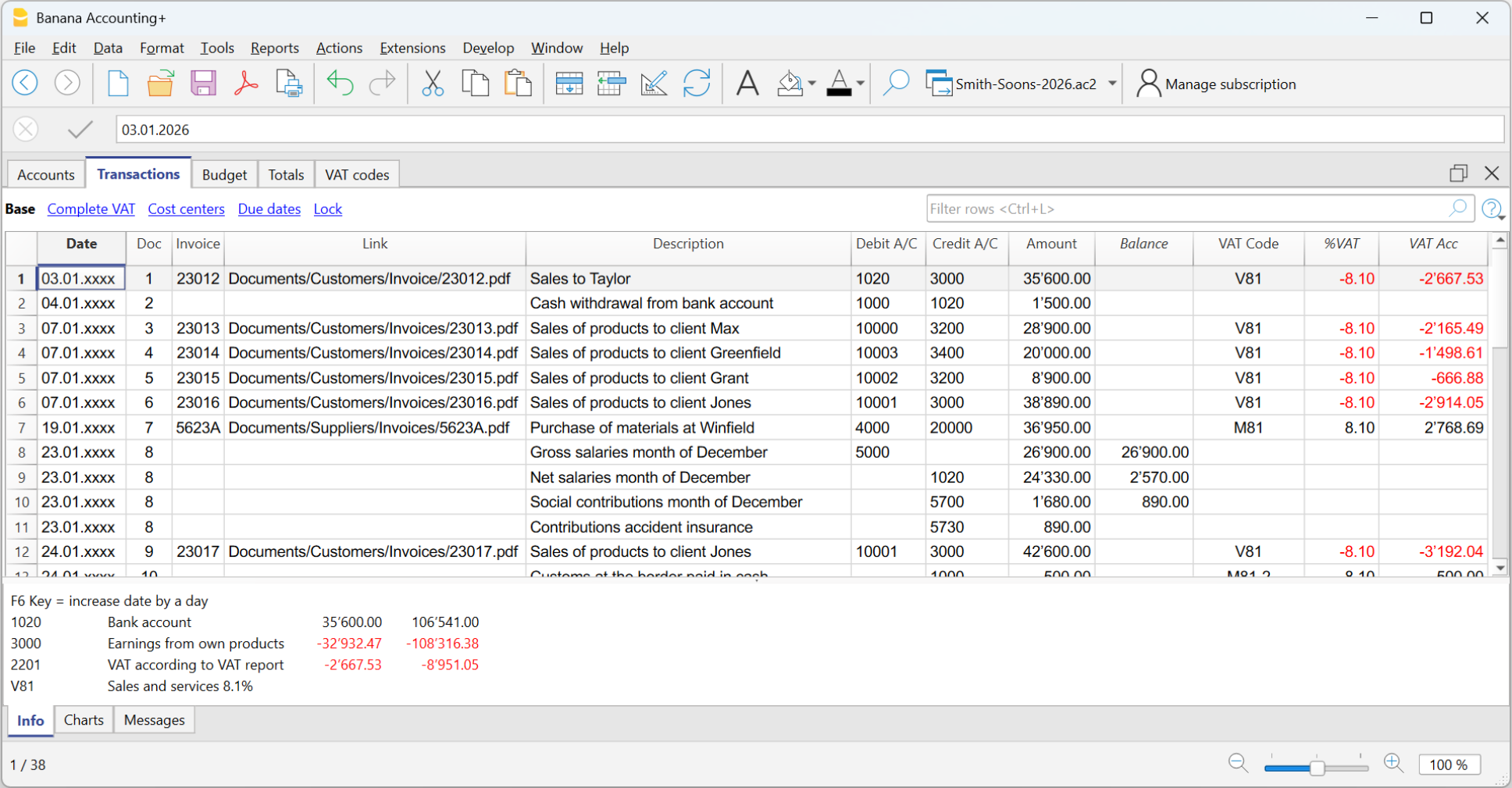

Transactions table | Double-entry accounting

The Transactions table is the central hub for keeping the accounts, where all the operations with financial and economic impact are entered. The use is similar to Excel. In the Transaction table the movements are always visible and in perfect order and by scrolling them, you instantly have a clear view of all the events.

