In dit artikel

At the end of the fiscal year, before opening the new accounting year, it is necessary to carry out some closing operations. Some transactions are simple and can be done independently, while others require specific technical skills or have tax and social security implications for which it is advisable to consult an accountant or fiduciary.

Preliminary checks

Before closing, make sure that:

- There are no errors using the Check accounting command.

- Bank balances in the accounting match the bank statements.

- Use the #CheckBalance function.

- There are no differences between the Debit and Credit columns in the Transactions table.

- Display the Balance column and check that there are no discrepancies.

- All transactions for the year have been entered.

- The balance of the automatic VAT account has been transferred to the VAT due account.

Open customer and supplier invoices (with cash accounting)

If you use cash accounting, at the end of the year you must record:

- Customer invoices issued but not yet paid.

- Supplier invoices received but not yet paid.

These entries allow you to correctly allocate costs and revenues to the correct fiscal year.

You can use the Open customer invoices and Open supplier invoices functions.

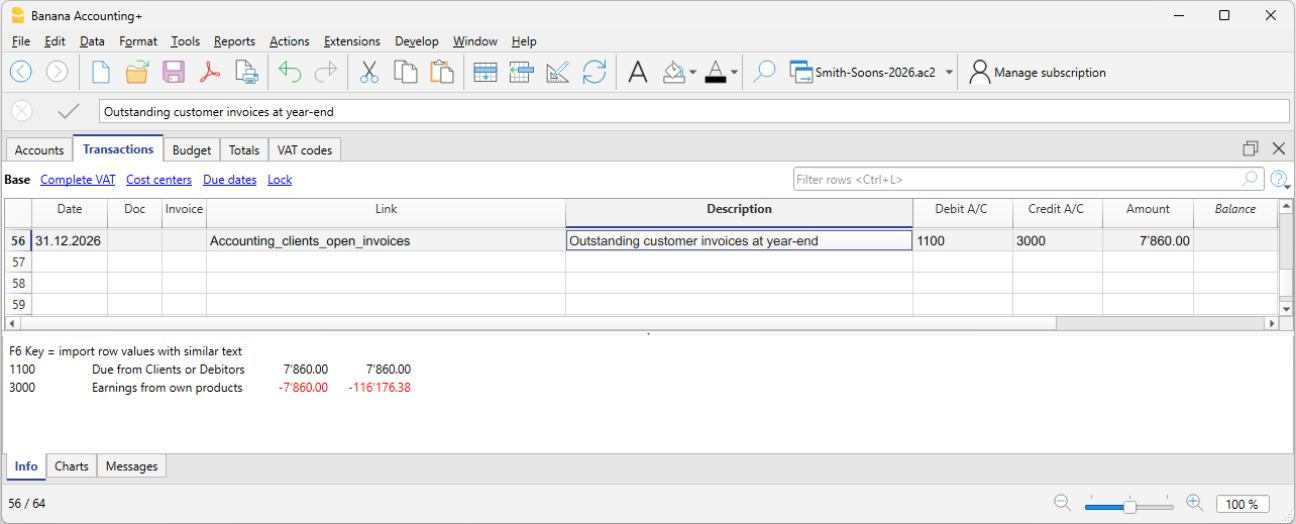

Open customer invoices as of 12/31

If you use cash accounting, at the end of the year you must record customer invoices that have been issued but not yet paid. This closing operation serves to determine the costs and revenues pertaining to the fiscal year. To make the process easier, you can quickly identify the values as of 12/31 using the open invoices by customer functions.

