Wertschriftenbuchhaltung integriert in der Finanzbuchhaltung (Universal)

Mit Banana Buchhaltung können Sie den Kauf und Verkauf von Wertpapieren direkt in der doppelten Buchhaltung mit Fremdwährungen verwalten. Auf diese Weise haben Sie neben der Bilanz, der Gewinn- und Verlustrechnung und allen anderen Funktionen, die die Finanzbuchhaltung bietet, genaue Informationen über die Wertpapiersituation und insbesondere über den Buchwert jedes einzelnen Wertpapiers, dass für steuerliche Zwecke wichtig ist.

Vorteile der integrierten Wertschriftenverwaltung in der Buchhaltung

Banana Buchhaltung ist eine der wenigen Software, die es erlaubt, die Wertschriften direkt in der Buchhaltung zu verwalten.

- Sie haben eine komplette Buchhaltungsansicht in Bezug auf die Wertpapiere, ohne dass Sie externe Tabellen führen müssen.

- Sie sparen Zeit, weil Sie gleichzeitig mit der Verbuchung der Finanztransaktion (Kauf oder Verkauf von Wertpapieren) in der Buchhaltung auch die Mengen und Preise eingeben.

- Sie können den buchhalterischen Gewinn/Verlust und den Kursgewinn/-verlust des einzelnen Wertpapiers zum Zeitpunkt des Verkaufs oder des Abschlusses ermitteln.

Nachstehend finden Sie eine Buchungstabelle mit Transaktionen für den Verkauf und den Kauf von Wertpapieren in verschiedenen Währungen.

Käufe und Verkäufe von Wertpapieren erfassen

Die Tabelle Buchungen, das Herzstück der Buchhaltung, kann durch Hinzufügen der Spalten 'Menge und Stückpreis' individuell angepasst werden. So können Sie bei der Erfassung von Wertpapiergeschäften alle Informationen, die für die Wertpapierverwaltung erforderlich sind, direkt eingeben:

- Die gekaufte und verkaufte Menge und den entsprechenden Preis eingeben.

- Der Bankkostenanteil trennen.

- Der Gewinn oder Verlust zum Zeitpunkt des Verkaufs erfassen.

- Der Wechselkursgewinn oder -verlust zum Zeitpunkt des Verkaufs erfassen.

In der obigen Abbildung sehen Sie Beispiele für Kauf- und Verkaufsbuchungen, die Mengen und Preise angeben. Zum Zeitpunkt des Verkaufs wird auch der Gewinn verbucht, so dass der Buchwert der Wertpapiere dem Buchwert entspricht.

Liste der Wertpapiere

In der Buchhaltung können Sie die Tabelle Artikel hinzufügen, die wie ein integriertes Mini-Lager in der Buchhaltung funktioniert.

Sie wird für die integrierte Rechnungsstellung und Kostenkontrolle verwendet, eignet sich aber auch hervorragend für die Wertpapierverwaltung.

- Sie können alle von Ihnen erworbenen Wertpapiere auflisten und dabei alle erforderlichen Informationen eingeben.

- Sie können die Wertpapiere nach Wunsch gruppieren und Anleihen von Aktien trennen.

- Die Tabelle "Artikel" ist über den Positionscode mit der Tabelle "Buchungen" verknüpft. Wenn Sie eine Bewegung eingeben, aktualisiert das Programm die aktuelle Menge, so dass Sie immer wissen, welche Menge für jedes Wertpapier verfügbar ist.

Berechnung des Buchwerts

Das Ziel der Wertpapierverwaltung von Banana Buchhaltung ist es, den Buchwert jedes Wertpapiers zu kennen.

Der Buchwert eines Wertpapiers wird für die Erstellung der Bilanz verwendet und ist allgemein der Selbstkostenpreis oder der Durchschnittspreis.

- Der wird zur Berechnung des buchhalterischen Gewinns oder Verlusts verwendet, wenn die Wertpapiere verkauft werden.

- Der wird zur Berechnung des buchhalterischen Gewinns oder Verlusts verwendet, wenn die Wertpapiere zum Marktpreis neu bewertet werden.

Der ist daher sehr wichtig, da er zur Bestimmung des Buchwerts des gesamten Portfolios, des Unternehmensergebnisses und damit auch der Besteuerung beiträgt.

Die Instrumente zur Verwaltung von Wertpapieren, die von den Finanzinstituten zur Verfügung gestellt werden, sind sehr ausgeklügelt, aber sie verwalten nicht immer den Buchwert. Normale Buchhaltungsprogramme erfassen nicht die gekauften Mengen und Preise. Um den Buchwert der einzelnen Wertpapiere im Auge zu behalten, müssen die Buchhalter daher viel Zeit damit verbringen, Transaktionen zu rekonstruieren oder Excel-Tabellen zu führen.

Berechnung des Gewinns/Verlusts aus Wertpapieren

Wenn Sie eine Buchung für einen Wertpapierverkauf eingegeben haben, rekonstruiert die Erweiterung zur Gewinn-/Verlustberechnung den Buchwert und berechnet den Gewinn und Verlust.

Wenn Sie eine Buchhaltung mit Fremdwährungen verwenden, berechnet sie auch den realisierten Wechselkursgewinn/-verlust.

Diese Werte werden verwendet, um die Verkaufsbuchung abzuschliessen.

Bestandsaufnahme der Wertpapiere

Anhand der detaillierten Angaben in der Tabelle Buchungen und des Marktwerts der Wertpapiere in der Tabelle Positionen kann das Programm die aktuellen Werte der Wertpapiere sowie die nicht realisierten Gewinne und Verluste berechnen.

Erste Schritte

Sie können sich die Funktionsweise anhand einer unserer Vorlagen ansehen. Wenn Sie bereits über eine eigene Buchhaltung verfügen, können Sie Ihre aktuelle Buchhaltung in wenigen Schritten anpassen. Nutzen Sie die Erweiterungen, um den Gewinn oder Verlust aus dem Verkauf von Wertpapieren zu berechnen und verschiedene Berichte zu erhalten.

Dokumentation (in Englisch)

- Introduction to securities accounting

- Templates

- Securities list

- Account table

- Adapt accounting

- Transactions

- Extensions

Brauchen Sie mehr?

Die Erweiterungen für die Verwaltung der Wertpapierbuchhaltung befinden sich noch in der Beta-Version. Wenn Sie Vorschläge haben, wie der Inhalt der Vorlagen und Berichte verbessert werden können, oder wenn Sie denken, dass es nützlich/interessant wäre, neue Funktionen hinzuzufügen, senden Sie uns bitte Ihr Feedback über unseres Formular.

Introduction to Investments Manager for Accounting

Investments Manager is a comprehensive solution designed to help you efficiently manage bonds, shares, funds, and other securities within Banana Financial Accounting. It provides the tools needed to track your investments with precision while ensuring compliance with accounting standards.

This introduction not only presents the features of Investments Manager Solution but also helps you understand how securities accounting works. Whether you're an investor, accountant, or auditor, this guide will provide valuable insights into the financial and accounting aspects of investment management.

After reading this page, you will be able to manage your investments effectively, prepare accurate financial statements, and facilitate auditing with confidence.

Purpose of an Investment Accounting

Online investment platforms provided by your bank or broker are designed to help you follow the market, compare assets, and make informed buy or sell decisions. However, they do not give you full control over your investments from an accounting perspective.

The purpose of Investments Manager is to provide a comprehensive financial overview of your investments. It allows you to maintain an inventory of all your securities, track quantities and historical changes, and seamlessly integrate investment values, purchases, sales, and market fluctuations into your accounting records. Additionally, it ensures that revenues such as interest and dividends and costs like expenses and commissions are accurately reflected within your Balance Sheet and Income & Expense accounting.

Beyond financial tracking, Investment Accounting helps you optimize the fiscal impact of your investments, ensuring that tax-related aspects such as capital gains, withholding taxes, and deductions are properly accounted for. It also supports compliance and auditing, providing structured and transparent records that facilitate regulatory reporting and financial reviews.

Investments Manager Goals and Future Developments

Over the years, we have refined the Investments Manager solution based on feedback from Banana Accounting users who needed an efficient way to manage securities. Our goal aligns with their requests: to provide a straightforward solution for managing investments directly within financial accounting software. Typically, such integration is offered only by specialized financial-sector tools. Our focus is to keep the solution simple while delivering essential functionalities that give you control over your investments and streamline compliance. Rather than replicating the complexity of specialized platforms, we prioritize ease of use and core investment management features.

Many customers are already using the Investment Manager. Based on the valuable feedback we have received, we have identified several improvements for the solution. As it continues to evolve, we will finalize the documentation once the new enhancements are implemented.

We highly value your feedback and suggestions, as they help us improve the solution further. Kindly use the form at the bottom of this page to share your requests or any other input with us.

Learning Tool for Finance Students

In line with our company’s mission, we aim to provide a solution that enhances financial literacy. By integrating investment management directly into Banana Accounting, students in Finance, Accounting, and Auditing can engage with more complex topics and gain hands-on experience. This approach allows them to experiment with real-world scenarios, understanding how different operations impact the Balance Sheet, Income Statement, and overall financial performance.

Differentiating Investments from Bank Deposits & Cryptocurrency Holdings

From an accounting perspective, it is crucial to distinguish between bank deposits or cryptocurrency holdings and investments (securities) based on how they are recorded and valued.

Bank Deposits & Cryptocurrency Holdings – Tracked with an Accounting Balance

- Bank deposits and cryptocurrency holdings are monetary assets recorded as part of a company’s or individual’s cash or financial reserves.

- These holdings are easily tracked using a standard accounting balance, as they have a single value expressed in the account’s currency.

- If held in foreign currency or cryptocurrency, their value is adjusted using the exchange rate at the reporting date.

- Example: A bank account with $10,000 is recorded as a cash asset, converted into the base currency if needed (e.g., €9,090 at an exchange rate of 1.10).

Investments (Securities) – Require an Inventory-Like System

- Investments such as stocks, bonds, and mutual funds share similarities with inventory management, as they involve:

- A quantity (e.g., number of shares or bond nominal value).

- A unit price (e.g., market price per share or bond percentage value).

- An exchange rate, if denominated in a foreign currency.

- Unlike bank holdings, investments cannot be tracked using a simple accounting balance because their value changes not just due to exchange rates but also due to market price fluctuations and transactions (buying, selling, reinvesting).

- Proper Investment Accounting ensures that each transaction and value change is accurately recorded, much like how an inventory system tracks stock levels and price variations over time.

Why Investment Accounting Matters

Because investments behave more like an inventory of financial instruments, traditional accounting methods used for bank balances are not sufficient to track them accurately. Instead, a dedicated investment accounting system is required to properly manage:

- Purchases & Sales – Tracking quantities and cost basis.

- Market Value Changes – Adjusting for price fluctuations.

- Revenues & Expenses – Including dividends, interest, and commissions.

- Exchange Rate Effects – Converting values in foreign currencies.

By structuring investment records similarly to inventory management, Investment Accounting ensures full control and accurate reporting of financial assets.

The Investment Accounting Elements

The Investments Accounting is composed from this elements:

- Accounting period.

- Information regarding the investment.

Including Identifying information. - Investment Classification by Measurement Type.

- The Quantity element.

- Price and evaluation methods.

- Investment account.

The connection between the financial accounting and the Investments Inventory System. - Book Value and Book Price.

- Realized Profit and Loss

- Unrealized Profit and Loss

- Investments Revenues and Costs.

- Impact of exchange rates

- Double Entry Investments Transactions.

- Investments and account reconciliation.

- Investments (Items) card.

Accounting period

Financial accounting is always relative to a specific period. In the accounting you specify the start and end date:

- The balance sheet is prepared for a specific date (instant).

- The Balance at the begin of the period (opening balance).

- The current or end of period Balance.

- The Profit & Loss is prepared for a period (duration).

- The revenues, costs, gain and loss, and the tax are always referred to a period.

Inventory systems have not a period concept. They record buy and sell and continue over the time.

There is a conceptual difference in the temporal logic of the Financial Accounting and an Inventory system and a Portfolio management systems.

- Portfolio management systems

- Only track events that affect the change in a position (buy or sale).

- The profit or loss is calculated based on the difference between buying and sale.

- Accounting systems

- Require an initial balance and therefore a specific valuation. Quantity and price per unit for each investments at the begin of the period.

- Require an end balance and a valuation of each investment. Quantity and price per unit for each investments at the end of the period.

The end quantity and price will become the begin quantity and price for the following year. - With fair value method the Investment value is adapted and booked as unrealized profit or loss.

If the Investment value grows over time, each year a value increase and a gain is recorded and appears as revenue and contribute to the total profit and loss. - The profit and loss on the investment is the difference between the current Book value and the price of the transaction.

It is therefore the change in value relative to the being of the period and the sale of the investment.

Information Regarding the Investments

To properly manage and account for investments, it is essential to record key identifying information and classify them based on their measurement type.

Every investment should be clearly defined with standard financial identifiers:

- Investment Id (ItemId):

The ItemId is used to uniquely identify the Investment. You can use the Ticker Symbol, or ISIN as an ItemId. - Ticker Symbol.

The unique exchange-listed symbol for publicly traded securities (e.g., AAPL for Apple Inc.). - ISIN (International Securities Identification Number).

A globally recognized unique identifier for financial instruments (e.g., US0378331005 for Apple Inc.). - Description.

The full name and type of the investment (e.g., "Apple Inc. – Common Stock" or "U.S. Treasury Bond 10Y"). - Group different investments together to have a better view and also totals.

The Items Table where investments are inserted.

Investment Classification by Measurement Type

Investments can be classified based on how their value is measured in accounting records:

Investments Measured by Nominal Value

(e.g., Bonds, Treasury Notes)- These securities are expressed in terms of face value (nominal value).

- The book value is determined based on the purchase price, which may be different from the nominal value due to discounts or premiums.

- Example: A €100,000 corporate bond might be acquired at 97% of face value, meaning the actual acquisition cost is €97,000.

Investments Measured by Effective Quantity

(e.g., Shares, ETFs, Mutual Funds)- These securities are recorded based on the number of units owned.

- Each unit has a market price, and the total investment value fluctuates accordingly.

- Example: 200 shares of XYZ Corp. at €50 per share have a market value of €10,000.

By properly identifying and classifying investments, Investment Accounting ensures accurate tracking of asset values, market movements, and financial reporting.

Quantity Element

Investment accounting shares similarities with inventory systems. When buying or selling investments, a quantity element is involved, which can be expressed as either an effective quantity or a nominal value.

The key quantities to manage include:

- Quantity at the beginning of the accounting period. Recorded in the Items Table.

- Quantity changes during the accounting period.

Tracked through transactions. - Current Quantity.

Calculated as the initial quantity plus increases and minus decreases.

Price per Unit and Evaluation

Each Investment has the element Price per unit or simply the price.

- For quantity type (shares) is simple the Price.

- For nominal type (bonds) is a percentage.

The price multiplied by the quantity give the value of the Investment.

Investment Valuation Methods in Accounting

There are different methods for evaluating an investment.

