In this article

Multi currency-accounting template for enterprise in United Arab Emirates with VAT (account numbers)

Double entry accounting for keeping track of the VAT transactions and printing a VAT Report for the United Arab Emirates.

Open in Banana WebApp

Run Banana Accounting Plus on your browser without any installation. Customize the template, enter the transactions and save the file on your computer.

Open template in WebAppTemplate documentation

Information specific for United Arab Emirates:

Accounting template features

The template has been setup in order to let you manage a company in United Arab Emirates:

- Basic Currency is AED (UAE Dirham).

- Multi-currency accounting.

- VAT Table set up for UAE reporting.

Balance Sheet and Profit & Loss

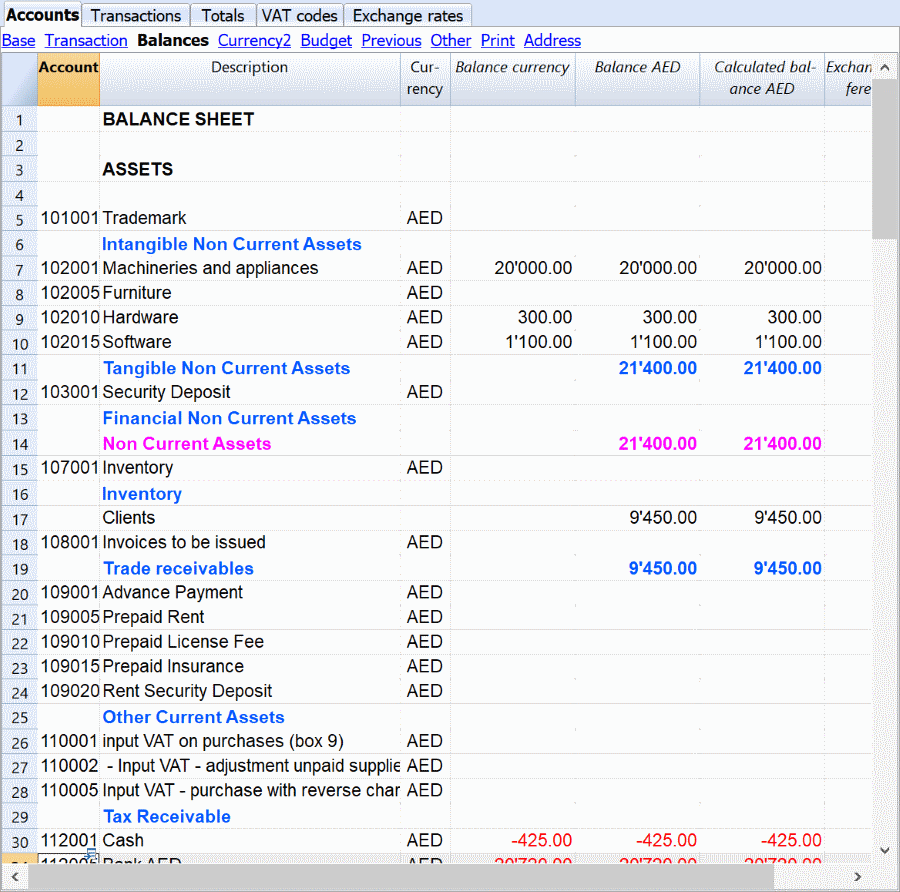

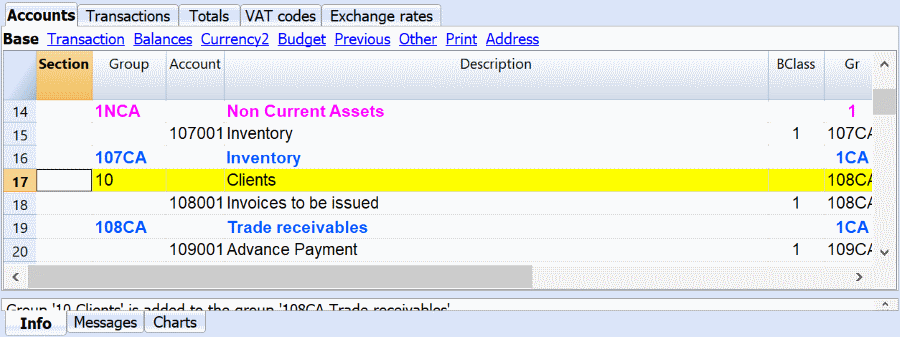

The Accounts table contains all accounts and groups, structured for balance sheet (BS) and the profit & loss statement (PL).

