The perfect software for accounting education worldwide

Students learn double-entry bookkeeping

and how to use an accounting software.

Prepares students for the professional world

Banana Accounting enables students to rapidly acquire accounting skills through hands-on practice, fostering confidence every step of the way.

They also develop the skills to work with any accounting software, like practicing with a car for a driver's license!

Read the article Accounting Learning Accelerator

A basic competence: Double-entry bookkeeping

The principle of double-entry bookkeeping is a global standard for the financial management of companies and organisations; it helps to manage them well and to understand financial details. Its knowledge is therefore essential for future entrepreneurs and managers in both the public and private sectors.

By using Banana Accounting to learn double-entry bookkeeping, students prepare for the professional world and develop digital skills, thus increasing their chances of finding a job.

Digital transformation of teaching

In all fields, from architecture to video making, software is already being used to learn the job. Now also in accounting!

To keep up with the times, schools, books publishers, and authors of accounting books and online courses must also undergo the digital transition. By integrating Banana Accounting into their courses, the process becomes much simpler because:

- It is the only software suitable for learning double-entry bookkeeping;

- At the same time, it allows students to acquire skills in using accounting software.

For schools all over the world

Many schools use the most common software in their country or the most widely used in companies, but that was not designed for education. Banana Accounting, on the other hand, has been constantly improved through collaboration with schools, making it as easy as possible to learn double-entry bookkeeping.

You can freely customise the accounting file, adapting it to the regulations of Switzerland, Italy or another country.

Software structure

Similar to Excel

Thanks to its Excel-looking interface, Banana Accounting minimizes the time required to explain the program's functioning to students. Its flexibility allows for free movement within the table, modification of data at any time, and the ability to color rows for easy analysis.

Additionally, unlike Excel, all calculations are automatic, thus eliminating the risk of errors.

Double-entry accounting made simple

Banana Accounting makes learning accounting easier because:

