In this article

Partnerships (general partnerships and limited partnerships) | Double-entry multi-currency accounting | VAT

Template for accounting of a partnership with foreign currency accounts and VAT management, using the new rates from 2024. Automated functions simplify and speed up entries, highlight errors, and minimize the margin for mistakes. You can create invoices in foreign currencies as well as in the national currency, send reminders, and generate quotes and cash flow forecasts. Online VAT returns are available with the Advanced plan. Get the balance sheet, income statement, account ledgers, journal, and other reports. Cost/profit centers help monitor performance. The budget feature helps forecast costs, revenues, and future liquidity. Open the template from our WebApp or the program and save the file to your computer.

Open in Banana WebApp

Run Banana Accounting Plus on your browser without any installation. Customize the template, enter the transactions and save the file on your computer.

Open template in WebAppTemplate documentation

Ideal template for a partnership. It includes all the columns and features to manage foreign currency accounts and VAT in compliance with the 2024 regulations. Automatic calculations and exchange rate differences.

Create your file

- Open the template with the Banana Accounting Plus WebApp

- From the File > File Properties menu, set the period, your company's name and the base currency in any currency you prefer.

- From the File > Save As menu, save the file. It is helpful to include the company name and year in the file name. For example "Rossi-SA-20xx.ac2".

- In the Exchange Rates table, set up the foreign currencies always with reference to the base currency and the rates. Opening exchange rates are set only the first time you use Banana Accounting. When moving to a new year, these will be automatically carried forward based on the closing exchange rates entered on 31.12.

WARNING: if you close your browser without saving, you will lose all entered data. Always save the file on your computer.

To reopen the saved file, click File > Open.

For VAT management with the new rates, you can find detailed information on the web page VAT Management.

Some features require a subscription to the Advanced plan of Banana Accounting Plus, such as generating the preview or the XML file for the VAT Report, and using the new features for Rules, Filter, and Temporary Row Sorting. See all features of the Advanced plan.

