In this article

New VAT reporting for small business

Starting from January 2018 businesses in the Kingdom of Saudi Arabia will have to pay VAT on their sales.

A VAT tax is an indirect tax imposed on most of the goods and services commercialized by a business. After collecting the tax, businesses will transfer it to the government. In Saudi Arabia, the tax authority in charge is the General Authority of Zakat and Tax (GATZ).

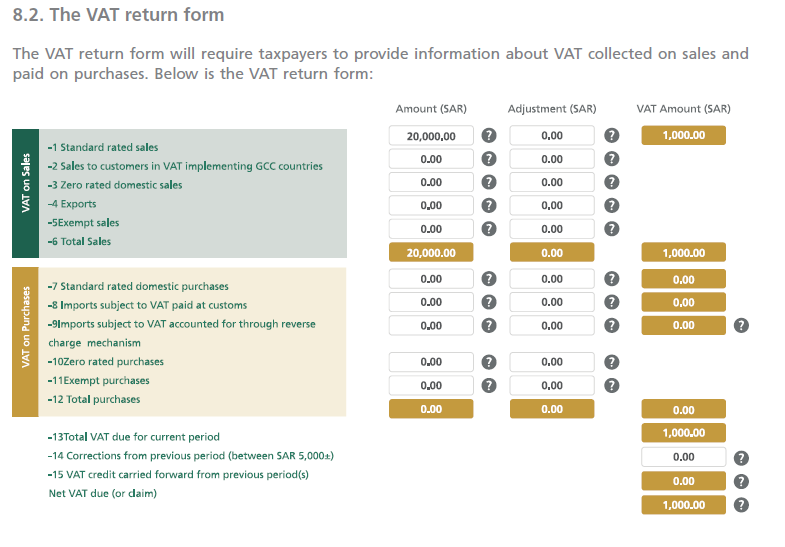

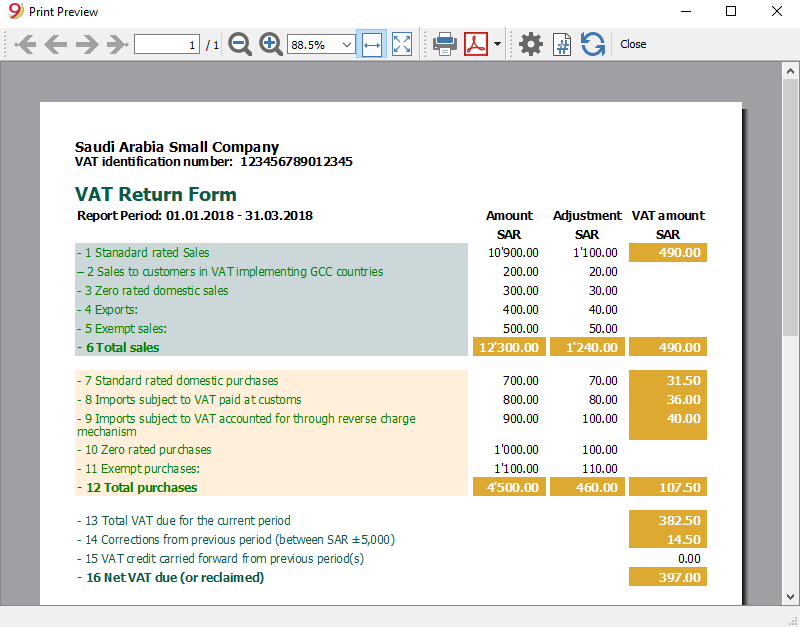

Every business will have to periodically calculate and report the VAT to GATZ by filling the official online form (see following image), with all the necessary figures.

Collecting all the necessary VAT information

To fill the online form, you need to calculate the VAT and collect all the information regarding issued and received invoices, VAT imposable and VAT amounts for the different required categories.

By using a specific tool, like Banana Accounting Software (lifetime license costs approximately US$ 135, VAT excluded) the process of collecting and calculating VAT is simplified.

