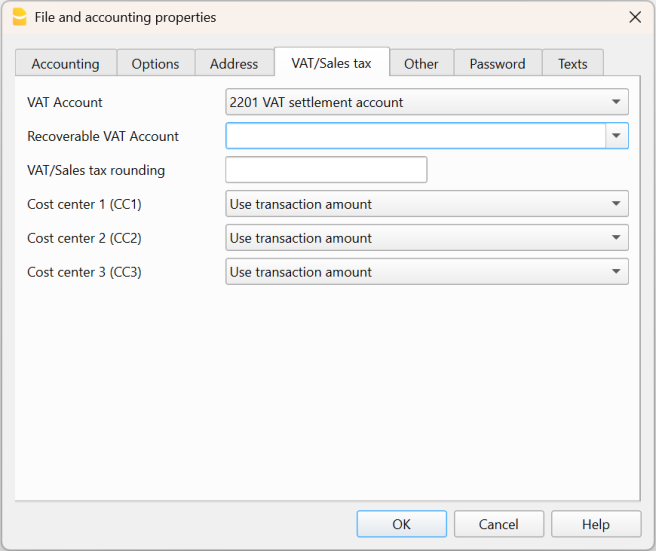

In Banana Accounting, to manage VAT, you must choose an accounting model with VAT that already includes the following settings:

- In the Banana chart of accounts, the VAT accounts are already set up according to the country

- The VAT Codes table is already prepared with country-specific VAT codes

- In the menu File > File properties, basic data > VAT section, the two VAT accounts where VAT is automatically recorded are set, one VAT payable account and one VAT receivable account.

- You can also set only one VAT account. This is used for both VAT payable and VAT receivable.

- In the VAT Codes table, you can set a specific VAT account for a single VAT code.

- If these settings are missing, it is possible to:

- Add an additional VAT account in the chart of accounts, named Automatic VAT account.

- Set the automatic VAT account as default by going to File > File properties, basic data > VAT section.