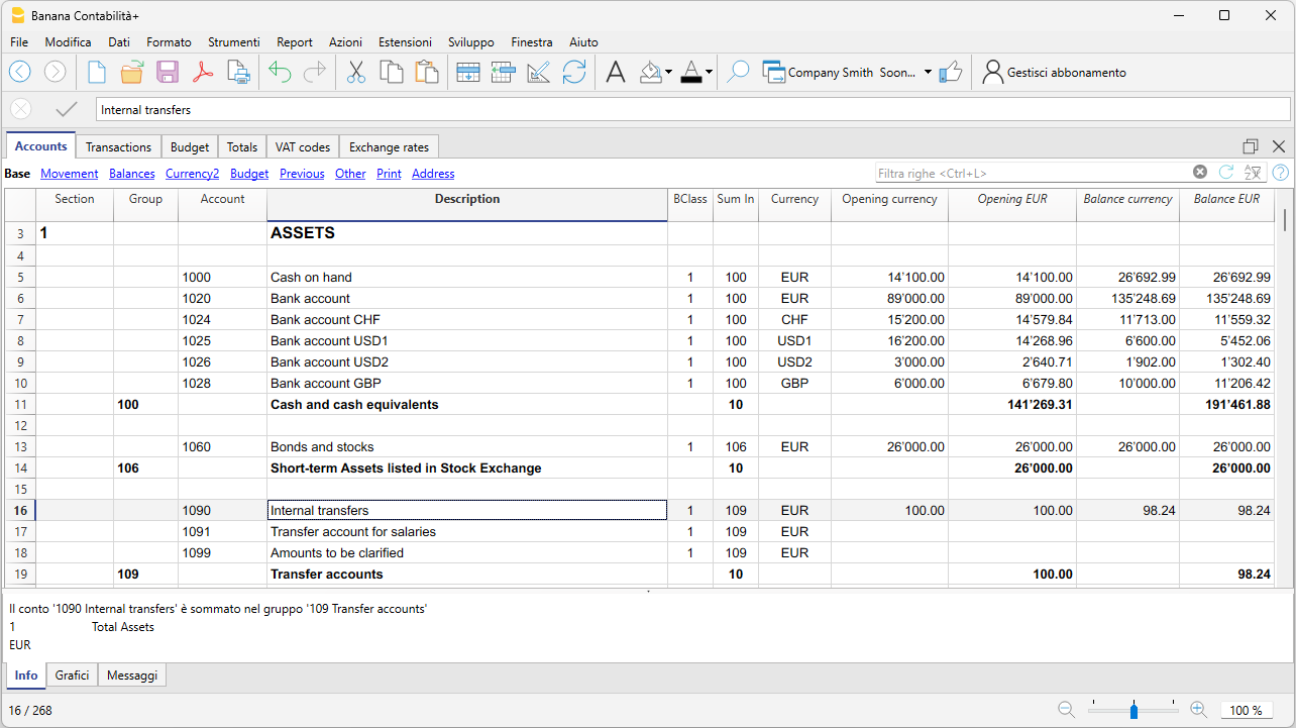

Accounts Table

In the Accounts table, customize the chart of accounts to your needs and add your customer and supplier accounts with all the necessary data, using the columns in the Address view.

The first time you use Banana Accounting, you need to enter the opening balances in the Opening column, which should match the closing balances from the previous year.

In the following year, when you move to the new accounting period, the program will automatically bring forward the closing balances from the previous year into the Opening column.

Project management can also be done using Segments and Cost Centers.

Transactions Table

In the Transactions table, daily entries are recorded. For quick data entry, refer to the web pages Text entry, editing and smart fill, and Recurring transactions.

You can make either simple transactions (one debit and one credit on the same row), or compound transactions (multiple debits and/or credits across several rows).

The Transactions table includes specific columns for multi-currency transactions.

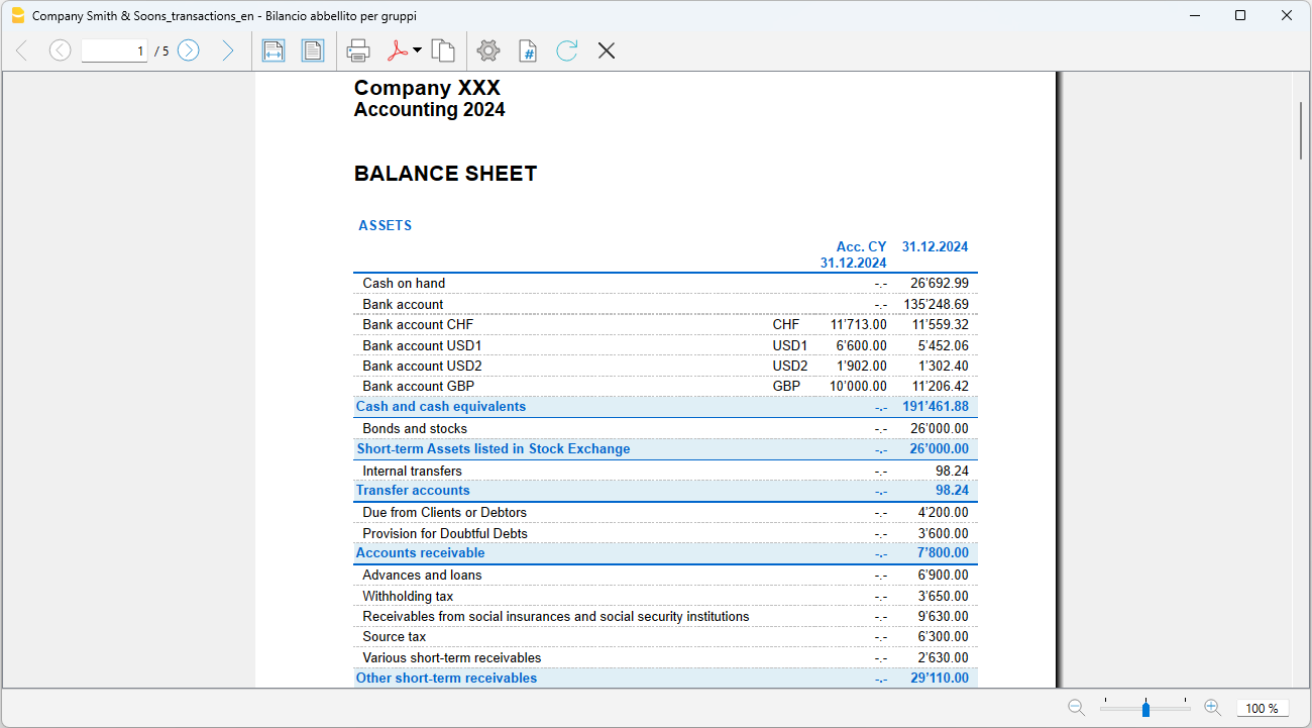

Balance Sheet

The Balance Sheet is generated from the Reports > Enhanced Balance Sheet by Groups menu and can be customized in its presentation. Each layout can be saved through Customizations, allowing you to reuse it as needed (e.g., quarterly, semi-annual balance sheet, audit, etc.).

