VAT Management in Banana Accounting+

Banana Accounting Plus simplifies VAT management by automating the calculation, recording, and submission of VAT returns to tax authorities. Cutting-edge features reduce manual errors, ensuring tax compliance. Banana Accounting Plus simplifies VAT management by automating the calculation, recording, and submission of declarations to tax authorities. Cutting-edge features reduce manual errors, ensuring tax compliance. Pre-set templates with VAT options and pre-configured codes are available for all accounting applications,

For Switzerland, the new 2024 VAT rates are already available. The new VAT extension for submitting returns digitally is available.

- Swiss VAT management

- ▶ Video: Swiss VAT return (in French, German, Italian)

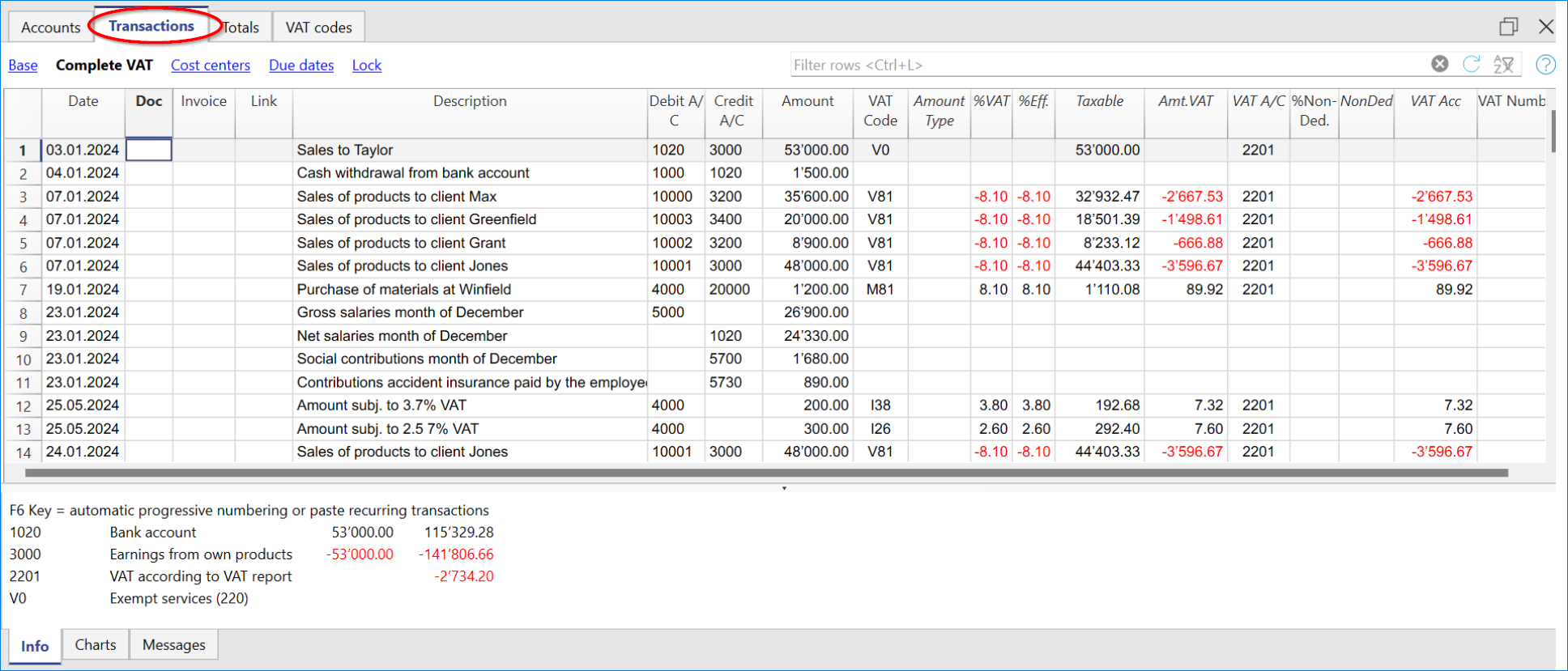

Recording transactions with VAT

With Banana Accounting, VAT management is very simple because it is completely automated. Transactions with VAT are recorded in the Transactions table, the main hub of all accounting, by entering for each VAT transaction the corresponding VAT code, referring to the sale or purchase, according to the rates in force.

Several pre-set columns are available, the display of which can be customised.

In addition, the programme offers:

- Accounting with different VAT rates in the same transaction

- Add the invoice in PDF in the link column.

In the Transactions table there are specific VAT Columns for various VAT-related information.

To record a transaction with VAT, enter the following data:

- The date of the transaction.

- The invoice number.

- In the Link column, you can enter the digital link to the Pdf accounting document.

- The Debit and Credit Account where you can indicate the account and the contra-account

- The amount.

- The VAT code relating to the purchase or sale (codes found in the VAT Codes table).

For each transaction, the programme performs the following automatisms:

- Accurately records the VAT paid on purchases and the VAT received on sales.

- Automatically calculates the VAT amount.

- Breaks down the VAT amount from the cost or revenue.

- Retreives the VAT amount, taxable amount and VAT amount on the VAT accounts.

Predefined VAT accounts and settings

In the Banana Accounting Plus VAT models, the VAT accounts are already set up in the Accounts table. In the passive accounts, there are the automatic VAT split account and the VAT due account (or VAT receivable account).

To speed up VAT transactions, it is possible to set the VAT code to each account that has VAT transactions in the Accounts table. This setting allows you to automate the entry of the VAT code when you enter the account in the Accounts table.

More details can be found on the page Match the VAT code to account.

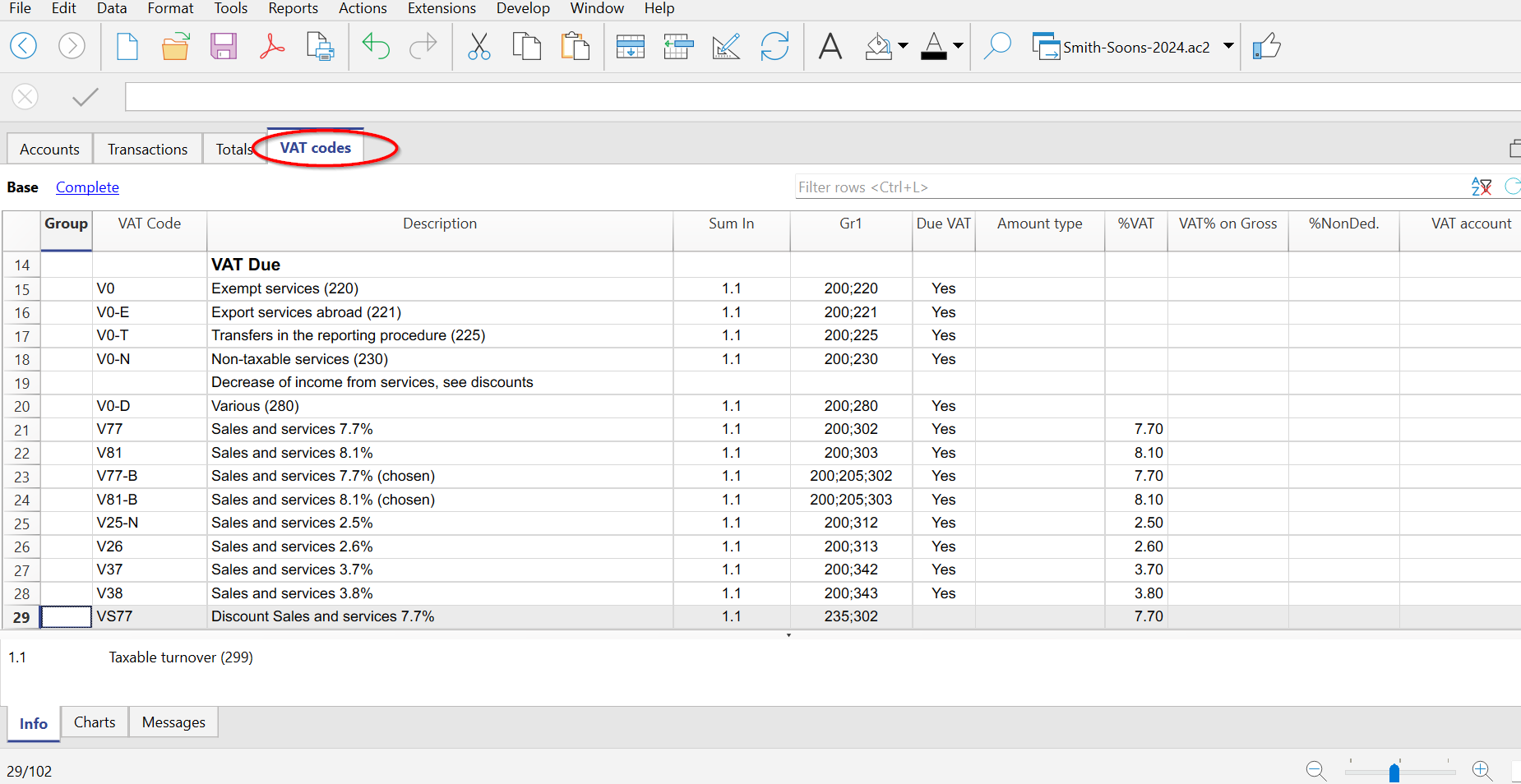

VAT Codes Table

The VAT Codes table defines the VAT codes for the rates in force and other parameters for calculating VAT.