All the data entered can be modified and corrected, making it easy to have a perfect accounting.

The Transaction Table is also characterized by the Balance Column, which allows identifying any differences between the Debit and Credit columns and especially the row where the difference originated. Additionally, errors and accounting differences are flagged in the information window at the bottom.

Key features:

- Single or compound entries: Single entries record simple transactions with one Debit and one Credit account, while compound entries are entered on multiple lines with different Debit and Credit accounts. The program suggests previously entered text for quick auto-completion.

- Recording Method: Transactions can be recorded using either the accrual or cash method, ensuring accuracy and compliance with accounting standards.

- Management of Repetitive Operations: Stores repetitive operations for quick future recording, reducing data entry time.

- Customizable Columns: Default columns can be made visible at the user's choice, including quantity, price, and other relevant information.

- Automatic Numbering: Automatically assigns document numbers with different numbering simultaneously, maintaining systematic order and facilitating search and archiving.

- Digital Attachments: Links digital justifications such as PDFs or images to files, accessible with a simple click for complete and organized documentation.

- Exception Management: Highlights rows to quickly identify entries to verify or correct, facilitating the review and control process.

- Data Integration: Imports transactions from various digital bank statements and other programs, speeding up entry of records and ensuring data accuracy.

- Cost/Profit Centers and Segmentation: Allows recording operations on cost/profit centers and segments for detailed analysis and better financial management.

- Balance Verification Entries: Before period or year-end closings, quickly identifies and corrects errors between actual balances, ensuring accurate and updated balances.

Fast insertion

The table is similar to Excel, you can scroll up and down and position yourself in any cell.

There are many features that make entering and editing data very fast.

The following operations are possible:

- Cancel and redo.

- Select one or more cells and copy / paste.

- Add, copy, paste and delete lines, individually or in bulk.

- Search and replace texts.

- Sort the rows by date.

- The auto-complete function suggests the values to enter (for example the list of accounts).

- With the F6 key the values of the row are completed, taking over those of the same row.

- The F4 key resumes the values from the previous row.

- The date is completed with the values from the previous row.

- In the Doc column progressive numbers (with different counters) are suggested.

- In the Debit or Credit Account column you can search for the account by typing it's description.

- In the columns of the amounts you can enter formulas, such as "30 + 25" and the program inserts the result.

Further information is available on the pages:

Movements import

By importing transactions from bank, postal or credit card statements, data entry in the Transactions table is speeded up and errors are avoided. Data is recorded exactly as it appears on the bank statement.

- In addition to the account statements, you can also import data from other programs.

- The program automatically completes the missing values.

- Several formats are available for importing.

- You can copy and paste data from other programs.

- Imported data can be completed, modified or deleted.

- Ability to program extensions to import any type of file.

Further information is available on the Import to Accounting page.

Management of multiple information

A lot of information can be indicated for each entry row:

- The value date and that of the document.

- A progressive number of document and protocol, or external reference.

- Any additional information you need by adding columns.

- Link to a digital document file.

- Add and remove links.

- Open the link and view the content.

- VAT management (if the type of accounting with VAT was chosen in the creation of the file):

- By entering the VAT code in the transaction, the program calculates the VAT automatically.

- Break down and post the VAT on the designated account.

- You can define whether the amount is net or gross of VAT.

- You can indicate that it is a reversal by inserting the minus sign "-" before the VAT code.

- You can indicate a VAT percentage that is not recoverable.

- You can encode special cases with additional codes.

- Cost and Profit centres:

- Up to 3 cost and profit centers for each posting line.

- You can post negative by indicating the "-" sign in front of the cost or profit center account.

- Segments:

- For each debit or credit account you can indicate up to 10 segments.

- Supplier management:

- Management both on the basis of competence (setting as ledger) and cash (setting as cost and profit centers).

- Management of due date and payment, to have the report of open and paid invoices.

- Client management:

- Management both on the basis of competence (setting as ledger) and cash (setting as cost and profit centers).

- Management of due date and payment, to have the report of open and collected invoices.

- Invoices to customers:

- Data entry for the creation of invoices.

- Customer account suggestion.

- Quantity and price (make columns visible).

- For billing or cost control.

- Automatic calculation of the amount.