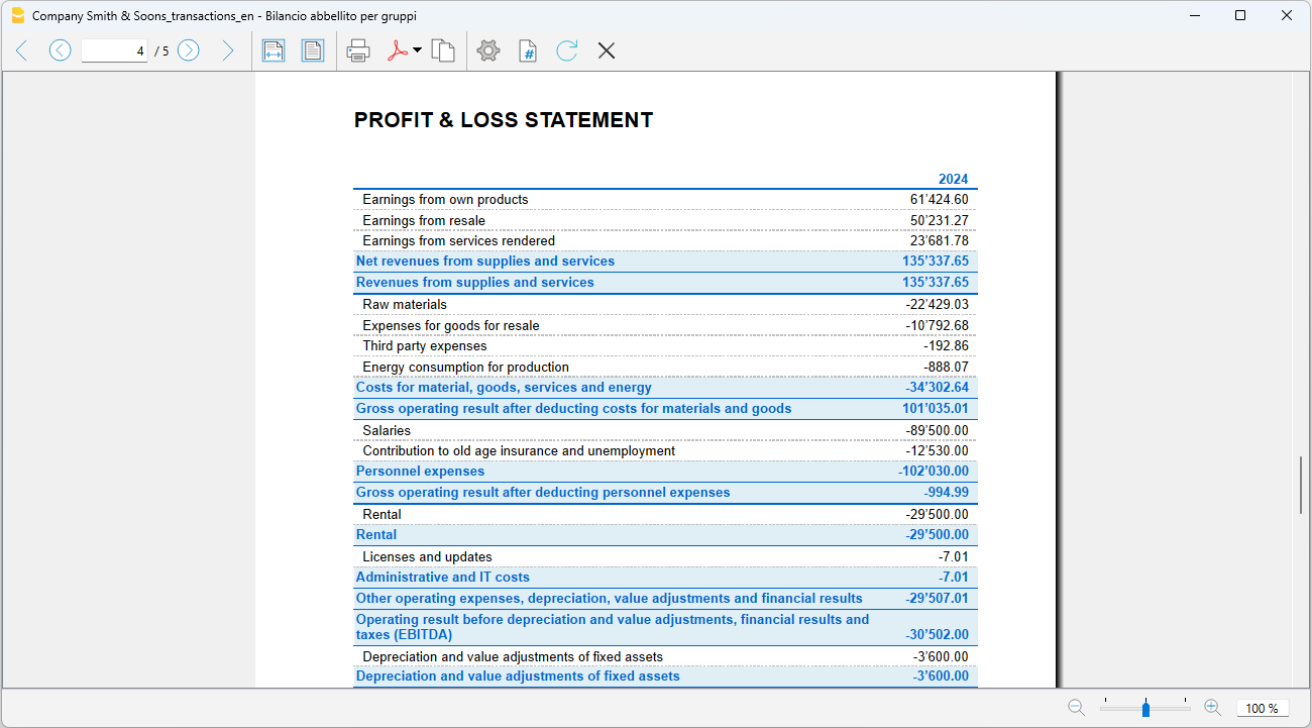

Profit and Loss Statement

The Profit and Loss Statement is generated from the Reports > Enhanced Balance Sheet by Groups menu and can be customized in its presentation. Each layout can be saved through Customizations, allowing you to reuse it as needed (e.g., quarterly, semi-annual balance sheet, audit, etc.).