- There are columns in which to set VAT codes for calculating VAT gross, net or by VAT amount only.

- There are both VAT codes for the effective method and for the flat rate method

- Swiss templates have the VAT Codes table already set up:

- with the VAT codes relating to the rates in force

- for each VAT code, in the GR1 column, the reference figure is set, which will allow the VAT data to be reported in the VAT reporting template and also in the Xml file to be transmitted to the Federal Tax Administration (FTA).

- For each country, there are files with the VAT codes already set according to the national reporting requirements.

Automated VAT reports and returns

The programme automatically generates various reports with very detailed summaries by VAT code, account, percentages, records and period. VAT summaries can be customised by displaying columns specific to the data you wish to obtain. VAT summaries are useful for understanding the movement of VAT (VAT due, recoverable and payable) and allow effective control and in the event of audits by tax authorities, targeted details are available to facilitate audit work.

More information is available on the VAT Report page.

The VAT functionalities of Banana Accounting Plus offer several advantages:

- Efficiency

You avoid preparing calculations and statements manually, saving time and effort - Accurate calculations and statements

Errors are avoided because calculations are performed automatically and accurately by the programme on the basis of the data recorded by the system. - Compliance with current regulations

The programme is updated according to current rates. Simply update the VAT Codes table and the calculations and statements are performed correctly and in a manner consistent with the regulations. - National VAT Reports Extensions

These are additional modules, different per country, that print or export VAT data in the format required by the tax authorities. Please refer to the national VAT documentation - Archiving of VAT printouts

All printouts with VAT data can be saved in pdf or other formats and archived. Archiving allows the data to be available at all times in case of tax audits.

Calculation methods

Banana Accounting is a powerful calculation tool and in VAT management, too, you can take advantage of its potential to always have accurate and correct VAT calculations and reports.

There are two calculation methods:

- Effective Method - calculations and accounting of VAT using the cash principle and on turnover

- Flat tax rate Method - Calculations and accounting of VAT upon the VAT rates granted by fiscal authorities

Accounting methods

- Turnover

Demands the for the keeping of a customer and supplier ledger.

Costs and revenues, with the corresponding VAT code, are recorded when the invoice is issued and received.

More information can be found on the page How to manage VAT on turnover.

- Cash principle/ Collection

It is not compulsory to keep a customer and supplier ledger, but if you still wish to have one, it is important to set it up with cost centres.

Costs and revenues, with the corresponding VAT code, are recorded when collected or paid.

More information can be found on the page Clients and Suppliers with VAT using the Cash principle

Features currently unavailable

These features are not available at the moment:

- In multi-currency accounting, the account to which VAT is recorded net (usually Revenue and Expense accounts) must be in base currency.

It is not possible to deduct VAT from accounts that are not in base currency. - The VAT amount is calculated by the programme and recalculated when the Recalculate accounting is done. This gives the auditor or others who check the accounts the certainty that the calculations are always made with the same logic.

For VAT rounding, it is not possible to enter a different VAT amount than the one calculated by the programme. Generally, these are VAT amounts that have been rounded on the invoice, even by a few cents.

Insights

VAT documentation specific to Switzerland, Italy and other countries.

In the section of each country you will find the most specific documentation on VAT.

English not being an official language, you will be redirected to the relevant pages in official languages for Switzerland.

- VAT management for Swizerland

Information pages specific to Switzerland:- Swiss VAT codes table.

- How to register VAT.

- Prepare the VAT return.

- Use the Swiss VAT Extension.

- VAT management for Italy

- Information pages specific to Italy:

- Italian VAT codes table.

- How to register VAT.

- Prepare the VAT return.

- Use the Italian VAT Extension.

Extensions for national VAT reports

For some countries there are Extensions that can be easily installed and allow you to print or export the VAT report in the format required by the authorities.

Each country's VAT extensions work in conjunction with the country's VAT Codes table.

Theory

VAT (Value-added Tax) is a tax that weighs on the final consumer. Every VAT subject must calculate and periodically deposit the tax to the Revenues Authority.

Every country has its own VAT rates that are established in different percentages depending on the type of merchandise or service. Certain merchandise and services are exempt or excluded.

The percentages vary according to the financial necessity of the country; therefore, there can be changes over the years.

VAT rate

In this document, to make calculations easier, we will use the following rates:

- 10 % normal rate

- 5% reduced rate

- 0% excluded operations or exempt operations

VAT calculation

Net Price x VAT Percentage / 100 = VAT Amount

Example:

Net price 300

Tax rate 10%

VAT amount = 300 x 10 / 100 = 30

Gross price calculation

Net price + VAT Amount = Gross Price

Example:

300 + 30 = 330

Sometimes the gross amount is known and it is necessary to find the net and VAT amounts.

Net price calculation

Gross Price / (100 + VAT rate) x 100 = Net Price

Example:

330 / (100 + 10) x 100 = 300

The net price represents the cost (purchase) or the revenue (sale) of the company

VAT amount calculation

Gross Price - Net Price = VAT Amount

Example:

330 - 300 = 30

or

330 - [330 / (100 + 10) x 100] = 30

The VAT amount represents the debit (sales) or the credit (purchases) towards the Revenues Authority.

VAT rate calculation

VAT Amount / Net Amount x 100 = VAT Rate

Example:

30 / 300 x 100 = 10%

or

[330 - 330 / (100 + 10) x 100]/100 = 10%

Another example:

20 / 400 x 100 = 5%

This way of calculating is used when the rate is not known.

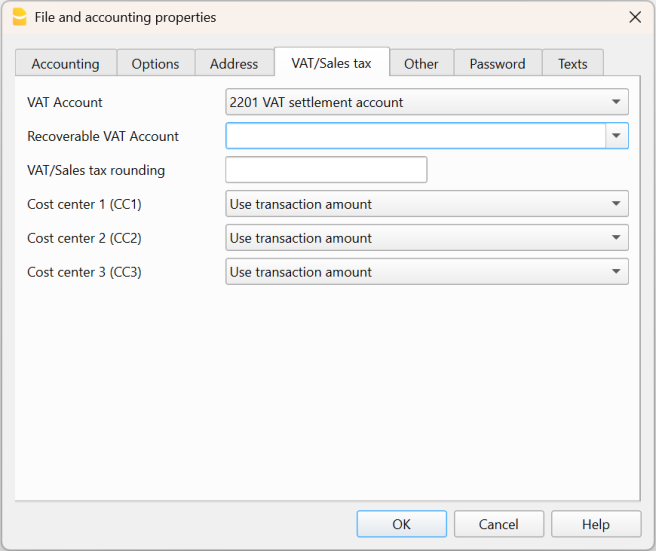

File properties (VAT/Sales tax tab)

This tab will only appear if an accounting template with VAT/Sales tax management is selected.

The VAT section for setting up VAT accounts is accessed via the File menu > File properties (basic data) > VAT/Sales tax tab.

VAT Account

The automatic breakdown VAT account, present in the chart of accounts, is set by default. For Swiss users it corresponds to the VAT according to VAT report. In this case it is not necessary to enter the VAT account in the VAT Code Table.

With the setting of the automatic breakdown VAT account only, all the VAT amounts, both of the sales and of the purchases, flow respectively into the credit and debit of this account and it is not necessary to set up the recoverable VAT account. At the end of the quarter, the balance of the automatic breakdown VAT account is turned over to the VAT payable account (or Inland Revenue VAT account).

Recoverable VAT Account

If the automatic breakdown VAT account is not set up as the only VAT account, the recoverable VAT account is set up. In this case it is not necessary to enter the account in the VAT Codes table.

VAT rounding

It is defined how the VAT amounts must be rounded; for example, if you enter 0.05, the VAT amounts are rounded to multiples of 0.05.

Cost centers 1 (CC1), 2 (CC2), 3 (CC3)

For each type of Cost Center it is possible to choose which amount to use for registration in the cost center:

- Use the transaction amount.

- Use the amount with VAT included

(In the case of cost centers used for customer or supplier accounts) - use the amount without VAT

Setting whether the cost center is used for costs or revenues.

Note

if one of these parameters is changed, the accounting will have to be recalculated.

Related documents:

VAT Codes Table

The settings in the VAT Codes table allow you to define all the parameters necessary to manage the procedures for registering with VAT. The settings concern:

- VAT due or recoverable.

- Transaction amount recorded as net, gross, or VAT amount at 100% (Customs VAT).

- Percentage of applicable VAT rates.

- The account in which VAT is be recorded.

- Special rounding off for each code.

- Grouping and totaling method.

The VAT Codes table has a Base view and a Complete view. The difference between the two is the fact that the Complete view presents several columns that are not available in the Base view.

Calculation method

The parameters indicated in the VAT Codes table are being used to calculate the VAT of the individual transactions.

The parameters established in the VAT Codes table cannot be changed in the transactions. This modality guarantees that the VAT calculations are correct and consistent.

Please note: if the values of a VAT Code, which has already been used in the transactions, are being modified, the changes are not active immediately; in this case it is necessary to use the Actions > Check accounting command.

When modifying the VAT table, the program, as a precaution, displays a message in the Info window inviting for a complete recalculation.

The following Table refers to the codes being used according to the Swiss legislation:

Detailed description of the columns

In the following columns, insert the following data:

- Group: an abbreviation or a number that indicates the group to which the codes belong.

For more information on the grouping system, please refer to the Grouping System page. - VAT Code:

- Normal VAT codes.

