In this article

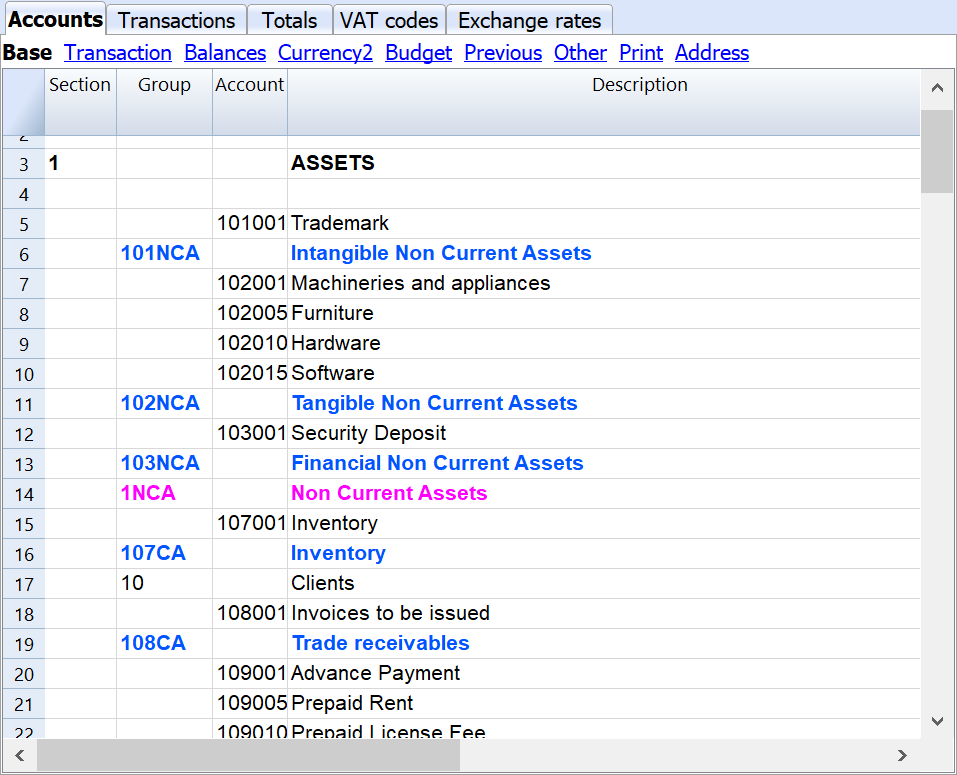

The Accounts table contains the balance sheet (BS) and the profit & loss statement (PL).

The first thing to do after downloading a template is to adjust the BS and PL to your needs. Every company will need specific accounts based on their own business. For detailed information about how to implement modifications on the accounts table, please visit this link.

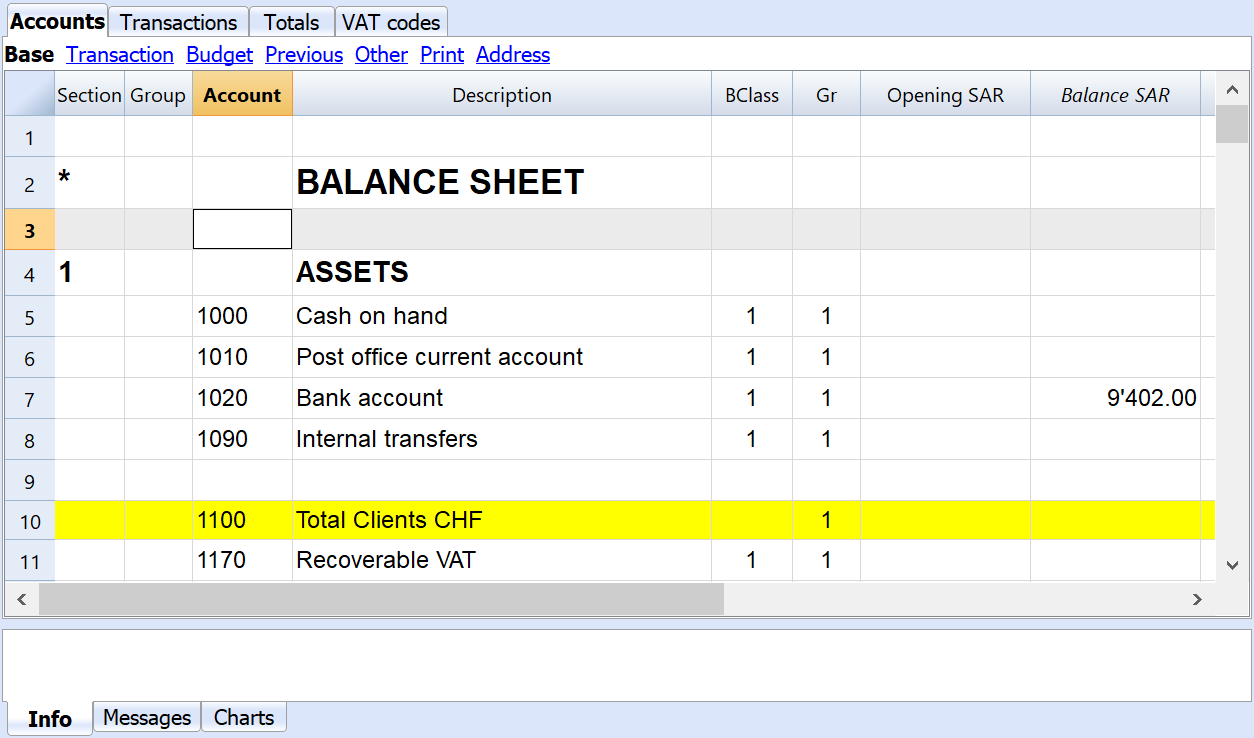

After the customization of the accounts, it is essential to input the opening balance available in the column “Opening SAR”.

