Neste artigo

In Banana Accounting Plus, you can customize your file by activating new features without complicating the main structure. To access the various options:

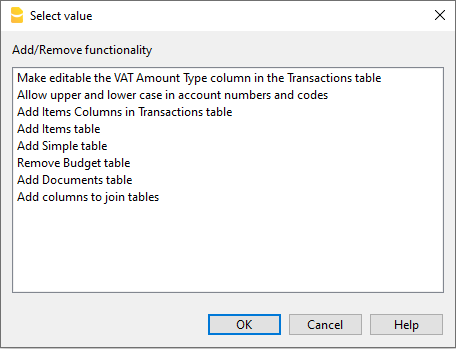

- go to the Tools > Add / Remove Fuctionalities > Add menu and select the desired option.

Important

- The options available in this dialog are specific to accounting files.

- In productivity applications (such as Offers and Invoices, Timesheet, etc.), the Add / Remove Functionalities dialog shows different options, designed for those types of files.

Enable Uppercase/ Lowercase in account description numbers and codes

Allows you to keep the descriptive accounts (Account column) as entered, without automatic conversion to uppercase.

Note: "Cash" and "cash" will be recognized as two different accounts.

Add Items Table

Information is available on the documentation Items Table.

Add Item Columns to the Transactions table

Information is available on the documentation page Items Columns in the Transactions table.

Add Items Table and Item Columns to the Transactions Table

The information can be found on the documentation page Items Table and on the documentation page Items columns in the Transactions table

Add Address columns in the Accounts table

Allows you to add addresses and personal details to the accounts in the Accounts table (customers, suppliers, members, etc.). When this option is selected, the Addresses view is added with all the new columns.

- You can make the columns visible in other views as well via the Data > Columns setup menu.

- To create additional views with specific columns, use the Data > Tables setup menu.

Add and Remove Budget Table

This function enables the accounting file for financial planning by adding the Budget table where you can enter transactions concerning the budget.

See the Budget table for more information.

Changing VAT amount type column in transactions

In accounting files with VAT, in the Transactions table, this function allows the column Amount type (VAT amount type) to be made editable. For each transaction, the program automatically enters the default data from the VAT Codes table (for each code) into the Amount Type column.

- 0 (or empty cell), this means VAT included

- 1 = VAT amount, means VAT excluded

- 2 = VAT amount, the amount of the entry is considered as 100 % VAT amount

If, exceptionally, the amount type for a VAT code changes, you can manually enter 1 or 2.

Note

This function is not compatible with files created in earlier versions that did not support this option.