In this article

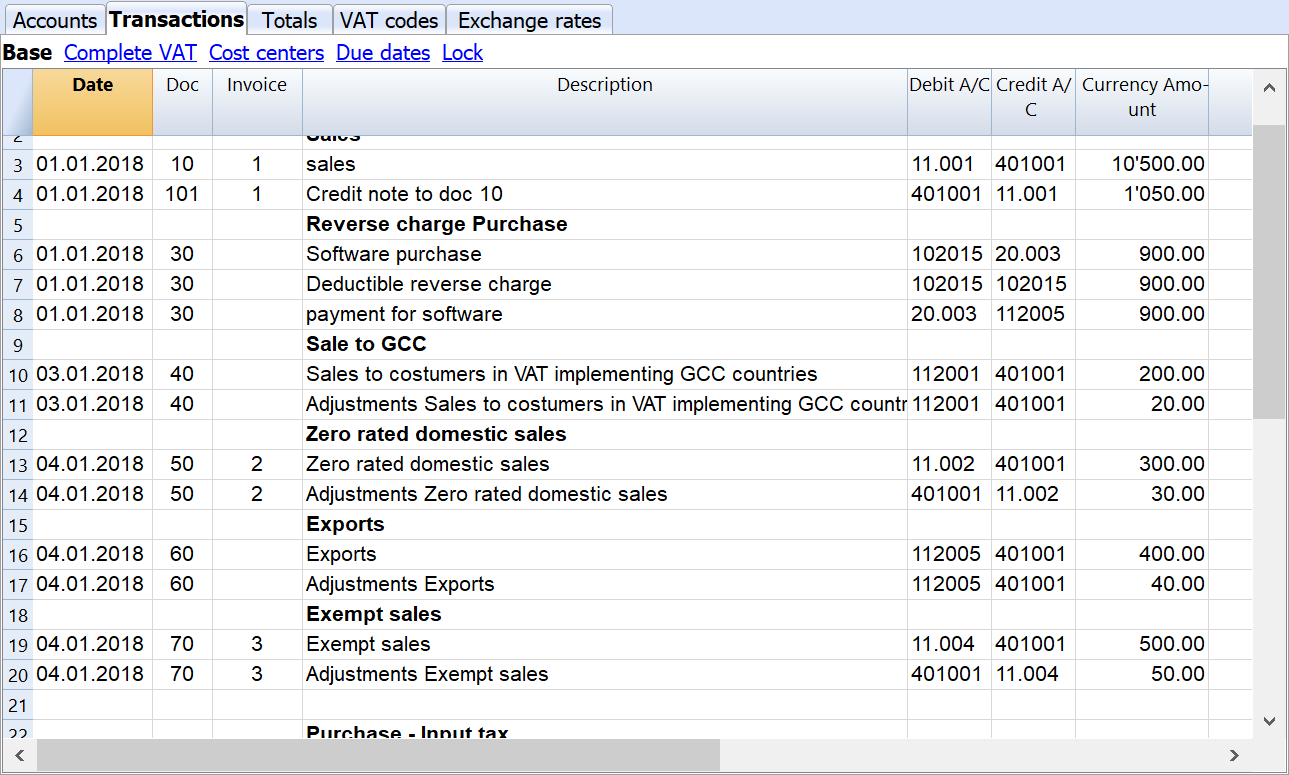

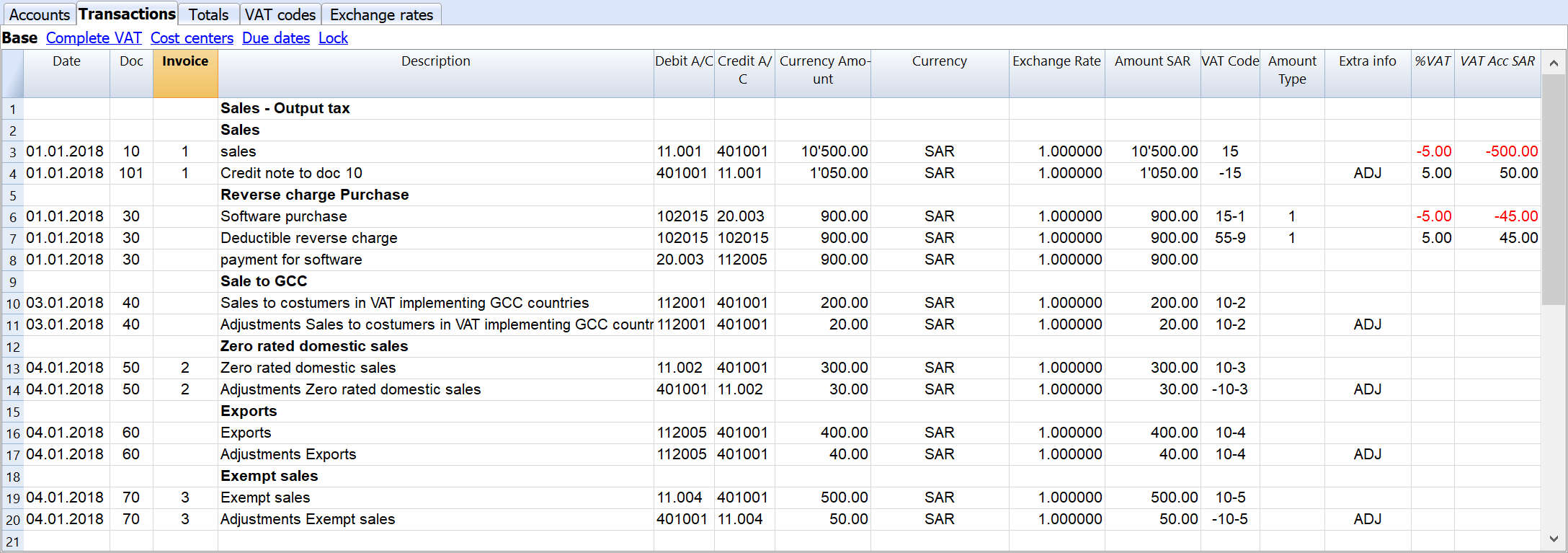

The transactions table contains all the transactions carried out by a business.

After having adjusted the accounts, you can start to input the transactions in the software.

In order to insert the transactions correctly, it is essential to know all the different vat codes for Saudi Arabia.

You can find detailed information about the double-entry accounting and about transactions. From the transaction is possible to generate invoices automatically.

Further down the page, you will find specific examples regarding Saudi Arabia on how to enter VAT transactions.

VAT due transactions

The “Doc” column is used to identify the transactions for the examples.

Standard rate sale

Standard rate sales include goods and services such as: food and beverage, commercial sales and rent, private education and private healthcare. Here, you can find a complete list.

- DOC 10 - This is an example for a simple transaction where the company sell products to a customer. The VAT code used is the number “15”, it corresponds to a standard rate sale.

Credit note

A credit note is normally issued to correct a mistake. It is usually sent by a seller to a buyer (e.g. the invoice amount was overstated and, therefore, the buyer reduces its amount).

- DOC 101 - This transaction represents a credit note. It is directly related to the DOC 10 transaction. The VAT code utilized is the same used in DOC 10. The minus sign shows that the amount is being reduced.

Reverse charge

The reverse charge is a mechanism which is sometimes used in VAT reporting. Importing services is one of the main causes for utilizing the reverse charge mechanism. In fact, the VAT arising from importing goods can be collected at the border. For services, it is impossible to collect the VAT at the border. Therefore, the reverse charge mechanism must be used because it is necessary to register the related VAT due. You can find specific information on the reverse charge mechanism on the user's manual.

- DOC 30 - This is a transaction where the reverse charge mechanism must be utilized. Two VAT codes must be used to correctly record the transaction.

Sales to customers in VAT implementing GCC countries

- DOC 40 - This kind of transaction happens when the company sells products to a customer from one of the GCC countries that is implementing the VAT. In this case, the rate is 0%. The second row shows a simple adjustment.

Zero rated domestic sales

Zero-rated goods and services are taxable but at a 0% rate. This regulation exists to allow companies selling 0% supplies to deduct the recoverable VAT and, therefore, get a refund. Here, you can find a complete list of zero rated goods and services.

- DOC 50 - This transaction involves a zero-rated sale. There are certain products which have a 0% VAT rate. In this case, the product sold is classified as zero rated. The second row of this transaction shows a simple adjustment.

Exports

Exports are subject to a 0% rate as ruled by the GATZ.