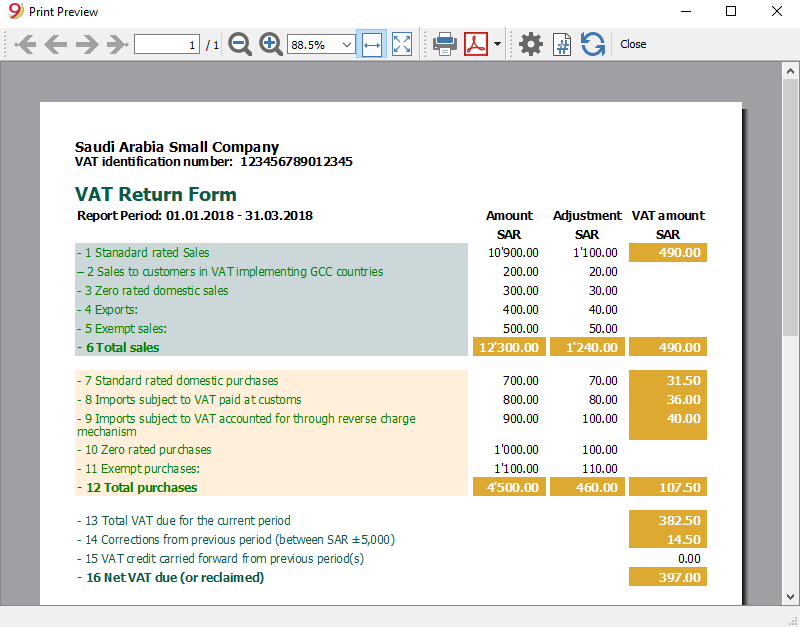

The following image shows that the VAT report prepared by Banana Accounting is the same as the official VAT form. Therefore, all you need to do is to copy the data from the Banana report to the online form.

Further down the page you can find directions on how small businesses can prepare for the VAT and generate the VAT report with Banana Accounting.

Documentation VAT Saudi Arabia

Here you can find all the documentation needed to successfully implement the VAT reporting.

- GATZ’s website

- VAT Tax Regulation.

- GATZ’s user manual.

It is a well written document with detailed explanations on how businesses should comply with VAT rules. - Taxpayer charter

- General FAQ and Technical FAQ

Registering your business and receive the VAT identification number

The GATZ has established that companies with annual taxable sales of more than SAR 1’000’000 must register by the end of 2017. Companies under SAR 1’000’000 annual taxable sales have time until the end of 2018.

Business will have to register on the GATZ’s website. Before starting the registration process, it is important to have a valid tax identification number (TIN), which is also obtainable on the website.

For additional information and guidelines about the registration process, consult the GATZ’s user manual.

Install the software

Install and start Banana Accounting

Preparing the VAT report with our accounting software is much easier.

Banana Accounting offers a free trial that allows the recording of up to 70 transactions. To register more transactions, it is necessary to buy the license key. The price is highly competitive as our software is used in many countries and has a large number of users.

Banana Accounting 9 is a universal accounting software which focuses on small businesses. It has an intuitive interface, which is similar to Excel. You will quickly learn how to use it and it will be easy to correct mistakes.

The first step to install the software, is to download it from our website. Here, you will find all the necessary information to successfully install Banana Accounting.

- Install Banana Accounting software

- Install the Banana Extension for VAT reporting Saudi Arabia 2019

Install the Banana Extension“Saudi Arabia VAT Report”