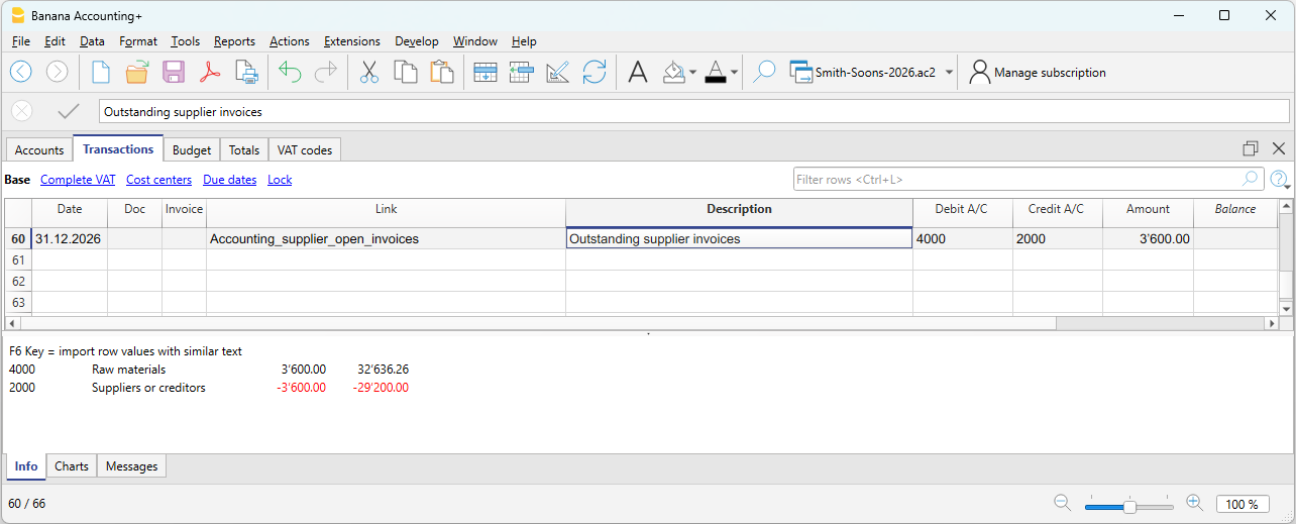

Open supplier invoices as of 12/31

If you use cash accounting, at the end of the year you must record supplier invoices received but not yet paid. This closing operation serves to determine the costs and revenues pertaining to the fiscal year. To make the process easier, you can quickly identify the values as of 12/31 using the open invoices by supplier functions.

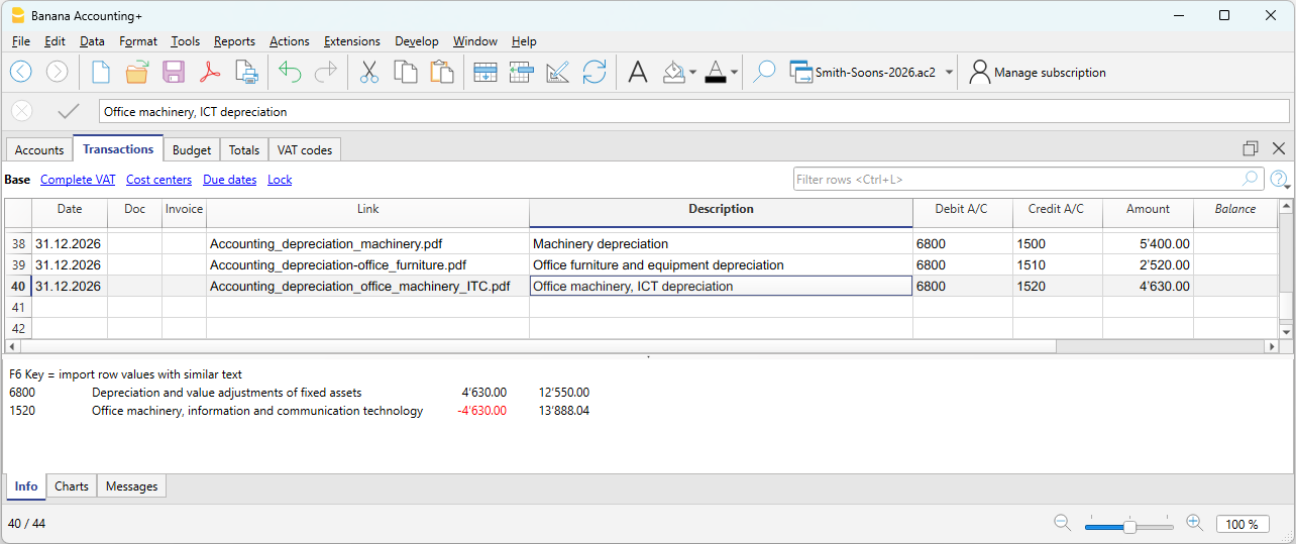

Depreciation

At the end of the fiscal year, you must record the depreciation of movable and immovable assets and consider accelerated depreciation for assets subject to rapid obsolescence.

