In this article

Banana Investment Accounting allows you to manage bonds, shares, funds and other financial instruments in multiple currencies, directly within your accounting file. It is an accessible solution that brings advanced features, typically found only in specialized investment software, within everyone’s reach. By integrating investment tracking directly into a comprehensive, double-entry accounting system, you gain an enterprise-level view of your entire financial position, including an instantly updated balance sheet and Profit & Loss (P&L) statement.

The double entry accounting advantages

Banana Investment Accounting makes complex investment tracking and reporting accessible to everyone. Built on double-entry accounting principles, it delivers fully traceable, transparent and reliable results, giving professionals complete confidence in their financial information. The software precisely tracks movements, quantities, prices and the accounting value of each security. Each investment transaction instantly updates both portfolio data and the balance sheet and profit and loss statement, with no additional steps or manual adjustments. At any time, you have full visibility and verifiable evidence of all portfolio components and their impact on your financial statements. When a security is sold, realized gains or losses are calculated automatically, and the required transactions to align book values with market prices are generated seamlessly.

The solution supports an unlimited number of securities and transaction amounts, while remaining well suited for moderate trading volumes, as imported investment transactions are completed semi-manually. It is already used by companies, pension funds and private individuals with complex portfolios, including securities and cryptocurrencies worth hundreds of millions across multiple countries and currencies, and it reliably manages portfolios valued in the billions in a simple, structured and controlled way.

- See How to Start.

Banana Investment Accounting can also be used by finance professors to improve investment education.

Ideal for

Banana Investment Accounting is a Swiss-quality professional software solution designed for investment managers all over the world, particularly for:

- Companies holding different investments.

- Pension funds overseeing large multi-asset portfolios.

- Non-profit organizations with investment or endowment funds.

- Private individuals with complex assets.

- Independent accountants and bookkeepers offering investment accounting services.

- Family offices managing diversified investment portfolios.

Key Features

Banana Accounting, thanks to its highly innovative features, stands out as one of the few international accounting solutions accessible to everyone, offering a fully integrated investment accounting system. It combines professional-grade functionality with Excel-like simplicity and flexibility, making it easy to use for any type of investor or organization anywhere in the world.

- All professional accounting features.

With a fully customizable chart of accounts and reporting. - Instantly updated balance sheet and profit and loss statement.

Transactions update both financial accounting, including the balance sheet and the profit and loss statement, and investment accounting. - Complete investment overview.

Keep a detailed list of all your investments — bonds, shares, ETFs, funds, and more — directly linked to specific asset accounts. - Multi-currency support.

Manage international portfolios with built-in currency conversion and automatic tracking of both unrealized and realized exchange rate gains and losses. - Detailed transaction recording.

Record quantities, prices, and exchange rates directly within standard accounting entries — no extra modules or steps required. - Full privacy and total independence.

The software runs on your computer and you decide where to save and keep your accounting data.

Introduction to the Investment accounting

Multi-currency investment accounting is one of the most complex areas in accounting.

It combines two different accounting approaches: financial accounting, based on the double-entry method, and securities accounting, which resembles inventory management, involving quantities and purchase prices.

- Theoretical Introduction to Investment and Portfolio Accounting

There are many aspects to consider — from valuation methods to profit and loss recognition — which is why we have prepared a theoretical guide that outlines the key challenges, including how to determine the book value of investments and how to calculate realized and unrealized gains and losses, both on securities and on exchange rate differences. - How to start

A short introduction guide that introduce to the logic and the workflow of Banana Investment Accounting.- Prior to starting investment accounting you need to set up all elements properly.

- When recording daily investment transactions you also need to follow a specific workflow.

- At the end of the year you have to adjust the investment value to the market price by recording the unrealized profit or loss.

Structure of the Investment Accounting File

Banana Accounting is a highly modular financial accounting system that allows you to create files with features activated only when needed.

The multi-currency investment accounting setup is among the most advanced, as it combines double-entry financial accounting with inventory-style management for tracking securities, quantities, and valuations. A typical Investment Accounting template or file includes the following elements:

- File properties

- Company names, Currency and Accounting Period.

- Settings Specific to the Investment accounting .

- Accounts Table

- Contains the chart of accounts and defines how data is grouped for the Balance Sheet and Income Statement.

- Enter the Opening amounts.

- Items Table

- Lists and codes all investments, such as bonds, shares, and funds.

