在此文中

Accounting closings are all the verification and control operations carried out at the end of the year (or accounting period) to ensure that the data is correct and that the year’s result is calculated without errors.

With Banana Accounting, many operations are simplified and automated, but it is important to use the available functions, including:

- The Balance column highlights any discrepancies and carries them forward to the following rows until they are corrected.

Tip: keep an eye on this column during the year to immediately correct errors and prevent them from accumulating.

With the Filter rows (only with the Advanced plan), you can quickly search for transactions with the same texts, amounts, or accounts, and correct them without scrolling through the entire table.

Automatic accounting check

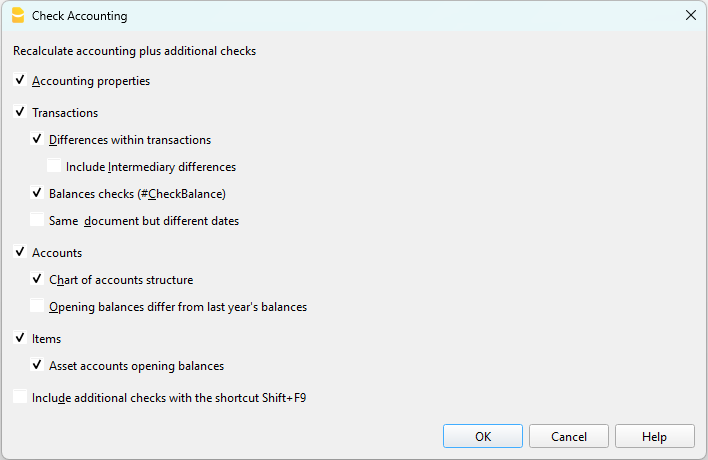

The Check accounting command (Actions menu) automatically performs a series of checks to immediately detect any errors or differences.

We recommend using it:

- when error messages appear

- after modifying Accounts, Categories, or VAT Codes

- during the annual closing

- after creating the new year and making further changes.

Errors are shown in the Messages window, with the indication of the table and row to be corrected.

With the Check accounting command, the program searches and reports:

- Differences in the Transactions table

All amounts must balance: income and expenses must not generate differences. Differences between accounting balances and actual balances

With the CheckBalance function you can automatically compare recorded balances with those from bank statements and detect discrepancies.

This is essential to ensure the truthfulness and accuracy of the accounting: the balances of the accounts must match the actual balances:- bank and credit card accounts must match bank/postal statements,

- the cash balance must match the actual cash,

- the VAT payable account must match the balance of the VAT Report account.

More information about Verification entries is available on the page Verification balance transactions.

- Summation errors in the Accounts and Categories table

If in the Accounts or Categories table you have added, deleted, or renamed accounts, groups, or subgroups, grouping errors may occur.

These are reported by the Check accounting command and must be corrected, otherwise the totals in the reports will be wrong.

- Differences in opening balances

In the Accounts table, the balances of the balance sheet accounts must always exactly match the closing balances of the previous year (previous year’s file).

Differences may occur for the following reasons:- In the previous year’s file, transactions were added or deleted after creating the new year.

- In the previous year’s file, errors were corrected after creating the new year.

- In these cases, to correct the opening balances, you need to use Update opening balances.

How to start the new year

In Banana Accounting, each year has its own separate file:

- from the menu Actions > Create New Year you generate the new year’s file,

- you can work simultaneously on the old file and on the new one,

- once the closing is complete, update the balances in the new file with Update opening balances.

Annual Report printing

The Annual Report is the document that summarizes all the year’s income and expenses, showing the final balance and the result (profit or loss).

It is based on the following calculation scheme:

- Sum of income → revenues and proceeds.

- Sum of expenses → costs and charges.

- Difference between income and expenses → profit or loss.

You can prepare it from the menu Reports > Enhanced statement with groups, customizing columns and print settings.

Carry forward the year’s result in Income / Expenses accounting

In Income/Expenses accounting, it is not necessary to allocate profit or loss, because the Net worth total in the Accounts table already represents equity.

The year’s result (income – expenses) is automatically carried forward into the balance sheet.

If you also want to display the results of previous years, you can create a specific account Previous years’ results and manually enter the amount in the Opening column.

Locking transactions

Once the checks and closings are completed, you can lock the transactions:

- From the menu Actions > Lock transactions

- The rows will be numbered and protected by a blockchain code that ensures their integrity.

PDF Dossier

With the Create PDF dossier command you can save all the year’s documents (account cards, journal, report, VAT report, etc.) in a single PDF file. We recommend saving it and, for security, making copies on external media.