In diesem Artikel

[This page is currently being updated]

INPAS key accounting documents

This page is dedicated to the chart of accounts template that conforms to the INPAS standard. The INPAS standard is designed to improve the transparency and accuracy of nonprofit associations' financial statements. It is also possible to download a complete Excel template that facilitates the compilation of all the documents required to comply with the standard.

The chart of accounts has been designed and interpreted based on the INPAS drafts and may require adjustments once the final guidance is published in 2025.

The compliance of the accounting with the INPAS standard always depends on the accountant and the auditor working on the accounts.

Updates may be possible following the final publication of INPAS in 2025.

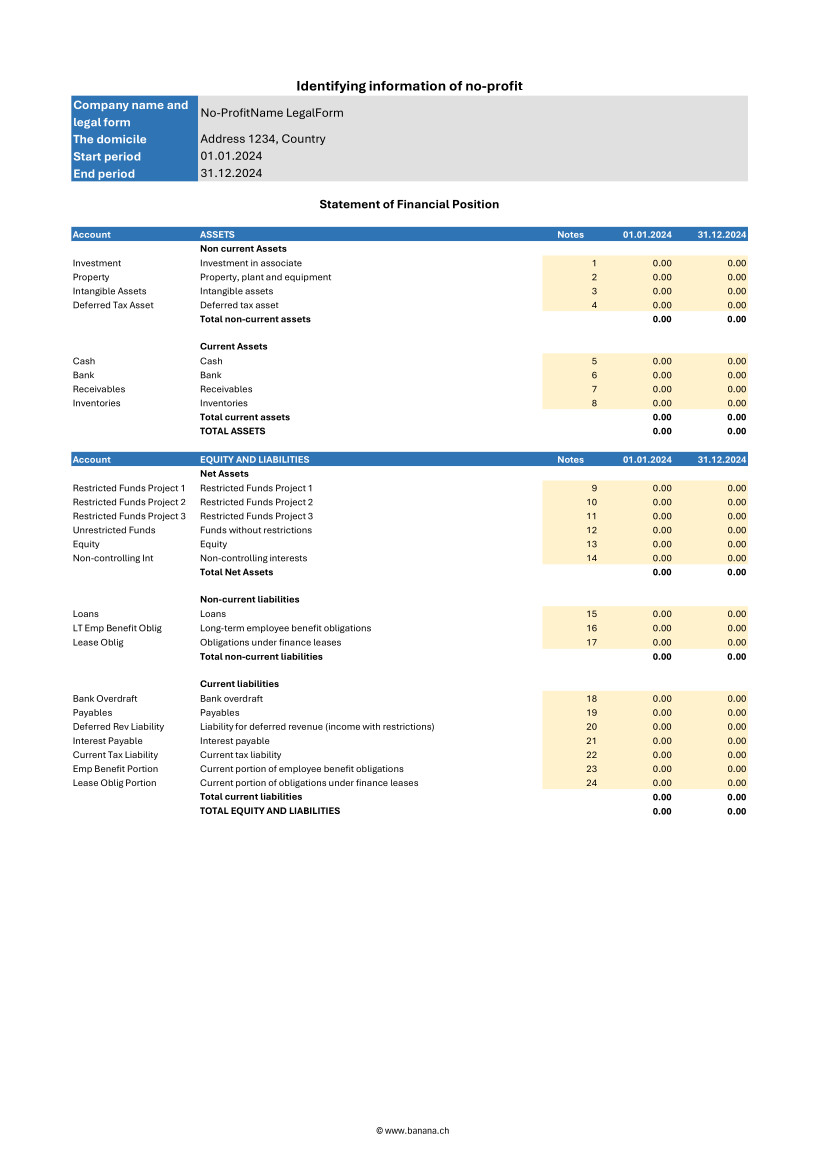

Statement of Financial Position

The balance sheet is an essential document that provides a detailed view of your organization's financial health, clearly showing assets, liabilities and net worth. Because of the flexibility of the INPAS standard, you can present the financial statements either vertically or horizontally, tailoring them to the specific needs of your nonprofit.

This document can be generated easily using Banana Accounting+ template.

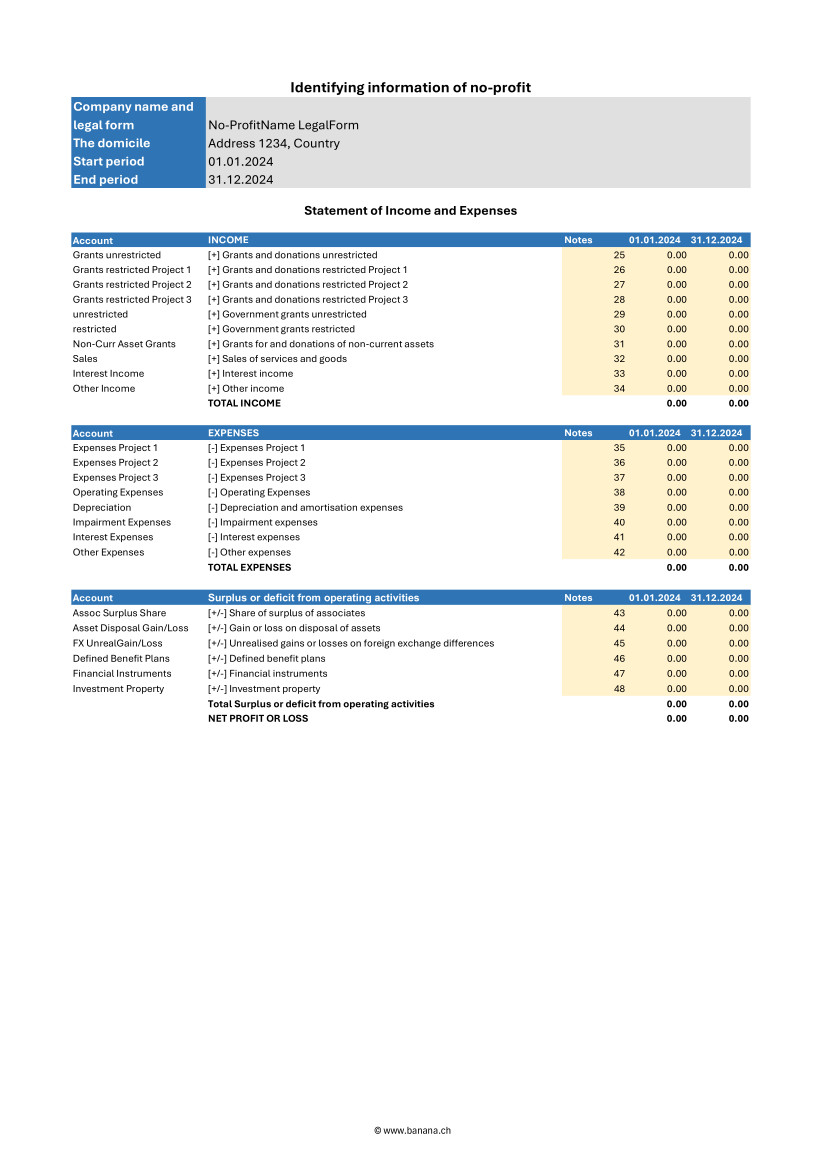

Statement of Income and Expenses

This document shows your organization's income and expenses during a period. Proper management of the income statement is crucial to demonstrate how resources were used to achieve missionary goals.

This document can be generated easily using Banana Accounting+ template.

