Neste artigo

Bank statement Camt ISO 20022 Switzerland (Banana+)

The extension allows you to import bank transactions from a CAMT ISO 20022 file. A CAMT file is provided by banks to download account statement transactions. In Switzerland, it is the standard format used by banks.

Supported versions of the CAMT ISO 20022 format (Switzerland):

- Swiss camt05x.001.08 schema (SPS 2022)

- Swiss camt05x.001.04 schema (SPS 2021)

Prerequisites

To use this extension, Banana Accounting Plus is required.

Features

This extension differs from the generic ISO20022 extension due to the following features:

- Follows the Swiss specifications.

- You can choose which transactions to import (all transactions, only credits or only debits).

- The QR reference number (old PVR) is entered in the description column of the Transactions table.

- It is possible to extract the invoice number from the QR reference number (old PVR). See Set parameters.

The extracted invoice number will be saved in the Invoice column of the Transactions table. - You can choose whether to extract the customer account from the QR reference number (old PVR). See Set parameters.

The extracted customer account will be saved as account/category or cost center depending on the parameters set by the user. - You can disable the automatic insertion of the temporary contra account [CA] in the transaction. See Set parameters.

Invoice matching

This extension works in conjunction with the Swiss QRCode invoice printout, see:

Extension installation

To install the extension, proceed as follows:

- From the Extensions > Manage Extensions > Online > Import > menu, select the extension Bank Statement Camt ISO 20022 Switzerland (Banana+) > button Install.

Set extension parameters

With these settings you can define which transactions to import and specify whether and how to automatically extract the invoice number and customer number, inserting them in the respective columns of the transactions table.

Extension parameters are required to electronically record invoice collection transactions.

To access the extension parameters, proceed as follows:

- Open the accounting file where you want to import the transactions.

- Access the parameters:

- From the Actions menu > Import to Accounting, select the extension Bank Statement Camt ISO 20022 Switzerland (Banana+) and click on Settings.

- Or, from the Actions menu > Import to Accounting > Manage Extensions, select the extension Bank Statement Camt ISO 20022 Switzerland (Banana+) and click on Settings.

- Or, from the Extensions menu > Manage Extensions, select the extension Bank Statement Camt ISO 20022 Switzerland (Banana+) and click on Settings.

