In this article

The Investment Accounting Extension is a simple and straightforward solution that allows you to manage bonds, shares, funds, and other securities directly within Banana Accounting. It is complementary to trading and portfolio management systems. It focuses mainly on accounting requirements, so you don’t need to maintain separate spreadsheets.

It helps accountants and auditors ensure accurate reporting and compliance. It provides in-depth insights into expenses, interest, commissions, book value, and fiscal changes, complementing the information provided by banks, brokers, and trading platforms.

Ideal for:

- Family offices managing portfolio

- Independent accountants and bookkeepers

- Non-profit organizations with investment funds

- Small businesses or self-employed professionals managing investments

- Pension funds with securities management

Key Features:

- Keep a complete list of your investments.

Bonds, shares, ETFs, funds, and more linked directly to specific asset accounts. - Multi-currency support.

Manage international investments with built-in currency conversion, and track both unrealized and realized exchange rate gains and losses. - Record transactions details.

Record quantity, price, and exchange rates within normal transactions, without extra steps. - Track the accounting value.

Maintain an accurate record of the accounting value of your investments. - Control expenses, commissions, dividends, and interest received.

- Automatic profit or loss calculation.

Determine gains or losses upon the sale of any investment. - Detailed reporting,

Generate comprehensive accounting and investment reports.

Items Table with all Investments

The Items Table is directly linked to the Transactions table, allowing it to function as a basic warehouse management system for your investments.

Before entering a transaction for a new stock or bond, you need to create a line of the Investment in the Item table:

- The id which is generally the ISIN of the security.

- The quantity and initial unit price.

- The Account specified in the Account Table

- Each Item need to be associated with an Asset account in the Account Table.

- The sum of the opening values all securities sharing the same account should be equal to the opening amount of the account.

- The currency of the Investment should be the same as the associated Investment account .

- The "Current Quantity" column automatically updates based on the purchases and sales recorded in the Transactions table.

- The "Current Price" field allows you to manually enter the latest market price of each security, enabling an up-to-date view of your portfolio's value.

You can easily paste updated prices from Excel to keep your portfolio values current. - Group different investments together to have a better view and also totals.

Account Table

Within the Accounts Table you define all the necessary accounts that are specific for the portfolio accounting:

- Accounts for investments.

The accounts that are associated with each Investment (Item Table, column Account).

It is in the Assets part of the accounting plan non displayed on the following image.- Opening amounts: Should be equal the sum of the opening amounts of all Investments associated with this account.

- Earning and Loss on investment sales.

Used when you enter a sales transaction. - Bank charges.

- Currency exchange gain or profit.

Accounting Transactions with Investments Details

The Transactions Table is central to this seamless integration of Double entry and Investment accounting.

All information in one place

With the well-known double-entry accounting method, you can easily track all types of investments, including:

- Purchase of investments

- Sale of investments

- Realized and unrealized gains or losses on investments

- Realized and unrealized exchange rate gains or losses

Transactions data with all relevant information

Within Transactions, you have dedicated fields to track all essential investment details, including:

- Security IDs

- Quantity

- Unit Price

- Exchange Rates

- Bank Charges

- Commissions

When selling an investment, you can also record:

- Realized Profit or Loss

- Realized Exchange Rate Profit or Loss

- Interest Income from Sale

- Any Additional Information You Need

Multi-line Double entry Transactions

Following the typical concept of double-entry accounting, all details related to investment purchases or sales are recorded in multi-line transactions. This allows you to enter all necessary information across multiple lines. The system is flexible — you can easily track additional expenses, commissions, or other details by simply adding a new line.

In the Transactions table the purchase or sale of investment is entered using a compound transaction, so you enter all detail using multiple rows:

- The first line is the Bank account of the transaction.

- Enter the Item identifying the security ID as specified in the Item Table.

The Item is repeated on each line so that the software can associate the information regarding costs, charges, commissions, gains and loss, to the specific investment and pepare reports. - Enter the Quantity and Unit Price and exchange rate.

The software will automatically calculate the amounts and update the accounts value and also the item current quantity. - Bank charges are entered in a separate line.

- When entering sale use separate lines to enter:

- Gain/Loss from investment.

- Gain/Loss from currencies.

- The command Calculate Sale Data will calculate both values based on the historical data, so you can easily complete the transaction.

This information is all what is needed for the software to generates comprehensive reports on the status, purchases, and sales of your securities, providing you with a clear overview of your portfolio.