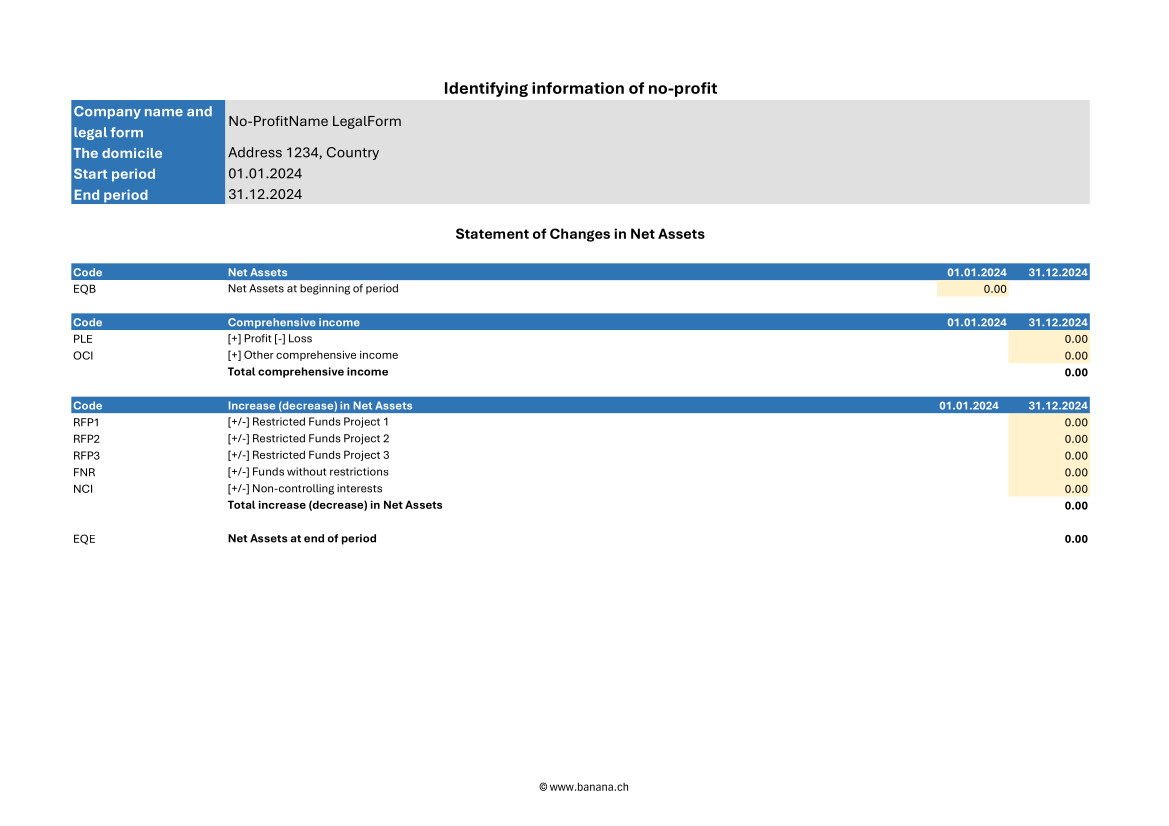

Statement of Changes in Net Assets

This document is critical to understanding the changes that have occurred in net assets during the fiscal year. The INPAS standard provides a sequence of elements that transparently reflects the changes, making clear the impact of financial activities on the organization's assets.