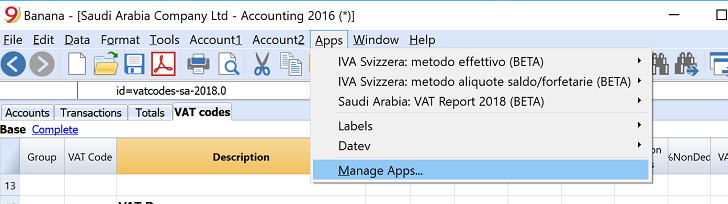

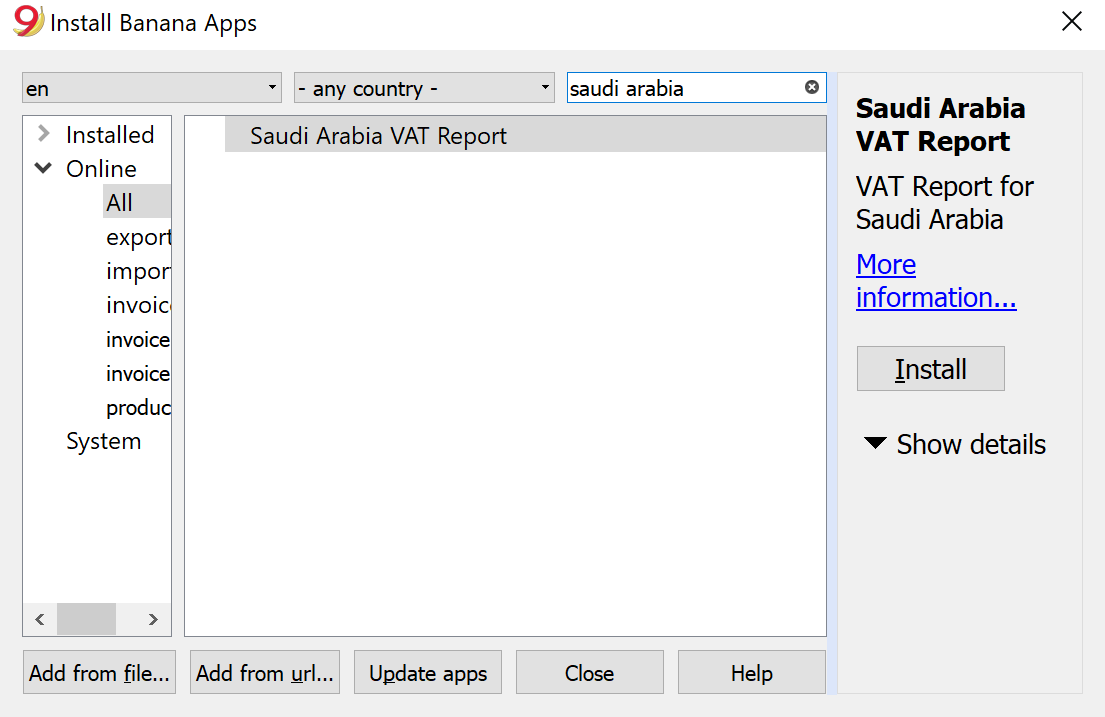

The first time you need to install the Banana Apps for Saudi Arabia VAT report.

Follow this procedure :

- Click on "Apps" and select "Manage Apps".

- Search for Saudi Arabia and click on "install".

Steps to create your accounting file and generate as VAT reporting

These are t list below is what you need to do to keep track of the VAT.

- Create a new accounting file starting with a template that is appropriate for you.

- Enter the data of your companies and save the file.

- Customize the accounting plan to your needs.

- Enter the transactions with the appropriate VAT Code.

- Run the report VAT Report

- Copy the data of the VAT Report on the online form.

2. Create a new accounting file

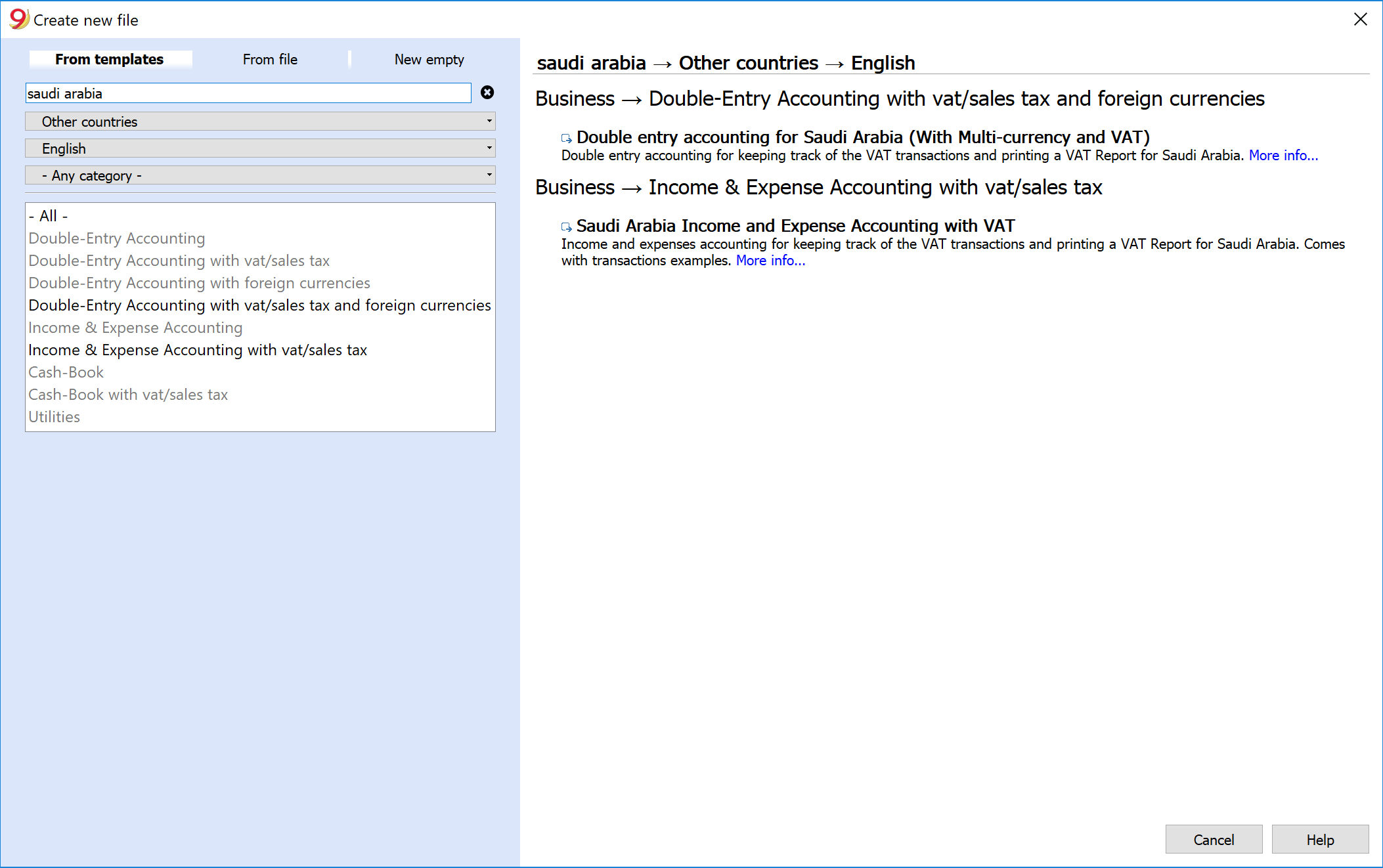

To start a new accounting for Saudi Arabia follow these steps:

- Click on “create new…”

- Enter “Saudi Arabia” in the search box.

A list of accounting templates will appear, with the VAT code table already set up for Saudi Arabia requirements.

Now, it is possible to select two templates that Banana Accounting has specifically created for Saudi Arabia. The income expenses accounting is a simplified cash accounting system.

After choosing the desired template, it is be possible to start a new accounting with our software.

Choosing between Double entry and Income and Expense accounting

Banana Accounting offers you a list of templates you can choose from.

Banana Accounting uses the double entry accounting methodology for calculation purposes.

For people who are not used to the double entry, it provides a simplified approach, based on income and expenses, that also support full VAT reporting.

- Double entry accounting:

- You can record transactions both with the cash or accrual approach.

- In case of doubt, use the double entry accounting method.

- When you are required to use the accrual accounting method.

- When you need multi-currency accounting.

- When you are required to comply with commercial accounting standards and have a full company report with Balance Sheet and Profit and Loss statement.

- If you are confident with the double entry accounting methodology.

- Income and expenses accounting:

- If you are allowed to keep accounting with the cash method.

- If you are not acquainted with the double entry accounting system and terminology.

Introduction to Banana Accounting

Here, you will find all the necessary information on how to start a double-entry accounting with an online template.

After, you will find specific instructions on how to use the Banana Accounting software with a Saudi Arabia template. All the instructions are based on a cash accounting template.