- Historical Cost

Investments recorded at the original purchase price, without considering market fluctuations. - Fair Value (Mark-to-Market)

Assets are revalued at their current market price, reflecting real-time changes. - Lower of Cost or Market (LCM)

The investment is valued at the lower of its historical cost or market value to prevent overstatement. - Weighted Average Cost (WAC)

The cost per unit is averaged over time with each purchase, smoothing price fluctuations. - Moving Average Cost with Market Adjustments

Uses WAC but adjusts the value periodically based on market price changes. - First-In, First-Out (FIFO)

The oldest purchases are considered sold first, often leading to lower costs and higher profits in rising markets. - Last-In, First-Out (LIFO)

The most recent purchases are considered sold first, often reducing taxable income but rarely used for investments. - Amortized Cost

Used for fixed-income securities, adjusting the value gradually based on interest income and principal repayments. - Net Realizable Value (NRV)

The investment is valued at the estimated selling price minus disposal costs. - Intrinsic Value

Based on the fundamental analysis of the asset’s true worth rather than market fluctuations. - Recoverable Amount

The higher of an asset’s fair value minus selling costs or its value in use, often used in impairment tests.

Market value of an investment

The market value of an investment is the current price assigned to it in the financial market, and this price can fluctuate based on market conditions. When securities are bought or sold, the portfolio manager informs the securities holder of the exact market price at which each transaction occurred. Unlike book value, which is determined by the accounting process, the market price is readily provided by the market itself and doesn't require the holder to calculate it.

Within the Investment Manager the the market value of the investment is entered in the 'Price Current' column within the Items table. By entering this market price, you can use the valuation report feature to calculate any unrealized gains or losses—the difference between the current market value and the original purchase price of the investment. This provides a snapshot of the potential profit or loss if the securities were sold at the current market price, even though they haven’t been sold yet.

FIFO

The FIFO (First In First Out) method means that the inventory or investments are evaluated based on the value of purchase, that the the investments purchased first are also sold first. FIFO method is a valid method in IFRS and in the GAAP of other countries. FIFO is also a method used in recognizing revenues for tax fir private investors, in countries where realized gains on sale of investments are taxable.

Investments Manager does not automatically calculate the realized gains using the FIFO method, but you can calculate and record it manually.

Moving Average Cost with Market Adjustments

Most companies evaluate investment at the Fair value. This means that investments value is adjusted regularly to the market price.

Therefore the Investments Manager allows to calculate based on the Moving Average Cost with Market Adjustments method (MAC-MA). It is an investment valuation method that combines the Weighted Average Cost (WAC) with fair value market adjustments to reflect market price changes. It balances the stability of average cost valuation with the accuracy of market-based adjustments.

Example Calculation

Step 1: Purchases and Moving Average Cost

- Buy 100 shares @ $10 → Cost = $1,000

- Buy 50 shares @ $15 → Total Cost = $1,000 + $750 = $1,750

- Total Quantity = 150 shares

- Moving Average Cost per share = $11.67

Step 2: Market Value Adjustment

- Market price rises to $14 per share → Total Market Value = $2,100 (150 × $14)

- Adjustment = $2,100 - $1,750 = $350

- The increase is recorded as an unrealized gain.

Step 3: Sale of Investments

- Sell 50 shares → Cost = 50 × $11.67 = $583.50

- If sold at $14, the realized gain = (50 × $14) - $583.50 = $116.50

- Remaining shares (100) retain the adjusted cost.

Investment Account and Book Value

Investment are assets that are part of the balance sheet. In financial accounting, unlike an inventory systems, there is no direct tracking of quantity and price. Instead, financial transactions are recorded based on monetary amounts, requiring the use of specific accounts to track changes in investments.

When setting up the accounting system, you must create investment accounts to track securities. If you hold investments in multiple currencies, you need at least one investment account per currency.

The investment account serves as the link between financial accounting and investment accounting. When creating investment records in the Items Table, each investment must be associated with an investment account of the same currency.

For each transaction affecting an investment account, you must also associate the corresponding investment item (Item ID). If you post an amount to an investment account without specifying the Item ID, discrepancies will arise between financial accounting and the investment inventory system.

Investment Value and Investment Unit Price

The Book Value, or Investment Value, is the balance of an investment account, representing the sum of all debit and credit transactions recorded for a specific investment. The Investment balance is the amount displayed on the Balance Sheet, making it the key financial measure for investment valuation.

Unlike inventory systems, where quantity and price per unit are explicitly recorded, investment accounts may include transactions that affect the balance without changing the quantity (e.g., adjustments, revaluations, dividends, or fees).

To determine the Investment Price per unit, the Investment Value (balance of the Investment) is divided by the investment’s quantity.

Profit and Loss on Investments

When you sell an investment you will get a gain if the price is above the book value price and have a loss is the price is below the the book price.

The sale if The gain is recorded

Realized Profit and Loss

When you sell an investment you will get a gain if the price is above the book value price and have a loss is the price is below the the Investment price. When you register the selling transactions in the double entry accounting you will debit the bank account and credit the Investment account for the amount of the sale.

Assuming you have sold all your stock the balance, the quantity will be zero and the balance of the account will be the gain or loss of the investments. Without any quantity the balance should be zero, so what you have to do is to record the profit or loss as a revenue or cost.

- If the balance is positive (debit) it means you have a loss.

You will have to record a realized loss, by debiting the Realized loss account (Cost) and crediting the Investment account. - If the balance is negative (credit) it means you have a gain.

You have sold the investment to an higher a remaining investment value.

You will have to record a realized gain, by debiting Investment account and crediting the Realized gain account (Revenue).

We can also see how the profit or loss per share is calculated when you sell all the shares:

- Investment Value is the balance of the account, prior to the sale divided by the quantity.

Assuming we had a balance of $ 200 and quantity of 10 the book price would be $ 20 per shares. - Selling all 10 shares at $ 25 per share the transactions value would be of $ 250.

- After recording the transaction (Bank to Investment account) the balance would be in credit of $ 50.

- The gain per share would be $ 5 per 10 share = $ 50.

- We will record Investment account to Realized gains $ 50.

- Selling all 10 shares at $ 18 per shares the transactions value would be of $ 180.

- After recording the transaction (Bank to Investment account) the balance would be in debit of $ 20.

- The loss per share would be $ 2 per 10 share = $ 20.

- We will record Realized Loss to Investment account $ 20.

Partial sales. If you have not sold all the investments but you still have the quantity, you need to record the profit or loss relative to the investments you have sold. Basically it means that the remaining balance should be equal to the quantity multiplied by the same price per unit, prior to the sale.

- Investment Values is the balance of the account, prior to the sale divided by the quantity.

Assuming we had a balance of $ 200 and quantity of 10 the book price would be $ 20 per shares. - Selling 4 shares at $ 25 per share the transactions value would be of $ 100.

- After recording the transaction (Bank to Investment account) the balance would be in debit of $ 100 ($200 - $100).

- The remaining value should be 6 shares at $ 20 = $ 120.

- The gain per share would be $ 5 per 4 shares = $ 20.

- We will record Investment account to Realized gains $ 20.

- The new balance of the Investment account would be $120 ($100 + $ 20) or exactly 6 @ $20.

- Selling 4 at $ 18 per share the transactions value would be of $ 72.

- After recording the transaction (Bank to Investment account) the balance would be in debit of $ 128 ($200 - $72).

- The remaining value should be 6 shares at $ 20 = $ 120.

- The loss per share would be $ 2 per 4 shares = $ 8.

- We will record Realized Loss to Investment account $ 8.

- The new balance of the Investment account would be $120 ($128 - $ 8) or exactly 6 @ $20.

The command "Sale transactions" automatically calculate the Profit or Loss and create the appropriate transactions.

