In this article

If there is a rounding in the invoice printout, the rounding must be reported into the accounting, otherwise the programme will report an error, indicating the difference to be recorded.

From the menu Reports > Customers > Settings > Advanced it is possible to set the roundings of the invoice to the desired cents, but only in base currency.

If you do not wish to round the invoice amount, you must set the rounding in the field Invoice rounding (basic currency) to 0.01; the invoice total will correspond to the amount of the transactions.

In the Exchange Rates table, the Reference Currency column typically contains the base currency, while the Currency column contains the foreign currency.

When the reference currency is not the base currency, it is not possible to set rounding from the customer settings (menu Report > Customers > Settings > Advanced). In this case, to set rounding, you need to use the Rounding column in the Exchange Rates table (menu Data > Columns setup > display the Rounding column). If you do not wish to round the invoice amount, set the rounding to 0.01 in this column.

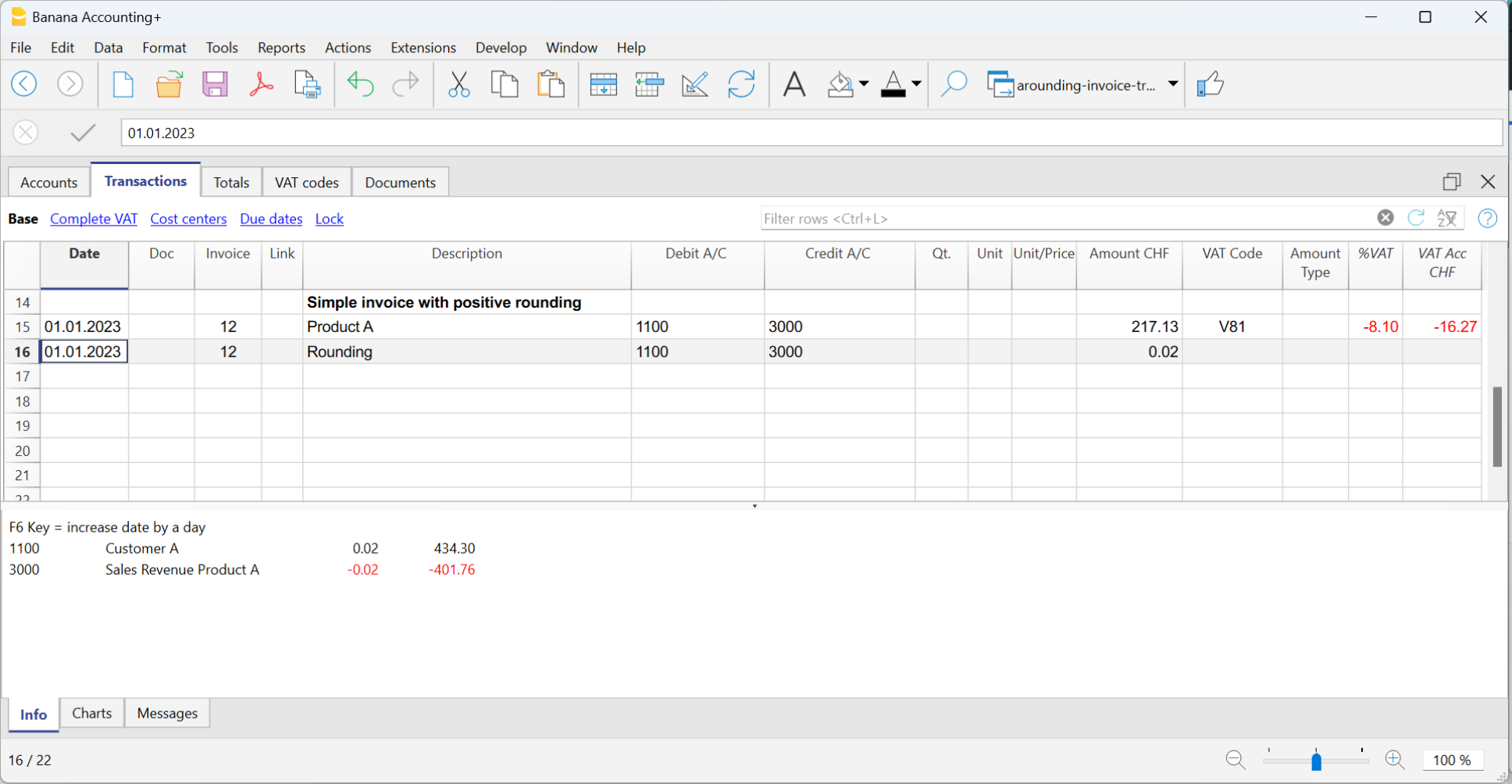

Record positive roundings in customer chart of accounts

When there is a positive rounding, enter the following in the Transactions table:

- Enter the date of the invoice in the Date column.