- Customize the accounting plan to exactly your needs by changing description, add or remove accounts and groups.

- Select the View Basic and enter the opening balance available in the column “Opening”.

The following image shows the Account table, Balances view.

- The column “Balance AED” is updated automatically when you change the opening amount or you enter transactions in the Transactions table”.

Balance sheet

The balance sheet shows your assets and your liabilities. Banana Accounting includes accounts that are usually utilized by SMEs. Nevertheless, you can customize the accounts. Be careful not to modify the accounts related to the VAT reporting. Those are essential to correctly generate the VAT report needed to fill out the online VAT return form in Saudi Arabia.

Profit & loss statement

The profit & loss statement shows the revenues and the expenses incurred by the company. Banana Accounting included accounts usually used by SMEs. Nevertheless, you can customize the accounts when needed.

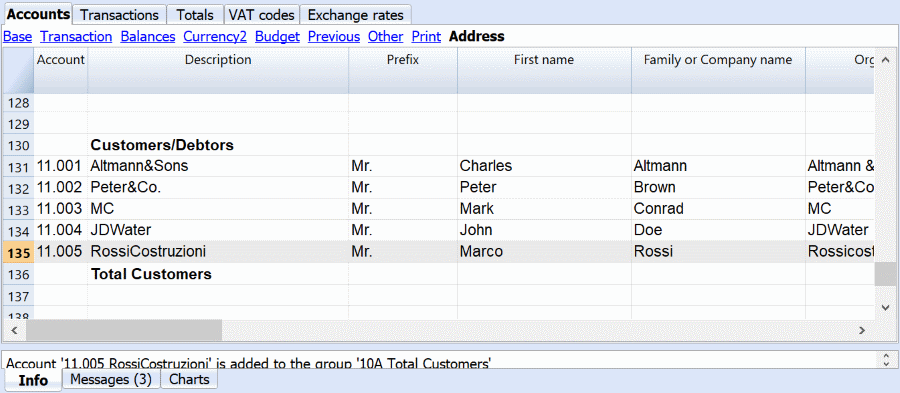

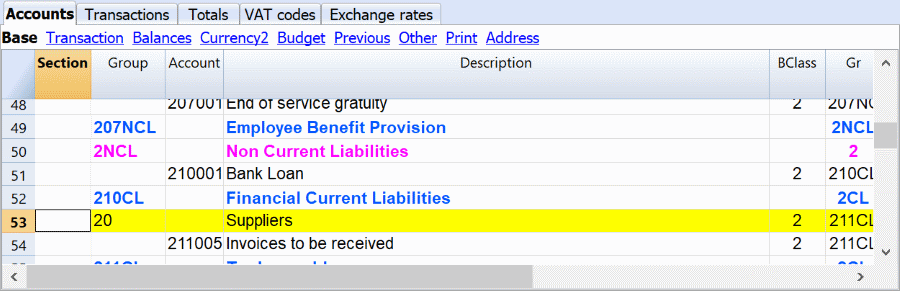

Clients/suppliers register

After the P&L statement, there is a section where you can assign accounts to specific customers and suppliers. You will use these accounts to register transactions directly related to specific customers or suppliers. Banana also offers the possibility to print invoices from these transactions.

All the accounts in the clients/suppliers register are regrouped under two accounts present in the assets and liabilities.

Double-entry accounting

You will notice that liability and revenue accounts are shown in negative and in red color. This is due to the fact that Banana Accounting fully leans on the concept of double-entry accounting. The principle of “debit and credit” present in the double entry accounting is usually represented in two separate columns. When it appears in a single column, as it happens in the accounts table, it is shown in red and in negative to better distinguish debit accounts from credit accounts.

