In this article

Transactions table

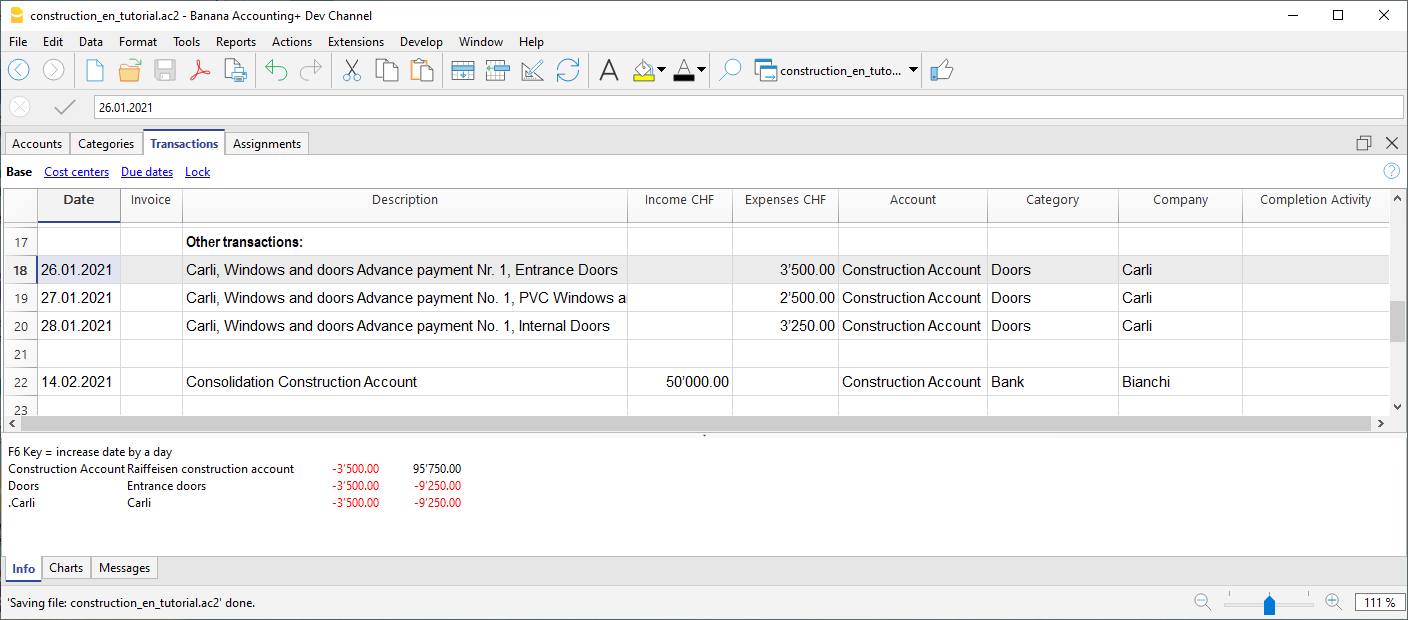

In the transactions table, record the payments that are made for the project. For each transaction, in addition to the account, it also indicates the company and the category to which it refers. In the Expenses column indicates the amount of the payment, this value is also included in the Categories table.

Advance payment and invoices

The advance payment or invoice payment is recorded, indicating the date, the amount, the account used for the payment, expense category and the company's account.

You can also link the transaction row to the digital slip, so that you can view it with one click.