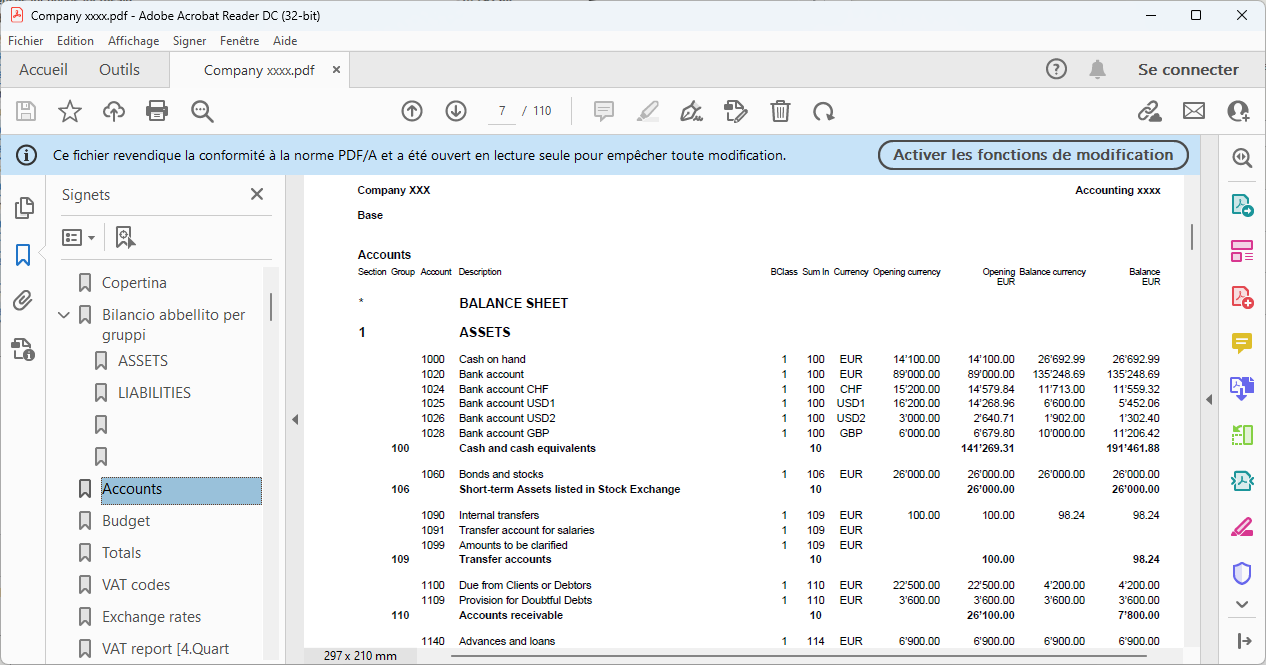

PDF Archive

At the end of the year, or whenever needed, you can archive all your accounting data by creating a PDF file from the File > Create PDF dossier menu.

The PDF dossier can be sent via email to the auditor and reused in case of tax inspections.

Additional Resources

In our Documentation you will find all insights and topics related to multi-currency accounting, in particular:

Template preview

Company XXX

Accounting 2024

Basic Currency: CHF

Double-entry with foreign currencies and VAT/Sales tax

| Group | Account | Description | Currency | Sum In | Gr1 |

|---|---|---|---|---|---|

| BALANCE SHEET | |||||

| ASSETS | |||||

| 1000 | Cash on hand | CHF | 100 | ||

| 1020 | Bank account | CHF | 100 | ||

| 1024 | Bank account Euro | EUR | 100 | ||

| 1025 | Bank account USD | USD | 100 | ||

| 100 | Cash and cash equivalents | 10 | 1 | ||

| 1060 | Bonds and stocks | CHF | 106 | ||

| 106 | Short-term Assets listed in Stock Exchange | 10 | |||

| 1090 | Internal transfers | CHF | 109 | ||

| 1091 | Transfer account for salaries | CHF | 109 | ||

| 1099 | Amounts to be clarified | CHF | 109 | ||

| 109 | Transfer accounts | 10 | |||

| 1100 | Due from Clients or Debtors | CHF | 110 | ||

| 1109 | Provision for Doubtful Debts | CHF | 110 | ||

| 110 | Accounts receivable | 10 | |||

| 1140 | Advances and loans | CHF | 114 | ||

| 1176 | Withholding tax | CHF | 114 | ||

| 1180 | Receivables from social insurances and social security institutions | CHF | 114 | ||