You can use our application Fixed assets register which automatically creates depreciation transactions that you can import into your accounting file. The depreciation transaction varies depending on the method used:

- Direct depreciation: the depreciation is recorded directly in the income statement, using the depreciation account on the debit side and the asset account on the credit side. In the balance sheet, the asset always appears with its residual value.

- Indirect depreciation: in this case, the depreciation is recorded not as a reduction of the asset but as an adjustment by posting it to a depreciation fund (reduction of assets).

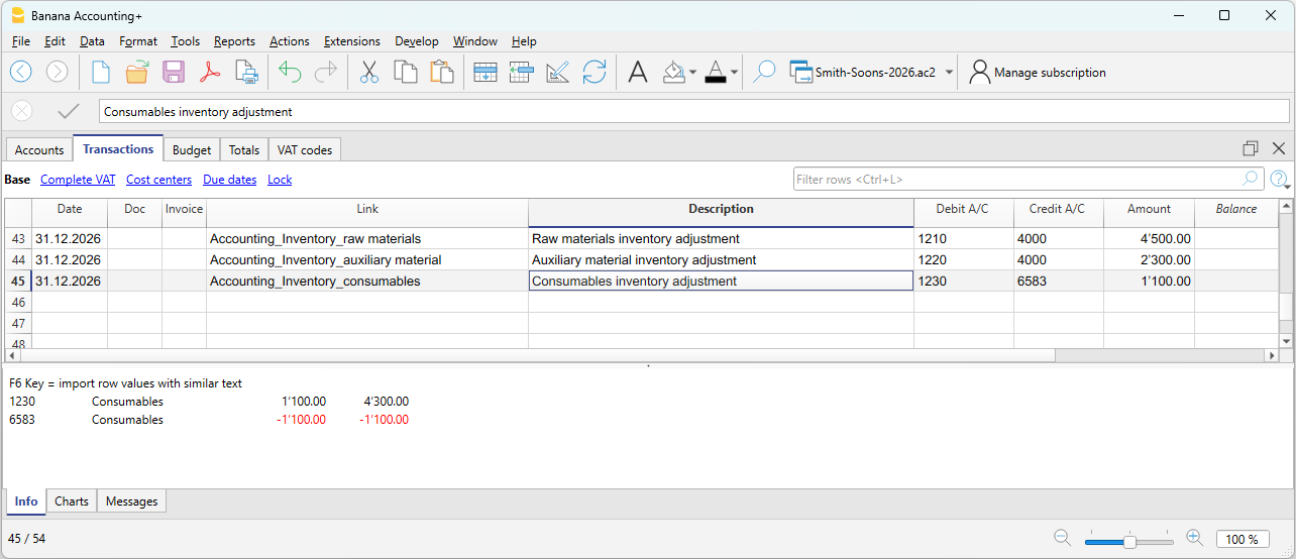

Inventory adjustment

If you have inventory with goods, or simply a company material inventory, the inventory value at year-end must be adjusted in accounting. During the year, inventory movements are not recorded in the accounting file:

- Incoming and outgoing goods and their respective values are managed and updated in a dedicated inventory file or application.

Our Inventory application makes it easier to manage incoming and outgoing quantities, unit prices and final inventory values, allowing you to quickly determine the adjustment to be recorded at year-end in your accounting.

To calculate the inventory value to report correctly in the Balance Sheet:

- Determine the inventory value.

- Compare the beginning inventory value with the ending value.

- Record the difference as a change in inventory using the income statement account for goods as the offset.

In our example shown in Banana, there is an assumed increase in inventory compared to the opening value. Therefore, inventory (account 1200) is recorded on the Debit side, while the decrease in cost of goods is recorded on the Credit side.

Private use

Private use occurs when the business owner uses goods or services belonging to the company (goods, materials, vehicles, premises, etc.) for personal purposes.

For tax purposes, it is as if the company sells to the owner and therefore it must be recorded as revenue. If the company is subject to VAT, the transaction is VAT taxable.

In Switzerland, according to the VAT Act (LIVA), private use is taxable because it represents a private use of goods for which the company has previously deducted VAT.

The value to be considered is generally:

- Market value of the used item, or

- Purchase cost if lower.

The applicable VAT rate is the one of the good (e.g. 8.1%).