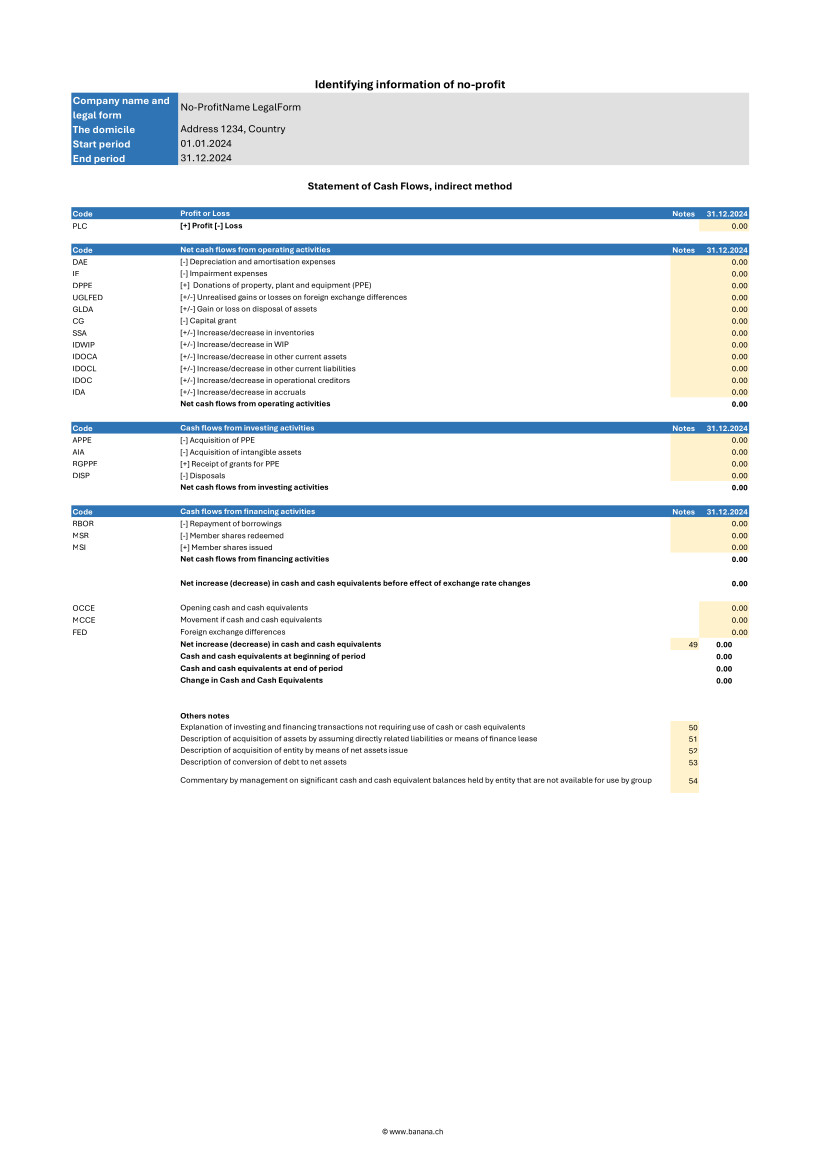

Statement of Cash Flows

The cash flow statement, which shows cash flows, is essential for monitoring your organization's liquidity and ability to fund its activities. With our INPAS template, you can present this information in a clear and accessible way, improving transparency to donors and board members.

Explanatory notes

Explanatory notes offer crucial details to fully understand the numbers presented in other accounting documents. They provide a clear description of adopted accounting policies and significant changes, contributing to a deeper and more accurate analysis of the institution's financial position.

Excel template to download

To facilitate the accounting management of associations, a complete Excel template can be downloaded to provide all the necessary documents according to the INPAS standard. In fact, this versatile and easy-to-use tool also allows you to create the Statement of Changes in Net Assets, Statement of Cash flows and Explanatory notes, completing the documentation with the Balance Sheet and Statement of Income and Expenses you can easily obtaine through Banana Accounting+.

Download the INPAS Excel Template

Statement of Financial Position

This document can be generated easily using Banana Accounting+ template. Here is what the statement of financial position must contain.

Current and non-current assets

Assets should be distinguished into current and non-current. Current assets are those that are expected to be converted to cash or used within one year. They include accounts such as cash and cash equivalents, short-term receivables, and inventories. Non-current assets, on the other hand, are those that are expected to be held for periods longer than one year and may include tangible assets, intangible assets, and long-term investments.

Current and non-current liabilities

Liabilities must also be classified into current and noncurrent. Current liabilities are payables and obligations that are expected to be settled within one year, such as accounts payable, accrued expenses, and other short-term liabilities. Non-current liabilities represent long-term commitments that the organization does not expect to settle within the next year, such as long-term debts and mortgages.

Shareholders' Net Assets

Net Assets represents the difference between the organization's total assets and total liabilities. In financial statements according to the INPAS standard, net assets should be divided into three main categories:

- Unrestricted funds: resources available for general use and not subject to specific restrictions. These funds may be used at the discretion of the organization to fund any activity or operational need.

- Restricted funds:

- Temporarily restricted funds: resources subject to restrictions imposed by donors or temporary conditions. These funds may be used only for specific purposes and for a specified period, after which, if conditions are met, they may be reclassified as unrestricted funds.

- Permanently restricted funds: resources that must be kept intact indefinitely, often to ensure a continuous source of income for the organization. These funds are typically associated with permanently restricted donations.

Statement of Income and Expenses

This document can be generated easily using Banana Accounting+ template. Here is what the statement of activities must contain.

Revenue

Income should be divided between restricted and unrestricted to reflect donor or regulatory restrictions. This distinction is crucial to understanding the organization's flexibility in the use of funds received.

- Restricted income: funds earmarked for specific purposes, such as particular projects or specific periods. These funds may come from donations, grants, or funding with donor-imposed conditions limiting their use.

- Unrestricted income: funds that can be used at the discretion of the organization for any operational need. These include general donations, proceeds from nonspecific fundraising events, and other income that has no special restrictions.

Expenses

Expenses should be broken down into major categories to give a clear view of how resources are allocated. This breakdown helps to better understand the organization's priorities and efficiency in managing funds.

- Programmatic expenses: costs directly associated with the implementation of the organization's core programs and activities. These include salaries of operational staff, costs of materials and equipment used in projects, and other expenses directly related to the organization's missions.

- Fundraising expenses: costs incurred for fundraising activities, including events, marketing campaigns, and salaries of dedicated fundraising staff. This category highlights the investment made to secure future financial resources.

- Administrative expenses: general costs of running and administering the organization. These include administrative staff salaries, office rent, consulting fees, and other overhead costs necessary for the day-to-day operation of the organization.

Changes in shareholders' Net Assets

The income and expenses statement should report changes in net worth during the reporting period, broken down by fund category:

- Unrestricted funds: changes resulting from the use or appropriation of unrestricted revenues and non-programmatic expenditures.

- Restricted funds:

- Temporarily restricted funds: changes due to the use of restricted funds according to donor-imposed conditions and their eventual transfer to unrestricted funds once conditions are met.

- Permanently restricted funds: changes related to new permanently restricted gifts or changes in the investment policies of permanent assets.

Statement of Changes in Net Assets

Here is what the statement of changes in net assets must contain.

Changes in shareholders' Net Assets by period

The statement should report all changes in net assets broken down by period, clearly showing increases and decreases in the various funds.

- Increases in net assets: these may result from new donations, contributions, grants received, or other sources of income. Each increase should be specified in terms of restricted and unrestricted funds to highlight restrictions on the use of funds.

- Decreases in net assets: decreases may result from the use of funds to cover programmatic, fundraising, and administrative expenses. Again, it is important to specify whether the decreases involve restricted or unrestricted funds.

Details on contributions, donations and other sources of funding

The statement should include a detailed description of all funding sources received during the period, broken down by type and restriction.

- Contributions and donations: specify donations received, indicating whether they are restricted or unrestricted, and describe any conditions or restrictions imposed by donors.

- Grants and funding: detail grants obtained, including conditions of use and periods of application.

- Other income: include any other sources of funding, such as income from fundraising activities, investment income, or income from ancillary activities, detailing any applicable restrictions.

Use of funds under restrictions

The statement should clearly show how funds have been used according to donor or regulatory restrictions, ensuring transparency and compliance.

- Restricted funds:

- Temporarily restricted funds: describe how these funds were used for specific projects or programs, and whether any restrictions were met, allowing the funds to be reclassified as unrestricted.

- Permanently restricted funds: highlight the use of income generated by these funds to support the organization's activities, keeping the principal capital intact according to the conditions set by the donors.

- Unrestricted funds: indicate how these funds have been allocated for general operating expenses and other needs without specific restrictions.

Mandatory elements of the statement of changes in Net Assets

- Beginning balances

- The beginning balances of each component of net assets at the beginning of the accounting period must be reported.

- Example: share capital, reserves, retained earnings.

- Changes for each component

- Detail all changes for each component of net assets during the accounting period.

- These changes may include:

- Profits or losses for the year.

- Increases in capital stock.

- Reductions in capital stock.

- Dividend distributions (if applicable).

- Contributions and distributions from owners

- If applicable, indicate contributions made by owners and distributions made to owners.

- Reserves

- Any changes in reserves, such as legal reserves, extraordinary reserves, revaluation reserves, etc.

- Ending balance

- Report the ending balances of each component of net assets at the end of the accounting period.

Steps to implement the statement of changes in Net Assets

- Identification of the components of shareholders' Net Assets

- Determine all components of net assets that should be reported in the statement, such as share capital, reserves, and retained earnings.

- Collection of initial data

- Collect the beginning balances of all components of net assets from the last closed financial statements.

- Recording of changes

- Record all changes that have occurred during the accounting period, such as capital increases, recorded gains or losses, dividend distributions, and other changes in reserves.

- Calculating ending balances

- Calculate the ending balances of each component of net assets taking into account the changes recorded.

- Preparation of schedule

- Compile the statement of changes in net worth with all the information collected, making sure that the totals are correct and that all changes are adequately explained.

Statement of changes in funds

The Statement of Changes in Funds is a crucial accounting document that illustrates the changes in an organization's funds during an accounting period. According to the INPAG standard, the Statement of Changes in Funds must include a detailed set of information to ensure transparency and accuracy in reporting.

Here are the required elements of the statement of changes in funds.

- Initial balances of funds

- The initial balances of each fund at the beginning of the accounting period must be reported.

- Revenue by fund

- Detail the income received for each fund during the accounting period.

- Expenditures by fund

- Detail the expenditures made for each fund during the accounting period.

- Transfers between funds

- Information on any transfers of resources between different funds.

- Ending fund balances

- Indication of the ending balance of each fund at the end of the accounting period.

- Variations in funds with restrictions

- Specific details on changes in time-restricted or donor-restricted funds.

Statement of Cash Flows

Here is what the cash flow statement must contain.

Cash flows from operating activities

This section reports cash flows generated or used by the daily operations of the organization. It must include:

- Income from donations and grants: cash flows from donations, grants, and other funding sources not specifically tied to investments or financing.

- Payments for operating expenses: cash flows used to cover programmatic, fundraising, and administrative expenses, including salaries, supplies, and other operating costs.

- Receivables collections and payables payments: cash flows associated with the management of short-term receivables and payables.

Cash flows from investing activities

This section covers cash flows related to the purchase and sale of long-term assets and other investments. It must include:

- Purchases of fixed assets: cash flows used to purchase tangible fixed assets, such as buildings, equipment, and intangible fixed assets.

- Income from sales of fixed assets: cash flows generated from the sale of long-term assets.

- Financial investments: cash flows related to acquisitions or disposals of financial investments, such as securities and other investment instruments.

Cash flows from financing activities

This section reports cash flows associated with the organization's financing activities, including changes in restricted and unrestricted funds. It must include:

- Receipts from long-term restricted loans and donations: cash flows from donations and loans restricted specifically for long-term purposes.

- Repayment of long-term debts: cash flows used to repay long-term debts and obligations.

- Interest payments and other financing costs: cash flows related to interest payments and other financing-related costs.

Reconciliation of net income to net cash flow from operating activities

This section is critical to linking net income with actual cash flows from operations. It must include:

- Net income: the net economic result of the organization for the period.

- Adjustments for nonmonetary items: for example, depreciation and amortization.

- Changes in financial statement balances: changes in accounts receivable, accounts payable, inventories and other operating items.

- Extraordinary items: any extraordinary non-recurring cash inflows or outflows.

Explanatory notes

Explanatory notes should include detailed information regarding the accounting policies adopted, explanations of major items in the financial statements, and details of material subsequent events that could affect the understanding of the financial statements.

Here is what the explanatory notes must contain.

Information on accounting policies adopted

The notes to the financial statements should provide a detailed description of the accounting policies followed by the organization. This information helps users of financial statements understand the principles on which the figures reported are based.

- Principles of recognition and measurement: description of the criteria used to recognize and measure assets, liabilities, income, and expenses.

- Depreciation methods: explanation of the methods used to depreciate tangible and intangible assets.

- Valuation policies: information on valuation policies for inventories, receivables, and liabilities.

- Revenue recognition: criteria adopted for revenue recognition, including restricted and unrestricted donations.

Additional details on items in the balance sheet and income statement

Explanatory notes should provide additional details that help to better understand the items presented in the balance sheet and income statement.

- Analysis of principal items: detailed explanation of major items of assets, liabilities, income, and expenses. For example, a breakdown of fixed assets, long-term debt, and major revenue categories.

- Significant transactions: description of significant transactions that occurred during the period, such as acquisitions, sales of fixed assets, or extraordinary events.

- Significant changes: explanation of significant changes from previous periods, providing a context for understanding changes in financial data.

Information on possible risks and uncertainties

Explanatory notes should include information on any risks and uncertainties that could affect the organization. This information helps assess the financial strength and risk management of the institution.

- Financial risks: description of key financial risks, such as credit risk, liquidity risk, and market risk, and the policies adopted to manage them.

- Contingencies and contingent liabilities: information on legal contingencies, contingent liabilities, or other uncertain events that could have a significant financial impact.

- Risk management: details of the risk management strategies and policies implemented by the organization to mitigate the effects of such risks.

Segment reporting if applicable

If the organization operates in different industries or geographic areas, the explanatory notes should include segment reporting information to provide a more detailed view of financial and operational performance.

- Information by segment: details on revenues, expenses, assets, and liabilities for each operating or geographic segment.

- Aggregation criteria: explanation of the criteria used to aggregate data for different segments.

- Performance by segment: analysis of the financial and operational performance of each segment, highlighting differences and relative contributions to the overall performance of the organization.

Accrual accounting requirement

The INPAG standard requires that all transactions be recorded on an accrual basis. This means that transactions must be recognized in the period in which they occur, regardless of actual cash flows. Adopting accrual accounting provides a more accurate and realistic view of an organization's financial position and performance, improving the transparency and reliability of financial information.

Examples for Income from donations

When a donation is promised but has not yet been received insert:

- in Debtor Account column the account Debtors from donations.

- in Creditor Account column the account Income from donations.

- in the Amount column the promised amount.

This record recognizes the income as a debt, reflecting the promise of the donation, even though the money has not yet been received.

When the donation is actually received insert:

- in the Debtor Account column the account Bank.

- in the Creditor Account column the account Donation debtor.

- in the Amount column the received amount.

This recording adjusts the accounts once the money is actually received, eliminating the previously recorded debt.

Examples for project expenses

When an invoice for project services is received but not yet paid insert:

- in the Debtor Account column the account Project expenses.

- in the Creditor Account column the account Creditors.

- in the Amount column the invoice total amount.

This entry recognizes the expense when the invoice is received, regardless of whether it has been paid or not.

When the invoice is actually paid insert:

- in the Debtor Account column the account Creditors.

- in the Creditor Account column the account Bank.

- in the Amount column the paid invoice total amount.

This entry reduces creditors once the invoice has been paid, reflecting actual cash flow.

Benefits of accrual accounting

Adopting accrual accounting, as required by the INPAG standard, ensures that revenues and expenses are recorded in the correct period. This approach provides a more accurate view of the organization's financial activities, facilitating better resource management and more accurate planning. Nonprofit organizations that follow these accounting practices can demonstrate greater transparency and accountability, increasing the trust of donors, board members and other stakeholders.

Accounting for restricted grants and donations

INPAG requires that funds be distinguished between restricted and unrestricted funds. This distinction should be visible in the financial statements or notes.

Accounting for grant and donation income according to the INPAG standard requires a specific structure to ensure proper recording and recognition. The accounting process includes the following steps:

- Identify whether there is an enforceable agreement that confers rights and obligations.

- Identify the enforceable obligations in the agreement.

- Determine the amount of the transaction.

- Allocate the transaction amount to the enforceable obligations.

- Recognize the revenue when (or while) the enforceable obligation is satisfied.

- These steps ensure that revenue is recognized appropriately, accurately reflecting the economic activity of the organization.

Example of accounting transactions for restricted donations

Receipt of a grant for a specific project with implementing obligations.

When you receive the amount insert:

- in the Debtor Account column the account Cash/Bank or Donation debtor if the donation was promised.

- in the Creditor Account column the account Liabilities for grants.

- in the Amount column the amount received.

At this stage the amount received is recorded as a liability because the organization has an obligation to meet the conditions of the grant.

