Neste artigo

With integrated invoicing, invoices are created and simultaneously recorded in the accounting. You can create invoices with or without VAT.

Before creating and recording invoices, you must define the accounting method. The available methods are:

- Invoicing on turnover (revenue-based accounting).

- Issued invoices are immediately recorded and accounted for.

- Revenue is recognized when the invoice is issued.

- Customer ledger through balance sheet accounts.

- Cash-based accounting.

- Issued invoices are only recorded when payment is received.

- Revenue is recognized only when the invoice is actually paid, by recording the transactions at the time of payment.

- Customer ledger through profit centers CC3.

VAT Management

- Accounting with the effective method

- Invoices are issued with rates according to the effective method (e.g. 8.1%, 3.8%, 2.6%).

- Revenue is recorded when the invoice is issued.

- The amount to be recorded is usually gross of VAT.

- The VAT code is entered on the revenue line when the invoice is issued.

- If the amounts are net, the invoices must be managed in a separate file (Quotations and Invoices application or accounting file).

- Accounting with flat rate VAT.

- Invoices are issued with a VAT rate different from the one used for accounting.

- Revenue is recognized only when the invoice is actually paid, by recording the transactions at the time of payment.

- If the amounts are gross, accounting can be done on issuance or on payment, entering the VAT code in square brackets.

- If the amounts are net, the invoices must be managed in a separate file (Quotations and Invoices application or accounting file).

- Invoice with net VAT and VAT management on payment

- When creating invoices with VAT, there are limitations if in the accounting the amounts are recorded net and the cash method is used. In this case, it is not possible to enter net VAT amounts, because at the time of issuing the invoice the VAT codes must be enclosed in square brackets. VAT is not calculated automatically, but shown only as an indication for printing purposes.

- When creating invoices with VAT, there are limitations if in the accounting the amounts are recorded net and the cash method is used. In this case, it is not possible to enter net VAT amounts, because at the time of issuing the invoice the VAT codes must be enclosed in square brackets. VAT is not calculated automatically, but shown only as an indication for printing purposes.

