The best way to teach double-entry accounting

Teach how to do double-entry transactions with the ease of digital technology,

thanks to Banana Accounting software.

Prepares students to the professional world

Banana Accounting allows students to learn the basics of double-entry accouning just by practising.

This will empower them to work with any accounting software in the future, as practicing with a car is necessary to obtain a driving license!

Double-entry accounting made simple

Learn the double-entry accounting method with Banana Accounting – the globally recognized software that makes learning this staple method easy and straightforward. Featuring a table interface that displays Debit and Credit columns at all times, Banana Accounting is the ideal tool to become an accounting expert.

With everything you need for accounting training, Banana Accounting provides an optimal learning experience.

Superior to Excel

Thanks to its intuitive interface similar to Excel, Banana Accounting minimizes the time required to explain the program's functioning to students. Its flexibility allows for free movement within the table, modification of data at any time, and the ability to color rows for easy analysis.

Additionally, unlike Excel, all calculations are automatic, thus eliminating the risk of errors.

Double-entry accounting made simple

Learn the double-entry accounting method with Banana Accounting – the globally recognized software that makes learning this staple method easy and straightforward. Featuring a table interface that displays Debit and Credit columns at all times, Banana Accounting is the ideal tool to become an accounting expert.

With everything you need for accounting training, Banana Accounting provides an optimal learning experience.

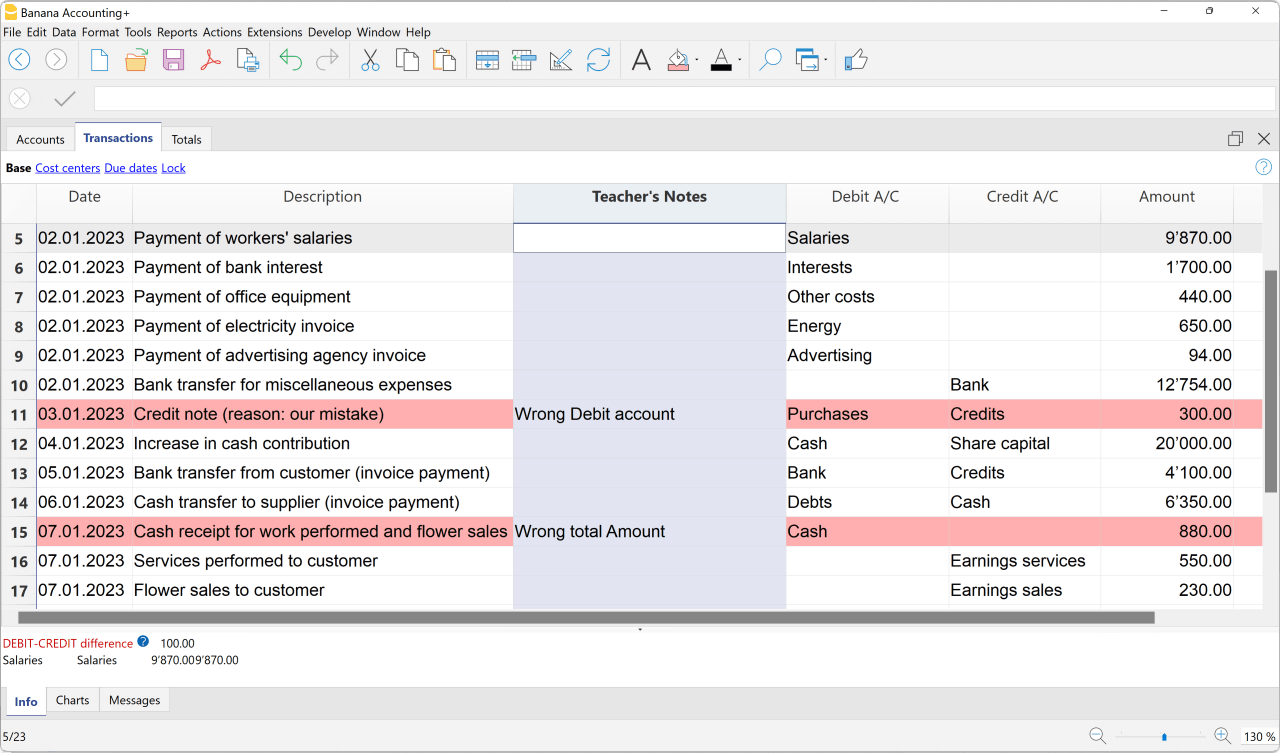

Transactions table

The Transactions table contains the journal and all the necessary elements for a complete and professional accounting.