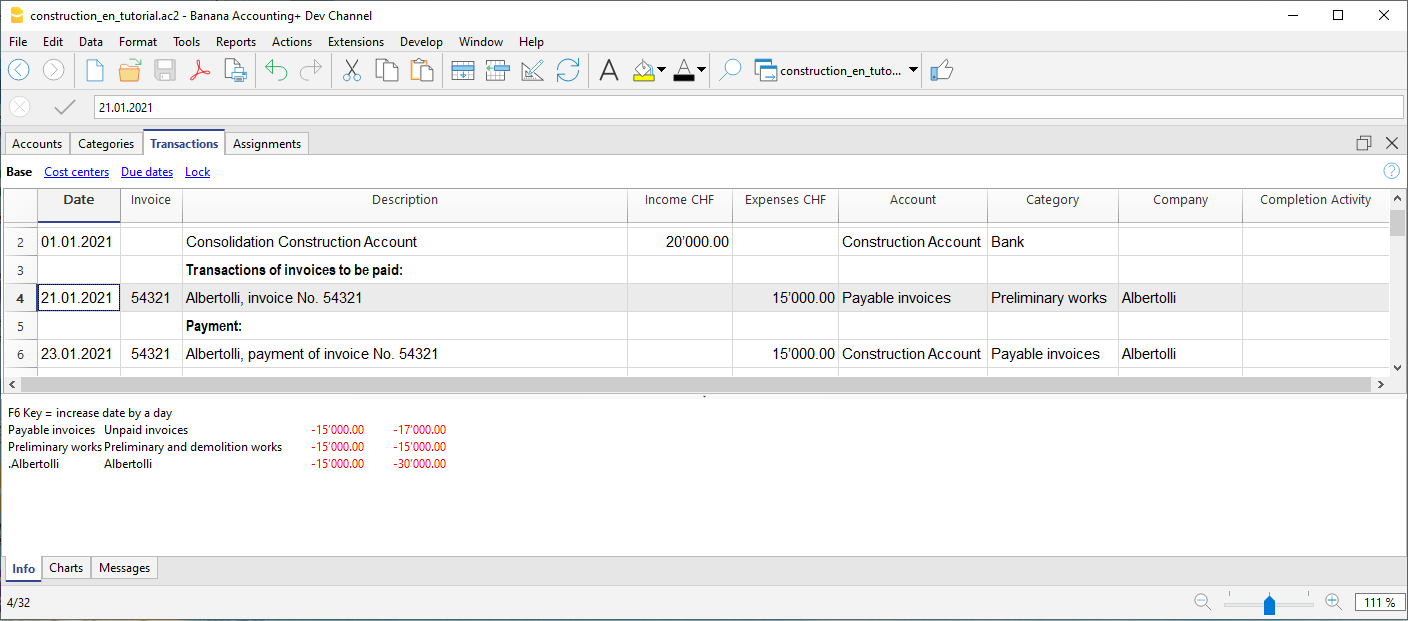

Receipt of invoice

The accounting management is carried out on the amounts actually been paid. To have an updated situation, it is possible to insert also the receipt of the invoice. In the account column you will have to insert the invoice account to be paid.

When you subsequently make the payment, the invoice receipt transaction must be overwritten with the payment information. If the payment is partial, you will need to create another transaction and split the amounts manually.