Unrealized Profit and Loss

Fair Value accounting requires to adjust investments value based on the market price. There are also fiscal regulation that require that investments are evaluated at year end at a price defined by the tax authority. These adjustments, increase or decrease the value of the investments in the Balance Sheet, and that are usually recorded in the Income & Expenses as unrealized profit or loss. Adjustments have consequences for the profit and loss calculation and therefore effect the tax calculation.

- Book Price Values is the balance of the account, prior to the adjustment divided by the quantity.

Assuming we had a balance of $ 200 and quantity of 10 the book price would be $ 20 per shares. - If the market price is $ 25 per share the market value $ 25 @ 10 = $ 250.

- The unrealized gain is $ 250 - $ 200 = $50.

- The gain per share is $ 50 divided 10 = $ 5 per share.

- The gain per share is also be calculated $ 25 minus $20 = $ 5.

- We will record "Investment account to Unrealized gains $ 50".

- The new balance of the Investment account would be $250 ($200 + $ 50) or exactly 10 @ $25.

- If the market price is $ 18 per share the market value $ 18 @ 10 = $ 180.

- The unrealized loss is $ 200 - $ 180 = $20.

- The loss per share is $ 20 divided 10 = $ 2 per share.

- The loss per share is also be calculated $ 20 minus $18 = $ 2.

- We will record "Unrealized loss to Investment account $ 20".

- The new balance of the Investment account would be $180 ($200 - $ 20) or exactly 10 @ $18.

The command "Adjust to current value" automatically calculate the adjustments and create the transactions.

Revenues and Costs of Investments

A key function of an accounting system is to track both revenues (such as interest and dividends) and costs (such as commissions, bank fees, and broker expenses) associated with investments.

Revenues and costs related to investments are recorded as transactions linked to the investment (ItemId) but using accounts different from the investment account. This ensures that these transactions do not affect the Book Value of the investment itself.

Each transaction can be assigned to an appropriate revenue or expense account, allowing for detailed reporting on all income and costs associated with a specific investment. This approach provides clear insights into the performance and profitability of investments while maintaining accurate financial records.

Impact of Exchange Rates on Investments

For investments denominated in foreign currencies, their valuation in accounting is affected by exchange rate fluctuations, which must be considered alongside market price changes.

Key Factors in Exchange Rate Impact

- Initial Exchange Rate at Purchase.

The exchange rate used to record the investment at the time of acquisition. - Current Exchange Rate at Reporting Date.

The rate used to update the investment’s book value in financial statements. - Market Price and Currency Interaction.

A security's value may increase in its original currency, but if the exchange rate moves unfavorably, the gain may be reduced or turned into a loss when converted. - Realized Gains/Losses on Sale.

When an investment is sold in a foreign currency, exchange rate differences can lead to additional gains or losses beyond market price changes.

Example of Exchange Rate Impact

- You purchase 100 shares of a stock at $200 per share, for a total cost of $20,000.

- At the time of purchase, the USD/EUR exchange rate is 1.10, meaning the recorded book value is €18,182.

- If the stock price remains at $200 but the exchange rate changes to 1.05, the book value in EUR would increase to €19,048, reflecting a gain purely due to currency fluctuation.

Because investments can be impacted by both market price movements and exchange rate variations, a proper Investment Accounting System ensures accurate financial reporting, helping investors and accountants manage risk and maintain compliance.

Impact of Exchange Rates on Investments and Adjustments

For investments denominated in foreign currencies, their valuation in accounting is influenced by both market price changes and exchange rate fluctuations. These fluctuations impact both unrealized gains/losses (before sale) and realized gains/losses (after sale), requiring proper adjustments in financial reporting.

Key Factors in Exchange Rate Impact

- Initial Exchange Rate at Purchase

- The exchange rate at the time of acquisition is used to record the investment's book value in the reporting currency.

- Current Exchange Rate at Reporting Date

- At each financial reporting period (e.g., month-end, quarter-end, year-end), investments in foreign currencies must be revalued based on the latest exchange rate.

- Market Price and Currency Interaction

- A security’s value may increase in its original currency, but if the exchange rate moves unfavorably, the gain could be reduced or even turned into a loss when converted to the reporting currency.

- Unrealized Gains/Losses Due to Exchange Rate Changes

- Even if an investment is not sold, the difference in exchange rates between the purchase date and the reporting date can create unrealized foreign exchange gains or losses, which should be recorded separately.

- Realized Gains/Losses on Sale

- When an investment is sold, the difference between:

- The original exchange rate at purchase, and

- The exchange rate at the time of sale,

determines an additional realized gain or loss due to currency fluctuations.

- When an investment is sold, the difference between:

Example of Exchange Rate Impact

- Step 1: Initial Investment Purchase

- You buy 100 shares at $200 per share, for a total cost of $20,000.

- At the time of purchase, the USD/EUR exchange rate is 1.10.

- The recorded book value in EUR is 20,000 divided by 1.10, which equals €18,182.

- Step 2: Exchange Rate Adjustment at Reporting Date

- At the reporting date, the stock price remains $200, but the exchange rate changes to 1.05.

- The new book value in EUR is 20,000 divided by 1.05, which equals €19,048.

- The unrealized foreign exchange gain is 19,048 minus 18,182, which equals €866.

- This gain is recorded in the foreign exchange adjustment account as an unrealized gain.

- Step 3: Realized Foreign Exchange Gain/Loss on Sale

- Later, you sell 100 shares at $210 per share, for a total of $21,000.

- At the time of sale, the USD/EUR exchange rate is 1.08.

- The converted sale amount in EUR is 21,000 divided by 1.08, which equals €19,444.

- The initial book value was €18,182, so the total realized gain is 19,444 minus 18,182, which equals €1,262.

- This realized gain includes both the market price gain (from $200 to $210) and the foreign exchange gain (due to currency movement from 1.10 to 1.08).

Accounting Treatment

- Unrealized Exchange Gains/Losses

- At reporting periods, any changes in exchange rates affect the book value.

- These adjustments are recorded in an exchange rate adjustment account.

- Realized Exchange Gains/Losses

- When an investment is sold, the foreign exchange gain or loss is finalized and recorded in the profit and loss statement.

Double entry Investments Transactions

Investments accounts transactions are recorded in the Banana Accounting Transactions table. As you will see the Transactions table, next to the typical double entry elements has also columns that can be used for the inventory:

- Investment Id (Item or ItemId).

When recording a transaction that refers to an Investments you always need to specify the Investment Id. - Quantity.

When you enter a quantity the program will update the existing quantity for the Investment in the Table Article.- When using quantities you always need to specify the Investment account as debit or credit account.

If not, the Investment unit price (Balance divided by the quantity) will be wrong. - Positive values will increase the existing quantity.

You will use when- buying investments.

- Split stock, that increase the quantity without affecting the value.

- Negative values will decrease the existing quantity.

You will use when selling investments. - Zero quantity

It is used to record changes to the Investments without effecting the quantity.

For example Market price adjustments, the quantity remains the same, but the value of the investment (balance) is changed. - Neutral values (zero).

Will not increment or decrement the existing quantity, but the value will be used to calculate the transactions amount.

- When using quantities you always need to specify the Investment account as debit or credit account.

- Price per unit.

It is used to calculate the transactions Amount. - Amount of the transactions.

- If you enter a quantity or a Unit Price the program will automatically calculate the quantity.

- For market price adjustments the amount is entered without quantity or with a neutral quantity.

- Account Debit or Account Credit

- Investment account

- When changing the quantity or the balance of the investment you always need to enter as a debit or credit account the Investment account associated with the Investment.

- Revenues and Cost accounts

- When recording revenues and costs related to the investment, you specify the account that is related to the revenue or cost.

- The program will create reports that calculate all the costs associated with a specific Investments.