- The Asset Investment column links each security to its corresponding Balance Sheet account — a key element of the entire solution.

- Exchange Rate Table

Defines the currency codes and stores both opening and current exchange rates for accurate multi-currency management. - Transactions Table

- Records all investment transactions.

- Enter the double entry account, amounts and exchange rate for the financial accounting.

- Enter the Item code, quantity and price specific for the Investment accounting.

- Double-Entry Accounting Reports

Provides access to all standard accounting reports such as Balance Sheet, Income Statement, Account Cards, and more. - Investment Accounting Extensions

You need to install the Add specific functionalities for investment management, including profit and loss calculations, valuation reporting, and other analytical tools tailored to securities accounting.

Account Table

Within the Accounts Table you define all the accounts including the one necessary for the Investment accounting: Balance Sheet accounts for investments, Profit and Loss Accounts.

In the Account table you also enter the opening amounts and you see the current balance.

Items Table with all Investments

In the Items Table you enter the information for each investment.

Through the Asset Account each security is linked to the Investment account you have specified in the Table Accounts.

You also enter the opening quantity and price.

Transactions Table with Investments Details

The Transactions Table is the place where you enter Double entry accounting transactions.

- For transactions regarding Investments you specify the Investment id, quantity and price.

- You can easily manage all the information in one place (Purchase of investments, Sale of investments, Realized and unrealized gains or losses on investments, Realized and unrealized exchange rate gains or losses, Commissions, Expenses, etc.)

- You can import transactions from bank statements and create rules that automatically complete them.