- Enter the invoice number in the Invoice column.

- Enter a description in the Description column.

- Enter the customer's account in the Debit column.

- Enter the counterpart (Sales, Consulting or other account) in the Credit column.

- Enter the hundredths of the rounding in the Amount column.

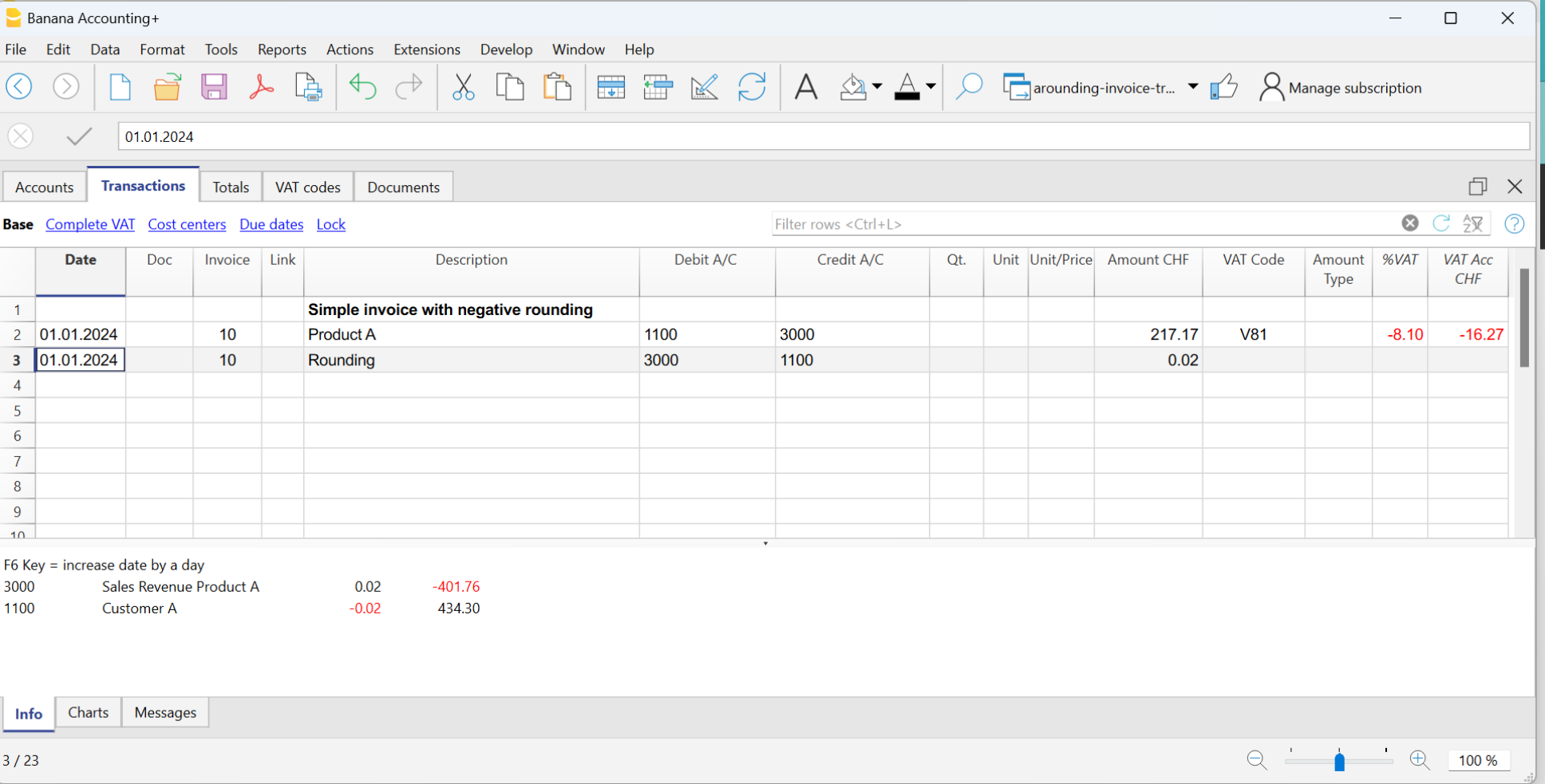

Record negative roundings in customer chart of accounts

When there is a negative rounding, enter the following in the Transactions table:

- Enter the date of the invoice in the Date column.