- Investment account

Examples of Double entry transactions

The Transactions Table is where you enter investment transactions. Here is a brief explanation:

- When buying or selling investments, multiple lines are typically needed to enter the necessary accounts, quantity, and price. The date and item are repeated.

- The Item column (Investment ID) allows you to specify the investment, while the Qt. (quantity) and Unit Price columns provide the necessary information for inventory tracking.

- The Account Debit and Account Credit columns enable you to specify the accounts for bank transactions, investment accounts, revenues, costs, and realized or unrealized gains or losses, including those related to exchange rates.

Opening value

When starting a new accounting or a new year you need to enter:

- Opening amounts for Investments accounts.

Like for any other accounts you have to enter the opening amount of the Investments accounts in the account currency.- The program will calculate the opening amount in basic currency, using the opening exchange rate (Exchange rate table).

- The opening balance should be equal the the sum of the value of the opening values of all the investments associated with this accounts.

- Quantity and Price at the investments.

For each investment you will have to enter the opening quantity and the price at the begin.- The program will calculate the begin value, multiplying quantity and price.

- The program will also calculate the begin value in basic currency, using the opening exchange rate.

Accounts and Investments reconciliation

When you insert a new Investment in the Items table you need specify the Account where the value of the investment is booked used the double entry accounting methodology.

Therefore, for all Investments that use the same account, there should be a full correspondence for:

- The opening amount of the account and the opening value of the investments.

- The balance of the account and the book value of all the investments.

The command Reconciliation report will calculate the book value of all accounts and check for the correspondence. If there are any differences it will notify to you.

Example Templates for Investment Accounting

If you have an existing accounting file you need to Adapt for the Investment accounting.

The following Accounting templates have been designed as examples for the securities management.

- Double-entry Example Template with accounts, tables and example transactions

- Multi-currency Example Template with accounts, tables, and example transactions

They all include:

- Items Table, with example titles.

- Balance sheet accounts for securities (they use accounts names and not numbers.

- Profit and loss accounts for profits and losses on securities.

- For multi-currency accounting, accounts for exchange gains and losses.

- Transactions table with example recording .

Double-Entry Accounting Example For Integrated Investment Accounting

Double-Entry Accounting Example For Integrated Investment Accounting michaelDouble-Entry Multi-Currency Accounting Example With Investment Accounting

Double-Entry Multi-Currency Accounting Example With Investment Accounting

For more information see:

Use for your accounting

This template is conceived to experiment with the Portfolio extension and it contains example of investments and transactions.

The accounts list is very limited, but if you want to use as a base of your accounting simply:

- Delete all transactions

- Delete the opening amount in the Accounts table

- Delete the opening values in the Items table.

Vorhandene Buchhaltungsdatei anpassen

Wenn Sie bereits mit einer doppelten Buchhaltung arbeiten (in einer bestehenden Buchhaltungsdatei), können Sie die Funktionen zur Wertschriftenverwaltung ganz einfach ergänzen.

Artikel-Tabelle und Artikel-Spalten hinzufügen

Falls Ihre Buchhaltungsdatei die Artikel-Tabelle noch nicht enthält, gehen Sie wie folgt vor:

- Artikel-Tabelle hinzufügen

Geben Sie anschliessend die Daten Ihrer Wertpapiere ein und unterteilen Sie sie in Kategorien (siehe Tabelle Artikel).

Füllen Sie alle Felder aus, indem Sie sämtliche Informationen zu Ihren Wertpapieren eintragen. - Artikel-Spalten der Tabelle Buchungen hinzufügen

Vergewissern Sie sich, dass die Artikel-Spalte in der Tabelle Buchungen angezeigt wird.

Andernfalls können Sie sie über das Menü Daten > Spalten einrichten aktivieren, indem Sie ein Häkchen bei der Spalte ID (Artikel-ID) setzen.

Anpassung des Kontenplans

Passen Sie Ihren Kontenplan an, indem Sie Konten für Wertpapiertransaktionen (auf englisch) einfügen.

Falls Sie mit dem Dateityp Einnahmen-Ausgaben-Rechnung/EÜR begonnen haben, müssen Sie zunächst Ihre aktuelle Datei in eine neue Datei des Dateityps "Doppelte Buchhaltung" umwandeln. Weitere Informationen finden Sie auf unserer Seite Datei in neue Buchhaltungsart konvertieren.

Dezimalstellen für den Stückpreis ändern

Standardmässig sind 4 Dezimalstellen für Stückpreise eingestellt. Um diese zu erhöhen:

Gehen Sie zu Werkzeuge > Funktionen hinzufügen/entfernen

Aktivieren Sie die Option „Dezimalstellen für Stückpreis ändern“

Dadurch können Sie auch Wertpapiere mit sehr kleinen Stückpreisen exakt abbilden.

Liste der Wertschriften (Artikel-Tabelle)

Wertschriften werden in der Tabelle Artikel erfasst. Die Verwendung dieser Tabelle in der Wertschriftenbuchhaltung (Portfolio) ermöglicht es, den Überblick über die gekauften, verkauften und aktuellen Bestände zu behalten.

Erfassen Sie alle Wertschriften in der Artikel-Tabelle. Sie funktioniert wie Excel – Sie können Zeilen hinzufügen, entfernen und duplizieren.

- Die ID, in der Regel die ISIN der Wertschrift

- Die Beschreibung

- Die Menge und der anfängliche Stückpreis

- Das in der Konten-Tabelle angegebene Konto, in dem alle Bewegungen im Zusammenhang mit dieser Investition erfasst werden sollen.

Dies ist die Verbindung zwischen der Finanzbuchhaltung und der Investitionsbuchhaltung.

Die Summe des Buchwerts aller Wertschriften, die demselben Konto zugeordnet sind, sollte dem Kontostand entsprechen.

Der Abstimmungsbericht prüft, ob der Kontostand und der Wertschriftenbestand übereinstimmen. - Die Einheit, die sein kann:

- S (Stock) - Aktie

- B (Bond) - Obligation

- Die Gruppierungen, um separate Totalbeträge für Aktien, Obligationen, Fonds oder nach Wunsch zu erhalten.

In der Regel wird für jede Gruppierung ein separates Investitionskonto verwendet. - Der aktuelle Preis (Marktwert)

Der Marktwert muss manuell eingegeben werden (dieser kann ggf. aus Excel eingefügt werden). - Bei einer Buchhaltung mit Fremdwährungen legen Sie auch die Währung der Wertschrift fest.

In diesem Fall muss auch das zugehörige Buchhaltungskonto in derselben Währung geführt werden.

Das Programm berechnet automatisch:

- Anfangswert

Eröffnungsmenge * Eröffnungswert - Die aktuelle Menge

Anfangswert plus/minus der gekauften und verkauften Mengen - Aktueller Wert

Gesamtwert * aktueller Preis. - Die Totale für die verschiedenen Gruppen

Gruppierung

Wir empfehlen, Gruppen für verschiedene Wertschriftenarten zu erstellen, damit der Gesamtbetrag pro Kategorie ersichtlich ist. Die Gruppierungen werden auch im Portfolio-Bewertungsbericht verwendet, um die Ergebnisse nach Gruppentypen aufzuschlüsseln.

Accounts table

In the Accounts table, in addition to the various accounts necessary for the financial accounting, it is necessary to define some specific accounts to keep track of securities.

To maintain an effective Investment Accounting system, various accounts must be set up and organized in the Accounts Table.

These accounts are grouped into three main categories, each serving a distinct purpose:

Balance Sheet Investments accounts

Represent the value of investments at their book value and summarize the total value of all investments.

- You need at least one asset account where to register the purchase and sell of the securities.

- If you have different securities types, like share, bonds, etc, we advise you to create a specific account for each type.

