Neste artigo

Double-Entry Accounting Tutorial File Budgeting and Financial Plan for a Startup

Learn how to create a professional financial plan for a Startup with a double entry accounting method. Quickly get detailed cash, balance sheet and profit and loss forecasts for the days, months and years to come. Modify the plan at any time and instantly see the updated forecasts.

Abrir na Banana WebApp

Abra a Banana Accounting Plus no seu navegador sem qualquer instalação. Personalize o modelo, introduza as transacções e guarde o ficheiro no seu computador.

Open template in WebApp Open tutorial in WebAppTemplate documentation

Whether you're planning to start a new business, or setting up a business plan, it is of the utmost importance to manage your liquidity projections. Especially at the beginning of a new activity, this could easily happen to land yourself in financial difficulties.

Banana Accounting software offers you the possibility to set up your financial planning and liquidity projections, allowing monitoring on a daily basis, with a high degree of accuracy. It allows you to project your accounting into the future and manage the years ahead of you in your ledger.

Note: For this business plan template, the management of a bar or restaurant has been taken as an example, since it is an activity that all people are familiar with and is therefore ideal to understand the functioning of Banana Accounting. Obviously, the template can also be used for other types of activities (Startups) for which you want to do financial and liquidity planning.

Financial planning and liquidity management of Luke's Restaurant

This section will explain how to set up a financial plan for a new entrepreneurial activity, according to the double-entry accounting model.

Consult the Benefits and Features of Financial Planning section for further information.

Luke plans to open a restaurant in 2022 and is preparing a financial plan, including all the necessary details.

- The financing of his project includes his proper means and a loan from a third person.

- In January 2022, he rents the premises, redecorates and furnishes them and starts his commercial activity.

- The Financial Planning is established for the period from January 2022 to December 2025.

Below you have an example of a monthly planning that Banana Accounting can make easy for you:

Economical forecasting and liquidity management

This model will help you to learn about the different features of Financial planning in Banana Accounting software. Some features, such as formulas, will be used in more advanced cases. The possibility to enter formulas is available in Banana Accounting Plus only with the Advanced plan. Update now!

- Use of budgeted transactions

- Repetitive transactions

- Using Quantities and Price

- Using Formulas

- Using Variables

- Calculation of interest on Asset and Liability Accounts

- Carrying forward of account balances

- Carrying forward of transactions recording

- Budgeting for one financial year divided by quarter, including results and liquidity projection

- Budgeting for several financial years, including results and liquidity projection

The File Properties

Opening date is 1st of January 2022 and closing date December 31st 2022.

This is also the period of calculation that will be used for the Total column in your Budget.

The Chart of Accounts

This example is intended to explain the functioning of your Budget table of forecasts.

- The Chart of Accounts, reduced to it's essence.

- Comprehensive name for accounts are used to illustrate the use of Banana Accounting software.

- Opening Basic Currency. The activity starts from scratch, so there are no opening balances.

- Budget Basic Currency. It's the overall budget at the end of the accounting period. Notice that this represents the balance sheet and income statement at the end of the budgeting period.

Create your own Chart of Accounts

The Chart of Accounts defines the elements of Expenses, Income and Investments. In case you want to subdivide the expenses more in detail, you need to add other accounts.

Rather than starting with a very simple Chart of Accounts and add on accounts and groups, it is recommended to start with a more structured Chart of Accounts. Banana Accounting software offers different Charts of Accounts templates, and it is recommended to choose and adapt the one closest to your needs and then add the Budget tab .

The Budget table

The budget table (see also explanation on columns) is where you insert recordings relative to the planning.

The financial plan is inserted via normal entering in double-entry bookkeeping in the Budget table. The budget table provides additional columns that greatly facilitate the preparation of the financial plan.

- Repeat

If you specify "M" = Monthly, for example, this will generate monthly registration for all subsequent months.

If the cell is left empty, the operation will be performed only once. - End (Date)

Used in combination with Repeat, setting the last date when the operation will occur. - Total

The total amount recorded in the current year. - Quantity, Price

Allows for indication of the combination of values on the basis of which the amount will be calculated. - Formula

Allows you to specify a formula for calculating the amount.

The formula has priority for the calculation of the amount.

Transactions for January

Those are identical to entering in the transactions table, because there is no Repeat yet.

This is the first month of the Coffeehouse's exploitation and these are the registrations of the owner's equity, payment of the furniture and the accession to a loan.