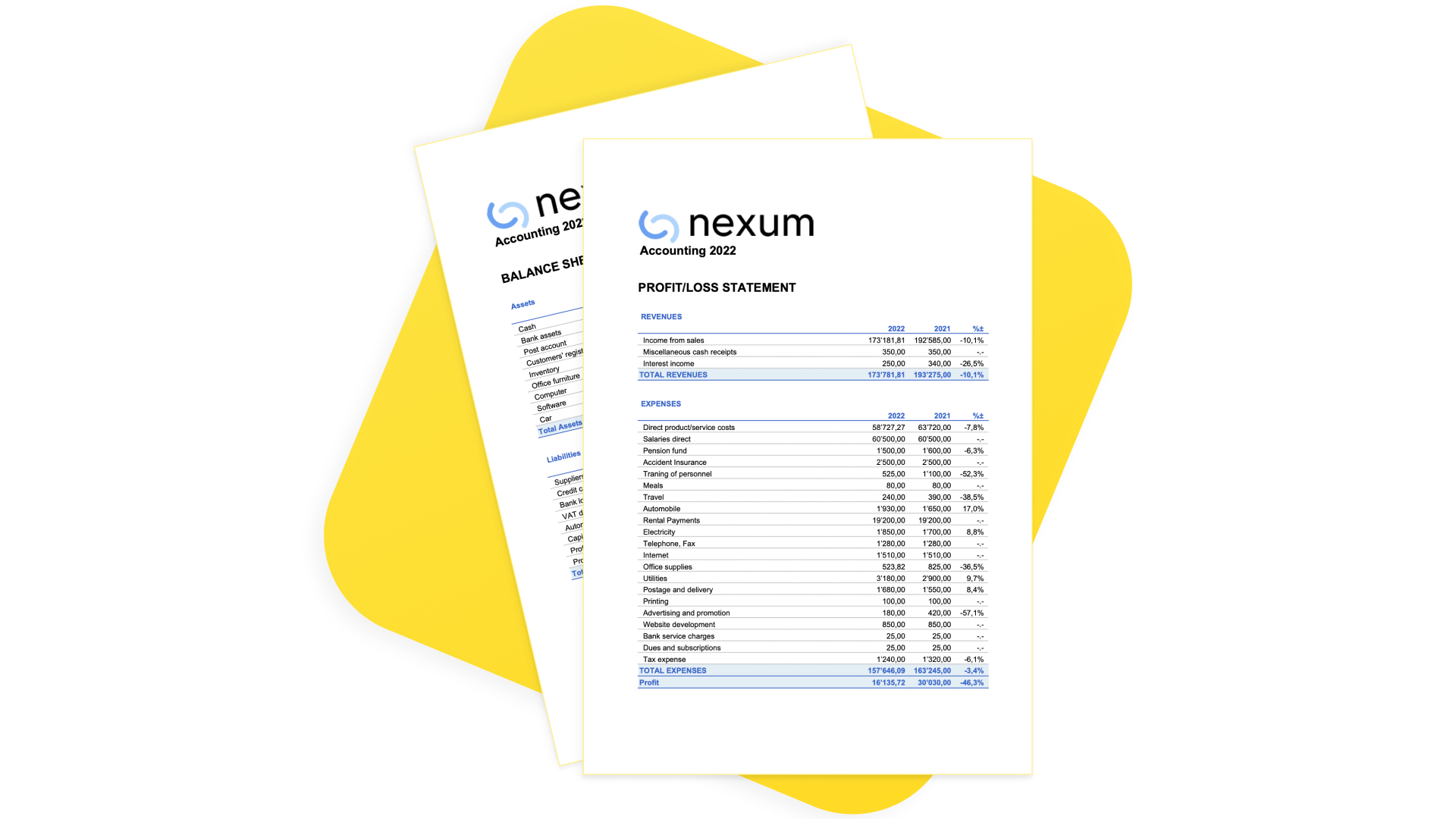

Balance Sheets & Income Statements

With fully customizable accounting plan and presentation, you can manage any kind of business, financial corporations, foundations, non-profit organization or private fortune. Get instantly Balance sheet, Income statements and all the other double entry reports ready for auditing.

Portfolio reporting

The software makes available multiple reports.

Getting Started

- You can see how it works by using one of our templates.

- Adapt your current accounting in just a few steps.

- Use the extensions to calculate the profit or loss on the sale of securities and obtain various reports.

Documentation

Is there more you need?

The solution is already in use by several customers, but we still consider it in development, as we continue to improve it based on user feedback and requests. Please feel free to reach out if you have any specific questions or requests. Given the time invested in development and the high value it provides to select customers, we may offer it through a specific subscription plan in the future.