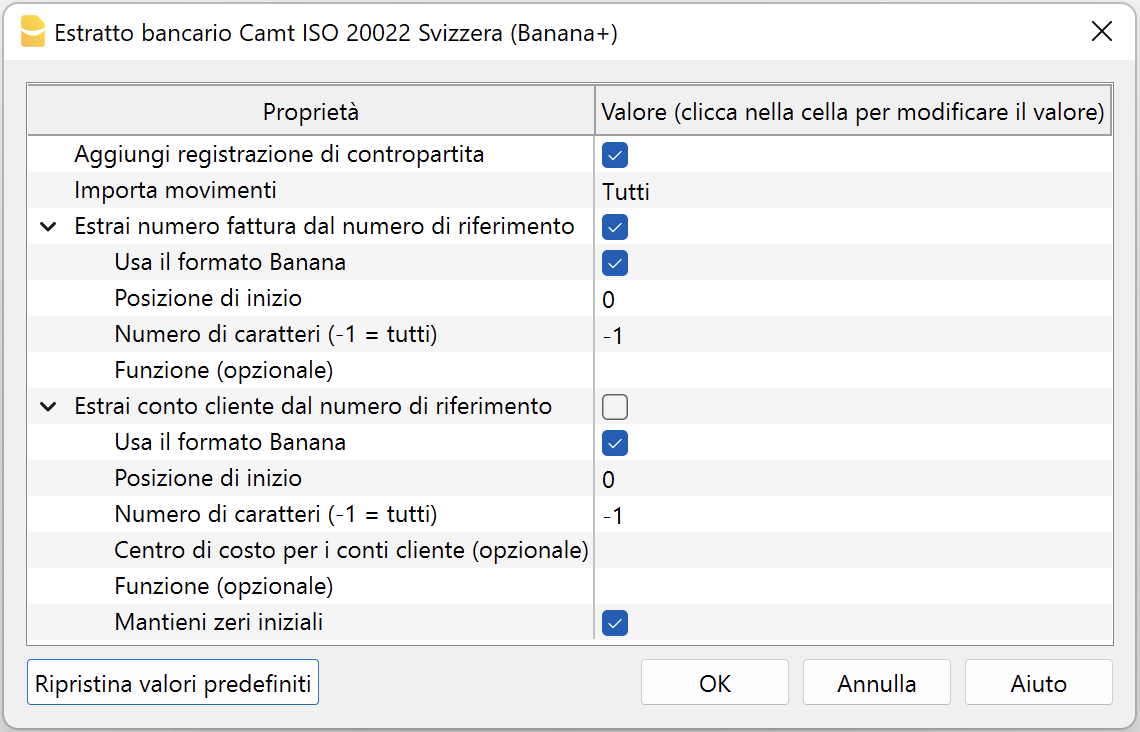

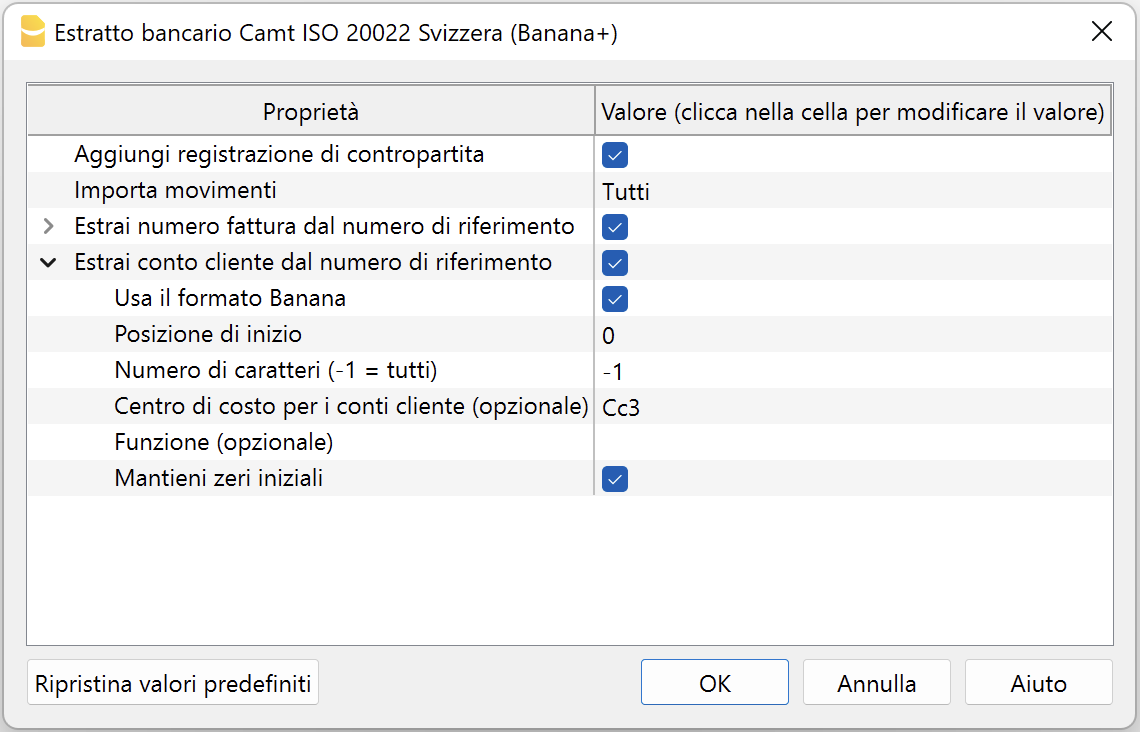

The following image shows the default parameters.

Add Contra Account Transaction

If this parameter option is enabled, for transactions with details the extension inserts a temporary contra transaction [CA] with the total amount of the details.

In the [CA] contra account, the corresponding account number must be entered manually.

If the option is disabled, no temporary contra transaction [CA] will be inserted.