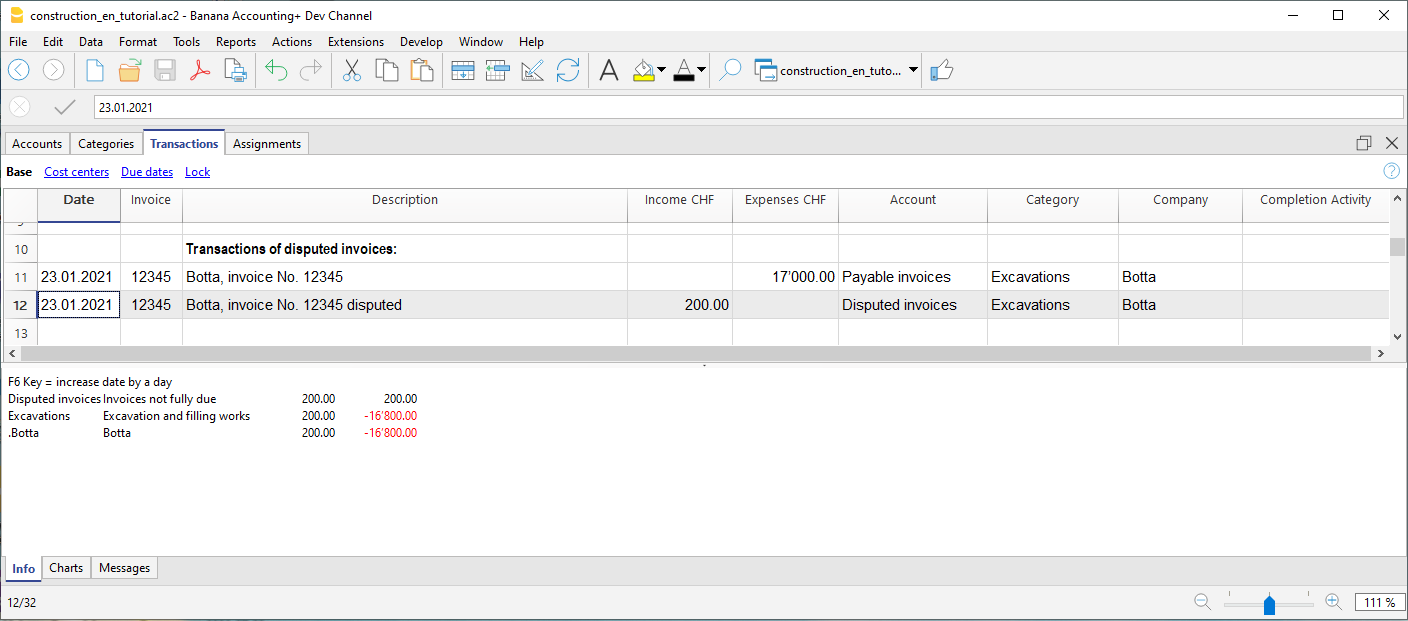

Disputed works

Records as if it were a payment, but using the account, disputed invoices.

