In this article

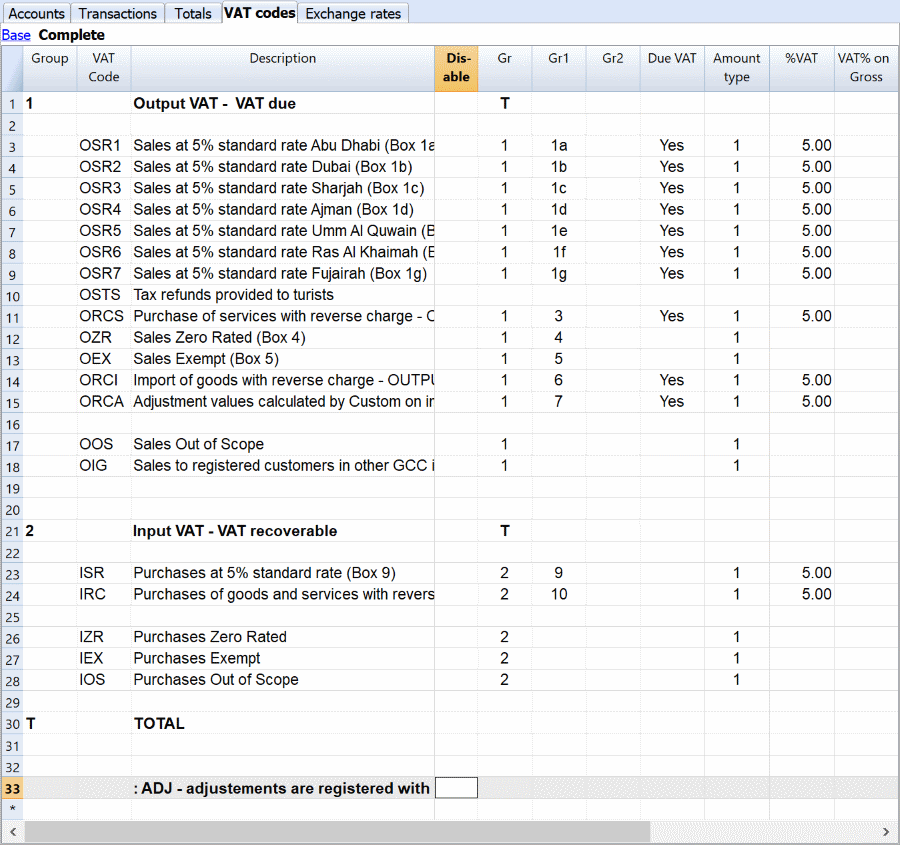

The Vat Table in Banana accounting contains the VAT codes that are setup accordingly the need for UAE, with all the cases you need in order to correctly calculate and report the VAT.

- The VAT Code is the code you will enter in the Transactions table. The program will automatically calculate the VAT and register on the specified account.

- The column “Gr 1” indicate in with box of the form the amount should be totalized. It is used by the Extension to appropriately sum amounts.

If you add a new VAT Code you should also specify the form code. - VAT percentage is 5% or 0%.

In case new percentages are introduced by the fiscal authorities, a new VAT percentage needs to be modified in the VAT table.

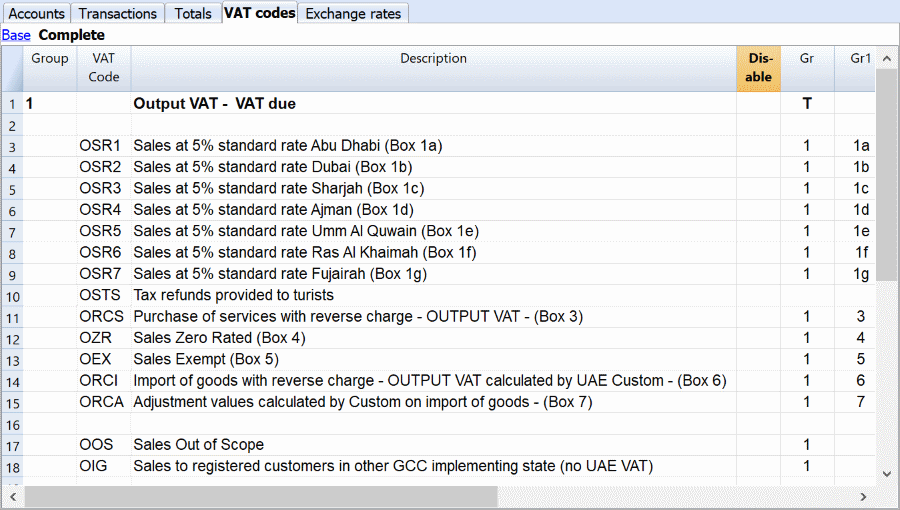

VAT due UAE

VAT code that are used for revenues. There are VAT Code for each Emirate.

- Sales at 5%: These vat codes include all goods and services subjected at the standard rate of 5%. The FTA requires to separate the sales.

- Tax refunds provided to tourists: this VAT code should be used only by retailers which provide the tax refunds to tourists.

- Reverse charge: this VAT code is used to record entries related to reverse charge mechanisms.

- Sales zero rated: all goods and services sold in the UAE which are subject to a rate of 0%.

- Exempt sales: all goods and services sold in or outside Saudi Arabia which are exempt from the VAT.

- Import of goods: all goods imported in the UAE and declared at customs.

- Sales out of scope: a VAT code for sales outside the scope of the VAT agreement.

- Sales to other GCC implementing states: GCC implementing states are not subject to the VAT agreement.

All the adjustments are registered with the same VAT code used for the transactions that needs an adjustment.

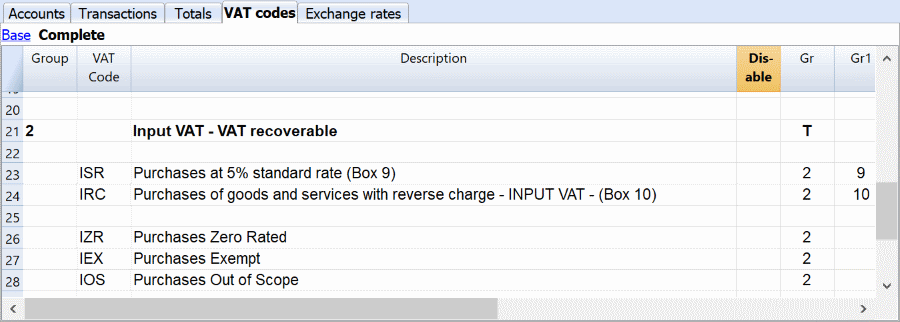

VAT recoverable UAE

- Purchases at 5% standard rate: VAT code for all the purchases subject to the standard rate of 5%.

- Purchases with reverse charge: VAT codes to recover any VAT paid as output VAT under the reverse charge mechanism.

- Purchases zero rated: All goods and services purchased which are subject to a 0% rate.

- Purchases exempt: All goods and services purchased which are exempted from the VAT.

- Purchases out of scope: a VAT code for purchases outside the scope of the VAT agreement.

All the adjustments are registered with the same VAT code used for the transactions that needs an adjustment.