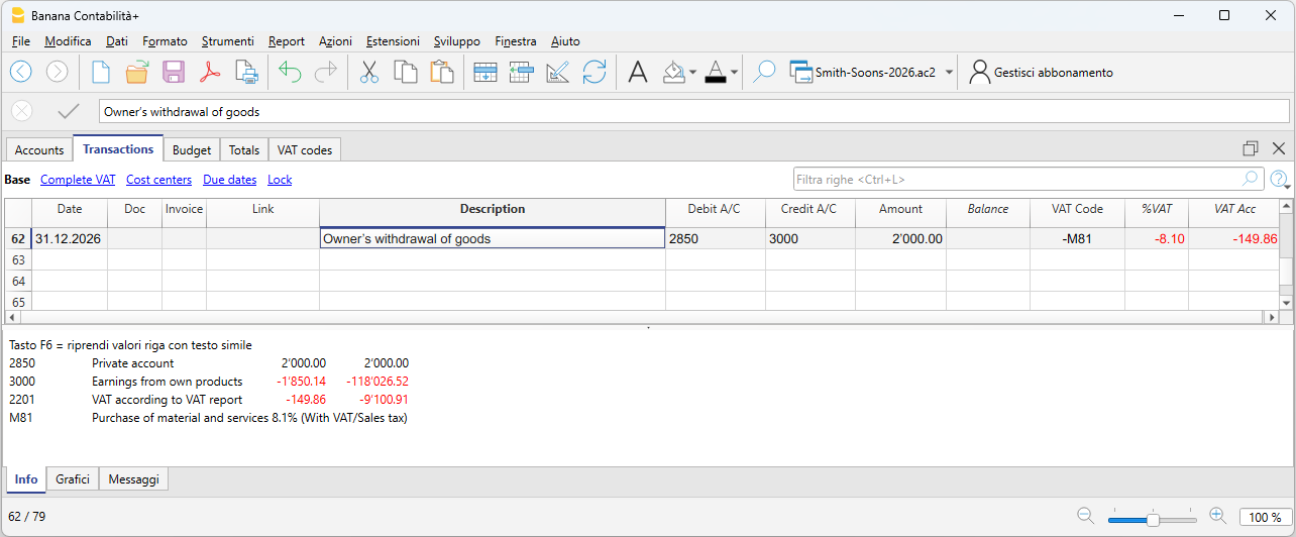

If the owner withdraws goods from the company for personal use:

- Revenue is recorded (as if it were a sale).

- VAT is calculated on the value of the goods.

- Inventory is reduced.

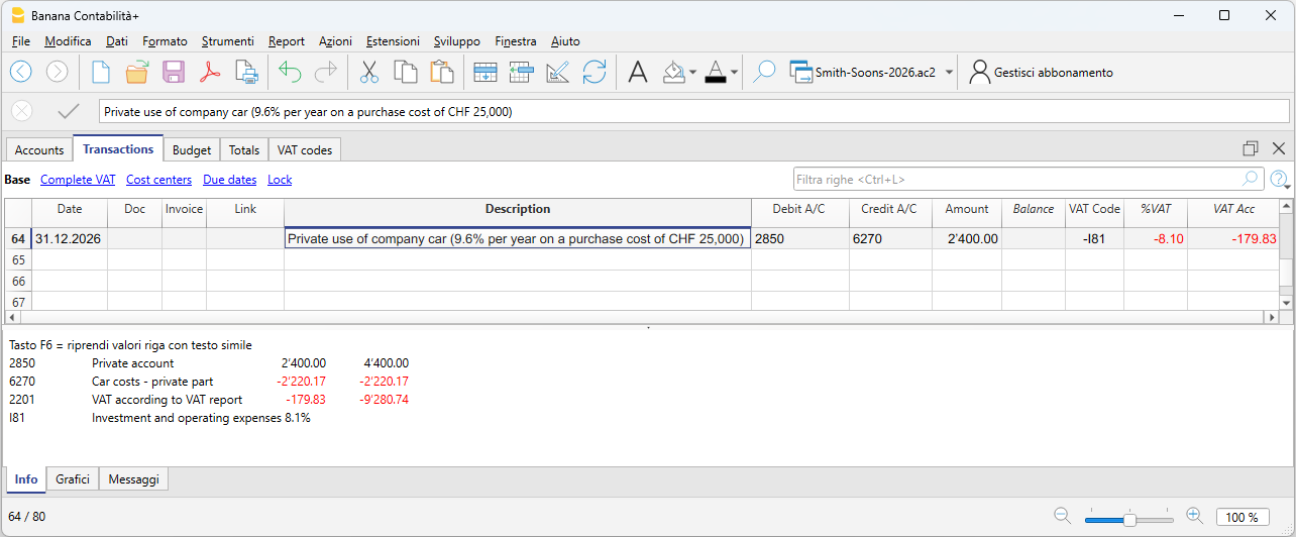

Private use of company vehicles:

If the owner uses the company car for personal purposes, the private use must be recorded as if it were company revenue. If the company is subject to VAT, the transaction is VAT taxable.