The abbreviation to identify and resume the VAT code in the registrations. - Codes preceded by a colon ":" :

They are not VAT codes. They are used in the Transactions table to specify VAT cases in greater detail (ex.: in Reverse charge transactions, two VAT codes are used at the same time, separated by ":", so that the program can calculate the VAT amount payable and receivable).

- Normal VAT codes.

- Description: a text for the description of the VAT Code or the group.

- Disable:

Allows you to disable VAT codes that are not used. Facilitates data entry in the Transactions table.- 1 - the VAT code is not visible in the auto-completion list (Transactions table), but it can still be used;

- 2 - the VAT code is not visible in the auto-complete list and must not be used.

- Sum in: abbreviation or number of the Group in which the row of a code must be totaled.

- Gr1: this column is used for specific groupings.

The screen capture shows the groupings for the encoding of the figures of the Swiss VAT return. - Gr2: code for additional groupings.

- Due VAT:

If the word Yes is being inserted, this means that the VAT is at debit (due to the State)

If the cell is empty, this means that the VAT is at credit (recoverable) - Amount type:

The code indicates how the VAT amount of the transaction is to be understood.- 0 (or empty cell) - with VAT/sales tax (the transaction amount is considered VAT included)

- 1 = without VAT/Sales tax (the transaction amount is considered VAT excluded)

- 2 = VAT amount (the transaction amount is considered the VAT amount, 100%)

The amount type 2 is used in particular to account for customs VAT paid or charged on the shipper's invoice. More details on the recording are available on the page: Entering VAT at customs for import

- % VAT: VAT code percentage.

- % NonDed.: if, for a VAT code, it is not possible to deduct the full 100%, enter the non deductible percentage here (example 100%)

- VAT% on gross: is usually left empty. The word "Yes" has to be inserted only if the VAT percentage has to be applied on the gross amount (VAT included) and not on the taxable amount (e.g. for flat rates).

- VAT account: The account to which the broken down VAT automatically is posted.

In the File and Accounting properties (File menu), a general account, that will be used as the VAT account, can be defined. - Round Min: minimum rounding value.

If left empty, the rounding indicated in the basic accounting data is used. - Don't warn: there are particular entries that the program might interpret as wrong, but which are in fact correct. To prevent the program from reporting error warnings, enter Yes to the code of interest.

Rechecking the accounting file

When the accounting is recalculated and the transactions are not blocked, the program resumes the VAT parameters assigned to each code in the transactions. Therefore, if a setting of a VAT code has been changed, the change is resumed in the respective columns of the transactions which are not editable by the user.

For this reason, when editing the VAT codes table, the program suggests to operate a full accounting recheck.

Adding a new percentage

When a new percentage is added, a new row has to be added; in the new row, insert the data of the new VAT code with the new percentage, while paying attention to insert the correct grouping. Don't change a code that has already been used in the transactions.

VAT codes for services provided abroad

In the VAT Codes table, it is possible to set up, in separate groups, VAT codes for the provision of services provided abroad, with specific rates for the country in which one operates and for which VAT is also due to foreign countries.

The corresponding VAT code is set for each country, which can be totaled in its own group or in a totalization group that refers to the VAT to be paid to foreign countries.

To view the amounts to be paid, go via the Reports > VAT /Sales tax report menu and select the specific code for the country or the totalization group for the VAT to be paid to foreign countries.

For the VAT to be paid in foreign countries, it is not possible to send it electronically.

Own Groupings

By creating groups with multiple totaling levels, the user can obtain the totals that are necessary for the VAT declaration.

In the VAT report, by activating the option Use own grouping scheme, the software calculates the totals exactly as indicated in the sequence of the indicated groupings in the VAT Codes table.

The groupings are being used to obtain totals for groups of transactions, for example, the totals for all exportations or importations.

Related document:

- Import VAT codes

- National VAT documentation

Link to specific VAT documentation for Switzerland, Italy and other countries.

Match the VAT code to the account

In an accounting with VAT, in the Accounts table, it is possible to link a VAT code to the income/expense accounts, so that, when the sales and purchases are being recorded, the program automatically inserts the VAT code and completes the columns with the VAT data while entering the account number.

In order to associate the codes:

- Click on the Other view. In this view, the VAT code column is visible by default.

In case you wish to display the VAT code column in the Base view, click on the Data > Columns setup command. - Insert the VAT codes for the income/expenses in the VAT code column. If the VAT code is inserted within square brackets, for example [V81], the VAT will only appear on issued invoices and will not be separated in the accounting records.

N.B: If the VAT rates have changed (refer to New VAT Rates 2024), the values entered in the VAT Code column must be updated manually.

The same applies to the already entered transactions (in theTransactions table, VAT Code column), which must be replaced manually in each registration row (or using the Replace command to modify them all together).

VAT rounding

The Swiss system for VAT calculation, provides for calculated to the cent, without rounding.

For those who need to have VAT amounts rounded up to cents, the following procedure is followed:

- In the Transactions table, post normally by applying the appropriate VAT code

- On the next row, post the expense or revenue account used in the previous line in debit and credit

- In the amount column, enter the cents to be rounded

- In the VAT Code column, enter a VAT code with amount type 2 (100% VAT amount), for example M81-2

- When the cents are to be decreased, enter the code with the minus sign in front of "-M81-2".

Setting up VAT accounts

What are VAT accounts?

The VAT accounts are accounting sheets where the VAT amounts are automatically posted, based on the VAT code settings in the VAT Codes table.

When a VAT code is used, the program automatically calculates the following data based on the values of the transaction:

- Taxable amount and the VAT amount.

- Taxable amount on the Debit account.

- Amount of the taxable amount on the credit account.

- Amount of the taxable amount on the credit account.

At the bottom of the information window, by moving the mouse over the transaction, you can see which amounts are recorded on the different accounts.

General VAT account (automatic)

If the VAT account is set as default in the File → Properties file → VAT, this is used whenever there is a registration with a VAT code. In this case, the VAT accounts for the various VAT codes must not be set up in the VAT Codes table.

Recoverable and Due VAT Accounts

In the VAT code table, VAT Account column, according to the VAT code (active or passive) you can indicate the recoverable VAT account or the VAT due account. In this case, if these specific accounts are set up in the VAT Codes table, the default VAT account (General VAT account - automatic) must not be set in the File Properties, VAT section.

Using a single VAT account or several VAT accounts?

In accounting, the active part must be separated from the passive part. If the recoverable VAT is offset against that due, only the VAT amount actually due must be shown in the balance sheet.

From an accounting point of view, in most cases, it is not essential, indeed it is better to have only one VAT account.

For reporting purposes, however, it is useful to have the different types of separate VAT transactions. In programs that do not use VAT codes it is necessary to separate each operation on separate accounts. With Banana Accounting, thanks to the VAT codes and the VAT Summary, it is possible to obtain much more meaningful details while also using a single VAT account:

- Movements and totals (taxable VAT, VAT amount, accounted VAT) for each VAT code.

- Movements and totals by VAT percentage.

- Movements and totals by VAT account.

- Movements and totals by amount due and recoverable.

In order to control VAT transactions, it is not necessary to use several separate VAT accounts.

Banana Accounting leaves the choice of using the general account, set up in the File Properties, or different VAT accounts, set up in the VAT Codes table.

Advantages of using a single VAT account

After several years we have seen that the use of a single VAT account is much more intuitive and, for the Swiss charts of accounts we have therefore chosen to use a single VAT account (2201, VAT statement), obviously leaving the possibility to each change the settings.

- Balance sheet and income statement much easier to read (there are not many VAT accounts).

- Possibility of having accounts (for example of revenues) in which to register transactions with different VAT rates.

- You know immediately the VAT due without having to add several accounts together.

- Immediate display of all VAT transactions.

In the VAT account card, all the VAT transactions in Debit and Credit are indicated.

Advantages of using multiple VAT accounts

If you use VAT codes, the registration on a specific VAT account is a repetition of information that you already have with the VAT code and its detailed summary.

In countries like Germany it is customary to have a different VAT account for each type of transaction, so that the VAT return can be made using the balances of the individual VAT account cards.

In these cases, for compatibility with this system, it is useful to have different VAT accounts for each VAT code.

Closing of VAT accounts at the end of the period

At the end of the VAT calculation period, it is useful to close the debit and credit VAT accounts and move the balance to one account. This allows:

- Accounting for the exact amount due to be paid or recovered

- At each new period, the account "2201, VAT return" starts from scratch, making it easier to check for any differences and errors.

For the periodic closure of the account "2201, VAT statement", see the Periodic closure and VAT payment page.

Transactions with VAT

In Banana Accounting, in the Charts of Accounts prepared for Switzerland, the VAT accounts and the VAT rates currently in force are already set. In particular, the 2201 "VAT according to VAT report" account (VAT account with automatic splitting) is set both in the Chart of accounts and in the File properties (basic data) → VAT section. In this case no VAT account needs to be inserted in the VAT Codes Table.

In case you are not using the Charts of accounts already available in Banana, make sure that the necessary VAT accounts are present in your own Chart of accounts. Our advice is to use the 2201 "VAT according to VAT report" account (VAT account with automatic splitting) and to enter it into the File properties (basic data) → VAT section.

In the VAT codes table, there are codes for the sales, the purchases and for services rendered. When entering the transactions, use the appropriate VAT code.

The software automatically splits the VAT amounts and records them in the "VAT according to VAT report" account or in the VAT account that has been indicated by the user in the File and Accounting properties.