Template preview

UAE-Multicurrency-VAT

Basic Currency: AED

Double-entry with foreign currencies and VAT/Sales tax

| Group | Account | Description | Currency | Sum In |

|---|---|---|---|---|

| BALANCE SHEET | ||||

| ASSETS | ||||

| 101001 | Trademark | AED | 101NCA | |

| 101NCA | Intangible Non Current Assets | 1NCA | ||

| 102001 | Machineries and appliances | AED | 102NCA | |

| 102005 | Furniture | AED | 102NCA | |

| 102010 | Hardware | AED | 102NCA | |

| 102015 | Software | AED | 102NCA | |

| 102NCA | Tangible Non Current Assets | 1NCA | ||

| 103001 | Security Deposit | AED | 103NCA | |

| 103NCA | Financial Non Current Assets | 1NCA | ||

| 1NCA | Non Current Assets | 1 | ||

| 107001 | Inventory | AED | 107CA | |

| 107CA | Inventory | 1CA | ||

| 10 | Clients | 108CA | ||

| 108001 | Invoices to be issued | AED | 108CA | |

| 108CA | Trade receivables | 1CA | ||

| 109001 | Advance Payment | AED | 109CA | |

| 109005 | Prepaid Rent | AED | 109CA | |

| 109010 | Prepaid License Fee | AED | 109CA | |

| 109015 | Prepaid Insurance | AED | 109CA | |

| 109020 | Rent Security Deposit | AED | 109CA | |

| 109CA | Other Current Assets | 1CA | ||

| 110001 | input VAT on purchases (box 9) | AED | 110CA | |

| 110002 | - Input VAT - adjustment unpaid suppliers older than 6 month (box 9) | AED | 110CA | |