The entering shown in the below screenshot, such as first month's rent, were included as not repetitive recordings, to illustrate some simple recordings that contain no Repeat.

Repetitive transactions for February

In February, enter the transactions that will occur on a monthly basis

- The rent from January to June is of 1'000 per month and increases to 1'200 as per July.

- Doc 5:

The first rent was paid cash. There will probably also be the payment of a guarantee. - Doc. 50:

The rent of 1'000 is budgeted rom February to June.- On 2nd Februar the rent is paid from the bank account.

In the following months the payment of the rent will figure on to 2nd of each month. - End Date is 30th June.

The last rent of 1'000 will be on 2nd June. - Repeat. M = monthly.

- Total 5'000 (5 x 1'000, automatically calculated) is the total amount for the transactions during this period.

- On 2nd Februar the rent is paid from the bank account.

- Doc 51:

Rent Budgeted from July onward.- Date 2nd July.

In the following months the payment of the rent of 1'200 will figure on to 2nd of each month. - End

As no date is indicated, this expense will be repeated for all the following months and years. - Repeat. M = monthly.

- Total 7'200 (5 x 1,200), automatically calculated.

Represents six months' rent from July to December.

- Date 2nd July.

- Doc 5:

- Doc. 52.

The leasing for the cash register.- Date is 10th of February.

- End (of lease) January 31st 2024. When the last installment on the lease is due.

- Repeat M = monthly.

The operation will be repeated each month, the last time in January 2024. - Debit A/C Administrative fees.

- Credit A/C BANK (used for payment).

- Amount 200.00 monthly lease rate.

- Total 2,200 (200 x 11 months).

- Doc. 53.

Payment towards the lease redemption.

This operation only takes place in 2024, but is included here, because it is linked to the monthly lease.- Date is 10th February 2024.

- Debit A/C Administrative fees.

- Credit A/C BANK (used for payment).

- Amount 400.00 the release amount.

- Total empty because there is no expenditure in the current year.

- Doc. 54:

Monthly salaries.- Date: 25th February.

- Repeat. M = monthly.

The operation will be repeated on the 25th of each month to come.. - Total 55,000 (5'000 x 11 months).

- Doc. 55.

Administrative expenses (this is an approximation: for a correct budgeting entering for each separate expense will be necessary).- Date is 28th February.

- Repeat is ME = Month End.

The operation will be repeated every month on the last day of the month.

In March it will be on 31st, in April 30th and so on. - Amount 300.00.

- Total 3,300 (300 x 11 months).

Budgeting for income and purchase of goods

Depending on the type of business activity, the most appropriate way to specify the revenues must be chosen.

Income and goods purchases are itemized below as monthly amounts, taking into account that there might be important monthly fluctuations.

It might prove more appropriate to use separate turnover figures for drinks or/and food.

February's Repeat column is empty, as we expect a higher figure for he next year and this will be added at a later stage.

From March onward the turnover is considered to be representative for the years to come.

Indications of forecast income and merchandise costs, calculated on a monthly basis.

- Doc 101

Income indications for February- Date: 20th February.

Income occurs on every day of a month. We choose a date towards mid-month as an approximated level for liquidity. - Repeat Empty (no repetition).

A higher figure is expected next year and will be recorded in the successive year.. - Debit A/C Cash register receipts that are deposited in BANK.

- Credit A/C Provenance of receipts in SALES account.

- Amount 10'000.00.

- Total 10'000.00 The next operation falls within next year, hence the total represents one single amount.

- Date: 20th February.

- Doc 102

Indications of forecast costs for goods, on 20%a pro rata monthly basis.- Date 21st February. The day after the entering of the sales transaction.

- Repeat no repetition.

The operation will be repeated on the 21st of each following month. Therefore, each month cost for goods will be calculated as a percentage of purchases of sales account transactions. - Debit A/C GOODS costs to be recorded in goods Account.

- Credit A/C BANK payment of goods costs through the bank.

- Doc 103

Two lines, which are similar to Doc 101 and 102, but for March.- Repeat Y=Yearly. Turnover and costs for the month of March for subsequent years.

- Doc 104 through to Doc 112: Each 20th of the month projected sales for the different months of the year are indicated.

Following Years' Proceeds

Transactions can also be indicated for the following years..

These data will be used to establish budgets for the years to come.

The Total column will remain empty, as these values are out of scope and only refer to the current accounting period.

- Doc 151

Transaction entering similar to the previous year- Date 20th January.

- Repeat Y = Yearly.

