Double-entry accounting

The professional tool to manage assets, liabilities, expenses and income according to the international rules of the Double-entry (debit and credit) and to obtain a Balance Sheet and a Profit/loss Statement.

The double-entry accounting application is available with or without the VAT management option.

Characteristics

- Manages the estate accounts and the profit/loss accounts (assets, liabilities, expenses and revenue)

- The accounting type with VAT features the VAT calculations and VAT reports

- Produces all the accounting extracts: journal, account cards, balances by period and annual balances

- Allows Cost Centers and Segments management

- Offers different ways of data presentation

- Exports data to Excel, Html, Xml, Pdf

- Imports data from different files formats

Tables and File properties

The double-entry accounting is composed by the following tables:

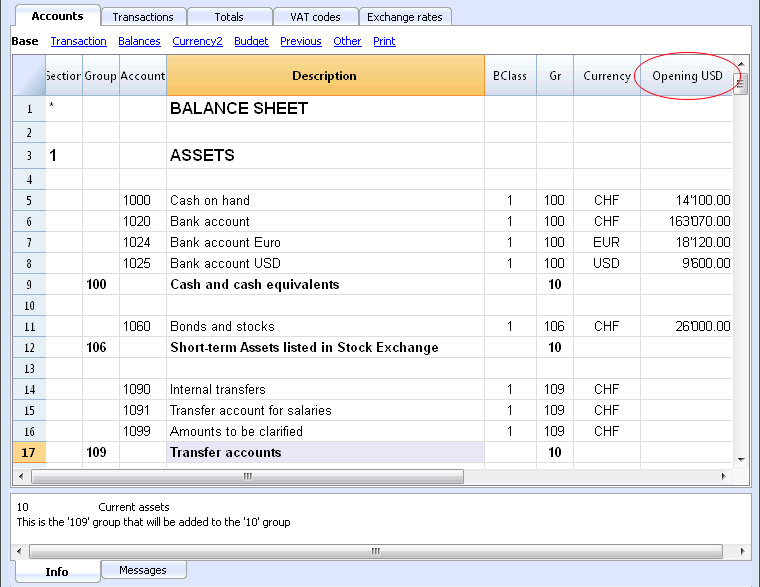

- Accounts table

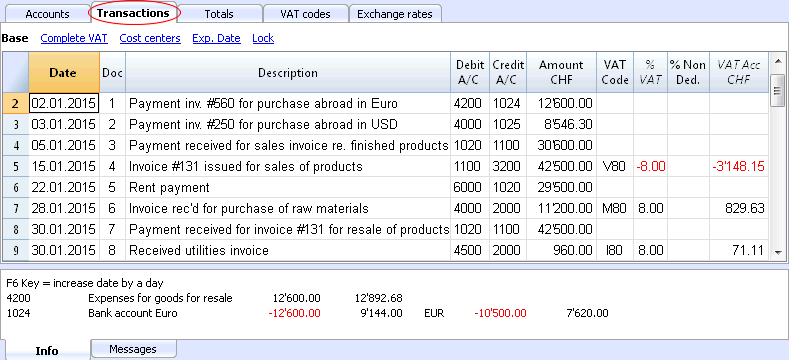

Where the accounting plan is located with opening balances, and where groups and subgroups can be defined along with cost centers and segments. - Transactions table

Where the accounting transactions are entered. - VAT Codes table

Where the VAT/Sales tax codes are set, only if the VAT management option has been chosen. - Exchange rates table

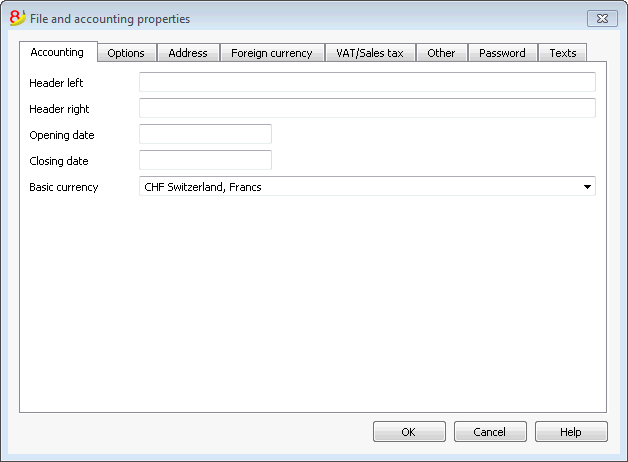

Where the different currencies are defined, only if the multi-currency accounting option has been chosen. - File properties

Where the accounting general settings are defined.

Changing accounting type

In order to change your file language, rounding system, or in order to add VAT or multicurrency columns, please refer to the Convert to new file command, from the Tools menu.

Theoretical part

In this chapter, the basic theory of the Double-entry accounting is being explained.

Debit and Credit

Double-Entry Accounting in Practice

Main rules to learn how to manage double-entry accounting Double-entry accounting is based on four main account categories:

| ASSETS | The accounts that represent the positive elements of the estate |

| LIABILITIES | The accounts that represent the negative elements of the estate |

| COSTS | The accounts that represent the costs (but not those related to the purchase of estate goods) |

| REVENUES | The accounts that represent the earnings (not those obtained by the sale of estate goods) |

- The account is an entity that groups the amounts that belong to the same transaction category.

- Every account must be registered as debit or credit depending on the type of accounting transaction.

- Double-entry accounting uses debit and credit instead of income and expenses.

The General Rule

|

ASSETS |

→ | DEBIT |

|

LIABILITIES |

→ | CREDIT |

|

COSTS |

→ | DEBIT |

|

REVENUES |

→ | CREDIT |

- The assets, liabilities, costs and revenues are subject to continuous variations: increases and decreases.

The increasing variations

|

INCREASE IN ASSETS |

→ |

DEBIT |

|

INCREASE IN LIABILITIES |

→ |

CREDIT |

|

INCREASE IN COSTS |

→ |

DEBIT |

|

INCREASE IN REVENUES |

→ |

CREDIT |

The decreasing variations

|

DECREASE IN ASSETS |

→ |

CREDIT |

|

DECREASE IN LIABILITIES |

→ |

DEBIT |

|

DECREASE IN COSTS |

→ |

CREDIT |

|

DECREASE IN REVENUES |

→ |

DEBIT |

Instruments in Double-entry Accounting

Double-entry accounting uses the following principal instruments: the Chart of Accounts, Journal, Balance Sheet and Profit and Loss Statement.

| Chart /Accounts |

This is the list of all the accounts that group the different transactions categories together (ex. cash book, bank, purchases, sales, etc.).

-

To use Banana Accounting, one must simply take an already predefined accounting plan, adapt it to the proper requirements and insert the transactions. The rest will be executed by the program.

| Journal |

This is the list of all the operations that influence the activity daily (withdrawals, deposits, purchases, sales, salaries, rent, etc.) It corresponds to that which the larger part of the small businesses already have even if it’s only on paper or Excel, to then give to the accountant.

| Balance Sheet |

This is a summary outline of the assets and liabilities. The difference between the assets and liabilities represents the net capital amount of the firm.

| Profit and Loss Statement |

This is a summary outline of all the costs and revenues. The balance represents the operational result (profit or loss).

Starting Accounting

Procedure to start accounting with Banana Accounting

|

1 |

Take an existing accounting model with a predefined chart of accounts. |

|

2 |

Adapt the chart of accounts to the proper requirements. |

|

3 |

Insert the transactions in the journal. |

Mathematical basis

For the user of Banana's Double-entry accounting, it may seem strange that the revenue/income (sales) and the liabilities (start-up capital) appear in negative, while normally one expects that the sales appear in positive and the expenses in negative.

The double-entry accounting is based on the debit and credit principle that usually appear in two seperate columns. If the amounts in debit and in credit appear in one column, the mathematics of the Double-entry accounting anticipates the use of the minus sign (-), so that the amounts in debit can be easily distinguished from the amounts in credit.

Banana goes completely with the mathematical logic of the Double-entry accounting and thus indicates the amounts with the minus sign (and in red print to let the user distinguish even better the amounts in debit and in credit). In the Double-entry accounting the amounts in negative (credit) don't have the same meaning as in the accounting that is based on income and expenses.

The indication of the credit amounts in negative is a much more efficient system than other ones that add codes to amounts, such CR, DEB, CR or brackets.

This system is based on simple mathematical equations which assure that the accounting is correct. It is not by accident that the Double-entry accounting method has in fact been encoded by Luca Pacioli in 1494, one of the most illustrious mathematicians of the Italian Renaissance (he taught mathematics to Leonardo da Vinci). In his "Summa de arithmetica, geometria, proportioni et proportionalita", Luca Pacioli didn't just deal with the Double-entry accounting, but also with other mathematical questions.

In the Renaissance there were no electronic calculators, and so they used to indicate the amounts in debit and in credit in separate columns. The result was that it became easier to totalize the amounts. Today, with the computers, no calculations need to be made and the principal issue is to use a user-friendly system which is at the same time easy and correct.

For those interested in accounting mathematics and the equations on which Banana accounting is based, the following explanation can be interesting.

Debit/Credit

The Double-entry accounting leans on the principle that each movement is noted in debit as well as in credit and the amounts have to match.

Debit = Credit

The balance (the total difference between debit and credit) has to always be equal to zero

Debit - Credit = 0

In order to easily distinguish (very useful while working on the screen), the amounts in credit are indicated in red, preceded by the minus sign

Debit + (-Credit) = 0

|

Two transaction examples |

Debit |

Credit |

|

Debit + (- Credit) |

|

Cash income |

200 |

|

|

200 |

|

for product sales |

|

200 |

|

-200 |

|

|

|

|

|

|

|

Several cash payments |

|

170 |

|

-170 |

|

for purchase of merchandise |

100 |

|

|

100 |

|

for office supplies |

50 |

|

|

50 |

|

small expenses |

20 |

|

|

20 |

|

Total |

370 |

370 |

|

0 |

|

Balance (Debit - Credit) |

0 |

|

0 |

|

Balance Sheet and Profit/Loss Statement

The mathematics of the Double-entry accounting anticipates the use of two "accounts".

- Balance Sheet Account (Balance Sheet) keeps note of the financial state at a certain moment.

- Debit represents the Assets

- Credit represents the Liabilities (here will always means including the Equity)

- Profit/Loss Account (Profit and Loss) keeps note of the progress.

- Debit represents the Expenses

- Credit represents the Revenue

The transactions are entered in debit and in credit in the appropriate accounts of the Balance Sheet and the Profit/Loss statement.

|

|

Balance Sheet |

|

Profit/Loss Statement |

||

|

Registrazioni |

Assets |

Liabilities |

|

Expenses |

Revenue |

|

Cash income |

200 |

|

|

|

|

|

for product sales |

|

|

|

|

200 |

|

|

|

|

|

|

|

|

Several cash payments |

|

170 |

|

|

|

|

for purchase of merchandise |

|

|

|

100 |

|

|

for office supplies |

|

|

|

50 |

|

|

small expenses |

|

|

|

20 |

|

|

Total |

200 |

170 |

|

170 |

200 |

|

Balance (difference debit - credit) |

30 |

|

30 |

||

|

Equations with two columns |

|

|

Debit = Credit |

370 = 370 |

|

Assets + Expenses = Liabilities + Revenue |

200 + 170 = 170 + 200 |

|

Assets - Liabilities = Revenue - Expenses |

200 - 170 = 200 - 170 |

|

Balance = Balance |

30 = 30 |

|

|

|

The same transactions can be represented in a single column (credit in negative)

The result is, of course, the same.

|

Transactions |

Balance Sheet |

|

Profit/Loss Statement |

|

Cash income |

200 |

|

|

|

for product sales |

|

|

-200 |

|

|

|

|

|

|

Several cash payments |

-170 |

|

|

|

for purchase of merchandise |

|

|

100 |

|

for office supplies |

|

|

50 |

|

small expenses |

|

|

20 |

|

|

|

|

|

|

Balence (debit - credit) |

30 |

|

-30 |

|

Equations single column (credit in negative) |

|

|

Debit - Credit = 0 |

270 - 270 = 0 |

|

Assets + Expenses - Liabilities - Revenue = 0 |

200 + 170 - 170 - 200 = 0 |

|

Assets - Liabilities - Revenue + Expenses |

200 - 170 - 200 + 170 = 0 |

|

Balance - Balance = 0 |

30 - 30 = 0 |

Equations for the business results

The business result is the balance (Debit - Credit) of the Balance Sheet and the Profit/Loss Statement.

|

Equations double column |

|

|

Assets - Liabilities = Revenue - Expenses |

200 - 170 = 200 - 170 |

|

Balance of the Balance Sheet = Balance of Profit/Loss Statement |

30 |

|

Balance of the Balance Sheet = Assets - Liabilities |

30 |

|

Equations for the determination of the result (in two columns) |

||

|

Profit |

Assets > Liabilities |

Expenses < Revenue |

|

Balance |

Assets = Liabilities |

Expenses = Revenue |

|

Loss |

Assets < Liabilities |

Expenses > Revenue |

One has a profit when the assets are higher than the liabilities and the revenue more than the expenses.

One has a loss when the liabilities are higher than the assets and the revenue is lower than the expenses.

|

Equations single column (credit in negative) |

|

|

Assets - Liabilities - (Revenue - Expenses) = 0 |

200 - 170 - (-200 - 170) = 0 |

|

Balance of the Balance Sheet - Balance of Profit/Loss Statement = 0 |

30 - 30 = 0 |

|

Balance of the Balance Sheet |

30 |

|

Balance of Profit/Loss Statement |

-30 |

|

Equations for the determination of the result in a single column |

||

|

Profit |

Assets - Liabilities > 0 |

Expenses - Revenue < 0 |

|

Balance |

Assets - Liabilities = 0 |

Expenses - Revenue = 0 |

|

Loss |

Assets - Liabilities <0 |

Expenses - Revenue > 0 |

One has a profit, when the balance of the Balance Sheet is positive and the balance of the Profit/Loss Statement negative.

One has a loss, when the balance of the Balance Sheet is negative and the balance of the Profit/Loss Statement positive.

Use of noting in a single column

Noting the data in double columns is ideal for transactions in paper books. The amounts in debit and in credit are inscribed in separate columns. The totals are being calculated at the end of the page and the totals and calculation of the results are being done at the end of the period.

Computerized systems offer the possibility to keep the balances of the accounts constantly updated. For the calculations, the software therefore normally use noting in a single column, with the amounts in debit in positive and the amounts in credit in negative. In order to use noting in double columns, the software would have to register the credit amounts in the Balance sheet in negative, and, in the Profit/loss Statement, register the credit amounts in positive and the debit amounts in negative.

For the programmer's point of view, this solution is more complicated, and thus the majority of the software use internally the mathematics of the single column and noting in double columns only for the presentation.

Banana Accounting instead systematically uses the minus sign to indicate the credit amounts. Initially, the user has to get used to this system, but it has the advantage of being linear and allows for a better understanding of the mathematics on which the Double-entry accounting is based, especially when more complicated operations are being required like write-off's, profit at the end of the year or VAT due/recoverable.

For the presentation of the Balance Sheet and the Profit/loss Statement, the logic of the double columns is however more adapted.

Thus the print-outs of the Balance Sheet and the Profit/Loss Statement that are used for the presentation of the results are edited with Assets, Liabilities, Expenses and Revenue always in positive. When the Profit/Loss Statement is presented in a scalar format (Revenue minus Expenses), the Revenue is indicated in positive and the Expenses in negative.

Organize yourself

At the basis of the accounting, there are the accounting documents and receipts.

The type of one's organizing with regard to the accounting, depends on the size of the activity and the amount of documents.

The way one organizes things has to be adapted to what is needed.

We are listing down below an indication of possibilities that have proven to be very useful.

The different types of documents

It is important to distinguish and organize specifically the different types of documents.

- Basic documents: contracts for rent, telephone subscriptions, statutes, insurance contracts and everything that gets signed only once and is valid for several years. These documents need to be kept in a separate folder or binder, containing just this type of documents. For some of these very important documents (like receipts for down payments, etc.) it may be useful to make a photocopy and keep the original in a safe or a safe place. Don't make holes in important documents, but put them in transparent plastic folders. This binder is the basis of your activity/company and you need to handle it carefully.

- Documents related to employees: Contracts, insurances related to personnel, and other; it is useful to keep these in a separate binder.

If there are lots of documents, we advise you to use one binder per theme. - VAT Declarations: it is good to keep a special binder with the different declarations that you present at a regular basis (quarterly, by semester or yearly). For your VAT inscription or other general documents, it is better to keep them together with the basic documents.

- Accounting receipts and documents of the year: these are receipts, invoices or other items that are related to an expense or a receipt. These have to be kept separately, year by year. For every year you will have a binder with these kinds of documents.

Accounting documents

A good day- to-day order is needed in order to enter the accounting transactions and to control the situation of the company, such as the cash flow, the totals of debtors and creditors, etc.

- All accounting documents (receipts, invoices, tickets) usually have to be kept for a minimum of ten years.

- Classify and put the accounting documents in order by date, together with the related bank statements for the payment or the receipt.

- Write a progressive number on the accounting documents (statements and others). With this number, that should be inserted in the Doc column, you can locate the accounting document, with the accounting as a starting point.

- At the end of the year, print a copy of the journal and keep it together with the accounting documents.

- Usually a new binder is being used for each year for the accounting documents.

Issued invoices or receipts with an accounting at the moment of payment

Small companies and associations enter the invoices only in the accounting at the moment of payment (cash method).

- Separate the issued invoices and those for which you have received the payment.

- Verify regularly the invoices on hold for which payment still needs to be received. As soon as the due date for the payment has passed, it is useful to send a payment reminder. Don't let too much time pass by, make sure you receive the payment for unpaid invoices. This takes time, but is it important.

- Once these invoices are paid, put them together with the normal accounting documents.

Issued invoices or receipts with an accounting on the sales volume

The invoices are being registered at the moment they are issued as well as at the time of payment.

See also: Clients/Suppliers Registers

- Separate the issued invoices and those for which you have received the payment.

- Verify regularly the invoices on hold for which payment still needs to be received.

As soon as the due date for the payment has passed, it is useful to send a payment reminder.

Don't let too much time pass by, make sure you receive the payment for unpaid invoices. This takes time, but is it important. - When you enter the issuing of the invoice in the accounting, make note of the registration on the invoice. On the transaction row, use the "Doc. Original" column to insert the invoice number.

- Once the are invoices are paid, move them over to the "paid" section, and enter them in the accounting.

- When you have entered them, make note of the accounting transaction on the invoice (for example with a "checked" sign)

Transactions / frequency

- It is good to regularly enter the transactions in the accounting (daily, weekly, monthly).

- We strongly advise you to not neglect entering the accounting transactions, so that you always have updated information and can evaluate the progress of your activity.

- By going over the different expenses account numbers, you can easily have an overview of the different expenses that you made.

- The accounting is not just done for the tax authority.

Starting a new accounting file

An even easier start with the new templates

In the new Banana Accounting Plus version, the start of a new accounting is made easier because many predefined templates for every need are included directly in the program. If you don't have specific accounting knowledge, you can use the new Income/Expense templates or the Cash Manager with descriptive accounts. The work will be intuitive, fast and professional.

We advise you to immediately switch to Banana Accounting Plus and take advantage of the many new features.

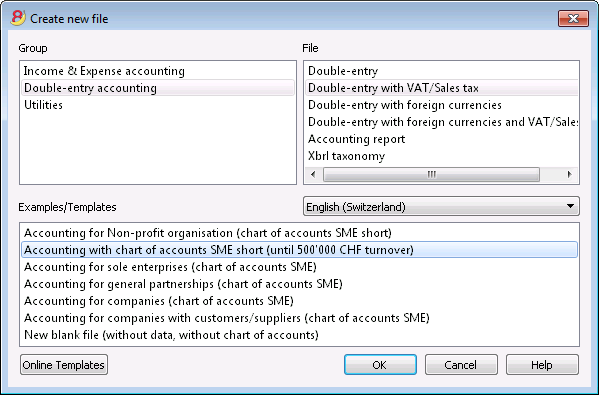

In order to create a new accounting file, there are different modes.

Creating an accounting file, starting from a template included in the program

Here we explain how to start an accounting file, starting from an existing template included in the program.

- File menu, New command

- From the Group section, select Double-entry accounting

- In the File section, select Double-entry accounting or Double-entry accounting with VAT/Sales tax.

- In the Examples/Templates section, select the language/nation and choose one of the templates that is closest to your own needs.

- By clicking on the Online Templates button you can access our website where we published all templates available for free.

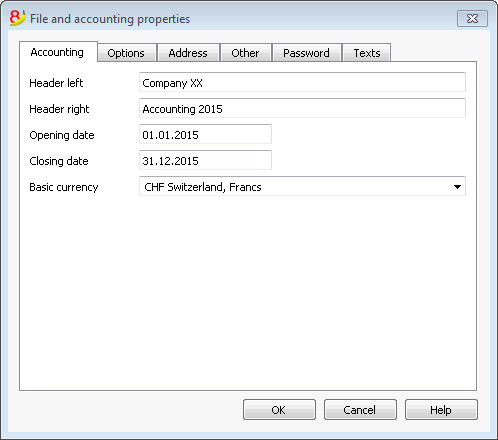

Setting up the file properties (basic data)

- From the File menu, File properties command, indicate the company name that will appear in the headers of the printouts and on the other data.

- Select the basic currency, with which the accounting will be kept.

General use of the program

Banana Accounting inspires itself from Excel. The user directions and the commands are kept as similar as possible to the ones of Microsoft Office.

For more information on the general use of the program, we refer to the explanations on our page Program interface.

The accounting is being contained in tables; all of them have the same way of operating.

Saving the file

- From the File menu choose the Save as... command, preferably indicating the name of the company and the current year (for example, "company_2017")

- Choose the folder where the file should be saved (for example, Documents -> Accounting)

- The program will add the "ac2" extension.

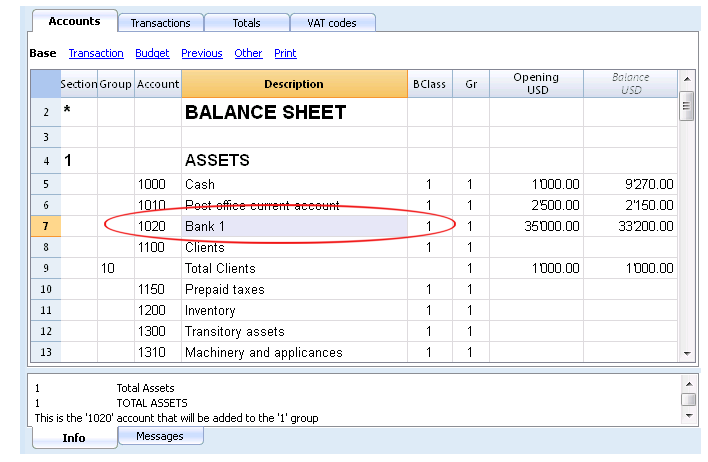

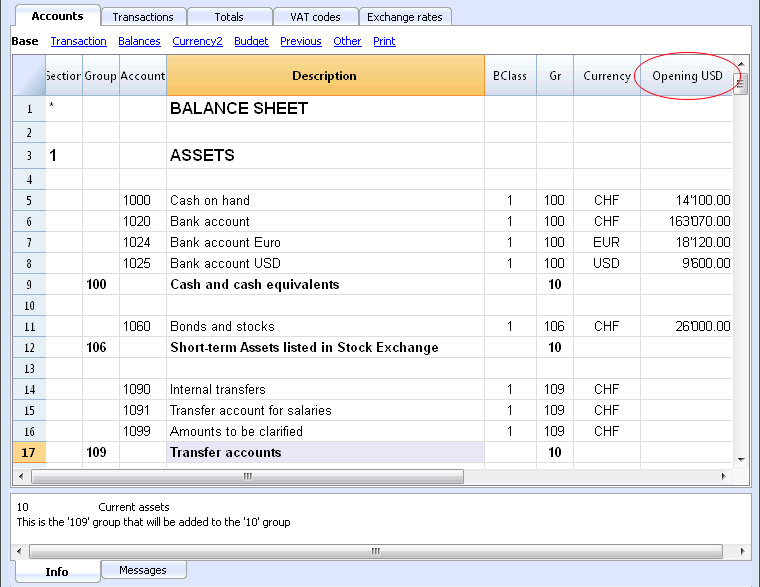

Customizing the Chart of accounts

In the Accounts table, customize the Chart of accounts and adapt it to your own needs:

- Add new accounts and /or delete existing ones (see Adding new rows)

- Modify the account numbers, the descriptions (for example, enter the name of your own Bank account), enter other groups, etc.

- To create subgroups, please consult our Groups page.

In the Chart of accounts, you can also define Cost centers or Segments, used to attribute the amounts in a more detailed or specific way.

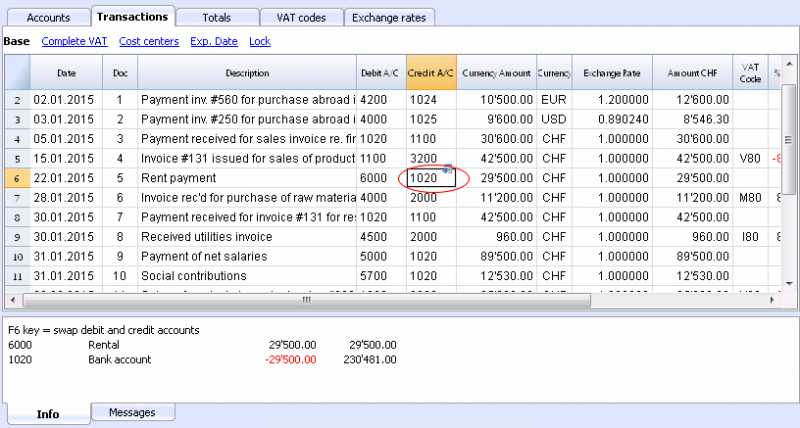

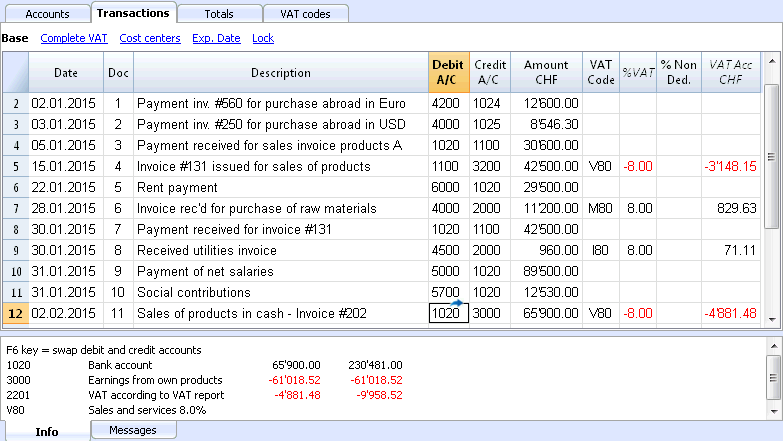

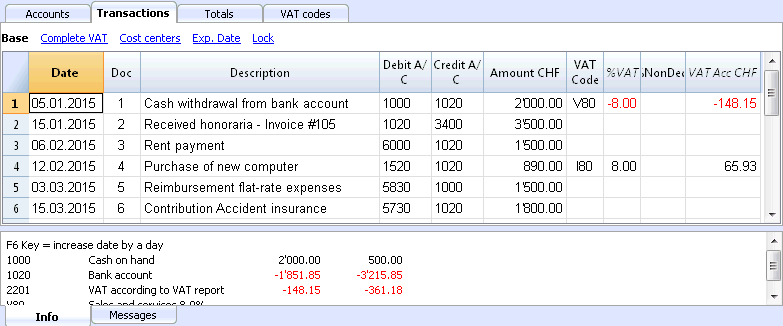

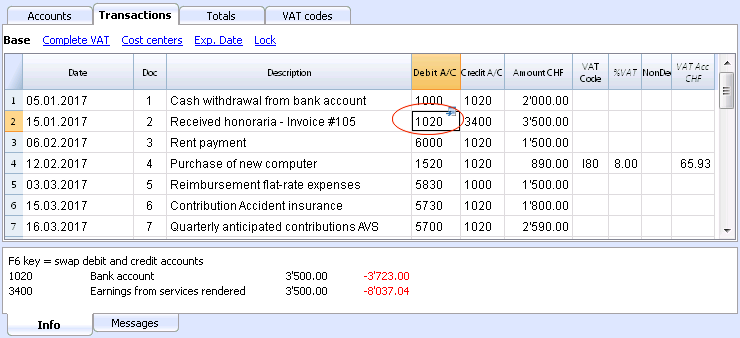

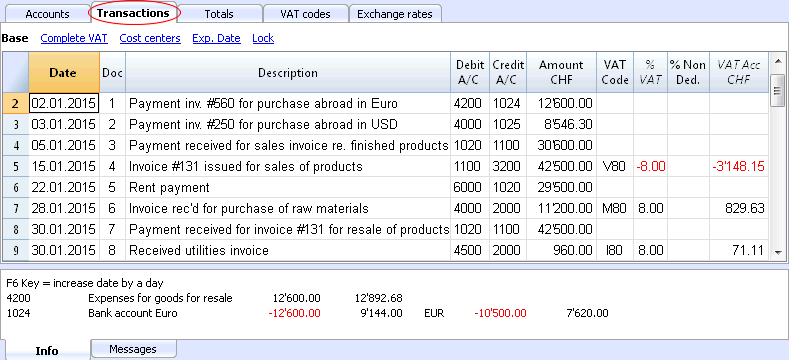

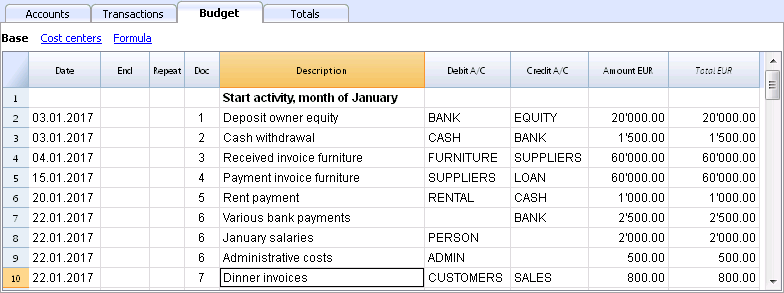

The Transactions

The Transactions have to be entered into the Transactions table; together they compose the Journal.

In the specific columns:

- Enter the Date

- Enter the Document number, manually assigned to the paper document. This makes it possible to easily locate the documents once the accounting transaction has been entered.

- Enter the Description

- Into the Debit account column, enter the destination account

- Into the Credit account column, enter the account of origin.

- Enter the Amount. In the accounting with VAT, enter the gross amount, VAT included. The program will separate the VAT, splitting the net cost or net income.

Speeding up the recording of the transactions

In order to accelarate the recording of the transactions, you can use

- the Smart fill function that allows the automatic autocomplete of data that have already been entered at an earlier date.

- the Recurring transactions function, used to memorize recurring transactions into a separate table.

- importing your bank or post office statement from the e-banking.

Transactions with VAT

In order to enter transactions with VAT please proceed as follows:

- from the File menu, choose New command and choose Double-entry accounting with VAT/Sales taxes

- Choose one of the existing templates for your nation with double-entry accounting with VAT codes and VAT Codes table.

In order to enter transactions with VAT, please visit the Transactions page.

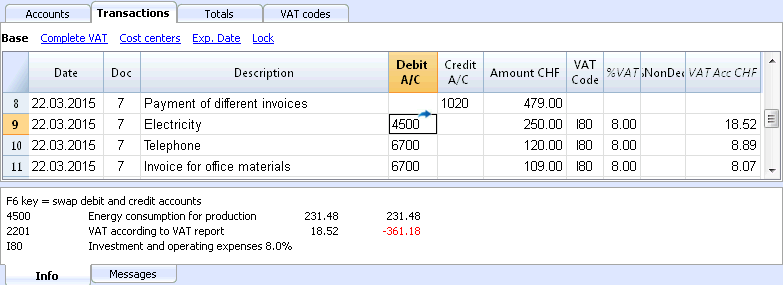

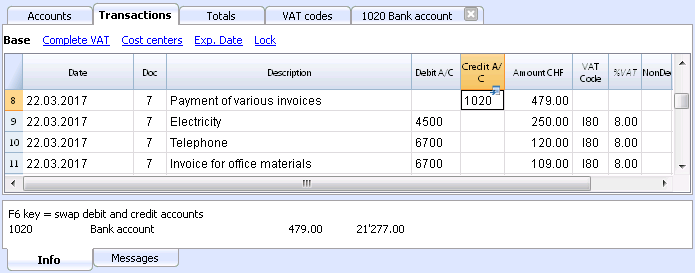

Transactions on multiple rows

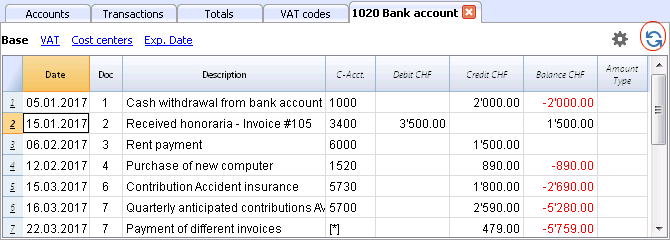

Transactions on multiple rows or Composed transactions are transactions involving more than two accounts and credits/debits on multiple accounts (for example when you pay different invoices from the bank account). In this case you need to enter the transaction on multiple rows:

- in the first row enter the total amount and the account debited or credited

- when all the individual debit and credit rows are entered there shouldn't be any difference

For more details, consult the page Composed transactions.

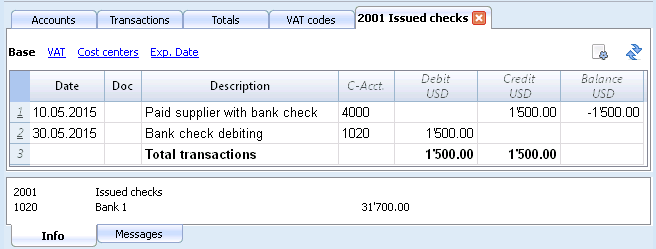

Checking customer and supplier invoices

Banana allows you to keep an eye on the invoices to be paid and the receivable, issued invoices. Please consult:

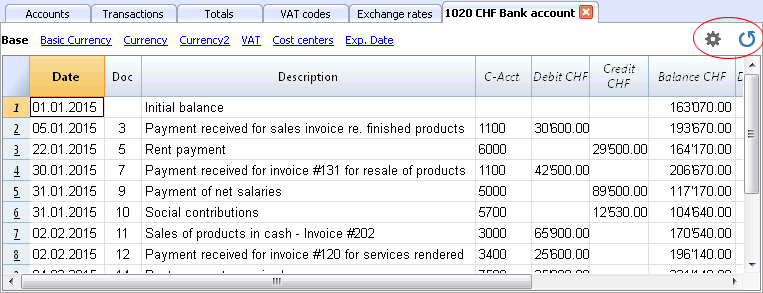

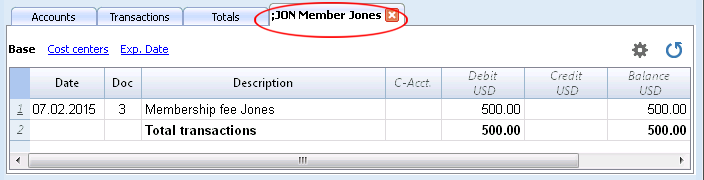

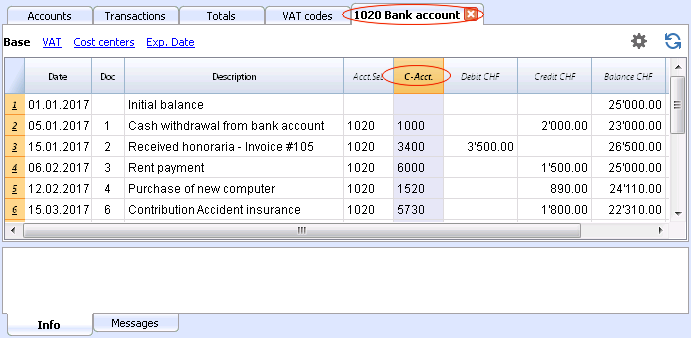

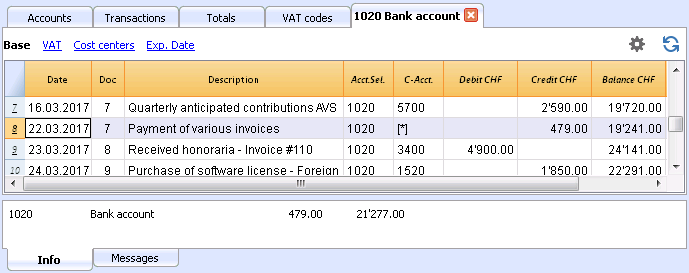

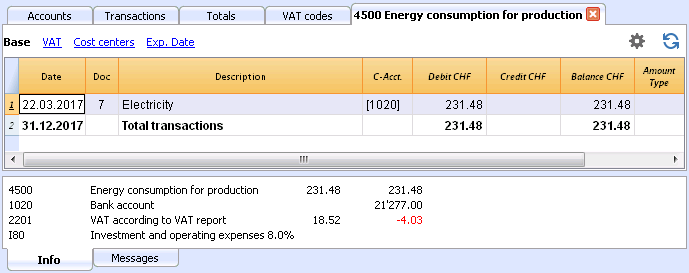

The Account card

The Account card automatically displays all the transactions that have been recorded on the same account (for example, cash, bank, clients, etc).

To display an account card, just position yourself with the mouse on the account number and click on the small blue symbol that appears.

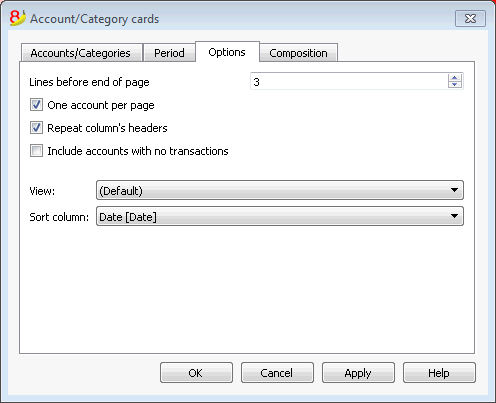

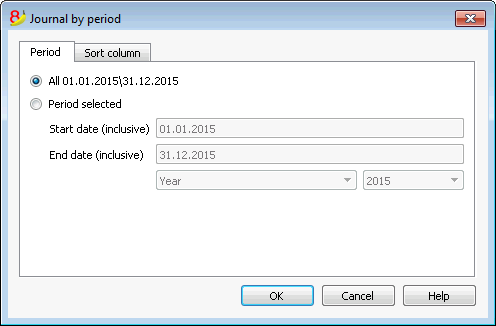

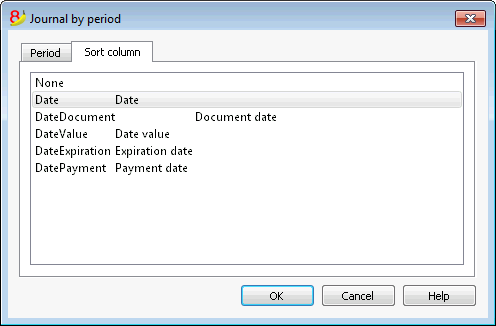

Account card by period

To display the account card with the balances referring to a specific period, click on the Account1 menu, Account card command, and in the Period section, activate Period Selected, entering the Start and the End date of the period.

For more details, consult the Period page.

Printing the Account card

In order to print one account card, just display the card from the Accounts or the Transactions table and launch the print from on the File menu.

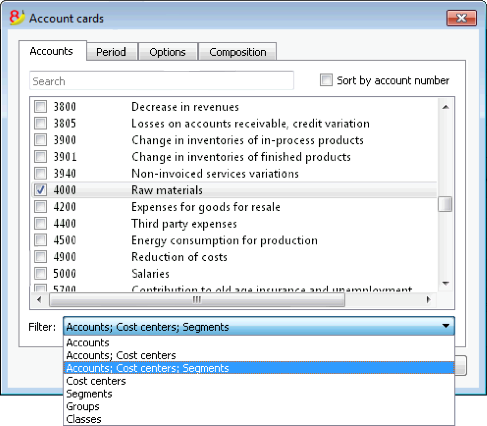

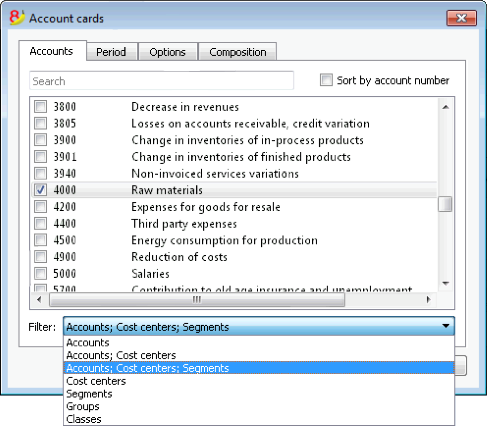

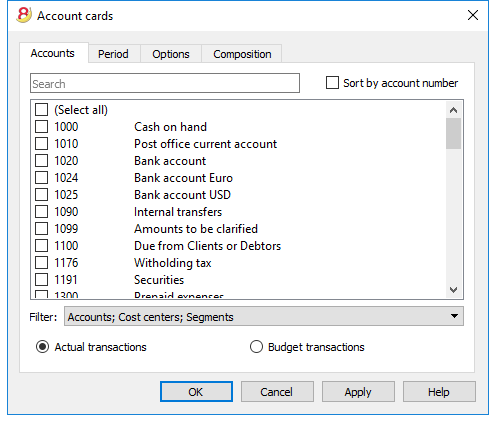

To print several or all account cards, click on the Account1 menu, Account card command, and select the account cards that need to be printed. By means of the Filter, all the account cards, or only a part of all of them (for example, only accounts, cost centers, segments), that need to be printed can be automatically selected.

For more details, consult the Account Card page.

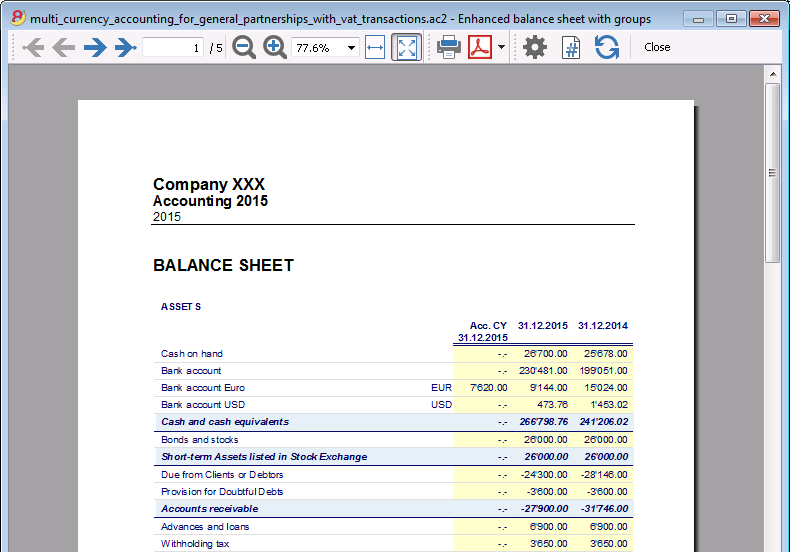

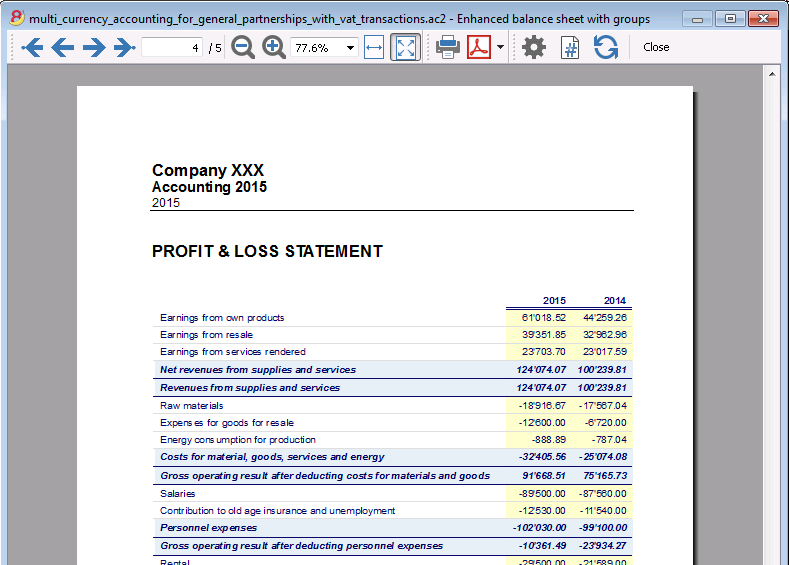

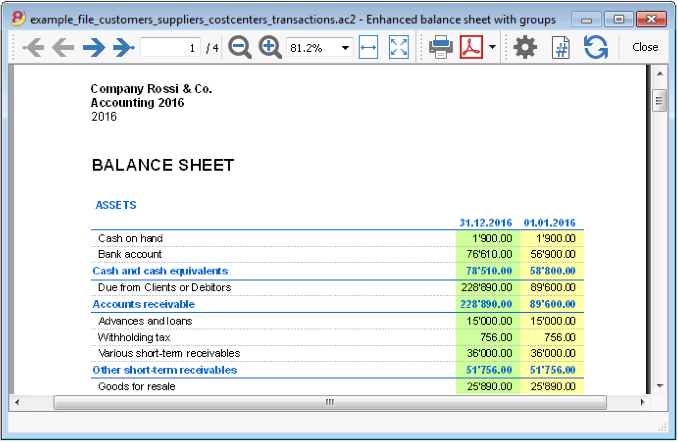

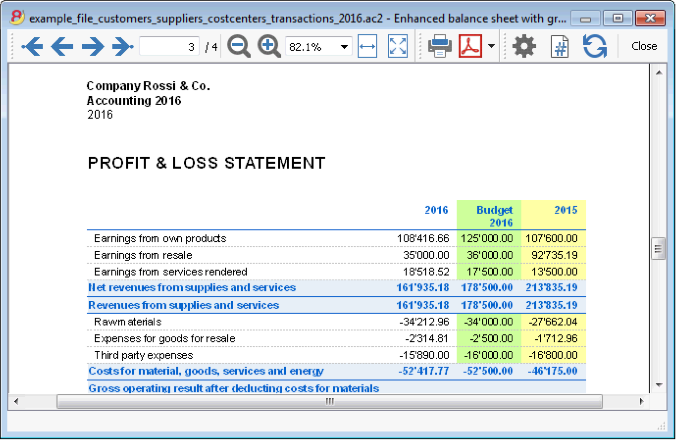

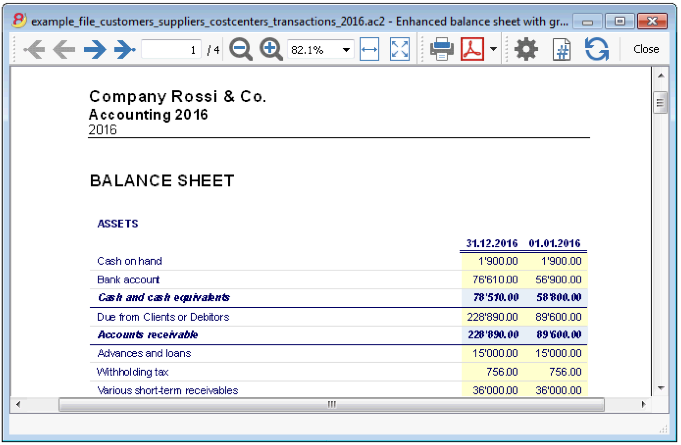

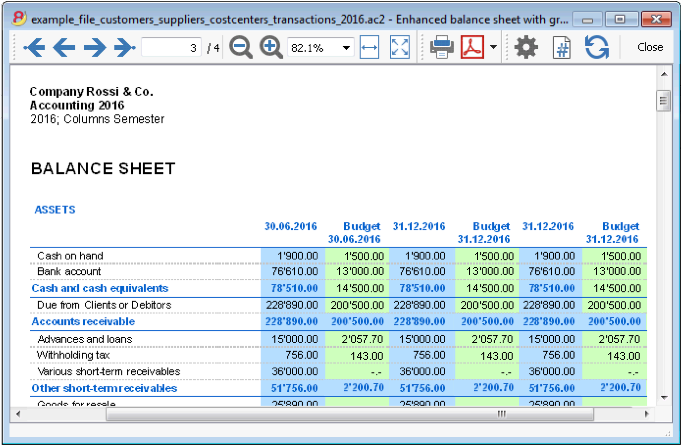

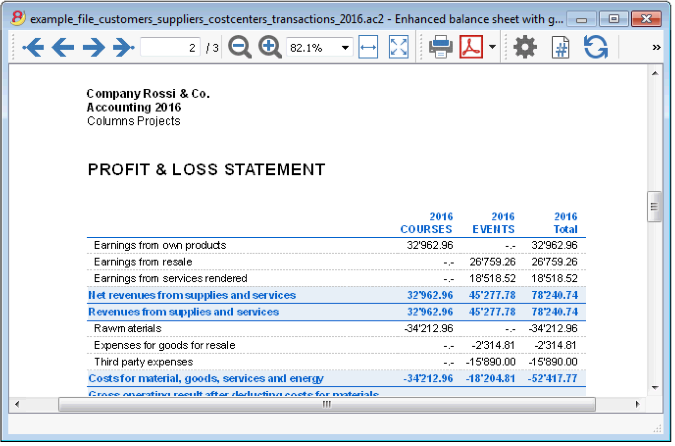

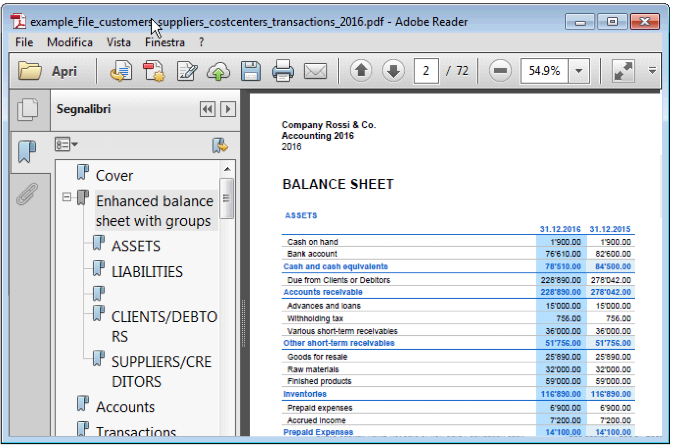

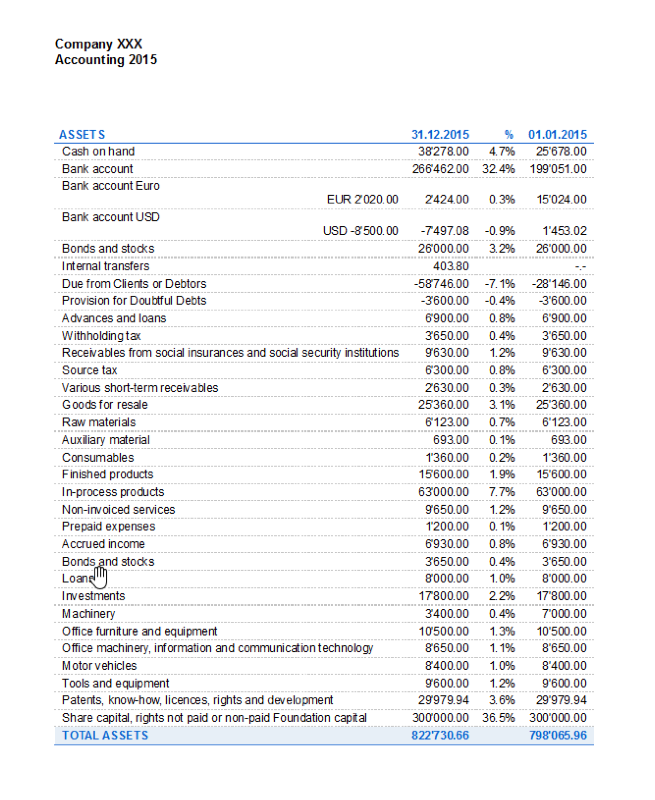

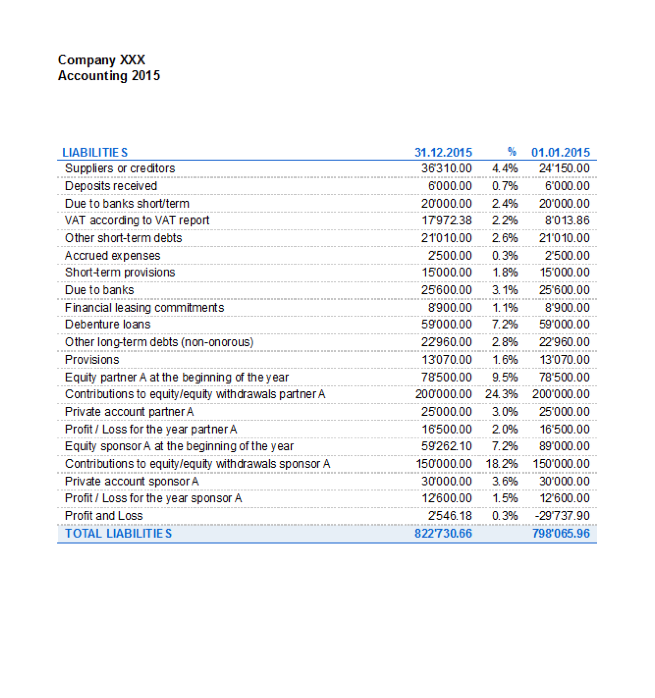

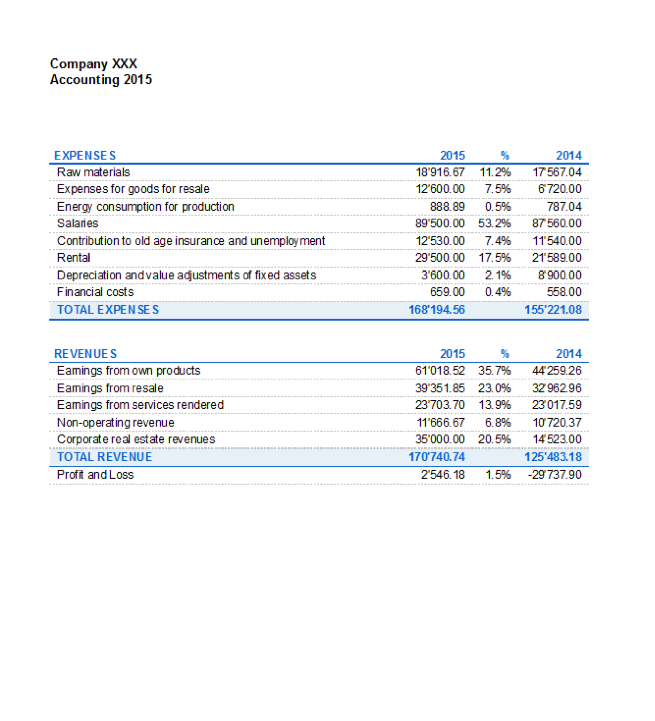

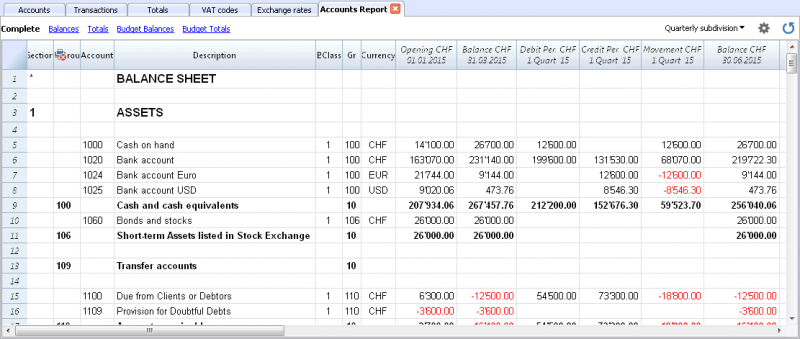

The Balance Sheet and Profit and Loss Statement

The Balance sheet shows the balances of all the estate accounts, Assets & Liabilities. The difference between the Assets and the Liabilities determines the Share capital.

The Profit & Loss statement shows all the Expense & Revenue accounts. The difference between the Expenses & Revenue determines the Profit or Loss of the Accounting year.

