In this article

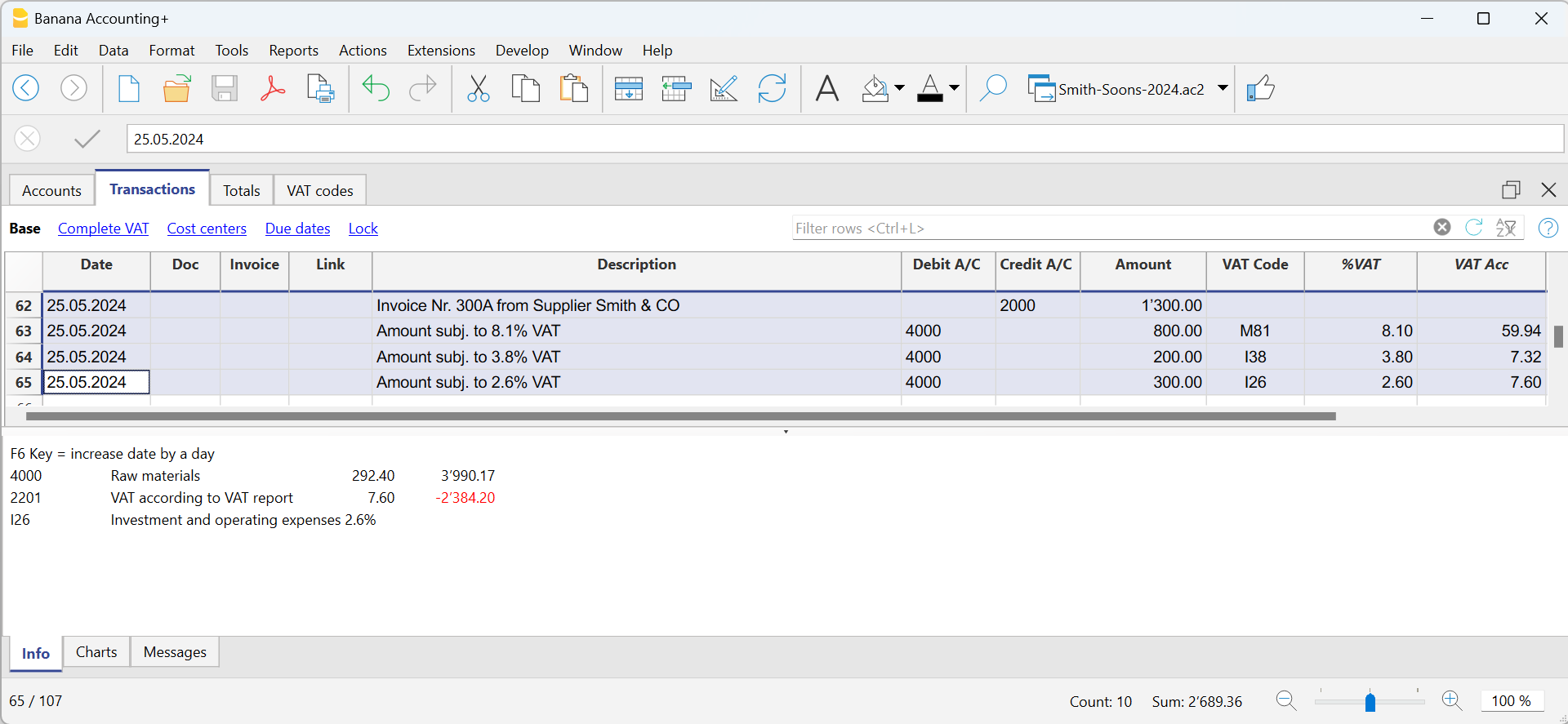

There may be cases in which the total amount is composed of several taxable amounts with different VAT rates. In this case the transaction is recorded on several rows.

For the transaction, it is necessary to:

- Subdivide the overall amount into the various amounts, each of which is subject to a specific VAT rate.

- On each row, enter the amount (amount with VAT) and insert the VAT code with the specific rate.

- Once the transaction is completed, check that the sum of the single gross amounts and the VAT amounts correspond to the invoice total.

Example

VAT EXEMPTION

When in the invoice the total amount subject to VAT is made up of a taxable part and a VAT-exempt part, it is necessary to register on more than one row as in the previous case, applying the exempt VAT code, present in the VAT Codes table.