- Item number (if option activated)

- To connect to the items table.

- Automatic calculation of the quantities of products entered and exited.

- Print invoices.

- Indication of further information needed to print the invoice.

Account card

From the Transactions table you can access any account card, just go to the account cell (in the Debit or Credit column) and click on the small icon that appears in the upper right corner of the cell.

When you are in the account card, clicking on the row number of a transaction takes you back to the Transactions table, on the original transaction precisely.

More information on account cards can be found on the Account / Category Card page.

Verify data

Entering values is very secure. Banana Accounting has functions that allow automatic detection and reporting of errors.

- The program verifies that the entered values are correct.

- If there is an imbalance between the Debit and Credit columns, this will be indicated in red in the Info window.

- Transactions you are unsure about can be left pending and completed later.

- For each error message there is a corresponding help page (requires internet connection).

- In the Info window below you have the following information:

- Description, movement and balance of the accounts used.

- Error reports error messages with a link to the help page.

- Reporting of the debit and credit difference.

- By entering the actual bank balances via the #checkbalance function, you can immediately check the correspondence of the balances in the accounting and avoid errors.

- With the Check accounting command, the program rechecks all the data entered and alerts you to oversights and errors.

- You can colour the rows, change fonts and make them bold.

- You can protect the rows.

- Lock transactions with blockchain technology.

Arrangement of columns

To have a more congenial data entry, you can arrange all the columns in your own order.

You can choose to:

- Move the columns to the right or left.

- Display additional columns or hide unnecessary ones.

- Add own columns

- Save the arrangement of the columns (views).

Further information is available on the Columns setup page.

Transactions table columns and views | Double-entry accounting

The Transactions table has a series of columns and views already set.

The columns of the Transactions table

The columns listed hereunder and preceded by an * are usually not visible.

In order to make them visible, use the Columns setup command from the Data menu.

Date

The date the program uses to attribute the transaction to a certain time frame. The date should be within the limits of the accounting period defined in the Basic data of the accounting. In the Options tab, one can indicate whether the transaction date is required, otherwise this value can also be left empty.

If there are locked transactions, the program triggers an error message when a date equal or earlier to the one of the lock is being entered.

*Date Document

The date of the document can be entered, for example the date of issue for an invoice.

*Date Value

The value date of the bank operation can be indicated. This value is being imported from an electronic bank statement.

Document

The number of the voucher that serves as a base for the accounting transaction. When entering transactions, it is advisable to indicate a progressive number on the document, so that the accounting document of the transaction can be easily traced.

The auto-complete feature proposes progressive values as well as transaction codes that have been defined earlier in the Recurring transactions table.

The program proposes the next document number, that can be resumed with the F6 key.

- In case of a numeric numbering, the program simply increases the highest value found in the Doc column.

- Alphanumeric numbering: the program increases the final numeric part; this is useful when one would like to keep a separate numbering for cash and bank movements:

- If earlier Doc number C-01 has been entered, and one starts to type C, the program proposes C-02.

- If earlier Doc number B104 has been entered, and one starts to type B, the program proposes B-105.

- If earlier Doc number D10-04 has been entered, and one starts to type D, the program proposes D10-05.

In the recurring transactions you can setup transactions groups that can be reloaded with a single code.

In order to add a large number of document numbers, you can also use Excel. You can create the desired quantity of document numbers in Excel and then copy and paste it into Banana, in the column of the Transactions Table.

*Document Protocol

An extra column in case an alternative numbering for the transactions or for the document is required.

The auto-complete feature proposes progressive values that function in the same way as the ones in the Document column. It is used, for example:

- When it is necessary to assign a progressive number to the transactions, different from the document number.

- If the transactions are entered by other people, using another file and then these are imported into the accounting. This way it is possible to use both a progressive numbering referred to the accounting and the original number.

*Document Type

Contains a code that the program uses to identify a type of transaction. If you prefer to use your own codes, it is advisable to add a new column.

- 01 In the reports, this transaction is considered an opening transaction, so it doesn't show in the period but in the opening balances.

- from 10 to 19: codes for customers' invoices

- from 20 to 29: codes for suppliers' invoices

- from 30 to 1000: codes reserved for future purposes.