- The amount to be recorded is either a flat rate or calculated according to tax rules (e.g. 9.6% of the purchase price per year).

- Private use is considered revenue.

- VAT must be declared as VAT payable.

- The offset can be:

- a reduction in vehicle costs (6900), or

- a reduction in the asset value (vehicle), often preferred for sole proprietorships.

Adjustment of Taxes and Duties account

The adjustment of taxes and duties is a year-end entry that serves to:

- Record the taxes and duties accrued during the year but not yet paid.

- Adjust previously estimated amounts based on the actual tax assessment.

This ensures the correct cost is recognized for the fiscal year and the related liability to the tax authority is recorded.

It is also necessary to check that the advance payments made during the year refer to the current fiscal year.

Tax payments relating to previous years must be recorded to close the accruals present in the "Direct taxes" (balance sheet) account.

If the accrual balance is insufficient or excessive, the difference must be recorded as an extraordinary cost or revenue, or as a prior period item, depending on the nature of the variation.

Adjustment of the Private account

The private account (usually 2850 / 2860) is used in sole proprietorships or partnerships to record:

- Personal withdrawals by the owner

- Personal deposits by the owner

- Use of company assets for personal purposes (private use)

- Private expenses mistakenly paid by the company

- Year-end adjustments

At the end of the year, this account must be adjusted to reflect the correct balance between the owner and the company.

If the private account is an asset (debit balance) and therefore represents a receivable from the owner to the company, interest could theoretically be recognized.

VAT closing and declaration

For companies subject to VAT, it is important at year-end to check the VAT entries and proceed with the closings correctly. Banana Accounting Plus supports data checking and the preparation of VAT declarations (Advanced plan) for Switzerland, making it easier to manage everything in an orderly and compliant manner. At the end of the year, after proper checks and error corrections, you must:

- Record VAT for the fourth quarter (or the last semester in the case of the flat-rate VAT method).

- You must transfer the balance of the automatic VAT account to the VAT due account.

- Before submitting the final VAT declaration:

- Open the PDF files of the VAT reports previously submitted to the FTA.

- Use the VAT extensions to recalculate the VAT reports for each previous period.

- Verify that the newly calculated VAT reports still match those already submitted.

- Use the VAT Summary command to view various reports and create a PDF printout for data archiving. These documents will be useful in case of a tax audit.