How to automatically clear VAT accounts at the end of the period

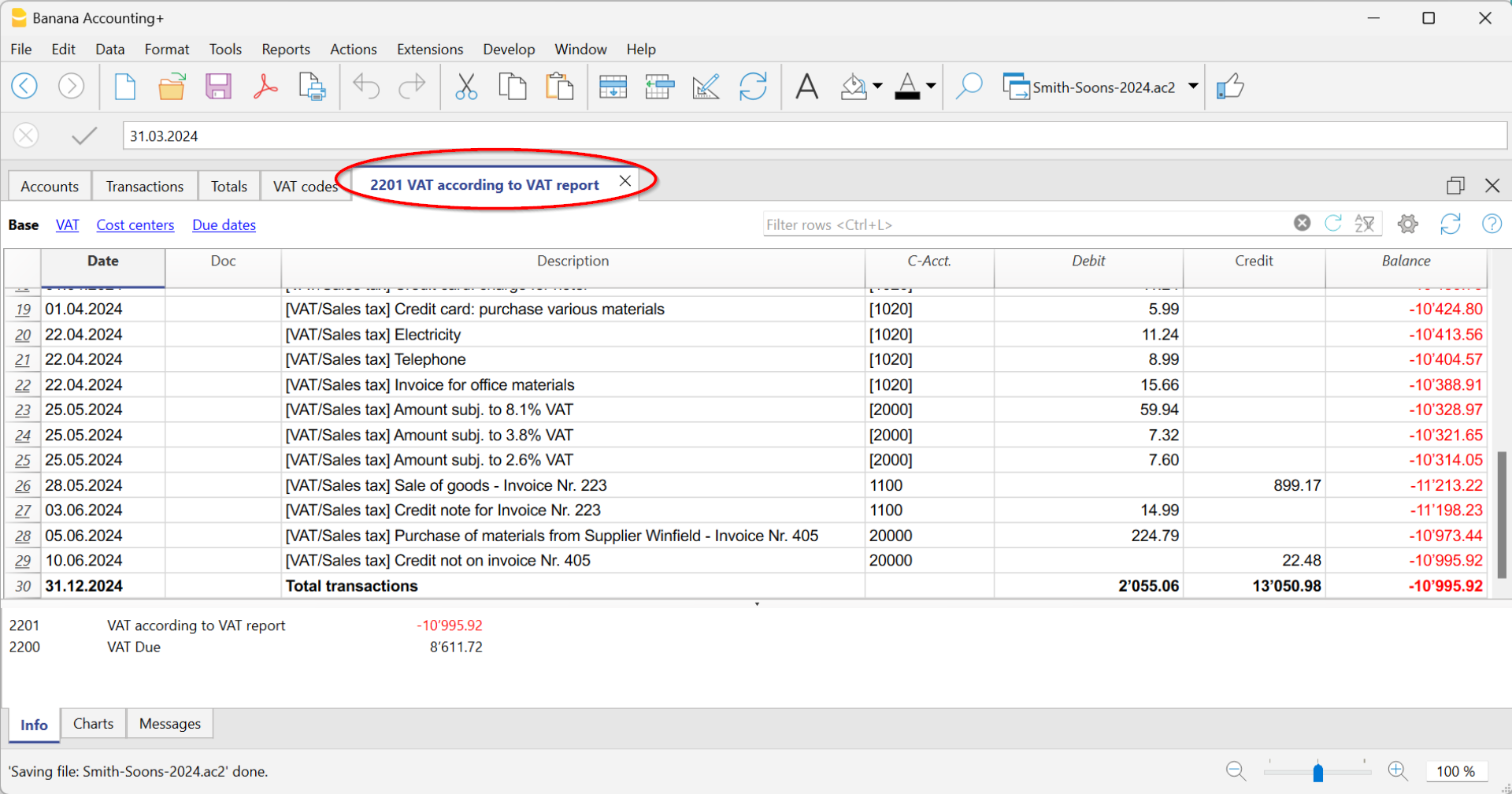

To better understand how the automatic VAT account is used, let’s look at a practical example.

Note: the VAT account numbers shown in the following example refer to the numbering used in Switzerland. In your own chart of accounts, you must adapt the account numbers according to your country.

- VAT account 2201 – Represents the automatic VAT account.

- VAT account 2200 – Represents the VAT payment account.

At the end of the period, to clear the balance of the automatic VAT account, the VAT amount recorded automatically must be transferred to the VAT payment account. This step allows you to determine the VAT to be paid or the possible VAT credit, simplifying accounting management.