| 1188 | Source tax | CHF | 114 | ||

| 1190 | Various short-term receivables | CHF | 114 | ||

| 1191 | Securities | CHF | 114 | ||

| 114 | Other short-term receivables | 10 | |||

| 1200 | Goods for resale | CHF | 120 | ||

| 1210 | Raw materials | CHF | 120 | ||

| 1220 | Auxiliary material | CHF | 120 | ||

| 1230 | Consumables | CHF | 120 | ||

| 1260 | Finished products | CHF | 120 | ||

| 1270 | In-process products | CHF | 120 | ||

| 1280 | Non-invoiced services | CHF | 120 | ||

| 120 | Inventories | 10 | 1 | ||

| 1300 | Prepaid expenses | CHF | 130 | ||

| 1301 | Accrued income | CHF | 130 | ||

| 130 | Prepaid Expenses | 10 | 1 | ||

| 10 | Current assets | 1 | 1 | ||

| 1400 | Bonds and stocks | CHF | 140 | ||

| 1440 | Loans | CHF | 140 | ||

| 1460 | Loan to partner | CHF | 140 | ||

| 140 | Financial assets | 14 | |||

| 1480 | Investments | CHF | 148 | ||

| 148 | Investments | 14 | |||

| 1500 | Machinery | CHF | 150 | ||

| 1510 | Office furniture and equipment | CHF | 150 | ||

| 1520 | Office machinery, information and communication technology | CHF | 150 | ||

| 1530 | Motor vehicles | CHF | 150 | ||

| 1540 | Tools and equipment | CHF | 150 | ||

| 150 | Tangible assets | 14 | |||

| 1600 | Commercial buildings | CHF | 160 | ||

| 160 | Tangible fixed asset management | 14 | |||

| 1700 | Patents, know-how, licences, rights and development | CHF | 170 | ||

| 1710 | Brands | CHF | 170 | ||

| 1712 | Models | CHF | 170 | ||

| 1770 | Goodwill | CHF | 170 | ||

| 170 | Intangible fixed assets | 14 | |||

| 1850 | Share capital, rights not paid or non-paid Foundation capital | CHF | 180 | ||

