In this article

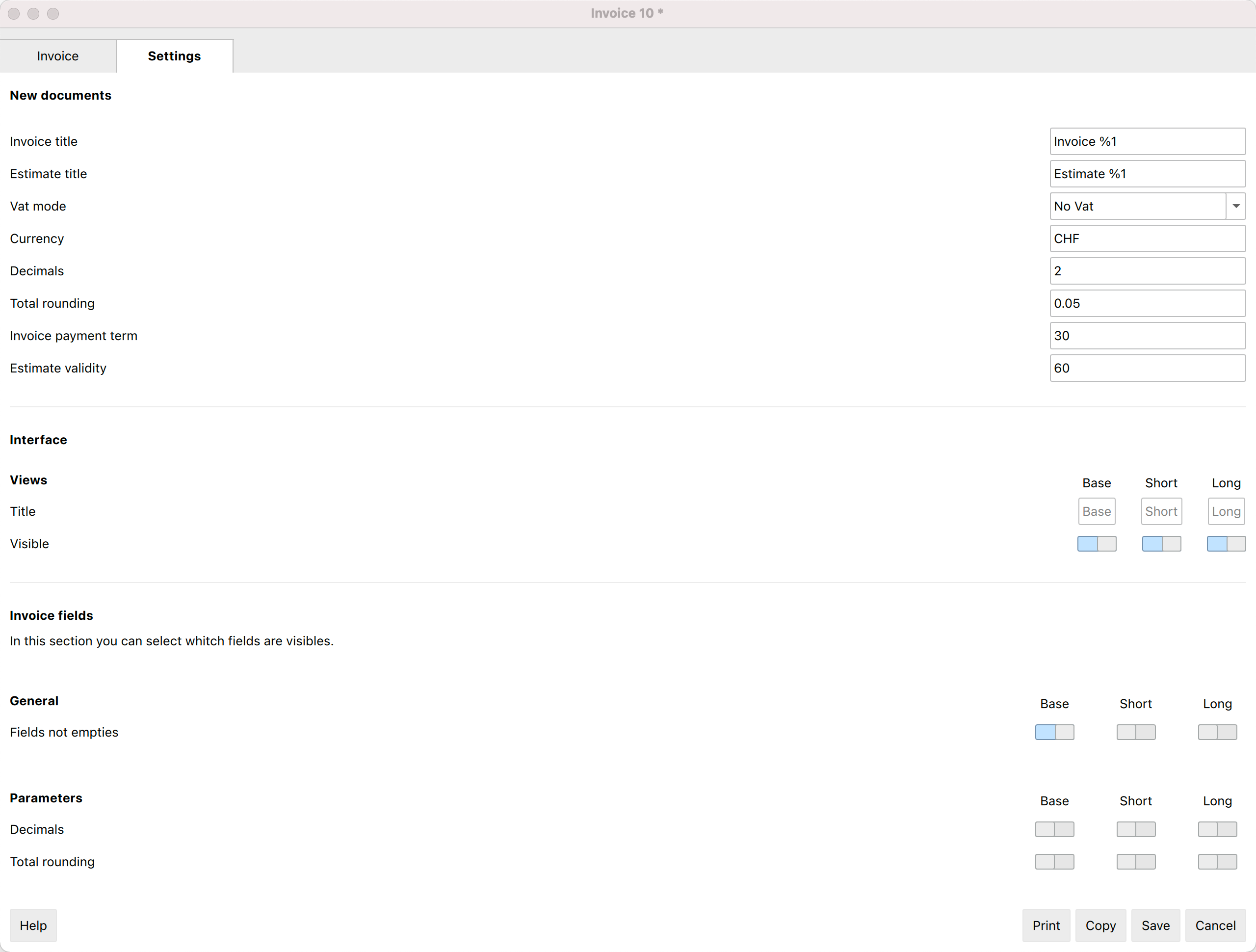

By clicking Settings (in the lower left corner) you enter the settings dialog of the invoice.

The settings you set are specific for the invoice.

- The currency code

You can indicate the code (CHF, EUR, USD, etc.) that will be printed on the invoice.

The program does not make exchanges and conversions in other currencies. - The number of decimals to be used for the amounts.

All amounts will have the number of decimals set. - Rounding up totals.

Put a "0.05", "0.10" amount that becomes the minimum rounding unit.

The decimal separator must always be the dot ".". - Payment term in days

It is used to preset the due date, which can then be changed manually. - Validity of the Estimate in days

This is used to preset the expiry date of the offer, which can then be changed manually. - The VAT mode

If the VAT mode is changed, the program modifies the amounts already entered, so that the same invoice can be printed with both gross and net amounts. If the VAT is set to gross and net amounts have been entered, once the setting has been changed, the amounts must also be changed so that they are net amounts.- No VAT. No VAT is applied.

- VAT Inclusive. The amounts are considered gross.

- VAT Exclusive. The amounts are considered net.

Use settings for new invoices

You can choose to use these settings for new invoices that will be created.

The settings of other existing invoices are not changed.

help_id

dlginvoiceedit::settings