*Document Invoice

A number of an issued or paid invoice that will be used together with the invoice control feature for Customers and Suppliers

*Document Original

The reference number present on a document, to enter, for example, the number of a credit note.

*DocLink to external file

Serves to enter a link to an external file, usually the accounting voucher.

Clicking on the small icon in the upper part of the cell, the program opens the document. See insert, edit and open links.

- When a link has been inserted in the cell, a small icon appears and clicking on it opens the document, but only if it is an extension considered to be safe.

- The other small icon allows you to insert and edit the link.

*External reference

The reference number that was allocated by a program that has generated this transaction. This value can be used to check whether a given operation is imported twice.

Description

The text of the transaction.

The auto-complete feature proposes the text of an already entered transaction, or of one that has been entered in the preceding year when the appropriate option has been activated. When pressing the F6 key, the program retrieves the data of the preceding row with the same description and completes the columns of the active row.

In case the description begins with #CheckBalance, the transaction is being considered as one that serves to check the balance.

Please consult our page Check accounting for more information on the subject.

*Notes

Useful to add notes to the transaction.

Debit Account

The account that will be charged.

- It is possible to also enter a segment in the Debit account column. These are usually separated by a ":" or a "-" o un "-".

By inserting the segment separator sign, immediately move to the next segment. - If instead the Enter key is being pressed, the input will end and one moves to the next column.

- The auto-complete feature proposes the accounts and segments of the Plan of Accounts.

- Instead of the account, you can enter a search text. The program proposes the list of accounts which contains the text in one of the columns.

*Debit Account Description

The description of the entered account retrieved from the Chart of accounts.

Credit Account

The account that will be credited. We refer to the explanation under Debit account for the rest of the information.

*Credit Account Description

The description of the entered account retrieved from the Chart of accounts.

Amount

The amount that will be entered unto the debit and credit account.

*Balance

The Balance column shows the sum of debit and credit. An amount is therefore only displayed for entries in several accounts. At the end of the entry the balance should be zero. If there is a recurring amount it is because there is an error.

VAT columns

Information on the VAT columns can be found att the VAT columns in the Transactions table page

CC1

The Cost center account preceded by "." to be entered without the ".".

If the initials are preceded by the minus sign "-P1", the amount is recorded in credit.

*CC1 Description

The description of the Cost centre, retrieved from the Chart of accounts.

CC2

The Cost center account preceded by "," to be entered without the ",".

If the acronym is preceded by the minus sign "-P2", the amount is recorded in credit.

*CC2 Description

The description of the Cost centre, retrieved from the Chart of accounts.

CC3

The Cost center account preceded by ";" to be entered without the ";".

If the abbreviation is preceded by the minus sign "-P3", the amount is recorded in credit.

*CC3 Description

The description of the Cost centre, retrieved from the Chart of accounts.

*Expiry date

The date before which the invoice has to be paid. For further information see the Customers and Suppliers pages.

*Payment date

Used in combination with the Show Expiry dates command.

When the invoices customers/suppliers control feature in order to check on the payments is used instead, a transaction has to be entered for an issued invoice and another one for the payment thereof.

*Lock Number, Lock Amount, Lock Progressive, Lock Line

More information at the Lock Transactions page.

Additional columns

From the menu Tools > Add New Features > Add Article columns in the Transactions table the following columns are added:

IdItem

The item identifier of the Items table. If you insert an article present in the Items table, the description, unit, unit price, VAT code and account are included.

Quantity

The quantity multiplied by the unit price will produce the total amount (can also be a negative number).

Unit

A description referring to the quantity, for example: mq, ton, pz.

Unit/Price

The unit price multiplied by the quantity, will produce the total amount (can also be a negative number).

If a value is entered in the Quantity or Unit Price columns, the amount is calculated on the basis of the contents in these two columns and converted to a positive value.

Adding new columns

With the Columns setup command, it is possible to display, hide or move the order of columns, add new ones, or indicate that a column should not be included in the printout.

- The added columns in the Transactions table will be added also in the Recurring transactions table, in the Account card and in the VAT report, without being made visible.

In order to display these columns in the other tables, use the Columns setup command. - If a column of the "amount" type is being added, the entered amounts will be added up in the Account card.