Adjustments for AVS/AI/IPG/AD

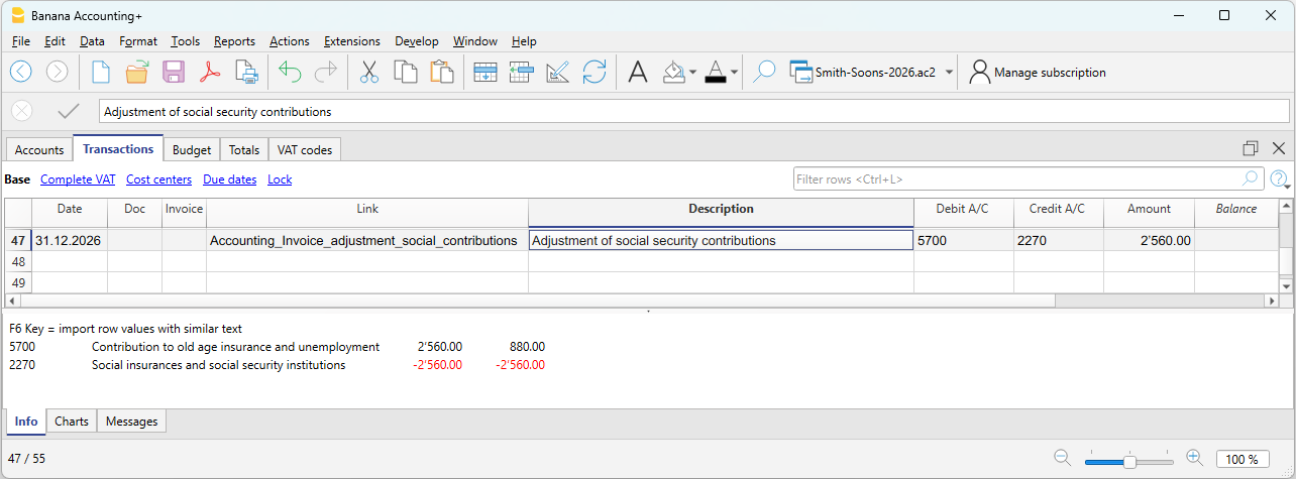

The AVS/AI/IPG/AD contributions are mandatory social security contributions in Switzerland covering pension (AVS), disability (AI), allowances for military service and maternity (IPG), and unemployment (AD).

- During the year, the AVS contributions account usually records advance payments made to the Cantonal AVS Compensation Office (Debit) and the amounts withheld from employee salaries (Credit).

- If during the year the family allowances paid to employees were recorded in a dedicated account, for example in the “Family allowance contributions” account, to reconcile the accounting with the AVS year-end statement and record the corresponding adjustment, you can transfer the balance from this account to the AVS/AD Contributions account.

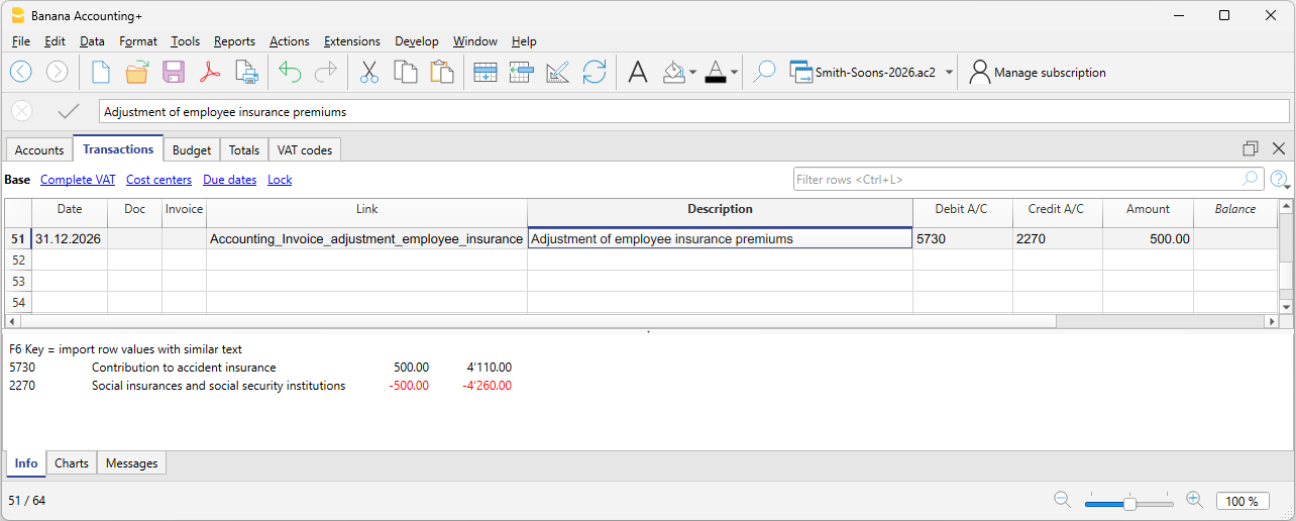

Accident insurance adjustments (LAINF, supplementary LAINF)

LAINF and supplementary LAINF contributions in Switzerland are mandatory insurance contributions against professional and non-professional accidents (LAINF) and additional coverage provided by the employer (supplementary LAINF).

With the recording of the December salaries and the payment of the thirteenth salaries, you need to print the salary list showing all gross wages. You must report the total AVS gross wages to the employee insurance providers, who will determine any adjustments to be paid.

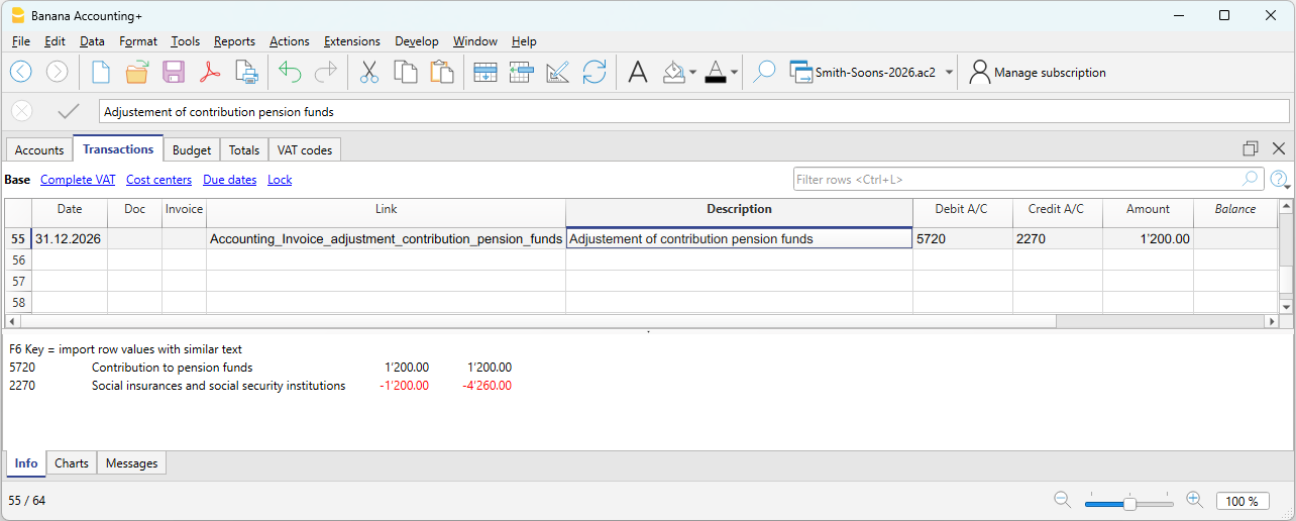

Pension fund adjustments

The pension fund (or LPP) is the mandatory Swiss occupational pension insurance that complements the AVS pension.

Many second pillar (LPP) pension providers calculate the annual premium based on salary estimates provided by the company before the end of the year. Bonuses are not included. Important changes during the year must be communicated promptly so the insurance can adjust the premium. The company may also decide to pay a higher amount in advance to avoid a deficit due to changes during the year.

At the end of the year, the LPP insurance sends a final statement showing either a payable or receivable balance, depending on whether too much or too little was paid.

In the following example, a balance is assumed to be payable. Therefore, the entry will be made in two accounts: Debit to the LPP Contributions account and Credit to the Liabilities to pension institutions account.

In case of a receivable, the LPP Contributions account is reversed: Debit the Receivables from pension institutions account and Credit the LPP Contributions account (as a decrease).

In the new year, the receivable must be reversed from the LPP Contributions account (for the new year) and the receivable is closed on the Credit side.

Adjustment of the allowance for doubtful accounts (Delcredere)

The allowance for doubtful accounts / Delcredere is a contra asset account associated with receivables. It is used to reduce the value of customer receivables to account for the risk that some may not be collected.

In practice:

- Receivables on the balance sheet are shown at a realistic value.

- The allowance represents an estimate of possible losses.

- It increases the prudence of the balance sheet, as required by the Swiss Code of Obligations.

Debit the expense account "Doubtful accounts" and credit the allowance for doubtful accounts.

Adjustment of withholding tax (IAF)

During the year, the employer withholds the tax at source from the salaries of foreign employees who are not fiscally domiciled in Switzerland. The withheld amounts must be paid to the Tax Office each quarter.

At the end of the year, with the final December report, the declaration for the last quarter’s withholding tax is made. All gross salaries paid are reviewed, and in case of changes or errors, corrections can be made in the final declaration.

Generally, the total amount payable for fourth quarter withholding tax is recorded as a liability as of 12/31 or, if too much was paid, as a receivable. The offset account is always the salaries account (account 5000).

Reimbursements for executive staff

“Executive staff” refers to management figures (CEO, directors, unit heads).

Reimbursements may be for actual expenses incurred by the executive employee on behalf of the company. These are not taxable for the employee and are therefore not subject to AVS, LPP, or withholding tax, provided that they are documented or, in the case of flat-rate allowances, approved through regulations by the FTA.

In this case, they are recorded in accounting as expense reimbursements or personnel expenses.