| 180 | Capital or non-paid Foundation capital | 14 | |||

| 14 | Fixed Assets | 1 | |||

| 1 | Total Assets | 00 | |||

| LIABILITIES | |||||

| 2000 | Suppliers or creditors | CHF | 200 | ||

| 2030 | Deposits received | CHF | 200 | ||

| 200 | Suppliers or creditors | 20 | 1 | ||

| 2100 | Due to banks short/term | CHF | 210 | ||

| 2120 | Financial leasing commitments | CHF | 210 | ||

| 2140 | Other onerous debts | CHF | 210 | ||

| 210 | Short-term onorous debts | 20 | |||

| 2200 | VAT Due | CHF | 220 | ||

| 2201 | VAT according to VAT report | CHF | 220 | ||

| 2206 | Withholding tax | CHF | 220 | ||

| 2208 | Direct taxes | CHF | 220 | ||

| 2210 | Other short-term debts | CHF | 220 | ||

| 2260 | Due to partner | CHF | 220 | ||

| 2270 | Social insurances and social security institutions | CHF | 220 | ||

| 2279 | Source tax | CHF | 220 | ||

| 220 | Other short-term debts | 20 | |||

| 2300 | Accrued expenses | CHF | 230 | ||

| 2301 | Next year's revenues collected | CHF | 230 | ||

| 2330 | Short-term provisions | CHF | 230 | ||

| 230 | Accruals and deferred income | 20 | |||

| 20 | Short-term third party capital | 2A | |||

| 2400 | Due to banks | CHF | 240 | ||

| 2420 | Financial leasing commitments | CHF | 240 | ||

| 2430 | Debenture loans | CHF | 240 | ||

| 2450 | Loans | CHF | 240 | ||

| 2451 | Mortgage | CHF | 240 | ||

| 240 | Long-term onorous debts | 24 | |||

| 2500 | Other long-term debts (non-onorous) | CHF | 250 | ||

| 250 | Other long-term debts | 24 | |||

| 2600 | Provisions | CHF | 260 | ||

| 260 | Provisions and similar statutory posts | 24 | |||

| 24 | Long-term third party capital | 2A | |||

| 2A | Third party capital | 2 | |||

| 2800 | Equity partner A at the beginning of the year | CHF | 28 | ||

| 2810 | Contributions to equity/equity withdrawals partner A | CHF | 28 | ||

| 2820 | Private account partner A | CHF | 28 | ||

| 2831 | Profit / Loss for the year partner A | CHF | 28 | ||

| 2850 | Equity sponsor A at the beginning of the year | CHF | 28 | ||

| 2860 | Contributions to equity/equity withdrawals sponsor A | CHF | 28 | ||

| 2870 | Private account sponsor A | CHF | 28 | ||

| 2881 | Profit / Loss for the year sponsor A | CHF | 28 | ||

| 297 | Profit/loss for the period | 28 | |||

| 28 | Equity | 2 | |||

| 2 | Total liabilities | 00 | 1 | ||

| PROFIT & LOSS STATEMENT | |||||

| 3000 | Earnings from own products | CHF | 30 | ||

| 3200 | Earnings from resale | CHF | 30 | ||

| 3400 | Earnings from services rendered | CHF | 30 | ||

| 3600 | Other revenues and services | CHF | 30 | ||

| 3710 | Own consumption | CHF | 30 | ||

| 3800 | Decrease in revenues | CHF | 30 | ||

| 3805 | Losses on accounts receivable, credit variation | CHF | 30 | ||

| 3809 | VAT flat tax rate | CHF | 30 | ||

| 30 | Net revenues from supplies and services | 3 | |||

| 3900 | Change in inventories of in-process products | CHF | 39 | ||

| 3901 | Change in inventories of finished products | CHF | 39 | ||

| 3940 | Non-invoiced services variations | CHF | 39 | ||

| 39 | Change in inventories and Non-invoiced services | 3 | |||

| 3 | Revenues from supplies and services | E1 | |||

| 4000 | Raw materials | CHF | 4 | ||

| 4200 | Expenses for goods for resale | CHF | 4 | ||

| 4400 | Third party expenses | CHF | 4 | ||

| 4500 | Energy consumption for production | CHF | 4 | ||

| 4900 | Reduction of costs | CHF | 4 | ||

| 4 | Costs for material, goods, services and energy | E1 | |||

| E1 | Gross operating result after deducting costs for materials and goods | E2 | |||

| 5000 | Salaries | CHF | 5 | ||

| 5700 | Contribution to old age insurance and unemployment | CHF | 5 | ||

| 5710 | Family equalization fund | CHF | 5 | ||

| 5720 | Contribution to pension funds | CHF | 5 | ||

| 5730 | Contribution to accident insurance | CHF | 5 | ||

| 5740 | Contribution to voluntary daily benefits insurance | CHF | 5 | ||

| 5790 | Source tax | CHF | 5 | ||

| 5800 | Other personnel expenses | CHF | 5 | ||

| 5810 | Training of personnel | CHF | 5 | ||

| 5820 | Travel and entertainment expenses effective | CHF | 5 | ||

| 5830 | Travel and entertainment expense allowance | CHF | 5 | ||

| 5900 | Temporary staff | CHF | 5 | ||

| 5 | Personnel expenses | E2 | |||

| E2 | Gross operating result after deducting personnel expenses | E3 | |||

| 6000 | Rental | CHF | 60 | ||

| 6040 | Cleaning of facilities | CHF | 60 | ||

| 60 | Rental | 6 | |||

| 6100 | Maintenance, repairs and replacement of tangible assets | CHF | 61 | ||

| 6105 | Leasing costs tangible assets | CHF | 61 | ||

| 61 | Maintenance, repairs and replacement of tangible assets | 6 | |||

| 6200 | Repairs | CHF | 62 | ||

| 6210 | Fuel | CHF | 62 | ||

| 6220 | Car insurance | CHF | 62 | ||

| 6260 | Car leasing and rental | CHF | 62 | ||

| 6270 | Car costs - private part | CHF | 62 | ||

| 6282 | Transportation expenses | CHF | 62 | ||

| 62 | Vehicle and transportation expenses | 6 | |||

| 6300 | Insurance for damage of items | CHF | 63 | ||

| 63 | Insurance for damage of items | 6 | |||

| 6402 | Electricity | CHF | 64 | ||

| 6410 | Heating expenses | CHF | 64 | ||

| 6430 | Water | CHF | 64 | ||

| 6460 | Garbage | CHF | 64 | ||

| 64 | Energy and disposal costs | 6 | |||

| 6500 | Office supplies | CHF | 65 | ||

| 6503 | Technical magazines, newspapers, periodicals | CHF | 65 | ||

| 6510 | Telephone / internet | CHF | 65 | ||

| 6511 | Hosting at third-party | CHF | 65 | ||

| 6513 | Postal charges | CHF | 65 | ||

| 6570 | IT charges including leasing | CHF | 65 | ||

| 6580 | Licenses and updates | CHF | 65 | ||

| 6583 | Consumables | CHF | 65 | ||

| 65 | Administrative and IT costs | 6 | |||

| 6600 | Advertising | CHF | 66 | ||

| 6642 | Gifts to customers | CHF | 66 | ||

| 66 | Advertising | 6 | |||

| 6700 | Various costs for the financial year | CHF | 67 | ||

| 67 | Various costs for the financial year | 6 | |||

| 6 | Other operating expenses, depreciation, value adjustments and financial results | E3 | |||

