In this article

Banana Accounting has specifically created a set of VAT codes for Saudi Arabia.

These codes are essential to report correctly the VAT. When a VAT code is inserted in a transaction the software will keep track of the total VAT due and recoverable.

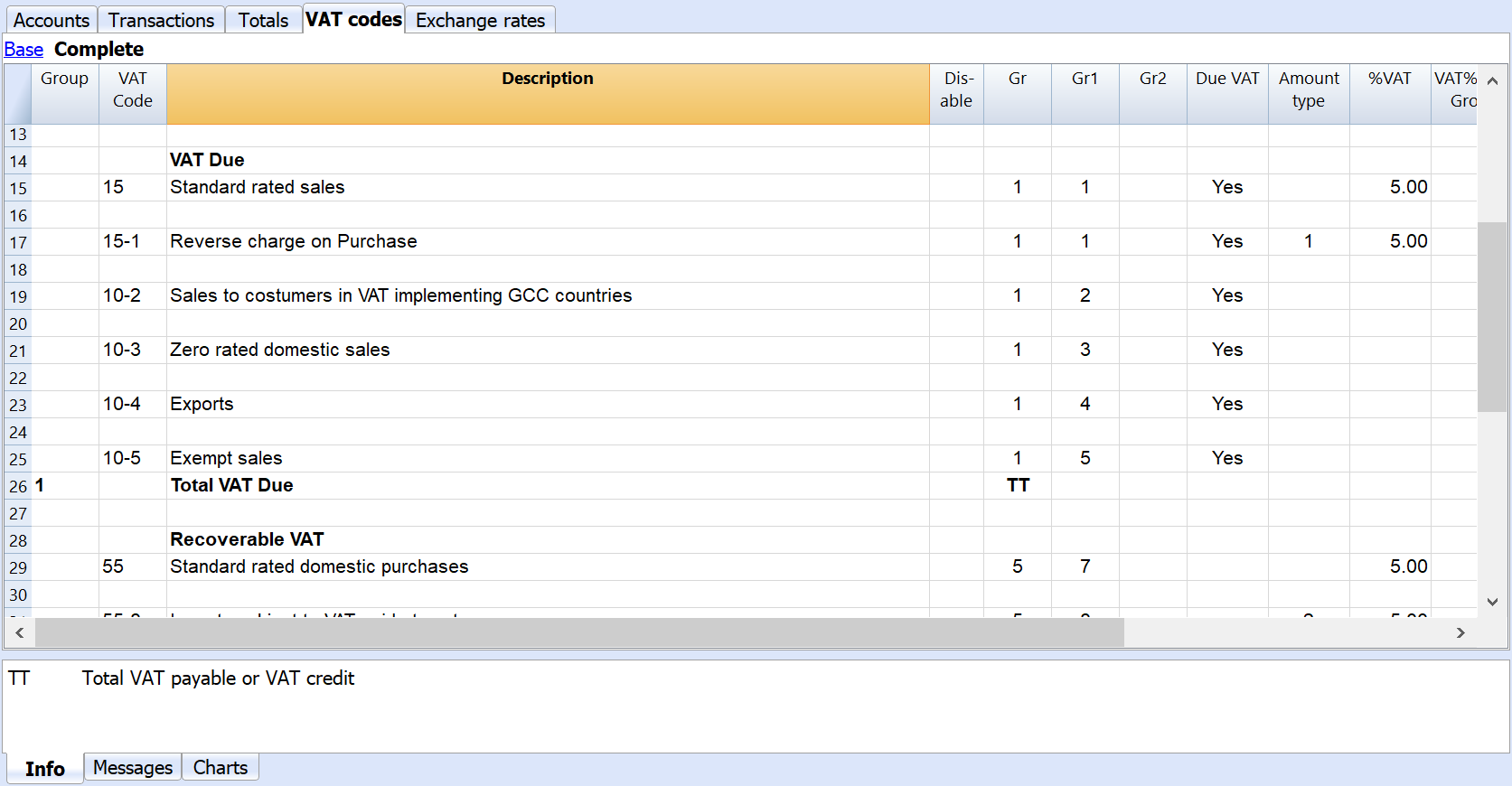

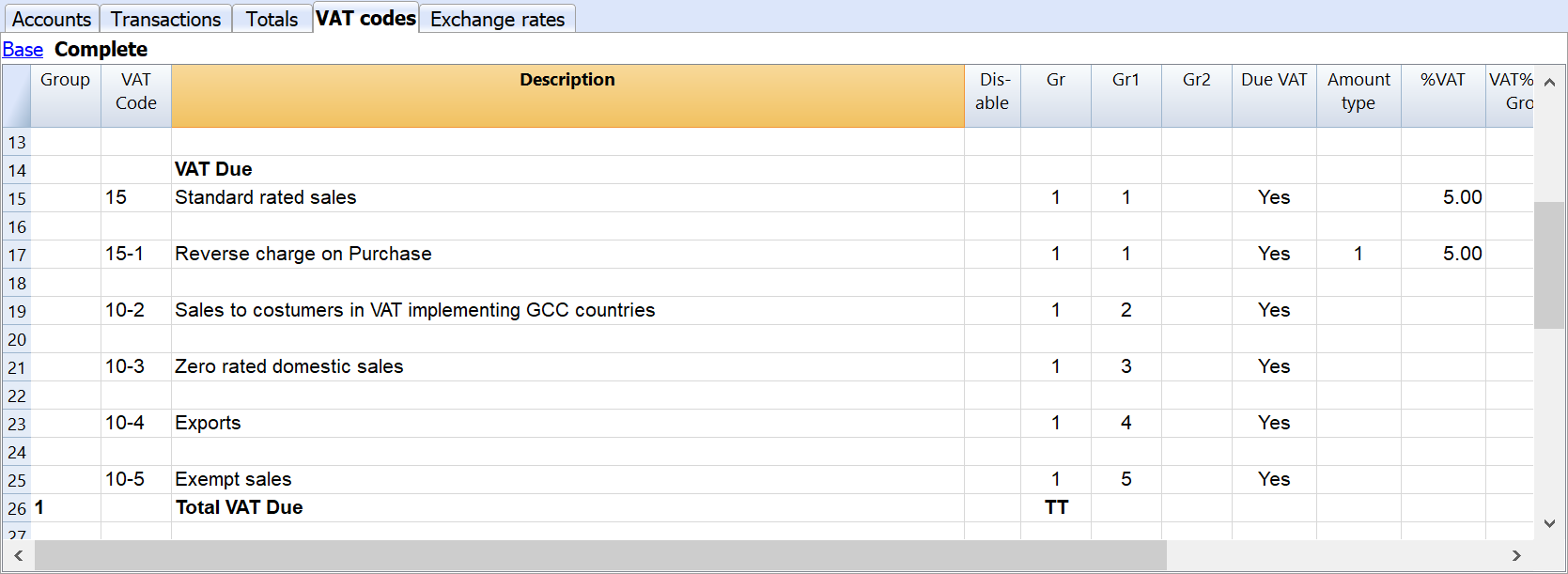

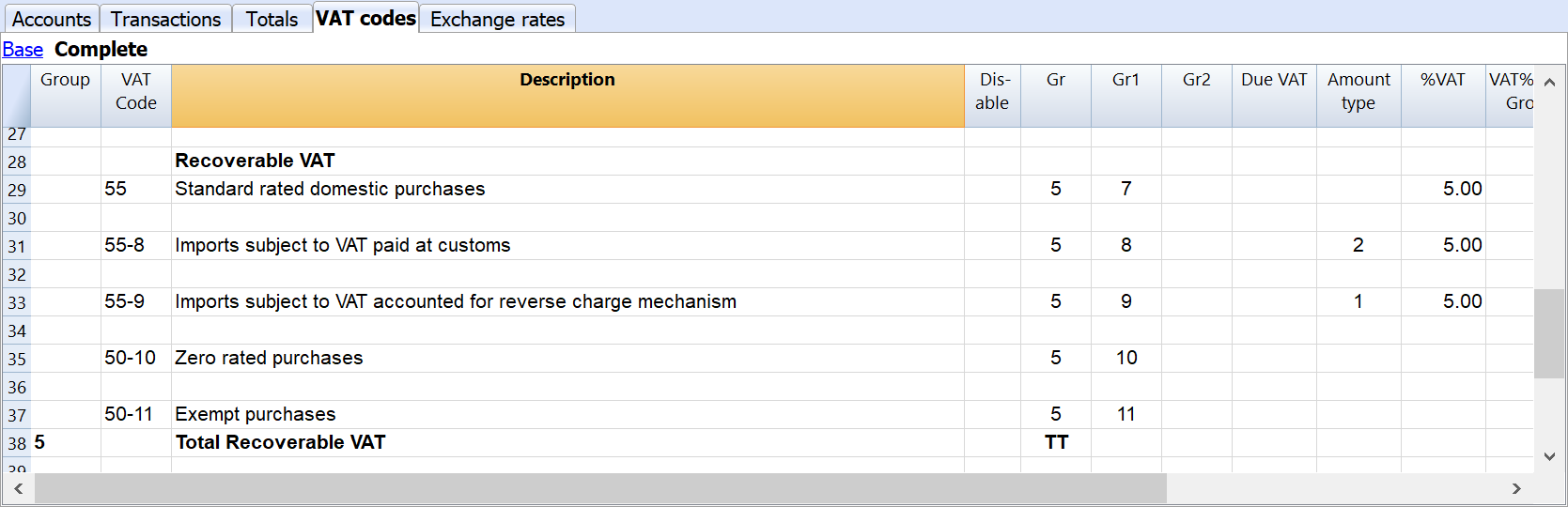

The column “Gr 1” shows the same coding you will find on the Saudi VAT report. This way, you will be able to find the corresponding code for each transaction.

Here, you can find the VAT code table.

VAT due Saudi Arabia

- Standard rate sales: all the goods and services sold or imported in Saudi Arabia are subject to VAT unless specified otherwise. Standard rate sales include all goods and services sold in Saudi Arabia which are subject to the standard rate of 5%.

- Reverse charge on purchase: this VAT code is used to record entries related to reverse charge mechanisms.