Views

When a new accounting is being created, the following views are being automatically created as well:

- Base: the main columns are being displayed

- Cost centres: the CC1, CC2 and CC3 columns are being displayed

- Expiry dates: the columns Expiry date and Payment date are being displayed

- Lock: the columns relative to the Lock function are being displayed.

With the Views setup command, the views can be customized and personal views can be created.

With the Page setup command, you can modify the print mode of the view.

Transaction types | Double-entry accounting

In double-entry accounting, there are different types of accounting transactions. Here's how to book them in Banana Accounting.

Simple transactions (on one row)

Simple transactions are the ones regarding two accounts (one Debit account and one Credit account) and entered in one single row.

The document number is different for each registration.

Composed transactions (on several rows)

Composed transactions with more than two accounts involved, have to be entered on several rows. The user should enter one account per row. The counterpart account for the entire transaction has to be entered on the first row.

The document number, entered on the different rows, is the same because we are dealing with one and the same transaction.

Note:

In composed transactions, the dates of the transaction rows should be the same, otherwise, when doing calculations by period, there may be differences in the accounting.

Opening transactions

The opening balances are normally indicated in the Accounts table.

Opening transactions are required in special cases such as:

- In multi-currency accounting, when you need to have different opening exchange rates than those indicated in the Exchange rates table, opening exchange rate. See Opening transactions in foreign currency.

- Entering Opening balances for segments.

The opening transactions are created by inserting the transactions with the opening date equal to the accounting start date and the code 01 in the DocType column.

- Opening transactions do not change the opening balance in the Accounts table.

- The opening balance entered with transactions is used in balance sheet printouts, account cards.

- If for the same account there is the opening balance and the recording of the opening balance, the two amounts will be added together.

This way, you can enter opening transactions that correct the opening of an account. - When entering opening balances in the transactions, it is necessary to make sure that the sum of the debit (positive) and credit (negative) are at zero.

For each debit entry there must be a corresponding credit entry.

It may be useful to have an opening account that serves as a counterpart for entering opening amounts.

After all the opening transactions, the balance of this account must obviously have zero balance.

When entering opening balances, only the debit or credit account is generally indicated. However, it is also possible to indicate a counterpart which is generally a specific account for openings.

Verification Balance transactions (#CheckBalance) | Double-entry accounting

Banana Accounting Plus includes the #CheckBalance function in the Check and recalculate accounting command for verifying and matching account balances.

This check is essential for the accuracy of the accounting. It is recommended to perform the balance verification periodically at the end of each month, in addition to the end of the accounting period, to avoid incorrect balances being carried over from month to month.

To perform this check, follow these steps:

- Record the date to which the balance refers.

- In the Description column, enter #CheckBalance followed by the amount corresponding to the balance to be verified (e.g., the actual cash balance, bank account balance from the bank statement, etc.).

- In the Debit column, indicate the account being checked (bank account, cash, VAT account, or another account to be verified).

- The Amount column must be left empty.

With this command, the program will flag any accounts with mismatched balances in the Messages window if discrepancies are found.

Recording Bank checks

To enter issued bank checks, the user needs to insert an Issued checks account in the Liabilities.

The check is issued at the moment of paying a supplier and later on is being debited from the Bank current account.