| 110005 | Input VAT - purchase with reverse charge (box 10) | AED | 110CA | |

| 110CA | Tax Receivable | 1CA | ||

| 112001 | Cash | AED | 112CA | |

| 112005 | Bank AED | AED | 112CA | |

| 112010 | Bank EUR | EUR | 112CA | |

| 112015 | Bank USD | USD | 112CA | |

| 112016 | Bank CNY | CNY | 112CA | |

| 112CA | Cash and cash equivalent | 1CA | ||

| 1CA | Current Assets | 1 | ||

| 1 | Total ASSETS | 00 | ||

| LIABILITIES | ||||

| 201001 | Share Capital | AED | 2SE | |

| 201005 | Reseve | AED | 2SE | |

| 201010 | Retained (Profit) or Loss | AED | 2SE | |

| 230 | Profit or loss of the current year | 2 | ||

| 2SE | Shareholders' Equity | 2 | ||

| 205001 | Shareholders' loan - AED | AED | 205NCL | |

| 201002 | Shareholders' loan - EUR | EUR | 205NCL | |

| 205010 | Long term loan | AED | 205NCL | |

| 205NCL | Financial Non Current Liabilities | 2NCL | ||

| 207001 | End of service gratuity | AED | 207NCL | |

| 207NCL | Employee Benefit Provision | 2NCL | ||

| 2NCL | Non Current Liabilities | 2 | ||

| 210001 | Bank Loan | AED | 210CL | |

| 210CL | Financial Current Liabilities | 2CL | ||

| 20 | Suppliers | AED | 211CL | |

| 211005 | Invoices to be received | AED | 211CL | |

| 211CL | Trade payables | 2CL | ||

| 212200A | Automatic VAT | AED | 212CL | |

| 212200 | VAT payable | AED | 212CL | |

| 212201 | Automatic VAT Account | AED | 212CL | |

| 212202 | VAT temporary reverse charge | AED | 212CL | |

| 212CL | Tax liabilities | 2CL | ||

| 213001 | Payables vs personnel | AED | 213CL | |

| 213015 | Accruals AED | AED | 213CL | |

| 213020 | Other current liabilities | AED | 213CL | |

| 213CL | Other Current Liabilities | 2CL | ||

| 2CL | Current Liabilities | 2 | ||

| 2 | Total LIABILITIES & EQUITY | 00 | ||

| PROFIT/LOSS STATEMENT | ||||

| EXPENSES | ||||

| 301001 | Variation of inventories | AED | 301MA | |

| 301005 | Purchase of materials | AED | 301MA | |

| 301015 | Duty and freight | AED | 301MA | |

| 301MA | Material | 3OC | ||

| 302001 | Licenses | AED | 302SE | |

| 302005 | Administrative costs | AED | 302SE | |

| 302010 | Professioanal consultancies | AED | 302SE | |

| 302015 | Legal fee | AED | 302SE | |

| 302020 | Accounting services | AED | 302SE | |

| 302025 | Audit fee | AED | 302SE | |

| 302030 | Utilities | AED | 302SE | |

| 302035 | Maintenance and repairs | AED | 302SE | |

| 302040 | IT services | AED | 302SE | |

| 302045 | Office rent | AED | 302SE | |

| 302050 | Travel expenses | AED | 302SE | |

| 302055 | Marketing expenses | AED | 302SE | |

| 302060 | Insurance | AED | 302SE | |

| 302SE | Services Rental and Lease | 3OC | ||

| 303001 | Salary | AED | 303PE | |

| 303005 | End of service | AED | 303PE | |

| 303010 | Health insurance | AED | 303PE | |

| 303015 | VISA | AED | 303PE | |

| 303020 | Other personnel cost | AED | 303PE | |

| 303PE | Personnel | 3OC | ||

| 304001 | Amort machineries and appliances | AED | 304AM | |

| 304005 | Amort furniture | AED | 304AM | |

| 304010 | Amort hardware | AED | 304AM | |

| 304AM | Amortisation | 3OC | ||

| 305001 | provision for doubtful accounts | AED | 305OT | |

| 305015 | other provision | AED | 305OT | |

| 305020 | Negative adjustments | AED | 305OT | |

| 305OT | Other costs | 3OC | ||

| 3OC | Operating costs | 3 | ||

| 306001 | Bank interest payable | AED | 3FC | |

| 306005 | Foreign currency losses | AED | 3FC | |

| 3FC | Finance Costs | 3 | ||

| 3 | Total EXPENSES | 02 | ||

| REVENUE | ||||

| 401001 | Sales | AED | 401EI | |

| 401EI | External Incomes | 4OI | ||

| 402001 | Services Intragroup | AED | 402II | |

| 402II | Intragroup Incomes | 4OI | ||

| 403001 | Positive adjustments | AED | 403OI | |

| 403005 | Ohter Incomes | AED | 403OI | |

| 403OI | Other Incomes | 4OI | ||

| 4OI | Operating revenues | 4 | ||

| 404001 | Bank interest receivable | AED | 4FI | |

| 404005 | Foreigh currency profit | AED | 4FI | |

| 4FI | Finance Income | 4 | ||

| 4 | Total REVENUE | 02 | ||

| 02 | Profit(-) Loss(+) from Profit & Loss Statement | 230 | ||

| 00 | Difference should be = 0 (blank cell) | |||

| Customers/Debtors | ||||

| 11.001 | Altmann&Sons | AED | 10A | |

| 11.002 | Peter&Co. | AED | 10A | |

| 11.003 | MC | AED | 10A | |

| 11.004 | JDWater | AED | 10A | |

| 11.005 | RossiCostruzioni | AED | 10A | |

| 10A | Total Customers | 10 | ||

| Suppliers/Creditors | ||||

| 20.001 | Smith&Co | AED | 20A | |

| 20.002 | Doe&Sons | AED | 20A | |

| 20.003 | BosiaSoftware | AED | 20A | |

| 20A | Total Suppliers | 20 |

| VAT Code | Description | %VAT |

|---|---|---|

| Output VAT - VAT due | ||

| OSR1 | Sales at 5% standard rate Abu Dhabi (Box 1a) | 5.00 |

| OSR2 | Sales at 5% standard rate Dubai (Box 1b) | 5.00 |

| OSR3 | Sales at 5% standard rate Sharjah (Box 1c) | 5.00 |

| OSR4 | Sales at 5% standard rate Ajman (Box 1d) | 5.00 |

| OSR5 | Sales at 5% standard rate Umm Al Quwain (Box 1e) | 5.00 |

| OSR6 | Sales at 5% standard rate Ras Al Khaimah (Box 1f) | 5.00 |

| OSR7 | Sales at 5% standard rate Fujairah (Box 1g) | 5.00 |

| OSTS | Tax refunds provided to turists | |

| ORCS | Purchase of services with reverse charge - OUTPUT VAT - (Box 3) | 5.00 |

| OZR | Sales Zero Rated (Box 4) | |

| OEX | Sales Exempt (Box 5) | |

| ORCI | Import of goods with reverse charge - OUTPUT VAT calculated by UAE Custom - (Box 6) | 5.00 |

| ORCA | Adjustment values calculated by Custom on import of goods - (Box 7) | 5.00 |

| OOS | Sales Out of Scope | |

| OIG | Sales to registered customers in other GCC implementing state (no UAE VAT) | |

| Input VAT - VAT recoverable | ||

| ISR | Purchases at 5% standard rate (Box 9) | 5.00 |

| IRC | Purchases of goods and services with reverse charge - INPUT VAT - (Box 10) | 5.00 |

| IZR | Purchases Zero Rated | |

| IEX | Purchases Exempt | |

| IOS | Purchases Out of Scope | |

| TOTAL | ||

| : ADJ - adjustements are registered with the same VAT code used for the transactions that needs an adjustment |

| Ref.Currency | Currency | Text |

|---|---|---|

| AED | EUR | Euro |

| AED | USD | US Dollars |

| AED | CNY | Chinese Yuan |