In this article

Swiss VAT Report when base currency is EUR or USD (not CHF) (Banana+) [BETA]

This extension converts the amounts in base currency to Swiss francs (CHF) and creates the summary for the Swiss VAT report (effective method) and a transactions report using the converted amounts.

These reports will report the VAT in CHF in case the the base accounting currency is in EUR, USD or another currency different from CHF.

Prerequisites

To use this extension it is necessary to have the Advanced plan of Banana Accounting Plus.

Beta Version

The extension is released as a beta version. This means that some details may change without notice.

Open source development

This report is been developed and maintained with an open source approach.

Banana makes available the development resource, but the software is maintained and upgraded only if we have users that provide help.

If you use this extension and you would like to have it updated, kindly help us develop further:

- Test case file data 2024.

Kindly prepare and send us per email an accounting file that is anonymized, with real amounts that make use of all VAT codes. - Kindly check the results and let us know how they work (even if they work fine).

Amounts conversion to CHF

If the base accounting currency is not CHF, the VatTaxable, VatPosted, VatAmount are in the base currency.

The amounts are converted to CHF using these rules:

- If the transaction currency is CHF:

- It will be used the exchange rate of the transactions.

- VAT will have the same CHF amounts.

- If the transaction currency is not CHF:

- It will be used the average monthly exchange rate.

- The average monthly exchange rate is considered to be the one of the 15. of each month (2024-01-15, 2024-02-15).

- You should enter in the Exchange rate table the average exchange rates for the currencies used.

- If the exchange rate with 15 of the Month is not found, it will be used the one older then the 15.

Reports

The extension creates the following reports:

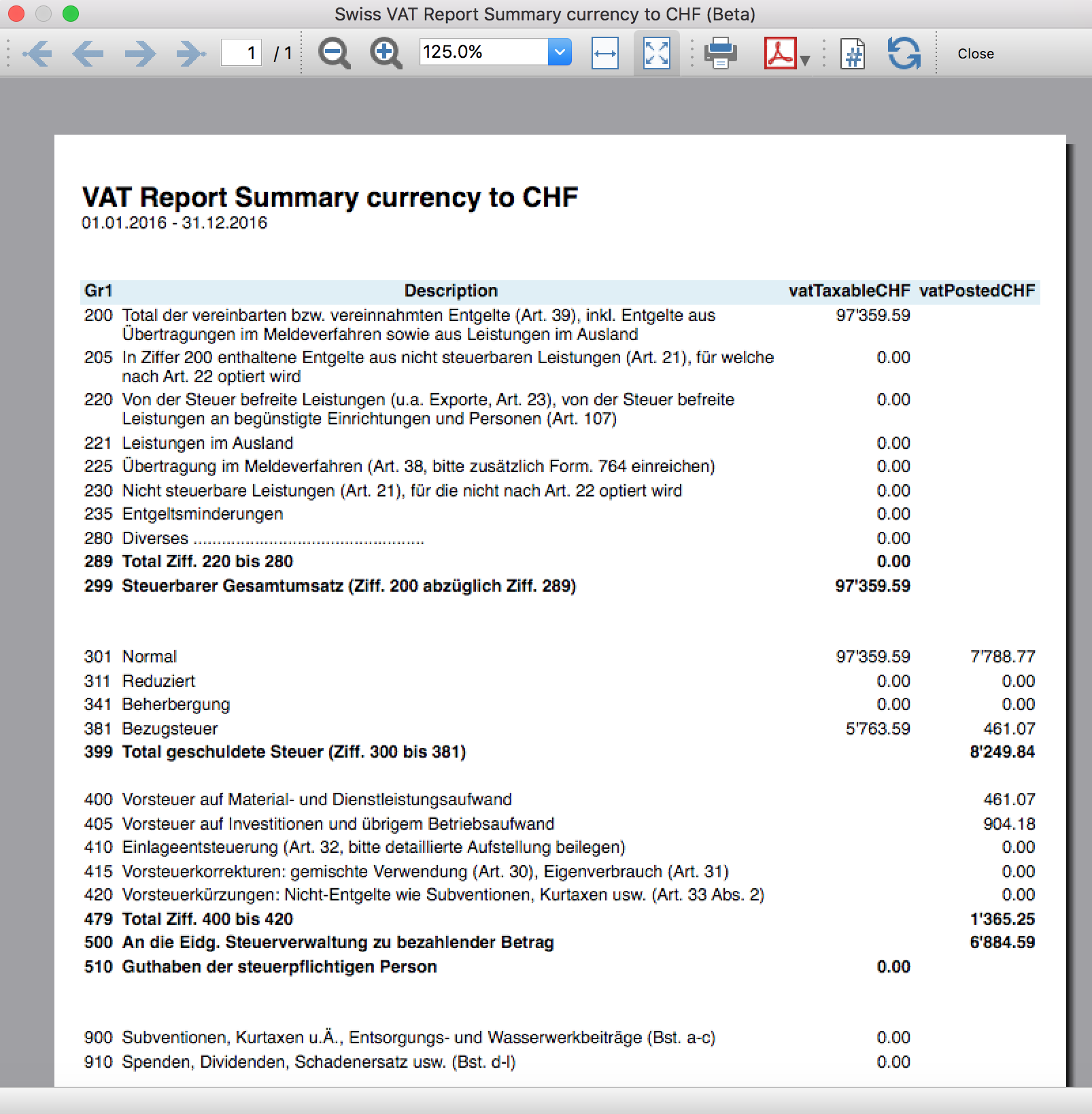

- VAT Report Summary currency to CHF.

The report sums the amounts accordingly to the Swiss VAT report 2024 using the content of the Gr1 column in the VatCodes Table. The new 2024 VAT codes are used. Texts are in German, French and Italian depending on the accounting language.

Example:

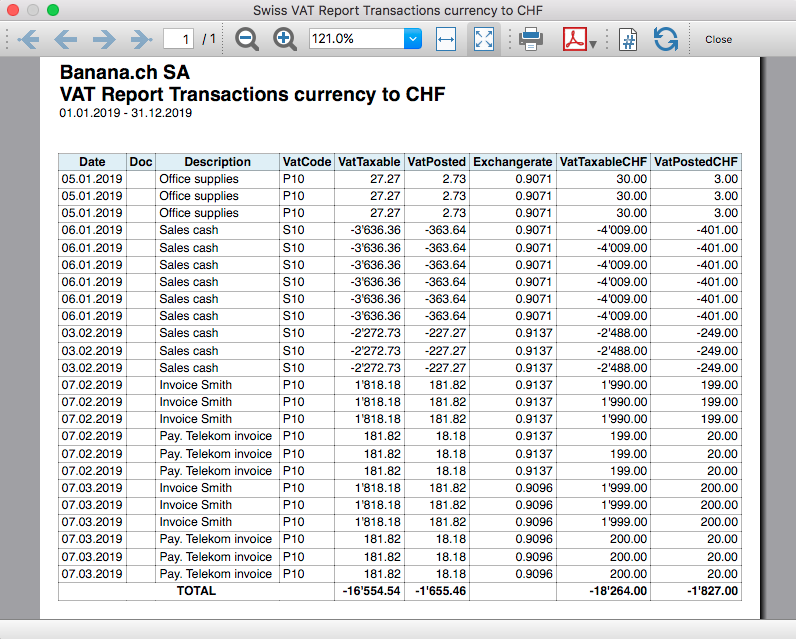

- VAT Report Transactions currency to CHF.

The report shows all the transactions that have a VAT code, indicating the amounts in base currency, the exchange rates, and the amounts in CHF after the conversion.

Example: