Neste artigo

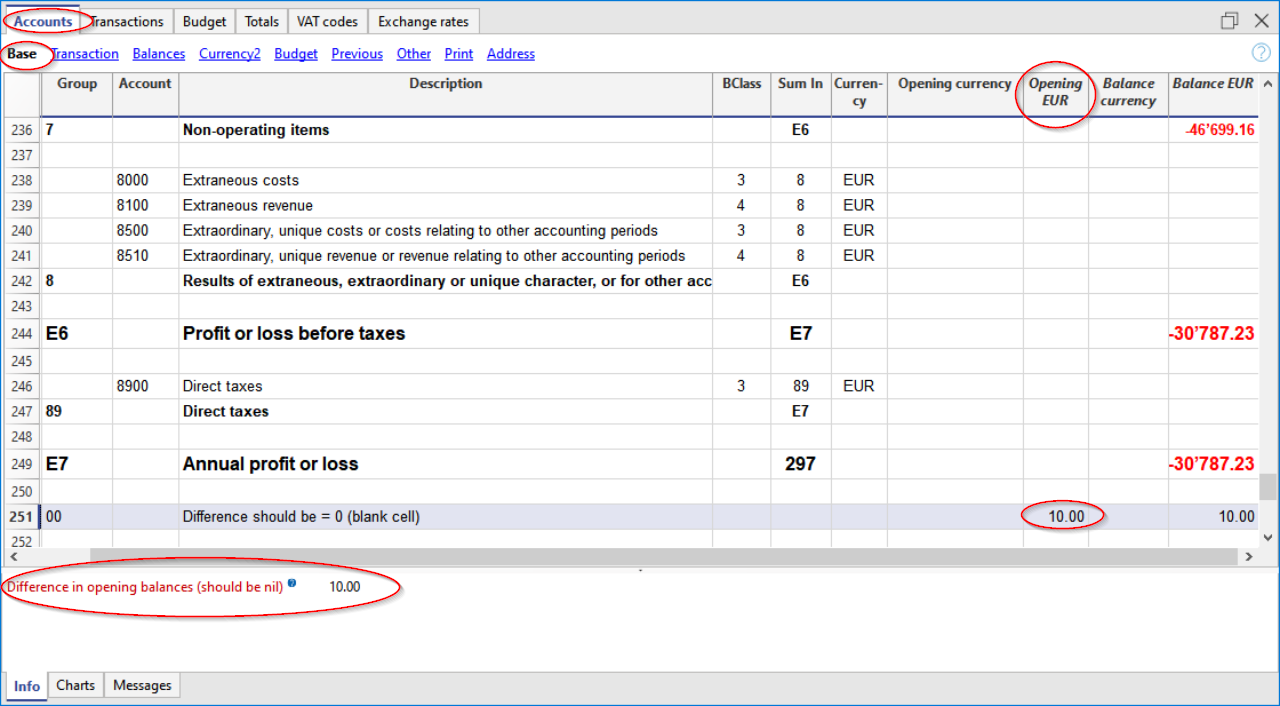

When the opening balances do not match the closing balances of the previous year, the program indicates a currency exchange difference in the initial balances.

This happens because the foreign currency values, converted into the base currency, are no longer aligned.

The most common causes are:

- Exchange rate differences not recorded in the previous year.

- Changes to foreign currency transactions after the exchange rate differences were created.

- Use of a historical exchange rate instead of the closing rate, which is present in the Exchange Rates table, in the Exchange Rate column.

- During the year, you can use the exchange rates with a date from the Exchange Rates table (historical rates).

- For year-end closing and opening of a new accounting file, you must not use historical exchange rates.

The program considers only the exchange rates of the rows without a date.

If you recorded the exchange rate differences using a historical exchange rate, remember to also update the row without a date in the previous year:

The exchange rate indicated must match the last rate used to generate the exchange rate differences.

The procedure is described on the documentation page Exchange Rates Table in the following paragraph.

How to record exchange rate differences

To correctly record exchange rate differences, you must:

- Update the Exchange Rates table, column Exchange Rate, with the official rate of 31.12, provided by the Federal Tax Administration.

- The closing rate must appear in the rows without a date.

- It is not possible to use a historical exchange rate (rate with a date), otherwise exchange rate differences may occur.