Students can do everything here: they practise entering the data, they can edit it and review it.

Moreover, the inclusion of the Balance column enables swift identification of any accounting discrepancies, facilitating prompt correction.

Chart of accounts

Banana Accounting's chart of accounts is entirely customizable to meet individual needs. Students can immediately view the balance sheet and income statement and easily add, modify, or delete accounts.

Account balances update automatically after each registration, ensuring organized accounting and constant control over activities.

Balance Sheet and Profit and Loss Account

Banana Accounting automatically performs all calculations and instantly prepares the Balance Sheet, Profit & Loss Account and other statements.

You can easily obtain various reports to analyse the data:

- Balance Sheet

- Profit and Loss Account

- Account cards

- Transactions Journal

- Balance sheet indices

- And much more!

Balance Sheet and Profit and Loss Account

Banana Accounting automatically performs all calculations and instantly prepares the Balance Sheet, Profit & Loss Account and other statements.

You can easily obtain various reports to analyse the data:

- Balance Sheet

- Profit and Loss Account

- Account cards

- Transactions Journal

- Balance sheet indices

- And much more!

Invoicing

Apprentices, students and small business owners can see how a programme for creating invoices works, adapting them to their needs and above all avoiding setting errors.

Invoices are entered as simple transactions, indicating the invoice number and customer account. With one command, the transactions become professional invoices.

How teaching with Banana Accounting works

Banana can be used for both for classroom and online lessons.

- The teacher prepares the exercise: use the pre-set double-entry accounting template, which you can adapt according to your needs. Share the file via e-learning platform, Dropbox or via e-mail.

- Students carry out the exercise: each student carries out the exercise independently, working on the file with their own device. Once the work is finished, the student saves the file and sends it back to the teacher.

- The teacher corrects the exercise: open the received files and easily correct the work, highlighting errors and entering notes. Once the correction is complete, you can send the file back to the student.

Transactions table

The Transactions table contains the journal and all the necessary elements for a complete and professional accounting.

Students can do everything here: they practise entering the data, they can edit it and review it.

Moreover, the inclusion of the Balance column enables swift identification of any accounting discrepancies, facilitating prompt correction.

Save files wherever you want

The software uses NoCloud technology, ensuring data privacy and providing the ability to save files in various modes:

- locally on your device

- on external devices

- on cloud systems such as Dropbox, ICloud, etc.

It is possible to work comfortably offline, both in class and at home, and create an unlimited number of accounting files.

Try it in the browser without installation

Try Banana Accounting Plus now on your browser without the need for registration or entering personal data, and save the file on your computer.

We are aware that every school has its own organization, which is why we offer various installation options:

- on school computers

- on student devices

Appreciated by many teachers

Numerous institutions, both in Switzerland and around the world, have been using Banana Accounting for several years.

Free for Schools

The Advanced plan of Banana Accounting Plus is offered completely free of charge for school teaching.

Free for Students

By downloading and installing Banana Plus on their computer, students can use the Free plan, which allows up to 70 accounting transactions.

Each exercise is performed on a separate file, and each student can create as many files as they wish. In this way, the Free plan of Banana Plus represents an excellent opportunity to practise accounting.

All the features of modern accounting software

Students can further expand their knowledge and familiarise themselves with accounting applications, thanks to comprehensive software.

Students can further expand their knowledge and familiarise themselves with accounting applications, thanks to comprehensive software.

Customers and Suppliers

Keep track of payments and receipts and have a complete customer and supplier database.

VAT management

To find out how software registers VAT and makes the declaration.

Multi-currency

Possibility to practise multi-currency and crypto-currencies.

Invoicing

Create customised invoices with double-entry transaction rows.

Financial planning

Develop financial forecasts for the profit and loss account and balance sheet over several years.

Blockchain

Opportunity to understand the benefits of digital seals for data protection.

Fixed asset register

Manage depreciable assets to immediately know their initial value, history and depreciation.

Inventory

Administer the inventory by updating items according to what is sold/purchased.