In this article

International Non-Profit Accounting Guidance - INPAS Standard Template

The INPAS International standard template for associations provides a comprehensive framework for organizing financial transactions and reporting for associations adhering to international standards.

In Banana WebApp openen

Open Banana Accounting Plus op uw browser zonder enige installatie. Pas het sjabloon aan, voer de transacties in en sla het bestand op uw computer op.

Open template in WebAppModel documentatie

[This page is currently being updated]

The INPAS International template for associations provides a comprehensive framework for organizing financial transactions and reporting for associations adhering to international standards.

This chart of accounts template is designed to streamline accounting processes, ensure consistency in financial reporting and facilitate compliance with regulatory requirements. With a user-friendly format and customizable accounts name, associations can efficiently track income, expenses, assets and liabilities, enabling clear and transparent financial management. Whether managing donations, membership dues or program expenditures, this template offers flexibility and adaptability to suit the unique needs of diverse associations while promoting transparency and accountability in financial operations.

The chart of accounts has been designed and interpreted based on the INPAS drafts and may require adjustments once the final guidance is published in 2025.

The compliance of the accounting with the INPAS standard always depends on the accountant and the auditor working on the accounts.

Updates may be possible following the final publication of INPAS in 2025.

Using Banana Accounting Plus you can manage the balance sheet and the income statement. All other documents are easily obtained thanks to the Excel template.

Create your file

- Create a new file, starting from this template (Template ID +11255), using one of the methods explained.

- With the command File → File properties, set the period, the association name and the basic currency.

- With the command File → Save as, save the file. Enter the association name and year in the file name.

For example "no-profit-2024.ac2".

See also Organize accounting files locally, online or in the cloud

Customize the Accounts table

Once you have entered the transactions, you can check the Accounts table. You will have an overview of your assets, liabilities, income and expenses, which allows you to keep your balance under control.

Customize the Accounts table to suit your needs: you can add, delete and edit accounts, groups or descriptions.

Enter Opening Balances

In the Opening column enter the opening balances of the Accounts. Negative asset account amounts are entered with a minus sign in front.

Enter the balances of the previous year

If you are creating a new accounting and you want the amounts of the previous year to appear in the statements to be printed, you must insert the values in the appropriate column. Go to the Previous view and in the Previous Year column enter the values.

Enter the Transactions

Register the accounting transactions in the journal. Enter the date, the document number and the description. Enter the destination account into the Debit account column, and the account of origin in the Credit account. Then add the amount.

You can modify the journal at any time.

Manage funds, grants and donations, project and operating expenses

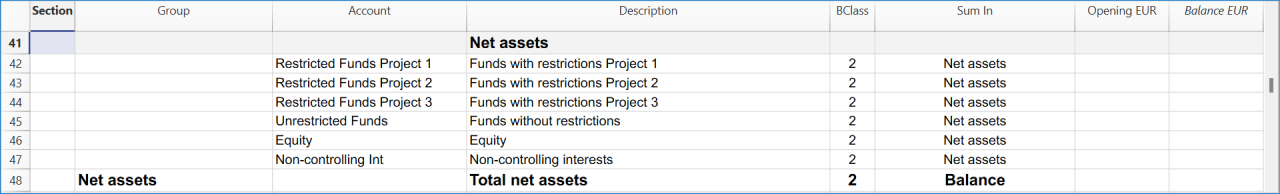

Manage funds in the Balance Sheet divided by project.

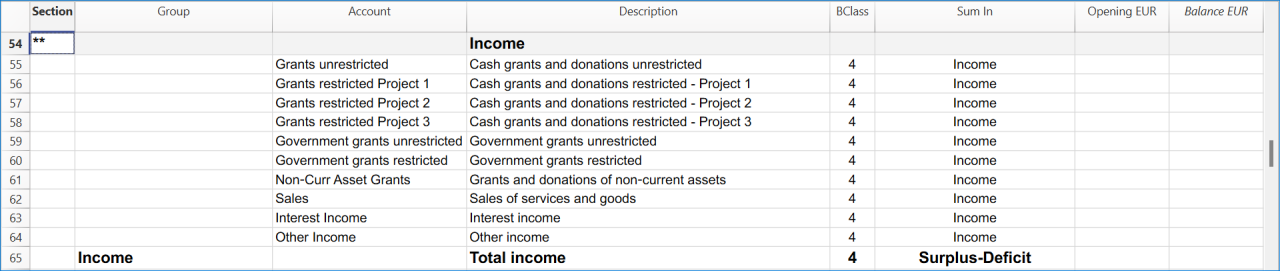

Manage grants and donations in the Income Statement.

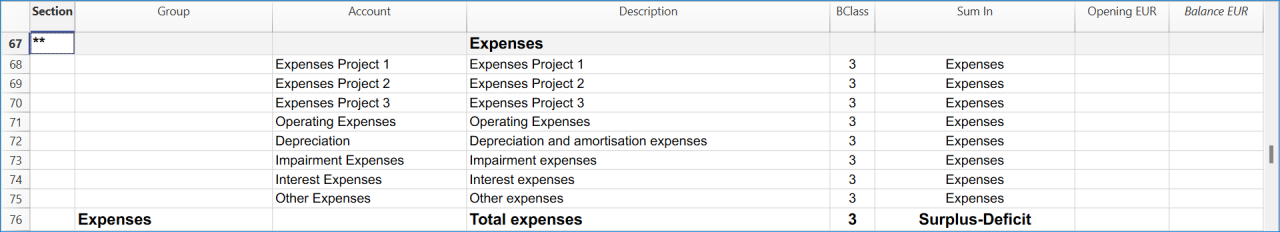

Manage projects expenses and operating expenses in the Income Statement.

Get the Statement of Financial Position and the Income Statement

At any time of the year you can create your Balance sheet, which is a financial report of your assets, liabilities and equity and the Profit and Loss statement, which includes income and expenses. You will achieve optimal reports because you can always modify the data until they are perfect. You have the possibility to print out your statements or save them in PDF format.

Complete the documentation using the Excel Template

When you get the balance sheet and the income statement, complete the Excel template to get all the documents needed to comply with the INPAG standard.