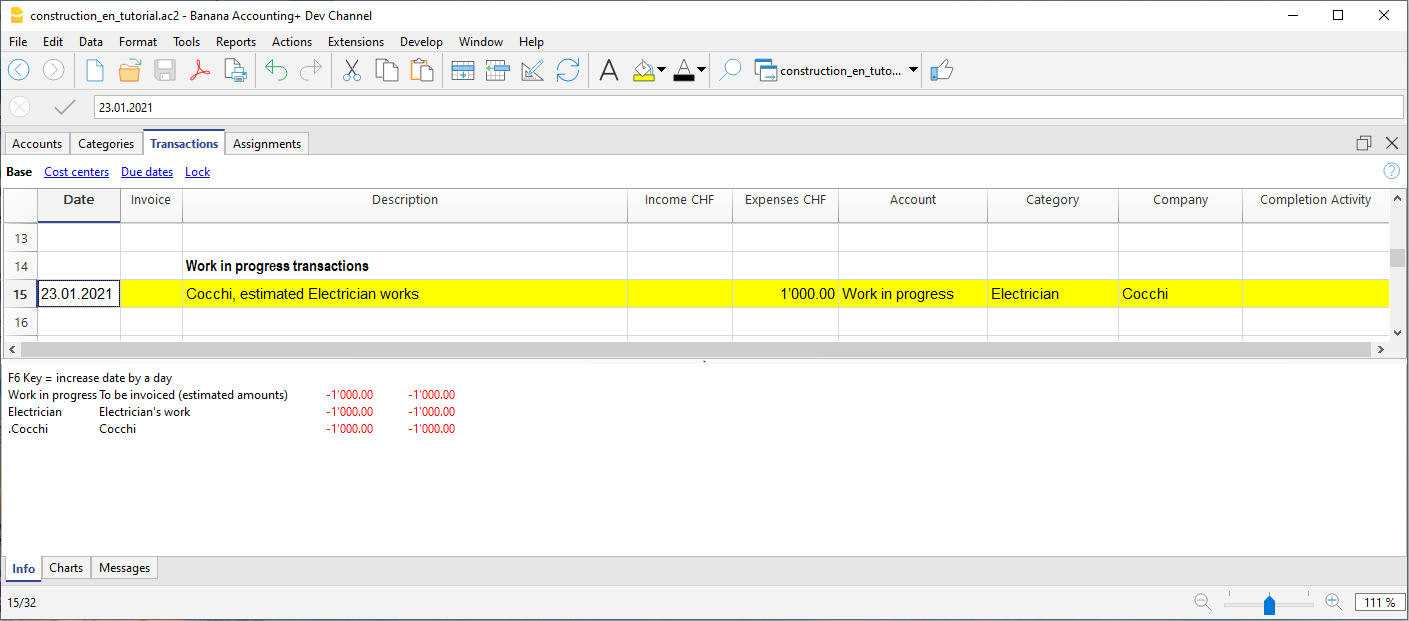

Work in progress

You can enter registrations, similar to payments, but indicating the work in progress account. The amount will be estimated by the construction management. In this way, you can have a progression of the works. You can also color these rows with a particular color, so that you can easily distinguish them from the others.

When the invoices arrive, you will need to replace the invoice.

Income and financial transactions

In the transactions table you can also enter income such as subsidies or other financial transactions, capital payment or construction account consolidation.

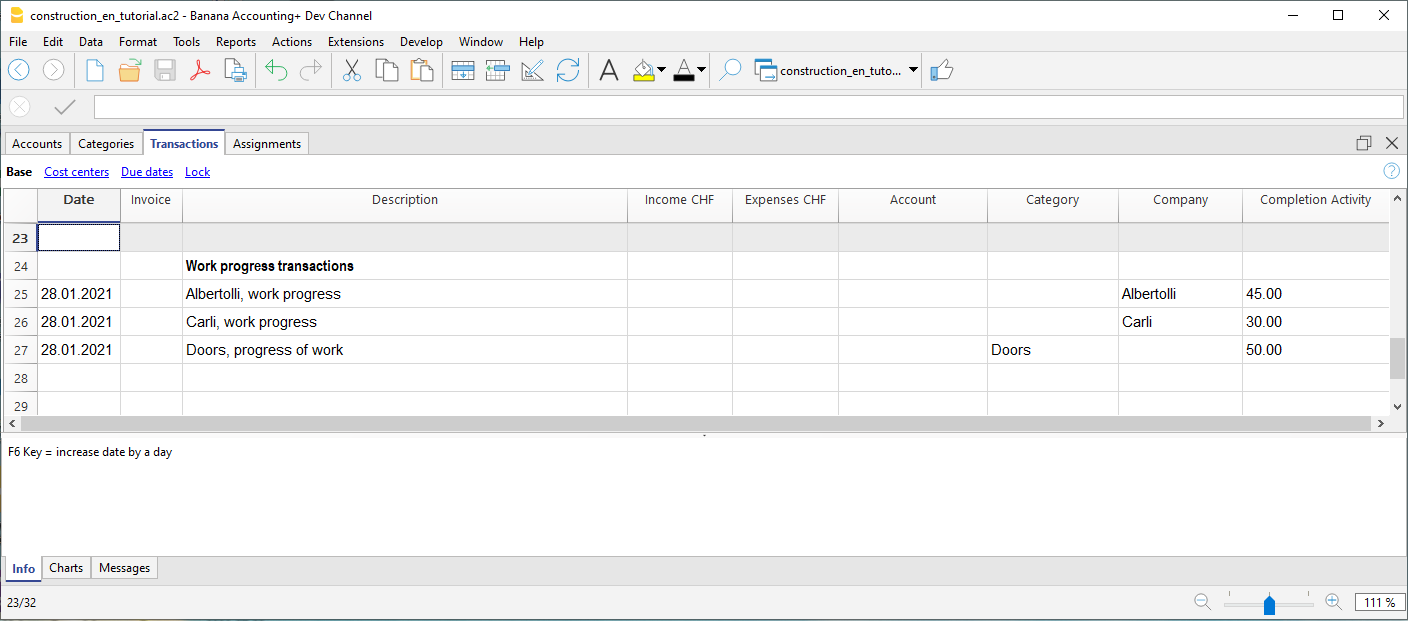

Percentage of work progress

Use the transactions table also to record manually the percentage of work progress. Define if the transaction is related to a company or a category, and the percentage. In the report you can evaluate the progress with the costs incurred.