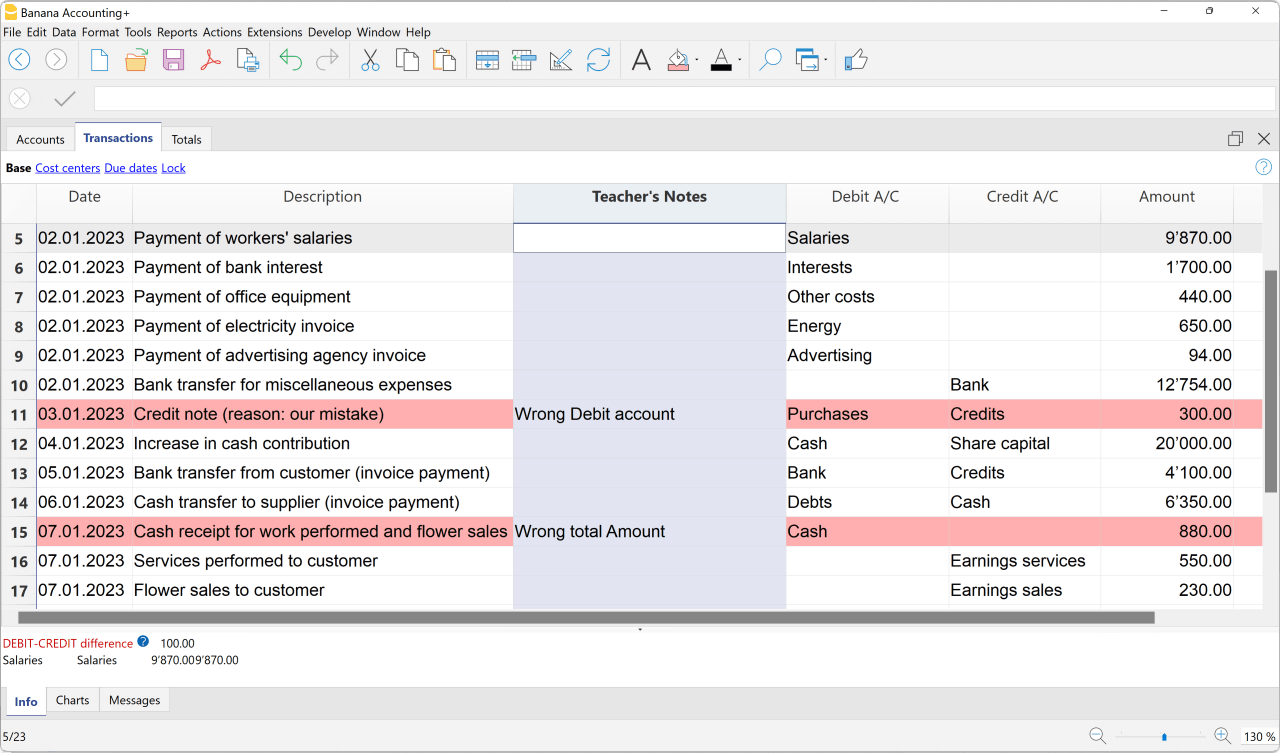

- The intuitive table-based interface always displays the Debit and Credit columns;

- It immediately indicates any errors or discrepancies, allowing students to correct them right away;

- It automatically performs all calculations and balances, and generates various reports.

Transactions table

The Transactions table contains the journal and all the necessary elements for a complete and professional accounting experience.

Students can practice entering the data, edit it and review it all.

Moreover, the addition of the Balance column in the Transactions table enables swift identification of any accounting discrepancies, facilitating prompt correction.

Chart of accounts

The Chart of Accounts of Banana Accounting is fully customisable to meet individual needs. Students:

- learn how to set up the Chart of Accounts;

- immediately view the Balance Sheet and Income Statement;

- can easily add, edit or delete accounts.

Account balances update automatically after each registration, ensuring organized accounting and constant control over activities.

Balance Sheet and Profit & Loss Statement

Banana Accounting automatically performs all calculations and instantly prepares the Balance Sheet, Profit & Loss Account and other statements.

You can easily obtain various reports to analyse the data:

- Balance Sheet

- Profit and Loss Statement

- Account ledgers and supportive subledgers

- Transactions Journal

- And much more!