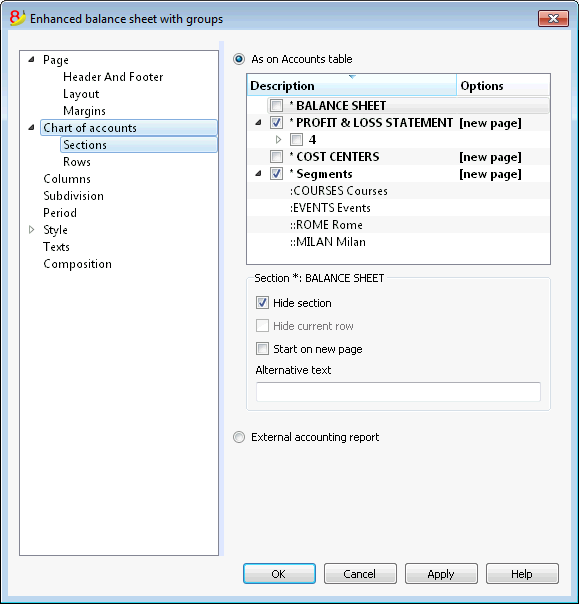

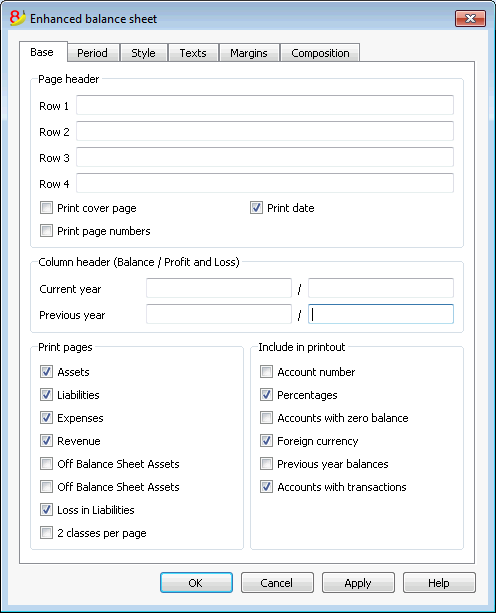

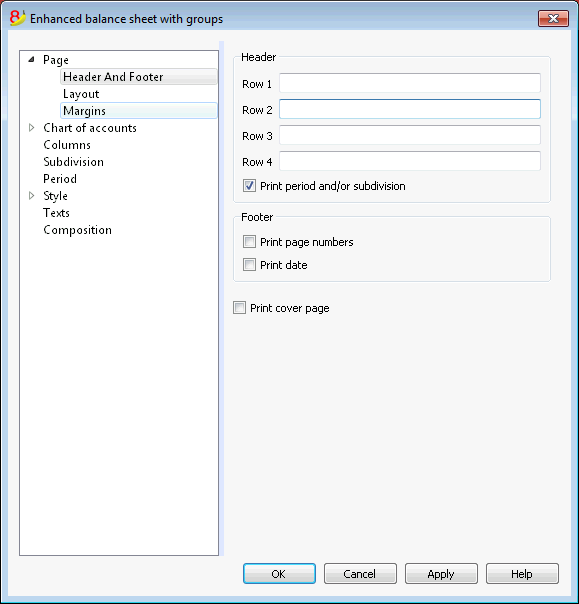

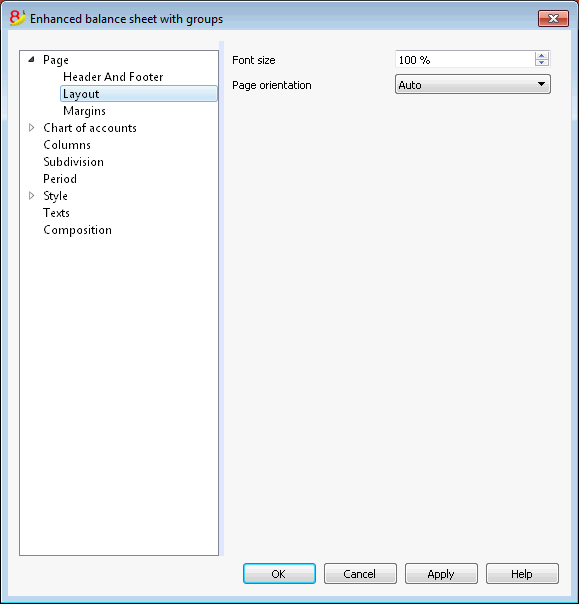

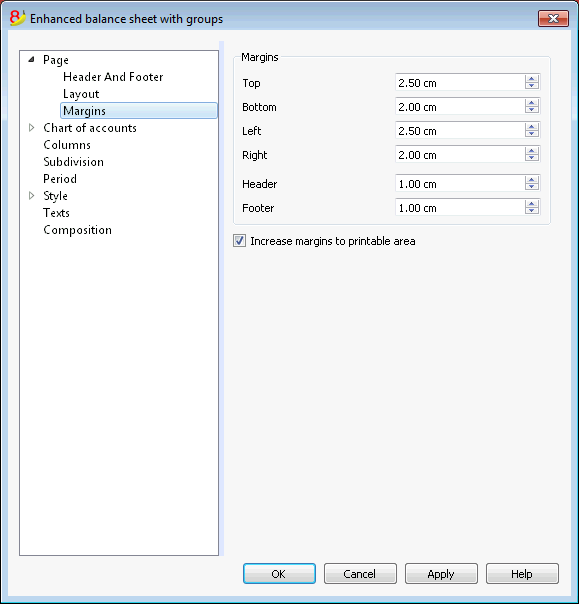

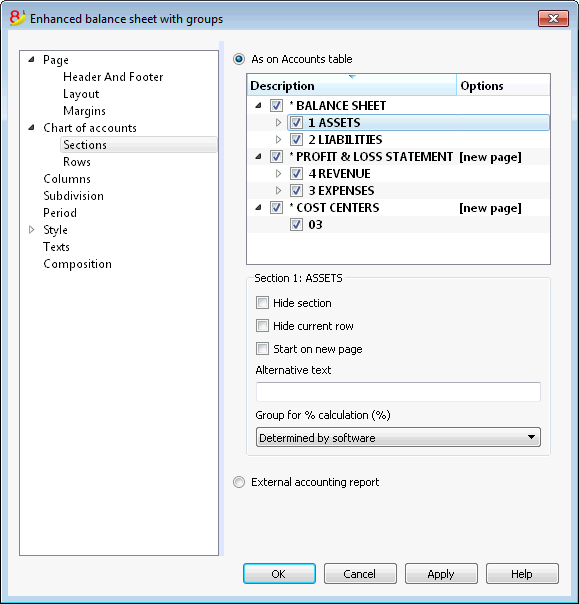

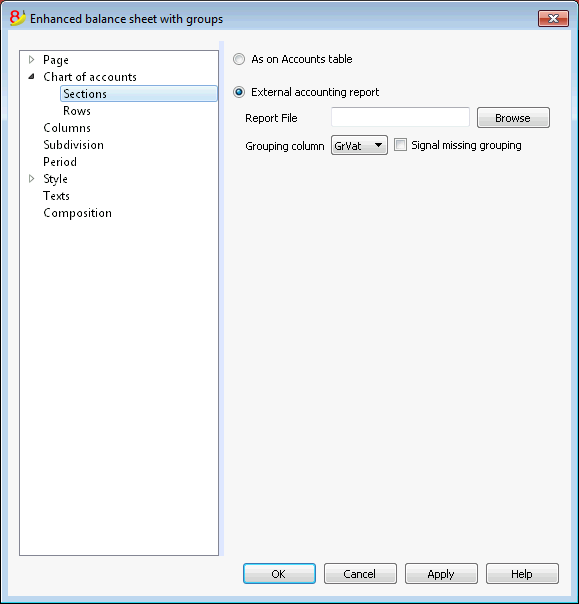

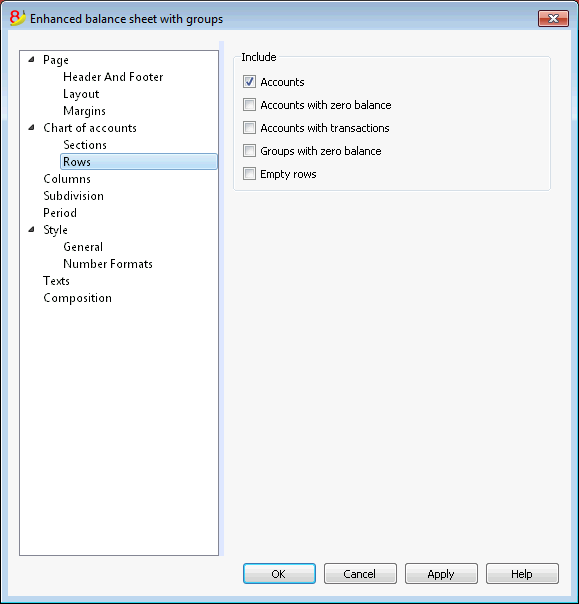

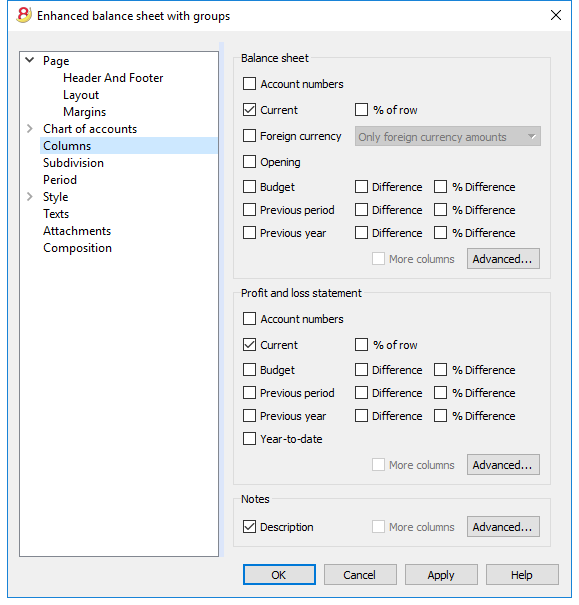

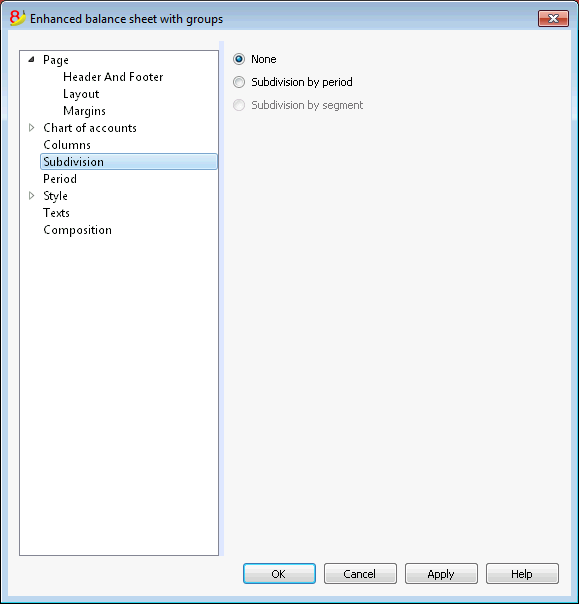

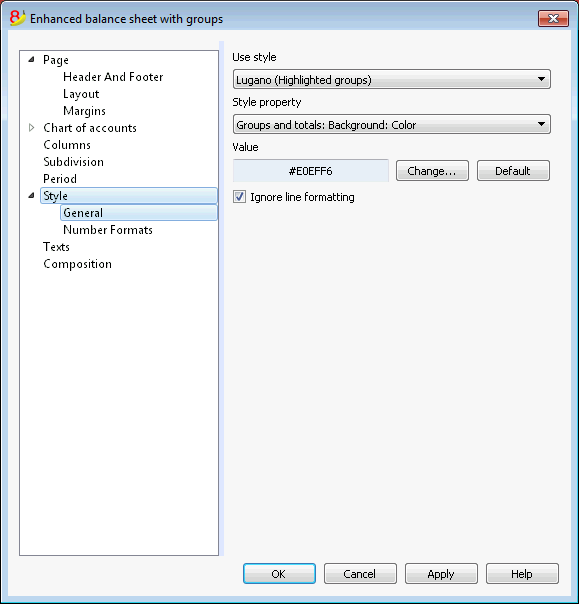

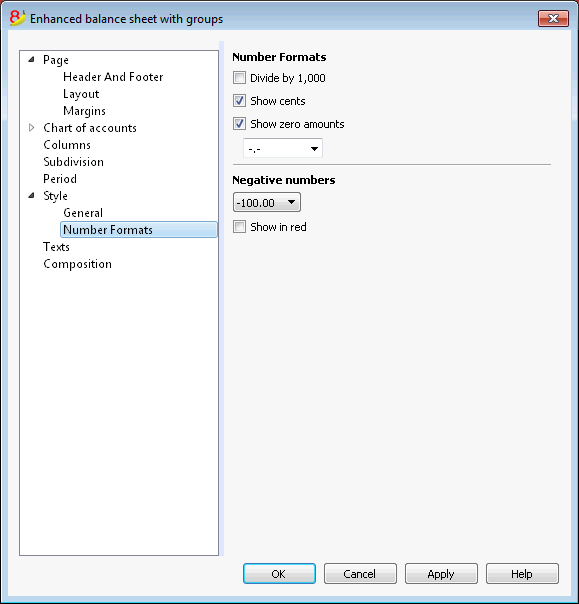

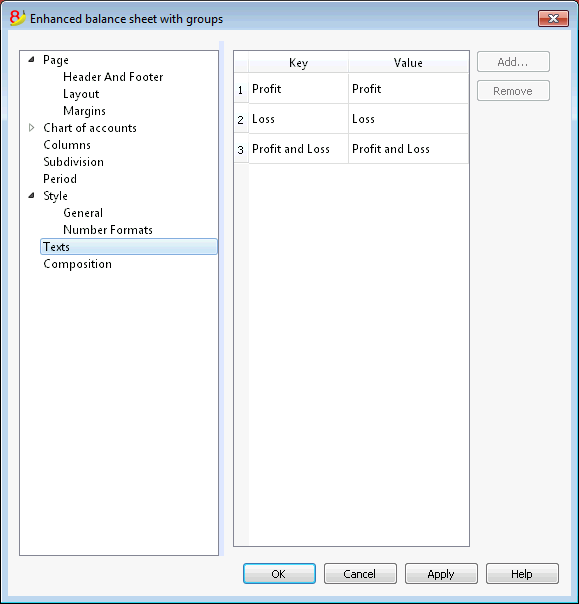

The display and the printing of the Balance Sheet is being executed from the Account1 menu, Enhanced Balance Sheet and Enhanced Balance Sheet with groups commands.

- The Enhanced Balance Sheet command simply lists all the accounts without distinguishing Groups and Subgroups

- The Enhanced Balance Sheet with groups command lists all the accounts while subdividing Groups and Subgroups; besides, it presents numerous features to customize the presentation, functions that are not provided in the Enhanced Balance Sheet.

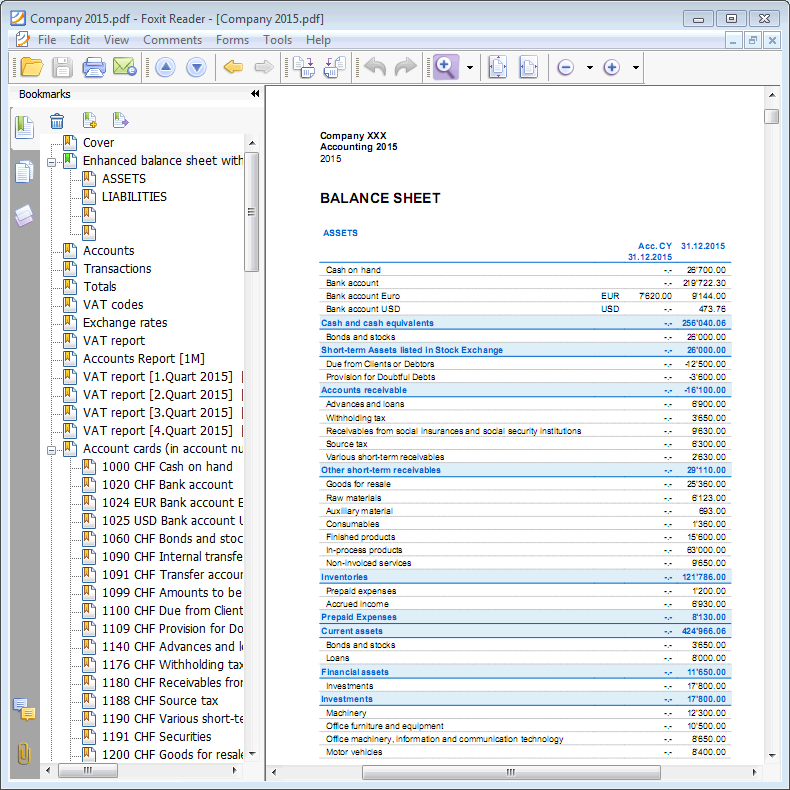

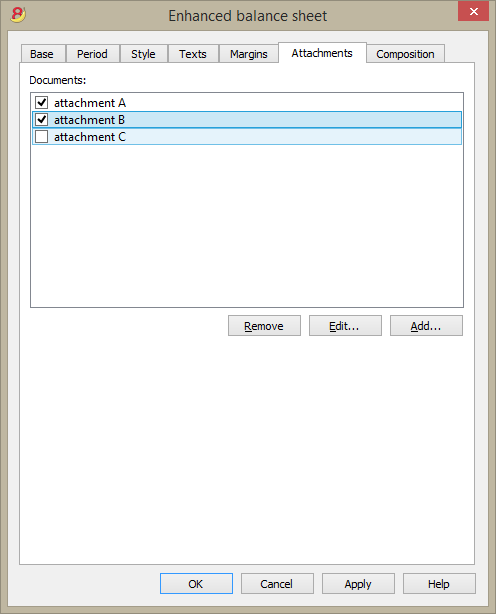

Data archiving in PDF format

At the end of the year, when the entire accounting has been completed, corrected and audited, all the accounting data can be archived with the Create PDF dossier command of the File menu.

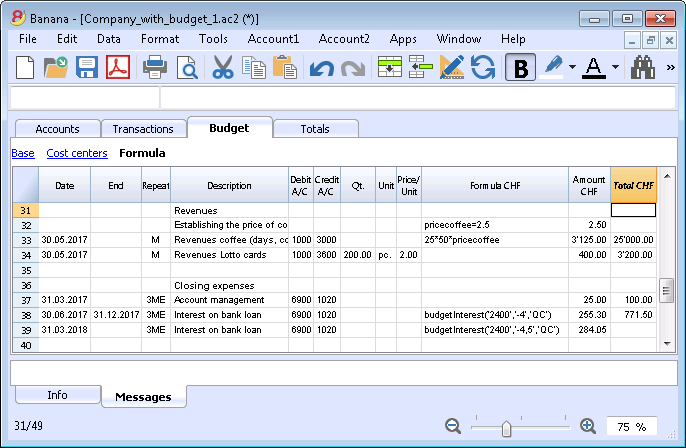

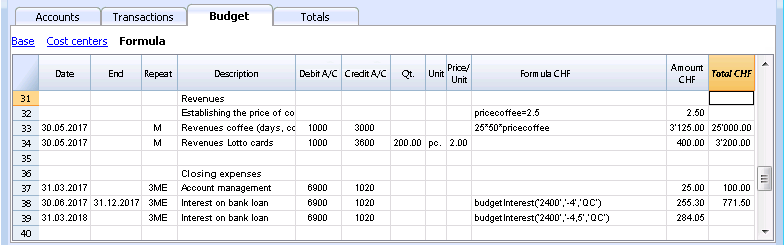

The Budget

- Accounts table, Budget column. For each account, the annual budget amount is being indicated.