- If you are using a multi-currency account you need at least an account for each currency.

- If you manage also bonds it is useful to have a credit account to hold the Withholding tax.

- Key Characteristics:

- Balance Accounts are directly linked to specific investments (Items).

- The currency of the Balance Account must match the currency of the Item ID.

- In transactions, Balance Accounts are always used in conjunction with a specific Item ID.

- Types of Balance Accounts:

- Investment Accounts: Track investments such as stocks or bonds.

- Asset Accounts: Represent ownership of assets, such as real estate or equipment.

- Liability Accounts: Represent obligations, such as loans secured by investments.

Value-Changing Contra Accounts

- Purpose: Record changes in the value of investments, such as gains, losses, and other adjustments.

These accounts are always paired with a Balance Account and require an Item ID in transactions. - Types of Value-Changing Contra Accounts:

- Realized Gains and Losses (recorded when investments are sold):

- Realized Gain on Investments: When the selling price exceeds the book value, the gain is calculated as:

(Selling Price−Book Price)×Quantity Sold - Realized Loss on Investments: When the selling price is below the book value, the loss is calculated similarly.

- Realized Exchange Rate Gain: When the base currency value of the investment increases due to exchange rate changes during the sale.

- Realized Exchange Rate Loss: When the base currency value decreases due to exchange rate changes during the sale.

- Realized Gain on Investments: When the selling price exceeds the book value, the gain is calculated as:

- Depreciation: Tracks the decrease in value for assets over time.

- Other Value-Changing Accounts:

- Costs: Expenses related to investments.

- Income: Earnings unrelated to direct transactions (e.g., rebates or adjustments).

- Rounding Differences: Adjustments for rounding errors in calculations.

- Unrealized Gains and Losses (revaluation to market price or exchange rates, typically at year-end):

- Unrealized Gain on Investments: The difference between the book value and the market value when the market value is higher.

- Unrealized Loss on Investments: The difference when the market value is lower than the book value.

- Unrealized Exchange Rate Gain: Adjustments in the base currency due to exchange rate fluctuations at year-end.

- Unrealized Exchange Rate Loss: Adjustments in the base currency due to exchange rate fluctuations at year-end.

- Realized Gains and Losses (recorded when investments are sold):

Profit & Loss Accounts

- Purpose: Record income and expenses associated with investments, such as dividends, interest, or fees. These accounts do not have a direct link to a Balance Account but are associated with an Item ID in transactions.

- Common Profit & Loss Accounts:

- Interest Earned: Income from interest-bearing investments.

- Interest Paid: Expenses from borrowing or margin accounts.

- Dividend Income: Earnings from stock dividends.

- Commissions Cost: Fees paid for investment transactions.

- Charges: Miscellaneous charges related to investments.

- Other Income: Any other investment-related income.

- Other Costs: Any additional costs incurred.

Wertpapiergeschäften erfassen

Für die Erfassung von Wertpapiergeschäften sehen Sie bitte unsere aktuell nur in Englisch verfügbare Webseite:

Opening and Closing the Year

Beginning of the year

At the start of a new accounting year, it is essential to ensure that the opening balances of securities and related account are correctly set. If you are continuing from a previous year, the program will automatically carry over key values such as quantities, prices, and account balances. However, if you need to add new securities, you must manually enter their initial values and ensure that the total matches the related account balances.

Add a new security

To manually add a new security at the beginning of the year in your accounting, you need to enter its initial values in the Items table.

- Initial Quantity: Enter the initial quantity of the security in the QuantityBegin column.

- Initial Price: Enter the initial unit price of the security in the UnitPriceBegin column.

The beginning value of the security (and its value in the base currency if using multi-currency accounting) is automatically calculated based on these values.

When adding a new security, you must also manually update the opening balance of the account it is assigned to. If multiple securities use the same account, the sum of their opening values must match the opening balance of the account.

Like in the following examples, where we have two shares, both uses the Shares CHF account, that means the sum of their values must match the opening balance of the Shares CHF account.

You can see in the following image of the Account table that the begin amounts in the Items table correctly match with the opening balance of the account.

To ensure accuracy, use the Check balances extension to verify that the total opening value of the securities matches the opening balance of the associated account. In the example, everything match so we have no differences.

Creation of a new year

When you create a new year using the create a new year command, the program automatically carries over the current values of each security:

- Current Quantity: The QuantityCurrent column is automatically updated based on transactions throughout the year.

- Current Price: Enter the closing price of the security in the UnitPriceCurrent column.

In the new accounting year, these values automatically become the opening values, appearing in the Initial Quantity and Initial Price columns in the Items table.

The program also automatically retrieves the account balance from the previous year and sets it as the opening balance for the current year. For more details, see Update Opening Balances.

To ensure consistency, use the Check balances extension to verify that the total opening value of the securities matches the opening balance of the associated account.

End of the Year

At the end of the year, when you create a new accounting year, as explained in the previous section, the program automatically carries over the current values of each security in the Items table.

Verify Adjustments Before Closing the Year

Before closing the year, make sure that all necessary adjustments have been correctly recorded. This is particularly important because the price entered in the UnitPriceCurrent column will serve as the new weighted average (WAC) reference price for the following year. Any missing or incorrect adjustments could lead to inconsistencies in the valuation of securities in the new accounting period.

To verify accuracy, use the Check Balances extension to ensure that:

- The total current value of the securities matches the balance of the associated account.

- The UnitPriceCurrent reflects the correct adjusted price before transitioning to the new year.

To ensure consistency, use the Check balances extension to verify that the total opening value of the securities matches the opening balance of the associated account.

Erweiterung für die Wertschriftenbuchhaltung

Erweiterung für die WertschriftenbuchhaltungEs handelt sich um ein Banana-Erweiterungspaket, welches die Integrierte Wertpapierverwaltung in Banana Buchhaltung ergänzt.

Dokumentation auf Englisch verfügbar:

- Accounts settings

- Update market prices

- Calculate unit price

- Calculate sales data

- Create adjustment transactions

- Check balances report

- Reconciliation report

- Security card report

- Evaluation of investments report

So beginnen

- Öffnen Sie Banana Buchhaltung Plus

- Öffnen Sie Ihre Banana-Buchhaltungsdatei (.ac2) mit Ihrer Wertpapierbuchhaltung oder erstellen Sie eine neue Wertpapierbuchhaltung (Portfolio) aufgrund einer schon vorhandenen Vorlage (Seite aktuell nur in Englisch verfügbar).

- Installieren Sie über das Menü Erweiterungen > Erweiterungen verwalten die Erweiterung Wertschriftenbuchhaltung.

Voraussetzung für die Verwendung

Um diese Erweiterung zu benutzen, wird Banana Buchhaltung Plus mit dem Advanced Plan vorausgesetzt.

Accounts settings

The Accounts Settings dialog allows you to specify which accounts should be used for different investment transactions, such as sales, revaluations, and other portfolio-related entries.

These accounts are referenced when the program automatically generates accounting transactions, ensuring that all portfolio movements are correctly recorded.

You are not required to fill in every account, only those relevant to your specific accounting setup. Thse used accounts must exists in the Accounts table, otherwise the dialog will display a message error when you try to accept the changes

Sections in the Dialog and Account Usage

The dialog is divided into three main sections.

Balance Accounts

This section contains accounts used to record the value of securities and related balances in the accounting system. These accounts define where investment assets and liabilities are stored.

- Investments: Contains the accounts used for securities and investment holdings.

- Assets: Contains the accounts used for recording other investment-related assets.

- Liabilities: Contains the accounts used for investment-related liabilities, such as margin loans or other financial obligations.

Value Changing Accounts

This section includes accounts that track gains, losses, and valuation adjustments for investments. These accounts are used when a security is sold or its market value changes.