If, when opening the new year (from the menu Actions > Create new year), or when updating opening balances (from the menu Actions > Update opening balances), the exchange rate differences are not recorded, the program will indicate a difference in the initial balances in the new accounting year.

To resolve this issue, there are two possible solutions:

- If the accounting year has not yet been definitively closed (and, if applicable, also audited):

- Enter in the Exchange Rates table, column Exchange Rate, in the rows without date, the official exchange rates of 31.12 (or the closing rates provided by the company's statute).

- Activate the command from the menu Actions > Create exchange rate difference transactions.

- Open the file for the new year and Update opening balances.

- If the accounting year has been definitively closed (and, if applicable, also audited):

- Open the newly created accounting file.

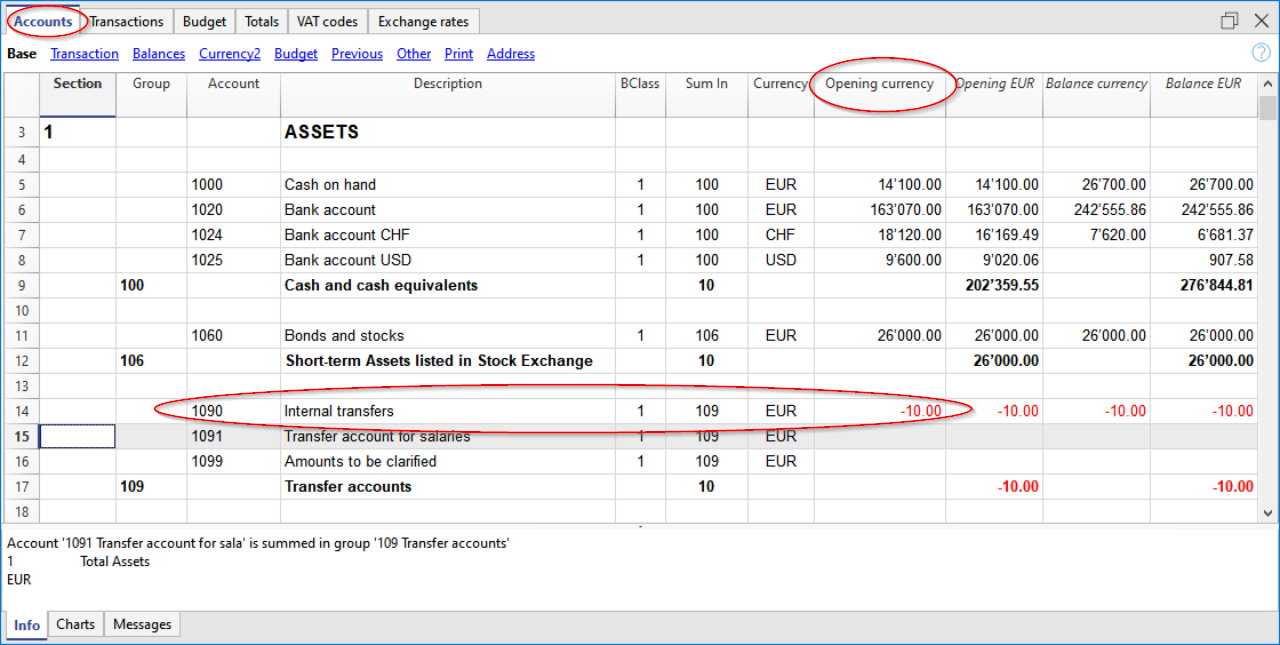

- Enter in the Assets or Liabilities (Accounts table), in case of a positive or negative exchange rate difference, a new account Unrecorded exchange rate differences, or simply record the amount in account 1090 Transfer account (as in the example below).

- In the Opening currency column, enter the amount corresponding to the exchange rate difference.

- In the accounting of the new year, in the Accounts table, Opening currency column, a balance related to the exchange rate differences has been generated.