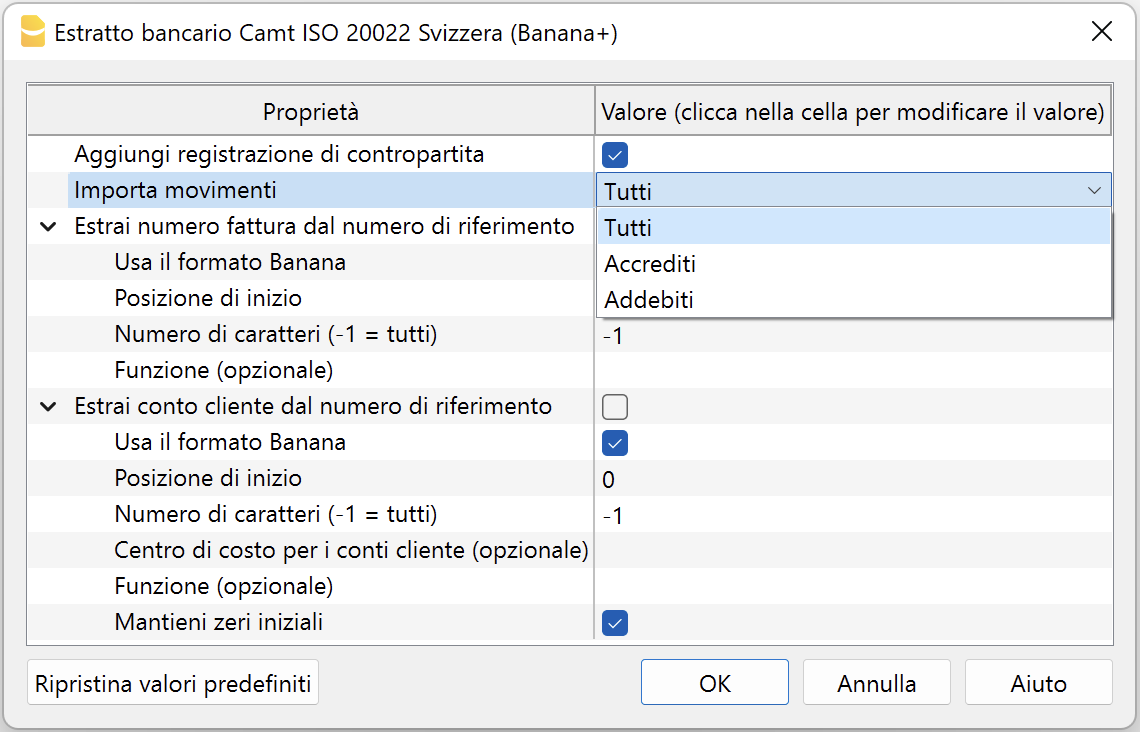

Import Transactions

You can choose which transactions to import by selecting one of the following options:

- All.

Imports all transactions. - Credits.

Imports only credits (incoming transactions). - Debits.

Imports only debits (outgoing transactions).

Extract customer invoice number from reference number

The reference number contains the invoice number. More information SCOR Reference and QRR Reference.

To extract the customer's invoice number from the reference number, there are two modes depending on whether the invoice reference number was created with Banana Accounting or other software.

