En este artículo

As a general rule, in Banana Accounting Plus all transactions that have a VAT code contribute to the VAT calculation and to the determination of the amounts in the respective fields of the VAT report. In the transactions, there may be various causes leading to discrepancies when comparing turnover:

- When a sales transaction subject to VAT is recorded without a VAT code, the amount is included in the accounting turnover but excluded from the VAT return, resulting in a discrepancy between the two values.

- For example, a sale of CHF 1,000 recorded without a VAT code increases the accounting turnover by CHF 1,000, but does not appear in the VAT return for the same period.

- If a transaction involving VAT is missing the VAT code, the corresponding VAT amount and taxable amount are not considered in the VAT facsimile form. However, in the accounting, since there is a sales entry posted to the sales account, the amount contributes to the turnover.

- Transactions with a VAT code were added after the VAT data was submitted to the FTA.

- Transactions with VAT were deleted, even accidentally, after the VAT data was submitted.

- Transactions were entered with the wrong date and ended up in a previously reported quarter.

- If there are reversals and the corresponding VAT code with a minus sign was not used.

- VAT codes were entered for adjustments and closing operations, which normally should not have a VAT code.

- For reversals of exports, the code VE-0 was mistakenly used. In this case, a discrepancy occurs because when the sale is reversed, it is recorded as a debit, which reduces the turnover, while with the VE-0 code, the amount is considered by the program as part of the turnover and is thus added.

Preparing a Reconciliation Report

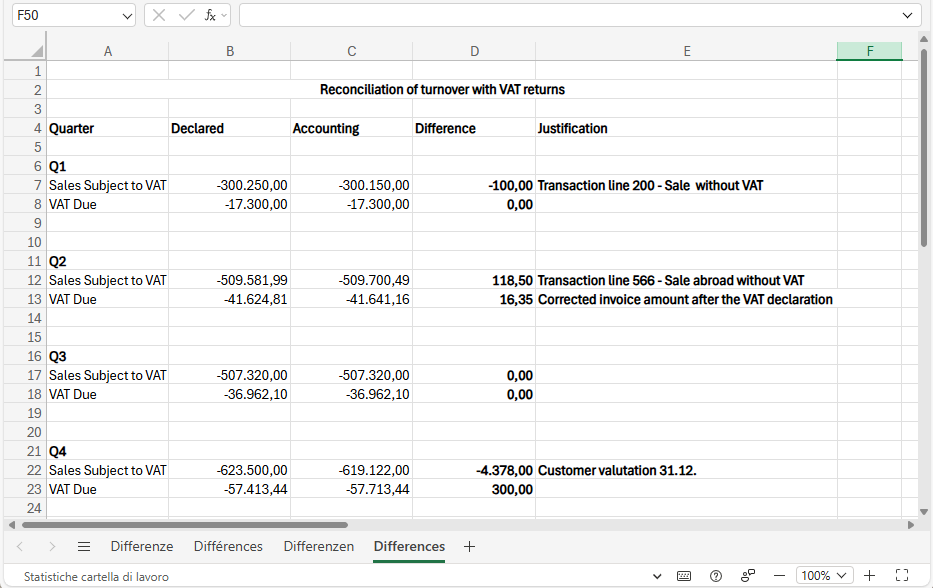

- Document the reconciliation process, indicating any identified differences and corrections made.

- Draft a detailed report highlighting all phases of the reconciliation process and the results obtained.

Useful Tools

- Accounting Software: Banana Accounting allows you to recreate the VAT form facsimiles, VAT summaries, annual account reports, and period-based breakdowns even after some time. This facilitates data comparison over time to find discrepancies or errors in VAT and turnover calculation.

- Spreadsheet: Create a spreadsheet (e.g. Excel) where you can copy and paste data from Banana to track and compare sales, purchases, and VAT declarations.

Tips

- Regular Checks: perform regular reconciliation checks to avoid the accumulation of errors and discrepancies over time.

- Precision and Attention to Detail: reconciliation requires particular attention to detail and accurate verification of all data.

- Professional Support: Consider involving an accountant or tax consultant to ensure the correctness of the process.

Summary

The reconciliation between turnover and VAT returns allows for verifying the accuracy of tax declarations against the accounting records.

Banana Accounting's VAT reports and templates make it possible to identify, analyse, and document any discrepancies in a structured way.