Neste artigo

If you are subject to VAT under the balance rate or flat-rate regime with the cash-based system, you must record the invoice issuance to the customer and its accounting registration separately, for the following reasons:

- Invoice to be sent to the customer:

It must show a normal commercial VAT rate (e.g., 8.1%), as required by tax regulations. - Accounting of the invoice:

It must instead be recorded in accounting with the effective balance rate (e.g., 6.2%), using the corresponding VAT code (e.g., F1).

This approach is essential to ensure that the VAT paid corresponds to the applicable reduced regime, while still maintaining a formally correct invoice for the customer.

Issuing the invoice to the customer

To issue the invoice to the customer, proceed as follows:

In the Accounts Table:

- Create a customer sub-account with the profit center CC3 (example: ;10001 for customer XX)

- In the Address view, enter all customer data.

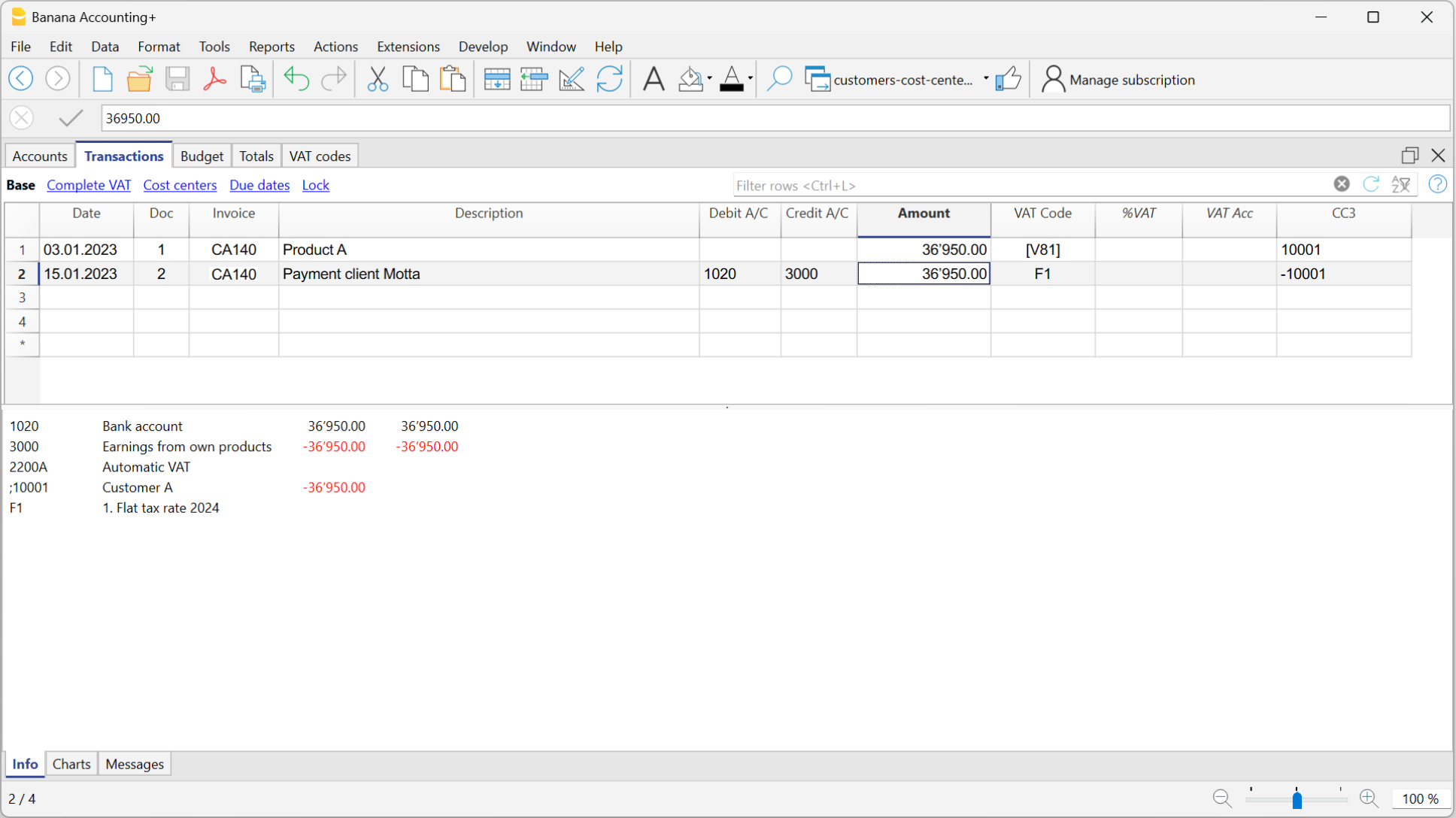

In the Transactions table:

- In the Date column, enter the invoice issue date.

- In the Invoice column, enter the invoice number.

It is important that the invoice number complies with certain requirements: see how to correctly create the invoice number. - In the Description column, enter the description that should appear in the invoice details.

- In the Amount column, enter the amount

- The Debit and Credit columns must remain empty.

- In the VAT Code column, type the code V81 in square brackets [V81].

VAT codes in square brackets do not generate any VAT entry. - In the CC3 column, indicate the profit center number without semicolon (e.g., 10001).

It is important that the customer number complies with certain requirements: see how to correctly create the customer number.

Since there are no accounts in the Debit and Credit columns, the invoice creation entry will not be recorded in accounting.

Recording the invoice with VAT balance rate

When recording an invoice subject to VAT with a balance rate in accounting, it is sufficient to proceed as with a normal entry, indicating the accounts in the Debit and Credit columns and entering the VAT code corresponding to the balance rate (e.g., F1).

Two recording systems can be used to register the invoice with the balance rate:

- Recording with split

In the VAT codes table, VAT percentages have been assigned to balance rate VAT codes. In the transactions table, by entering the balance rate VAT code (e.g., F1), the program automatically enters the corresponding VAT percentage (e.g., 6.2) and the VAT amount. - Recording without split, by entering the balance rate VAT code (e.g., F1), percentage and amount are not entered. At the end of the period, the specific extension for calculating balance VAT is used.

Based on the rate defined in the extension dialog, the program:- Identifies all entries with balance rate VAT code.

- Automatically calculates the VAT due for the reporting period.

- Totals the amounts on a periodic basis (e.g., monthly, quarterly, yearly).