Multi-currency Accounting & Budgeting

Learn how to set up a professional Multi-currency Accounting. Quickly get detailed cash, balance sheet and profit and loss forecasts for the days, months and years to come.

Detailed guide on how to start

Video texts

Multi-Currency Accounting

Get started now - Free up to 70 registrations

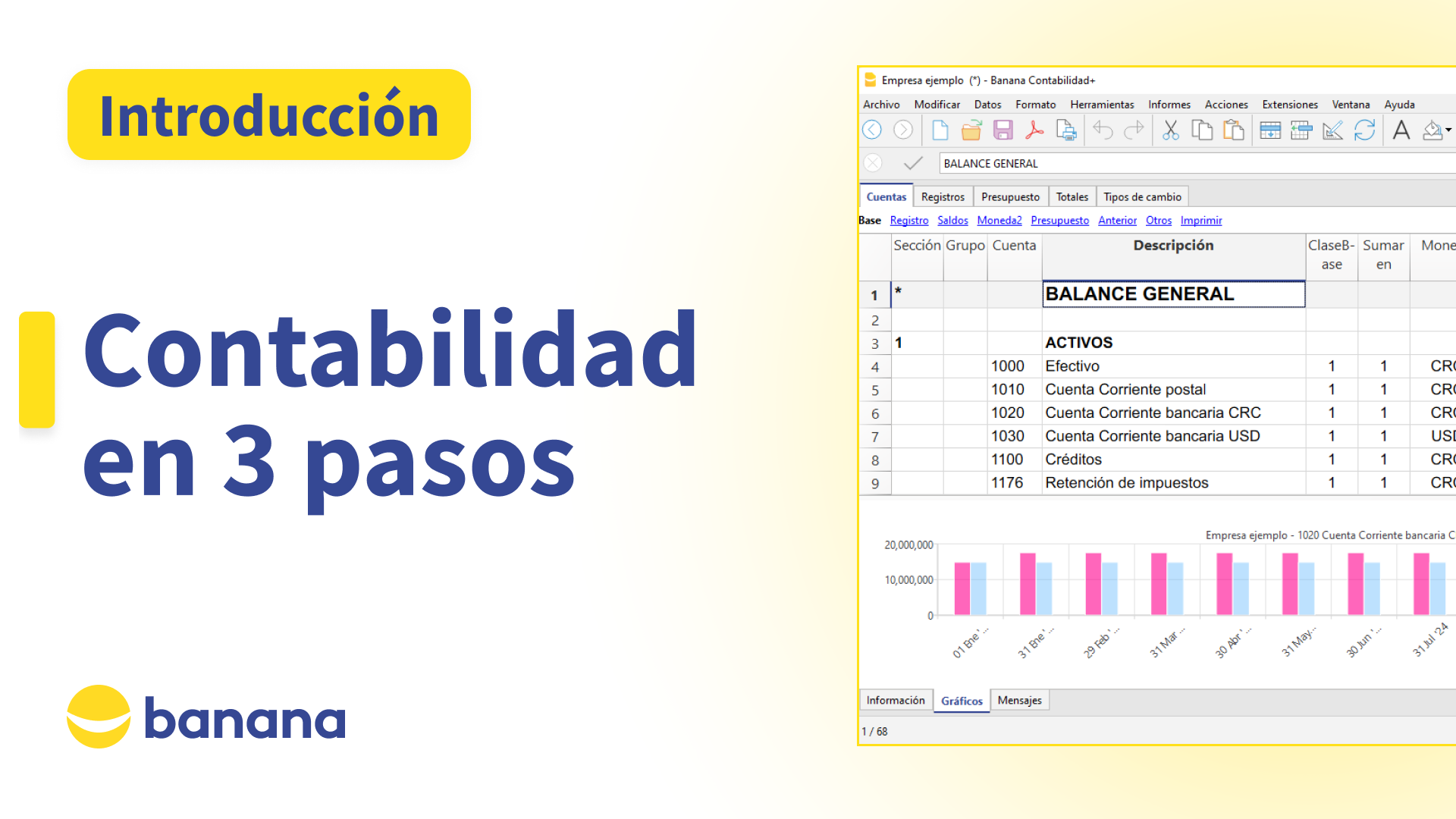

Welcome to Banana Accounting Plus

A professional accounting solution similar to Excel

Quickly obtain Balance Sheet, Income Statement, Budget and Liquidity Plan of your multy-currency accounting

1. Create your accounting

Click on the “Create New" icon

and choose the template that best suits your needs

Change the header

the opening and closing date

and the basic currency

2. Exchange rate table

Enter the exchange rate

This exchange is used as the closing exchange rate and as the current exchange rate

On the same row you can add the opening exchange rate

In the Exchange rate table you can enter all the currencies that you will use

or cancel those that you don't need

3. Transactions table

Enter your accounting transactions

Insert the date

the description

In the Debit account column enter the account that will be charged

In the Credit account column enter the account that will be credited

and the amount

The currency and the exchange rate columns are automatically filled in by the system

Repeat this operation for all movements

To speed up these operations you can directly import bank transactions

and by linking them to the digital receipts, you don’t need to print them on paper

4. Budget table

Enter the estimated income and expenses for the indicated year

The procedure is immediate and very similar to the Transactions table

Start by listing your monthly expenses

For example, the hosting expenses, the office rent and your employees' salaries

Remember to mention the repetition

Apply the same procedure for the monthly revenues

For example, the membership payments and the donations

5. Accounts table

In the accounts table, the balances are automatically updated

Therefore you can immediately make a comparison of your accounting data with your budget

This table shows the Balance sheet and Profit and Loss statement accounts

The Balance sheet shows you the balances of all the estate accounts, that is, Assets and Liabilities

The difference between the Assets and the Liabilities determines the personal capital

The Profit and Loss statement shows you all the Revenue and Expense accounts

and the difference determines the Profit or Loss of the Accounting year

You can adapt the accounts according to your needs

You can add accounts with the corresponding currency

edit or delete them

And you can enter the initial balance in the "Opening" column

6. Reports

All reports are just a click away

You can view the liquidity plan

And you can review your balance sheet and compare your past, present and future data of your accounting at any time

You can create your report by selecting from the Reports menu, Enhanced balance sheet with groups, Comparison Effective and Budget

To have a better overview of your cash flow and to make sure you have enough liquidity to pay your salaries at the end of the month

you can create a report with a monthly subdivision

or you can view the charts of your bank account

By following this step, you can control if the actual business is in line with your budget plan