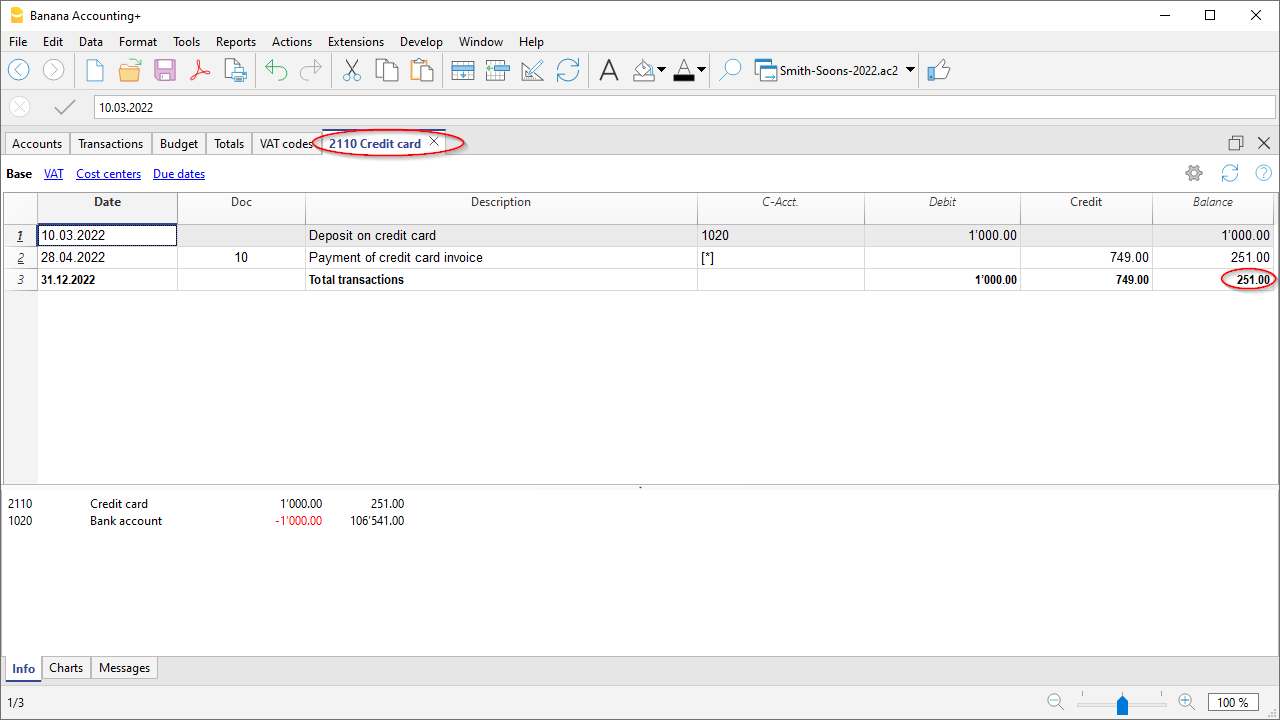

The Issued checks account card after the transactions.

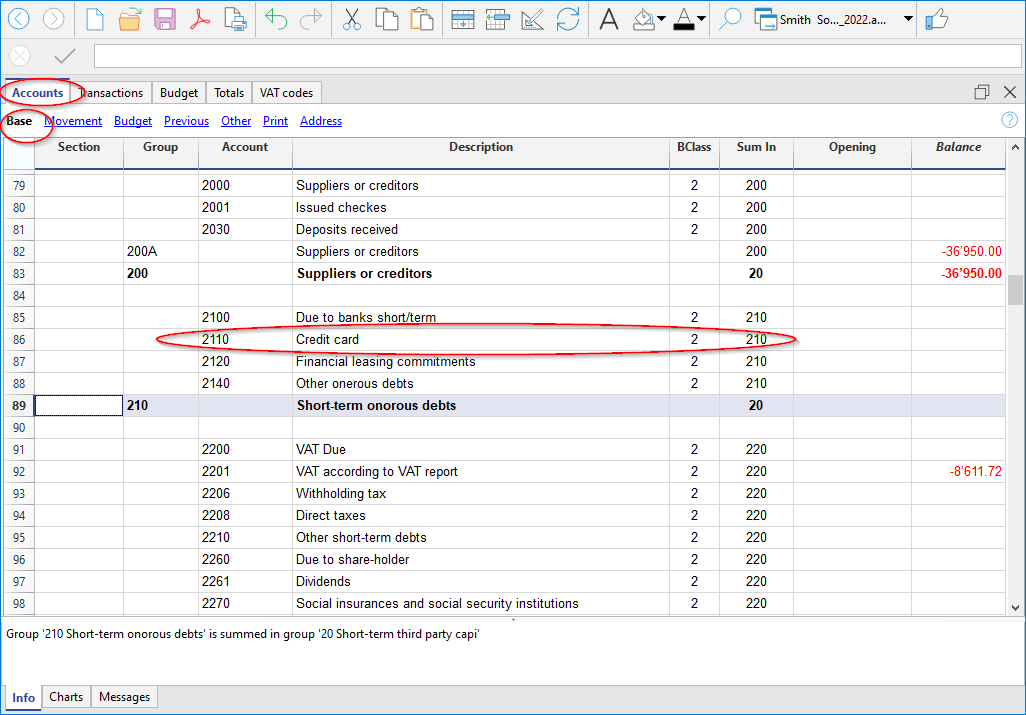

Credit card registration with advance payment

Advance payment on Credit cards

Before taking you through the procedure, check that an account for Credit card exists in the liabilities part of the Chart of Accounts. Create it if that is not the case.

The credit card account is added to the group or sub-group of short-term debts, as long as this is pre-requisite of the Chart of Accounts selected. If there are no sub-groups, it must be listed in the liabilities section.

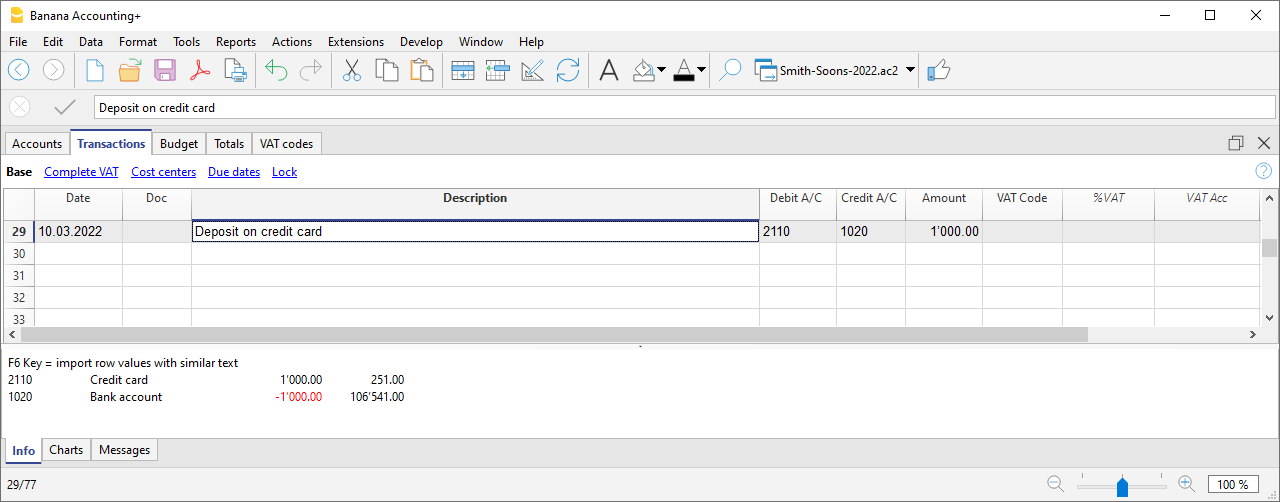

Example:

An amount of CHF 1'000.- is transferred from the bank account to the credit card.

- In Debit the credit card account is recorded

- In Credit the bank account with which the payment is made is recorded.

Register your credit card bill

When the credit card bill arrives, you must record all charges listed on the credit card and reverse the credit from the credit card account.

Example:

The credit card statement shows a total of CHF 749.- (detail: CHF 479.- for computer purchase, CHF 150.- for hotel expenses, CHF 120.- purchase of office supplies) (Doc.10)

Enter on several rows:

- All costs related to the expenses listed on the credit card are recorded as a Debit; you post a cost per line.

- Enter your credit card account as a Credit.

Check the credit card account balance

Each time you pay an advance towards the credit card and once all the costs listed on the credit card have been recorded, you must verify that the credit card balance matches the balance stated on the credit card.

Register your credit card transactions according to the Cash and the Turnover principle

Credit Card with an accounting using the Cash principle

If no down payments are made on the credit card and the invoice is paid in full by the bank, you should record the credit card invoice at the time of payment when the costs should also be recorded.

You need to record on several rows:

- Enter the same date and the same Document No. for each transaction on all the rows that make up for the transaction.

- In the Debit column, enter one account per row, referring to the cost or investment of the credit card transaction.

- Enter the amount of each single transaction recorded in Debit.

- In the Credit column, enter the bank or post office account with which the invoice is paid.

- In the Amount column, enter the total amount paid on the credit card invoice.

- In the case of VAT liability, enter the VAT code for each row in the VAT Code column.

After recording all movements, check your credit card balance by opening the credit card account card.

Credit card and turnover accounting

If the accounting postings are based on turnover, all costs related to credit card purchases are recorded upon receipt of the credit card invoice:

- Enter the same date and the same Document No. for each transaction for all the rows that make up for the transaction.

- All cost accounts are posted as a Debit. Each cost must be recorded on one row.

- In the Amount column, enter the amount of the single transaction recorded in Debit.

- Register your credit card account, as a Credit, as any supplier.

- In the Amount column, enter the total amount to be payed by the credit card.

- In the case of VAT liability, enter the VAT code for each row in the VAT Code column.

When the credit card bill is paid, enter the payment:

- As Debit in credit card account (the debt is extinguished).

- As Credit in the bank or post office account with which the invoice is paid.

- The total amount of the credit card paid is entered as the amount.

Registrazioni su conto privato

Il conto privato è un conto finanziario, utilizzato nella contabilità per registrare quelle transazioni che non riguardano direttamente l'azienda, ma il patrimonio personale del titolare. Questo conto tiene traccia dei prelievi e degli apporti del titolare a scopi privati; pertanto serve per tenere separate le finanze aziendali da quelle personali, evitando confusione contabile.

Prelievi dall'azienda del privato/socio

I prelievi personali vengono registrati come diminuzione del patrimonio netto. Se il titolare/socio utilizza fondi aziendali per spese personali, l'importo viene addebitato al conto privato.

Esempio di scrittura contabile per un prelievo in contanti:

- Dare: Conto privato (per il prelievo del titolare/socio)

- Avere: Cassa/Banca (per l'importo prelevato).

Apporti nell'azienda dal privato/socio

Gli apporti personali del titolare (es. aumento di capitale o versamenti per coprire spese) vengono registrati come incremento del patrimonio netto.

Esempio di scrittura contabile per un apporto in contanti:

- Dare: Cassa/Banca (per l'importo versato dal titolare/socio)

- Avere: Conto privato (per l'apporto del titolare/socio).

Utili prelevati

Se il titolare/socio preleva utili maturati:

- Dare: Conto utili a nuovo (o Risultato di esercizio)

- Avere: Conto privato

Saldo del Conto Privato/socio

- Saldo positivo: indica che il titolare ha un credito verso l'azienda.

- Saldo negativo: indica che il titolare ha debito verso l'azienda.

Importing transactions from your credit card

Banana Accounting allows the importation of movements from the credit card into the main accounting file.

You must ensure that the chart of accounts includes the credit card account and the transfer account to be used for down payments.

Install the format of your bank

In order to be able to carry out the import it is necessary that the data format, provided by the credit card issuing bank, is compatible with the formats provided by Banana accounting.

To install the extension related to the data format released by the issuing bank, proceed as follows:

- Menu Extensions → Manage Extensions

- Select the issuing bank of the credit card and click on the Install button.

The format will be displayed in the Import into accounting box.

Importing the credit card movements

After having installed the extension for the Banana compatible data format, proceed as follows to import the data:

- Actions Menu → Import into accounting → Transactions:

- Select the format type of the bank that issued the credit card.

- With the Browse button, select the file transmitted by the bank and confirm with OK.

- Enter the period and indicate the credit card account and confirm with OK.

All transactions are imported into the Transactions table. - Enter the counterpart account that refers to the movement for each row.

Import credit card transactions with deposits made

When deposits have been made on the credit card, they are recorded in the accounting system. In this case, after importing the credit card data, there is the problem of the recording of the deposits. In this case a double transaction appears on the credit card account:

- Presence of the credit card account as a counterpart to the bank charges for payments to the credit card.

- Presence of the credit card account in the transactions imported from the credit card.

To avoid this overlap, the transfer account is being used at the time of import.

How to proceed with the import:

- Actions Menu → Import into accounting → Transactions:

- Select the format type of the bank that issued the credit card.

- With the Browse button, select the file transmitted by the bank and confirm with the OK button

- Enter the period and indicate the transfer account. Confirm with the OK button.

All transactions are imported into the Transactions table. - Enter the counterpart account that refers to the movement for each row.