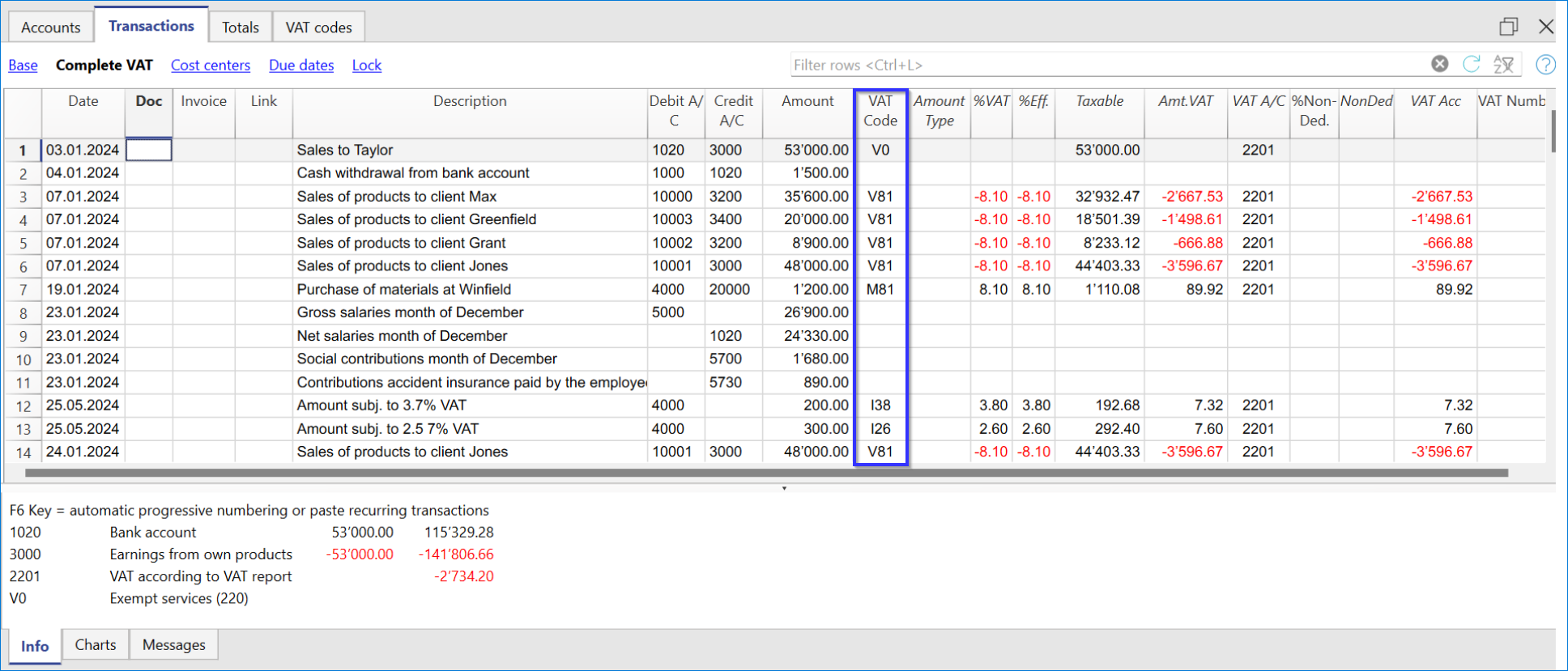

VAT columns in the Transactions table (Complete VAT view)

You can find the full explanation of the main Transactions table columns in the Columns and Views page.

In the Double-entry accounting with VAT or in the Income & Expense accounting with VAT, you will find the following VAT columns:

- VAT Code: for each transaction with VAT you need to enter one of the VAT codes from the VAT codes table. In Reverse Charge operations, two VAT codes can be used, separated by the symbol ":".

- VAT %: the program automatically enters the VAT percentage associated with the VAT code you entered. If the amount is preceded by a "+/-" sign, it is a Reverse Charge operation.

- VATExtraInfo: A code related to extra info about the VAT, to be used only in very exceptional cases.

It is possible to enter a symbol to identify specific VAT cases. The program suggests options, corresponding to the VAT Codes that start with a colon ":". - %Eff.: the program automatically enters the VAT percentage referred to the net amount (taxable amount). It is different from the percentage applied when the latter is calculated on the gross amount (balance rate).

- Taxable: once you enter the VAT code, the software automatically indicates the taxable amount (without VAT).

- VAT amount: the program automatically indicates the VAT amount.

- VAT A/C: the account where the VAT is registered is automatically indicated (for Switzerland, this is normally the 2201 "VAT according to VAT report" account) previously entered in the File Properties (basic data), VAT tab (from the File menu).

- Amount type: this is a code that indicates how the software considers the transaction amount:

- 0 (or empty cell) with VAT/sales tax, the transaction amount is VAT included.

- 1 = without VAT/Sales tax, the transaction amount is VAT excluded.

- 2 = VAT amount, the transaction amount is considered the VAT amount at 100%.

- Amount type not editable: Default mode.

- The column is protected.

- The program uses the associated value of the VAT Codes table.

- When you edit the value in the VAT Codes table and you recalculate the accounting, the program uses the new value associated with this VAT Code.

- Amount type editable: this option can be activated with the Add new functionalities command. The activation of the option cannot be undone.

- When you edit the VAT Code, the program uses the Amount type associated with this code.

- The value can be edited manually.

- When the accounting is being recalculated, the value indicated in the Transactions table is being maintained.

- Non. Ded. %: this indicates the non deductible %.

- The program uses the Non. Ded. % associated to a VAT Code that is present in the VAT Codes table.

- You can manually edit the value.

- VAT Acc.: this is the VAT amount registered in the VAT account.

It is calculated by the program according to the transaction amount, the Amount type and the non deductible percentage. - VAT number: this is the code or VAT number of your client/supplier.

When you enter a transaction with VAT, it is possible to enter the VAT number of your counterparty. If in the Accounts table, Address view, in your clients/suppliers register accounts, you enter their VAT number, this is automatically loaded in the Transactions table, in the VAT number column.

Transactions with VAT

Before entering transactions with VAT, you must keep in mind all the information on the Transactions page.

Entering a VAT transaction is very easy:

- Enter the date, document number and invoice number in the respective columns

- Enter the description, the Debit account and the Credit account

- Enter the gross amount (including VAT)

- Enter the VAT code provided for the type of transaction (purchases, sales, investments...) and present in the VAT Codes Table.

How to correct VAT transactions

In case of an error in a transaction with VAT, it is possible to correct it directly on the transaction row, provided that no VAT declaration has been submitted or no accounting lock has been executed.

If however your accounting file is locked or if you have already sent your VAT declaration, you cannot simply delete the wrong transaction, but you need to operate some cancellation-transaction and then re-enter the correct transaction.

In order to rectify VAT operation(s), you need to:

- Make a new transaction by inverting the Debit and Credit accounts used in the wrong transaction.

- Enter the same amount.

- Enter the same VAT code but preceded by the minus sign (ex.: -V81).

- Enter a new transaction with the correct accounts, amount and VAT code.

Depending on the entity of the mistake, you should consider informing your local VAT office; usually they ask you to download a specific form for correcting mistakes in the previous VAT period that you already declared.

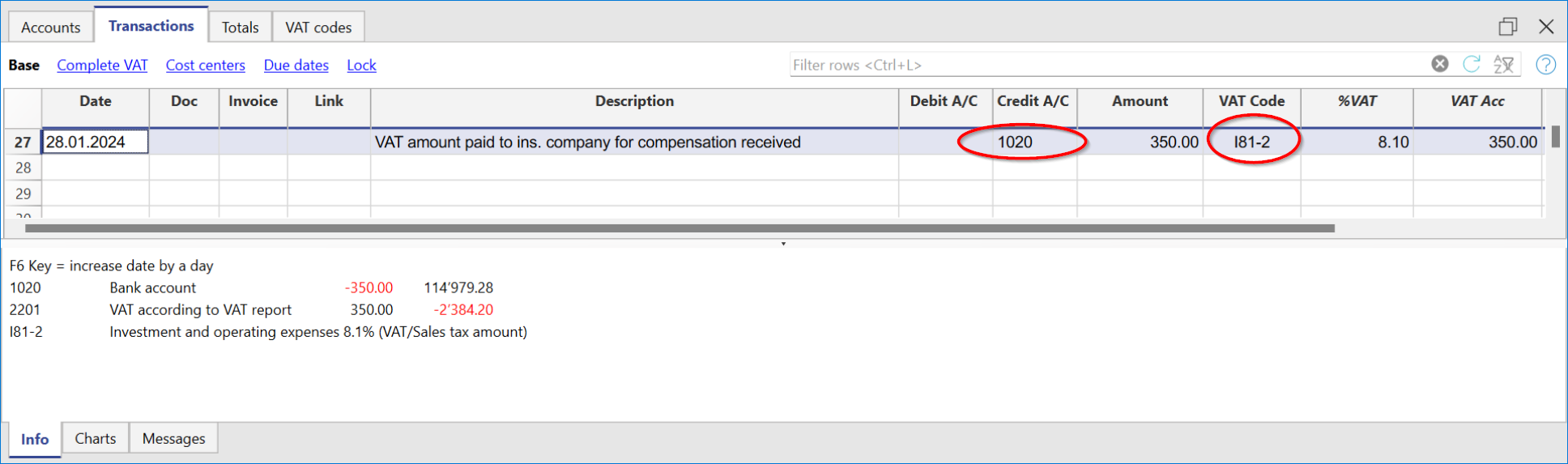

How to only enter the VAT amount

There are cases where only the VAT amount needs to be recorded, such as when you receive compensation from the car insurance.