In this case, when you set up the Budget from the Account1 menu, Enhanced Balance Sheet with groups command, the Budget column displays the amounts that refer to the entire year. - In the Budget table, that can be activated through the Tools menu, Add new functionalities command.

In this table, you can enter all the budgeted costs and revenue by means of entering transactions. If you activate this table, the column of the accounts table will be automatically deactivated.In this case you can set up a detailed budget, taking into account the possible variations over the year and in different periods of the year.

For more details, consult the page Budget.

Chart of accounts

Financial situation under control

You need to setup you chart of accounts in the Accounts table: setup the accounts and the groups where the accounts must be totalized. With this operation you create the accouts that will be used when entering the transactions. The chart of accounts structure is the same that will show in all Balanche sheet and Profit & Loss statement presentations.

In the Accounts table there are also the columns of the initial balances, movements and current balance, which are automatically updated by the program.

The chats of accounts therefore provides an immediate and complete view of your financial situation.

- Liquidity accounts

- Balance sheet

- Profit & Loss statement

- Result of the current year

- Clients and Suppliers register

- Cost and Profit Centers

Different kinds of rows and sections

The Accounts table (charts of accounts) is both the setup tool and the viewing tool for the economic and financial situation.

In the chart of accounts (Accounts table) all data necerrary to group the mouvements are entered:

- Accounts

They indicate on what account (debit ore credit) the transactions must be registered.

Each account has a code or number (account number), a description, a class and a group to which it belongs; they also have an opening balance, the current balance, the budget, etc... - Costs and Profits centers

They are special accounts whose number is preceded by a full stop ".", a comma "," or by a semi-colon ";". Their purpose is to be able to assign some amounts to special accounts other than the basic accounting accounts. - Segments

They are a sort of sub-accounts who's number is preceded by a ":". Their purpose is to be able to assign some transactions to subcategories of the accounting plan. - Groups

Their purpose is to create rows where the program adds up the amounts of other rows. - Sections

They indicate the accounting plan divisions for the Balance Sheet and Profit and Loss Statement printouts, ...

The columns of the double-entry accounting charts of accounts

- Section

Codes are being entered that allow the user to only print determined parts of the Chart of accounts, when printing the Enhanced Balance sheet by groups. - Group

Contains the code that defines that this is a group row. The group code is then used in the GR column to indicate the totalization of an account or group.

- Account

The account number, cost center or segment is being entered. - Description

A text to indicate the name of the account, group, or section. - Disable (only visible in the Other view)

By entering 1, the account does not appear in the autocomplete list, but can be used in the Transactions table;

By entering 2, the account is disabled and can not be used. - BClass

It indicates whether the account is 1 = Assets, 2 = Liabilities, 3 = Expenses, 4 = Revenue, see the Accounts

- Gr (Totalize in)

It indicates a group so that the program can totalize this line in the group. - Gr1 and Gr2

Additional grouping codes to use with external accounting report files.

- Opening balance

Insert the account balance at the beginning of the year.The amounts in credit must be entered preceded by a minus sign. The total of the debit amounts (positive) and those in credit (negative) must balance and result in zero. If the opening balances do not balance a difference is shown in the information window.If you have added or pasted accounts and the difference is not correct, proceed with a Recheck of the accounting (Shift + F9)

- Movement Debit and Movement Credit (Protected columns)

The total of the debit and credit movements included in the Transactions table.

- Balance (Protected column)

The balance of the account includes the opening balance and the movements in debit and credit.The balance in debit is positive, while a credit balance is negative (minus sign). - Budget

The budget amount for the current year is being entered.The budget amount for the Expenses (debit) must be inserted in positive, the Revenue in negative (credit). -

Difference Budget (Protected column)

The difference between Balance and Budget amount. - Previous

The balance of the account at the end of the preceding year.

With the command "Create new year" or "Update opening balances", the values in the Balance column of the file of the preceding year are being carried forward.

When a new accounting is being created and the user wants to obtain printouts with the amounts of the preceding year, the values of that year have to be entered manually. - Prev. yr. Difference (Protected column)

The difference between the Balance and the amount of last year. - VATNumber

The VAT number in case this account is linked to a client or a supplier. - VATCode

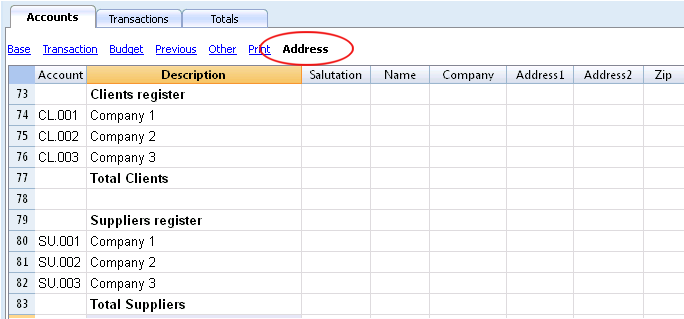

The VAT code that needs to be applied automatically, when this account is being entered in the debit A/c or credit A/c column of the Transactions. - Adresses columns

It is possible to have the program add addresses columns in order to manage customers or suppliers data.

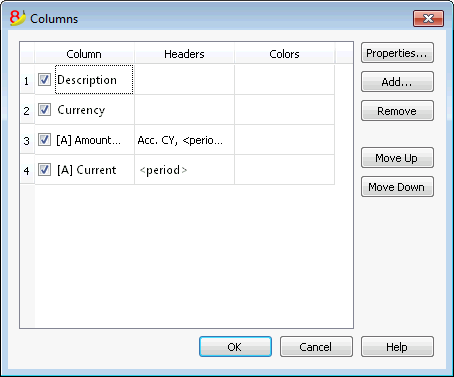

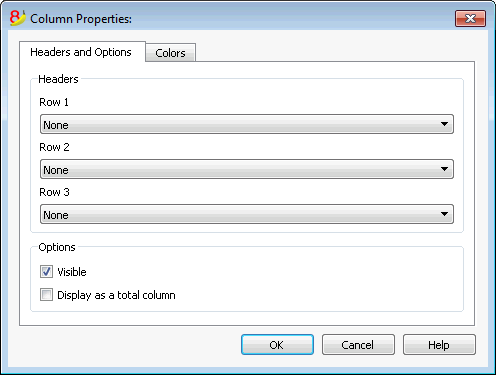

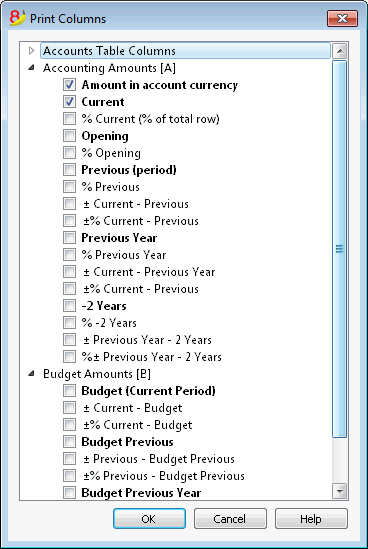

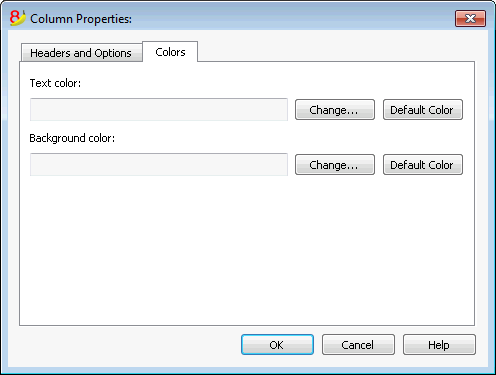

Adding or moving columns

- When an Amount column is being added in the Chart of accounts, the program composes the total of the amounts according to the selected grouping scheme

-

Added columns of the Number type, on the contrary, are not being totaled.

- With the Columns setup command, the columns can be made visible, the sequences can be altered and it is also possible to add other columns.

- With the Page setup command one can also define the layout of the print (portrait or landscape) and the zoom.

Accounts list ordered by description or other criteria

In you need to order your accounts in a different way, use the Extract and sort rows command from the Data menu.

Views

- Base Displayed are the principal columns, the grouping columns and the balances

- Transaction Displayed are the columns with the Debit and Credit transactions.

- Budget Displayed are the Budget column and the Difference Budget column.

- Previous Displayed are the Previous column and the Difference Prior columns regarding the previous year

- Other The Disable column, the VAT number and the Fiscal number column are being displayed.

- Print Just the Account column, the Description and the Balance is being displayed.

The views can be customized and others can be added with the command Views setup.

Trial Balance sheet

At any time, positioning yourself in the Accounts table and using the Print or Print preview commands (from the File menu), you can view and print the account plan or part of it.

Also from the Accounts table, if you select Movement view, you can view and print your trial balance sheet.

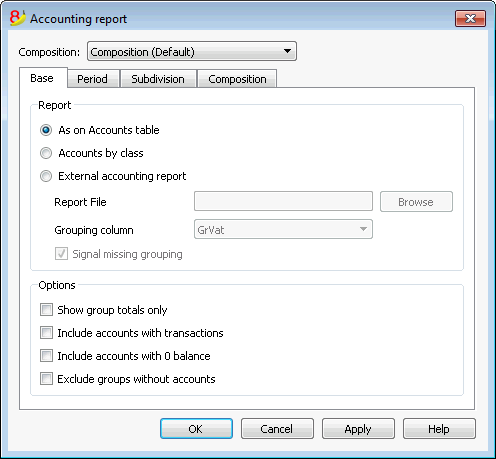

Advanced printouts

- Accounting report

It is possible to select just the accounts with transactions, to obtain temporary groupings or accounts grouped according to the BClass or an external grouping scheme. - Enhanced Balance sheet

Prints all the accounts of the accounting divided by Assets, Liabilities, Expenses and Revenue - Enhanced Balance sheet by groups

Allows the user to obtain customized printouts with groups - Specific advanced printouts are available using the BananaApps

Accounts

Bookkeeping accounts

In order to create an account, go to the Accounts table and enter a number or a code in the Account column.

This same number is then used in the Transactions table as Debit or Credit account.

- The account number can be composed by numbers, letter and separations characters.

- It is not possible to have more than one account with the same number.

- Each account must have a BClass and must belong to a group.

The BClasse

Each account must belong to one of the following BClasses:

- 1 for Assets

- 2 for Liabilities

- 3 for Expenses

- 4 for Income

The BClasse number must be as indicated, regardless the account or group code. It is also possible to create Off Balance Sheet accounts (for example for warranty down payments, e conditional committments), that must have the following BClass:

- 5 for Off Balance Sheet: Assets

- 6 for Off Balance Sheet: Liabilities

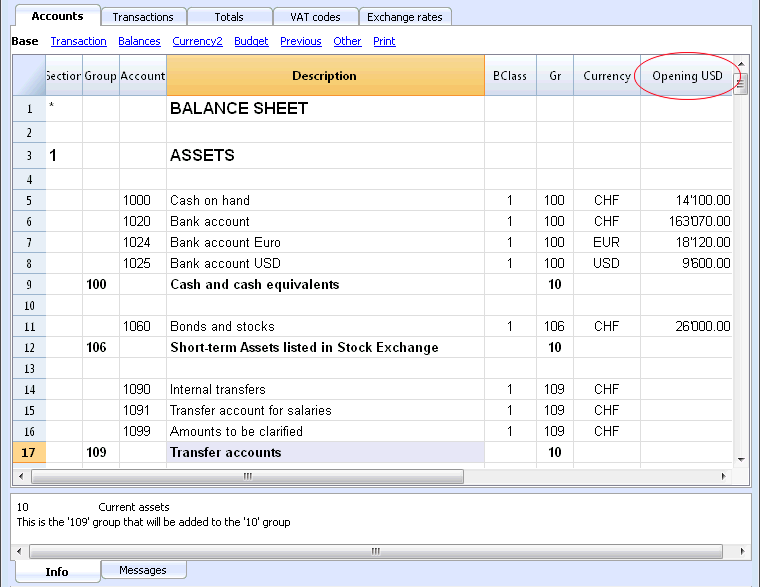

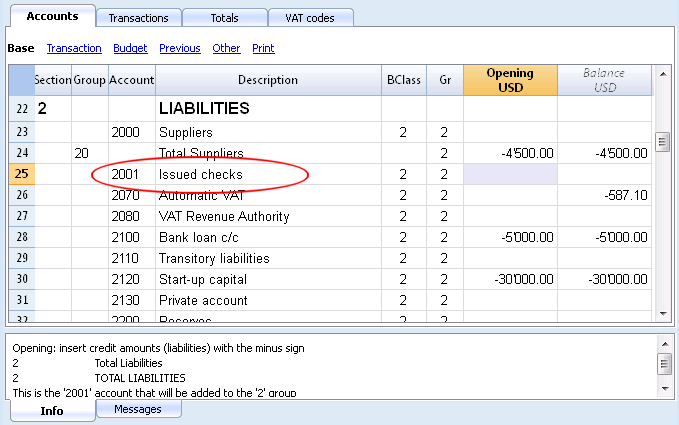

Opening balances

The opening balance of each account is entered in the Opening + currency symbol column.

- The Assets balances are shown normally

- The Liabilities balances are entered with the minus sign (negative)

- Usually only the Assets and Liabilities opening balances are entered.

In order to automatically transfer the opening balances for the following year, please visit the Create New Year lesson.

Opening balances differences

In a correct accounting file, the total of the Assets opening balance should be equal to the total of the Liabilities opening balance, so no differences are shown.

If the totals do not match, the program will show a warning message telling you that there is a opening balances difference (Information window).

If you have changed some account numbers and you think the error message is not correct, please Recheck the accounting.

When using Banana Accounting for the first time, the opening balances must be entered manually.

Accounts with addresses

It is possible to add a few columns in the chart of accounts, to include the addresses management:

Tools menu -> Add new functionalities command

This command will add in the Chart of accounts the following things:

- several columns (name, last name, company, town, ...) where you can enter the client / supplier / member address and data

- the Address view where you can see the added columns (in order to change the view or the views organization please consult the Tables setup page)

Clients/supplier register

When in the accounting plan you need to manage a clients/supplier register, meaning a specific account list for all clients, you need to have complete data with address, phone number, email, VAT number, etc. in this case adding the columns of the Address view is very useful.

Groups

The grouping and totaling system

The Banana grouping and totaling system is based on the following columns:

- Group (TOTAL row)

When, in a row, a group identifier is being entered, the row becomes a TOTAL row.

In this row the amounts of the Gr column, that contain the same identifier, are being totaled.

When a group is present, there cannot be an account. . - Gr (Adds this row into the TOTAL row)

The number here must be one of the numbers defined in the Group column.

With this system, an account can be totaled in a group row, the group in another group and so on... in order to create different totaling levels.

This totaling system is very powerful and flexible, but it takes some "getting used" to it, in order to be able use it well.

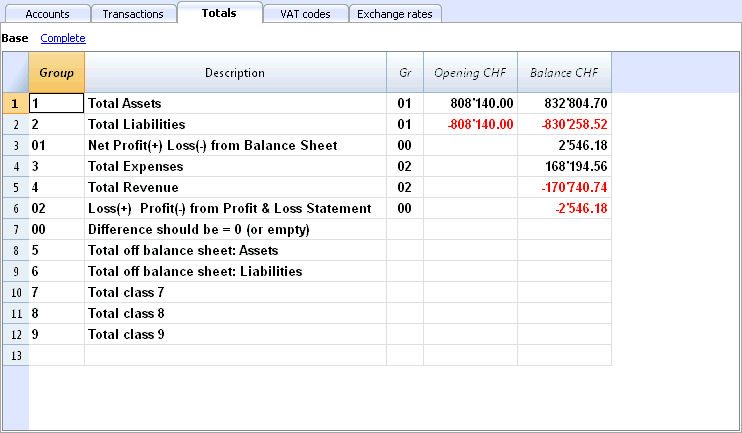

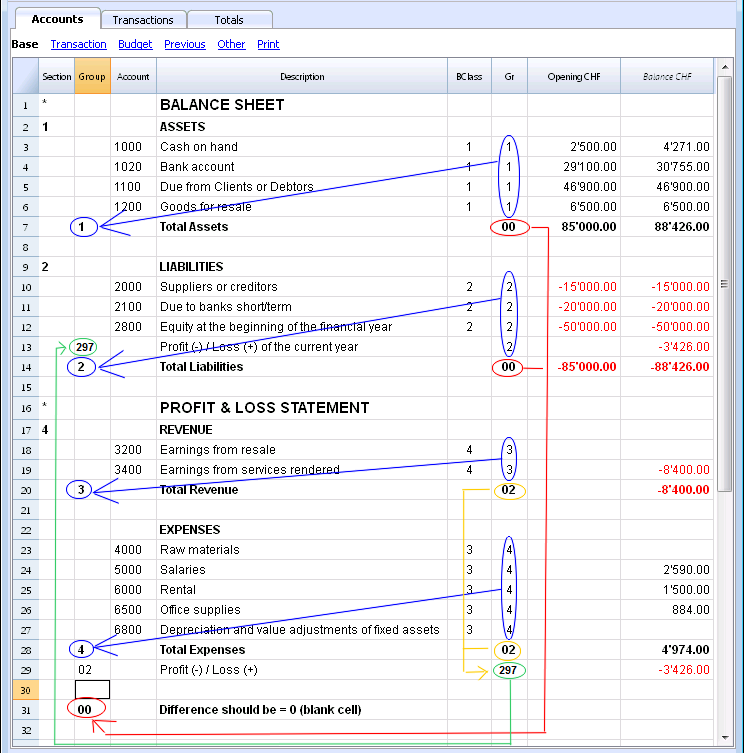

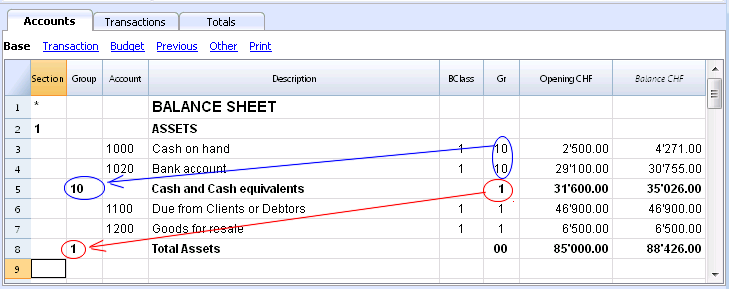

Examples of the main groupes in the Double-entry accounting

Every Chart of accounts uses its own totaling system. Hereunder the main groupes of the Double-entry accounting are being explained.

In the Double-entry accounting, the total of the Debit balances (positive) together with the Credit balances (negative) have to result in 0 (zero).

- The 00 is the row where all the amounts are being added together.

It is the "Summa summarum" of all the Debit & Credit balances.

In case the Balances columns do not amount to zero, it means there is a Debit/Credit difference and thus most likely a mistake. In these cases it is useful to proceed with a checking of the accounting (see next point).

In the Debit and Credit columns of the Transactions view (Accounts table), there are only positive amounts, so also in the row of the 00 group, there will be the total of the transctions not equal to zero.