This will be repeated in the subsequent years. - Total empty (calculated automatically). The Total column will remain empty, as these values are out of scope and only refer to the current accounting period.

End of quarter

Indications of some typical entries that are repeated at the end of a quarter.

- Doc 70

Here's an example for the use of the quantity and price column.

Known bank charges are 50 per month and we indicate the amount for a 3 months period.- Date 31st March.

- Repeat 3ME=3 Months End.

- Debit A/C ADMIN. Administrative costs, this would normally be financial bank charges.

- Credit A/C BANK. Administrative costs.

- Amount 150 (Automatically calculated) by multiplying the quantity by the unit price.

- Total 600 (Automatically calculated) 150 quarterly until the end of the year.

- Doc 71

Interest on the loan that must be paid quarterly.- Date 31st March.

- Repeat 3ME=3 Months End.

- Debit A/C INTEXP interest expense on liabilities.

- Credit A/C LOAN interests are added to the loan.

- Amount interest for current quarter.

- Total interest for the current year.

- Doc 72

Interest accrued on the LOAN are payed from the Bank count.- Date 31st March 31.

- Repeat 3ME=3 Months End.

- Debit A/C LOAN interest expense account.

- Credit A/C BANK the account used to pay interest.

- Amount the result of the formula, i.e the interest for this quarter.

- Total total interests for the current year.

- Doc 73

Interest earned on current account with the Bank.- Date 31st March 31.

- Repeat 3ME=3 Months End.

- Debit AC BANK Bank account.

- Credit A/C INTINC interest income.

- Amount interest income for this quarter.

- Total total interest for the current year.

Year End

These are some year-end operations. Here we use Repeat "Y" in order for them to be carried out for subsequent years.

- Doc 200

Attribution to staff of a 1% commission on annual sales at the end of the year.- Date 31st December.

- Repeat Y= calculation is repeated each year.

- Debit A/C PERSON Personnel expenses.

- Credit A/C BANK Bank account.

- Amount is the commission payed to the sales staff.

- Total identical to Amount.

- Doc 201

Reimbursement of 10% of he outstanding loan- Date 31st December.

- Repeat Y calculation will be repeated each year.

- Debit A/C LOAN Loan account (your liability).

- Credit A/C BANK Bank account used for reimbursement.

- Amount 6'000 is the equivalent of 10% of your total Loan.

- Total identical to Amount.

- Doc 202

Use for the amortization of your furniture. - Doc 203

Use for adjustment of your inventory.

This is non-repetitive, because the assessment should be based on the asset values of your inventory.

Customization

Use the create new customization command to generate new customization for the printout including print parameters already preset in Budget and enhanced for groups.

You can preset the prints configuration according to your requirements.

If you understand how customization works, you will be able to use it with other commands and create prints or other adapted to your own purpose.