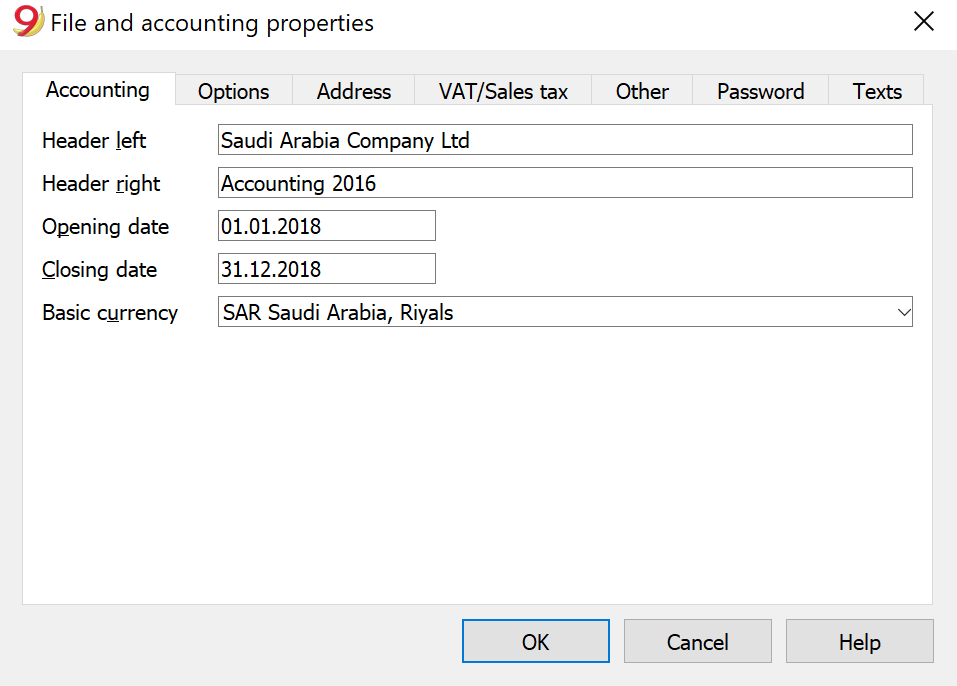

Setting the “file and accounting properties”

This page will open the first time you choose a template, see file and accounting properties .

- Complete the information of the company.

- Complete the Address tab.

Under VAT number enter your Company Identification Number

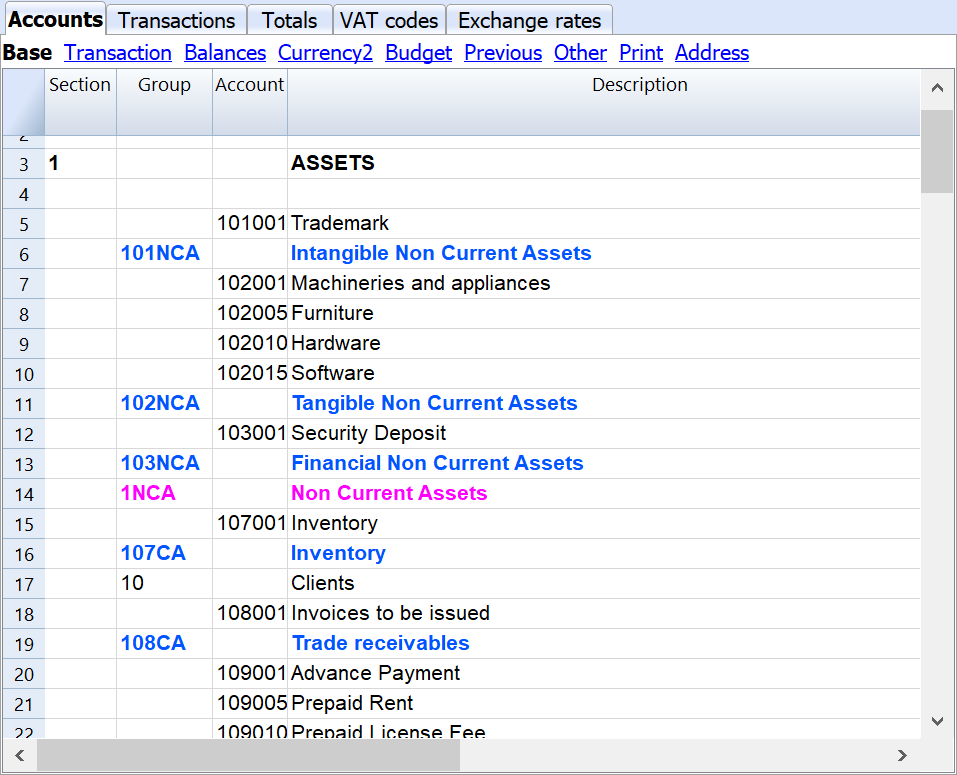

Accounts table

In the Accounts table you setup the balance sheet and the profit and loss statement. The template contains a standard set of accounts that you can modify based on your needs.