- Realized Gain: Account for recording realized profits from security sales.

- Realized Loss: Account for recording realized losses from security sales.

- Unrealized Gain: Account for recording unrealized profits due to an increase in the market value of securities.

- Unrealized Loss: Account for recording unrealized losses due to a decrease in the market value of securities.

- Realized Exchange Rate Gain: Account for gains resulting from foreign currency exchange rate fluctuations when selling a security.

- Realized Exchange Rate Loss: Account for losses resulting from foreign currency exchange rate fluctuations when selling a security.

- Unrealized Exchange Rate Gain: Account for recording unrealized currency gains due to favorable exchange rate movements.

- Unrealized Exchange Rate Loss: Account for recording unrealized currency losses due to unfavorable exchange rate movements.

- Depreciations: Account for recording investment depreciation adjustments, if applicable.

- Other Value Changing Costs: Account for miscellaneous expenses affecting the value of investments.

- Other Value Changing Income: Account for miscellaneous income affecting the value of investments.

- Rounding Differences: Account for small discrepancies due to rounding or decimal precision differences.

Profit and Loss Accounts

This section contains accounts that track income and expenses related to investment transactions. These accounts are used to record direct costs and revenues generated from investment activities.

- Charges: Account for general investment-related charges and fees.

- Commissions: Account for broker or bank commissions on security trades.

- Interest Earned: Account for interest income from bonds or other financial instruments.

- Interest Paid: Account for interest expenses related to investment loans or margin trading.

- Dividends Income: Account for dividend income received from stock holdings.

- Other Income: Account for any additional investment-related income not classified elsewhere.

- Other Costs: Account for any additional investment-related costs not classified elsewhere.

Update market prices

This command imports and updates the current market prices of your securities by reading data from either a CSV file or Excel. Once you confirm the operation, the new prices are written to the UnitPriceCurrent column in the Items table.

You can gather current market prices from various financial portals (e.g., Yahoo Finance, Google Finance, ecc), directly copying the latest quotes into an Excel or CSV file. Ensure each security’s ISIN and current price are correctly aligned with the required format (one ISIN-price pair per line). When you’re satisfied with the data, save it or copy it into the format required for importing. The ISIN must have the same format as the ISIN inserited into the Items table.

Data Format

The extension expects the data to be in the following two-column format, with ISIN and Current Price separated by a semicolon (;):

US123456789;11.04873

IT000792468;10.98732

...

- First column: The ISIN (or security identifier).

- Second column: The latest market price, without thousands separators and using a period (".") as the decimal separator.

How It Works

- Open the command: Choose Import & Update Current Prices from the menu or toolbar.

- Select the file: In the dialog, you can either browse to a CSV file or paste data directly from Excel containing ISIN and price pairs.

- Preview and confirm: The extension parses the data, matching each ISIN to the corresponding security in your accounting file. You will see a confirmation dialog listing the changes, so you can verify them before they are applied.

- Update current prices: Upon confirmation, the program updates the UnitPriceCurrent column in the Items table with the new market prices.

Calculate unit price

This command helps you determine the unit price when only the total amount and the quantity of the securities sold are known. It is particularly useful when a bank statement provides only these two values, but not the precise unit price.

How It Works

- Select the security sale transaction row: This row should contain the total amount of the sale (the net proceeds), but no quantity or unit price yet.

- Enter the quantity: When you run the Calculate Unit Price command, a dialog will ask you to enter the quantity of the securities sold.

- Review the Preview: After the command calculates the unit price by dividing the total amount by the entered quantity, a preview of the updated row is displayed. You can accept or cancel these changes before they are applied.

- Confirm the Changes: Once you confirm, the newly calculated unit price is applied to the transaction row, making it ready for any further actions (e.g., generating a final sale record or calculating profit or loss).

Troubleshooting

- The selected row does not contain the Security ID: This message is shown when you are trying to create sales records having selected a row without a valid security id. Each row on which changes are made must contain the valid id of a title in the Items table.

- The selected row does not contain a valid Amount: This message is shown when you are trying to create sales records having selected a row with a non valid amount.

- The selected row in the Transactions table is not valid: The selected row in the transactions table is not a valid row.

Calculate sales data

The Calculate sales data dialog allows you to determine the book profit or loss from a security sale. It provides two main functions within a single dialog:

- Calculate the Sale Result (independent of the selected row): By clicking "Calculate profit or loss" button, you can immediately see a preview of the sale result based on the data entered (or automatically retrieved) without recording any transaction. This function works even if you are not starting from the net sale transaction row.

- Create the Sales Record (requires the net sale transaction row): By clicking "Create sales record" button, you instruct the program to generate the necessary accounting entries for the sale. To do this, you must start from the sale transaction row in the Transactions table, which records the net sale of the security.

Start from the Sale Transaction Row

When creating the actual sales record, the program needs to know which transaction to update or supplement with additional entries (such as fees, net proceeds, exchange differences, etc.). Therefore, you must begin with the row that already documents the net sale of the security.

If this row already includes:

- Item (Security ID)

- Quantity

- Unit Price (Market Price)

- Exchange Rate (for multi-currency accounting)

The dialog retrieves them automatically. Otherwise, you will need to enter them in the dialog.

This sale transaction row is currently the only row that must be entered manually. Once it exists, the program can create and add all other entries automatically.

How to use the dialog

When you execute this command, a dialog titled "Calculate book profit/loss on sale" opens.

Here, you must enter specific details about the sale, including:

- Security Data:

- Id (ISIN): Select the security from the dropdown.

- Type: Displays whether the security is a Stock or a Bond

- Quantity/Nominal Value: Enter the quantity of the security being sold.

- Current Price: The market price per unit at which the security is being sold.

- Current Exchange Rate: If applicable, enter the exchange rate for the transaction currency.

- Bank Charges: Specify any bank fees related to the sale. If not present, the record line is not added

- Other Charges: Enter any additional costs associated with the transaction, If not present, the record line is not added.

- Accrued Interests: If selling bonds, include the accrued interest amount (enabled only with bonds).

- Results Preview: Once the required data is entered, clicking "Calculate profit or loss" generates a preview showing:

- Actual Quantity: The number of units held before the transaction.

- Book Value per Unit: The average purchase price of the security.

- Total Book Value: The total purchase value of the securities being sold.

- Total at Current Price: The total market value of the securities at the entered price.

- Book Profit/Loss: The difference between the book value and the sale value.

- Exchange Rate Profit/Loss: If the security is in a different currency, the profit or loss due to exchange rate variations.

Amounts are shows using the number of decimals available in the column where the value would be placed in the Transactions table.

When entering an amount in the dialog, always use a period (".") as the decimal separator and do not use any thousands separators.

The Sale recording

Once you are satisfied with the preview, you can click "Create sales record" to finalize the transaction. The program will then present a confirmation dialog showing the entries to be added or modified, allowing you to review everything before proceeding.

- Upon confirmation, the program updates the accounting records with any new or modified entries.

- If the quantity is zero or the calculated profit/loss is zero, no transaction is created.

- The program also adds a transaction identifier to the ExternalReference column (both for the starting row and any newly added rows) to prevent duplications if you run the command multiple times on the same sale row.

- If the program detects an existing record for this sale, it will ask whether you want to overwrite it.

This feature ensures that securities sales are correctly recorded, while giving you full control over transactions before they are finalized.

In the example shown in the photo, placeholder accounts have been used. These are essentially used when no accounts are defined in the Accounts Settings dialog.

Troubleshooting

- The selected row does not contain the Security ID: This message is shown when you are trying to create sales records having selected a row without a valid security id. Each row on which changes are made must contain the valid id of a title in the Items table.