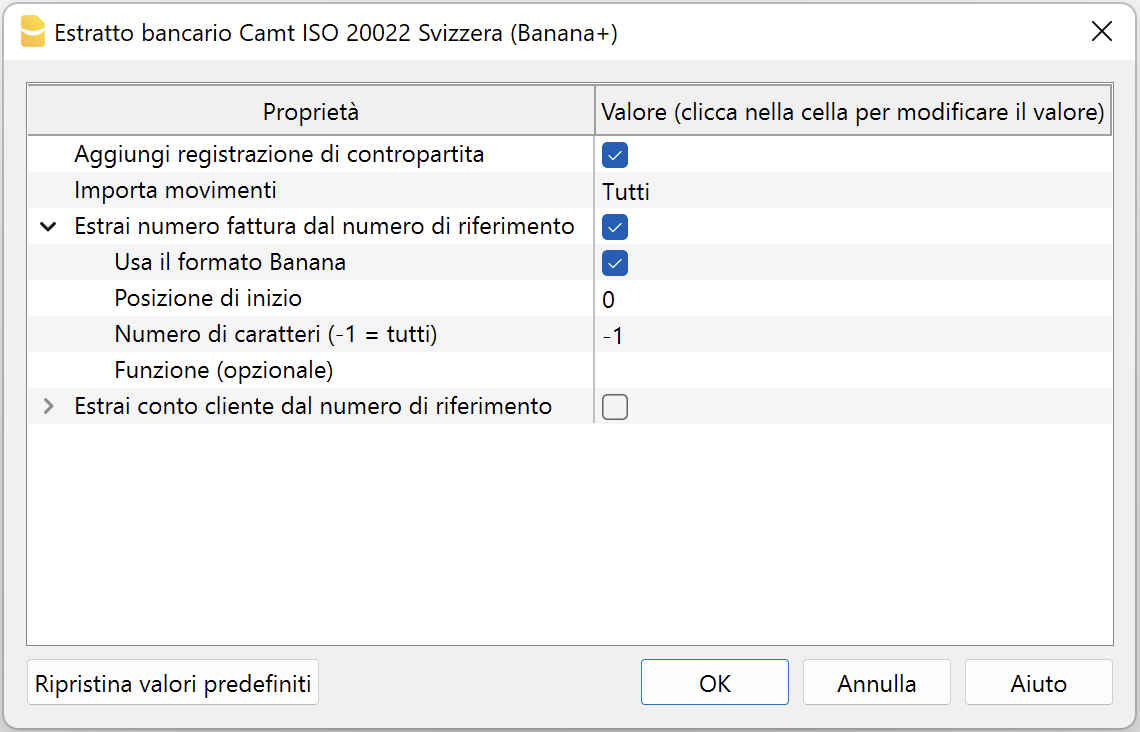

Case 1: Invoices created with Banana Accounting Plus

If the reference number was created by the Banana Accounting Plus program:

- Check the box Extract customer invoice number from reference number.

- Check the box Use Banana format.

- The fields 'Start position', 'Number of characters' and 'Function' should not be used.

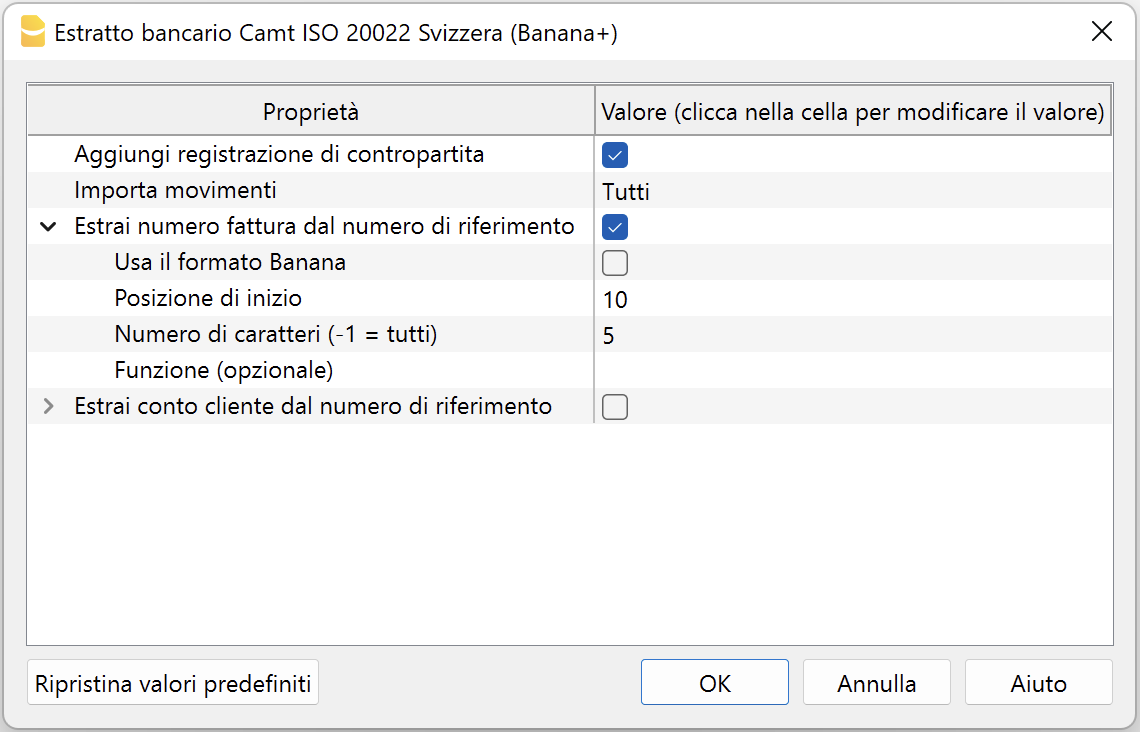

Case 2: Invoices created with other software

If the reference number was created with other invoicing systems:

- Do not check the 'Use Banana format' box.

- In the Start position field, indicate the position of the first character where the invoice number starts within the reference number.

- In the Number of characters field, indicate how many characters the invoice number consists of.

- Alternatively, instead of indicating position and number of characters, you can enter a JavaScript function that extracts the invoice number. For example: (function(text) {return text.substr(10,5);}). Note: the string must include the opening and closing parentheses.