- Enter the invoice number in the Invoice column.

- Enter a description in the Description column.

- Enter the counterpart (Sales, Consulting or other account) in the Debit column.

- Enter the customer account in the Credit column.

- Enter hundredths of the rounding in the Amount column.

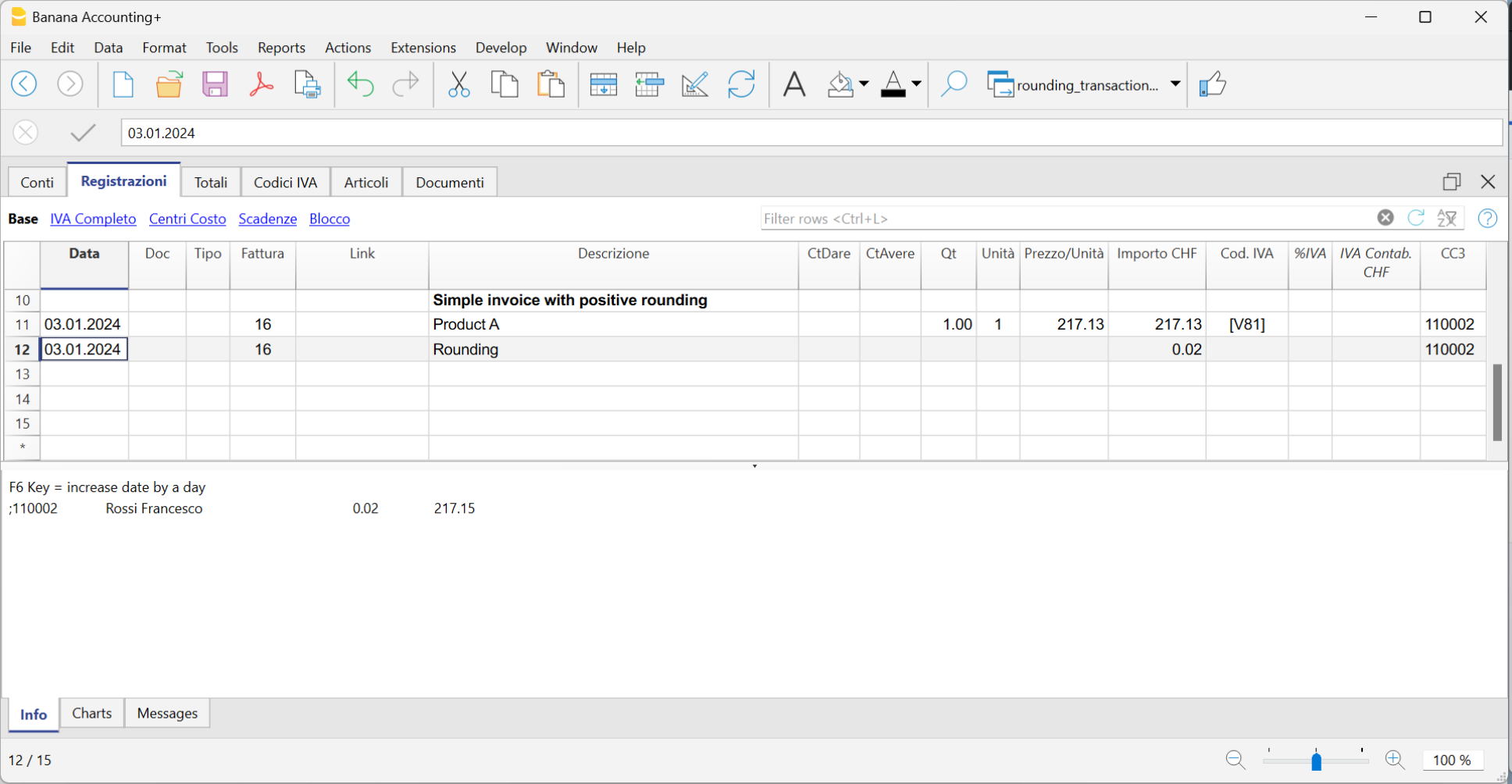

Record positive roundings in the cost centre (CC3)

When there is a positive rounding, enter the following in the Transactions table:

- Enter the date of the invoice in the Date column.