The column “Balance SAR” is updated automatically by the software when you input a transaction in the “transactions table”. You cannot manually modify the balances.

Balance sheet

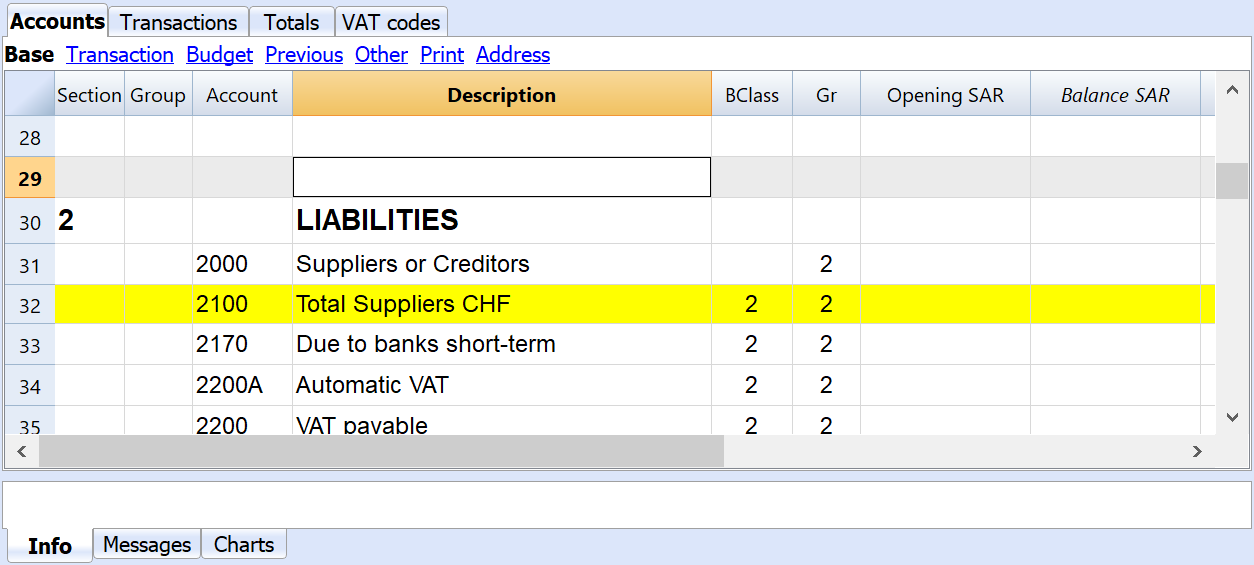

The balance sheet shows your assets and your liabilities. Banana Accounting includes accounts that are usually utilized by SMEs. Nevertheless, you can customize the accounts. Be careful not to modify the accounts related to the VAT reporting. Those are essential to correctly generate the VAT report needed to fill out the online VAT return form in Saudi Arabia.

Profit & loss statement

The profit & loss statement shows the revenues and the expenses incurred by the company. Banana Accounting included accounts usually used by SMEs. Nevertheless, you can customize the accounts when needed.

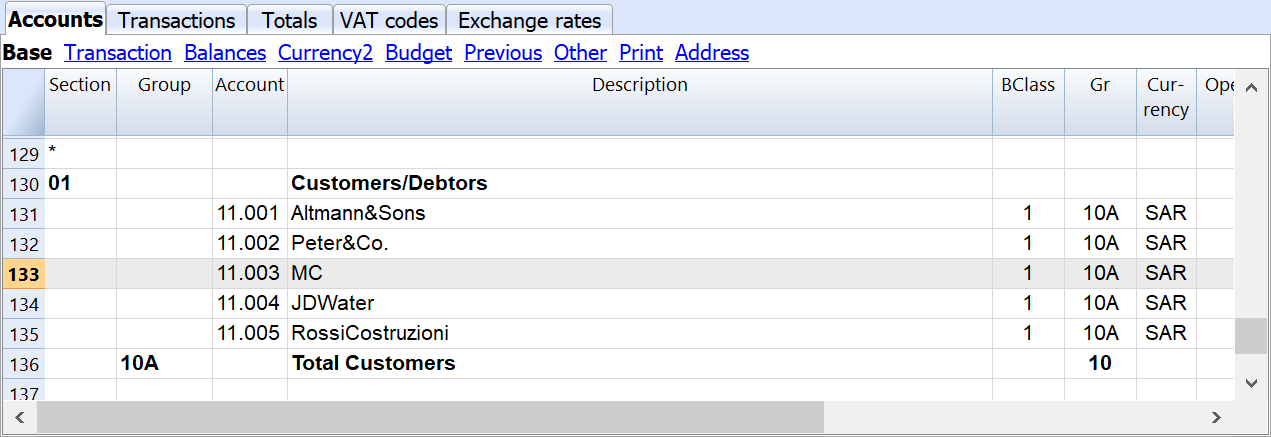

Clients/suppliers register

After the P&L statement, there is a section where you can assign accounts to specific customers and suppliers. You will use these accounts to register transactions directly related to specific customers or suppliers. Banana also offers the possibility to print invoices from these transactions.

All the accounts in the clients/suppliers register are regrouped under two accounts present in the assets and liabilities.

Double-entry accounting

You will notice that liability and revenue accounts are shown in negative and in red colour. This is due to the fact that Banana Accounting fully leans on the concept of double-entry accounting. The principle of “debit and credit” present in the double entry accounting is usually represented in two separate columns. When it appears in a single column, as it happens in the accounts table, it is shown in red and in negative to better distinguish debit accounts from credit accounts.

Check here for detailed information about the double entry accounting,