In this article

We would like to remind you that, as of 1 July 2024, the new VAT Statement 2024 is only available with the Advanced plan of Banana Accounting Plus.

If you have the Professional plan of Banana Accounting Plus or an earlier version (Banana Accounting 9, ...), switch to the Advanced plan now so that you can easily create your VAT Statement (paper facsimile or Xml file for uploading to the FTA portal) without losing valuable time in manual calculation. More information about VAT Statement 2024

The Advanced plan: an extra gear!

The Advanced plan of Banana Accounting Plus not only allows you to create the VAT Statement, but it considerably speeds up your work with a number of other features such as the Filter function and the Rules for completing imported transactions!

- Upgrade from the Professional to the Advanced plan; along with the upgrade you can also renew for an additional 12 months.

- You don't have Banana Accounting Plus yet? Update from an earlier version to Banana Plus and receive 1 FREE month of the Advanced plan.

Renew before going on holiday

Is your Banana Accounting Plus subscription expiring during your summer holidays? Renew it before leaving so you don't have to worry any more. The new annual subscription will automatically extend the current subscription by 12 months, replacing the auto-renewal, if activated.

Useful Resources on 2024 Swiss VAT Management

Still need to update your VAT Codes table with the 2024 rates? Here is how to do it:

Need more information on 2024 VAT Statements 2024?

- 2024 Swiss VAT Extensions

- 2024 VAT Extensions: software update and subscription plans

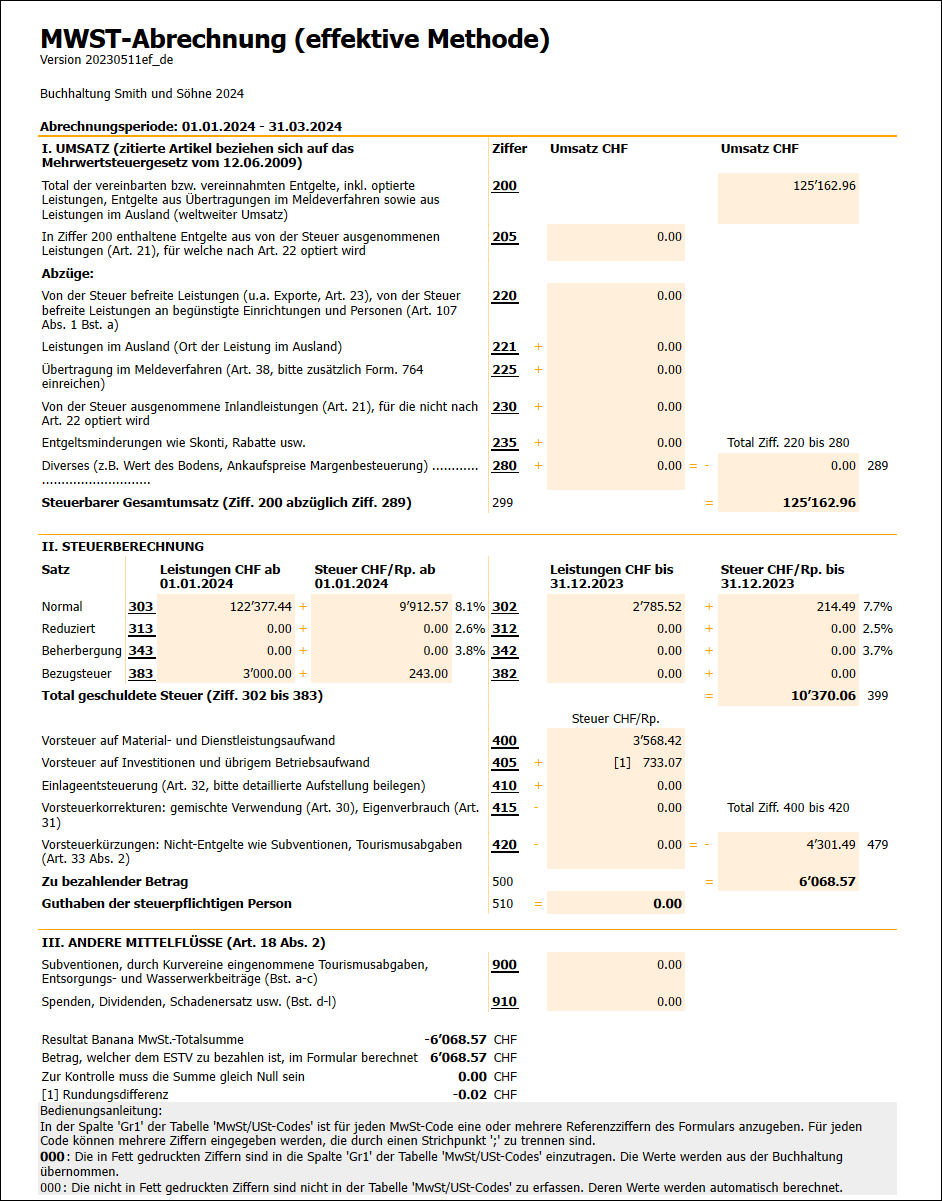

- Swiss VAT Report: effective method 2024

- Swiss VAT Report: net tax rate method 2024

Other useful documentation: