Neste artigo

VAT on goods purchased abroad must be paid directly at customs. After payment, customs issues a clearance document that shows the taxable amount and the VAT paid. VAT-registered businesses can reclaim this amount.

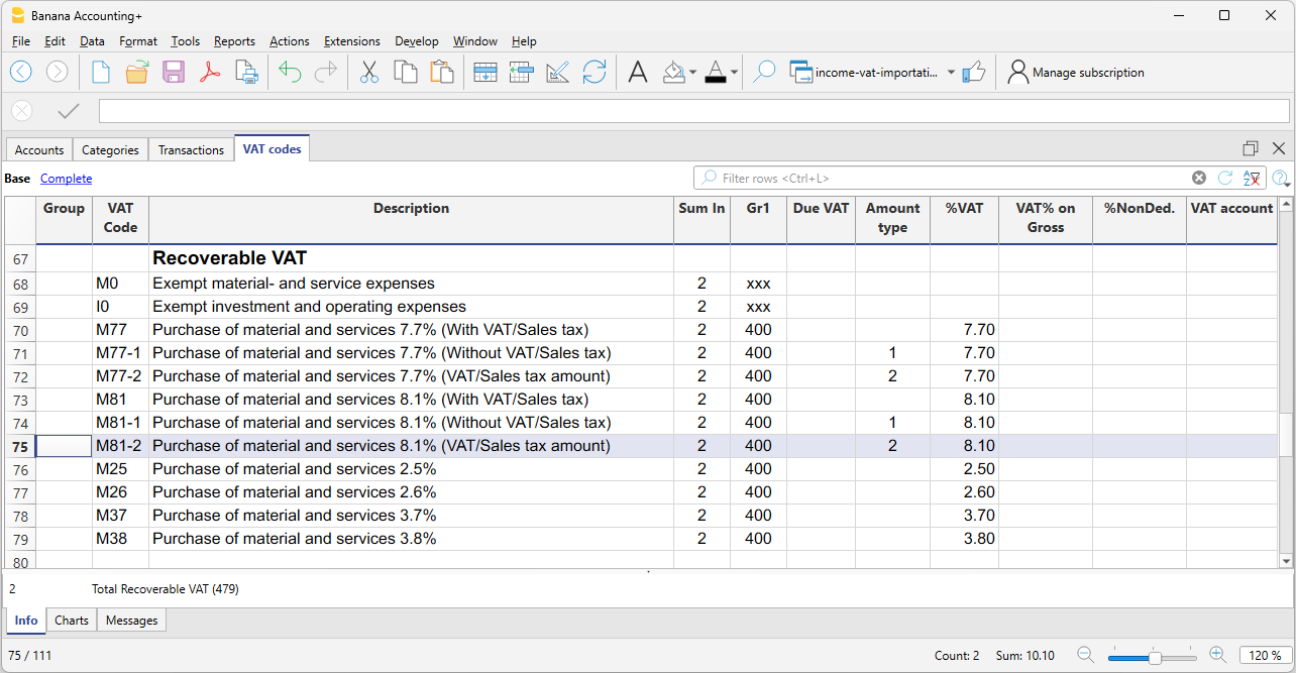

VAT codes for VAT paid at customs

All preconfigured accounting templates with VAT include a specific code for recording VAT on imported goods:

- M81-2 Purchase of goods and services 8.1% (VAT amount)

By using this code, the program considers the amount entered in the Amount column as 100% VAT. As a result, the full amount paid at customs is correctly recorded in the VAT return.

- Adding custom VAT codes

In the VAT Codes table, you can add new codes, for example to manage a different rate.

To reclaim customs VAT at 2.6%, simply:- create a new code, for example M26-2

- set the GR1 group in the Sum in column

- set amount type 2

- indicate 2.6% as the rate

Customs VAT paid in cash

When VAT on imported goods is paid in cash, to reclaim the VAT proceed as follows:

- In the Transactions table:

- enter the date, document number, and description in the respective columns

- in the Expenses column, enter the amount paid in cash

- in the Account column, enter the Cash account

- in the Category column, enter the shipping expense category

- in the VAT Code column, enter the M81-2 code, which calculates and automatically enters the full VAT amount into the VAT account.

The program posts the full VAT amount without creating discrepancies in the entries.

Customs VAT paid by the freight forwarder

In this case, VAT is advanced by the freight forwarder, who handles the transport and customs clearance of the goods. The freight forwarder’s invoice will include transport costs, customs charges, and the advanced VAT on the imported goods.

The process is similar to the previous case, but the entry is made over several rows, as the forwarder's invoice may include both transport expenses and customs VAT.

Example

Forwarder's invoice paid for a total of CHF 250, of which CHF 200 is for transport and CHF 50 is for VAT advanced at customs.

In the Transactions table:

- In the first row, record in the appropriate columns:

- the date, document number, description

- in the Expenses column, the total amount of the forwarder's invoice

- in the Account column, the bank account. The Category column remains empty

- In the second row, record in the appropriate columns:

- the date, document number, description

- in the Expenses column, the amount of transport costs with VAT code M81

- in the Category column, the shipping expense account or similar

- in the VAT Code column, enter M81 to calculate VAT on the transport costs

- In the third row, record in the appropriate columns:

- the date, document number, description

- in the Expenses column, the amount of VAT paid at customs by the forwarder

- the Account and Category columns remain empty

- in the VAT Code column, enter the code M81-2, which calculates and automatically posts the full VAT amount to the VAT account