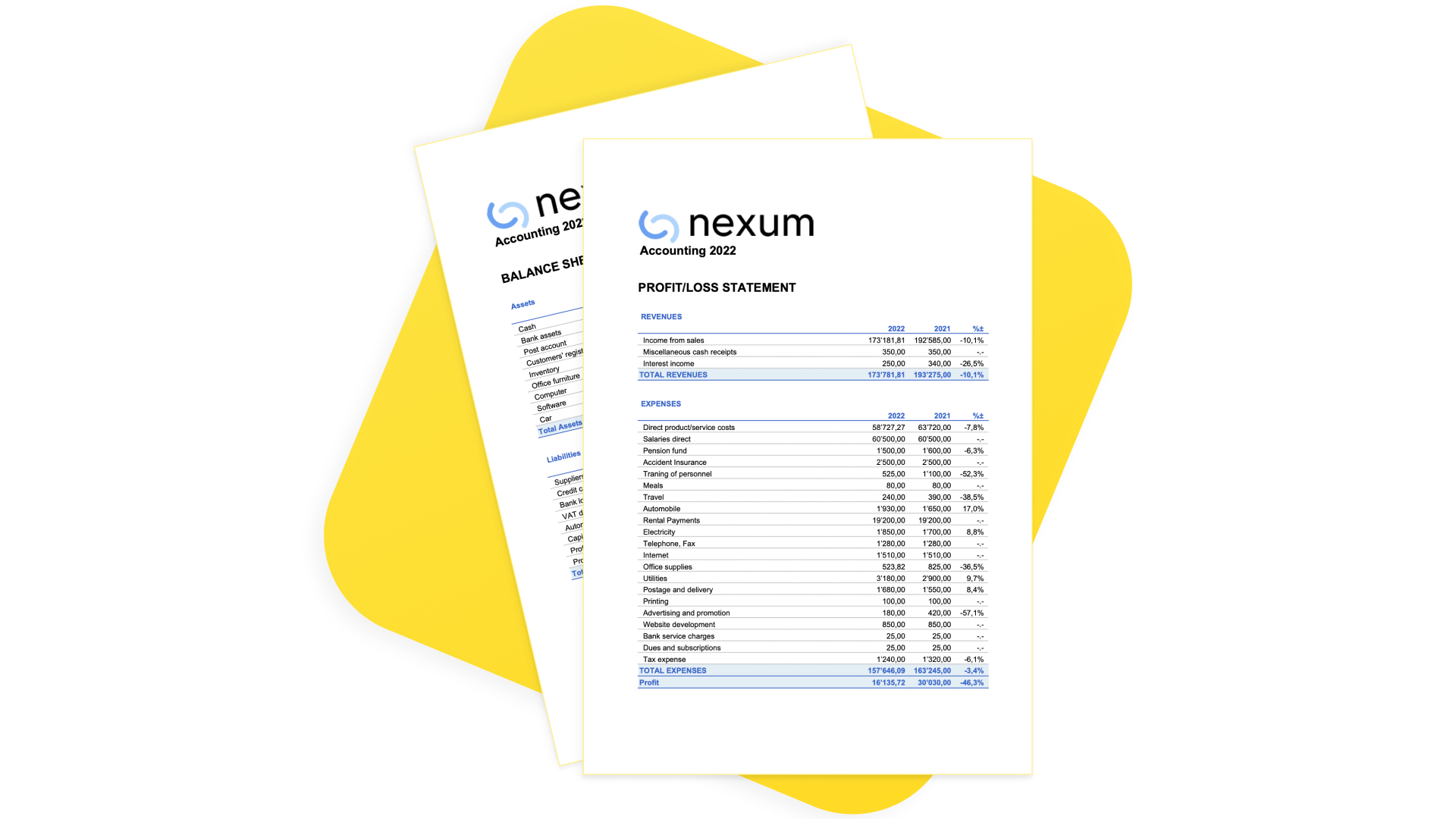

Balance Sheets & Income Statements

With fully customizable accounting plan and presentation, you can manage any kind of business, financial corporations, foundations, non-profit organization or private fortune. Get instantly Balance sheet, Income statements and all the other double entry reports ready for auditing.

Investments and Portfolio Reporting

The software makes available multiple reports.

Getting Started

- You can see how it works by using one of our templates.

- Adapt your current accounting in just a few steps.

- Use the extensions to calculate the profit or loss on the sale of securities and obtain various reports.

Documentation

Limitations

The current version has some limitations:

- There is no automatic update of market prices.

Current prices must be entered manually or imported from other tools. - The current account value of each item is available as a report, but it is not displayed in the Item table.

Improvements version 10.2.1

Version 10.2.1 of Banana Accounting, released at the end of October 2025, introduces important new features specifically designed to support securities management. It represents a significant step forward from previous versions, solving some limitations and making the solution more powerful and professional, while also making data entry easier.

Enhancements in the Items Table

New specific columns have been added to the Items table to facilitate and strengthen the management of investments in Banana:

- AssetAccount: Balance sheet account for managing investments.

- AssetType: Identifies the type of investment.

New Validations

- In the Transactions table, for operations involving investments, the program now verifies that the correct account is used for a given security (Item).

- Using the command Actions → Check Accounting, it is now possible to verify that the opening values of investments in the Items table correspond to the balance of the assigned account.

Automatic Unit Price Calculation

In the Transactions table, it is now possible to automatically calculate the unit price based on the entered amount and quantity.

Extension Update

Together with this new program version, the Investment accounting extension will soon be updated and will be compatible only with version 10.2.1 or later of the program.

The new extension version includes:

- Adaptation to work with the new columns.

- Update to use the new neutral numbers.

- Removed extension "Calculate Unit Price" as it is no longer necessary (see the Automatic Unit Price Calculation section).

- Fixes for several minor report-level bugs.

The new version of the extension will require users who are already managing investment accounting to follow the simple steps below to adapt their existing file. All the following changes must be made in the Items table:

- Make visible the two new columns:

- AssetAccount

- AssetType

- Copy all accounts from the “Account” column to the “AssetAccount” column by simply copying and pasting the content of the column.

For simplicity, the “Account” column can be cleared if it is not used for other purposes, as it is no longer relevant for investment management. - Enter the asset type in the “AssetType” column:

- 1 = Shares — previously, in the Units column, shares were identified using the symbol “S”.

- 2 = Bonds — previously, in the Units column, bonds were identified using the symbol “B”.

- The Units column can also be cleared (if not used for other purposes), since it is no longer used for investment management.

Dedicated Newsletter

Subscribe to our newsletter to stay updated on new features and tips about Investment Accounting in Banana. Interested? Just write to us at info@banana.ch and mention that you’d like to subscribe to the newsletter.

Is there more you need?

The solution is already used by several customers, but we still consider it under development, as we continue to improve it based on user feedback and requests. We also plan to add the automatic import of investment data (ISIN, quantity, price, commission) from bank statements.

Please feel free to reach out if you have any specific questions or requests. Given the time invested in development and the high value it provides to select customers, we may offer it through a specific subscription plan in the future.