- Enter the invoice number in the Invoice column.

- Enter a description in the Description column.

- Leave the Debit column blank.

- Leave the Credit column blank.

- Enter hundredths of a rounding in the Amount column.

- In the CC3 column, enter the customer's cost centre.

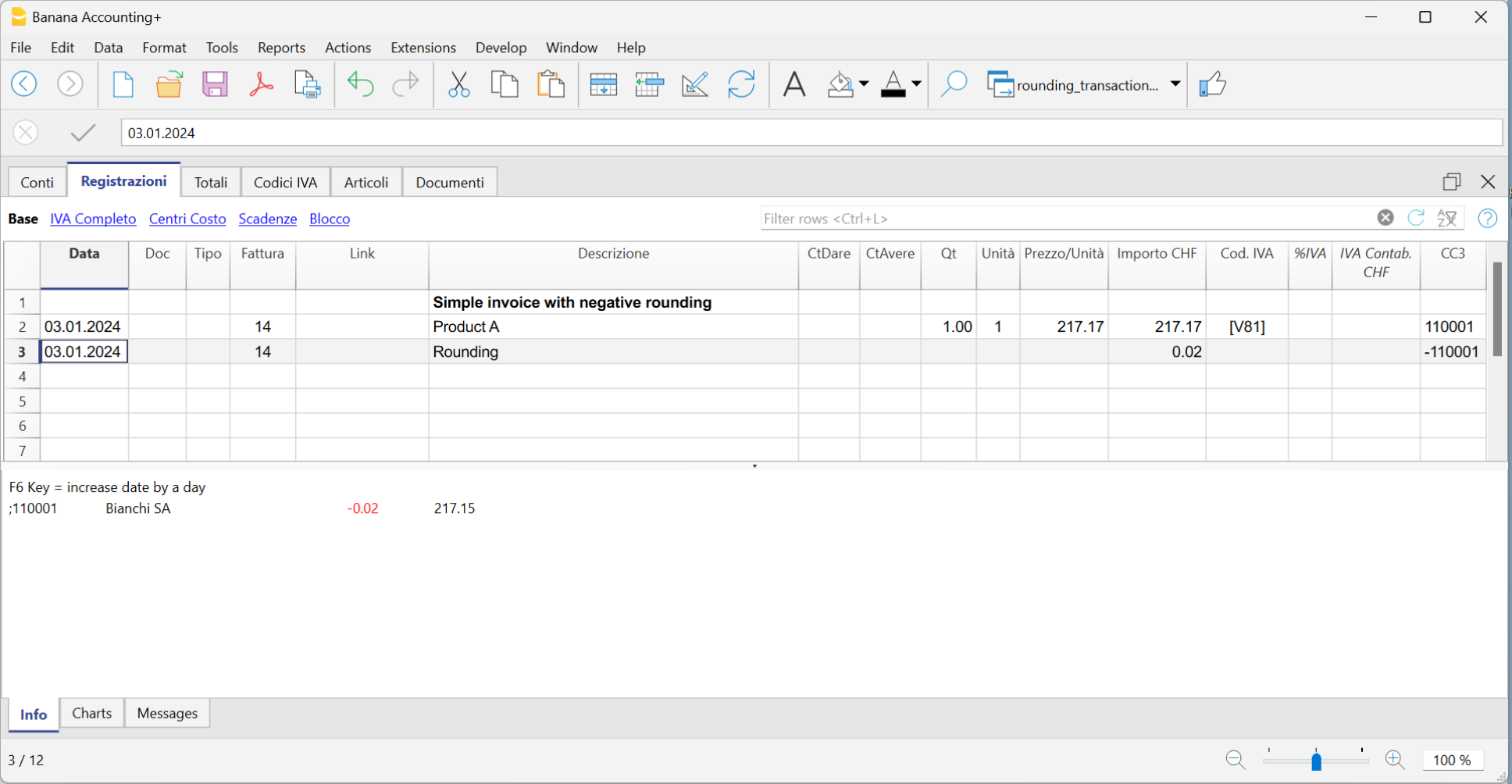

Record negative roundings in cost centre (CC3)

When there is a negative rounding, record in the Transactions table as follows:

- Enter the date of the invoice in the Date column.

- Enter the invoice number in the Invoice column.

- Enter a description in the Description column.

- Leave the Debit column blank.

- Leave the Credit column blank.

- Enter hundredths of the rounding in the Amount column.

- Enter the customer's cost centre with a minus sign in front in the CC3 column.