| E3 | Operating result before depreciation and value adjustments, financial results and taxes (EBITDA) | E4 | |||

| 6800 | Depreciation and value adjustments of fixed assets | CHF | 68 | ||

| 68 | Depreciation and value adjustments of fixed assets | E4 | |||

| E4 | Operating result before financial results and taxes (EBIT) | E5 | |||

| 6900 | Costs for bank interest | CHF | 69 | ||

| 6940 | Bank costs | CHF | 69 | ||

| 6949 | Exchange rate loss | CHF | 69 | ||

| 6950 | Financial revenue | CHF | 69 | ||

| 6999 | Exchange rate profit | CHF | 69 | ||

| 69 | Financial costs and revenue | E5 | |||

| E5 | Operating result before taxes (EBT) | E6 | |||

| 7000 | Non-operating revenue | CHF | 7 | ||

| 7010 | Non-operating costs | CHF | 7 | ||

| 7500 | Corporate real estate revenues | CHF | 7 | ||

| 7510 | Corporate real estate costs | CHF | 7 | ||

| 7 | Non-operating items | E6 | |||

| 8000 | Extraneous costs | CHF | 8 | ||

| 8100 | Extraneous revenue | CHF | 8 | ||

| 8500 | Extraordinary, unique costs or costs relating to other accounting periods | CHF | 8 | ||

| 8510 | Extraordinary, unique revenue or revenue relating to other accounting periods | CHF | 8 | ||

| 8 | Results of extraneous, extraordinary or unique character, or for other accounting periods | E6 | |||