The opening SAR column must be filled with the opening balance of your company at the beginning of the reporting period. The Balance SAR column will show the current balance of a given account. Credit opening amounts need to be entered in negative. Positive and negative amounts should equal zero.

See the Table accounts for additional information on how to enter opening balances, add accounts or groups.

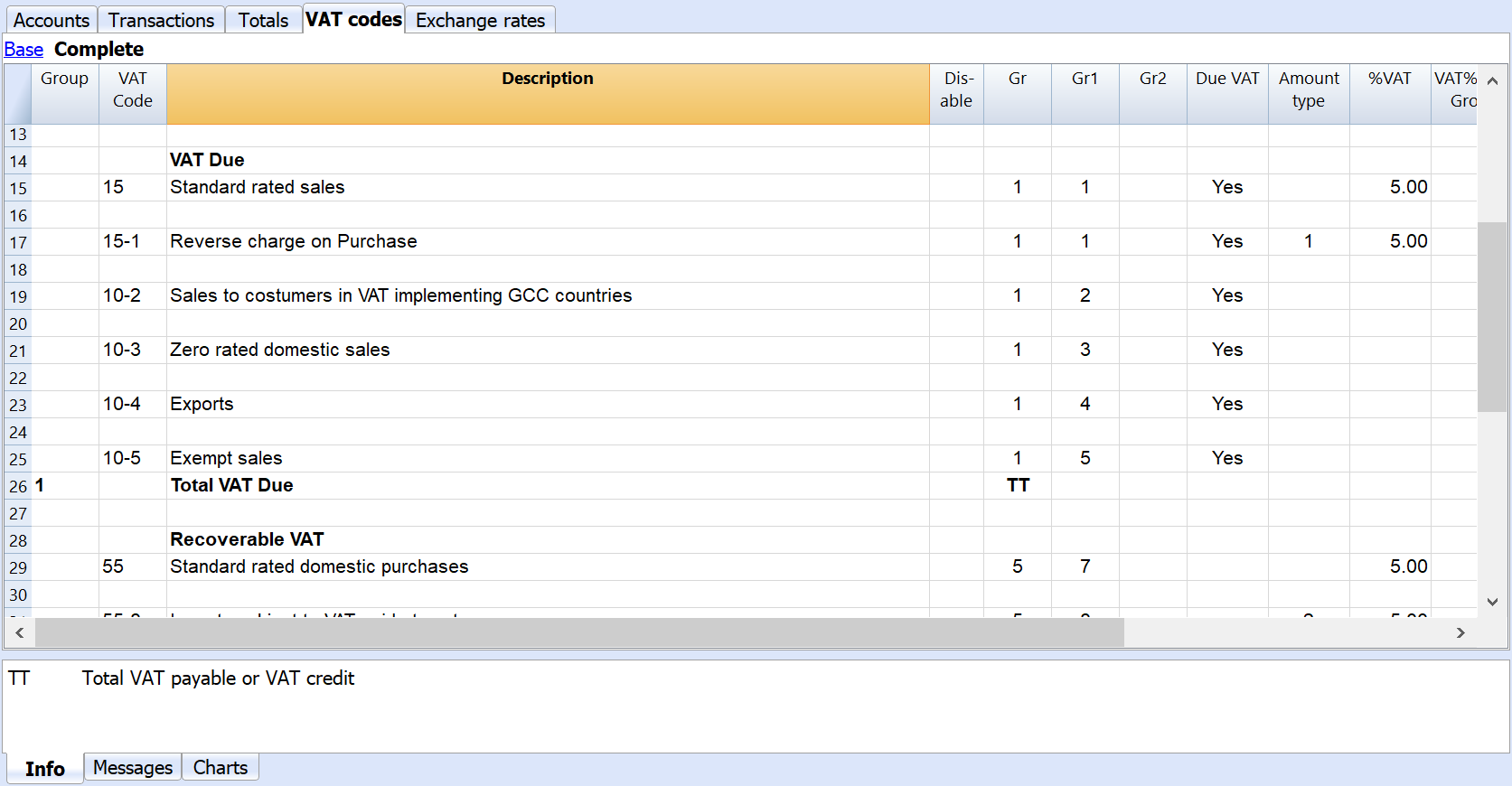

VAT codes table