In these cases, you can proceed as follows:

- Enter the date, document number and description in the appropriate columns.

- In the Credit A/C column enter the account used to pay the VAT amount (the Debit A/C column remains empty).

- In the Amount column enter the VAT amount to be paid.

- In the VAT code column enter the VAT code I81-2 (the code that refers to 100% amount VAT).

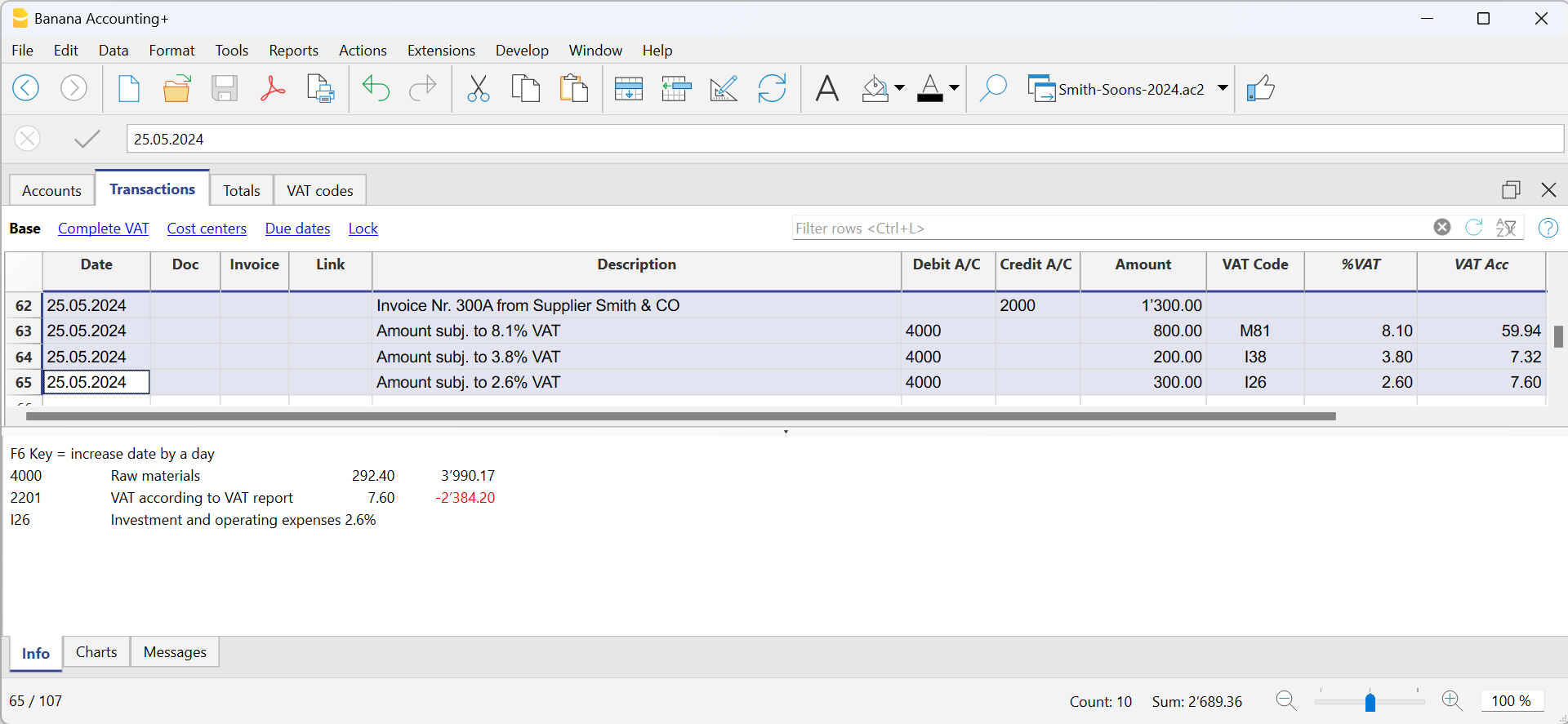

Transactions with different VAT rates

There may be cases in which the total amount is composed of several taxable amounts with different VAT rates. In this case the transaction is recorded on several rows.

For the transaction, it is necessary to:

- Subdivide the overall amount into the various amounts, each of which is subject to a specific VAT rate.

- On each row, enter the amount (amount with VAT) and insert the VAT code with the specific rate.

- Once the transaction is completed, check that the sum of the single gross amounts and the VAT amounts correspond to the invoice total.

Example

VAT EXEMPTION

When in the invoice the total amount subject to VAT is made up of a taxable part and a VAT-exempt part, it is necessary to register on more than one row as in the previous case, applying the exempt VAT code, present in the VAT Codes table.

Reversals/Credit note

When there are reversal operations for credit or debit notes, or simply to rectify previously recorded transactions whose amounts are subject to VAT, the VAT must also be reversed in the reversal transaction.

For the transaction:

- Reverse in the Debit and in the Credit column the accounts that were used in the previous transaction, to which the credit note refers.

To reverse the VAT there are two possibilities:

- Put the minus sign in front of the VAT code (e.g. -V81).

- Use one of the codes that refer to discounts, already set in the VAT Codes table.

With these procedures the VAT amount will be adjusted.

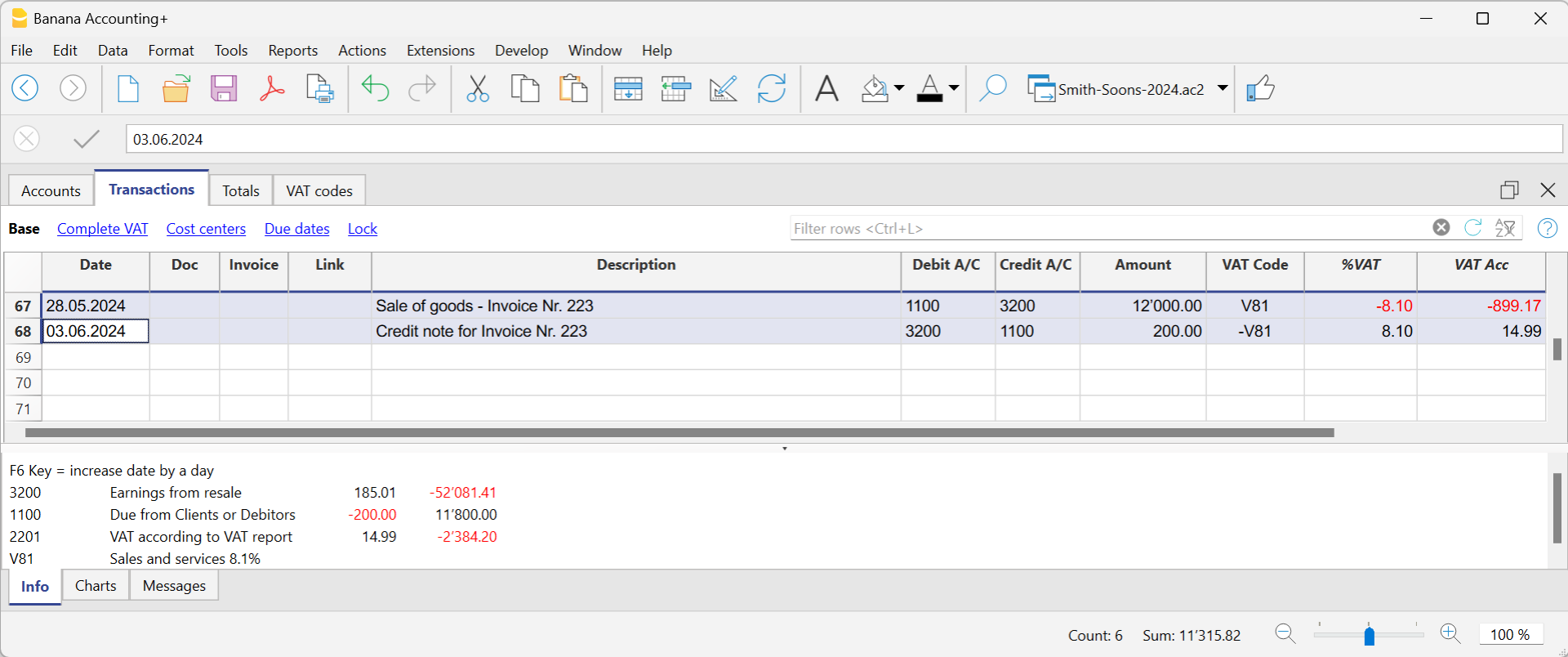

Example of a credit note on a sale

When a client finds a defect on a sold product, usually a credit note on his behalf is being issued. The credit note implies a decrease of the income and as a result a recovery of the VAT (Sales tax).

For example, we enter a sale amount of 12'000 including a 8.1% VAT. We then issue on the client's behalf a credit note of CHF 200.- for a product defect.

In the transaction of the credit note issued to the customer:

- The accounts of the sale, to which the credit note refers, have been reversed

- For VAT recovery on the credit note, the VAT code of the sales is recorded, preceded by the minus sign.