| E6 | Profit or loss before taxes | E7 | |||

| 8900 | Direct taxes | CHF | 89 | ||

| 89 | Direct taxes | E7 | |||

| E7 | Annual profit or loss | 297 | |||

| 00 | Difference should be = 0 (blank cell) | ||||

| 1 | |||||

| COST CENTERS | |||||

| .PAC | Packaging A | CHF | INV | ||

| .RM | Raw materials A | CHF | INV | ||

| .AM | Auxiliairy materials A | CHF | INV | ||

| INV | Total inventories | ||||

| ,MAN1 | Maintenance 1 | CHF | MAN | ||

| ,MAN2 | Maintenance 2 | CHF | MAN | ||

| ,MAN3 | Maintenance 3 | CHF | MAN | ||

| MAN | Total maintenance | ||||

| ;PB1 | Publicity 1 | CHF | PU | ||

| ;PB2 | Publicity 2 | CHF | PU | ||

| PU | Total publicity | ||||

| VAT Code | Description | %VAT |

|---|---|---|

| Explanations | ||

| V = Sales (200) | ||

| VS = Discount sales and services (235) | ||

| B = Acquisition tax (38x) | ||

| M = Expenses for material and services (400) | ||

| I = Investments and other operating expenses (405) | ||

| K = Corrections (410, 415, 420) | ||

| Z = Not considered (910) | ||

| VAT codes information (do not modify) | ||

| id=vatcodes-che-2024.20230614 | ||

| Last update: 14.06.2023 | ||

| VAT Due | ||

| V0 | Exempt services (220) | |

| V0-E | Export services abroad (221) | |

| V0-T | Transfers in the reporting procedure (225) | |

| V0-N | Non-taxable services (230) | |

| Decrease of income from services, see discounts | ||

| V0-D | Various (280) | |

| V77 | Sales and services 7.7% | 7.70 |

| V81 | Sales and services 8.1% | 8.10 |

| V77-B | Sales and services 7.7% (chosen) | 7.70 |

| V81-B | Sales and services 8.1% (chosen) | 8.10 |

| V25-N | Sales and services 2.5% | 2.50 |

| V26 | Sales and services 2.6% | 2.60 |

| V37 | Sales and services 3.7% | 3.70 |

| V38 | Sales and services 3.8% | 3.80 |

| VS77 | Discount Sales and services 7.7% | 7.70 |

| VS81 | Discount Sales and services 8.1% | 8.10 |

| VS25-N | Discount Sales and services 2.5% | 2.50 |

| VS26 | Discount Sales and services 2.6% | 2.60 |

| VS37 | Discount Sales and services 3.7% | 3.70 |

| VS38 | Discount Sales and services 3.8% | 3.80 |

| Taxable turnover (299) | ||

| F1 | 1. Flat tax rate 2024 | |

| F2 | 2. Flat tax rate 2024 | |

| FS1 | Discount Sales and services 1. Flat tax rate 2024 | |

| FS2 | Discount Sales and services 2. Flat tax rate 2024 | |

| F3 | 1. Flat tax rate 2018 | |

| F4 | 2. Flat tax rate 2018 | |

| FS3 | Discount Sales and services 1. Flat tax rate 2018 | |

| FS4 | Discount Sales and services 2. Flat tax rate 2018 | |

| Total Flat tax rate (322-333) | ||

| B77 | Acquisition tax 7.7% (With VAT/Sales tax) | 7.70 |

| B77-1 | Acquisition tax 7.7% (Without VAT/Sales tax) | 7.70 |

| B77-2 | Acquisition tax 7.7% (VAT/Sales tax amount) | 7.70 |

| B81 | Acquisition tax 8.1% (With VAT/Sales tax) | 8.10 |

| B81-1 | Acquisition tax 8.1% (Without VAT/Sales tax) | 8.10 |

| B81-2 | Acquisition tax 8.1% (VAT/Sales tax amount) | 8.10 |

| Total Tax on purchases (382-383) | ||

| Total VAT Due (399) | ||

| Recoverable VAT | ||

| M0 | Exempt material- and service expenses | |

| I0 | Exempt investment and operating expenses | |

| M77 | Purchase of material and services 7.7% (With VAT/Sales tax) | 7.70 |

| M77-1 | Purchase of material and services 7.7% (Without VAT/Sales tax) | 7.70 |

| M77-2 | Purchase of material and services 7.7% (VAT/Sales tax amount) | 7.70 |

| M81 | Purchase of material and services 8.1% (With VAT/Sales tax) | 8.10 |

| M81-1 | Purchase of material and services 8.1% (Without VAT/Sales tax) | 8.10 |

| M81-2 | Purchase of material and services 8.1% (VAT/Sales tax amount) | 8.10 |

| M25 | Purchase of material and services 2.5% | 2.50 |

| M26 | Purchase of material and services 2.6% | 2.60 |

| M37 | Purchase of material and services 3.7% | 3.70 |

| M38 | Purchase of material and services 3.8% | 3.80 |

| Investment and operating expenses | ||

| I77 | Investment and operating expenses 7.7% | 7.70 |

| I77-1 | Investment and operating expenses 7.7% (Without VAT/Sales tax) | 7.70 |

| I77-2 | Investment and operating expenses 7.7% (VAT/Sales tax amount) | 7.70 |

| I81 | Investment and operating expenses 8.1% | 8.10 |

| I81-1 | Investment and operating expenses 8.1% (Without VAT/Sales tax) | 8.10 |

| I81-2 | Investment and operating expenses 8.1% (VAT/Sales tax amount) | 8.10 |

| I25 | Investment and operating expenses 2.5% | 2.50 |

| I26 | Investment and operating expenses 2.6% | 2.60 |

| I37 | Investment and operating expenses 3.7% | 3.70 |

| I38 | Investment and operating expenses 3.8% | 3.80 |

| Corrections and adjustments | ||

| K77-A | Subsequent adjustment of prior tax 7.7% (410) | 7.70 |

| K81-A | Subsequent adjustment of prior tax 8.1 % (410) | 8.10 |

| K77-B | Corrections of prior tax 7.7% (415) | 7.70 |

| K81-B | Corrections of prior tax 8.1% (415) | 8.10 |

| K77-C | Reductions of the deduction of prior tax 7.7% (420) | 7.70 |

| K81-C | Reductions of the deduction of prior tax 8.1% (420) | 8.10 |

| F1050 | Tax computation according to form Nr. 1050 | |

| F1055 | Tax computation according to form Nr. 1055 | |

| Total Recoverable VAT (479) | ||

| Total VAT payable (500) or VAT credit (510) | ||

| Other financial flows | ||

| Z0-A | Subsidies, tourist taxes collected by the tourism offices, contributions to the institutions responsible for the elimination of waste and for the supply of water (let. a - c) | |

| Z0 | Gifts, dividends, compensation for damages etc. | |

| Not considered | ||

| Final total for control | ||

| Ref.Currency | Currency | Text |

|---|---|---|

| CHF | EUR | Euro |

| CHF | USD | US Dollar |