This table is essential for the VAT reporting. It contains all the necessary codes to successfully calculate the VAT due and the VAT recoverable. Here, you can find detailed information about VAT codes for Saudi Arabia.

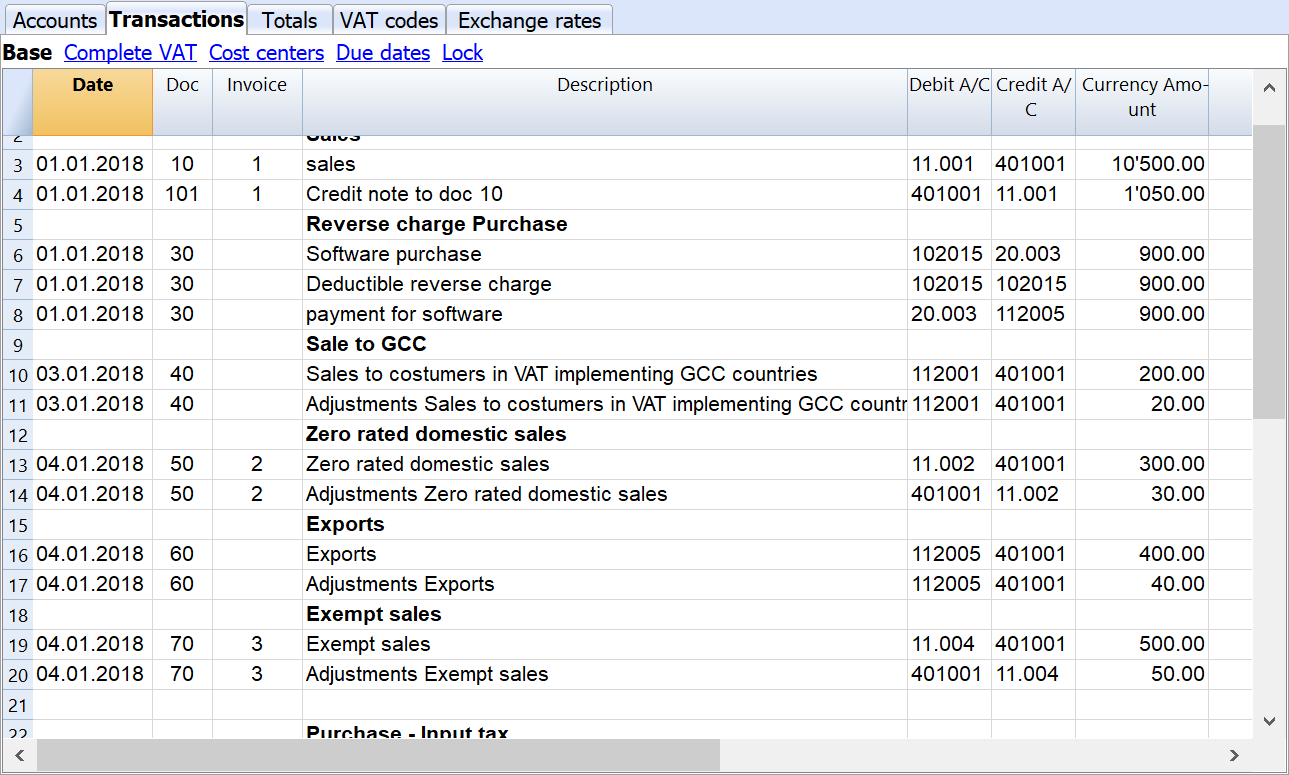

Transactions table

This is the table where all the transactions must be recorded. To successfully generate a VAT report, it is important that each transaction has a VAT code associated to it.