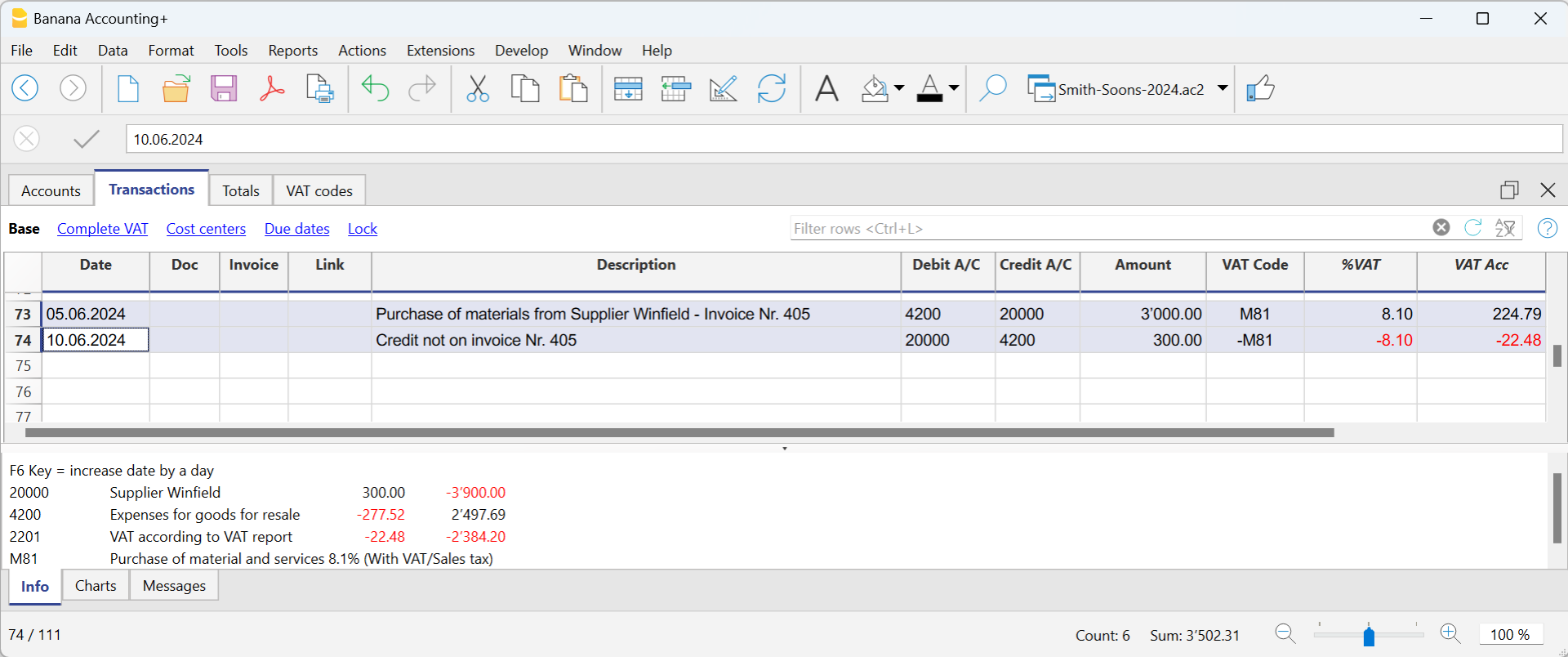

Example of a credit note on a purchase

When we receive a credit note from a supplier, the procedure for the transaction is similar:

- The accounts used for the purchase are reversed.

- Enter the same VAT code used for the purchase, preceded by the minus sign.

For example, we record an invoice for the purchase of goods for CHF 3'000 including a 8.1% VAT. We then receive a credit note of CHF 300.- from our supplier for a product defect.

In the transaction of the credit note received from the supplier:

- The accounts of the purchase, to which the credit note refers, have been reversed.

- For VAT recovery on the credit note, the VAT code of the purchases is recorded, preceded by the minus sign.

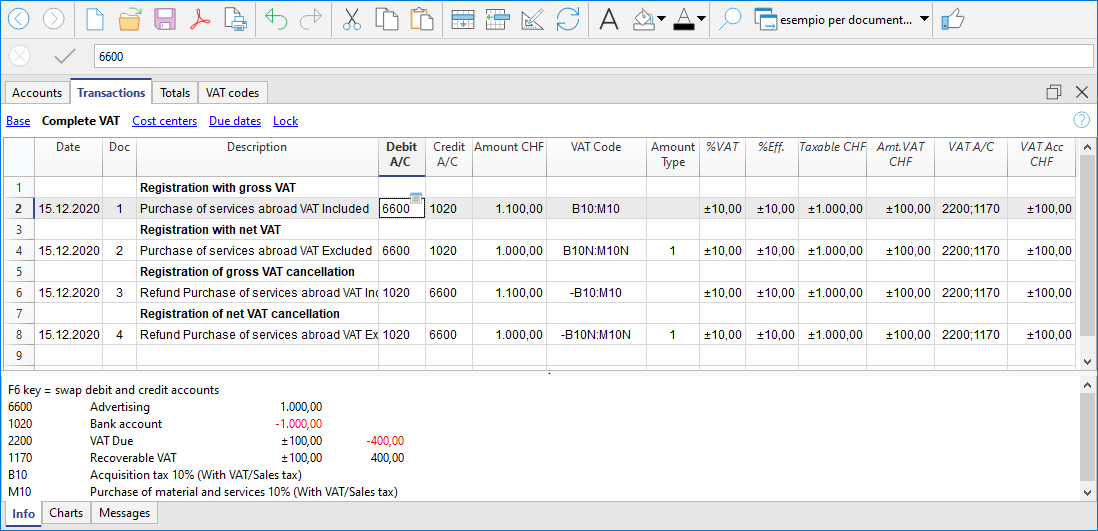

VAT registration with the Reverse Charge

VAT with the Reverse Charge

Normally VAT is applied to the seller of the goods. Reverse Charge is the term used to indicate that the VAT tax is applied to the buyer.

The Reverse Charge is used mainly when buying goods or services abroad and that have not been taxed at customs. In these cases, the exporting seller is exempted from VAT, while the importing buyer is taxed at the local rate and can possibly deduct it. In addition, there are other cases of purchases abroad subject to the Reverse Charge and each country, in its tax legislation, provides for different situations. When registering VAT with the Reverse Charge:

- The transaction must be included so that it will result as VAT due.

- If the VAT is also deductible, the deductible part of VAT must also be recorded.

Software prerequisites

The possibility of recording the transaction subject to the Reverse Charge, tax liability and VAT recovery on one single row, is available for the Banana Accounting Plus.

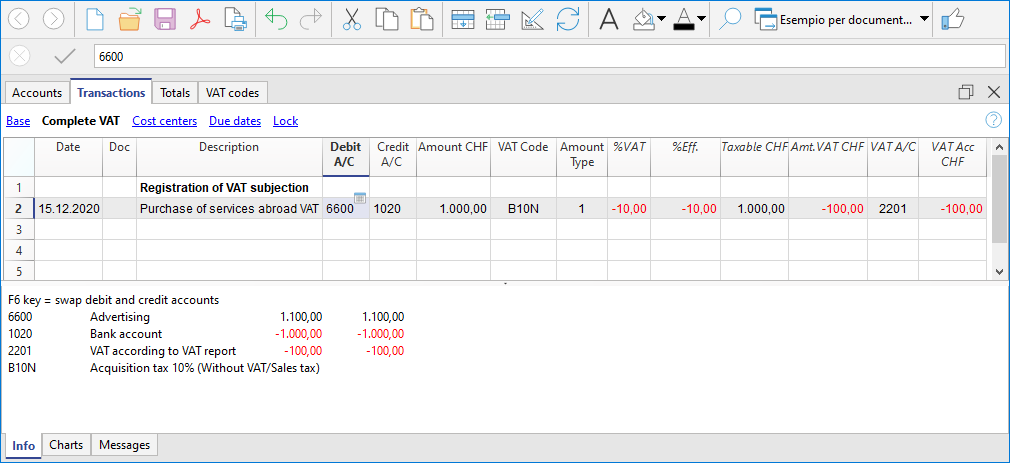

Reverse Charge with tax liability only

If you have to include the purchase of goods or services, but do not have the possibility to deduct VAT:

- Indicate the VAT code due to the appropriate case in the transaction.

The liability with the Reverse Charge without deduction is generally used in the case one is benefiting from a flat-rate scheme or when the type of expense is not considered deductible.

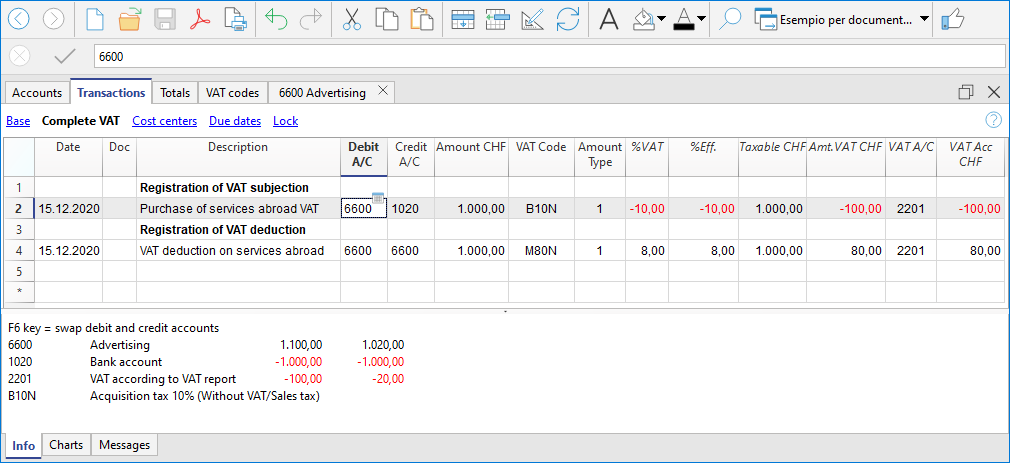

Reverse Charge with tax liability and VAT deduction

If the amount of VAT due is equal to that of the deductible VAT, the Reverse Charge can be registered on a single row, by simultaneously entering both the code for the VAT due and the code for the recoverable VAT.