The calculation sequence to arrive at 00 is therefore as follows:

- The 1000 account -> group 1 (Total Assets)-> Group 00

- The 2000 account -> group 2 (Total Liabilities) -> Group 00

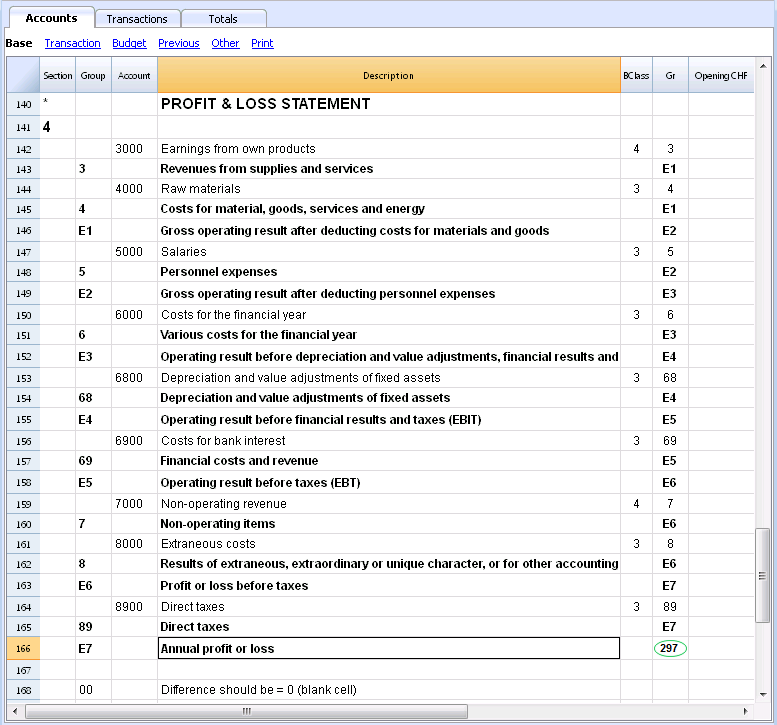

- The 3000 account -> group 3 (Total Revenue) -> Group 02 (result Profit & Loss Statement) -> Group 297 (Profit/Loss of the current year in the Balance Sheet) -> Group 2 (Total Liabilities) -> Group 00.

- The 4000 account -> group 4 (Total Expenses) -> Group 02 (result Profit & Loss Statement) -> Group 297 (Profit/Loss of the current year in the Balance Sheet) -> Group 2 (Total Liabilities) -> Group 00.

The result of profit & loss statement is added in equity

As you can see in the example, the Group 02 (Profit /Loss from Profit & Loss statement) is totalized in the 297 liabilities group (current year result).

With this group organization, we have several advantages:

- In current year operating result is displayed in the balance sheet

- The Total Liabilities will match the Total Assets (provided that there is no accounting error).

Adding or deleting subgroups

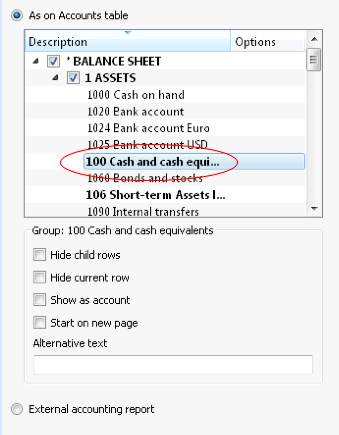

Adding a totaling level

With this system it is easy to add totaling levels.

When we want to create a subgroup for the Cash & Cash equivalents accounts:

- Enter an empty row after the bank account

- Enter the value 10 into the Group column

- Enter the value 1 into the Gr column

- Indicate the Gr 10 in the accounts 1000 et 1020

- The sequence for the calculation becomes:

The 1000 account -> Group 10 (Cash & Cash equivalents) -> Group 1 (Total Assets) -> Group 00.

In case you want to insert another subgroup, "Current Assets", proceed in the same way.

- Add an empty row above the row of the Total Assets.

- In the new row:

- Indicate the number 11 in the Group column

- Indicate the number 1 in the Gr column

- In the Clients and Goods for resale (inventory) rows, indicate the Gr 11.

Deleting subgroups

In case the Chart of accounts shows subgroups that are no longer needed or not wanted, these can be deleted. Just delete the row of the subgroup and modify the Gr of every account that was part of that subgroup.

Checking of the structure

Once the Chart of accounts has been set up, execute the Check accounting command of the Account1 menu. In case there are errors, the program issues a warning.

Infinite loop error

This warning appears when a Group is being totaled in a Group of a lower level, reason for which an infinite error loop is being created.

There would be an infinite loop when, in the preceding example, the Assets Group (1) would be totaled in Group 10.

The program, after having calculated the Group 1, would total the amount in Group 10, which in turn would total the amount in Group 1, and then again in 10 without ending.

Profit & Loss Statement with Gross Profit

It is also possible to use a Profit & Loss Statement that starts with the total Business result and that subtracts the costs.

Hereunder the example of the Swiss PME Chart of Accounts is shown.

Extended use of the totaling system

The totaling system is very flexible:

- In one Group, it is possible to add Groups as well as Accounts

This can be seen in the earlier shown example where the Group Cash & cash equivalents (10) and the accounts (1100 and 1300) are being totaled in the Assets - You can use whatever kind of numbering

- You can create up to a hundred totaling levels

- The Total row can be after the rows

- The Total row can be before the rows

- The Total row can be completely elsewhere, in a separate position

This is being used to create registers (for example, a client register)

- The accounts and the Groups can be totaled in one single other Group.

It is not possible to total one and the same account at the same time in two groups. - This system is also being used to total the Cost centers and the Segments

Pay attention though to not use different groups for normal accounts and for cost centers, because the resulting amounts will not be correct.

Totaling of the Amount columns

The calculation procedure totals the amount columns

- The amount columns defined by the system are being totaled.

- The amount columns added by the user are being totaled.

The sequence of the calculation

The programme calculates the totals in the following manner:

- Sets the values of the Amount columns of the Groups rows on zero

- Totals the amounts of the Account rows into the Group rows (first calculation level)

- Adds the balance of the Group rows into the Group(s) of a superior level

Repeats the operation until all the levels have been calculated.

Related Documents

Sections

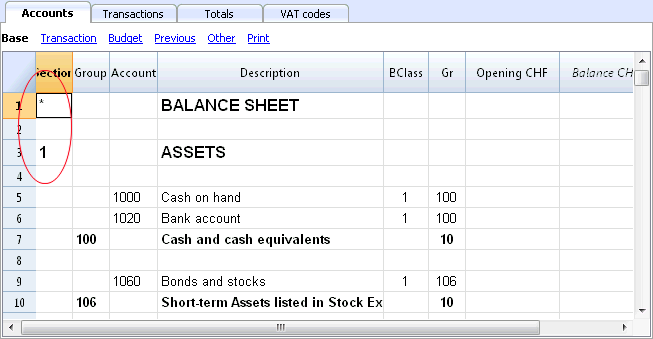

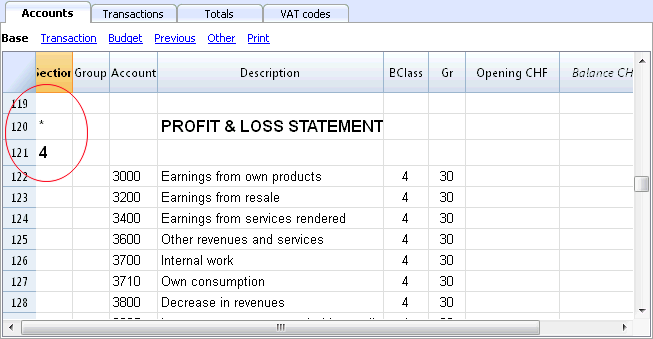

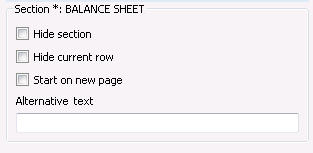

In order to create automatically an Enhanced Balance Sheet with groups, the chart of accounts needs to be configured with special codes that are to be entered in the Section column:

| * | Title 1 | the asterisk separates the sections and indicates the main headers |

| ** | Title 2 | to be entered for the secondary headers |

| 1 | Assets | to be entered in the row of the Assets title |

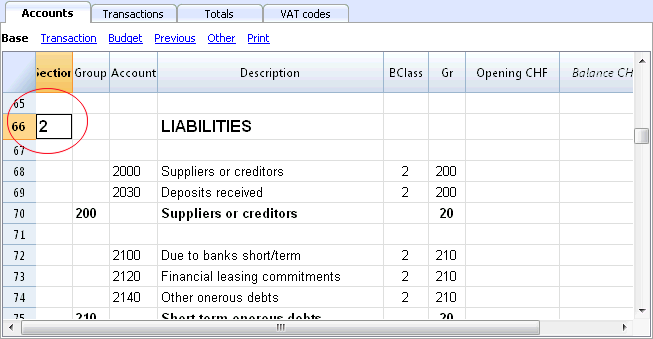

| 2 | Liabilities | to be entered in the row of the Liabilities title |

| 3 | Expenses | to be entered in the row of the Expenses title |

| 4 | Revenue | to be entered in the row of the Revenue title |

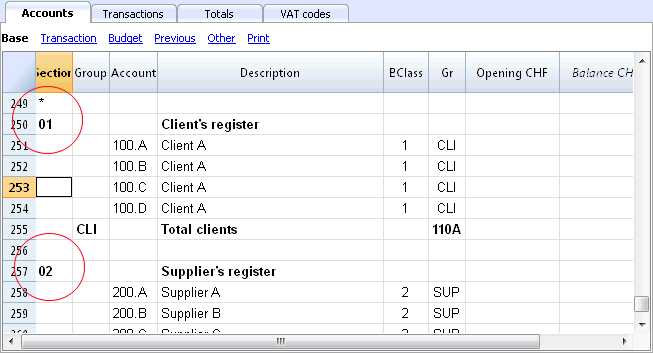

| 01 | Client's Register | to be entered in the row of the Client's Register title |

| 02 | Supplier's Register | to be entered in the row of the Supplier's Register title |

| 03 | Cost Centers | to be entered in the row of the Cost Centers title |

| 04 | Profit Centers | to be entered in the row of the Profit Centers title |

| # | Notes | to be entered in the row of the Notes title |

| #X | Hidden data |

to be entered in the row from whereon the data have to be hidden |

Sections in the Assets

- Enter a * on the same row as the Balance Sheet title

- Enter 1 on the same row as the Assets title

Sections in the Liabilities

- Enter 2 on the same row as the Liabilities title

Sections in the Profit & Loss Statement

- Enter a * on the same row as the Profit/Loss Statement title

- Enter 4 on the empty row below the Profit/Loss Statement title

Note: when there is a clear distintion between Revenue and Expenses in the Chart of accounts, you need to:

- Enter 3 on the same row as the Expenses title

- Enter 4 on the same row as the Revenue (Income) title .

Sections in the clients/suppliers register

- Enter * in the same row as the Clients/Suppliers register title or on a empty row (as in the following example)

- Enter 01 on the same row as the Clients register title

- Enter 02 on the same row as the Suppliers register title

The amounts will be shown in the same way as for the Assets and the Liabilities.

This encoding is also valid when the clients and suppliers are configured as cost centers.

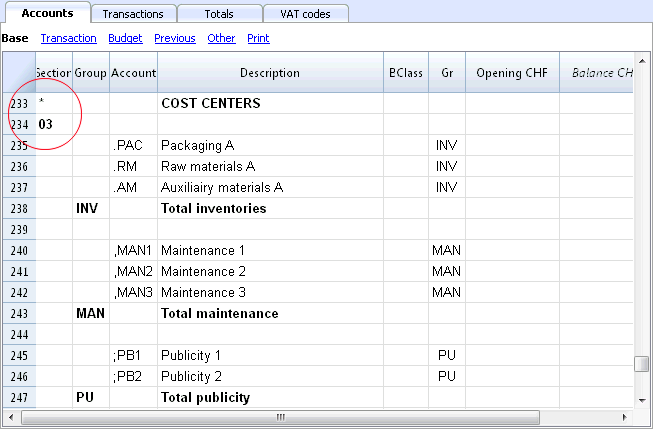

In case there are cost or profit centers configured, enter the following elements

- An * on the row of the Costs and Profit Centers title, or on a empty row

- 03 on the same row as the Cost centers title or on an empty row preceeding the Cost Centers

- 04 on the same row as the Profit centers title or on an empty row preceeding the Profit Centers

The Cost Centers amounts will be shown as positive (in black) like the expenses; the Profit Centers amounts will be shown in negative (in red) like the revenue;

For more information please vist the Sections logic page

Related document: Enhanced Balance Sheet with groups

The Sections logic

The sections different encoding entered in the Section column determines how the printout will come out.

Each section is printed as a separate table.

The directories

- * Title 1 creates a level 1 directory.

It can contain level 2 sections or directories.

It is useful to group sections that need to be printed together, such as the Balance sheet, which contains Assets and Liabilities. - ** Title 2 creates a level 2 directory.

The Base sections

The section number or code determines:

- how the amounts are printed; the amounts can be visualized just like in the Balance sheet or inverted.

If the Credit amounts (in negative) are inverted, they will be visualized in positive, and the positive amounts will be visualized in negative. - which amount columns will be used; the Balance column or the Period Movement column are used.

The Balance column indicates the account balance at a specific date (balance at Jun 30th).

The Total Period Movement column indicates the movement amount on the indicated period.

It is used for the Profit and Loss Statement and indicates the costs or the revenues for a certain period.

Here is the explanation of the different sections

- 1 Assets (amounts as in the accounting plan, balance column)

- 2 Liabilities (inverted amounts, balance column)

- 3 Costs (amounts as in the accounting plan, total movement column)

- 4 Revenues (inverted amounts, total movement column)

This section can be also used alone and it can include both costs and revenues (in case of a Profit & Loss Statement that starts with the total Business result and that subtracts the costs). In this case revenues would be displayed in positive and costs in negative.

These sections must be unique. Therefore there can only be one 1 Assets, or one 2 Liabilities section. For other sections, like clients/suppliers register or cost center similar sections can be used.

Derivatives Sections

Those are Sections that are similar to the Base Sections

- 01 Similar to Assets (amounts as in the accounting plan, balance column)

It is used for the clients register. - 02 Similar to Liabilities (inverted amounts, balance column)

It is used for the suppliers register. - 03 Similar to Costs (amounts as in the accounting plan, total movement column)

It is used for Cost Centers. - 04 Similar to Revenues (inverted amounts, total movement column)

It is used for Profit Centers.

Other Sections

There are other kinds of sections

- # Indicates a Notes Section (it prints only the Description column)

It is used for the Balance sheet attachments - #X Hidden Section. This section is not included in the sections selection and it is not printed.

It is used to indicate parts not to be printed.

Column width in printout

The columns width is automatically set by the program.

Sections 1, 2, 01, 02 have the same column width

Sections 3, 4, 03, 04 have the same column width.

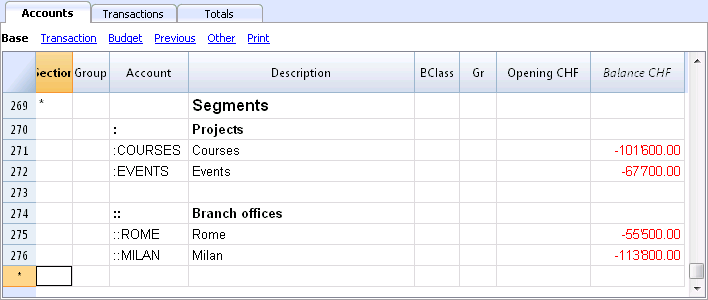

Segments

Introduction

Segments are being used to have a more detailed classification of the costs, also to obtain calculations of components or departments of the company. By using the segments you can obtain a Profit & Loss Statement per unit, department or branch, without having to create specific accounts for each unit.

For example a museum can use the segments in order to know the income, the personnel expenses or the setting up expenses for each exhibit.

Segments are being used when a systematic attribution is necessary, that follows the transaction in debit or credit.

Cost centers, on the contrary, are normally being used for additional cataloging, less structured and when the account sign is not necessarily being followed.

Cost centers and segements can be used at the same time.

Characteristics of the segments

- Segments are accounts preceded by a colon ":".

- Segments codes can consist of numbers or letters.

- There may be up to 10 levels of segments.

- The number of colons preceding the symbol for the segment indicates the number of level.

- :LU segment of level 1

- ::P1 segment of level 2

- :::10 segment of level 3

- For each level there may be an illimited number of segments.

- The different levels of the segment are independent of each other.

- The segments do not have BClasses and do not have a currency symbol

- The calculations for segments are done in basic currency.

- In the transactions, the segment follows the debit and credit account.

It is not possible to record on a segment without having an account. - In the transactions, one can use a "-" as a separator instead of a ":" if on the File properties (Basic data) of the File menu the option Use the minus sign (-) as segments separator has been activated.

- Account cards of the transactions on single segments can be obtained.

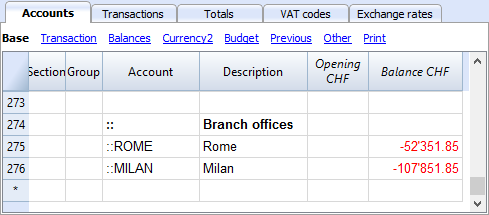

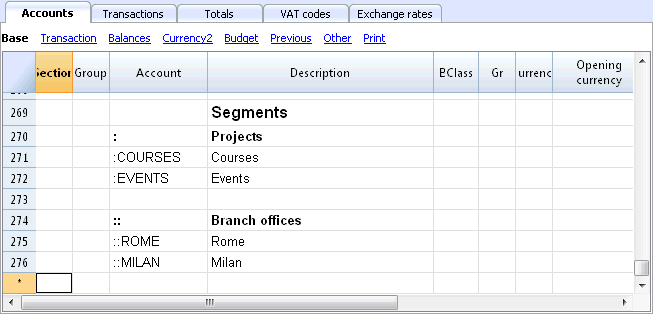

Setting up segments

The segments have to be configured in the Accounts table, Account column, at the end of the chart of accounts.

- Insert an asterisk in the Section column in order to define the section relative to the segments

- In the Description column enter the Segments title

- Enter the description of the first-level segments, and in the Account column, insert ":"

- List the segments of the first level, entering an identification code for each one of them in the Account column, preceded by ":"

- Proceed by entering the segments of the second level (and, if necessary, those of the third), in the same way as those of the first level, with the only difference that the segment codes need to be preceded by "::" or by ":::", depending on their level.

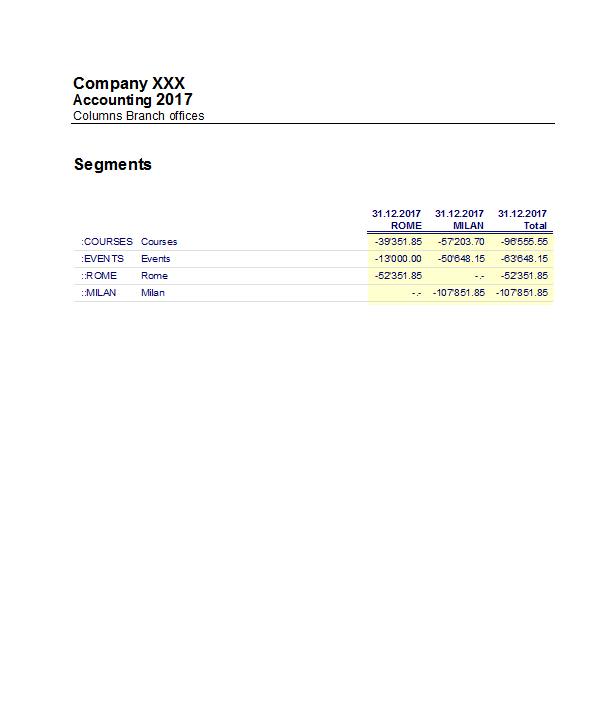

Segment balance

The segment is a subdivision of what has been entered on an account. The segment amount is thus always relative to an account, and in order to have the segment total, you need to use an Accounting report (from the Account1 menu), with a subdivision by segment (Subdivision tab).