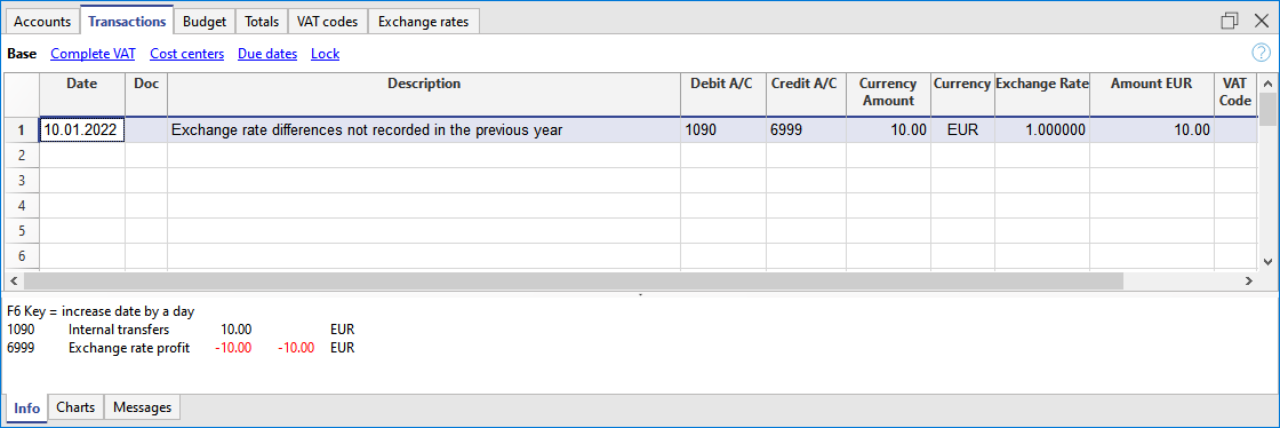

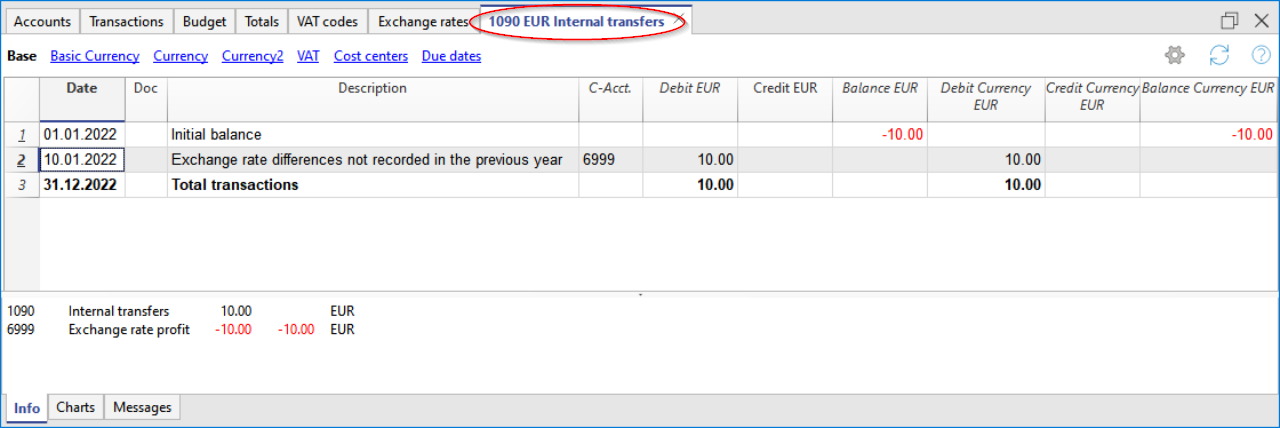

To adjust the difference, proceed as follows:- In the Transactions table, on January 1st (or on the statutory opening date), record the exchange rate difference amount in the account Unrecorded exchange rate differences, or as shown in the example, in account 1090 Transfer account, using as counterpart the exchange rate differences account (Gains and/or losses on exchange) in the income statement.

After recording the adjustment for exchange rate differences, the account used should have a balance of 0, or equal to the balance prior to recording the exchange rate difference.

If it is a gain on exchange, the difference amount should be entered in a liabilities account, or in assets with a minus sign in front of the amount.

This amount, which initially affects the income statement of the new year, is then canceled with the first exchange rate update operation, which can be done according to your needs during the year. Otherwise, if the exchange rate update is only done at year-end, the exchange rate gains and/or losses account will still be correctly adjusted.

Warning:

If the exchange rates are updated only at year-end, the interim Balance Sheet and Income Statement will be “affected” by the amount of the Exchange Rate Difference related to the Opening adjustment.