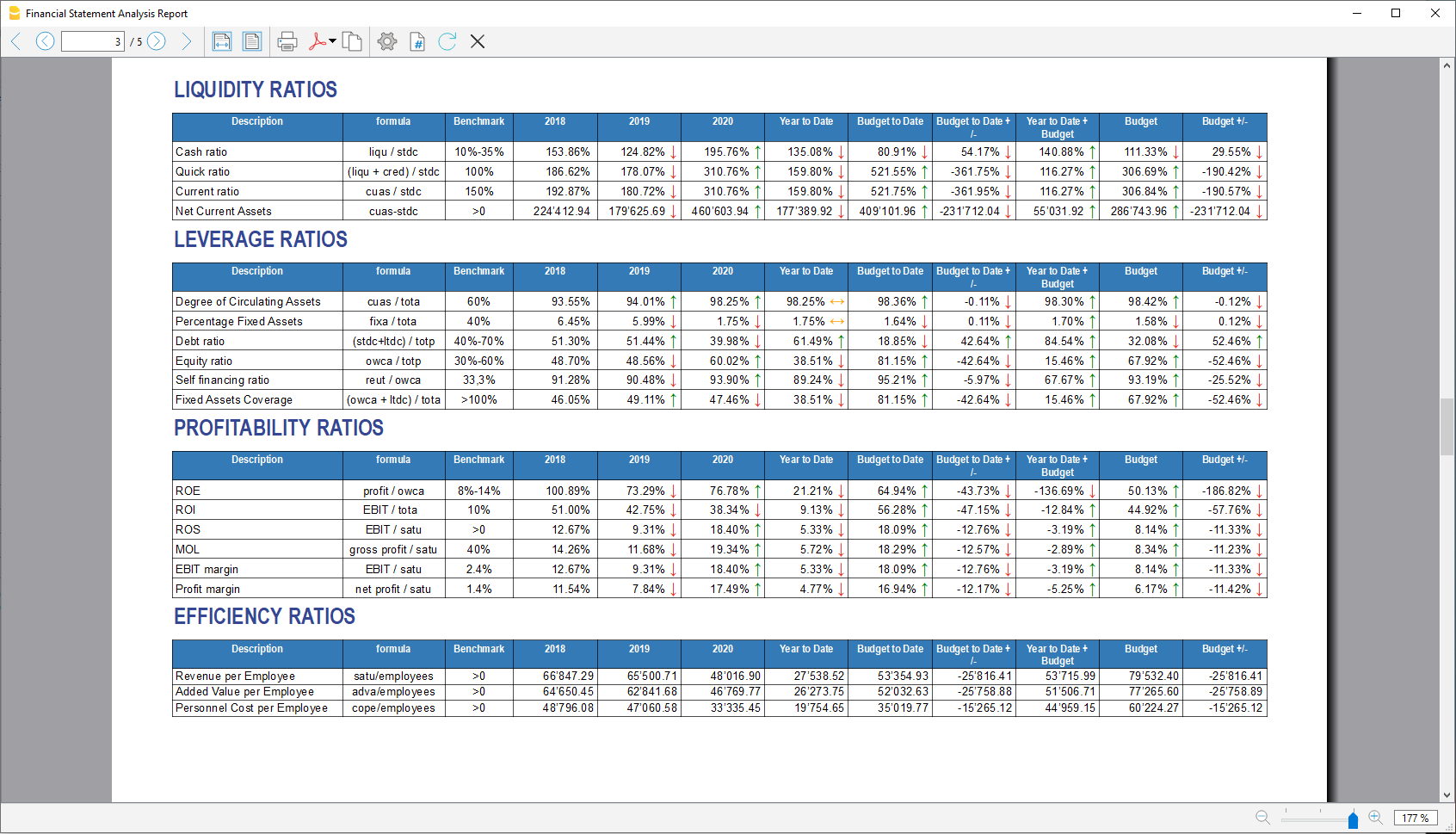

Balance sheet analysis

Students can quickly generate reports with comprehensive KPIs and balance sheet ratios, in order to focus more on data analysis:

- Liquidity ratios (Cash ratio, Quick ratio, Current ratio)

- Profitability ratios (ROE, ROI, ROS, ... )

- Efficiency ratios

- Cash Flow

- DuPont Analysis and Altman Index Z-Score

- And much more!

Teaching double-entry bookkeeping

How teaching with Banana Accounting works

Banana can be used for both for classroom and online lessons.

- The teacher prepares the exercise: use the pre-set double-entry accounting template, which you can adapt according to your needs. Share the file via e-learning platform, OneDrive, Dropbox or via e-mail.

- Students carry out the exercise: each student carries out the exercise independently, working on the file with their own device. Once the work is finished, the student saves the file and sends it back to the teacher.

- The teacher corrects the exercise: with Automatic Exercise Correction you correct students' work without wasting time. You can later send the file back to the student.

