In dit artikel

When a depreciable asset is disposed of, certain steps must be followed in accounting to zero out its value both in the Fixed Asset Register and in the Balance Sheet, recording any capital gains or capital losses.

To reverse the value in the Fixed Asset Register

Before proceeding to zero the value in the Fixed Asset Register, the following elements should be considered:

- Disposal date to calculate the periodic depreciation amount (from the beginning of the year up to the date of disposal or sale)

- Residual book value

- Sale value

- The difference between the residual book value and the sale value may result in a capital loss or capital gain.

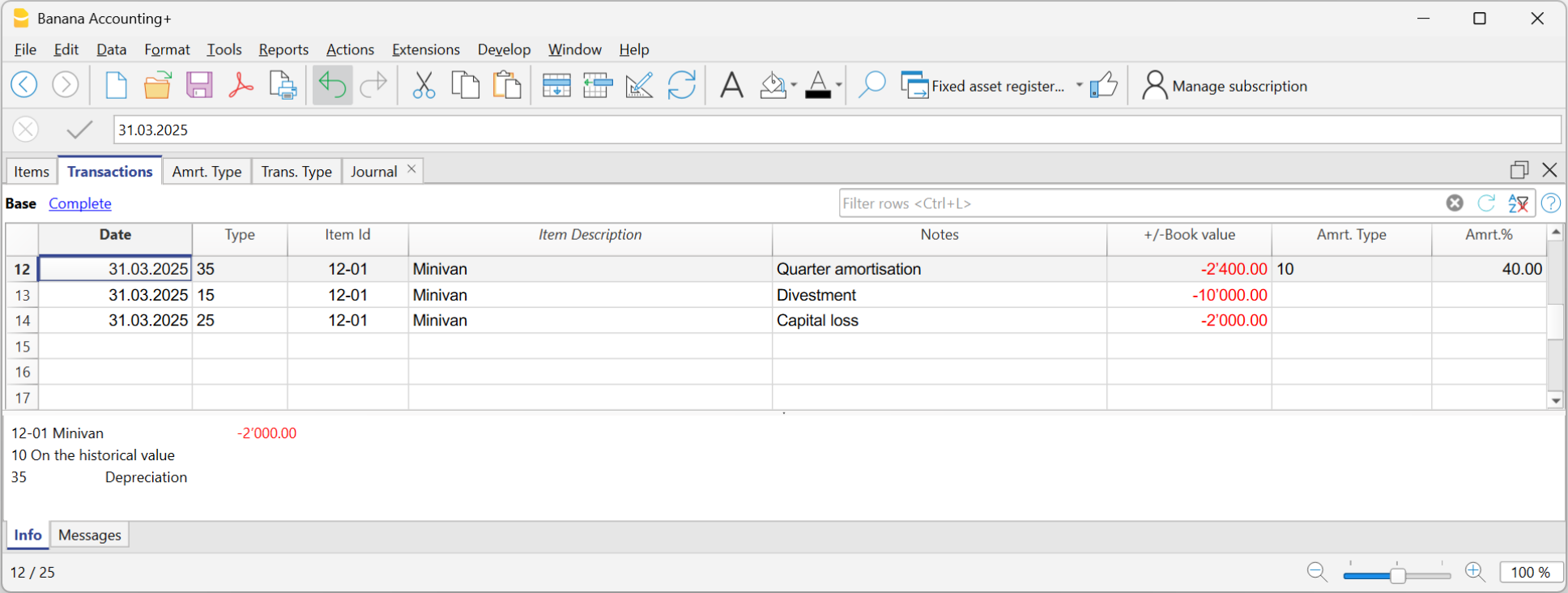

Below is an example of a vehicle disposal on 31.03.2025, with the following elements:

- Disposal date: 31.03.2025

- Residual book value: 12,000.-

- Sale value: 10,000

- Capital loss: 2,000 (12'000 - 2'000).

In the Fixed Asset Register application on 31.03.2025, record:

- The depreciation amount up to 31.03.2025 for the asset being disposed of.

- Enter the date, select "35" in the Type column,

- Enter the asset number in the Items Id column

- Enter the description "first quarter depreciation" in the Notes column

- Enter the depreciation amount for the first quarter in the +/- Book Value column

- The disposal or sale on 31.03.2025

- Enter the date, select "15" in the Type column

- Enter the asset number in the Items column

- Enter the description "disposal or sale" in the Notes column

- Enter the residual book value in the +/- Book Value column

- The capital loss (or capital gain, as the case may be) on 31.03.2025

- Enter the date, select "25" in the Type column,

- Enter the asset number in the Items column

- Enter the description "capital loss" in the Notes column

- Enter the difference between the book value and the sale value in the +/- Book Value column

Recording the disposal in the accounting file

When an asset is disposed of in the accounting file, its book value must be removed from the Balance Sheet.

- If there is an accumulated depreciation account related to the asset:

- Reverse the accumulated depreciation up to that point with the asset account

- Reverse the residual book value of the asset

- Recognize the capital gain or capital loss