- Sales to customers in VAT implementing GCC countries: goods and services sold to costumers which are registered for VAT in other GCC countries are subject to a VAT rate of 0%.

- Zero rated domestic sales: all goods and services sold in Saudi Arabia which are subject to a rate of 0%.

- Exports: goods and services exported outside the GCC countries are subject to a 0% rate.

- Exempt sales: all goods and services sold in or outside Saudi Arabia which are exempt from the VAT.

- Total VAT due: in Banana Accounting the “Total VAT due” correspond to number 6 under GATZ’s coding (you will put the “total VAT due” in box 6 on the online form).

All the adjustments are registered with the same VAT code used for the transactions that needs an adjustment.

You can find an exhaustive lists of items subject to the different percentages and the ones that are exempted from the VAT tax at these links: GATZ’s website, User’s manual.

VAT recoverable Saudi Arabia

- Standard rated domestic purchases: All goods and services purchased in Saudi Arabia which are subject to the standard rate of 5%.

- Import subject to VAT paid at customs: All goods and services purchased outside Saudi Arabia are subject to a 5% rate payed at the customs.

- Imports subjected to VAT accounted for reverse charge mechanism: Comprehends the total amount of imports subject to the reverse charge mechanism.

- Zero rated purchases: All goods and services purchased in Saudi Arabia which are subject to a 0% rate.

- Exempt purchases: All goods and services purchased in Saudi Arabia which are exempted from the VAT.

- Total recoverable VAT: In Banana Accounting the “Total VAT due” corresponds to number 12 under GATZ’s coding (you will put the “total VAT due” in box 12 on the online form).

All the adjustments are registered with the same VAT code used for the transactions that needs an adjustment.

You can find an exhaustive lists of items subject to the different percentages and the ones that are exempted from the VAT tax at the following links: GATZ’s website, User’s manual.