In this article

The December credit card invoice is usually received in January of the following year, and consequently, the payment is also made in January.

All expenses listed in the December credit card invoice belong to the previous year; therefore, they must be recorded in the accounting of the previous year.

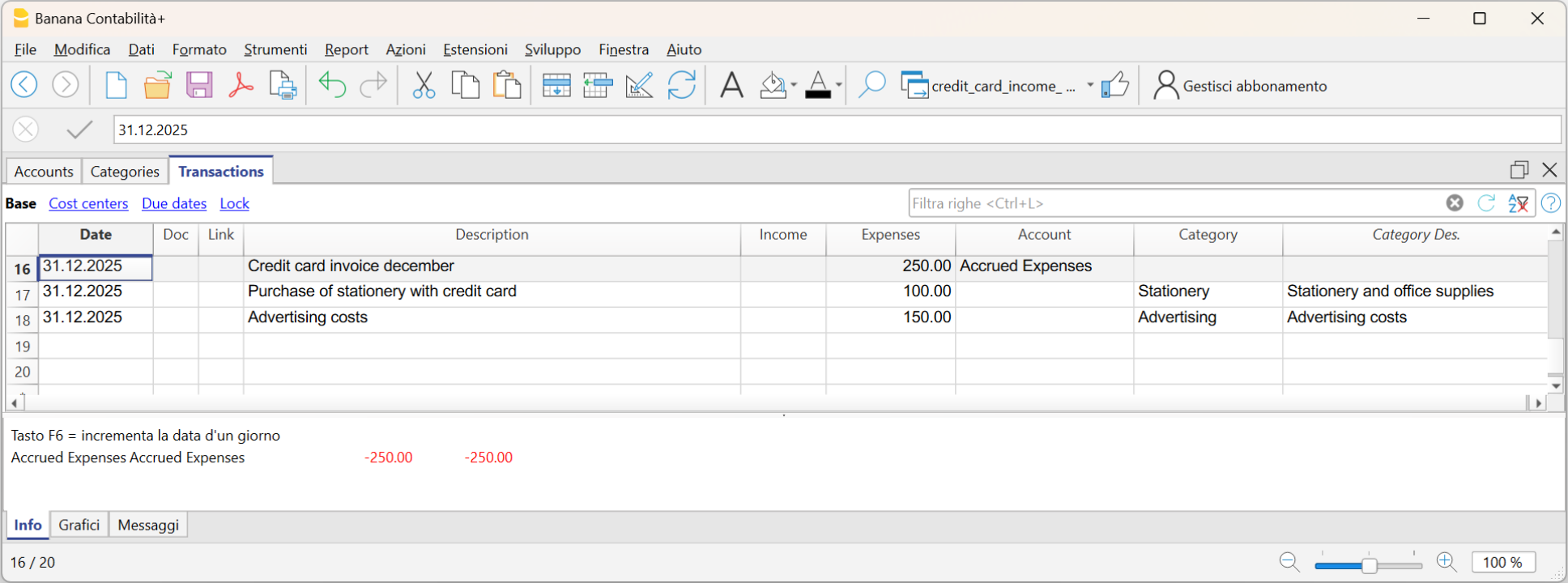

Recording the December credit card invoice

To record it correctly, it is necessary to have the liability account Costs to be Paid in the Accounts table, which is a transitional account. If it is not present, it must be added.

In the Transactions table, enter:

- Date and any document number in the respective Date and Doc. columns.

- Description

- Total credit card amount in the Expenses column

- Costs to be Paid account in the Account column

- Expense category in the Category column. If the invoice includes multiple expenses, record each expense on a separate row.

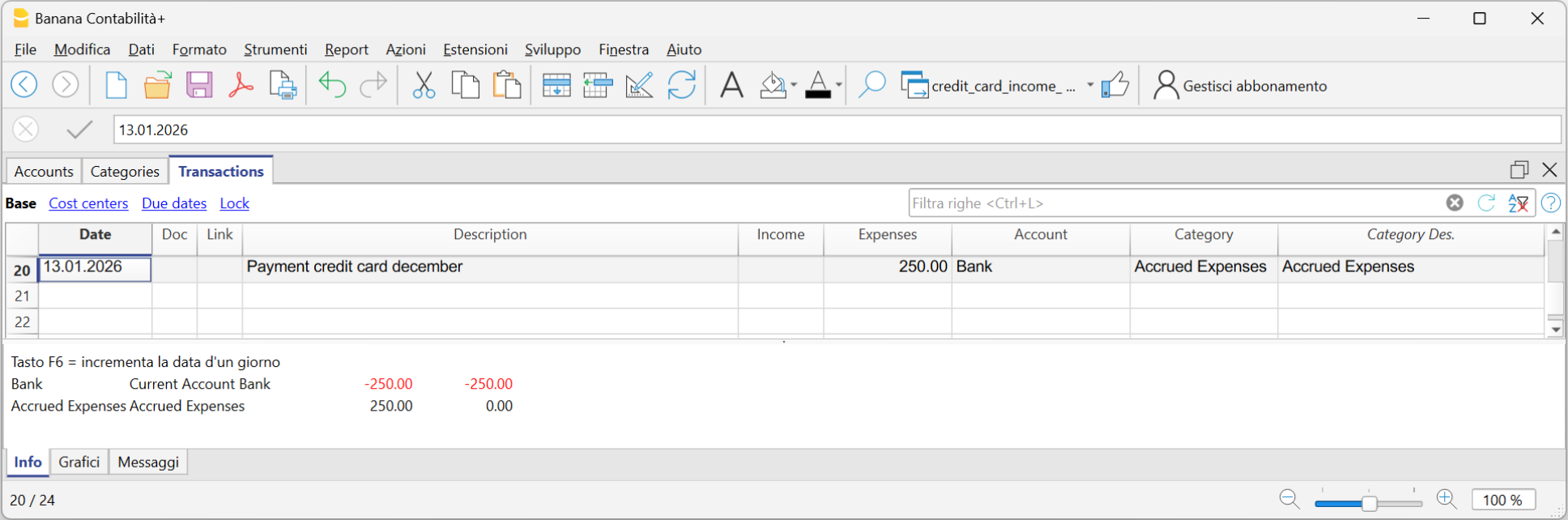

Recording the payment of the December credit card invoice in the following year

In the following year, when the new year is created, the balance of the Costs to be Paid account is displayed as an opening balance in the Accounts table.

When the credit card invoice is paid, the Costs to be Paid account is cleared.

To record the payment of the credit card invoice, enter:

- Date, any document number

- Description

- Total amount of the credit card invoice in the Expenses column

- Liquidity account from which the invoice is paid in the Account column

- The Costs to be Paid category in the Category column.