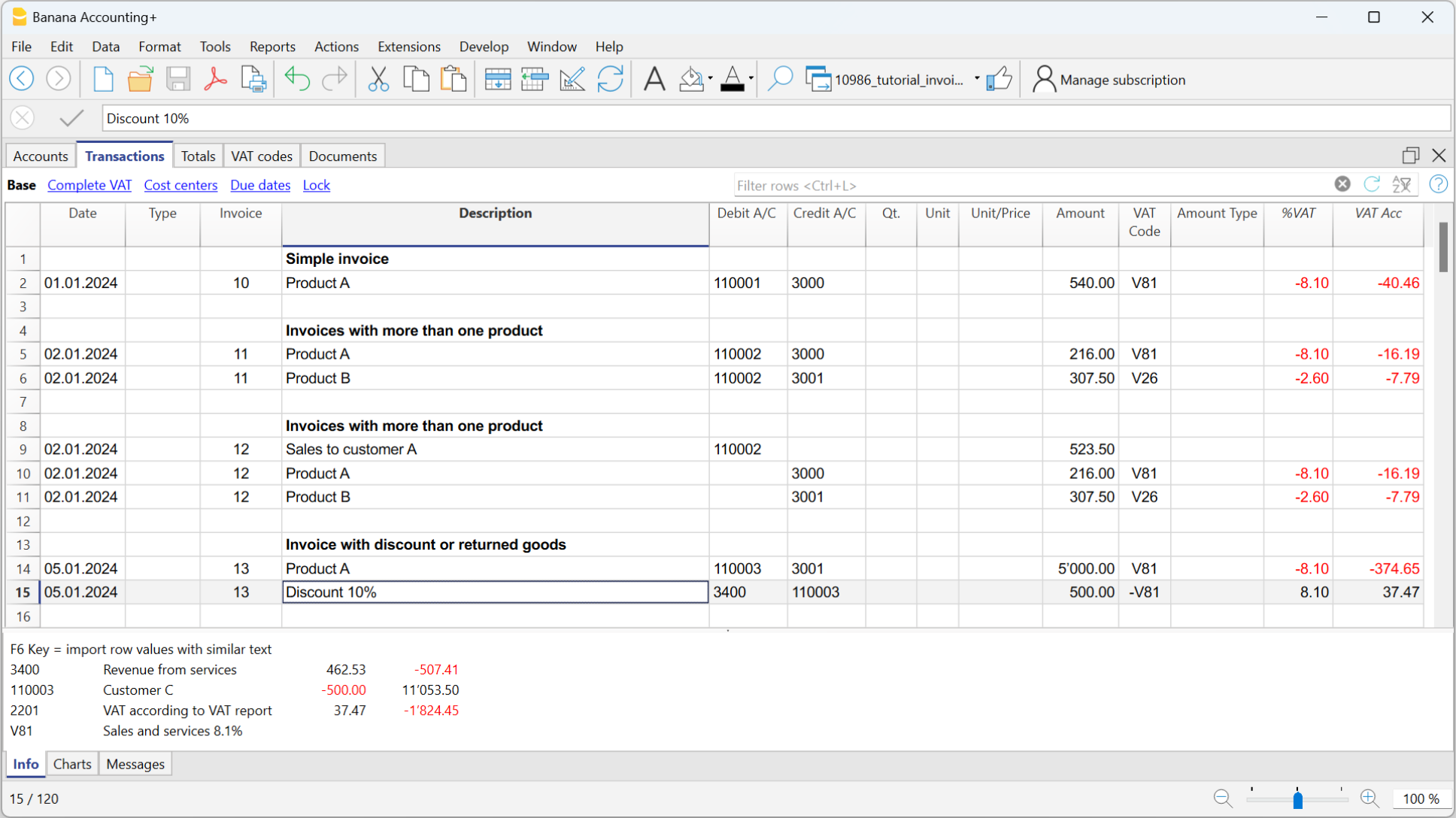

The columns to create invoices

To enter the standard invoice data, there are basic columns. If more details are needed, such as quantity, unit price, etc., additional columns can be added by adding the Items table.

The columns can also be customized in terms of display order.

Basic columns

Date

The invoice will show the date indicated in this column. All rows belonging to the document must show the same date.

Invoice

To manage invoices, it is mandatory to indicate an invoice number in the Invoice column.

Description

A description of the goods or services to be invoiced. These texts appear on the invoice.

Debit

Use this column only to record the payment of the invoice, entering the liquidity account (bank, postal account,...).

Credit

Use this column only to record the payment of the invoice, entering the revenue account.

Amount

An amount. If VAT is managed, enter the gross amount (including VAT).

VAT Code

The VAT code corresponding to the revenue account (sales or services):

- When issuing the invoice, the VAT code must be entered in square brackets (e.g. "[V81]").

- When recording the payment of the invoice, the VAT code must be entered without square brackets.

CC3

A customer account present in the Accounts table, in the Profit Center CC3 group.

Optional columns

Type

In the Type column you can define detail rows, such as subtotal rows or specific payment terms for an invoice.

This column is not visible by default but must be displayed through the Data menu > Columns setup command and by selecting the DocType column.

Quantity

The quantity of goods or services to be invoiced.

To add the quantity column, use the menu Tools > Add new features > Add Item columns in the Transactions table.

Unit

A type of unit (e.g. 'pcs', 'h', 'm', 'kg').

Unit Price

The unit price for the goods or services.

The program automatically calculates the total amount based on the quantities entered in the Quantity column.

Other columns

When printing the invoice, you can add other columns from the Transactions table, including those that were manually added to the table. See example Use columns from the Transactions table.

Invoice with multiple rows

When the invoice includes multiple items to be charged (products, services or both), you must enter each item on a separate row.

- Enter a new transaction row for each item you want to include in the invoice.

- On each additional row, repeat the invoice date and number, identical to those in the first row.

Customer account management

- Composed transactions (on several rows)

If the customer account is not indicated in the detail rows, but only the account opposite, you must specify the customer account in the first row.

Otherwise, the accounts of the following rows will not be correctly displayed in the invoice printout. - Simple transactions (on one row)

Alternatively, you can enter both the customer account and the income account on each detail row, ensuring a correct data association.