In the chart of accounts the segment balance is indicated. This balance will be zero if the segment is used in both Debit and Credit accounts, since the amounts compensate themselves). The segment balance will be visible only when using it with the Credit or the Debit account, associated with the Profit and Loss statement account.

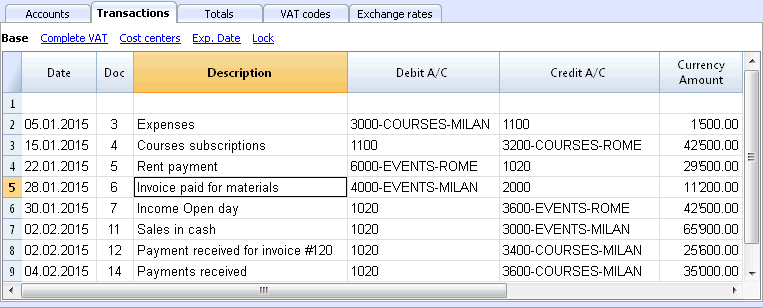

Transactions

The segments are being entered in the Transactions table, followed by the main account from the account segment.

Each segment is preceded by the colon, or by the minus sign (-), in case the option Use the minus sign (-) as segments separator has been activated in the File and Accounting properties (File menu).

If the chart of accounts contains accounts with "-" or "_", as for example in the clients/suppliers register's accounts), you can't use the same symbols as segments separators; in this case you need to deactivate the corresponding option and use the ":" symbol.

When a segment that belongs to more than one level is being recorded, the segment of the first level needs to be entered right after the main account; then, continue with the code of the second level.

Report

Reports of the segments are obtained with:

- Enhanced balance sheet with groups

- Accounting report.

- Account card

- Multi-level report

In order to obtain reports that combine accounts and segments (for example, all the expenses of the LU Branch for P1), the features of the Banana applications need to be used.

Report subdivision by level

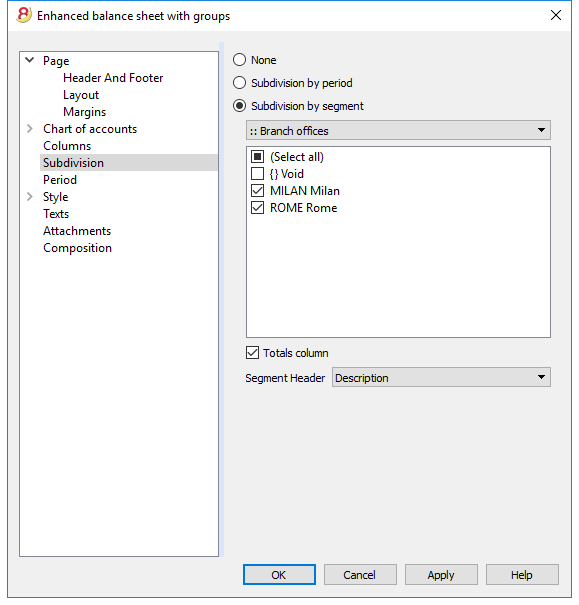

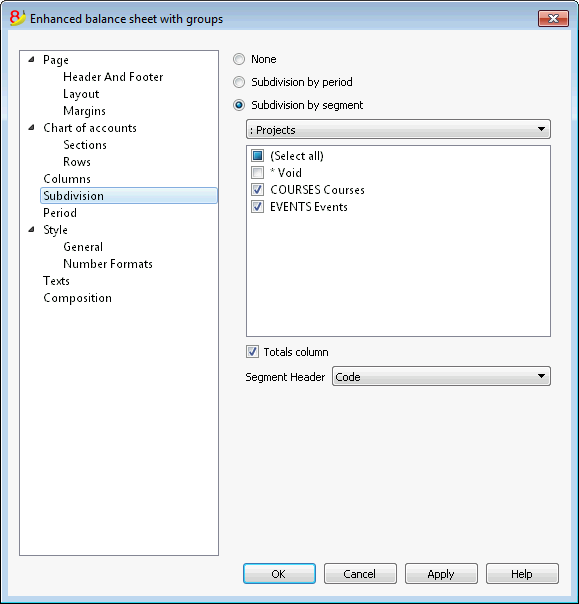

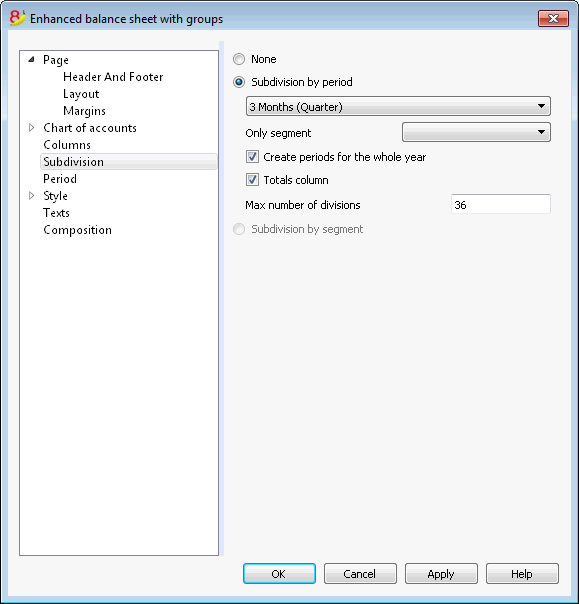

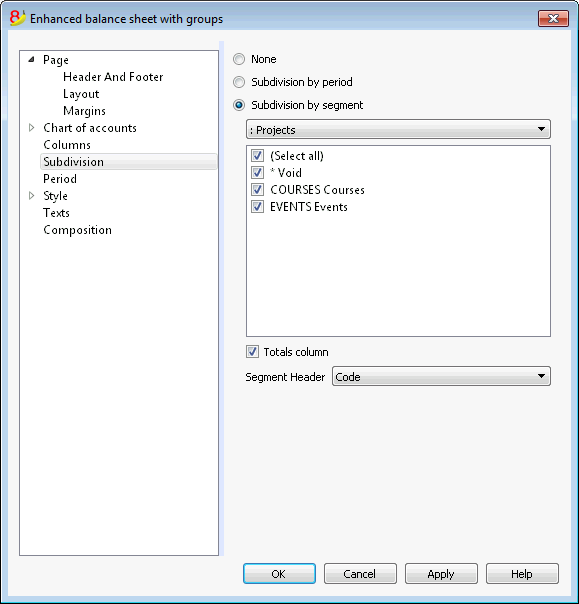

In the Enhanced Balance Sheet with groups, in the Subdivision tab, indicate the segment level to be used.

Summary Report

This is a summary with the segment that have been setup in the Accounting plan section, with a possible subdivsion (if desired) by period or by segment.

Segment non assigned

The "empy" segment gathers all the amounts that have been recorded without specifying a segment. It is possible to setup the title for this segment in the Accounts table. Please also select the Segment heather: Description option in the Subdivision section.

Related document: Managing different projects

Managing different projects

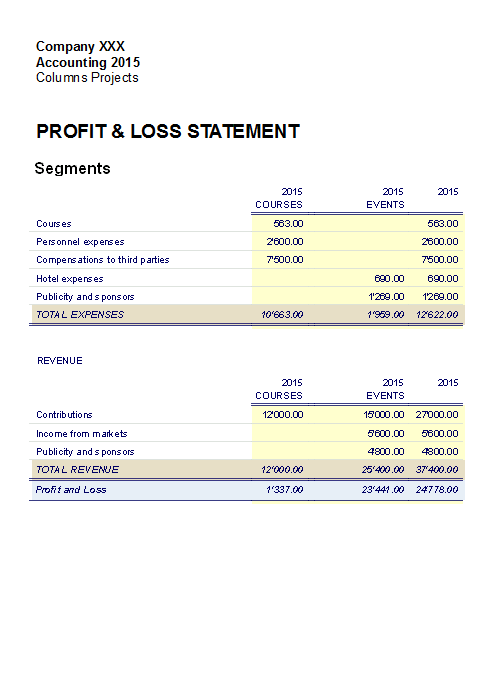

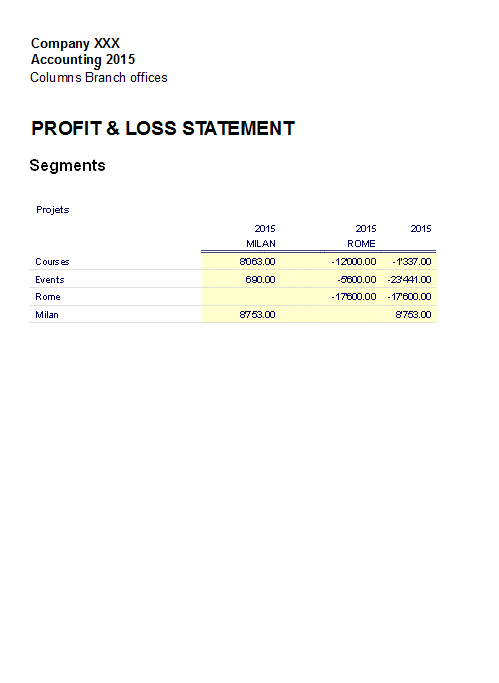

With the Segments feature, it is possible to manage different projects, obtaining balance sheets that determine the profit or the loss of each project.

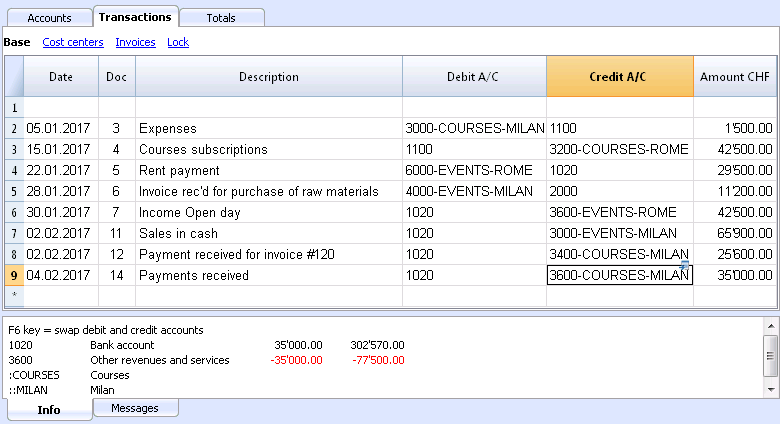

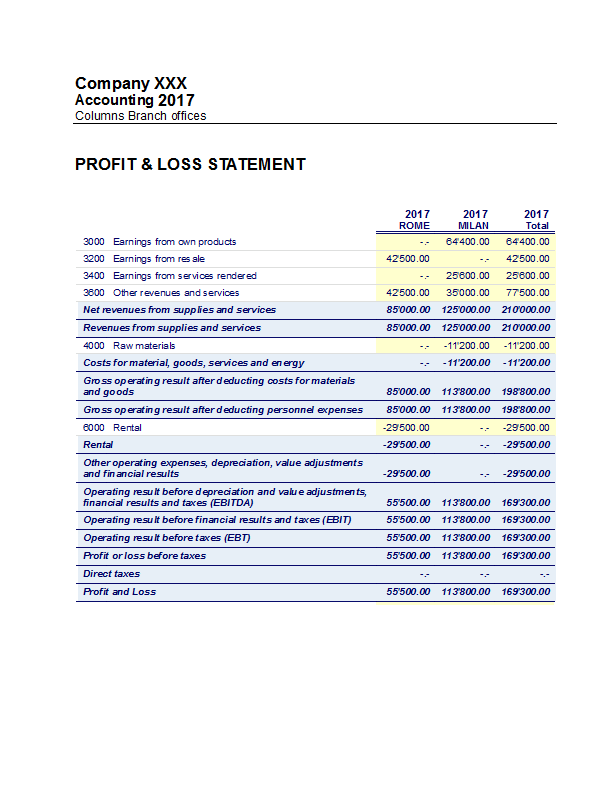

Example

In an association, there are two projects that need to be managed:

- Courses

- Events

On top of that, there are different branch offices with the same projects to be managed:

- Rome

- Milan

The user wishes to obtain a balance sheet which indicates the profit or the loss of each project and branch office.

How to proceed:

- Insert the segments at the end of the chart of accounts

- Enter the transactions, and complete the debit and the credit accounts with the segments

- From the Account1 menu, activate the Enhanced balance sheet with groups command

- Select the available configurations in the different tabs; in the Sections tab in particular, deactivate the display of the Balance sheet accounts, the Client/Suppliers accounts and the Cost centers. The segments usually refer to the accounts of the Profit & Loss statement.

- In the Subdivision tab, activate the Subdivision by segment option

- Select the segment for which the balance sheet should be obtained (by project or by branch office)

- Click on the OK button in order to display the report

Report by projects

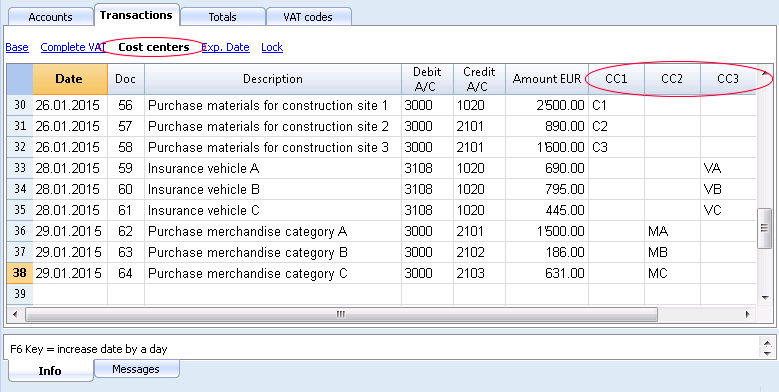

Cost and Profit Centers

The Cost and Profit centers (hereunder being indicated as Cost centers) allow the user to catalog the transactions according to different criteria than the usual accounts.

Characteristics of Cost centers

- The Cost and Profit centers (CC) are accounts, preceded by the ".", "," and ";" signs

- There are three cost center levels:

- CC1 preceded by a period "."

- CC2 preceded by a comma ","

- CC3 preceded by a semicolon ";"

- Each level is independant of the other

- For each level, there can be an unlimited number of cost centers.

- A superior level can be used without using an inferior

- Cost center codes can be alphabetic or numeric

- Cost centers can have there own grouping, different than those of normal accounts. For the same level of cost centers, subgroups can be created. Be careful to not mix cost centers groups with other groups of a different level or with normal accounts or segments.

- Each cost and profit center has its own account card, complete with transactions and balance

- Recording on the cost center is independant of the account recorded in debit or credit. One can even record on a cost center without any account in the debit and credit column.

When to use cost centers

Cost centers are usually being used to catalog certain expenses to specific activities, that are not necessarily linked between each other.

- Projects, Events, Construction sites

- Clients and suppliers, Members, Sales agents

- Extra details for certain expenses

The segments, on the contrary, follow the debit and credit accounts, and are being used as further subdivisions for expenses and revenue.

It is possible to use cost centers and segments together at the same time.

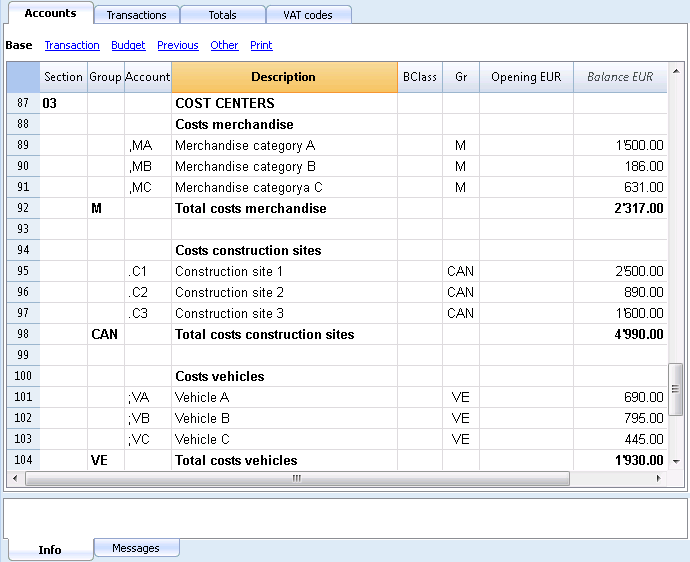

Setting up cost centers in the Accounts table

Attention: If you work with a cash book, the cost and profit centers must be set up in the Categories table!

- Create a specific section for the cost centers.

This setup will be necessary for the presentation of the cost centers in the Enhanced Balance Sheet by groups.- Enter a section with an asterisk * for a section change

- In the next row, enter 03 (or 04 for a profit center).

- Add some empty rows for the cost center

- In the Group column, enter the group to which the cost center account belongs

- In the Account column, enter the cost center account precededs by a full stop "." for those to be registered in CC1 column (Transactions table), a comma "," for those to be registered in CC2 column and a semicolon ";" for the ones to be registered in the CC3 column.

- In the Gr column, indicate the group in which the amounts have to be totalized.

- In a Multi-currency accounting, the account currency is also specified.

- Add the cost center groups

- In one and the same group, totalize only one specific level.

- As for normal accounts, different levels can be created.

File Properties (VAT amount)

In the File and accounting properties command, in the VAT tab you can set the amount of cost centers with the following options:

- Use transaction amount - The amount of the cost center is registered according the registration amount

- Use amount excluding VAT - The amount of the cost center is registered net of VAT.

- Use amount including VAT - The amount of the cost center is registered inclusing the VAT.

Transactions

In order to register on the cost centers, it is assumed that the cost center accounts have already been entered into the Chart os accounts.

To proceed with the recordings, you need to be in the Transactions table, in the Cost centers view; in the CC1, CC2, CC3 columns, you need to enter the cost center account without the punctuation that precedes it.

- To record on the cost center in credit, the cost center needs to be entered preceded by the minus sign (-).

- For the Income & Expense accounting, in the File and accounting properties, you can define for the cost centers to follow the sign of the category.

- In order to record a global amount on more than one cost center of the same level, a different row needs to be created for each different cost center.

Cost center account card

The cost center is treated as any other account, so each cost center has its own account card with account balance and account transactions.

In order to view all cost center account cards, click on the command Account/Category cards in the Account1, and then on the Cost centers button (Filter option).