When you fulfill the executive obligation insert:

- in the Debtor Account column the account Expense1.

- in the Creditor Account column the account Bank.

- in the Amount column the paid amount.

The second transaction must be insert:

- in the Debtor Account column the account Liabilities from grants.

- in the Creditor Account column the account Income from grants.

- in the Amount column the paid amount.

Once the enforceable obligation is fulfilled, the liability is reduced and the amount is recognized as revenue, reflecting the completion of the project or condition fulfilled.

Accounting for unrestricted donations

Unrestricted donations, which do not impose specific obligations on the organization, follow a simpler accounting process than donations with enforceable obligations. These receipts can be recognized immediately upon receipt.

Example of an unrestricted donation

When you receive the amount insert:

- in the Debtor Account column the account Cash/Bank or Donation debtor if the donation was promised.

- in the Creditor Account column the account Income from donations.

- in the Amount column the received amount.

In this case the amount is immediately recognized as income since there are no specific obligations to be met.

Foreign currency conversion

Managing foreign currency transactions is an essential part of accounting, especially for nonprofit organizations that receive international grants and donations. The INPAS standard establishes precise rules for managing these transactions, including disclosure of foreign exchange gains and losses and retranslation of foreign currency monetary assets and liabilities related to grant agreements.

Foreign currency transactions must be translated into the functional currency using the exchange rate in effect on the date of the transaction. Monetary items, such as debtors and creditors, must be retranslated at the balance sheet date to reflect current exchange rates.

Example of transactions for foreign currency conversion

Receipt of 10'000$ grant when the exchange rate is 1$ = 0.90€.

Initial acknowledgement:

- in the Debtor Account column the account Cash/Bank.

- in the Creditor Account column the account Liabilities for grants.

- in the Amount column the amount 9'000€ (10'000$ * 0.90€ = 9'000€).

In this case the grant is recorded in euros at the exchange rate in effect at the time of the transaction.

Retranslation on the balance sheet date with the exchange rate 1$ = 0.85€.

- in the Debtor Account column the account Loss on exchange.

- in the Creditor Account column the account Cash/Bank.

- in the Amount column the lost amount 500€.

At the balance sheet date the grant must be retranslated at the new exchange rate. The difference between the initial value and the retranslated value is recorded as an exchange loss.

Treatment of exchange rate changes on grants

Exchange rate differences on monetary items related to grants should be treated in a manner consistent with the nature of the transaction. For example, if a grant received is to be spent on a specific project and the exchange rate varies, the amount to be reimbursed could differ due to exchange rate fluctuations.

For example a grant received of 10'000$ must be spent on a specific project. If the exchange rate varies and the grant must be partially repaid due to exchange rate differences.

No INPAS adoption for certain transactions

When an organization chooses not to apply INPAS standard for certain transactions, it is essential to provide a clear explanation and details of the accounting management adopted. The INPAS standard requires disclosure of the following information to maintain transparency and understandability in financial statements.

Mandatory disclosures in the case of no INPAS adoption

- Disclosure of transactions not compliant with INPAS

- The organization must specify which transactions do not follow INPAS standards.

- Example: “Donations in kind were not accounted for in accordance with INPAS standards.”

- Accounting treatment adopted

- The alternative accounting treatment used for these transactions must be described.

- Example: “In-kind donations were recorded at appraised value rather than market value according to INPAS guidelines.”

- Rationale for non adoption of INPAS

- It is necessary to explain the reasons why INPAS standards were not applied.

- Example: “Valuation of in-kind donations according to INPAS standards required specialized skills that the organization does not currently possess.”

- Impact on budgets

- It must be indicated how the financial statements would differ if INPAS requirements had been applied.

- Example: “If in-kind donations had been valued according to INPAS, the total value of income would have increased by €10,000.”

- Quantification of differences

- Where possible differences between the accounting treatment adopted and that provided by INPAS should be quantified, without excessive costs.

- Example: “Donations in kind were recorded at €5,000, while according to INPAS the correct value would have been €15,000, resulting in a difference of €10,000.”

References

- International Financial Reporting For Non Profit Organisations: www.ifr4npo.org