- The selected row does not contain a valid sale Quantity: This message is shown when you are trying to create sales records having selected a row with a positive quantity, this could happen if you forget to put the minus '-' sign before the quantity or if you selecte a purchase row.

- The selected row in the Transactions table is not correct: This message is shown when you are trying to create sales records having selected a row that is not the security sale row.

- The selected row in the Transactions table is not valid: The selected row in the transactions table is not a valid row.

- Item: CHXXX not found: The selected item does not exists in the Items table.

- Item: CHXXX without assigned type. Define the type in the Items table: This message is shown when you are trying to create sales records having selected an item for which a reference unit (ReferenceUnit column) has not been defined in the item table.

Create adjustment transactions

This extension allows you to generate accounting adjustment transactions (revaluation or devaluation to fair market value) for all securities by entering their market price in the dialog. To ensure correct input, the value must be entered without a thousands separator, and the decimal separator must be a period ("."). The program automatically proposes the list of securities found in the Items table.

Once you enter the market price, the program calculates the necessary adjustment by comparing the book value with the market value. The market price used for the adjustment is automatically inserted into the transaction description.

Before recording the transactions, a preview dialog is displayed, allowing you to review and confirm the adjustments. If the book value and the market value are identical, or if the security has a quantity of zero, no adjustment transaction is created.

The adjustment transaction is recorded using the cost or revenue account specified in the Account settings dialog under the "Other value changing income field". If no account is found, a placeholder is inserted instead.

This feature ensures that your securities are properly revalued while giving you full control over the adjustments before they are recorded. This operation could be performed multiple time in a year.

Check balances report

The Check Balances report verifies that the balances of individual securities match the balances of the accounts to which they are assigned.

This check is particularly useful at the beginning of a new accounting year to ensure that:

- Opening and closing balances have been recorded correctly.

- The balances of individual securities align with the total balances of their respective accounts.

Currently, this check is performed only for the current accounting year.

Why Use This Report?

- Helps detect discrepancies early, preventing accounting errors.

- Ensures that securities and their assigned accounts remain in sync.

- Provides a quick validation step after year-end closing.

Reconciliation report

This report provides the necessary information to reconcile accounting transactions related to securities. For each selected security account, it summarizes the movements associated with that security, allowing you to compare all recorded transactions with the totals calculated by the program.

Alongside the totals, there is a "Differences" field that highlights any discrepancies between the recorded transactions and the calculated totals. This amount should be zero; otherwise, it indicates that there is an inconsistency in the accounting records.

Selection Dialog

Select the account(s) for which you want to view the reconciliation

Report structure

The structure of this report is similar to that of the security card, as it includes all movements for each security. The only additional column identifies the accounting account associated with each security.

For each security account, the report provides summary totals after listing the movements:

- Opening Balance: Opening Balance of the security account

- Current Balance: Current balance of the security account returned by the program.

- Total securities movements: Sum of the total movements concerning the security (should correspond to the current Balance)

- Differences: Shows the difference between the balance reported in the field Current Balance and the total movements, if everything is correct the amount is equal to zero

Security card report

This report creates a table that summarises all the movements regarding a certain security. The structure is similar to that of the account card, but besides being filtered by security, it also shows the variation of the quantity of securities over time and how the securities' book value changes after each operation.

The header of the table shows the id, description and currency of the security along with the current date.

Selection Dialog

Enter the id of the title for which you want to create a tab. If the title is not found in the Items table, an error message is displayed, in this case make sure that the title exists in the table. By default is shown the list of the securities existing in the Items table.

When you reopen the dialog the title you entered last time will be displayed again.

Report structure

- Date: Transaction date.

- Doc: Transaction number.

- Description: Transaction description.

- Debit (item Currency): Debit amount in the item currency.

- Credit (item Currency): Credit amount in the item currency.

- Quantity: Purchased or sold quantity.

- Unit Price (item Currency): purchase or sale (unit) price of the security.

- Balance (item Currency): Balance amount in the item currency.

- Quantity Balance: Current quantity of securities.

- Book value per unit (item Currency): Current average accounting cost of the security.

- Debit (Base Currency): Debit amount in base currency.

- Credit (Base Currency): Credit amount in base currency.

- Balance (Base Currency): Balance amount in base currency.

Evaluation of investments report

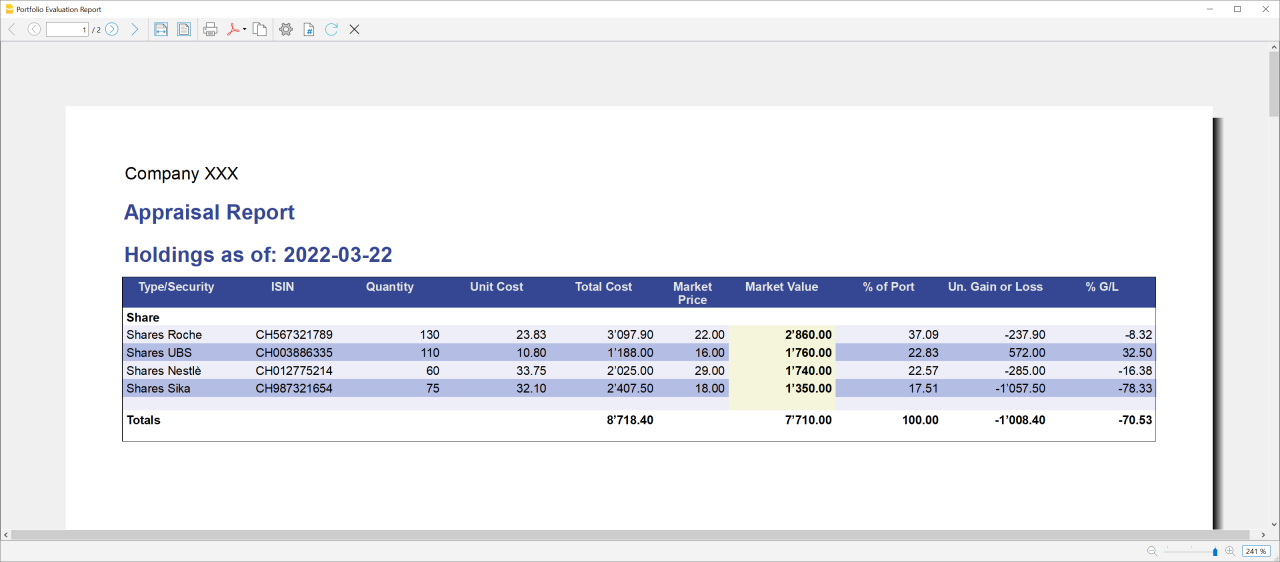

The report provides a comprehensive overview of your current investments. It is divided into two main sections:

- Appraisal Report: Offers a snapshot of your investments, comparing the book value of each security with its current market value.

- Investment accounting transactions: Displays a detailed list of all transactions carried out for each security.

Appraisal Report

The Appraisal Report is designed to help you quickly assess the situation of your investments. It displays key information such as book value, current market value, and any unrealized gains or losses for each security.

To use this report effectively, ensure you enter the latest market price for each security in the Items table under the Price Current column.

- Type/Security: Name of the group or security.

- ISIN: Isin or identification number of the security.

- Currency: Currency in which the value of the security is expressed.

- Current quantity: Quantity of securities.

- Book value per unit: Average unit cost of securities.

- Book value: Value of the securities.

- Market value per unit: The current unit price of the securities, to be entered manually in the Price Current column.

- Market value: Market value of the securities.

- % of Port: Percentage of investments represented by securities.

- Un.Gain or Loss: Unrealised Profit/Loss

- % G/L: Ratio of Unrealized Gain/Loss to Market Value.

Investment accounting transactions report

Summarises the accounting operations carried out for each security.