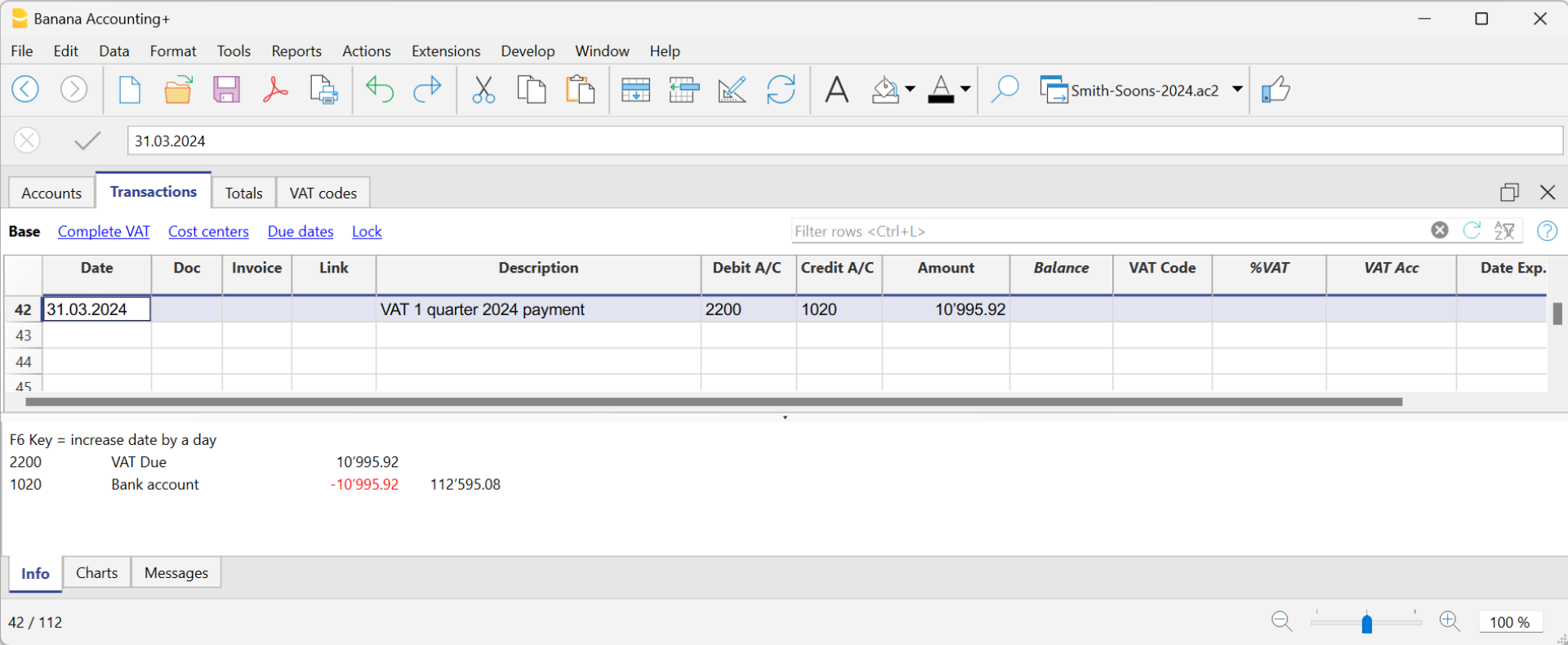

In our example shown in the image, at the end of the period, scheduled for VAT submission and payment, the balance of the automatic VAT account shows a balance of 10,995.92.

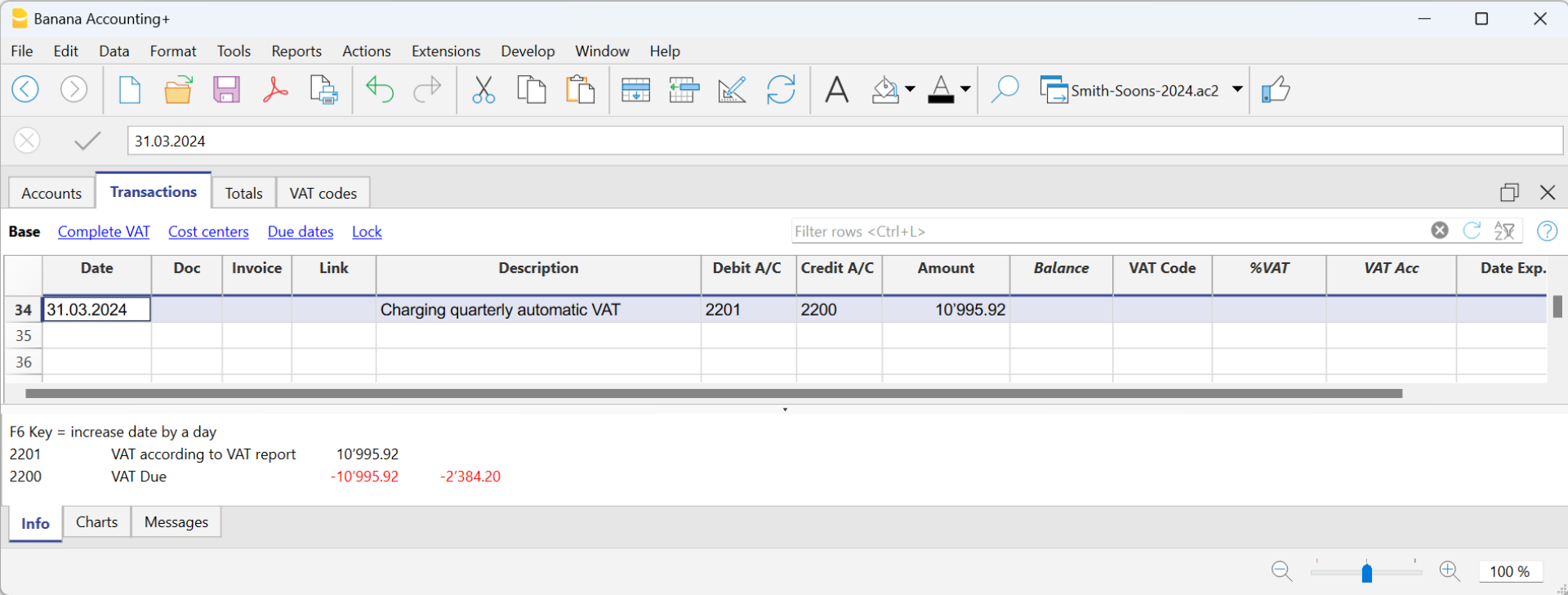

The balance of account 2201 VAT Report (automatic VAT account) must be cleared with a reversal entry by entering:

- In the Debit column, account 2201 VAT report (automatic VAT account)

- In the Credit column, account 2200 VAT due (VAT payment account).