- The pre-defined VAT codes are used and there is no need to change the VAT table.

- In the row of the entry with VAT Reverse Charge, enter the two predefined VAT codes in the VAT Code column, separated by a colon ":".

- The two VAT codes must be complementary in order for the result to offset one other.

- One of the two codes must be set up with VAT due and the other with recoverable VAT.

- The VAT rate and all other calculation parameters must also be identical.

- If the VAT codes do not have the same parameters, an error message will be displayed.

- The sequence of codes is not relevant, you can put one or the other first.

- When reversing an operation, the first VAT code must be preceded by the minus sign "-".

Reversal is used to cancel an incorrectly posted transaction. In this case, the same elements are kept, but the original transaction is reversed:- The VAT payable code is recorded as recoverable.

- The recoverable VAT code is posted as due.

- In the VAT columns, the amounts are preceded by the sign "+/-", which signals that the amounts offset each other for VAT purposes.

- In the account card and in the VAT summary there are separate entries for the debit and credit entries.

Example of transaction with Reverse Charge

Below are some examples of the Reverse Charge transaction inclusive of VAT due and recoverable:

- VAT included and excluding operations.

- Cancellation transactions, with VAT codes preceded by the "-" sign.

Notes: The examples in the image below are purely indicative. These codes must be adapted according to the rates in your country. Further information:

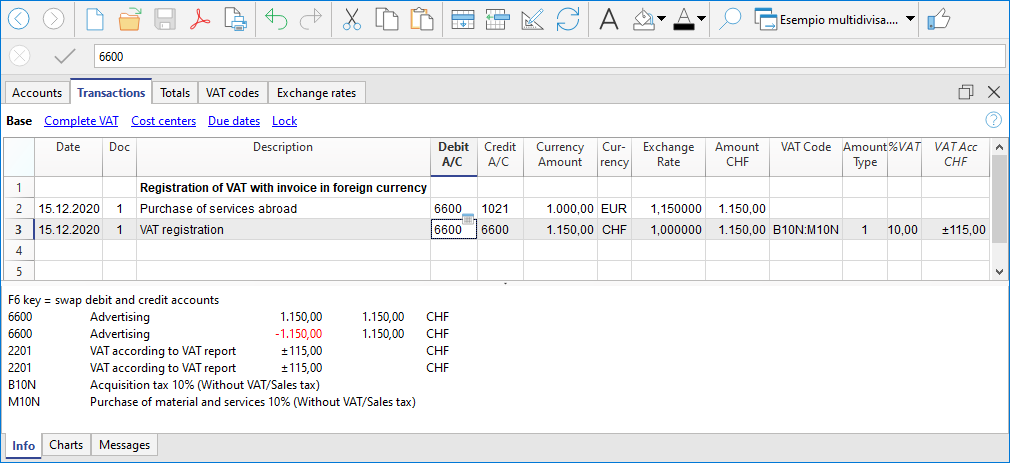

Reverse Charge with account in foreign currency

When the invoice is presented in a currency other than the accounting currency, the posting must be carried out on two lines:

- the invoice in foreign currency is entered on the first row

- the second line records the taxation and deduction of VAT, taking up the amount calculated in the accounting currency.

Reverse Charge at different rates

When different rates are to be considered in the taxation of the due and recoverable VAT or the VAT is partially deductible, the transaction must be made on several rows:

- On one row, enter the VAT due code (tax liability).

- On another row, the recoverable VAT code is entered.

Reverse charge with the net / flat rate method (CH)

In this case, it is not possible to post the VAT deduction, as it is not possible to recover the VAT on purchases. In any case, the tax liability must be registered.

VAT Summary (Report)

The VAT Summary is a document or a section of an accounting ledger where transactions subject to Value Added Tax (VAT) are summarized for a specific period (monthly, quarterly, or yearly).

Main elements of the VAT summary

- VAT payable: total amount of VAT due on issued or collected invoices (sales).

- VAT receivable: total amount of VAT recoverable on received or paid invoices (purchases).

- VAT to be paid or credited: Difference between VAT due and VAT recoverable.

- If VAT payable > VAT receivable: The company must pay VAT to the State.

- If VAT receivable > VAT payable: The company has a VAT credit that can be offset or claimed for a refund.

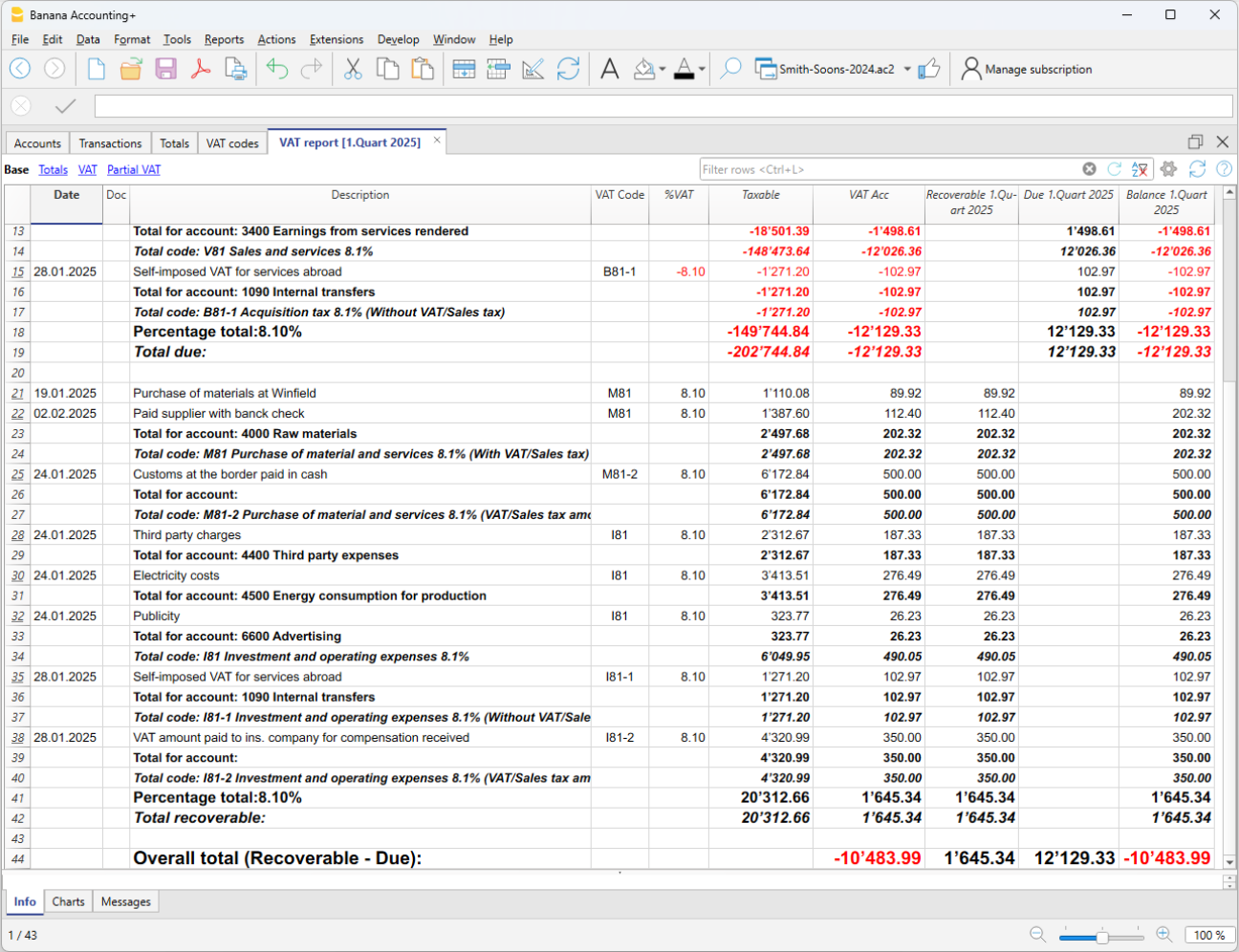

The VAT Summary in Banana Accounting Plus is a journal that records VAT transactions and balances, based on the set parameters and selected options.

It is automatically generated by the program through the Reports > VAT Summary menu and can be saved and archived in PDF format. All transactions with a VAT code, depending on the selected options, can be broken down by account, VAT code, and percentage.

There are two main groups:

- Total Due

- Total Recoverable

The difference between these two totals results in the VAT to be paid or recovered with respect to the FTA (Federal Tax Administration).

Below is an example of a VAT summary table for the first quarter of 2025:

For users who do not wish to use automated solutions for managing and submitting VAT data online, the VAT Summary is essential for calculating the VAT amounts to be manually entered into the Swiss paper VAT return or the FTA online portal.

