En este artículo

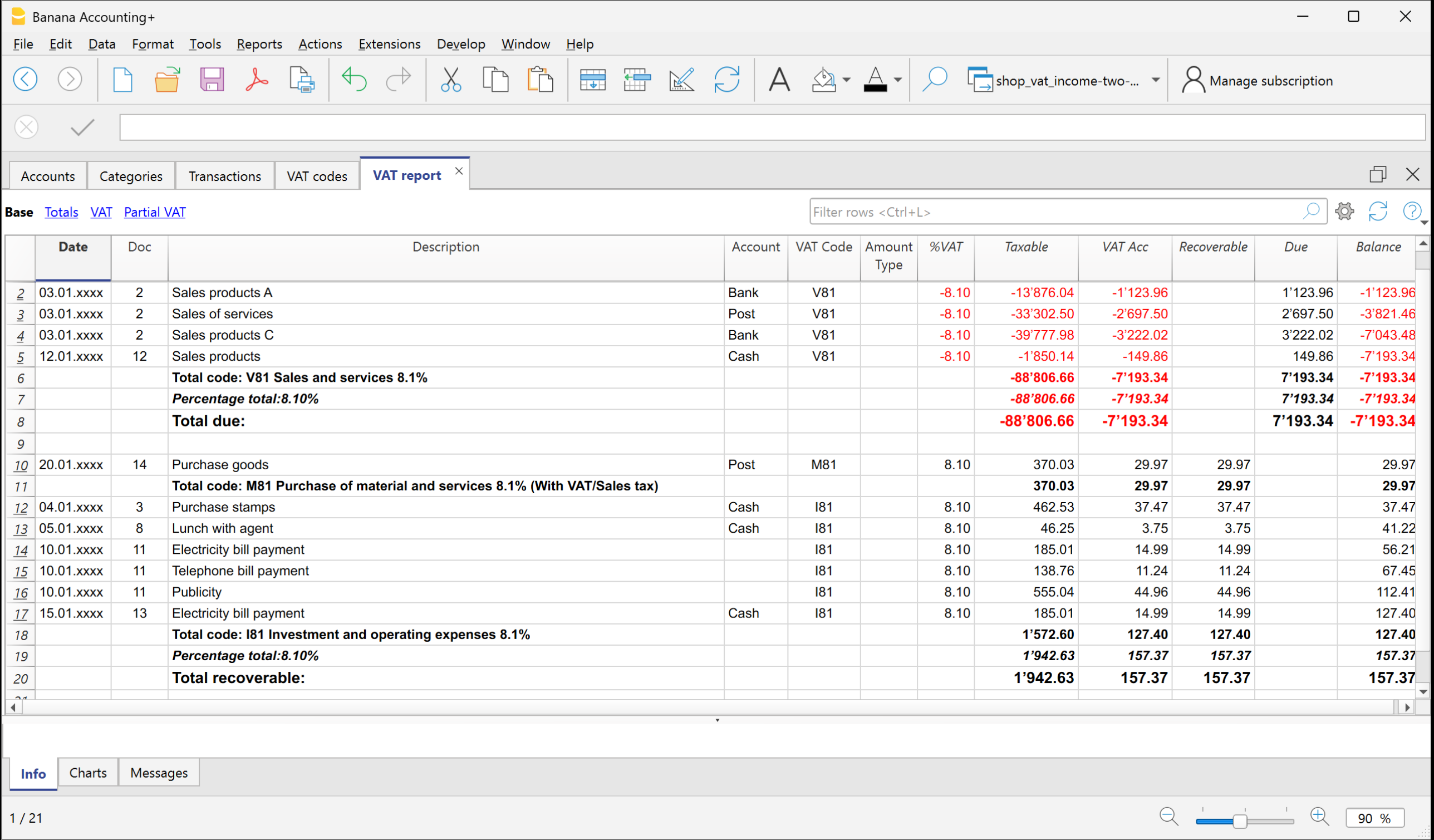

The VAT Report in Banana Accounting is a report that gives you a complete and up-to-date overview of all VAT transactions recorded in your accounting. It is a useful tool both for internal control and for preparing periodic VAT returns.