Related documents:

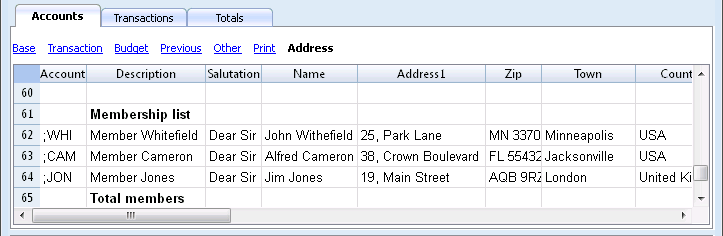

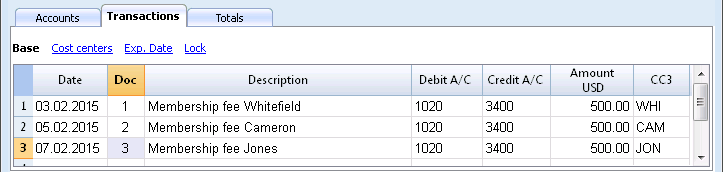

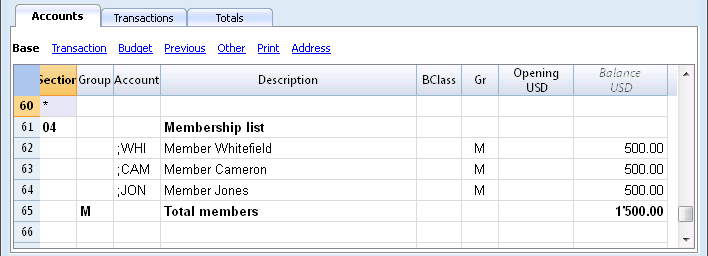

Membership list

In order to obtain the membership list with all the data that are useful for an association, the user needs to proceed as follows:

- In the Accounts table, at the end of the Chart of Accounts, the membership list can be created by using the CC3 cost center column.

- Activate the Address view, selecting from the Tools menu, the Add new functionalities command

- In the window that appears, confirm the option Add addresses columns in Accounts table

- Insert the data of the members

- For a print-out: select the rows that need to be printed and activate the printing option only Selection.

In order to record the transfers from every member in the Transactions table, insert the CC3 account for each member, using the CC3 column. In order to display the CC3 column, click on the Columns setup command of the Data menu; double click on CC3 and activate Visible check box.

In the Accounts table, the balance of the member's transactions is shown.

To see all of a member's transactions, double-click on the CC3 account number.

Related document: Cost and Profit centers

Add / Rename

Adding a new account or category

- Position yourself in the row above the one where you want to add the new account

- Add a new empty row with the command Add rows from the Edit menu

- In the columns, insert the account number, the description, the BClass (1 for the Assets, 2 for the Liabilities, 3 for the Expenses and 4 for the Revenue), and the Gr which needs to be the same as the one inserted for the accounts belonging to the same Group.

Note: If you first enter a transaction with a non existing account and later you create the new account in the accounting plan, you will first get an error message, that will go away only if you recheck the accounting with the Shift + F9 key, or the Recheck accounting command from the Account1 menu.

Adding a new group

- Position yourself in the row above the one where you want to add the new group

- Add a new empty row with the command Add rows from the Edit menu

- In the columns, insert the group number, the description and the Gr which needs to be the same as the group you wish this group to be totalized.

Renaming an account or a group

- Position yourself in the Account or Group column in the Accounts table, or in the Category column of the Categories table (or in the VAT code column in the VAT codes table)

- Choose the Rename command from the Data menu

- Enter the new account, group, category or code number

The program will automatically update the Transactions table with the new number or code.

Deleting an account or a group

- Position yourself on the row number that contains the account that is to be deleted

- From the Edit menu, click on the Delete rows command

- Enter the number of rows that you wish to delete

After deleting an account, a category or a group it is necessary to use the Recheck accounting command from the Account1 menu. The program will give you a warning message if the deleted account, category or group was used in the Transactions table.

Opening balances

Avoid mistakes with Banana Accounting Plus

In order to facilitate checking your accounting work and to immediately find differences, in Banana Accounting Plus, our new version, we added the Balance column in the Transaction table. You can now see potential differences on each row and you can correct them right away. It is a very useful feature when closing the accounting period.

Many of our clients have already tried it and are enthusiastic about it. We advise you to switch now to Banana Accounting Plus and take advantage of the many new features.

Opening balances

When using Banana Accounting for the first time, the opening balances need to be inserted manually in order to create the opening balance sheet.

After having set up the Chart of Accounts, proceed as follows:

- Place yourself in the Accounts table, Base view, Opening column.

- Manually enter the opening balances of the Assets and Liabilities accounts. The Liabilities are entered preceded by the minus (-) sign.

- Check if the total Assets equals the total Liabilities so that your accounting balances. If there are differences in the opening balances you need to check and correct them.

In order to automatically transfer the opening balances for the next year, consult the lesson Create New Year

Transactions

Avoid mistakes with Banana Accounting Plus

In order to facilitate checking your accounting work and to immediately find differences, in Banana Accounting Plus, our new version, we added the Balance column in the Transaction table. You can now see potential differences on each row and you can correct them right away. It is a very useful feature when closing the accounting period.

Many of our clients have already tried it and are enthusiastic about it. We advise you to switch now to Banana Accounting Plus and take advantage of the many new features.

Entering Transactions

Transactions must be entered in the Transactions table.

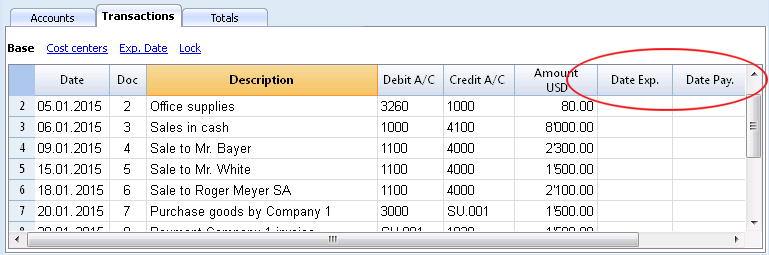

The columns of the Transactions table

The columns listed hereunder and preceded by an * are usually not visible.

In order to make them visible, use the Columns setup command from the Data menu.

Date

The date the program uses to attribute the transaction to a certain time frame. The date should be within the limits of the accounting period defined in the Basic data of the accounting. In the Options tab, one can indicate whether the transaction date is required, if not this value can also be left empty.

If there are locked transactions, the program gives an error message when an equal or earlier date than the one of the lock is being entered.

*Date Document

The date of the document can be entered, for example the date of issue for an invoice.

*Date Value

The value date of the bank operation can be indicated. This value is being imported from an electronic bank statement.

Document

The number of the voucher that serves as a base for the accounting transaction. When entering transactions, it is advisable to indicate a progressive number on the document, so that the accounting document can be easily traced from the transaction.

The autocomplete feature proposes progressive values as well as transaction codes that have been defined earlier in the Recurring transactions table.

The program proposes the next document number, that can be resumed with the F6 key.

-

In case of a numeric numbering, the program simply increases the highest value found in the Doc column.

- Alphanumeric numbering: the program increases the final numeric part; this is useful when one would like to keep a separate numbering for cash and bank movements.

If earlier Doc number C-01 has been entered, and one starts to type C, the program proposes C-02.

If earlier Doc number B104 has been entered, and one starts to type B, the program proposes B-105.

If earlier Doc number D10-04 has been entered, and one starts to type D, the program proposes D10-05.

In the recurring transactions you can setup transactions groups that can be reloaded with a single code.

In order to add a large number of document numbers, you can also use Excel. You can create in Excel the desired quantity of document numbers and then copy and paste it into Banana, in the bcolumn of the Transactions Table.

*Document Protocol

An extra column in case an alternative numbering for the transactions or for the document is needed.

The autocomplete feature proposes progressive values that function in the same way as the ones in the Document column.

*Document Type

Contains a code that the program uses to identify a type of transaction. If you prefer to use your own codes, it is advisable to add a new column.

- 01 In the reports, this transaction is considered an opening transaction, so it doesn't show in the period but in the opening balances.

- from 10 to 19: codes for customers' invoices

- from 20 to 29: codes for suppliers' invoices

- from 30 to 1000: codes reserved for future purposes.

*Document Invoice

A number of an issued or paid invoice that will be used together with the invoice control feature for customers/suppliers

*Document Original

The reference number present on a document, to enter, for example, the number of a credit note.

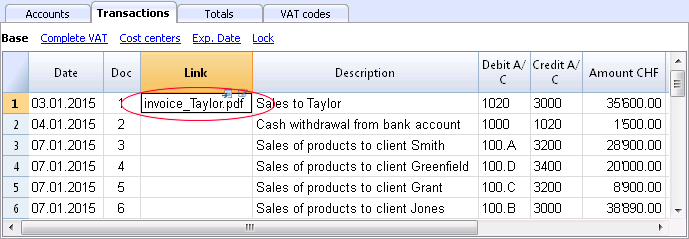

*Link to external file

Serves to enter a link to an external file, usually the accounting voucher.

Pressing on the little arrow on the upper part of the cell, the program opens the document.

*External reference

Any reference number all ocated by a program that generated this operation. This value can be used to check whether a given task is imported twice.

Description

The text of the transaction.

The autocomplete feature proposes the text of an already entered transaction, or of one that has been entered in the preceding year when the appropriate option has been activated. When pressing the F6 key, the program retrieves the data of the preceding row with the same description and completes the columns of the active row.

In case the description begins with #CheckBalance, the transaction is being considered as one that serves to checkup the balance.

Please consult our page Check accounting for more information on the subject.

*Notes

Useful to add notes to the transaction.

Debit Account

The account that will be charged.

It is possible to also enter a segment in the Debit account column. These are usually separated by a ":" or a "-".

In the accounts list, pressing the key with the segment separator symbol, one goes immediately to the next segment.

If instead the Enter key is being pressed, the input finishes and one moves to the next column.

The autocomplete feature proposes the accounts and segments. One can also enter a search text and the program shows all the accounts that contain that text in one of the columns.

*Debit Account Description

The description of the entered account retrieved from the Chart of accounts.

Credit Account

The account that will be credited. We refer to the explanation under Debit account for the rest of the information.

*Credit Account Description

The description of the entered account retrieved from the Chart of accounts.

Amount

The amount that will be entered unto the debit- and credit account.

VAT columns

Information on the VAT columns can be found att the VAT columns in the Transactions table page

CC1

The Cost center account preceded by "."

*CC1 Description

The description of the Cost center, retrieved from the Chart of accounts.

CC2

The Cost center account preceded by ","

*CC2 Description

The description of the Cost center, retrieved from the Chart of accounts.

CC3

The Cost center account preceded by ";"

*CC3 Description

The description of the Cost center, retrieved from the Chart of accounts.

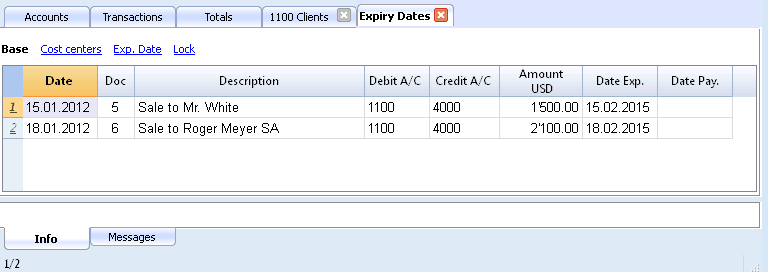

*Expiry date

The date before which the invoice has to be paid.

*Payment date

Used in combination with the Show Expiry dates command.

When instead using the invoices customers/suppliers control feature in order to check on the payments, a transaction has to be entered for an issued invoice and another one for the payment thereof.

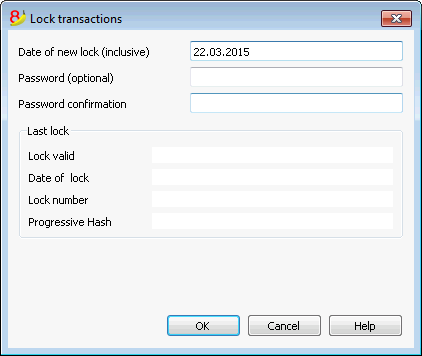

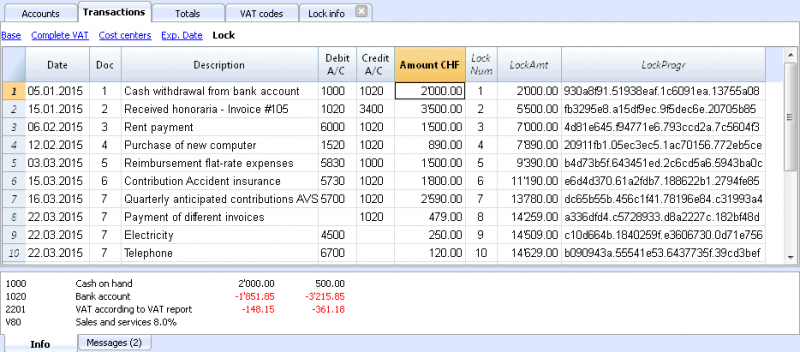

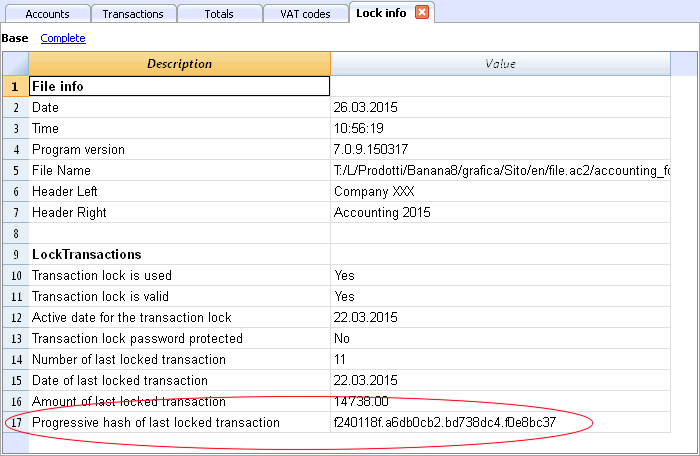

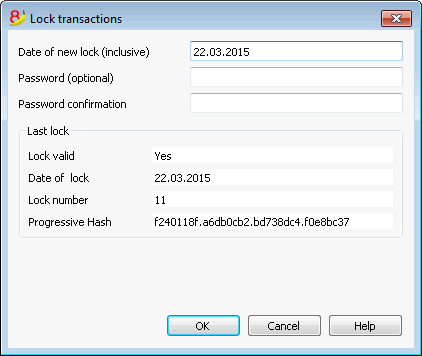

*Lock Number, Lock Amount, Lock Progressive, Lock Line

More information at the Lock Transactions page.

Adding new columns

With the Columns setup command, it is possible to display, hide or move the order of columns, add new ones, or indicate that a column should not be included in the printout.

- The added columns in the Transactions table will be added also in the Recurring transactions table, in the Account card and in the VAT report, without being made visible.

In order to display these columns in the other tables, use the Columns setup command. - If a column of the "amount" type is being added, the entered amounts will be added up in the Account card.

Views

When a new accounting is being created, the following views are being automatically created as well:

- Base: the main columns are being displayed

- Cost centers: the CC1, CC2 and CC3 columns are being displayed

- Expiry dates: the columns Expiry date and Payment date are being displayed

- Lock: the columns relative to the Lock function are being displayed.

With the Views setup command, the views can be customized and personal, added views can be created.

With the Page setup command, you can modify the print mode of the view.

Info window

In the Information window at the bottom part of the screen, error messages and extra information about the used accounts and VAT codes are being displayed.

For the accounts, the Account number, the Description, the Amount of the transaction (debit or credit) and the Current balance of the account is being indicated.

Transaction types

Avoid mistakes with Banana Accounting Plus

In order to facilitate checking your accounting work and to immediately find differences, in Banana Accounting Plus, our new version, we added the Balance column in the Transaction table. You can now see potential differences on each row and you can correct them right away. It is a very useful feature when closing the accounting period.

Many of our clients have already tried it and are enthusiastic about it. We advise you to switch now to Banana Accounting Plus and take advantage of the many new features.

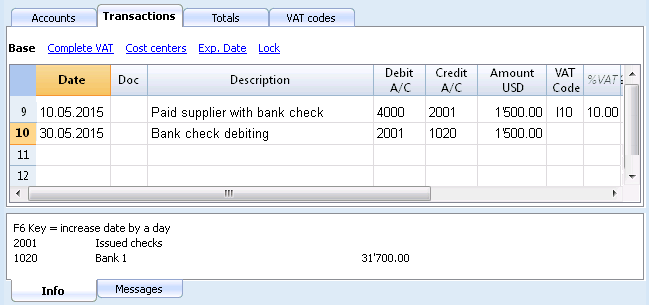

Simple transactions

Simple transactions are the ones regarding two accounts (one Debit account and one Credit account) and entered in one single row. Each transaction has its own document number.

Composed transactions

Composed transactions with more than two accounts involved, have to be entered on several rows. The user should enter one account per row. The counterpart account for the entire transaction has to be entered on the first row.

The document number, entered on the different rows, is the same because we are dealing with one and the same transaction.

Note:

In composed transactions, the dates of the transaction rows should be the same, otherwise, when doing calculations by period, there may be differences in the accounting.

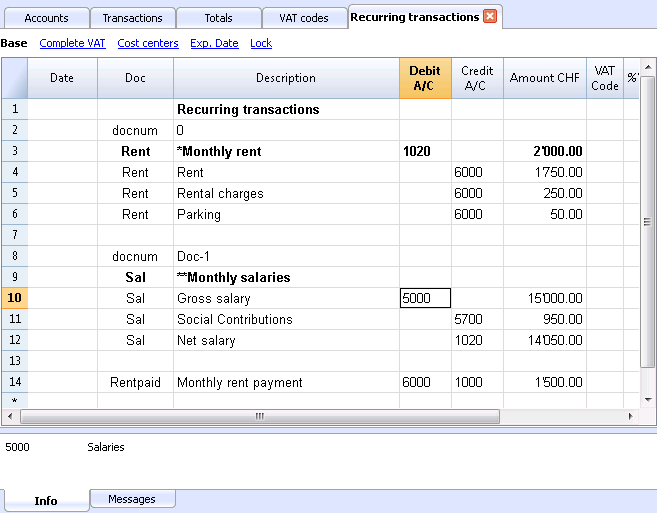

Recurring Transactions

Recurring Transactions table

In order to avoid rewriting always the same texts, it is possible to store transaction groups in the Recurring transactions table (Account2 menu). These groups are identified with a code and can be retrieved and entered into the Transactions table just by entering the corresponding code.

When positioned on the Doc column of the Transactions table, the program proposes the list of the recurring transactions, grouped bycode. If one of these codes is selected:

- the program enters the recurring rows that have the same code

- the program completes the entered rows with the date and other values that have been entered earlier

- the program enters the progressif number in the Doc column (based on earlier entered values)

Entering recurring transactions

- You need to enter into the Recurring transactions table (or copy from the Transactions table) the transaction rows that should be retrieved regurlarly.

- Enter the code related to the recurring transactions group into the Doc column.

Rows with the same group code will be retrieved together (transaction on multiple rows).

- Progressive numbering of documents "docnum"

If, when retrieving recurring transactions, you wish to have a Doc number different from the automatic one, you need to create a row containing the code "docnum" in the Doc column, and your desired text in the Description column. For the following rows, the text specified in the Description column, will be applied in the Doc column when retrieving the transactions- "0" when no automatic numberting is desired

- "1" progressive numbering

- "cash-1" progressive numbering with the prefix "cash-" (cash-2, cash-3)