The extracted invoice number is saved in the Invoice (DocInvoice) column of the Transactions table.

Extract customer account from reference number

The reference number contains the customer account. More information SCOR Reference and QRR Reference.

To extract the customer's invoice number from the reference number, there are two modes depending on whether the invoice reference number was created with Banana Accounting or other software.

Case 1: Invoices created with Banana Accounting Plus

If the reference number was created by the Banana Accounting Plus program:

- Check the Extract customer account from reference number box.

- Check the Use Banana format box.

- The fields 'Start position', 'Number of characters', and 'Function' should not be used.

- If using general ledger accounts as customer accounts, leave the Cost center for customer accounts parameter empty.

Otherwise, if using cost centers as customer accounts, indicate the cost center used (Cc1, Cc2, Cc3). - Check the Keep leading zeros box if the customer account starts with one or more zeros.

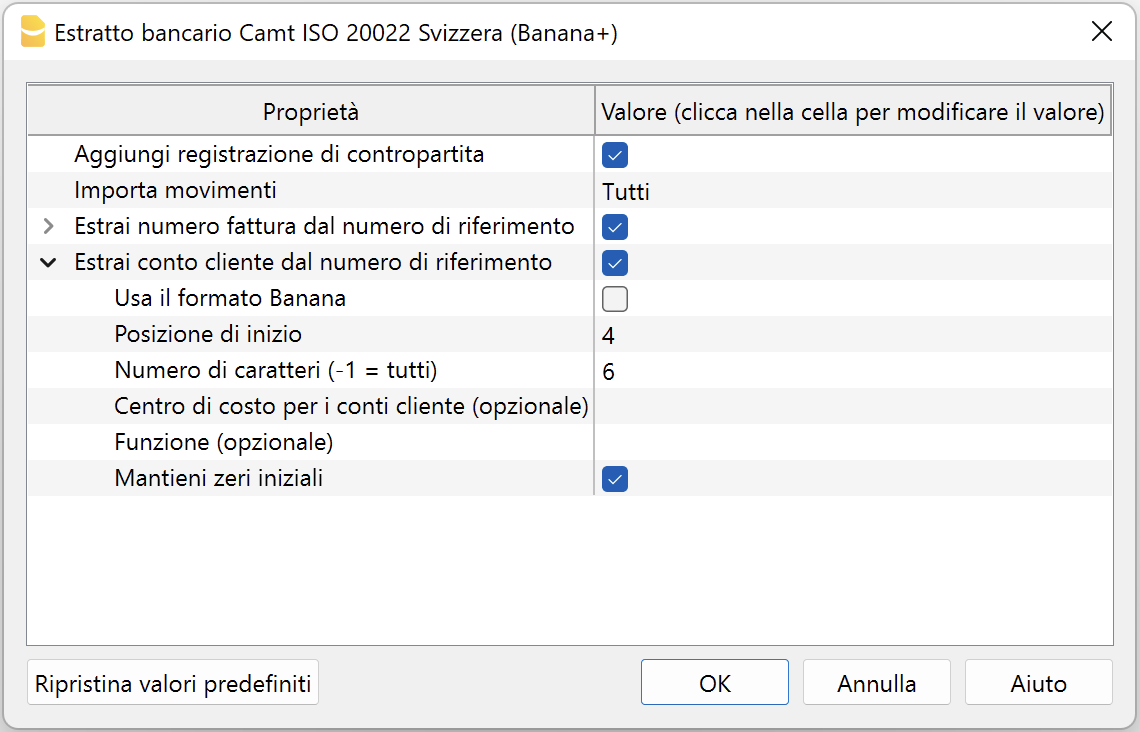

Case 2: Invoices created with other software

If the reference number was created with other invoicing systems:

- Do not check the 'Use Banana format' box.

- In the Start position field, indicate the position of the first character where the customer account starts within the reference number.

- In the Number of characters field, indicate how many characters the customer account consists of.

- If using general ledger accounts as customer accounts, leave the Cost center for customer accounts parameter empty.

Otherwise, if using cost centers as customer accounts, indicate the cost center used (Cc1, Cc2, Cc3). - Alternatively, instead of indicating position and number of characters, you can enter a JavaScript function in the Function field to extract the invoice number. For example: (function(text) {return text.substr(10,5);}). Note: the string must include the opening and closing parentheses.

- Check the Keep leading zeros box if the customer account starts with one or more zeros.