If you wish to have a fully automated Swiss VAT return and electronic VAT data transmission, we recommend using the new VAT extensions, available in the Advanced plan of Banana Accounting Plus.

Comparison between VAT summary and VAT extension

To better understand the differences between the VAT Summary and the VAT Extension, below are their main features:

VAT Summary

- Available in all plans of Banana Accounting Plus, in all accounting applications with VAT management.

- It is an integral part of accounting because it represents a ledger where all VAT transactions are recorded.

- It is particularly important as it provides details that allow monitoring of sales.

- Serves as a basis for manually preparing the VAT declaration and settlement.

- It is a support tool for auditors and tax inspections, facilitating the verification of VAT records.

- In case of tax audits, it provides all the details necessary to verify VAT transactions.

- Does not allow automatic preparation of the VAT form. Everything must be manually reported.

- The user must identify and manually sum the amounts to be reported in the various sections of the VAT return.

- Does not provide automatic submission of data to the Federal Tax Administration (FTA).

VAT Extension

- Available only with the Advanced plan of Banana Accounting Plus.

- A set of advanced features to automate VAT management and data submission to the FTA.

- Filters, calculates, and automatically fills in VAT amounts in the correct sections of the VAT return.

- Always performs calculations according to predefined rules, reducing the risk of errors.

- Automatically generates an XML file for electronic submission of VAT data to the FTA portal.

- Creates a PDF file with a facsimile of the VAT return, facilitating documentation and archiving.

At the end of the return, there is a section where any calculation and rounding differences are reported.

Thanks to the VAT Extension, VAT management becomes simpler, faster, and free from manual errors, improving administrative efficiency.

The Advanced plan includes the two VAT calculation and reporting methods:

The VAT summery dialog

The VAT report is obtained by clicking on the menu Reports > VAT report

When activated, the following options allow you to include the following data in the VAT report:

Include movements

All transactions with VAT are included.

Include totals for accounts

The totals of transactions with VAT are included, grouped by single account.

Include totals by codes

The totals of transactions with VAT are included, grouped by single VAT code.

Include totals by percentages

The totals of transactions with VAT for each individual rate are included.

Include unused codes

Also included are the unused codes present in the VAT Codes table.

Use own grouping (group and Gr)

Transactions with VAT are grouped according to the grouping of the VAT Codes table.

Order registration by

This function allows you to sort the recordings based on the selected option (date, doc.,

description, etc ....).

Partial Report

By specifying a code or a group and checking the appropriate boxes, the total of transactions with VAT is obtained:

- just the code indicated (by selecting from the list)

- just the indicated group (by selecting from the list).

Other sections

Information for the other sections is available on the following web pages:

VAT Report / transactions with totals by code

The overall total in the last row of the VAT report has to correspond with the amount for the end of period of the Automatic VAT account, Balance column, on the condition that both of them refer to the same period.

The data of the VAT report can also be transferred to and elaborated by other programs (f.i. Excel, XSLT) and be presented in formats that are similar to the forms of the tax authority

For Switzerland, one can automatically obtain a document similar to the form that has to be sent to the VAT office. This form shows the amount to enter for each number. Please consult (in German, French, or Italian) Swiss VAT Report.

Period closing and VAT payment

In VAT management, each country requires specific VAT accounts within the chart of accounts. These accounts are used to record and manage input and output VAT:

- VAT payable – Account where VAT amounts related to sales and services are recorded.

- VAT receivable – Account where VAT amounts on purchases of goods and services are recorded.

- VAT payment account – Account where, at the end of the period, the balances of VAT payable and VAT receivable are transferred.

The account balance represents the VAT to be paid to the tax authorities or the credit to be received. This account is cleared once the VAT payment is made.

In Banana Accounting, to manage VAT, you must choose an accounting model with VAT that already includes the following settings:

- In the Banana chart of accounts, the VAT accounts are already set up according to the country

- The VAT Codes table is already prepared with country-specific VAT codes

- In the menu File > File properties, basic data > VAT section, the two VAT accounts where VAT is automatically recorded are set, one VAT payable account and one VAT receivable account.

- You can also set only one VAT account. This is used for both VAT payable and VAT receivable.

- In the VAT Codes table, you can set a specific VAT account for a single VAT code.

- If these settings are missing, it is possible to:

- Add an additional VAT account in the chart of accounts, named Automatic VAT account.

- Set the automatic VAT account as default by going to File > File properties, basic data > VAT section.

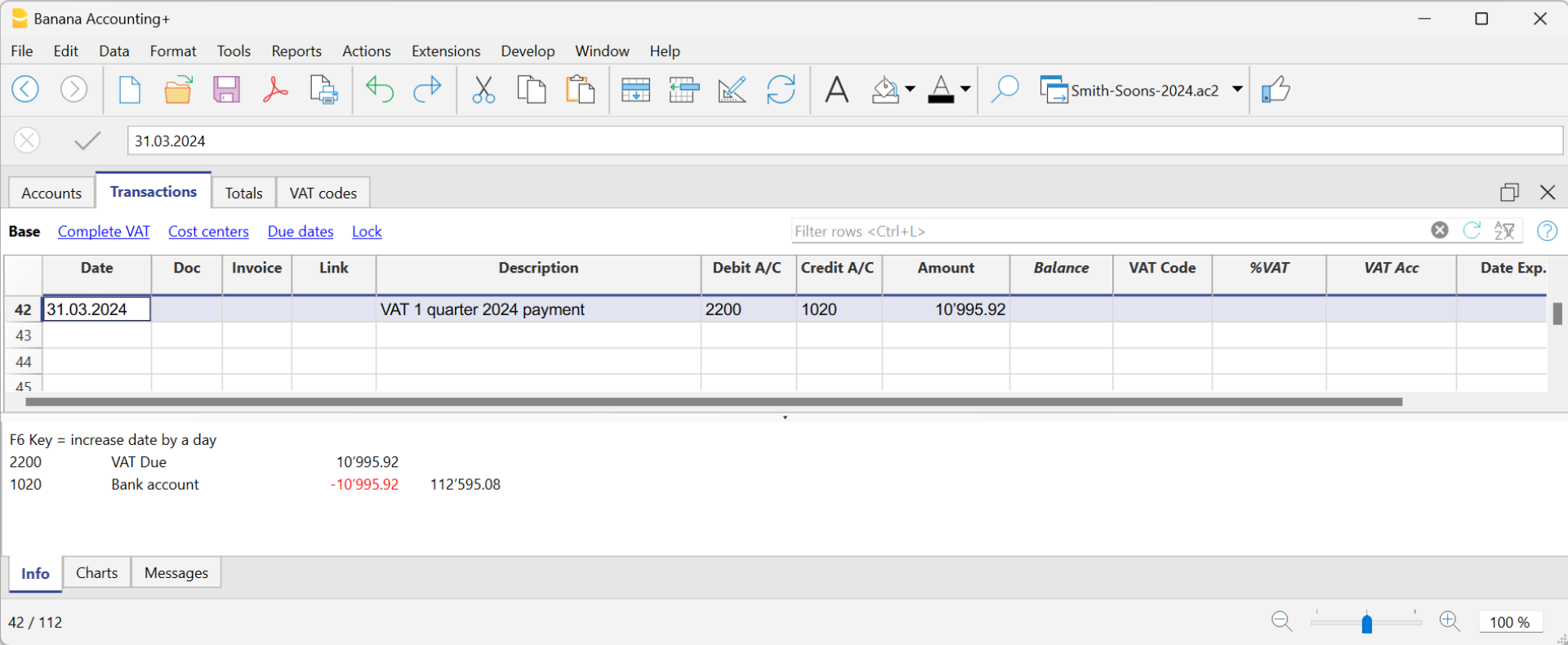

How to automatically clear VAT accounts at the end of the period

To better understand how the automatic VAT account is used, let’s look at a practical example.

Note: the VAT account numbers shown in the following example refer to the numbering used in Switzerland. In your own chart of accounts, you must adapt the account numbers according to your country.

- VAT account 2201 – Represents the automatic VAT account.

- VAT account 2200 – Represents the VAT payment account.

At the end of the period, to clear the balance of the automatic VAT account, the VAT amount recorded automatically must be transferred to the VAT payment account. This step allows you to determine the VAT to be paid or the possible VAT credit, simplifying accounting management.

In our example shown in the image, at the end of the period, scheduled for VAT submission and payment, the balance of the automatic VAT account shows a balance of 10,995.92.

The balance of account 2201 VAT Report (automatic VAT account) must be cleared with a reversal entry by entering:

- In the Debit column, account 2201 VAT report (automatic VAT account)

- In the Credit column, account 2200 VAT due (VAT payment account).

This entry is made in this way if there is an amount owed to the tax authorities. If there is a VAT credit, the VAT account transactions are reversed.

This operation results in:

- Clearing of the balance in account 2201, VAT Report (automatic VAT account).

- Transferring the VAT balance to the VAT due account (VAT payment account).

Payment of the VAT due account balance

When the VAT amount is paid to the tax authorities, the balance of the VAT due account is cleared.

For the entry:

- Enter the date, document number, and description in the respective columns.

- In the Debit column, enter the VAT Due account.

- In the Credit column, enter the liquidity account.

- In the Amount column, enter the VAT amount paid.

With this system, it is possible to monitor the balance of each quarter, and in case of errors, it is possible to identify in which period the balance no longer matches.

Ledger of account 2200 VAT due after recording the payment