Neste artigo

Reset of Account 2201, VAT Return

At the end of the period, the balance of account 2201 VAT Return (automatic VAT account) must be reset with a reversal entry by entering:

- In the Debit column: account 2201 VAT Return

- In the Credit column: account 2200 VAT Payable

This operation involves:

- Reset of the balance of account 2201, VAT Return (automatic VAT account).

- Transfer of the VAT balance to the VAT due account (or Treasury VAT account).

- If this results in a VAT debit, the VAT balance is posted in Credit of the VAT due account; in Debit of the "VAT according to VAT report" account, the balance is set to zero.

- If this results in a VAT credit, the VAT balance is posted in Debit of the VAT due account; in Credit of the "VAT according to VAT report" account, the balance is set to zero.

Transaction for charging the quarter balance to the Due VAT account

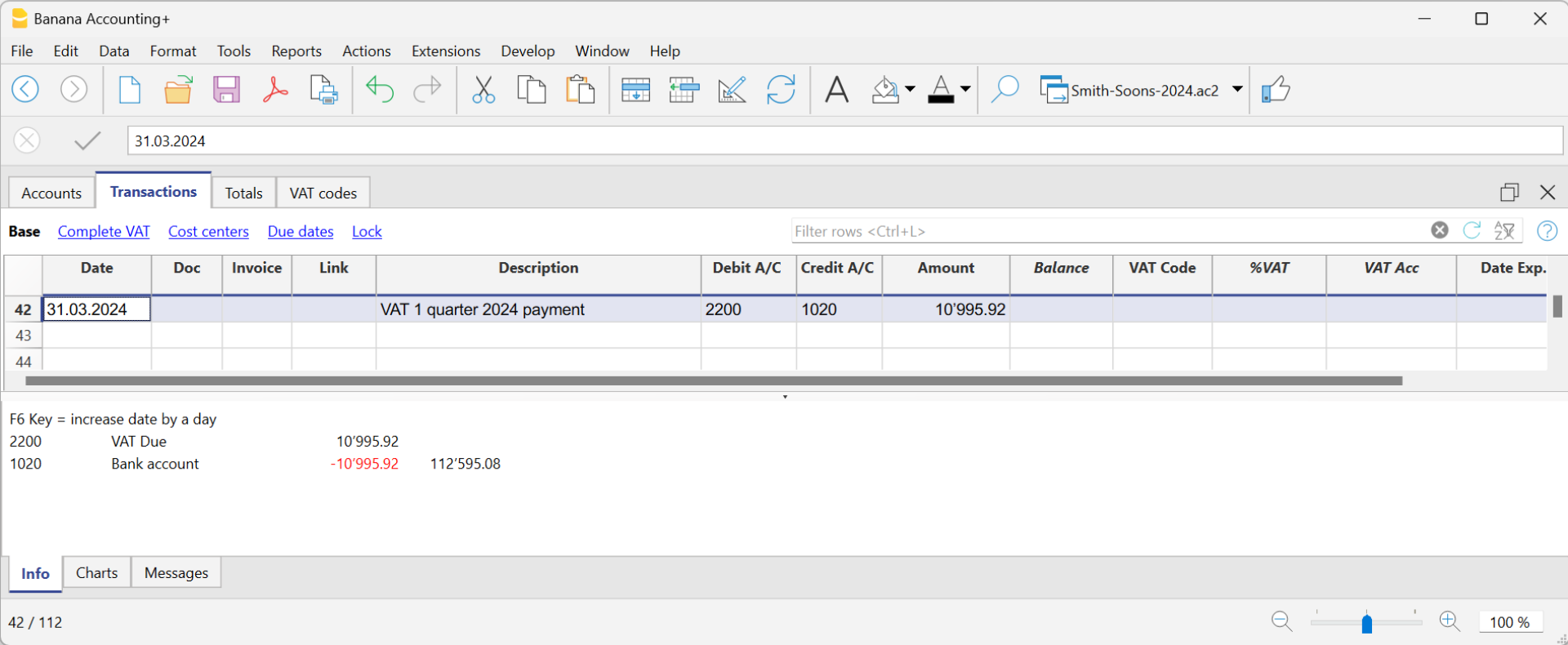

VAT balance payment

When the VAT amount is paid to the FTA (Federal Tax Administration), the balance in the VAT Due account resets to zero.

For the transaction:

- Enter the Date, Document number, and Description in the respective columns.

- In the Debit column, enter the VAT Due account.

- In the Credit column, enter the liquidity account.

- In the Amount column, enter the VAT Due amount paid.

With this system, it is possible to monitor the balance for each quarter, and in case of an error, identify the period in which the balance no longer matches.

Ledger of account 2200 VAT Payable after the payment entry

Note

The procedure explained refers to the payment of VAT recorded using the effective method and also applies to the flat-rate VAT method with VAT breakdown.

For those who have recorded VAT using the balance rate method without VAT breakdown, specific information can be found on the web page Accounting Adjustment and VAT Payment.

VAT due account card after the payment

How to register a VAT credit (Switzerland)

If at the end of a period, when calculating the VAT declaration, the previous VAT is bigger than the due VAT, your VAT report has a Debit balance.

To reset the "VAT according to VAT report" account to zero, you need to enter a transaction as follows:

- put in Debit A/C the VAT Due account

- put in Credit A/C the "VAT according to VAT report" account

Usually, in Switzerland the VAT credit is reimbursed to the company, without having to move the credit to the following period.

When your VAT is reimbursed, you need to enter a transaction as follows:

- put in Debit A/C your liquidity account

- put in Credit A/C your Due VAT account (where the balance should go to zero).