The VAT Report function is only available in the Income and Expenses templates with VAT.

What the VAT Report is for in Banana Accounting

With the VAT Report you can:

- clearly see VAT on sales (VAT payable),

- check VAT on purchases (VAT receivable),

- calculate the VAT balance to be paid or recovered,

- get a summary of the transactions divided by VAT codes.

This way you always know your VAT position without having to make manual calculations.

How to get the VAT Report

Based on the transactions with a VAT code, the program calculates and displays the VAT Summary.

To get the VAT Summary:

- From the menu Reports > VAT /Sales tax report.

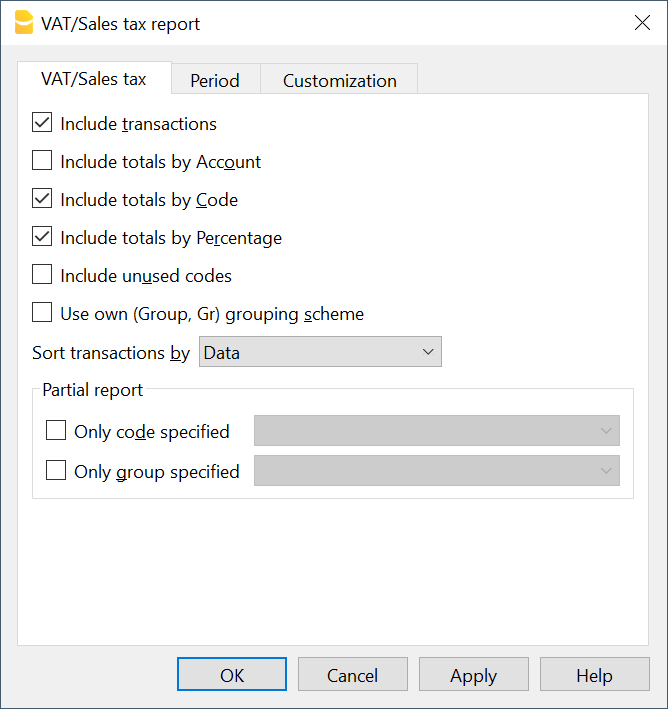

- In the window that opens you can select:

- the period to analyze (e.g. month, quarter, year),

- optional filters to display only certain codes or transactions.

The program processes the data and shows you a report with the totals of VAT collected and paid.

VAT Report options

When you generate the VAT Report, you can activate several options that allow you to create a customized VAT Report, from the details of individual transactions to totals by account, code, or rate, so that you always have your VAT position under control.

Include transactions

Shows in detail all the accounting records with VAT.

Include totals by Accounts

Sums up VAT operations grouped by each account (e.g. Bank, Cash).

Include totals by Code

Shows the totals of VAT operations grouped by VAT code (e.g. V81, M81, I81).

Include totals by Percentage

Groups the totals of VAT operations based on the applied VAT rate (e.g. 8.1%).

Include unused codes

Adds to the report also the VAT codes present in the table but not used in transactions.

Use own (group and Gr)

VAT operations are sorted according to the groupings defined in the VAT Codes table.

Sort transactions by filter

You can choose how to sort the transactions: by date, document number, description, etc.

Partial Report

Allows you to get a VAT summary limited to a specific element:

- only one VAT code (by selecting it from the list),

- only a group of codes (for example all codes related to purchases).

What the VAT Summary contains

The report shows, for each VAT code:

- the taxable amount (the amount on which VAT is calculated),

- the VAT rate applied,

- the corresponding VAT amount,

- the overall totals of VAT payable and VAT receivable.

Printing and saving the VAT Report

The VAT Report can be:

- printed on paper,

- saved in PDF, HTML or Excel for digital archiving,

- copied to the clipboard to be pasted into other documents.