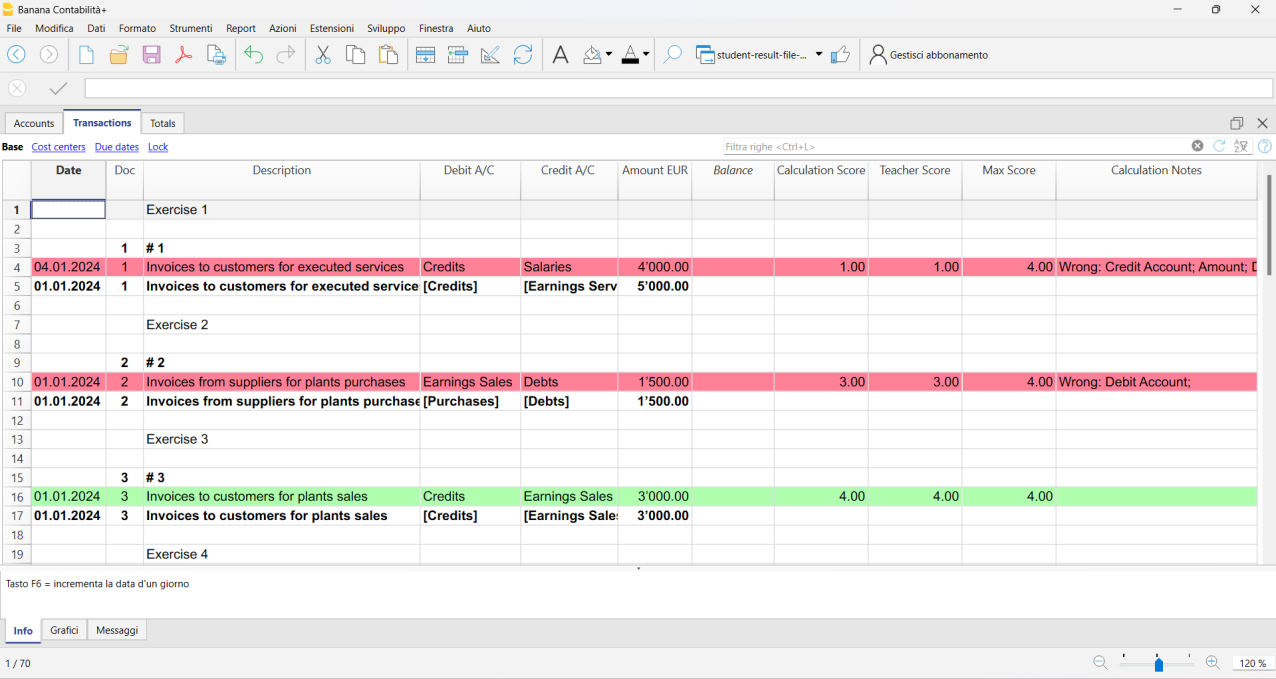

Automatic Correction of excercises

Manually correcting each exercise takes up too much of your time?

No need to worry anymore: with the Extension for Accounting exercise correction, that’s a thing of the past!

Here’s how it works:

- Prepare the accounting file containing the exercise solutions.

- Open the accounting file with the student's exercise.

- Start the extension: the correct information will be automatically inserted next to the student's entries.

You'll save hours of work and finally enjoy your Saturday afternoon off!

Save files wherever you want

The software does not have its own cloud but allows you to use your own or the school's cloud, ensuring data privacy and providing the ability to save files in various modes:

- locally on your device

- on external devices

- on cloud systems such as Microsoft OneDrive, Google Drive, Dropbox, iCloud, etc.

It is possible to work comfortably offline, both in class and at home, and create an unlimited number of accounting files.

Use it in the browser without installation

Thanks to the WebApp of Banana Accounting, you can also use the software directly in the browser, without installing it on your computer. This mode provides interesting advantages:

- No loss of time to install the software in the computer

- Teachers and students can immediately start working on accounting

- Possibility to integrate the program into the school platform (Moodle, ...), so students can work without leaving the learning environment.

Try Banana Accounting now on your browser

Each school can then decide whether to use Banana Accounting in the browser or install it on the school computers or on the students' devices.

Online and offline documentation

Contextual help - the programme alerts you of any errors and helps you solve them thanks to integrated contextual help. You will find immediate help buttons relating exactly to the context you are working on.

Online resources - constantly updated and expanded online documentation, including video tutorials.

PDF manual - PDF documentation to download and consult offline.

Appreciated by many teachers and students

Numerous institutions, both in Switzerland and around the world, have been using Banana Accounting for several years.

▶️ See the testimonial video of teachers and students in Congo

Free for Schools

For more than 30 years, Banana.ch SA has been committed to offering its software to schools free of charge. This helps young people enter the professional world, reflecting our dedication to social and educational responsibility.

The Advanced plan of Banana Accounting Plus is offered completely free of charge for school teaching.

Free for Students

By downloading and installing Banana Plus on their computer, students can use the Free plan, which allows up to 70 accounting transactions.

Each exercise is performed on a separate file, and each student can create as many files as they wish. In this way, the Free plan of Banana Plus represents an excellent opportunity to practise accounting.

All the features of modern accounting software

Students can further expand their knowledge and familiarise themselves with accounting applications, thanks to comprehensive software.

Students can further expand their knowledge and familiarise themselves with accounting applications, thanks to comprehensive software.

Customers and Suppliers

Keep track of payments and receipts and have a complete customer and supplier database.

Sales Tax management

To find out how software registers Sales Tax and have all under control.

Multi-currency & Multi-language

Possibility to practise multi-currency and crypto-currencies.

Invoicing

Create customised invoices with double-entry transaction rows.

Financial planning

Develop financial forecasts for the profit and loss account and balance sheet over several years.

Blockchain

Opportunity to understand the benefits of digital seals for data protection.

Fixed asset register

Manage depreciable assets to immediately know their initial value, history and depreciation.

Inventory

Administer the inventory by updating items according to what is sold/purchased.