The template contains examples of typical transactions that show how to deal with different situations that could arise in VAT reporting.

Here, you can find detailed information about the specific transactions for Saudi Arabia.

- Date: the date is used by the program to attribute the transaction to a certain time frame. The date should be within the limits of the accounting period defined in the Basic data of the accounting

- Doc: the number of the voucher which serves as a base for the accounting transaction. When entering transactions, it is advisable to indicate a progressive number on the document, so that the accounting document can be easily traced from the transaction.

- Invoice: it is possible to insert a number to classify the transactions. This way it is possible to automatically generate an invoice for each transaction.

- Description: the text of the transaction. The autocomplete feature proposes the text of an already entered transaction, or one that has been entered in the previous year when the appropriate option was activated.

- Debit A/C: the account that will be charged.

- Credit A/C: the account that will be credited.

- Amount SAR: the amount that will be entered unto the debit- and credit account.

- VAT code: for each transaction with VAT you need to enter one of the VAT codes from the VAT codes table.

- Amount type: this is a code that indicates how the software considers the transaction amount:

- 0 (or empty cell) with VAT/sales tax, the transaction amount is VAT included

- 1 = without VAT/Sales tax, the transaction amount is VAT excluded

- 2 = VAT amount, the transaction amount is considered the VAT amount at 100%.

- It is not modifiable.

- %VAT: the program automatically enters the VAT percentage associated with the VAT code you entered.

- Non Ded %: this indicates the non-deductible %:

- When you enter or change the VAT Code, the program uses the Non Ded. % associated to this VAT Code in the VAT Codes table.

- You can manually edit the value

- VAT Acc SAR: this is the VAT amount registered in the VAT account. It is calculated by the program according to the Transaction amount, the Amount type and the non-deductible percentage.

For more detailed information about the Transactions table visit this link.

Generating a VAT report to submit the VAT return

GATZ established when a company must submit a VAT return.

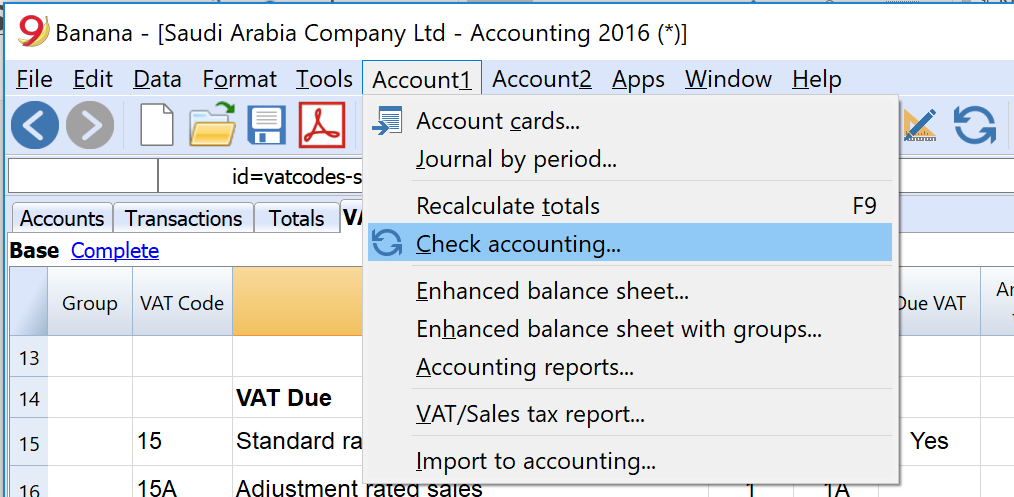

Before generating the automatic VAT report that will be used to fill in the VAT return form, it is essential to check the accounting.

To check it, go to Account 1 and select check accounting.

After checking the accounting, you are ready to generate the VAT report.

- Click on the Apps Menu

- Saudi Arabia: VAT return 2018 (beta).

This is the result that you will obtain, you will only need to copy the data onto the online form.

Open source collaboration

The solution has been developed with an open source concept. We welcome suggestions and feedback, see our web page on github/SaudiArabia.

For any questions or suggestions, please contact us at: contact form.