The extracted customer account is saved in the Account/Category or cost center (Cc1/Cc2/Cc3) column of the Transactions table.

For example, if by mistake you use general ledger accounts as customer accounts and specify Cc1 in the 'Cost center for customer accounts' field, the respective general ledger account will be treated as a cost center and shown in the Cc1 column of the Transactions table with a minus sign in front, for example: -110001. In this case, simply correct the parameters and repeat the operation.

Swiss Specifications

The Swiss banking system has defined specific formats for the international ISO20022 standard format.

The formats have been standardized as follows:

- camt053 (Standard electronic bank statement IBAN)

- QR-Invoice with standard IBAN account.

- Standard electronic bank statement with full details of transactions (debits and credits). It can be used when invoicing with the standard IBAN and SCOR reference number, to automatically record both debits and credits using auto-completion rules.

- If you receive payments to the special QR-IBAN account, the daily total of received payments (without detail) will also be included.

- camt054 (Special QR-IBAN electronic bank statement)

- QR-Invoice with special QR-IBAN account.

- This is the electronic bank statement that contains only the details of payments received on the QR-IBAN account (only credits invoiced with QRR reference type).

- camt052 (Accounting report)

- Used only in specific cases for transactions made during the day.

Integration between camt054 and camt053 statement

Those who collect payments via QR-IBAN can use the camt054 XML file to import and automatically record payments. At the same time, the full bank statement can be imported using the camt053 XML file.

How the camt054 and camt053 XML files work:

- The camt054 XML file contains only the details of payments from each customer (e.g. two invoices from two different customers result in two separate entries of CHF 100.00 each).

- The camt053 XML file, on the other hand, reports the total daily credit, without details (e.g. same two invoices, but only one credit entry of CHF 200, without identifying who paid).

- The payments received on the QR-IBAN account and imported via camt054 are transferred daily to the linked IBAN account (main bank account in the chart of accounts).

Issue: If both XML files (camt054 and camt053) are imported into the bank account, the same credit is recorded twice: once with detailed entries (camt054) and once with the total daily amount (camt053). This causes duplication of credited amounts.

There are two possible solutions:

- Use a clearing account.

- Manually delete the total credits from the camt053 file.

Below is the clearing account procedure, designed to avoid manually deleting duplicate credits and to prevent accidentally removing other accounting entries.

Solution: using the clearing account

To avoid double credit entries, a clearing account is used.

The clearing account is used:

- As an intermediary account to record payments from both camt054 and camt053 formats.

- To record incoming payments on the QR-IBAN.

- To transfer the payments to the IBAN account.

To avoid duplicate entries, follow a procedure similar to credit card management:

- Set up the chart of accounts

- Create the main bank account (e.g. 1020, IBAN account)

- Create the clearing account for the QR-IBAN (e.g. 1021, QR-IBAN account)

- Importing the camt054 file (QR-IBAN payments)

- Import the camt054 XML file selecting the clearing account (QR-IBAN) as the import bank account.

- Complete each transaction by entering as counter account CA the respective customer account.

- Importing the camt053 file (IBAN bank statement)

- Import the camt053 XML file selecting the bank account (IBAN) as the import account.

- Complete each transaction by entering, as counter account CA:

- the related account for detailed debit and credit transactions

- the clearing account (QR-IBAN), for global credits without detail, i.e., the total amount of customer credits

In the example, the account card for account 1021 (bank with QR-IBAN) shows:

- In the Debit column, the detailed payments from each customer (camt054).

- In the Credit column, the reversal of the global credit to zero out the clearing account.

In the example, the account card for account 1020 (bank with IBAN) shows:

- In the Debit column, the global credits from the camt053 file.

In the balance sheet, after import:

- The clearing account should have a balance of zero.

- The bank account (IBAN account) should show the global credit.

- Individual payments will be recorded in the customer subledger.

Related documents

Enter supplier account and invoice number

Unlike customer invoices, it is not possible to automatically retrieve the supplier invoice number from the reference number, because its structure varies from one supplier to another. Each supplier defines the structure of their reference number independently, making standardized recognition impossible. This is currently a technical limitation that applies to all accounting software.

However, it is possible to automatically assign the supplier account using Rules, but the invoice number must be entered manually for each transaction. To facilitate entry, you can use the F2 key or double-click in the Invoice column: a list of the supplier's open invoices will appear, from which you can select the correct one. Alternatively, in the Invoice column, you can directly type the supplier's name to display the list of their open invoices.