- DOC 60 - This transaction represents an export of goods. Exports have a VAT rate of 0%. The second row of this transaction shows a simple adjustment.

Exempted sales

Exempted goods and services are not subjected to VAT. When you sell exempt supplies, you do not collect the VAT. A company selling only exempt supplies cannot register for VAT. A complete list of exempted goods and services is available.

- DOC 70 - In this case, the product sold is exempted from the VAT. The main difference from a 0% VAT rate is that with exempted good it is not possible to obtain a VAT refund. The second row shows an adjustment.

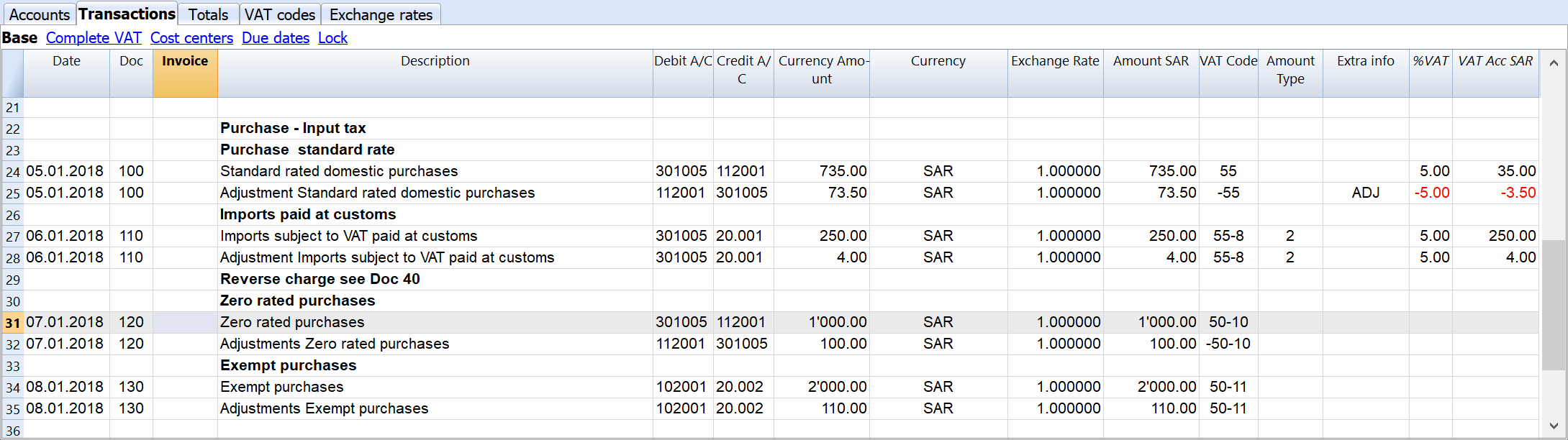

VAT recoverable transactions

The “Doc” column is used to identify the transactions for the examples.

Standard rate purchase

Standard rate purchases include goods and services such as: food and beverage, commercial sales and rent, private education and private healthcare. Here, you can find a complete list.

- DOC 100 - This transaction represents a standard rate purchase on the first row. In the second row, there is an adjustment related to the transaction in the first row.

Imports paid at customs

Imported goods are subjected to the VAT at the border. Since the VAT is paid, there is no need for a reverse charge mechanism.

- DOC 110 - This transaction regards a simple import of goods. The second row represents an adjustment of the previous transactions.

Zero rated purchase

Zero rated goods and services are taxable but at a 0% rate. This regulation exists to allow companies selling 0% supplies to deduct the recoverable VAT and, therefore, get a refund. Here, you can find a complete list of zero rated goods and services.

- DOC 120 - This is an example of zero rated purchases. In this case, the product purchased by the company belongs to a 0% rate VAT category. In the second row, there is an adjustment for the previous transaction.

Exempt purchase

Exempted goods and services are not subjected to VAT. When you buy exempt supplies, you cannot claim a deduction. A complete list of exempted goods and services is available.

- DOC 130 - This transaction represents an exempt purchase. The product purchased is exempted according to the VAT regulations. In the second row, there is an adjustment for the previous transaction.

Corrections

At the bottom of the transactions table, you will find examples of corrections from previous periods. You should use this functionality to correct mistakes from previous reporting periods.