This entry is made in this way if there is an amount owed to the tax authorities. If there is a VAT credit, the VAT account transactions are reversed.

This operation results in:

- Clearing of the balance in account 2201, VAT Report (automatic VAT account).

- Transferring the VAT balance to the VAT due account (VAT payment account).

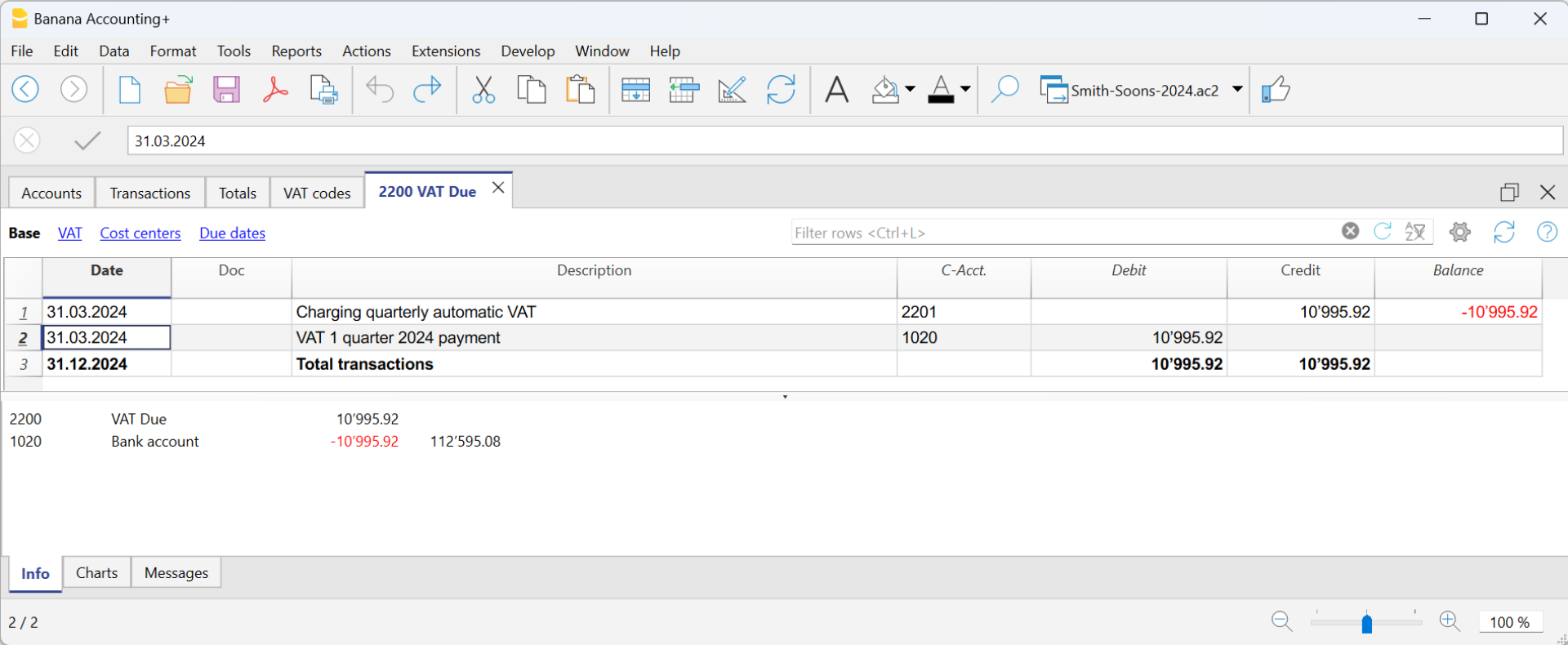

Payment of the VAT due account balance

When the VAT amount is paid to the tax authorities, the balance of the VAT due account is cleared.

For the entry:

- Enter the date, document number, and description in the respective columns.

- In the Debit column, enter the VAT Due account.

- In the Credit column, enter the liquidity account.

- In the Amount column, enter the VAT amount paid.

With this system, it is possible to monitor the balance of each quarter, and in case of errors, it is possible to identify in which period the balance no longer matches.

Ledger of account 2200 VAT due after recording the payment