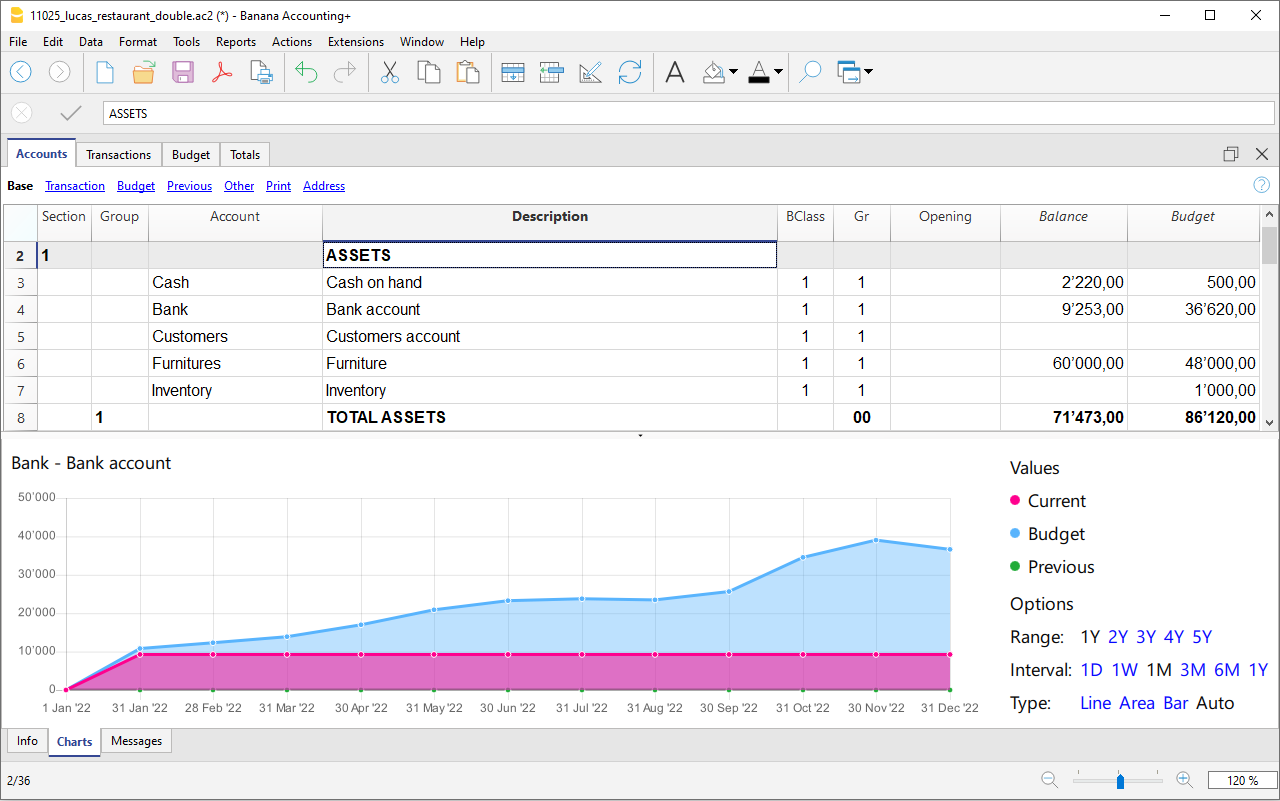

Reports in the Accounts table

In the Accounts tab, view Budget to access the updated budget amounts.

Financial and liquidity planning for the first year

With Command

- Reports → Enhanced balance sheet with groups → Quarterly forecast 1st year, the evolution during the first year can be seen.

The customization that has been set up can be visualized

- Breakdown by Period → Quarter

These two prints will allow you to apprehend:

-

The economic forecast (expenses and income) and budgeting of current financial year..

- The detailed evolution of liquidity in your bank's current account.

Modifying or Creating a new customization will give you a breakdown by month.

By month

Financial and liquidity planning for a four year period

With Command

- Reports →Enhanced balance sheet with groups → Budget 4 years

This will display the predefined customization for:

- Period from 01/01/2022 to 31/12/2025

In this report, you can specify a period that differs from the accounting period. The program will then project the data for the specified period. - Subdivision per year.

Account card

After opening the Budget table, click on the BANK cell and all budgeted transactions contained in the account card will be displayed.

Template preview

Luke's Restaurant

| Group | Account | Description | Sum In | Gr1 |

|---|---|---|---|---|

| BALANCE SHEET | ||||

| Assets | ||||

| Cash | Cash on hand | Assets | ||

| Bank | Bank account | Assets | ||

| Customers | Customers account | Assets | ||

| Furniture | Office furniture and equipment | Assets | ||

| Inventory | Inventory | Assets | ||

| Appliances | Machinery and appliances | Assets | ||

| Computer | Computer & Software | Assets | ||

| Assets | Total Assets | 00 | 1 | |

| Liabilities and Equity | ||||

| Suppliers | Suppliers | Liabilities | ||

| Loan | Loan | Liabilities | ||

| Equity | Owner equity | Liabilities | ||

| Profit Loss | Profit(-) or loss (+) from current year | Liabilities | 1 | |

| Liabilities | Total Liabilities and Equity | 00 | 1 | |

| PROFIT AND LOSS STATEMENT | ||||

| Income | ||||

| Sales | Income from sales | Income | ||

| Interest Income | Interest income | Income | ||

| Income | Total Income | Result | ||

| Expenses | ||||

| Goods | Cost of goods | Expenses | ||

| Materials | Raw materials | Expenses | ||

| Salary | Personnel expenses | Expenses | ||

| Social contributions | Social contributions | Expenses | ||

| Insurance | Health insurance | Expenses | ||

| Rent | Rental and related expenses | Expenses | ||

| Admin | Administrative costs | Expenses | ||

| Interest expenses | Interest expense | Expenses | ||

| Depreciation | Depreciation | Expenses | ||

| Taxes | Direct taxes | Expenses | ||

| Expenses | Total Expenses | Result | 1 | |

| Result | Profit(-) Loss(+) from Profit and Loss Statement | Profit Loss | 1 | |

| 00 | Difference should be zero (void) | |||